Futures Pointing To Initial Strength On Wall Street

February 07 2024 - 9:12AM

IH Market News

The major U.S. index futures are currently pointing to a higher

open on Wednesday, with stocks likely to add to the modest gains

posted during yesterday’s choppy trading session.

The markets may benefit from recent upward momentum, which

helped lift the Dow and S&P 500 to record highs last week

despite waning optimism about the Federal Reserve cutting interest

rates in March.

While CME Group’s FedWatch Tool suggests the chances of March

rate cut are just 20.5 percent, the Fed is still expected to begin

lowering rates sometime in the coming months.

Recent upbeat economic data has seemingly reduced the likelihood

of a near-term rate cut but a strong economy is still seen as a net

positive for stocks.

A positive reaction to some of the latest earnings news may also

generate buying interest, with shares of Enphase Energy

(NASDAQ:ENPH) soaring in pre-market trading after the solar

inverter maker reported weaker than expected fourth quarter

revenues but said it expects demand to improve throughout 2024.

Auto giant Ford (NYSE:F) is also likely to see initial strength

after reporting better than expected fourth quarter results,

providing upbeat guidance for 2024 and announcing a supplemental

dividend of 18 cents per share.

On the other hand, shares of Snap (NYSE:SNAP) are plummeting in

pre-market trading after the Snapchat parent reported mixed fourth

quarter results and forecast first quarter sales below analyst

estimates.

Following the significant volatility seen over the past few

sessions, stocks showed a lack of direction throughout the trading

day on Tuesday. The major averages spent the day bouncing back and

forth across the unchanged line before eventually closing modestly

higher.

The Dow climbed 141.24 points or 0.4 percent to 38,521.36, the

S&P 500 rose 11.42 points or 0.2 percent to 4,954.23 and the

Nasdaq inched up 11.32 points or 0.1 percent to 15,609.00.

The choppy trading on Wall Street came as some traders seemed

reluctant to make significant moves amid uncertainty about the

near-term outlook for the markets the following recent

volatility.

Stocks fell sharply following the Federal Reserve’s monetary

policy announcement last Wednesday but rebounded to record highs

over the following two sessions only to pullback sharply once again

in early trading on Monday.

While the major averages climbed well off Monday’s early lows,

fading optimism the Fed will lower interest rates in March

continued to hang over the markets.

A lack of major U.S. economic data also kept some traders on the

sidelines following several key events last week.

Among individual stocks, shares of Palantir Technologies

(NYSE:PLTR) skyrocketed by 30.8 percent after the data analytics

provider reported better than expected fourth quarter revenues amid

strong demand for its artificial intelligence offerings.

Audio streaming service provider Spotify (NYSE:SPOT) also jumped

by 3.9 percent after reporting stronger than expected fourth

quarter subscriber growth and providing upbeat guidance.

On the other hand, shares of Rambus (NASDAQ:RMBS) plunged by

19.2 percent after the chipmaker reported a year-over-year decline

in fourth quarter revenue.

While most of the major sectors showed only modest moves on the

day, airline stocks showed a substantial move back to the

upside.

Reflecting the strength in the sector, the NYSE Arca Airline

Index soared by 5.3 percent after plunging by 2.9 percent on

Monday.

Considerable strength was also visible among oil service stocks,

as reflected by the 2.0 percent jump by the Philadelphia Oil

Service Index. The strength in the sector came amid an increase by

the price of crude oil.

Biotechnology, commercial real estate and healthcare stocks also

moved notably higher, while semiconductor stocks showed a

significant move to the downside.

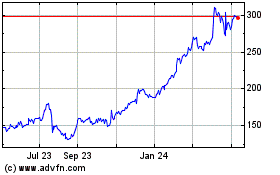

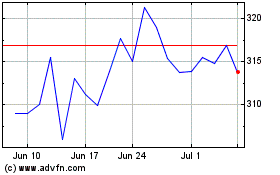

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Apr 2023 to Apr 2024