U.S. Index Futures Dip Ahead of Key Earnings Reports, Oil Prices Climb

February 07 2024 - 6:17AM

IH Market News

In Wednesday’s pre-market, U.S. index futures show a negative

trend, reflecting investor uncertainty as they await a new round of

quarterly reports from renowned companies.

At 5:49 AM, Dow Jones futures (DOWI:DJI) fell 38 points, or

0.10%. S&P 500 futures dropped 0.07%, and Nasdaq-100 futures

were stable. The 10-year Treasury bond yield was at 4.121%.

In the commodities market, West Texas Intermediate crude oil for

March rose 0.67%, to $73.80 per barrel. Brent crude for April

increased by 0.61%, to around $79.07 per barrel. Iron ore with a

62% concentration, traded on the Dalian exchange, rose 1.12%, to

$132.75 per ton.

In today’s US economic agenda, investors await the 7:30 AM

release of the Trade Balance data for December. The LSEG consensus

anticipates a $62.2 billion deficit in this indicator. Later, at

10:30 AM, the weekly report on oil inventories will be announced.

According to LSEG projections, an increase of 2.133 million barrels

is expected.

Asian markets closed mixed today, with Chinese exchanges

continuing to rise in response to measures taken by Beijing to stem

losses in local markets. Yesterday, a major investment fund and

China’s securities regulator intervened to stabilize the country’s

exchanges, which were suffering from concerns about economic

recovery. Meanwhile, the Shanghai SE (China) rose 1.44%, the Nikkei

(Japan) fell 0.11%, the Hang Seng Index (Hong Kong) retreated

0.34%, the Kospi (South Korea) advanced 1.30%, and the ASX 200

(Australia) gained 0.45%.

European markets are currently operating without a clear

direction, reflecting the ongoing uncertainty surrounding the

possibility of interest rate cuts. This uncertainty was sparked by

comments from the US Federal Reserve Chairman, Jerome Powell, last

week, suggesting that investors may need to wait longer than

initially expected for changes in central bank interest rate

policy. The UK’s FTSE 100 and Germany’s DAX are recording slight

declines. Meanwhile, France’s CAC 40 and Italy’s FTSE MIB are

posting modest gains. The STOXX 600 index, which encompasses a

broad range of European companies, is experiencing a slight

decline.

On Tuesday, US markets closed slightly higher. The Dow Jones

increased by 0.37%, the S&P 500 by 0.23%, and the Nasdaq by

0.07%. Concerns about a possible interest rate cut in March

diminished, while companies such as Palantir

(NYSE:PLTR) and Spotify (NYSE:SPOT) had notable

performances. The airline sector recovered, and semiconductor

stocks fell.

For Wednesday’s quarterly results, financial reports are

scheduled to be presented by Alibaba Group

(NYSE:BABA), Uber (NYSE:UBER), CVS

Health (NYSE:CVS), Roblox (NYSE:RBLX),

Hilton (NYSE:HLT), Yum! Brands

(NYSE:YUM), among others, before the market opens.

After the close, numbers from PayPal

(NASDAQ:PYPL), Walt Disney (NYSE:DIS),

Arm (NASDAQ:ARM), Wynn Resorts

(NASDAQ:WYNN), Mattel (NASDAQ:MAT),

McKesson (NYSE:MCK), Confluent

(NASDAQ:CFLT), and more are awaited.

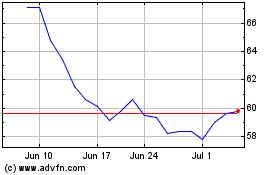

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

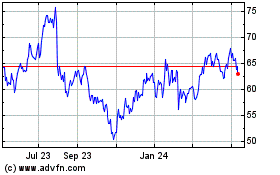

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Apr 2023 to Apr 2024