Series G and Series H American Depositary Shares of Navios Maritime Holdings Inc. Delisted from New York Stock Exchange

February 08 2024 - 4:20PM

Navios Maritime Holdings Inc. (the “Company”) announced today that

the Company’s (i) American Depositary Shares each representing

1/100th of a share of the Company’s 8.75% Series G Cumulative

Redeemable Perpetual Preferred Stock, $0.0001 par value per share

(the “Series G ADSs”) and (ii) American Depositary Shares each

representing 1/100th of a share of the Company’s 8.625% Series H

Cumulative Redeemable Perpetual Preferred Stock, $0.0001 par value

per share (the “Series H ADSs” and, together with the Series G

ADSs, the “ADSs”) and the preferred stock underlying the ADSs have

been delisted from the New York Stock Exchange (the “NYSE”).

The Company has also filed a Form 15 with the Securities and

Exchange Commission (the “SEC”) to suspend its reporting

obligations under the Securities Exchange Act of 1934. As a result,

the Company’s obligation to file periodic reports with the SEC,

including its annual report on Form 20-F, is immediately

suspended. Once the Form 15 is effective, which is

expected to occur within 90 days of today’s filing, the Company’s

obligations to file all other reports with the SEC will also be

suspended.

The Company intends to make publicly available the financial

information about the Company necessary in order to allow the ADSs

to be quoted on an over-the-counter (“OTC”) market. However, no

assurance can be provided that any broker-dealer will make a market

in the ADSs, which is a requirement for OTC quotation, or that

trading of the ADSs will continue on an OTC market or

elsewhere.

Forward-Looking Statements

This communication contains forward-looking statements relating

to the Company’s delisting of its ADSs and deregistration under the

Securities Exchange Act of 1934. Statements in this communication

that are not statements of historical fact are considered

forward-looking statements, which are usually identified by the use

of words such as “anticipates,” “believes,” “continues,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predicts,” “projects,” “seeks,” “should,” “will,” and variations

of such words or similar expressions. These forward-looking

statements are neither forecasts, promises nor guarantees, and are

based on the current beliefs of management of the Company as well

as assumptions made by and information currently available to the

Company. Such statements reflect the current views of the Company

with respect to future events and are subject to known and unknown

risks The Company cautions you not to place undue reliance on any

forward-looking statements, which speak only as of the date hereof.

The Company does not undertake any duty to update any

forward-looking statement or other information in this

communication, except to the extent required by law.

About Navios Maritime Holdings Inc.

Navios Maritime Holdings Inc. owns (i) a controlling equity

stake in Navios South American Logistics Inc., one of the largest

infrastructure and logistics companies in the Hidrovia region of

South America and (ii) an interest in Navios Maritime Partners L.P.

(NYSE:NMM), an international shipping company, listed on the New

York Stock Exchange, that owns and operates dry cargo and tanker

vessels. For more information, please visit our website:

www.navios.com.

Contact

Navios Maritime Holdings Inc.+ 1-345-232-3067+

1-212-906-8643investors@navios.com

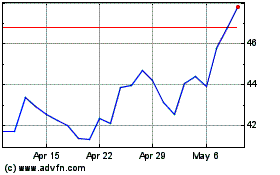

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

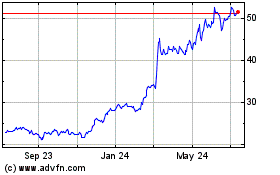

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Apr 2023 to Apr 2024