As filed with the Securities and Exchange Commission on February 6, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TALPHERA, INC.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

41-2193603

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification Number)

|

1850 Gateway, Suite 175

San Mateo, CA 94404

(650) 216-3500

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Vincent J. Angotti

Chief Executive Officer

1850 Gateway Drive, Suite 175

San Mateo, CA 94404

(650) 216-3500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

John T. McKenna

Cooley LLP

3175 Hanover Street

Palo Alto, California 94304

(650) 843-5000

|

Thomas P. McCracken

General Counsel

1850 Gateway Drive, Suite 175

San Mateo, CA 94404

(650) 216-3500

|

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| |

|

|

|

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

|

|

| Emerging growth company |

☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated February 6, 2024

PRELIMINARY PROSPECTUS

Up to 7,792,208 Shares of Common Stock Issuable Upon Exercise of Pre-Funded Warrants

This prospectus relates to the proposed resale from time to time by the selling stockholders of up to 7,792,208 shares of common stock issuable upon exercise of pre-funded warrants.

The selling stockholders purchased the pre-funded warrants from us pursuant to securities purchase agreements, dated January 17, 2024.

We are not selling any of our common stock pursuant to this prospectus, and we will not receive any proceeds from the sale of our common stock offered by this prospectus by the selling stockholders.

The selling stockholders may offer and sell or otherwise dispose of the shares of our common stock described in this prospectus from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. The selling stockholders will bear all underwriting fees, commissions and discounts, if any, attributable to the sales of shares and any transfer taxes. We will bear all other costs, expenses and fees in connection with the registration of the shares. See “Plan of Distribution” for more information about how the selling stockholders may sell or dispose of their shares of our common stock.

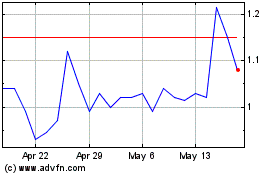

Our common stock is listed on The Nasdaq Global Market under the trading symbol “TLPH.” On February 2, 2024, the last reported sale price of the common stock was $0.94 per share.

Investing in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” on page 3 of this prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024.

TABLE OF CONTENTS

| |

Page |

| |

|

| ABOUT THIS PROSPECTUS |

ii |

| |

|

| PROSPECTUS SUMMARY |

1 |

| |

|

| RISK FACTORS |

3 |

| |

|

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS |

4 |

| |

|

| USE OF PROCEEDS |

7 |

| |

|

| DESCRIPTION OF CAPITAL STOCK |

8 |

| |

|

| SELLING STOCKHOLDERS |

11 |

| |

|

| PLAN OF DISTRIBUTION |

14 |

| |

|

| LEGAL MATTERS |

16 |

| |

|

| EXPERTS |

16 |

| |

|

| WHERE YOU CAN FIND ADDITIONAL INFORMATION |

16 |

| |

|

| INCORPORATION OF CERTAIN INFORMATION BY REFERENCE |

17 |

i

ABOUT THIS PROSPECTUS

Neither we nor the selling stockholders have authorized anyone to provide you with any information other than that contained in, or incorporated by reference into, this prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares of our common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should not assume that the information contained in or incorporated by reference in this prospectus is accurate as of any date other than their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section titled “Where You Can Find Additional Information.”

Unless the context indicates otherwise, as used in this prospectus, the terms “Talphera,” “Talphera, Inc.,” “we,” “us” and “our” refer to Talphera, Inc., a Delaware corporation.

ii

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus or incorporated by reference in this prospectus, and does not contain all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus, including the risks of investing in our securities discussed under the heading “Risk Factors” contained in this prospectus and under similar headings in the other documents that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

Talphera, Inc.

Overview

We are a specialty pharmaceutical company focused on the development and commercialization of innovative therapies for use in medically supervised settings. Our lead product candidate, Niyad™, is a lyophilized formulation of nafamostat and is currently being studied under an investigational device exemption as an anticoagulant for the extracorporeal circuit, and has received Breakthrough Device Designation Status from the U.S. Food and Drug Administration, or the FDA. We are also developing two pre-filled syringes in-licensed from our partner Laboratoire Aguettant: Fedsyra™, a pre-filled ephedrine syringe, and PFS-02, a pre-filled phenylephrine syringe. Our strategy is focused on developing, obtaining approval and commercializing our product candidates, Niyad and the pre-filled syringes. We are focused on submitting a Premarket Approval application for Niyad to the FDA in the second half of 2024.

In April 2023, we divested DSUVIA to Alora Pharmaceuticals, LLC, or Alora, who will continue to commercialize the product and pay us sales-based milestone and other payments. We believe this will maximize the value of DSUVIA as Alora has more available resources to invest on DSUVIA commercialization and as a result can execute a more robust commercial plan to support DSUVIA sales expansion, while we further reduce our operating costs. We have no plans on further developing or commercializing any of our other sufentanil sublingual products that were previously our product candidates. In January 2024, we and XOMA (US) entered into a payment interest purchase agreement pursuant to which we sold our right, title and interest in and to certain amounts payable to us pursuant to our 2023 asset purchase agreement and marketing agreement with Vertical Pharmaceuticals, LLC with respect to net sales of DSUVIA®, DZUVEO® or any other single-dose pharmaceutical product for use in medically supervised settings containing a sublingual tablet that includes sufentanil as the sole active ingredient, as a 30 mcg tablet or other dosage form or strength as reasonably necessary for lifecycle management, excluding sales of such product by Laboratoire Aguettant.

Private Placement of Pre-Funded Warrants

On January 17, 2024, we entered into securities purchase agreements with the selling stockholders pursuant to which we issued in a private placement transaction, or the Private Placement, pre-funded warrants at a purchase price of $0.769 per share, to purchase up to an aggregate of 7,792,208 shares of common stock at an exercise price of $0.001 per share. The pre-funded warrants are exercisable immediately and have an unlimited term.

Nantahala Board Nomination Right

Pursuant to the securities purchase agreements with Nantahala Capital Management, LLC and its affiliates (collectively, Nantahala), for so long as Nantahala beneficially own securities representing at least 10% of the voting power of all our common stock then outstanding (including for purposes of such calculation, assuming the exercise in full of any derivative securities then beneficially owned by Nantahala and not giving effect to any contractual prohibition on exercise contained therein), Nantahala shall have the right, subject to compliance with the applicable rules and regulations of The Nasdaq Global Market, to designate one member of our board of directors, or the Nantahala Board Representative. In connection with this nomination right, we appointed Abhinav Jain as the Nantahala Board Representative to serve as a Class II Director to hold office for the balance of a term expiring at our 2025 annual meeting of stockholders and until his successor has been duly elected and qualified, or until his earlier death, resignation or removal. We also agreed that if requested by Nantahala, and subject to compliance with the applicable rules and regulations of The Nasdaq Global Market, the Nantahala Board Representative shall be appointed to such committees of the board of directors that now exist or may be established pursuant to our governing documents or by the board of directors from time to time. For as long as Nantahala holds the right to designate a member of the board of directors, we will not, without the affirmative consent of the Nantahala Board Representative, increase the size of the board of directors to more than ten members.

Use of Proceeds

We will not receive any of the proceeds from the sale of shares of our common stock by the selling stockholders in this offering. The selling stockholders will receive all of the proceeds from the sale of shares of our common stock hereunder.

The Nasdaq Global Market Listing

Our common stock is listed on The Nasdaq Global Market under the symbol “TLPH.”

Company Information

We were originally incorporated as SuRx, Inc. in Delaware on July 13, 2005, and changed our name to AcelRx Pharmaceuticals, Inc. on January 6, 2006, and mostly recently to Talphera, Inc. on January 9, 2024. Our principal executive offices are located at 1850 Gateway Drive, Suite 175, San Mateo, California 94404, and our telephone number is (650) 216-3500. Our website address is www.talphera.com. The information contained in, or that can be accessed through, our website is not part of, and is not incorporated into, this prospectus and should not be considered part of this prospectus.

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before deciding whether to invest in our common stock, you should consider carefully the risks and uncertainties described under the heading “Risk Factors” contained in our most recent annual report on Form 10-K, as updated by our subsequent quarterly reports on Form 10-Q and other filings we make with the Securities and Exchange Commission, or the SEC, which are incorporated by reference into this prospectus in their entirety, together with other information in this prospectus and the documents incorporated by reference. The risks described in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occur, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below titled “Special Note Regarding Forward-Looking Statements.”

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents we have filed with the SEC that are incorporated by reference contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements relate to future events or to our future operating or financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Forward-looking statements may include, but are not limited to, statements about:

| |

●

|

our ability to obtain additional required financing and to continue as a going concern;

|

| |

●

|

our ability to manage our operating costs and reduce our cash burn;

|

| |

●

|

the accuracy of our estimates regarding the sufficiency of our cash resources, future revenues, expenses, and capital requirements;

|

| |

●

|

our ability to maintain listing of our securities trading on the Nasdaq exchange;

|

| |

●

|

the historical performance and high volatility in the market price of our common stock;

|

| |

●

|

macroeconomic uncertainties, including inflationary pressures, domestic and global supply chain disruptions, labor shortages, significant volatility in global markets, recession risks and the worldwide COVID-19 pandemic;

|

| |

●

|

our ability to conduct ourselves, or through a contract research organization, clinical trials in a timely and effective manner to advance the development of our product candidates;

|

| |

●

|

our ability to successfully file for and obtain regulatory approval for, and then successfully launch and commercialize our developmental product candidates, including our lead nafamostat developmental product candidate, Niyad™;

|

| |

●

|

the success of our corporate partner, Vertical Pharmaceuticals LLC, a wholly owned subsidiary of Alora Pharmaceuticals, LLC, or Alora, in integrating and commercializing the DSUVIA asset in the United States, including their effectiveness in marketing, sales, and distribution of the DSUVIA product, itself or with potential collaborators;

|

| |

●

|

the extent of future sales of DSUVIA by Alora to the Department of Defense;

|

| |

●

|

the size and growth potential of the potential markets for our developmental product candidates in the United States and in other jurisdictions, and our ability to serve those markets;

|

| |

●

|

our ability to realize the expected benefits and potential value created by the acquisition of Lowell Therapeutics, Inc., for our stockholders, on a timely basis or at all;

|

| |

●

|

our ability to develop sales and marketing capabilities in a timely fashion, whether alone through recruiting qualified employees, by engaging a contract sales organization, or with potential future collaborators;

|

| |

●

|

successfully establishing and maintaining commercial manufacturing and supply chain relationships with domestic and global third-party service providers;

|

| |

●

|

our ability to manage effectively, and the impact of any costs associated with, potential governmental investigations, inquiries, regulatory actions or lawsuits that may be, or have been, brought against us;

|

| |

●

|

our ability to obtain adequate government or third-party payer reimbursement for our developmental product candidates, if approved;

|

| |

●

|

our ability to gain access to formularies and establish and then maintain effective relationships with pharmaceutical benefit managers and/or group purchasing organizations for our developmental product candidates, if approved;

|

| |

●

|

our ability to attract additional collaborators with development, regulatory and commercialization expertise;

|

| |

●

|

our ability to identify and secure potential strategic partners to develop, secure regulatory approval for and then commercialize our developmental product candidates;

|

| |

●

|

our ability to successfully retain our key commercial, scientific, engineering, medical or management personnel and hire new personnel as needed;

|

| |

●

|

existing and future legislation and other regulatory developments in the United States and foreign countries;

|

| |

●

|

the performance of our third-party suppliers and manufacturers, including any supply chain impacts or work limitations;

|

| |

●

|

the success of competing therapies that are or become available; and

|

| |

●

|

our ability to obtain and maintain intellectual property protection for our approved products and product candidates.

|

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential” and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events, are based on assumptions and are subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We discuss in greater detail, and incorporate by reference into this prospectus in their entirety, many of these risks under the section titled “Risk Factors” in our most recent annual report on Form 10-K, and in our subsequent quarterly reports on Form 10-Q, as updated by our subsequent filings under the Exchange Act, which are incorporated herein by reference, as may be updated or superseded by the risks and uncertainties described under similar headings in the other documents that are filed after the date hereof and incorporated by reference into this prospectus. Also, these forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement.

These risks are not exhaustive. Other sections of this prospectus may include additional factors that could harm our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time, and it is not possible for our management to predict all risk factors nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ from those contained in, or implied by, any forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this prospectus or to conform these statements to actual results or to changes in our expectations.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance and achievements may be different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

USE OF PROCEEDS

All the shares of our common stock to be sold pursuant to this prospectus will be sold by the selling stockholders. We will not receive any of the proceeds from such sales.

DESCRIPTION OF CAPITAL STOCK

Summary

Our authorized capital stock consists of 200,000,000 shares of common stock and 10,000,000 shares of preferred stock, $0.001 par value. As of January 31, 2024, we had 16,952,519 shares of common stock issued and outstanding and no shares of preferred stock issued and outstanding.

A description of the material terms and provisions of our amended and restated certificate of incorporation and amended and restated bylaws affecting the rights of holders of our capital stock is set forth below. The description is intended as a summary, and is qualified in its entirety by reference to our amended and restated certificate of incorporation and our amended and restated bylaws which are incorporated by reference into the registration statement of which this prospectus is a part.

Common Stock

Voting Rights. Each holder of common stock is entitled to one vote for each share on all matters submitted to a vote of the stockholders, including the election of directors. In all matters other than the election of directors, the affirmative vote of the majority of shares present in person, by remote communication, or represented by proxy at a meeting of the stockholders and entitled to vote generally on the subject matter shall be the act of the stockholders. Directors shall be elected by a plurality of the votes of the shares present in person, by remote communication, or represented by proxy at a meeting of the stockholders and entitled to vote generally on the election of directors. Our stockholders do not have cumulative voting rights in the election of directors. Accordingly, the holders of a majority of the voting shares are able to elect all of the directors to be elected at any particular time.

Dividends. Subject to preferences that may be applicable to any then outstanding preferred stock, holders of our common stock are entitled to receive dividends, if any, as may be declared from time to time by our board of directors out of funds legally available if our board of directors, in its discretion, determines to issue dividends and then only at the times and in the amounts that our board of directors may determine.

Liquidation. In the event of our liquidation, dissolution or winding up, holders of common stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities and the satisfaction of any liquidation preference granted to the holders of any then outstanding shares of preferred stock.

Rights. Holders of common stock have no preemptive, conversion, subscription or other rights, and there are no redemption or sinking fund provisions applicable to shares of common stock.

Fully Paid and Nonassessable. All of outstanding shares of common stock are fully paid and nonassessable.

Preferred Stock

Our board of directors may, without further action by our stockholders, fix the rights, preferences, privileges and restrictions of up to an aggregate of 10,000,000 shares of preferred stock in one or more series and authorize their issuance. These rights, preferences and privileges could include dividend rights, conversion rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting any series or the designation of such series, any or all of which may be greater than the rights of our common stock. The issuance of our preferred stock could adversely affect the voting power of holders of our common stock, and the likelihood that such holders will receive dividend payments and payments upon liquidation. In addition, the issuance of preferred stock could have the effect of delaying, deferring or preventing a change of control or other corporate action.

Anti-Takeover Effects of Provisions of our Certificate of Incorporation and Bylaws and Delaware Law

Certificate of Incorporation and Bylaws. Our amended and restated certificate of incorporation and amended and restated bylaws include a number of provisions that may deter or impede hostile takeovers or changes of control or management. These provisions include:

Issuance of Undesignated Preferred Stock. Under our certificate of incorporation, our board of directors has the authority, without further action by the stockholders, to issue up to 10,000,000 shares of undesignated preferred stock with rights and preferences, including voting rights, designated from time to time by the board of directors. The existence of authorized but unissued shares of preferred stock enables our board of directors to make it more difficult or to discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest or otherwise.

Classified Board. Our certificate of incorporation provides for a classified board of directors consisting of three classes of directors, with staggered three-year terms. Only one class of directors will be elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. This provision may have the effect of delaying a change in control of the board.

Board of Directors Vacancies. Our Certificate of Incorporation and Bylaws authorize only our board of directors to fill vacant directorships. In addition, the number of directors constituting our board of directors may be set only by resolution adopted by a majority vote of our entire board of directors. These provisions prevent a stockholder from increasing the size of our board of directors and gaining control of our board of directors by filling the resulting vacancies with its own nominees.

Stockholder Action; Special Meetings of Stockholders. Our certificate of incorporation provides that our stockholders may not take action by written consent and may only take action at annual or special meetings of our stockholders. Stockholders will not be permitted to cumulate their votes for the election of directors. Our bylaws further provide that special meetings of our stockholders may be called only by a majority of our board of directors, the chairman of our board of directors, or our chief executive officer. These provisions may prevent stockholders from corporate actions as stockholders at times when they otherwise would like to do so.

Advance Notice Requirements for Stockholder Proposals and Director Nominations. Our bylaws provide advance notice procedures for stockholders seeking to bring business before our annual meeting of stockholders, or to nominate candidates for election as directors at our annual meeting of stockholders. Our bylaws also specify certain requirements as to the form and content of a stockholder’s notice. These provisions may make it more difficult for our stockholders to bring matters before our annual meeting of stockholders or to nominate directors at our annual meeting of stockholders.

These provisions are intended to enhance the likelihood of continued stability in the composition of our board of directors and its policies and to discourage certain types of transactions that may involve an actual or threatened acquisition of us. These provisions are designed to reduce our vulnerability to an unsolicited acquisition proposal. The provisions also are intended to discourage certain tactics that may be used in proxy fights. However, these provisions could have the effect of discouraging others from making tender offers for our shares and, as a consequence, they may also reduce fluctuations in the market price of our shares that could result from actual or rumored takeover attempts.

Section 203 of the Delaware General Corporation Law

We are subject to the provisions of Section 203 of the Delaware General Corporation Law regulating corporate takeovers. This section prevents some Delaware corporations from engaging, under some circumstances, in a business combination, which includes a merger or sale of at least 10% of the corporation’s assets with any interested stockholder, meaning a stockholder who, together with affiliates and associates, owns or, within three years prior to the determination of interested stockholder status, did own 15% or more of the corporation’s outstanding voting stock, unless:

| |

●

|

the transaction is approved by the board of directors prior to the time that the interested stockholder became an interested stockholder;

|

| |

●

|

upon consummation of the transaction which resulted in the stockholder’s becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced; or

|

| |

●

|

at or subsequent to such time that the stockholder became an interested stockholder the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders by at least two-thirds of the outstanding voting stock which is not owned by the interested stockholder.

|

In general, Section 203 defines “business combination” to include the following:

| |

●

|

any merger or consolidation involving the corporation and the interested stockholder;

|

| |

●

|

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

|

| |

●

|

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

|

| |

●

|

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock or any class or series of the corporation beneficially owned by the interested stockholder; or

|

| |

●

|

the receipt by the interested stockholder of the benefit of any loss, advances, guarantees, pledges or other financial benefits by or through the corporation.

|

In general, Section 203 defines an “interested stockholder” as an entity or person who, together with the person’s affiliates and associates, beneficially owns, or within three years prior to the time of determination of interested stockholder status did own, 15% or more of the outstanding voting stock of the corporation.

A Delaware corporation may “opt out” of these provisions with an express provision in its original certificate of incorporation or an express provision in its certificate of incorporation or bylaws resulting from a stockholders’ amendment approved by at least a majority of the outstanding voting shares. We have not “opted out” of these provisions and do not plan to do so. The statute could prohibit or delay mergers or other takeover or change in control attempts and, accordingly, may discourage attempts to acquire us.

Listing on The Nasdaq Global Market

Our common stock is listed on The Nasdaq Global Market under the symbol “TLPH.”

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Computershare, Inc.: 1-800-736-3001. The transfer agent’s address is 250 Royall Street, Canton, Massachusetts 02021.

SELLING STOCKHOLDERS

The selling stockholders may offer and sell, from time to time, any or all of the shares of common stock being offered for resale by this prospectus, which consists of up to 7,792,208 shares of common stock issuable upon exercise of the pre-funded warrants. For additional information regarding the issuance of these securities, see the section titled “Prospectus Summary - Private Placement of Pre-Funded Warrants.” The selling stockholders have not had any material relationship with us within the past three years, except for (i) the ownership of our securities and (ii) the board of director nomination right we granted to Nantahala Management, LLC in connection with the Private Placement, see the section titled “Prospectus Summary – Nantahala Board Nomination Right.”

As used in this prospectus, the term “selling stockholders” includes the selling stockholders listed in the table below, together with any additional selling stockholders listed in a subsequent amendment to this prospectus, and their donees, pledgees, assignees, transferees, distributees and successors-in-interest that receive shares in any non-sale transfer after the date of this prospectus.

In accordance with the terms of a registration rights agreement with the selling stockholders, this prospectus covers the resale of the maximum number of shares of common stock issuable upon exercise of the pre-funded warrants without regard to any limitations on the exercise of such warrants. Under the terms of the pre-funded warrants held by selling stockholders, a selling stockholder may not exercise any such warrants to the extent such exercise would cause such selling stockholder, together with its affiliates and attribution parties, to beneficially own a number of shares of common stock which would exceed 4.99% or 9.99%, as applicable, of our then outstanding shares common stock following such exercise, excluding for purposes of such determination shares of common stock issuable upon exercise of such warrants which have not been exercised.

The table below lists the selling stockholders and other information regarding the beneficial ownership of the shares of common stock by each of the selling stockholders as of January 31, 2024, assuming the full exercise of the pre-funded warrants held by the selling stockholders on that date, without regard to any limitations on exercises. The following table also provides the number of shares of common stock that may be sold by each selling stockholder under this prospectus and that each selling stockholder will beneficially own assuming all the shares of common stock that may be offered pursuant to this prospectus are sold. Because each selling stockholder may dispose of all, none or some portion of their shares of common stock, no estimate can be given as to the number of shares of common stock that will be beneficially owned by a selling stockholder upon termination of this offering. For purposes of the table below; however, we have assumed that after termination of this offering none of the shares of common stock covered by this prospectus will be beneficially owned by the selling stockholders and further assumed that the selling stockholders will not acquire beneficial ownership of any additional securities during the offering. In addition, the selling stockholders may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, our securities in transactions exempt from the registration requirements of the Securities Act after the date on which the information in the table is presented. See the section titled “Plan of Distribution.”

| |

|

Beneficial Ownership

Prior to This Offering

|

|

|

Number of

Shares Being

|

|

|

Beneficial Ownership

After This Offering

|

|

|

Name of Selling Stockholder

|

|

Shares

|

|

|

%

|

|

|

Offered |

|

|

Shares

|

|

|

%

|

|

|

Blackwell Partners LLC – Series A(1)

|

|

|

6,154,735 |

|

|

|

27.5 |

% |

|

|

2,322,142 |

|

|

|

3,832,593 |

|

|

|

19.1 |

% |

|

Investor Company ITF Rosalind Master Fund L.P.(2)

|

|

|

5,664,437 |

|

|

|

25.9 |

|

|

|

1,298,701 |

|

|

|

4,365,736 |

|

|

|

21.2 |

|

|

Pinehurst Partners, L.P.(3)

|

|

|

2,272,728 |

|

|

|

11.8 |

|

|

|

2,272,728 |

|

|

|

- |

|

|

|

- |

|

|

Nantahala Capital Partners Limited Partnership(4)

|

|

|

2,007,594 |

|

|

|

10.8 |

|

|

|

639,596 |

|

|

|

1,073,228 |

|

|

|

6.1 |

|

|

NCP RFM LP(5)

|

|

|

1,806,557 |

|

|

|

9.7 |

|

|

|

934,366 |

|

|

|

1,166,961 |

|

|

|

6.5 |

|

|

Corbin Sustainability & Engagement Fund, L.P.(6)

|

|

|

324,675 |

|

|

|

1.9 |

|

|

|

324,675 |

|

|

|

- |

|

|

|

- |

|

|

(1)

|

The shares reported under “Beneficial Ownership Prior to This Offering” consist of the following securities: (i) 2,322,142 shares of common stock issuable upon the exercise of pre-funded warrants issued in the Private Placement, (ii) 707,153 shares of common stock, (iii) 570,378 shares of common stock issuable upon the exercise of pre-funded warrants issued in July 2023 in connection with a prior private placement transaction, (iv) 1,390,246 shares of common stock issuable upon the exercise of Series A common stock warrants, and (v) 1,390,246 shares of common stock issuable upon the exercise of Series B common stock warrants. Nantahala Capital Management, LLC is a Registered Investment Adviser and has been delegated the legal power to vote and/or direct the disposition of such securities on behalf of the selling stockholder as a General Partner, Investment Manager, or Sub-Advisor and would be considered the beneficial owner of such securities. The above shall not be deemed to be an admission by the record owners or the selling stockholder that they are themselves beneficial owners of these securities for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or any other purpose. Wilmot B. Harkey and Daniel Mack are managing members of Nantahala Capital Management, LLC and may be deemed to have voting and dispositive power over the shares held by the selling stockholder. The pre-funded warrants are subject to a beneficial ownership limitation of 9.99%, which such limitation restricts the selling stockholder from exercising that portion of the pre-funded warrants that would result in the selling stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The address of Blackwell Partners LLC – Series A is c/o Nantahala Capital Management, LLC, 130 Main St. 2nd Floor, New Canaan, CT 06840.

|

|

(2)

|

The shares reported under “Beneficial Ownership Prior to This Offering” consist of the following securities: (i) 1,298,701 shares of common stock issuable upon the exercise of pre-funded warrants issued in the Private Placement, (ii) 758,966 shares of common stock, (iii) 665,590 shares of common stock issuable upon the exercise of pre-funded warrants issued in July 2023 in connection with a prior private placement transaction, (iv) 1,470,590 shares of common stock issuable upon the exercise of Series A common stock warrants, and (v) 1,470,590 shares of common stock issuable upon the exercise of Series B common stock warrants. Each of Rosalind Advisors, Inc., Steven Salamon, and Gilad Aharon have shared voting and dispositive power with respect to these securities. The pre-funded warrants are subject to a beneficial ownership limitation of 4.99%, which such limitation restricts the selling stockholder from exercising that portion of the pre-funded warrants that would result in the selling stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The address for Rosalind Advisors, Inc., Mr. Salamon and Mr. Aharon is 15 Wellesley Street West, Suite 326, Toronto, Ontario, M4Y 0G7 Canada. The address of Investor Company ITF Rosalind Master Fund L.P. is c/o TD Waterhouse, 77 Bloor Street West, 3rd Floor, Toronto, ON M5S 1M2 Canada.

|

|

(3)

|

The shares reported under “Beneficial Ownership Prior to This Offering” consist of 2,272,728 shares of common stock issuable upon the exercise of pre-funded warrants issued in the Private Placement. Nantahala Capital Management, LLC is a Registered Investment Adviser and has been delegated the legal power to vote and/or direct the disposition of such securities on behalf of the selling stockholder as a General Partner, Investment Manager, or Sub-Advisor and would be considered the beneficial owner of such securities. The above shall not be deemed to be an admission by the record owners or the selling stockholder that they are themselves beneficial owners of these securities for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or any other purpose. Wilmot B. Harkey and Daniel Mack are managing members of Nantahala Capital Management, LLC and may be deemed to have voting and dispositive power over the shares held by the selling stockholder. The pre-funded warrants are subject to a beneficial ownership limitation of 9.99%, which such limitation restricts the selling stockholder from exercising that portion of the pre-funded warrants that would result in the selling stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The address of Pinehurst Partners, L.P. is c/o Corporation Trust Center, 1209 Orange Street, Wilmington, DE 19801.

|

|

(4)

|

The shares reported under “Beneficial Ownership Prior to This Offering” consist of the following securities: (i) 934,366 shares of common stock issuable upon the exercise of pre-funded warrants issued in the Private Placement, (ii) 321,884 shares of common stock, (iii) 375,672 shares of common stock issuable upon the exercise of Series A common stock warrants, and (iv) 375,672 shares of common stock issuable upon the exercise of Series B common stock warrants. Nantahala Capital Management, LLC is a Registered Investment Adviser and has been delegated the legal power to vote and/or direct the disposition of such securities on behalf of the selling stockholder as a General Partner, Investment Manager, or Sub-Advisor and would be considered the beneficial owner of such securities. The above shall not be deemed to be an admission by the record owners or the selling stockholder that they are themselves beneficial owners of these securities for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or any other purpose. Wilmot B. Harkey and Daniel Mack are managing members of Nantahala Capital Management, LLC and may be deemed to have voting and dispositive power over the shares held by the selling stockholder. The pre-funded warrants are subject to a beneficial ownership limitation of 9.99%, which such limitation restricts the selling stockholder from exercising that portion of the pre-funded warrants that would result in the selling stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The address of Nantahala Capital Partners Limited Partnership is 130 Main St. 2nd Floor, New Canaan, CT 06840.

|

|

(5)

|

The shares reported under “Beneficial Ownership Prior to This Offering” consist of the following securities: (i) 639,596 shares of common stock issuable upon the exercise of pre-funded warrants issued in the Private Placement, (ii) 208,482 shares of common stock, (iii) 180,505 shares of common stock issuable upon the exercise of pre-funded warrants issued in July 2023 in connection with a prior private placement transaction, (iv) 439,965 shares of common stock issuable upon the exercise of Series A common stock warrants, and (v) 439,965 shares of common stock issuable upon the exercise of Series B common stock warrants. Nantahala Capital Management, LLC is a Registered Investment Adviser and has been delegated the legal power to vote and/or direct the disposition of such securities on behalf of the selling stockholder as a General Partner, Investment Manager, or Sub-Advisor and would be considered the beneficial owner of such securities. The above shall not be deemed to be an admission by the record owners or the selling stockholder that they are themselves beneficial owners of these securities for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or any other purpose. Wilmot B. Harkey and Daniel Mack are managing members of Nantahala Capital Management, LLC and may be deemed to have voting and dispositive power over the shares held by the selling stockholder. The pre-funded warrants are subject to a beneficial ownership limitation of 9.99%, which such limitation restricts the selling stockholder from exercising that portion of the pre-funded warrants that would result in the selling stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The address of NCP RFM LP is 130 Main St. 2nd Floor, New Canaan, CT 06840.

|

|

(6)

|

The shares reported under “Beneficial Ownership Prior to This Offering” consist of 324,675 shares of common stock issuable upon the exercise of pre-funded warrants issued in the Private Placement. Corbin Capital Partners, L.P., a Delaware limited partnership (“CCP”), is the investment manager of the selling stockholder and may be deemed to have beneficial ownership over the securities held by the selling stockholder. Corbin Capital Partners GP, LLC (“Corbin GP”) is the general partner of CCP and may be deemed to share beneficial ownership over the securities held by the selling stockholder over which CCP shares beneficial ownership. Craig Bergstrom, as the Chief Investment Officer of CCP, makes voting and investment decisions for the Selling Holder. Each of CCP, Corbin GP and Craig Bergstrom disclaim beneficial ownership of all reported securities except to the extent of its or his pecuniary interests therein and the inclusion of such shares in this prospectus shall not be deemed to be an admission of beneficial ownership of such shares for the purposes of Section 16 or otherwise. The pre-funded warrants are subject to a beneficial ownership limitation of 9.99%, which such limitation restricts the selling stockholder from exercising that portion of the pre-funded warrants that would result in the selling stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The address of Corbin Sustainability & Engagement Fund, L.P. is 590 Madison Avenue, 31st Floor, New York, New York 10022.

|

PLAN OF DISTRIBUTION

Each selling stockholder and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their shares of common stock covered hereby on The Nasdaq Global Market or any other stock exchange, market or trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. A selling stockholder may use any one or more of the following methods when selling such shares of common stock:

| |

●

|

ordinary brokerage transactions and transactions in which the broker‑dealer solicits purchasers;

|

| |

●

|

block trades in which the broker‑dealer will attempt to sell the shares of common stock as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

| |

●

|

purchases by a broker‑dealer as principal and resale by the broker‑dealer for its account;

|

| |

●

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

| |

●

|

privately negotiated transactions;

|

| |

●

|

settlement of short sales;

|

| |

●

|

in transactions through broker‑dealers that agree with the selling stockholders to sell a specified number of such shares of common stock at a stipulated price per security;

|

| |

●

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

| |

●

|

a combination of any such methods of sale; or

|

| |

●

|

any other method permitted pursuant to applicable law.

|

The selling stockholders may also sell the shares of common stock under Rule 144 or any other exemption from registration under the Securities Act of 1933, as amended, if available, rather than under this prospectus.

Broker‑dealers engaged by the selling stockholders may arrange for other brokers‑dealers to participate in sales. Broker‑dealers may receive commissions or discounts from the selling stockholders (or, if any broker‑dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

In connection with the sale of the shares of common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The selling stockholders may also sell the shares of common stock short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell the shares of the common stock. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of the shares of common stock offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholders and any broker-dealers or agents that are involved in selling the shares of common stock may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each selling stockholder has informed us that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the shares of common stock.

We are required to pay certain fees and expenses incurred by us incident to the registration of the shares of common stock. We have agreed to indemnify the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We have agreed to keep the registration statement of which this prospectus forms a part effective until the earlier of (i) the date on which the shares of common stock may be resold by the selling stockholders without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for us to be in compliance with the current public information under Rule 144 under the Securities Act or any other rule of similar effect, and (ii) all of the shares of common stock have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The shares of common stock will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the shares of common stock covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Securities Exchange Act of 1934, as amended, any person engaged in the distribution of the shares of common stock may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling stockholders will be subject to applicable provisions of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the selling stockholders or any other person. We will make copies of this prospectus available to the selling stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

Cooley LLP, Palo Alto, California, will pass upon the validity of the shares of our common stock offered by this prospectus.

EXPERTS

WithumSmith+Brown, PC, independent registered public accounting firm, has audited our consolidated financial statements and related schedule included in our Annual Report on Form 10-K for the year ended December 31, 2022, as set forth in their report dated March 31, 2023, which includes an explanatory paragraph relating to Talphera, Inc.’s (formerly known as AcelRx Pharmaceuticals, Inc.) ability to continue as a going concern, except for the effects of the discontinued operations disclosed in Note 3, as to which the date is July 31, 2023, which appears in our Current Report on Form 8‑K dated July 31, 2023, both of which are incorporated by reference in this prospectus and elsewhere in the registration statement. Such financial statements are incorporated by reference in reliance on WithumSmith+Brown, PC’s report, given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

This prospectus is part of the registration statement on Form S-3 we filed with the SEC under the Securities Act and does not contain all the information set forth in the registration statement. Whenever a reference is made in this prospectus to any of our contracts, agreements or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by reference into this prospectus for a copy of such contract, agreement or other document. Because we are subject to the information and reporting requirements of the Exchange Act, we file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. Our website address is http://www.talphera.com. Information contained on or accessible through our website is not a part of this prospectus and is not incorporated by reference herein, and the inclusion of our website address in this prospectus is an inactive textual reference only.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC prior to the date of this prospectus, while information that we file later with the SEC will automatically update and supersede the information in this prospectus. We incorporate by reference into this prospectus and the registration statement of which this prospectus is a part the information or documents listed below that we have filed with the SEC (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8‑K and exhibits filed on such form that are related to such items unless such Form 8‑K expressly provides to the contrary):

| |

●

|

our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 31, 2023; as amended by our Annual Report on Form 10-K/A for the year ended December 31, 2022, filed with the SEC on May 1, 2023;

|

| |

●

|

our Current Reports on Form 8‑K, which were filed with the SEC on March 16, 2023, March 30, 2023 (other than Item 2.02), April 7, 2023 (other than Item 7.01), April 28, 2023, June 15, 2023, July 21, 2023, August 1, 2023, September 22, 2023, October 5, 2023, October 10, 2023, October 20, 2023, January 9, 2024 (other than Item 7.01), January 18, 2024, and January 22, 2024 (other than Item 2.02 and Item 7.01); and

|

| |

●

|

the description of our common stock in our registration statement on Form 8-A filed with the SEC on February 1, 2011, as updated by Exhibit 4.1 to our Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC on March 15, 2021, and any amendments or reports filed for the purpose of updating such description.

|

All filings filed by us pursuant to the Exchange Act after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of the registration statement shall be deemed to be incorporated by reference into this prospectus.

We also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8‑K and exhibits filed on such form that are related to such items unless such Form 8‑K expressly provides to the contrary) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of such registration statement, until we file a post-effective amendment that indicates the termination of the offering of the securities made by this prospectus and will become a part of this prospectus from the date that such documents are filed with the SEC. Information in such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

You can request a copy of these filings, at no cost, by writing or telephoning us at the following address or telephone number:

Talphera, Inc.

1850 Gateway Drive, Suite 175

San Mateo, California 94404

Attn: Investor Relations

(650) 216-3500

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

Item 14.

|

Other Expenses of Issuance and Distribution.

|

The following table sets forth an estimate of the fees and expenses, other than the underwriting discounts and commissions, payable by us in connection with the issuance and distribution of the securities being registered. All the amounts shown are estimates, except for the SEC registration fee.

| |

|

Amount

|

|

|

SEC registration fee

|

|

$ |

1,093 |

|

|

Financial Industry Regulatory Authority filing fee

|

|

|

(1 |

) |

|

Accounting fees and expenses

|

|

|

25,000 |

|

|

Legal fees and expenses

|

|

|

35,000 |

|

|

Transfer agent and registrar fees and expenses

|

|

|

15,000 |

|

|

Miscellaneous fees and expenses

|

|

|

15,007 |

|

|

Total

|

|

$ |

91,100 |

|

|

(1)

|

This fee is calculated based on the securities offered and the number of issuances and accordingly cannot be estimated at this time.

|

|

Item 15.

|

Indemnification of Directors and Officers.

|

The following summary is qualified in its entirety by reference to the complete copy of the Delaware General Corporation Law, Talphera’s amended and restated certificate of incorporation, as amended, and Talphera’s amended and restated bylaws.

Section 145 of the Delaware General Corporation Law authorizes a court to award, or a corporation’s board of directors to grant indemnity to directors and officers under certain circumstances and subject to certain limitations. The terms of Section 145 of the Delaware General Corporation Law are sufficiently broad to permit indemnification under certain circumstances for liabilities, including reimbursement of expenses incurred, arising under the Securities Act of 1933, as amended.

As permitted by the Delaware General Corporation Law, Talphera’s amended and restated certificate of incorporation, as amended, contains provisions that eliminate the personal liability of its directors for monetary damages for any breach of fiduciary duties as a director, except liability for the following:

| |

●

|

any breach of the director’s duty of loyalty to Talphera or its stockholders;

|

| |

●

|

acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law;

|

| |

●

|

under Section 174 of the Delaware General Corporation Law (regarding unlawful dividends and stock purchases); or

|

| |

●

|

any transaction from which the director derived an improper personal benefit.

|

As permitted by the Delaware General Corporation Law, Talphera’s amended and restated bylaws provide that:

| |

●

|

Talphera is required to indemnify its directors and executive officers to the fullest extent permitted by the Delaware General Corporation Law, subject to very limited exceptions;

|

| |

●

|

Talphera may indemnify its other employees and agents as set forth in the Delaware General Corporation Law;

|

| |

●

|

Talphera is required to advance expenses, as incurred, to its directors and executive officers in connection with a legal proceeding to the fullest extent permitted by the Delaware General Corporation Law, subject to very limited exceptions; and

|

| |

●

|

the rights conferred in the bylaws are not exclusive.

|

Talphera has entered, and intends to continue to enter, into separate indemnification agreements with its directors and executive officers to provide these directors and executive officers additional contractual assurances regarding the scope of the indemnification set forth in Talphera’s amended and restated certificate of incorporation, as amended, and amended and restated bylaws and to provide additional procedural protections. At present, there is no pending litigation or proceeding involving a director or executive officer of Talphera regarding which indemnification is sought. The indemnification provisions in Talphera’s amended and restated certificate of incorporation, as amended, amended and restated bylaws and the indemnification agreements entered into or to be entered into between Talphera and each of its directors and executive officers may be sufficiently broad to permit indemnification of Talphera’s directors and executive officers for liabilities arising under the Securities Act. Insofar as indemnification for liabilities arising under the Securities Act of 1933, as amended, may be permitted to directors, officers and controlling persons of Talphera pursuant to the foregoing provisions, or otherwise, Talphera has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933, as amended, and is, therefore, unenforceable.

Talphera currently carries liability insurance for its directors and officers.

Talphera has entered into a registration rights agreement with the stockholders of the shares of common stock registered hereby which obligates the parties to indemnify, under certain circumstances, the other party, its officers, directors, and controlling persons within the meaning of the Securities Act of 1933, as amended, against certain liabilities.

|

(a)

|

The undersigned registrant hereby undertakes:

|

| |

(1)

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

| |

(i)

|

to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

| |

(ii)

|

to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

|

| |

(iii)

|

to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

provided, however, that paragraphs (1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

| |

(2)

|

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

| |

(3)

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

| |

(4)

|

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

|

| |

(i)

|

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

|

| |

(ii)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

|

| |

(5)

|

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

|

| |

(i)

|

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

|

| |

(ii)

|

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

|

| |

(iii)

|

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

|

| |

(iv)

|

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

|

|

(b)

|

That, for the purpose of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

(c)

|