0001107843false00011078432024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 8-K

_________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 7, 2024

_________________________

QUALYS, INC.

(Exact name of registrant as specified in its charter)

_________________________

| | | | | | | | |

| Delaware | 001-35662 | 77-0534145 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

919 E. Hillsdale Boulevard, 4th Floor

Foster City, California 94404

(Address of principal executive offices, including zip code)

(650) 801-6100

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

_________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.001 par value per share | | QLYS | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On February 7, 2024, Qualys, Inc. (“Qualys”) issued a press release announcing its financial results for the quarter and fiscal year ended December 31, 2023. In the press release, Qualys also announced that it will hold a conference call on February 7, 2024, to discuss its financial results for the quarter and fiscal year ended December 31, 2023. The full text of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

This information is intended to be furnished under Item 2.02 of Form 8-K, “Results of Operations and Financial Condition” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| 99.1 | |

| |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| QUALYS, INC. | |

| | |

| By: | /s/ Joo Mi Kim | |

| Joo Mi Kim

Chief Financial Officer | |

Date: February 7, 2024

Exhibit 99.1

Qualys Announces Fourth Quarter and Full Year 2023 Financial Results

2023 Revenue Growth of 13% Year-Over-Year

Q4 Revenue Growth of 10% Year-Over-Year

2023 GAAP EPS: $4.03; Non-GAAP EPS: $5.27

Q4 GAAP EPS: $1.08; Q4 Non-GAAP EPS: $1.40

Announces $200 Million Increase to Share Repurchase Program

FOSTER CITY, Calif., – February 7, 2024 – Qualys, Inc. (NASDAQ: QLYS), a pioneer and leading provider of disruptive cloud-based IT, security and compliance solutions, today announced financial results for the fourth quarter ended December 31, 2023. For the quarter, the Company reported revenues of $144.6 million, net income under United States Generally Accepted Accounting Principles (“GAAP”) of $40.6 million, non-GAAP net income of $52.8 million, Adjusted EBITDA of $65.8 million, GAAP net income per diluted share of $1.08, and non-GAAP net income per diluted share of $1.40.

"In 2023, we continued to execute against our strategic vision of helping organizations consolidate security tools on a natively integrated platform to measure, communicate, and eliminate cyber risk,” said Sumedh Thakar, president and CEO of Qualys. “Our financial results, growing scale, and increased module adoption demonstrate customers are starting to leverage the breadth and depth of the Qualys Enterprise TruRisk Platform to transform their security stack for transparent risk assessment, measurable business results, and lower TCO. Looking ahead, we believe we’re well positioned as the fundamental risk management platform for the future and remain committed to further advancing our position in the market with a balanced approach to growth and profitability.”

Fourth Quarter 2023 Financial Highlights

Revenues: Revenues for the fourth quarter of 2023 increased by 10% to $144.6 million compared to $130.8 million for the same quarter in 2022.

Gross Profit: GAAP gross profit for the fourth quarter of 2023 increased by 14% to $117.4 million compared to $103.1 million for the same quarter in 2022. GAAP gross margin was 81% for the fourth quarter of 2023 compared to 79% for the same quarter in 2022. Non-GAAP gross profit for the fourth quarter of 2023 increased by 14% to $120.2 million compared to $105.7 million for the same quarter in 2022. Non-GAAP gross margin was 83% for the fourth quarter of 2023 compared to 81% for the same quarter in 2022.

Operating Income: GAAP operating income for the fourth quarter of 2023 increased by 35% to $41.5 million compared to $30.7 million for the same quarter in 2022. As a percentage of revenues, GAAP operating income was 29% for the fourth quarter of 2023 compared to 23% for the same quarter in 2022. Non-GAAP operating income for the fourth quarter of 2023 increased by 28% to $60.8 million compared to $47.4 million for the same quarter in 2022. As a percentage of revenues, non-GAAP operating income was 42% for the fourth quarter of 2023 compared to 36% for the same quarter in 2022.

Net Income: GAAP net income for the fourth quarter of 2023 increased by 43% to $40.6 million, or $1.08 per diluted share, compared to $28.3 million, or $0.74 per diluted share, for the same quarter in 2022. As a percentage of revenues, GAAP net income was 28% for the fourth quarter of 2023 compared to 22% for the same quarter in 2022. Non-GAAP net income for the fourth quarter of 2023 was $52.8 million, or $1.40 per diluted share, compared to $38.9 million, or $1.01 per diluted share, for the same quarter in 2022. As a percentage of revenues, non-GAAP net income was 37% for the fourth quarter of 2023 compared to 30% for the same quarter in 2022.

Adjusted EBITDA: Adjusted EBITDA (a non-GAAP financial measure) for the fourth quarter of 2023 increased by 20% to $65.8 million compared to $55.1 million for the same quarter in 2022. As a percentage of revenues, Adjusted EBITDA was 46% for the fourth quarter of 2023 compared to 42% for the same quarter in 2022.

Operating Cash Flow: Operating cash flow for the fourth quarter of 2023 decreased by 23% to $33.8 million compared to $43.8 million for the same quarter in 2022. As a percentage of revenues, operating cash flow was 23% for the fourth quarter of 2023 compared to 34% for the same quarter in 2022.

Fourth Quarter 2023 Business Highlights

•Showcased the Company's innovation and leadership to more than 500 customers and partners at its annual Qualys Security Conference (QSC) in Orlando, Florida.

•Announced the results of a Return on Investment (ROI) study conducted by leading analyst firm IDC, which found organizations achieved $5.1M per year in benefits from leveraging Qualys and a three-year ROI of 403%.

•Qualys released small-to-medium sized business (SMBs) and small-to-medium enterprises (SMEs) offerings of Qualys' VMDR with TruRisk, Patch Management and Endpoint Detection and Response (EDR) for the AWS Marketplace.

Full Year 2023 Financial Highlights

Revenues: Revenues for 2023 increased by 13% to $554.5 million compared to $489.7 million for 2022.

Gross Profit: GAAP gross profit for 2023 increased by 16% to $447.0 million compared to $386.9 million for 2022. GAAP gross margin was 81% for 2023 compared to 79% in 2022. Non-GAAP gross profit increased by 15% to $457.3 million for 2023 compared to $397.6 million for 2022. Non-GAAP gross margin was 82% in 2023 compared to 81% in 2022.

Operating Income: GAAP operating income for 2023 was $163.1 million compared to $130.5 million for 2022. As a percentage of revenues, GAAP operating income was 29% for 2023 compared to 27% for 2022. Non-GAAP operating income for 2023 was $235.2 million compared to $189.6 million for 2022. As a percentage of revenues, non-GAAP operating income was 42% for 2023 compared to 39% for 2022.

Net Income: GAAP net income for 2023 increased by 40% to $151.6 million, or $4.03 per diluted share, compared to $108.0 million, or $2.74 per diluted share for 2022. As a percentage of revenues, GAAP net income was 27% for 2023 compared to 22% for 2022. Non-GAAP net income for 2023 was $198.1 million, or $5.27 per diluted share, compared to non-GAAP net income of $146.5 million, or $3.72 per diluted share for 2022. As a percentage of revenues, non-GAAP net income was 36% for 2023 compared to 30% for 2022.

Adjusted EBITDA: Adjusted EBITDA (a non-GAAP financial measure) for 2023 increased by 19% to $259.1 million compared to $218.6 million for 2022. As a percentage of revenues, Adjusted EBITDA was 47% for 2023 compared to 45% for 2022.

Operating Cash Flow: Operating cash flow for 2023 was $244.6 million compared to $198.9 million for 2022. As a percentage of revenues, operating cash flow was 44% for 2023 compared to 41% for 2022.

Full Year 2023 Business Highlights

Market Recognition

•Qualys’ VMDR was recognized by SC Awards Europe as the best vulnerability management solution, and peer review site G2 named Qualys’ VMDR the top Risk-based vulnerability product in its summer 2023 G2 Grid Report.

•CRN recognized Qualys as a leader in its 2023 Cloud 100 list for relentless innovation in cloud-based technology development.

•The Qualys Threat Research Unit (TRU) has received prestigious Pwnie award nominations for work on RenderDoc, marking the fifth consecutive year of recognition for their exceptional contributions to cybersecurity research.

Products & Features

•Unveiled the Qualys Enterprise TruRisk Management platform to provide a unified view of cyber risk, empowering customers to bring security and vulnerability findings from third-party security solutions into the Qualys platform.

•Unified Cloud Workload Protection (CWP), Cloud Security Posture Management (CSPM), Cloud Detection and Response (CDR), Infrastructure as Code (IaC), and Container Security and brought an organically integrated agent and agentless TotalCloud Cloud Native Application Protection Platform (CNAPP) solution to market.

•Introduced GovCloud, a FedRAMP Ready (High Impact Level) vulnerability and patch management platform that comprehensively meets Executive Orders and National Institute of Standards and Technology (NIST) compliance and helps federal agencies improve their security posture.

•Harnessed technology from our acquisition of Blue Hexagon and extended our cloud-scale deep learning Artificial Intelligence (AI) to discover and identify relationships and patterns within our own highly integrated data lake that are invisible and undetectable in traditional signature-based solutions.

•Introduced Qualys' First-Party Software Risk Management, to enable application security teams to detect, prioritize and remediate vulnerabilities within company-developed software and embedded open-source components.

Business Developments

•The inaugural Qualys Environmental, Social and Governance (ESG) report was launched to showcase the company's robust adherence to responsible business practices and sustainable operations.

•The relationship between Qualys and Cowbell was expanded as Cowbell added Qualys’ External Attack Surface Management (EASM) real-time intelligence feed to access clients’ risk posture.

•Expanded Qualys VMDR offering with new packages for small enterprises and small/medium businesses to offer simple, easy-to-deploy, all-inclusive security solutions to manage, remediate and protect against cyber threats and reduce risk.

•Launched Qualys' inaugural 2023 TruRisk Research Report, offering a reliable resource for security practitioners seeking data-driven, real-world, and actionable perspectives on vulnerabilities and trends critical to organizations across all industries and sizes.

•Mazars integrated Qualys' cybersecurity solutions into its Cybersecurity Managed Services offering to empower customers with unprecedented insights into their risk postures with integrated vulnerability detection, prioritization and remediation capabilities.

•Demonstrated the company’s cutting-edge innovation and industry leadership to over 1,000 participants during the Qualys Security Conferences held throughout the year in Orlando, Florida, London and Munich.

•Launched a virtual thought leadership Cyber Risk Series holding three events in 2023 with more than 3,500 attendees offering insightful content on PCI DSS and compliance, reducing risk and attack surface management.

Financial Performance Outlook

Based on information as of today, February 7, 2024, Qualys is issuing the following financial guidance for the first quarter and full year fiscal 2024. The Company emphasizes that the guidance is subject to various important cautionary factors referenced in the sections entitled “Legal Notice Regarding Forward-Looking Statements” and “Non-GAAP Financial Measures” below.

First Quarter 2024 Guidance: Management expects revenues for the first quarter of 2024 to be in the range of $144.5 million to $146.5 million, representing 11% to 12% growth over the same quarter in 2023. GAAP net income per diluted share is expected to be in the range of $0.84 to $0.92, which assumes an effective income tax rate of 22%. Non-GAAP net income per diluted share is expected to be in the range of $1.27 to $1.35, which assumes a non-GAAP effective income tax rate of 21%. First quarter 2024 net income per diluted share estimates are based on approximately 37.9 million weighted average diluted shares outstanding for the quarter.

Full Year 2024 Guidance: Management expects revenues for the full year of 2024 to be in the range of $600.0 million to $610.0 million, representing 8% to 10% growth over 2023. GAAP net income per diluted share is expected to be in the range of $3.11 to $3.43. This assumes an effective income tax rate of 22%. Non-GAAP net income per diluted share is expected to be in the range of $4.95 to $5.27. This assumes a non-GAAP effective income tax rate of 21%. Full year 2024 net income per diluted share estimates are based on approximately 37.9 million weighted average diluted shares outstanding.

Qualys has not reconciled non-GAAP net income per diluted share guidance to GAAP net income per diluted share guidance because Qualys does not provide guidance on the various reconciling cash and non-cash items between GAAP net income and non-GAAP net income (i.e., stock-based compensation, amortization of intangible assets from acquisitions

and non-recurring items). The actual dollar amount of reconciling items in the first quarter and full year 2024 is likely to have a significant impact on the Company’s GAAP net income per diluted share in the first quarter and full year 2024. A reconciliation of the non-GAAP net income per diluted share guidance to the GAAP net income per diluted share guidance is not available without unreasonable effort.

Investor Conference Call

Qualys will host a conference call and live webcast to discuss its fourth quarter and full year 2023 financial results at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time) on Wednesday, February 7, 2024. To access the conference call by phone, please register here. A live webcast of the earnings conference call, investor presentation and prepared remarks can be accessed at https://investor.qualys.com/events-presentations. A replay of the conference call will be available through the same webcast link following the end of the call.

Investor Contact

Blair King

Vice President, Investor Relations and Corporate Development

(650) 801-6299

ir@qualys.com

About Qualys

Qualys, Inc. (NASDAQ: QLYS) is a pioneer and leading provider of disruptive cloud-based Security, Compliance and IT solutions with more than 10,000 subscription customers worldwide, including a majority of the Forbes Global 100 and Fortune 100. Qualys helps organizations streamline and consolidate their security and compliance solutions onto a single platform for greater agility, better business outcomes, and substantial cost savings.

The Qualys Cloud Platform leverages a single agent to continuously deliver critical security intelligence while enabling enterprises to automate the full spectrum of vulnerability detection, compliance, and protection for IT systems, workloads and web applications across on premises, endpoints, servers, public and private clouds, containers, and mobile devices. Founded in 1999 as one of the first SaaS security companies, Qualys has strategic partnerships and seamlessly integrates its vulnerability management capabilities into security offerings from cloud service providers, including Amazon Web Services, the Google Cloud Platform and Microsoft Azure, along with a number of leading managed service providers and global consulting organizations. For more information, please visit www.qualys.com.

Qualys, Qualys VMDR® and the Qualys logo are proprietary trademarks of Qualys, Inc. All other products or names may be trademarks of their respective companies.

Legal Notice Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements generally relate to future events or our future financial or operating performance. Forward-looking statements in this press release include, but are not limited to, quotations of management and statements related to: the benefits of our existing, new and upcoming products, features, integrations, acquisitions, collaborations and joint solutions, and their impact upon our long-term growth; our ability to advance our value proposition and competitive differentiation in the market; our ability to address demand trends; our ability to maintain and strengthen our category leadership; our ability to solve modern security challenges at scale; our strategies and ability to achieve and maintain durable profitable growth; statements regarding our share repurchase program; our guidance for revenues, GAAP EPS and non-GAAP EPS for the first quarter and full year 2024; and our expectations for the number of weighted average diluted shares outstanding and the GAAP and non-GAAP effective income tax rate for the first quarter and full year 2024. Our expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks include our ability to continue to develop platform capabilities and solutions; the ability of our platform and solutions to perform as intended; customer acceptance and purchase of our existing solutions and new solutions; real or perceived defects, errors or vulnerabilities in our products or services; our ability to retain existing customers and generate new customers; the budgeting cycles and seasonal buying patterns of our customers; general market, political, economic and business conditions in the United States as well as globally; our ability to manage costs as we increase our customer base and the number of our platform solutions; the market for cloud solutions for IT

security and compliance not increasing at the rate we expect; competition from other products and services; fluctuations in currency exchange rates; unexpected fluctuations in our effective income tax rate on a GAAP and non-GAAP basis; our ability to effectively manage our rapid growth and our ability to anticipate future market needs and opportunities; and any unanticipated accounting charges. The forward-looking statements contained in this press release are also subject to other risks and uncertainties, including those more fully described in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

The forward-looking statements in this press release are based on information available to Qualys as of the date hereof, and Qualys disclaims any obligation to update any forward-looking statements, except as required by law.

Non-GAAP Financial Measures

In addition to reporting financial results in accordance with GAAP, Qualys provides investors with certain non-GAAP financial measures, including non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income, non-GAAP net income, non-GAAP net income per diluted share, Adjusted EBITDA (defined as earnings before interest expense, interest income and other income (expense), net, income taxes, depreciation, amortization, and stock-based compensation) and non-GAAP free cash flows (defined as cash provided by operating activities less purchases of property and equipment, net of proceeds from disposal).

In computing non-GAAP financial measures, Qualys excludes the effects of stock-based compensation expense, amortization of intangible assets from acquisitions, non-recurring items and for non-GAAP net income, certain tax effects. Qualys believes that these non-GAAP financial measures help illustrate underlying trends in its business that could otherwise be masked by the effect of the income or expenses that are excluded in non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income, non-GAAP net income, non-GAAP net income per diluted share, Adjusted EBITDA and non-GAAP free cash flows.

Furthermore, Qualys uses some of these non-GAAP financial measures to establish budgets and operational goals for managing its business and evaluating its performance. Qualys believes that non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income, non-GAAP net income, non-GAAP net income per diluted share, Adjusted EBITDA and non-GAAP free cash flows provide additional tools for investors to use in comparing its recurring core business operating results over multiple periods with other companies in its industry.

Although Qualys does not focus on or use quarterly billings in managing or monitoring the performance of its business, Qualys provides calculated current billings (defined as total revenues recognized in a period plus the sequential change in current deferred revenue in the corresponding period) for the convenience of investors and analysts in building their own financial models.

In order to provide a more complete picture of recurring core operating business results, the Company’s non-GAAP net income and non-GAAP net income per diluted share include adjustments for non-recurring income tax items and certain tax effects of non-GAAP adjustments to achieve the effective income tax rate on a non-GAAP basis. The Company’s non-GAAP effective tax rate may differ from the GAAP effective income tax rate as a result of these income tax adjustments. The Company believes its estimated non-GAAP effective income tax rate of 21% in 2024 is a reasonable estimate under its current global operating structure and core business operations. The Company may adjust this rate during the year to take into account events or trends that it believes materially impact the estimated annual rate. The non-GAAP effective income tax rate could be subject to change for a number of reasons, including but not limited to, significant changes resulting from tax legislation, material changes in geographic mix of revenues and expenses and other significant events.

The presentation of this non-GAAP financial information is not intended to be considered in isolation or as a substitute for results prepared in accordance with GAAP. A reconciliation of the non-GAAP financial measures discussed in this press release to the most directly comparable GAAP financial measures is included with the financial statements contained in this press release. Management uses both GAAP and non-GAAP information in evaluating and operating its business internally and as such has determined that it is important to provide this information to investors.

Qualys, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues | $ | 144,570 | | | $ | 130,849 | | | $ | 554,458 | | | $ | 489,723 | |

Cost of revenues (1) | 27,130 | | | 27,748 | | | 107,485 | | | 102,788 | |

| Gross profit | 117,440 | | | 103,101 | | | 446,973 | | | 386,935 | |

| Operating expenses: | | | | | | | |

Research and development (1) | 27,471 | | | 27,810 | | | 110,472 | | | 101,186 | |

Sales and marketing (1) | 31,941 | | | 28,302 | | | 111,691 | | | 97,221 | |

General and administrative (1) | 16,559 | | | 16,316 | | | 61,741 | | | 57,981 | |

| Total operating expenses | 75,971 | | | 72,428 | | | 283,904 | | | 256,388 | |

| Income from operations | 41,469 | | | 30,673 | | | 163,069 | | | 130,547 | |

| Other income (expense), net: | | | | | | | |

| | | | | | | |

| Interest income | 5,563 | | | 2,266 | | | 16,905 | | | 5,191 | |

| Other income (expense), net | 560 | | | 1,458 | | | (1,323) | | | (2,038) | |

| Total other income, net | 6,123 | | | 3,724 | | | 15,582 | | | 3,153 | |

| Income before income taxes | 47,592 | | | 34,397 | | | 178,651 | | | 133,700 | |

| Income tax provision | 6,999 | | | 6,071 | | | 27,056 | | | 25,708 | |

| Net income | $ | 40,593 | | | $ | 28,326 | | | $ | 151,595 | | | $ | 107,992 | |

| Net income per share: | | | | | | | |

| Basic | $ | 1.10 | | | $ | 0.75 | | | $ | 4.11 | | | $ | 2.81 | |

| Diluted | $ | 1.08 | | | $ | 0.74 | | | $ | 4.03 | | | $ | 2.74 | |

| Weighted average shares used in computing net income per share: | | | | | | | |

| Basic | 36,845 | | 37,781 | | 36,879 | | 38,453 |

| Diluted | 37,748 | | 38,480 | | 37,602 | | 39,344 |

(1) Includes stock-based compensation as follows: | | | | | | | |

| Cost of revenues | $ | 2,045 | | | $ | 1,567 | | | $ | 7,300 | | | $ | 5,305 | |

| Research and development | 5,357 | | | 4,521 | | | 21,091 | | | 14,585 | |

| Sales and marketing | 3,654 | | | 3,007 | | | 12,234 | | | 9,837 | |

| General and administrative | 7,463 | | | 6,456 | | | 28,454 | | | 23,681 | |

| Total stock-based compensation, net of amounts capitalized | $ | 18,519 | | | $ | 15,551 | | | $ | 69,079 | | | $ | 53,408 | |

Qualys, Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

(in thousands)

| | | | | | | | | | | |

| December 31,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 203,665 | | | $ | 173,719 | |

| Restricted cash | 1,500 | | | — | |

| Short-term marketable securities | 221,893 | | | 147,608 | |

| Accounts receivable, net | 146,226 | | | 121,795 | |

| Prepaid expenses and other current assets | 26,714 | | | 30,216 | |

| Total current assets | 599,998 | | | 473,338 | |

| Long-term marketable securities | 56,644 | | | 59,206 | |

| Property and equipment, net | 32,599 | | | 47,428 | |

| Operating leases - right of use asset | 22,391 | | | 33,752 | |

| Deferred tax assets, net | 62,761 | | | 45,412 | |

| Intangible assets, net | 9,715 | | | 12,801 | |

| Goodwill | 7,447 | | | 7,447 | |

| Noncurrent restricted cash | 1,200 | | | 2,700 | |

| Other noncurrent assets | 19,863 | | | 18,857 | |

| Total assets | $ | 812,618 | | | $ | 700,941 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 988 | | | $ | 2,808 | |

| Accrued liabilities | 43,096 | | | 42,592 | |

| Deferred revenues, current | 333,267 | | | 293,728 | |

| Operating lease liabilities, current | 11,857 | | | 13,060 | |

| Total current liabilities | 389,208 | | | 352,188 | |

| Deferred revenues, noncurrent | 31,671 | | | 23,490 | |

| Operating lease liabilities, noncurrent | 16,885 | | | 29,121 | |

| Other noncurrent liabilities | 6,680 | | | 7,013 | |

| Total liabilities | 444,444 | | | 411,812 | |

| Stockholders’ equity: | | | |

Common stock | 37 | | | 37 | |

| Additional paid-in capital | 597,921 | | | 512,486 | |

| Accumulated other comprehensive loss | (1,704) | | | (1,947) | |

| Accumulated deficit | (228,080) | | | (221,447) | |

| Total stockholders’ equity | 368,174 | | | 289,129 | |

| Total liabilities and stockholders’ equity | $ | 812,618 | | | $ | 700,941 | |

Qualys, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

(in thousands)

| | | | | | | | | | | |

| Twelve Months Ended December 31, |

| 2023 | | 2022 |

| Cash flow from operating activities: | | | |

| Net income | $ | 151,595 | | | $ | 107,992 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization expense | 26,991 | | | 34,622 | |

| | | |

| Provision for credit losses | 547 | | | 590 | |

| Loss on disposal of property and equipment | — | | | 6 | |

| Loss on non-marketable securities | 533 | | | — | |

| Stock-based compensation, net of amounts capitalized | 69,079 | | | 53,408 | |

| Amortization (accretion) of premiums (discount) on marketable securities, net | (5,712) | | | 833 | |

| Deferred income taxes | (16,636) | | | (20,251) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (24,978) | | | (13,387) | |

| Prepaid expenses and other assets | (3,407) | | | 3,878 | |

| Accounts payable | (1,578) | | | 2,107 | |

| Accrued liabilities and other noncurrent liabilities | 451 | | | 3,867 | |

| Deferred revenues | 47,720 | | | 25,189 | |

| Net cash provided by operating activities | 244,605 | | | 198,854 | |

| Cash flow from investing activities: | | | |

| Purchases of marketable securities | (306,812) | | | (178,788) | |

| Sales and maturities of marketable securities | 242,432 | | | 347,837 | |

| Purchases of property and equipment | (8,786) | | | (15,361) | |

| | | |

| Purchases of intangible assets | — | | | (8,620) | |

| | | |

| Net cash (used in) provided by investing activities | (73,166) | | | 145,068 | |

| Cash flow from financing activities: | | | |

| Repurchase of common stock | (170,800) | | | (317,344) | |

| Proceeds from exercise of stock options | 45,576 | | | 24,483 | |

| Payments for taxes related to net share settlement of equity awards | (22,346) | | | (17,615) | |

| Proceeds from issuance of common stock through employee stock purchase plan | 6,077 | | | 4,445 | |

| | | |

| Net cash used in financing activities | (141,493) | | | (306,031) | |

| Net increase in cash, cash equivalents and restricted cash | 29,946 | | | 37,891 | |

| Cash, cash equivalents and restricted cash at beginning of period | 176,419 | | | 138,528 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 206,365 | | | $ | 176,419 | |

Qualys, Inc.

RECONCILIATION OF NON-GAAP DISCLOSURES

ADJUSTED EBITDA

(unaudited)

(in thousands, except percentages)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 40,593 | | | $ | 28,326 | | | $ | 151,595 | | | $ | 107,992 | |

| Net income as a percentage of revenues | 28 | % | | 22 | % | | 27 | % | | 22 | % |

| Depreciation and amortization of property and equipment | 5,080 | | | 7,688 | | | 23,904 | | | 28,936 | |

| Amortization of intangible assets | 771 | | | 1,161 | | | 3,087 | | | 5,686 | |

| Income tax provision | 6,999 | | | 6,071 | | | 27,056 | | | 25,708 | |

| Stock-based compensation | 18,519 | | | 15,551 | | | 69,079 | | | 53,408 | |

| Total other income, net | (6,123) | | | (3,724) | | | (15,582) | | | (3,153) | |

| Adjusted EBITDA | $ | 65,839 | | | $ | 55,073 | | | $ | 259,139 | | | $ | 218,577 | |

| Adjusted EBITDA as a percentage of revenues | 46 | % | | 42 | % | | 47 | % | | 45 | % |

Qualys, Inc.

RECONCILIATION OF NON-GAAP DISCLOSURES

(unaudited)

(in thousands, except per share data) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| GAAP Cost of revenues | $ | 27,130 | | | $ | 27,748 | | | $ | 107,485 | | | $ | 102,788 | |

| Less: Stock-based compensation | (2,045) | | | (1,567) | | | (7,300) | | | (5,305) | |

| Less: Amortization of intangible assets | (746) | | | (1,076) | | | (2,987) | | | (5,347) | |

| Non-GAAP Cost of revenues | $ | 24,339 | | | $ | 25,105 | | | $ | 97,198 | | | $ | 92,136 | |

| GAAP Gross profit | $ | 117,440 | | | $ | 103,101 | | | $ | 446,973 | | | $ | 386,935 | |

| Plus: Stock-based compensation | 2,045 | | | 1,567 | | | 7,300 | | | 5,305 | |

| Plus: Amortization of intangible assets | 746 | | | 1,076 | | | 2,987 | | | 5,347 | |

| Non-GAAP Gross Profit | $ | 120,231 | | | $ | 105,744 | | | $ | 457,260 | | | $ | 397,587 | |

| GAAP Research and development | $ | 27,471 | | | $ | 27,810 | | | $ | 110,472 | | | $ | 101,186 | |

| Less: Stock-based compensation | (5,357) | | | (4,521) | | | (21,091) | | | (14,585) | |

| Less: Amortization of intangible assets | (25) | | | (85) | | | (100) | | | (339) | |

| Non-GAAP Research and development | $ | 22,089 | | | $ | 23,204 | | | $ | 89,281 | | | $ | 86,262 | |

| GAAP Sales and marketing | $ | 31,941 | | | $ | 28,302 | | | $ | 111,691 | | | $ | 97,221 | |

| Less: Stock-based compensation | (3,654) | | | (3,007) | | | (12,234) | | | (9,837) | |

| Non-GAAP Sales and marketing | $ | 28,287 | | | $ | 25,295 | | | $ | 99,457 | | | $ | 87,384 | |

| GAAP General and administrative | $ | 16,559 | | | $ | 16,316 | | | $ | 61,741 | | | $ | 57,981 | |

| Less: Stock-based compensation | (7,463) | | | (6,456) | | | (28,454) | | | (23,681) | |

| Non-GAAP General and administrative | $ | 9,096 | | | $ | 9,860 | | | $ | 33,287 | | | $ | 34,300 | |

| GAAP Operating expenses | $ | 75,971 | | | $ | 72,428 | | | $ | 283,904 | | | $ | 256,388 | |

| Less: Stock-based compensation | (16,474) | | | (13,984) | | | (61,779) | | | (48,103) | |

| Less: Amortization of intangible assets | (25) | | | (85) | | | (100) | | | (339) | |

| Non-GAAP Operating expenses | $ | 59,472 | | | $ | 58,359 | | | $ | 222,025 | | | $ | 207,946 | |

| GAAP Income from operations | $ | 41,469 | | | $ | 30,673 | | | $ | 163,069 | | | $ | 130,547 | |

| Plus: Stock-based compensation | 18,519 | | | 15,551 | | | 69,079 | | | 53,408 | |

| Plus: Amortization of intangible assets | 771 | | | 1,161 | | | 3,087 | | | 5,686 | |

| Non-GAAP Income from operations | $ | 60,759 | | | $ | 47,385 | | | $ | 235,235 | | | $ | 189,641 | |

| GAAP Net income | $ | 40,593 | | | $ | 28,326 | | | $ | 151,595 | | | $ | 107,992 | |

| Plus: Stock-based compensation | 18,519 | | | 15,551 | | | 69,079 | | | 53,408 | |

| Plus: Amortization of intangible assets | 771 | | | 1,161 | | | 3,087 | | | 5,686 | |

| Less: Tax adjustment | (7,046) | | | (6,187) | | | (25,615) | | | (20,563) | |

| Non-GAAP Net income | $ | 52,837 | | | $ | 38,851 | | | $ | 198,146 | | | $ | 146,523 | |

| GAAP Net income per share: | | | | | | | |

| Basic | $ | 1.10 | | | $ | 0.75 | | | $ | 4.11 | | | $ | 2.81 | |

| Diluted | $ | 1.08 | | | $ | 0.74 | | | $ | 4.03 | | | $ | 2.74 | |

| Non-GAAP Net income per share: | | | | | | | |

| Basic | $ | 1.43 | | | $ | 1.03 | | | $ | 5.37 | | | $ | 3.81 | |

| Diluted | $ | 1.40 | | | $ | 1.01 | | | $ | 5.27 | | | $ | 3.72 | |

| Weighted average shares used in GAAP and non-GAAP net income per share: | | | | | | | |

| Basic | 36,845 | | 37,781 | | 36,879 | | 38,453 |

| Diluted | 37,748 | | 38,480 | | 37,602 | | 39,344 |

Qualys, Inc.

RECONCILIATION OF NON-GAAP DISCLOSURES

FREE CASH FLOWS

(unaudited)

(in thousands)

| | | | | | | | | | | |

| Twelve Months Ended December 31, |

| 2023 | | 2022 |

| GAAP Cash flows provided by operating activities | $ | 244,605 | | | $ | 198,854 | |

| Less: | | | |

| Purchases of property and equipment, net of proceeds from disposal | (8,786) | | | (15,361) | |

| Non-GAAP Free cash flows | $ | 235,819 | | | $ | 183,493 | |

Qualys, Inc.

RECONCILIATION OF NON-GAAP DISCLOSURES

CALCULATED CURRENT BILLINGS

(unaudited)

(in thousands, except percentages)

| | | | | | | | | | | |

| Three Months Ended December 31, |

| 2023 | | 2022 |

| GAAP Revenue | $ | 144,570 | | | $ | 130,849 | |

| GAAP Revenue growth compared to same quarter of prior year | 10 | % | | 19 | % |

Plus: Current deferred revenue at December 31 | 333,267 | | | 293,728 | |

Less: Current deferred revenue at September 30 | (307,179) | | | (278,947) | |

| Non-GAAP Calculated current billings | $ | 170,658 | | | $ | 145,630 | |

| Calculated current billings growth compared to same quarter of prior year | 17 | % | | 12 | % |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

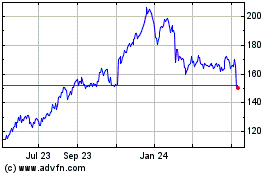

Qualys (NASDAQ:QLYS)

Historical Stock Chart

From Apr 2024 to May 2024

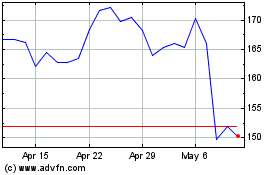

Qualys (NASDAQ:QLYS)

Historical Stock Chart

From May 2023 to May 2024