0001855457false00018554572024-02-012024-02-010001855457us-gaap:CommonStockMember2024-02-012024-02-010001855457us-gaap:WarrantMember2024-02-012024-02-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 1, 2024

_____________________

KORE Group Holdings, Inc.

(Exact name of registrant as specified in its charter)

_____________________

| | | | | | | | |

| Delaware | 001-40856 | 86-3078783 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

3 Ravinia Drive NE, Suite 500

Atlanta, GA 30346

877- 710-5673

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

_________________

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.0001 par value per share | | KORE | | New York Stock Exchange |

Warrants to purchase common stock (1) | | KOREGW | | NONE |

(1) On December 21, 2023, the New York Stock Exchange filed a Form 25 to delist the Company’s warrants and remove such securities from registration under Section 12(b) of the Exchange Act. Effective December 7, 2023, the Company’s warrants are trading on the OTC Pink Marketplace under the symbol “KOREGW.”

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 1, 2024, the Company entered into retention letter agreements (each a “Retention Agreement” and, collectively, the “Retention Agreements”) with certain key employees, including each of Romil Bahl, the Company’s President and Chief Executive Officer, Paul Holtz, the Company’s Executive Vice President and Chief Financial Officer, Jack Kennedy, the Company’s Executive Vice President, Chief Legal Officer and Secretary, Bryan Lubel, the Company’s Executive Vice President and General Manager, Global Industries, Tushar Sachdev, the Company’s Executive Vice President and Chief Technology Officer, and Louise Winstone, the Company’s Executive Vice President and Chief Human Resources Officer. The Compensation Committee of the Company’s Board of Directors authorized the Company to enter into the Retention Agreements to retain critical talent.

The aggregate payment under each Retention Agreement is as follows:

a.For Mr. Bahl, $196,875;

b.For Mr. Holtz, Canadian $106,769;

c.For Mr. Lubel, $105,000; and

d.For Messrs. Kennedy and Sachdev and Ms. Winstone, $78,750.

Each Retention Agreement entered into with the above Company officers provide that the Retention Payment will be paid in two equal installments, with the first no later than March 31, 2024 and the second no later than November 30, 2024, less applicable tax withholdings and deductions (each, a “Retention Payment”), provided that such individual is currently employed with the Company on the date of such payment. If prior to March 31, 2026, the officer resigns their employment (other than for “Good Reason”, as defined in the officer’s employment agreement) or they are terminated by the Company for Cause (as defined in the officer’s employment agreement), the officer is required to repay the Retention Payment to the Company no later than fifteen (15) days following the date on which such officer’s employment is terminated.

The foregoing description of the Retention Agreements does not purport to be complete and is qualified in its entirety by the terms and conditions of the Retention Agreements, a form of which is filed as Exhibit 10.1 hereto and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| KORE Group Holdings, Inc. |

| | |

| Date: February 6, 2024 | By: | /s/ Jack W. Kennedy Jr. |

| Name: | Jack W. Kennedy Jr. |

| Title: | Executive Vice President, Chief Legal Officer & Secretary |

[LETTERHEAD]

[DATE]

Via Email

[NAME]

Re: Retention Bonus

Dear [EMPLOYEE NAME]:

As you may know, KORE Group Holdings, Inc. (“KORE” or the “Company”) did not achieve the threshold criteria for payment of short-term incentives with respect to Fiscal Year 2023. However, we consider your continued service and dedication to KORE and its subsidiaries essential to our success in 2024 and beyond. To incentivize you to remain employed with KORE or one of its subsidiaries, we are pleased to offer you a retention bonus, as described in this letter agreement.

In recognition of your continued service with KORE or one of its subsidiaries from the date of this letter agreement through and until March 31, 2026 (the “Retention Period”), we are offering you a retention bonus in the aggregate amount of [AMOUNT] (the “Retention Bonus”). The Retention Bonus will be paid in two equal installments, with the first occurring on or before March 31, 2024 and the second occurring on or before November 30, 2024 (each, a “Retention Bonus Payment”).

You acknowledge and agree that the Company may deduct or withhold, or require you to remit to the Company or one of its subsidiaries, an amount sufficient to satisfy any United States federal, state, local and foreign taxes of any kind that the Company, in its good faith discretion, deems necessary to be withheld or remitted to comply with the Internal Revenue Code of 1986 and regulations promulgated thereunder (the “Code”) and/or any other applicable law, rule or regulation with respect to the Retention Bonus.

You will be eligible to receive each Retention Bonus Payment if (a) you have not been terminated for Cause (as defined in your employment agreement with the Company) on the date of such Retention Bonus Payment and (b) you have not given notice of your intent to resign from employment on or before the date of such Retention Bonus Payment.

If you are eligible to receive the Retention Bonus and sign and return this letter agreement to [POSITION] within five (5) days of receiving this letter agreement, it will be paid to you as described above; provided, however, that you acknowledge and agree that you will not earn the Retention Bonus until the end of the Retention Period. Accordingly, if your employment with KORE or one of its subsidiaries ends before the close of the Retention Period, you agree to re-pay the Retention Bonus you received within fifteen (15) days after the termination of your employment, unless such the requirement of repayment is prohibited by applicable law. Notwithstanding the foregoing, you shall not be required to repay any portion of the Retention Bonus if, prior to the end of the Retention Period, your employment is terminated by KORE or one of its subsidiaries without Cause or you resign for Good Reason (as defined in your employment agreement with the Company).

It is intended that this letter agreement be exempt from the provisions of Section 409A of the Internal Revenue Code of 1986, as amended, and the Treasury Regulations and guidance promulgated thereunder (collectively, “Section 409A”). Whenever a payment under this letter agreement specifies a payment period with reference to a number of days, the actual date of payment within the specified period shall be within the sole discretion of the Board. In no event whatsoever shall the Company or any of its subsidiaries be liable for any additional tax, interest, income inclusion, or other penalty that may be imposed on you by Section 409A or for damages for failing to comply with Section 409A.

This letter agreement contains all of the understandings and representations between KORE and you relating to the Retention Bonus and supersedes all prior and contemporaneous understandings, discussions, agreements, representations, and warranties, both written and oral, with respect to any retention bonus; provided, however, that this letter agreement shall not supersede any other agreements between KORE or one of its subsidiaries and you, and specifically your offer letter in connection with your employment, any employment agreement regarding your employment with KORE or one of its subsidiaries, and any confidentiality, nonsolicitation, noncompete, and assignment of inventions agreements shall remain in full force and effect.

The Company shall have the responsibility, in its sole discretion, to control, operate, construe, interpret, and administer this letter agreement and shall have all the discretionary authority that may be necessary or helpful to enable it to discharge its responsibilities with respect to the Retention Bonus.

You hereby acknowledge and agree that the terms and conditions of this letter agreement shall remain strictly confidential, except for (a) disclosures to your immediate family and any tax, legal, or other counsel that you have consulted regarding this Agreement, whom you will instruct not to disclose the same, and (b) disclosures, if any, required by applicable law.

The Company may amend, modify, or terminate this letter agreement for the purpose of meeting or addressing any changes in legal requirements or for any other purpose permitted by law, except that no amendment or alteration that would materially adversely affect your rights under this letter agreement shall be made without your consent.

This letter agreement and all related documents, and all matters arising out of or relating to this letter agreement, whether sounding in contract, tort, or statute for all purposes shall be governed by and construed in accordance with the laws of the State of Delaware, USA, without giving effect to any conflict of laws principles that would cause the laws of any other jurisdiction to apply.

To the extent that any person acquires a right to receive payments under this letter agreement, such right shall be no greater than the right of an unsecured general creditor. All payments to be made hereunder shall be paid from general assets.

Other than your rights under this letter agreement that are assignable by you to your estate, this letter agreement is personal to each of the parties hereto. Except as provided in this paragraph, no party may assign or delegate any rights or obligations hereunder without first obtaining the advanced written consent of the other party hereto. Any purported assignment or delegation by you in violation of the foregoing will be null and void ab initio and of no force or effect. The Company may assign this letter agreement to a subsidiary of the Company or to any successor to all or substantially all of the business and/or assets of the Company that assumes in writing, or by operation of law, the obligations of the Company hereunder.

Please sign and date this letter agreement and return the signed copy to [NAME] no later than [DATE].

Thank you for your continued contributions to KORE.

[SIGNATURE PAGE FOLLOWS]

| | | | | |

| Very truly yours, KORE Group Holdings, Inc. |

| By: [NAME] [TITLE] [DATE] |

| Agreed to and accepted by: | |

[EMPLOYEE NAME] Date: _____________ | |

|

|

v3.24.0.1

Cover

|

Feb. 01, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 01, 2024

|

| Entity Registrant Name |

KORE Group Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40856

|

| Entity Tax Identification Number |

86-3078783

|

| Entity Address, Address Line One |

3 Ravinia Drive NE

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30346

|

| City Area Code |

877

|

| Local Phone Number |

710-5673

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001855457

|

| Amendment Flag |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, $0.0001 par value per share

|

| Trading Symbol |

KORE

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase common stock (1)

|

| Trading Symbol |

KOREGW

|

| Security Exchange Name |

NONE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

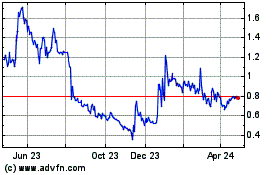

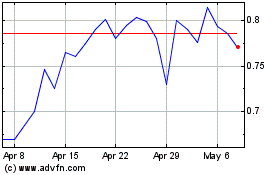

KORE (NYSE:KORE)

Historical Stock Chart

From Mar 2024 to Apr 2024

KORE (NYSE:KORE)

Historical Stock Chart

From Apr 2023 to Apr 2024