FALSE000130940200013094022024-02-062024-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2024

_______________________________

GREEN PLAINS INC.

(Exact name of registrant as specified in its charter)

_______________________________

| | | | | | | | |

| Iowa | 001-32924 | 84-1652107 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1811 Aksarben Drive

Omaha, Nebraska 68106

(Address of Principal Executive Offices) (Zip Code)

(402) 884-8700

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | GPRE | | The Nasdaq Stock Market LLC |

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On February 6, 2024, Green Plains Inc., an Iowa corporation (the “Company”), entered into a Cooperation Agreement (the “Cooperation Agreement”) with Ancora Holdings Group, LLC, a Delaware limited liability company (collectively with its affiliates and associates, the “Investor”).

During the term of the Cooperation Agreement, the Investor has agreed to vote all Voting Securities (as defined in the Cooperation Agreement) beneficially owned by it or its affiliates at all meetings of the Company’s shareholders in accordance with the Board’s recommendations, except that the Investor (a) may vote in its discretion on any proposal of the Company in respect of any Extraordinary Transactions (as defined in the Cooperation Agreement), share issuance or the implementation of takeover defenses not in existence as of the date of the Cooperation Agreement and (b) will be permitted to vote in accordance with the recommendation of Institutional Shareholder Services Inc. (“ISS”) and Glass, Lewis & Co., LLC (“Glass Lewis”) if ISS and Glass Lewis issue a voting recommendation that differs from the Board’s recommendation with respect to any proposal submitted to shareholders at a shareholder meeting (other than any proposal related to director elections, removals or replacements).

The Investor has also agreed to certain customary standstill provisions prohibiting it from, among other things, (a) soliciting proxies; (b) advising or knowingly encouraging any person with respect to the voting or disposition of any securities of the Company, subject to limited exceptions; (c) beneficially owning more than 9.9% of the then‑outstanding shares of the Company’s common stock and (d) taking actions to change or influence the Board, management or the direction of certain Company matters; in each case as further described in the Cooperation Agreement.

The Cooperation Agreement will terminate on the date that is the earlier of (a) thirty days prior to the notice deadline under the Company’s bylaws for the submission of shareholder director nominations for the Company’s 2025 annual meeting of shareholders and (b) one hundred days prior to the first anniversary of the Company’s 2024 annual meeting of shareholders.

The foregoing description of the Cooperation Agreement contained in this Current Report on Form 8-K does not purport to be complete and is qualified in its entirety by reference to the full terms and conditions of the Cooperation Agreement, which is filed with this Current Report on Form 8-K as Exhibit 10.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed as part of this report.

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Green Plains Inc. | |

| | | |

| Date: February 7, 2024 | By: | /s/ Michelle Mapes | |

| | Michelle Mapes | |

| | Chief Legal & Administration Officer and Corporate Secretary | |

COOPERATION AGREEMENT

This Cooperation Agreement (this “Agreement”), effective as of February 6, 2024 (the “Effective Date”), is entered into by and between Green Plains Inc., an Iowa corporation (the “Company”), and Ancora Holdings Group, LLC, a Delaware limited liability company (collectively with its Affiliates and Associates, the “Investor”). The Company and the Investor are together referred to herein as the “Parties,” and each of the Company and the Investor, respectively, a “Party.” Unless otherwise defined herein, capitalized terms shall have the meanings given to them in Section 16 herein.

WHEREAS, as of the Effective Date, the Investor beneficially owns an aggregate of 4,151,058 shares of common stock, par value $0.001 per share, of the Company (the “Common Stock”);

WHEREAS, the Company and the Investor desire to enter into this Agreement regarding the Company’s evaluation of strategic alternatives and certain other matters, as provided in this Agreement.

NOW, THEREFORE, in consideration of the promises, representations and mutual covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereby agree as follows:

1. Strategic Alternatives.

(a) No later than the date on which the Company issues a press release announcing its financial results for the three months and year ended December 31, 2023 (the “Earnings Release”), the Company shall prominently announce that the Board will initiate a formal review to consider and evaluate strategic alternatives for the Company to maximize value for shareholders (the “Announcement”); provided, that if the Announcement is included within the Earnings Release, then the first reference to the Announcement will be included as a header and made in an above-the-fold manner; provided, further, that if the Announcement is not included within the Earnings Release, then the Announcement of such formal review will be made in a standalone press release.

(b) Neither the Company nor the Investor shall make or cause to be made, and the Company and the Investor shall cause their respective Affiliates and Associates not to make or cause to be made, any public statement with respect to the subject matter of this Section 1 that is inconsistent with (i) the statements made in the Announcement included within the Earnings Release or in the standalone press release, as applicable, and/or (ii) the terms of this Agreement, except, in each case, as required by law or the rules of any stock exchange or with the prior written consent of the other Party.

2. Voting. From the Effective Date until the Termination Date (the “Standstill Period”), the Investor agrees that it shall, or shall cause its Representatives to, appear in person or by proxy at each annual or special meeting of shareholders of the Company (including, but not limited to, any adjournments or postponements thereof and any meetings which may be called in lieu thereof), whether such meeting is held at a physical location or virtually by means of remote communications, and will vote (or execute a consent with respect to) all Voting Securities beneficially owned by it or its Affiliates in accordance with the Board’s recommendations with respect to any and all proposals, including, but not limited to, proposals related to director elections, removals or replacements; provided, however, that if Institutional Shareholder Services Inc. (“ISS”) and Glass Lewis & Co. LLC (“Glass Lewis”) issue a voting recommendation that differs from the Board’s recommendation with respect to any proposal submitted to shareholders at a shareholder meeting (other than any proposal related to director elections, removals or

replacements), the Investor shall be permitted to vote in accordance with ISS’s and Glass Lewis’s recommendation; provided, further, that the Investor may vote in its discretion on any proposal of the Company in respect of any Extraordinary Transaction, share issuance, or the implementation of takeover defenses not in existence as of the Effective Date.

3. Mutual Non-Disparagement.

(a) Until the Termination Date, neither Party shall, nor shall it permit any of its Representatives to, directly or indirectly, in any capacity or manner, make, transmit or otherwise communicate any public statement of any kind, whether verbal, in writing, electronically transferred or otherwise, including, but not limited to, any member of the media, that constitutes an ad hominem attack on, or otherwise disparages or defames any other Party (including, but not limited to, in each case its current and former directors, officers, employees and Affiliates).

(b) Notwithstanding the foregoing, nothing in this Section 3 or elsewhere in this Agreement shall prohibit either Party from making any statement or disclosure required under the federal securities laws, the rules of any self-regulatory organization or other applicable laws (including, but not limited to, to comply with (i) any valid subpoena or other legal process from any court, governmental body or regulatory authority, in each case, with competent jurisdiction over the relevant Party hereto, or (ii) any deposition, interrogatory, request for documents, civil investigative demand or other similar process) or stock exchange regulations.

(c) The limitations set forth in Section 3(a) shall not prevent either Party from responding to any public statement made by the other Party of the nature described in Section 3(a), if such statement by the other Party was made in breach of this Agreement.

4. No Litigation. Each Party hereby covenants and agrees that, prior to the Termination Date, it shall not, and shall not permit any of its Representatives (solely in the context of their representation of such Party in connection with the subject matter of this Agreement) to, directly or indirectly, alone or in concert with others, encourage, pursue, or assist any other person to threaten, initiate or pursue any lawsuit, claim or proceeding (including, but not limited to, with respect to the Investor, commencing, encouraging or supporting any derivative action in the name of the Company or any class action against the Company or any of its directors or officers, in each case with the intent of circumventing any terms of this Agreement) before any Governmental Authority (each, a “Legal Proceeding”) against the other Party or any of its Representatives (solely in the context of their representation of such Party in connection with the subject matter of this Agreement), except for (a) any Legal Proceeding initiated primarily to remedy a breach of or to enforce this Agreement, (b) counterclaims with respect to any proceeding initiated by or on behalf of one Party or its Affiliates against the other Party or its Affiliates or (c) any Legal Proceeding with respect to claims of fraud in connection with, arising out of or related to this Agreement; provided, however, that the foregoing shall not prevent either Party or any of its Representatives from responding to oral questions, interrogatories, requests for information or documents, subpoenas, civil investigative demands or similar processes (each, a “Legal Requirement”) in connection with any Legal Proceeding if such Legal Proceeding has not been initiated by, on behalf of, or at the direct or indirect suggestion of such Party or any of its Representatives (solely in the context of their representation of such Party in connection with the subject matter of this Agreement), except as provided in Section 5(e); provided, further, that in the event either Party or any of its Representatives receives such Legal Requirement (solely with respect to the subject matter of this Agreement), such Party shall, unless prohibited by applicable law, give prompt written notice of such Legal Requirement to the other Party.

5. Releases.

(a) As of the Effective Date, the Company permanently, fully and completely releases, acquits, and discharges the Investor, and the Investor’s Affiliates and Associates (including, but not limited to, in each case its current and former directors and officers), jointly or severally, of and from any and all claims, demands, damages, causes of action, debts, liabilities, controversies, judgments, and suits of every kind and nature whatsoever, foreseen, unforeseen, known or unknown, that the Company has had, now has, or may have against any of the Investor and/or the Investor’s Affiliates or Associates (including, but not limited to, in each case its current and former directors and officers), collectively, jointly or severally, at any time prior to and including the Effective Date, including, but not limited to, any and all claims arising out of or in any way whatsoever related to the Investor’s involvement with the Company.

(b) As of the Effective Date, the Investor permanently, fully and completely releases, acquits and discharges the Company, and the Company’s Affiliates and Associates (including, but not limited to, in each case its current and former directors and officers), jointly or severally, of and from any and all claims, demands, damages, causes of action, debts, liabilities, controversies, judgments, and suits of every kind and nature whatsoever, foreseen, unforeseen, known or unknown, that the Investor has had, now has, or may have against any of the Company and/or the Company’s Affiliates or Associates (including, but not limited to, in each case its current and former directors and officers), collectively, jointly or severally, at any time prior to and including the Effective Date, including, but not limited to, any and all claims arising out of or in any way whatsoever related to the Investor’s involvement with the Company.

(c) The Parties each acknowledge that as of the time of the Effective Date, the Parties may have claims against one another that a Party does not know or suspect to exist in its favor, including, but not limited to, claims that, had they been known, might have affected the decision to enter into this Agreement, or to provide the releases set forth in this Section 5. In connection with any such claims, the Parties agree that they intend to waive, relinquish, and release any and all provisions, rights, and benefits any state or territory of the United States or other jurisdiction that purports to limit the application of a release to unknown claims, or to facts unknown at the time the release was entered into. In connection with this waiver, the Parties acknowledge that they, or any of them, may (including, but not limited to, after the Effective Date) discover facts in addition to or different from those known or believed by them to be true with respect to the subject matter of the releases set forth in this Section 5, but it is the intention of the Parties to complete, fully, finally, and forever compromise, settle, release, discharge, and extinguish any and all claims that they may have one against another, known or unknown, suspected or unsuspected, contingent or absolute, accrued or unaccrued, apparent or unapparent, that now exist or previously existed, without regard to the subsequent discovery of additional or different facts. The Parties acknowledge that the foregoing waiver is a key, bargained-for element to this Agreement and the releases that are part of it.

(d) The releases provided for in this Section 5 are intended to be broad, and this breadth is a bargained-for feature of this Agreement. Despite this, the releases provided for in this Section 5 are not intended to, and do not, extend to either Party’s obligations under this Agreement.

(e) Notwithstanding anything in this Agreement, including, but not limited to, this Section 5, the Parties acknowledge and agree that this Agreement does not waive, release, acquit or discharge any of the Company’s claims that are or could be asserted in the litigation brought by the Company currently pending in the District Court for the

District of Nebraska and styled Green Plains Inc. v. Hakmiller, No. 8:23-cv-00440-JFB-SMB (D. Neb.), Green Plains Inc. v. Crotteau, No. 8:23-cv-00439-JFB-SMB (D. Neb.), and Green Plains Inc. v. Chandler, No. 8:23-cv-00438-JFB-SMB (D. Neb.) (collectively, the “Lawsuits”). Further, Investor agrees that, notwithstanding Section 4 of this Agreement, (i) the Company’s continued prosecution of the Lawsuits shall not be considered a breach or violation of this Agreement, (ii) the Company and/or its Representatives may propound any subpoenas or other Legal Requirements in the Lawsuits, including, but not limited to, Legal Requirements directed to Investor and/or its Representatives and (iii) Investor will respond to such Legal Requirements as required by applicable law and will cooperate with the Company in responding to such Legal Requirements.

6. Standstill.

(a) During the Standstill Period, the Investor agrees that it shall not, and shall cause its Affiliates and Associates not to, directly or indirectly:

(i) make any public announcement or proposal with respect to, or publicly offer or propose, (A) any form of business combination or acquisition or other transaction relating to a material amount of assets or securities of the Company or any of its subsidiaries, (B) any form of restructuring, recapitalization or similar transaction with respect to the Company or any of its subsidiaries or (C) any form of tender or exchange offer for shares of Common Stock or other Voting Securities, whether or not such transaction involves a Change of Control of the Company; it being understood that the foregoing shall not prohibit the Investor or its Affiliates or Associates from (i) acquiring Voting Securities, (ii) selling or tendering their shares of Common Stock, and otherwise receiving consideration, pursuant to any such transaction or (iii) voting on any such transaction in accordance with Section 2;

(ii) engage in, or knowingly assist in the engagement in (including, but not limited to, engagement by use of or in coordination with a universal proxy card), any solicitation of proxies or written consents to vote any Voting Securities, or conduct, or assist in the conducting of, any type of binding or nonbinding referendum with respect to any Voting Securities, or assist or participate in any other way, directly or indirectly, in any solicitation of proxies (or written consents) with respect to, or from the holders of, any Voting Securities, or otherwise become a “participant” in a “solicitation,” as such terms are defined in Instruction 3 of Item 4 of Schedule 14A and Rule 14a-1 of Regulation 14A, respectively, under the Securities Exchange Act of 1934, as amended, and with the rules and regulations thereunder (the “Exchange Act”), to vote any securities of the Company (including, but not limited to, by initiating, encouraging or participating in any “withhold” or similar campaign), in each case other than in a manner that is consistent with the Board’s recommendation on a matter;

(iii) acquire or offer, seek, propose or agree to acquire, whether by purchase, tender or exchange offer, through the acquisition of control of another person, by joining a group, through swap or hedging transactions or otherwise, ownership (including beneficial ownership) of any securities of the Company, any direct or indirect rights or options to acquire any such securities, any rights decoupled from the underlying securities of the Company or any derivative securities, or contracts or instruments in any way related to the price of shares of Common Stock, or any assets or liabilities of the Company, such that the

Investors hold, directly or indirectly, in excess of 9.9% of the then-outstanding shares of Common Stock of the Company;

(iv) advise or knowingly encourage any person with respect to the voting of (or execution of a written consent in respect of) or disposition of any securities of the Company other than in a manner that is consistent with the Board’s recommendation on a matter or in connection with an Extraordinary Transaction;

(v) other than in open market sale transactions where the identity of the purchaser is not known, sell, offer or agree to sell directly or indirectly, through swap or hedging transactions or otherwise, the securities of the Company or any rights decoupled from the underlying securities held by the Investor to any Third Party that would result in such Third Party, together with its Affiliates, owning, controlling or otherwise having any, beneficial or other ownership interest representing in the aggregate in excess of 5.0% of the shares of Common Stock outstanding at such time;

(vi) take any action in support of or make any proposal or request that constitutes or would result in: (A) advising, replacing or influencing any director or the management of the Company, including, but not limited to, any plans or proposals to change the number or term of directors or to fill any vacancies on the Board, (B) any material change in the capitalization, stock repurchase programs and practices or dividend policy of the Company, (C) any other material change in the Company’s management, business or corporate structure, (D) seeking to have the Company waive or make amendments or modifications to the Bylaws or the Articles of Incorporation, or other actions that may impede or facilitate the acquisition of control of the Company by any person, (E) causing a class of securities of the Company to be delisted from, or to cease to be authorized to be quoted on, any securities exchange, or (F) causing a class of securities of the Company to become eligible for termination of registration pursuant to Section 12(g)(4) of the Exchange Act (in each case except as otherwise permitted by Section 2);

(vii) call or seek to call, or request the call of, alone or in concert with others, any meeting of shareholders, whether or not such a meeting is permitted by the Bylaws, including, but not limited to, a “town hall meeting”;

(viii) deposit any shares of Common Stock or other Voting Securities in any voting trust or subject any shares of Common Stock or other Voting Securities to any arrangement or agreement with respect to the voting of any shares of Common Stock or Voting Securities (other than (A) any such voting trust, arrangement or agreement solely among the Investor and its Affiliates that is otherwise in accordance with this Agreement or (B) customary brokerage accounts, margin accounts, prime brokerage accounts and the like);

(ix) seek, or knowingly encourage or advise any person, to submit nominations in furtherance of a “contested solicitation” for the election or removal of directors with respect to the Company or seek, or knowingly encourage or take any other action with respect to the election or removal of any directors;

(x) form, join or in any other way participate in any “group” (within the meaning of Section 13(d)(3) of the Exchange Act) with respect to any Voting

Security; provided, however, that nothing herein shall limit the ability of an Affiliate of the Investor to join or in any way participate in the “group” currently in existence as of the Effective Date and comprising the Investor following the execution of this Agreement, so long as any such Affiliate agrees to be subject to, and bound by, the terms and conditions of this Agreement and, if required under the Exchange Act, files a Schedule 13D or an amendment thereof, as applicable, within two (2) business days after disclosing that the Investor has formed a group with such Affiliate;

(xi) demand a copy of the Company’s list of shareholders or its other books and records or make any request pursuant to Rule 14a-7 under the Exchange Act or under any statutory or regulatory provisions of Iowa providing for shareholder access to books and records (including, but not limited to, lists of shareholders) of the Company;

(xii) engage any private investigations firm or other person to investigate any of the Company’s directors or officers;

(xiii) disclose in a manner that could reasonably be expected to become public any intent, purpose, plan or proposal with respect to any of the Company’s directors or the Company’s management, policies, strategy, operations, financial results or affairs, any of its securities or assets or this Agreement that is inconsistent with the provisions of this Agreement;

(xiv) make any request or submit any proposal to amend or waive the terms of this Section 6 other than through non-public communications with the Company that would not be reasonably likely to trigger public disclosure obligations for either Party;

(xv) take any action challenging the validity or enforceability of any provisions in this Agreement; or

(xvi) enter into any discussions, negotiations, agreements or understandings with any Third Party with respect to any action the Investor is prohibited from taking pursuant to this Section 6, or advise, assist, knowingly encourage or seek to persuade any Third Party to take any action or make any statement with respect to any such action, or otherwise take or cause any action or make any statement inconsistent with any of the foregoing.

(b) Notwithstanding anything contained in Section 6(a) or elsewhere in this Agreement, the Investor shall not be prohibited or restricted from: (A) communicating privately with the Board or any officer or director of the Company regarding any matter, so long as such communications are not intended to, and would not reasonably be expected to, require any public disclosure of such communications by either Party; (B) making any statement to the extent required by applicable law, rule or regulation or legal process, subpoena or legal requirement from any Governmental Authority with competent jurisdiction over the Investor, provided, that a breach by the Investor of this Agreement is not the cause of the applicable requirement; or (C) communicating privately with shareholders of the Company or others when such communication is not made with an intent to otherwise violate, and would not be reasonably expected to result in a violation of, any provision of this Agreement.

7. Representations and Warranties of the Company. The Company represents and warrants to the Investor that (a) the Company has the corporate power and authority to

execute this Agreement and to bind it thereto, (b) this Agreement has been duly and validly authorized, executed and delivered by the Company, constitutes a valid and binding obligation and agreement of the Company, and is enforceable against the Company in accordance with its terms, except as enforcement thereof may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or similar laws generally affecting the rights and remedies of creditors and subject to general equity principles, and (c) the execution, delivery and performance of this Agreement by the Company does not and will not violate or conflict with (i) any law, rule, regulation, order, judgment or decree applicable to it, or (ii) result in any breach or violation of or constitute a default (or an event which with notice or lapse of time or both could become a default) under or pursuant to, or result in the loss of a material benefit under, or give any right of termination, amendment, acceleration or cancellation of, any organizational document, or any material agreement, contract, commitment, understanding or arrangement to which the Company is a party or by which it is bound.

8. Representations and Warranties of the Investor. The Investor represents and warrants to the Company that (a) this Agreement has been duly and validly authorized, executed and delivered by the Investor, and constitutes a valid and binding obligation and agreement of the Investor, enforceable against the Investor in accordance with its terms, except as enforcement thereof may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or similar laws generally affecting the rights and remedies of creditors and subject to general equity principles, (b) the signatory for the Investor has the power and authority to execute this Agreement and any other documents or agreements entered into in connection with this Agreement on behalf of itself and the Investor, and to bind the Investor to the terms hereof and thereof, and (c) the execution, delivery and performance of this Agreement by the Investor does not and will not violate or conflict with (i) any law, rule, regulation, order, judgment or decree applicable to it, or (ii) result in any breach or violation of or constitute a default (or an event which with notice or lapse of time or both could become a default) under or pursuant to, or result in the loss of a material benefit under, or give any right of termination, amendment, acceleration or cancellation of, any organizational document, agreement, contract, commitment, understanding or arrangement to which such member is a party or by which it is bound.

9. No Other Discussions or Arrangements. The Investor represents and warrants that, as of the Effective Date, except as publicly disclosed in its SEC filings or otherwise specifically disclosed to the Company in writing prior to the Effective Date, (a) the Investor does not own, of record or beneficially, any Voting Securities or any securities convertible into, or exchangeable or exercisable for, any Voting Securities and (b) the Investor has not entered into, directly or indirectly, any agreements or understandings with any person (other than its own Representatives) with respect to any potential transaction involving the Company or the voting or disposition of any securities of the Company.

10. SEC Filings.

(a) The Company shall file with the SEC a Current Report on Form 8-K reporting its entry into this Agreement and appending this Agreement as an exhibit thereto (the “Form 8-K”). The Form 8-K shall be consistent with the terms of this Agreement. The Company shall provide the Investor a reasonable opportunity to review and comment on the Form 8-K prior to the filing of the Form 8-K with the SEC and shall consider in good faith any comments of the Investor.

(b) No later than two (2) business days following the Effective Date, the Investor shall file with the SEC an amendment to its Schedule 13D in compliance with Section 13 of the Exchange Act reporting entry into this Agreement. The Schedule 13D/A shall be consistent with the terms of this Agreement. The Investor shall provide the

Company a reasonable opportunity to review and comment on the Schedule 13D/A prior to the filing of the Schedule 13D/A with the SEC and shall consider in good faith any comments of the Company.

11. Term; Termination. The term of this Agreement shall commence on the Effective Date and shall continue until the date that is the earlier of (a) thirty (30) days prior to the notice deadline under the Bylaws for the submission of shareholder director nominations for the Company’s 2025 annual meeting of shareholders and (b) one hundred (100) days prior to the first anniversary of the Company’s 2024 annual meeting of shareholders (such earlier date, the “Termination Date”); provided, however, that (x) the Investor may earlier terminate this Agreement if the Company commits a material breach of its obligations under this Agreement that (if capable of being cured) is not cured within fifteen (15) days after receipt by the Company from the Investor of written notice specifying the material breach, or, if impossible to cure within fifteen (15) days, that the Company has not taken any substantive action to cure within such fifteen (15) day period, and (y) the Company may earlier terminate this Agreement if the Investor commits a material breach of this Agreement that (if capable of being cured) is not cured within fifteen (15) days after receipt by the Investor from the Company of written notice specifying the material breach, or, if impossible to cure within fifteen (15) days, that the Investor has not taken any substantive action to cure within such fifteen (15) day period. Notwithstanding the foregoing, the provisions of Section 11 through Section 23 shall survive the termination of this Agreement. Termination of this Agreement shall not relieve either Party from its responsibilities in respect of any breach of this Agreement prior to such termination.

12. Expenses. Each Party shall bear its own expenses in connection with the negotiation, execution and effectuation of this Agreement and the transactions contemplated hereby; provided, however, that the Company shall reimburse the Investor for its reasonable and well documented out-of-pocket legal fees incurred by the Investor in connection with the negotiation, execution and effectuation of this Agreement and the transactions contemplated hereby, provided, that such reimbursement shall not exceed $250,000 in the aggregate.

13. Governing Law; Jurisdiction. This Agreement is for the benefit of each of the Investor and the Company and is governed by the laws of the State of Iowa without regard to any conflict of laws principles thereof. Any action brought in connection with this Agreement shall be brought in the federal or state courts located in the State of Iowa. The Parties hereby (a) irrevocably submit to the exclusive jurisdiction of such courts for the purpose of any such action or proceeding, (b) waive any objection to laying venue in any such action or proceeding in such courts, (c) waive any objection that such courts are an inconvenient forum or do not have jurisdiction over either Party hereto and (d) agree that service of process upon such Party in any such action shall be effective if notice is given in accordance with Section 17 of this Agreement. Each Party agrees that a final judgment in any action brought in such courts shall be conclusive and binding upon each Party and may be enforced in any other courts, the jurisdiction of which each Party is or may be subject, by suit upon such judgment.

14. Waiver of Jury Trial. EACH PARTY HERETO ACKNOWLEDGES AND AGREES THAT ANY CONTROVERSY WHICH MAY ARISE UNDER THIS AGREEMENT IS LIKELY TO INVOLVE COMPLICATED AND DIFFICULT ISSUES AND, THEREFORE, EACH SUCH PARTY IRREVOCABLY AND UNCONDITIONALLY WAIVES TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LEGAL ACTION ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT. EACH PARTY TO THIS AGREEMENT CERTIFIES AND ACKNOWLEDGES THAT (A) NO REPRESENTATIVE OF ANY OTHER PARTY HERETO HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT SEEK TO ENFORCE THE FOREGOING WAIVER IN THE EVENT OF A

LEGAL ACTION, (B) SUCH PARTY HAS CONSIDERED THE IMPLICATIONS OF THIS WAIVER, (C) SUCH PARTY MAKES THIS WAIVER VOLUNTARILY, AND (D) SUCH PARTY HAS BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 14.

15. Specific Performance. Each Party acknowledges and agrees that irreparable injury to the other Party may occur in the event any of the provisions of this Agreement are not performed in accordance with their specific terms or are otherwise breached and that such injury may not be adequately compensable by the remedies available at law (including, but not limited to, the payment of money damages). It is accordingly agreed that each Party (the “Moving Party”) shall be entitled to seek specific enforcement of, and injunctive or other equitable relief as a remedy for any such breach or to prevent any violation or threatened violation of, the terms hereof, and the other Party will not take action, directly or indirectly, in opposition to the Moving Party seeking such relief on the grounds that any other remedy or relief is available at law or in equity. The Parties further agree to waive any requirement for the security or posting of any bond in connection with any such relief. The remedies available pursuant to this Section 15 shall not be deemed to be the exclusive remedies for a breach of this Agreement but shall be in addition to all other remedies available at law or equity.

16. Certain Definitions. As used in this Agreement:

(a) “Affiliate” shall mean any “Affiliate” as defined in Rule 12b-2 promulgated by the SEC under the Exchange Act, and, for the avoidance of doubt, including, but not limited to, persons who become Affiliates prior to the Termination Date; provided, however, that, for purposes of this Agreement, the Investor shall not be deemed an Affiliate of the Company and the Company shall not be deemed an Affiliate of the Investor;

(b) “Articles of Incorporation” shall mean the Second Amended and Restated Articles of Incorporation of the Company, dated October 10, 2008, as amended by the Articles of Amendment, dated May 9, 2011, the Second Articles of Amendment, dated May 14, 2014, and the Third Articles of Amendment, dated May 4, 2022, and as may be further amended, corrected, or amended and restated from time to time;

(c) “Associate” shall mean any “Associate” as defined in Rule 12b-2 promulgated by the SEC under the Exchange Act, and, for the avoidance of doubt, including, but not limited to, persons who become Associates prior to the Termination Date;

(d) “beneficial owner,” “beneficial ownership” and “beneficially own” shall have the same meanings as set forth in Rule 13d-3 promulgated by the SEC under the Exchange Act;

(e) “business day” shall mean any day other than a Saturday, Sunday or day on which the commercial banks in the State of New York are authorized or obligated to be closed by applicable law; provided, however, that banks shall not be deemed to be authorized or obligated to be closed due to a “shelter in place,” “non-essential employee” or similar closure of physical branch locations at the direction of any Governmental Authority if such banks’ electronic funds transfer systems (including, but not limited to, for wire transfers) are open for use by customers on such day;

(f) “Bylaws” shall mean the Fifth Amended and Restated Bylaws of the Company, adopted as of November 14, 2022, as may be further amended, corrected, or amended and restated from time to time;

(g) a “Change of Control” transaction shall be deemed to have taken place if (i) any person is or becomes a beneficial owner, directly or indirectly, of securities of the Company representing more than fifty percent (50%) of the equity interests and voting power of the Company’s then-outstanding equity securities or (ii) the Company enters into a stock-for-stock transaction whereby immediately after the consummation of the transaction the Company’s shareholders retain less than fifty percent (50%) of the equity interests and voting power of the surviving entity’s then-outstanding equity securities;

(h) “Extraordinary Transaction” shall mean any equity tender offer, equity exchange offer, merger, acquisition, joint venture, business combination, financing, restructuring, recapitalization, reorganization, disposition, distribution, or other transaction with a Third Party that, in each case, would require the approval of such action or event by shareholders of the Company and would result in a Change of Control of the Company, liquidation, dissolution or other extraordinary transaction involving a majority of its equity securities or a majority of its assets, and, for the avoidance of doubt, including, but not limited to, any such transaction with a Third Party that is submitted for a vote of the Company’s shareholders;

(i) “Governmental Authority” shall mean any federal, state, local, municipal, or foreign government and any political subdivision thereof, any authority, bureau, commission, department, board, official, or other instrumentality of such government or political subdivision, any self-regulatory organization or other non-governmental regulatory authority or quasi-governmental authority (to the extent that the rules, regulations or orders of such organization or authority have the force of law), including, but not limited to, the SEC and its staff, and any court of competent jurisdiction;

(j) “person” or “persons” shall mean any individual, corporation (including, but not limited to, not-for-profit), general or limited partnership, limited liability company, joint venture, estate, trust, association, organization or other entity of any kind, structure or nature;

(k) “Representative” shall mean (i) a person’s Affiliates and Associates and (ii) its and their respective directors, officers, employees, partners, members, managers, consultants or other advisors, agents and other representatives; provided, that when used with respect to the Company, “Representatives” shall not include any non-executive employees;

(l) “SEC” shall mean the U.S. Securities and Exchange Commission;

(m) “Third Party” shall mean any person that is not (i) a party to this Agreement, (ii) a member of the Board, (iii) an officer of the Company or (iv) an Affiliate of either Party; and

(n) “Voting Securities” means the Common Stock and any other securities of the Company entitled to vote in the election of directors.

17. Notices. All notices, requests, consents, claims, demands, waivers, and other communications hereunder shall be in writing and shall be deemed to have been given: (a) when delivered by hand (with written confirmation of receipt), (b) when received by the addressee if

sent by a nationally recognized overnight courier (receipt requested), (c) on the date sent by email (with confirmation of transmission) if sent during normal business hours, and on the next business day if sent after normal business hours; or (d) on the third day after the date mailed, by certified or registered mail, return receipt requested, postage prepaid. Such communications must be sent to the respective Party at the addresses set forth in this Section 17 (or to such other address that may be designated by a Party from time to time in accordance with this Section 17).

If to the Company, to its address at:

Green Plains Inc.

1811 Aksarben Drive

Omaha, Nebraska 68106

Attention: Michelle Mapes

Email: michelle.mapes@gpreinc.com

with a copy (which shall not constitute notice) to:

Vinson & Elkins L.L.P.

1114 Avenue of the Americas, 32nd Floor

New York, New York 10103

Attention: Lawrence S. Elbaum

C. Patrick Gadson

Email: lelbaum@velaw.com

pgadson@velaw.com

If to the Investor, to the address at:

Ancora Holdings Group, LLC

6060 Parkland Boulevard, Suite 200

Cleveland, Ohio 44124

Attention: Jim Chadwick

Email: jchadwick@ancora.net

with a copy (which shall not constitute notice) to:

Olshan Frome Wolosky LLP

1325 Avenue of the Americas

New York, New York 10019

Attention: Andrew M. Freedman

Email: afreedman@olshanlaw.com

18. Entire Agreement. This Agreement constitutes the sole and entire agreement of the Parties with respect to the subject matter contained herein, and supersedes all prior and contemporaneous understandings, agreements, representations, and warranties, both written and oral, with respect to such subject matter. This Agreement may only be amended, modified or supplemented by an agreement in writing signed by each Party.

19. Severability. If any term or provision of this Agreement is invalid, illegal or unenforceable in any jurisdiction, such invalidity, illegality or unenforceability shall not affect any other term or provision of this Agreement or invalidate or render unenforceable such term or provision in any other jurisdiction.

20. Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall be deemed to be one and the same

agreement. A signed copy of this Agreement delivered by email or other means of electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

21. Assignment. No Party may assign any of its rights or delegate any of its obligations hereunder without the prior written consent of the other Party; provided, that either Party may assign any of its rights and delegate any of its obligations hereunder to any person or entity that acquires substantially all of that Party’s assets, whether by stock sale, merger, asset sale or otherwise. Any purported assignment or delegation in violation of this Section 21 shall be null and void. No assignment or delegation shall relieve the assigning or delegating Party of any of its obligations hereunder. This Agreement is for the sole benefit of the Parties and their respective successors and permitted assigns and nothing herein, express or implied, is intended to or shall confer upon any other person or entity any legal or equitable right, benefit or remedy of any nature whatsoever under or by reason of this Agreement.

22. Waivers. No waiver by either Party of any of the provisions hereof shall be effective unless explicitly set forth in writing and signed by the Party so waiving. No waiver by either Party shall operate or be construed as a waiver in respect of any failure, breach, or default not expressly identified by such written waiver, whether of a similar or different character, and whether occurring before or after that waiver. No failure to exercise, or delay in exercising, any right, remedy, power, or privilege arising from this Agreement shall operate or be construed as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power, or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power, or privilege.

23. Interpretation. Each Party acknowledges that it has been represented by counsel of its choice throughout all negotiations that have preceded the execution of this Agreement and that it has executed the same with the advice of said counsel. Each Party and its respective counsel cooperated and participated in the drafting and preparation of this Agreement and the documents referred to herein, and any and all drafts relating thereto exchanged among the parties shall be deemed the work product of the Parties and may not be construed against either Party by reason of its drafting or preparation. Accordingly, any rule of law or any legal decision that would require interpretation of any ambiguities in this Agreement against either Party that drafted or prepared it is of no application and is expressly waived by each Party hereto, and any controversy over interpretations of this Agreement shall be decided without regard to events of drafting or preparation. The headings set forth in this Agreement are for convenience of reference purposes only and shall not affect or be deemed to affect in any way the meaning or interpretation of this Agreement or any term or provision of this Agreement. In this Agreement, unless a clear contrary intention appears, (a) the word “including” (in its various forms) means “including, but not limited to;” (b) the words “hereunder,” “hereof,” “hereto” and words of similar import are references in this Agreement as a whole and not to any particular provision of this Agreement; (c) the word “or” is not exclusive; (d) references to “Sections” in this Agreement are references to Sections of this Agreement unless otherwise indicated; and (e) whenever the context requires, the masculine gender shall include the feminine and neuter genders.

(Remainder of Page Intentionally Left Blank)

IN WITNESS WHEREOF, the Parties have executed this Agreement to be effective as of the Effective Date.

The Company:

GREEN PLAINS INC.

By: /s/ Todd Becker

Name: Todd Becker

Title: President and Chief Executive Officer

Signature Page to

Cooperation Agreement

The Investor:

ANCORA HOLDINGS GROUP, LLC

By: /s/ Frederick DiSanto

Name: Frederick DiSanto

Title: Chairman and Chief Executive Officer

Signature Page to

Cooperation Agreement

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

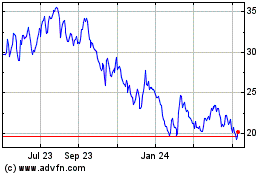

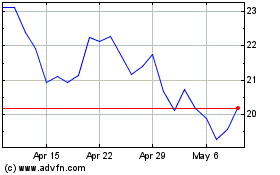

Green Plains (NASDAQ:GPRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Green Plains (NASDAQ:GPRE)

Historical Stock Chart

From Apr 2023 to Apr 2024