0001114936false--09-30FY2023Causeway Bay2500000001105450052500000000.120.05103000000.1500011149362022-10-012023-09-300001114936umewf:OneCustomerMemberumewf:ConcentrationOfCustomersAndVendorsMember2022-10-012023-09-300001114936umewf:TwoVendorsMemberumewf:ConcentrationOfCustomersAndVendorsMember2022-10-012023-09-300001114936us-gaap:SegmentDiscontinuedOperationsMember2022-10-012023-09-300001114936umewf:RubyHuiMember2021-02-230001114936umewf:RubyHuiMember2021-02-222021-02-230001114936umewf:LeeMember2021-09-300001114936umewf:LeeMember2021-10-012022-09-300001114936umewf:LeeMember2020-10-012021-09-300001114936umewf:LeeMember2022-10-012023-09-300001114936umewf:RubyHuiMemberus-gaap:PrivatePlacementMember2020-10-012020-10-280001114936umewf:RubyHuiMemberus-gaap:PrivatePlacementMemberus-gaap:RestrictedStockMember2020-09-012020-09-160001114936umewf:MooreMemberus-gaap:PrivatePlacementMemberus-gaap:RestrictedStockMember2020-04-012020-04-130001114936umewf:YongbiaoDingMemberus-gaap:PrivatePlacementMemberus-gaap:RestrictedStockMember2019-11-012019-11-220001114936umewf:RubyHuiMemberus-gaap:PrivatePlacementMember2020-10-280001114936umewf:MooreMemberus-gaap:PrivatePlacementMemberus-gaap:RestrictedStockMember2020-04-130001114936umewf:YongbiaoDingMemberus-gaap:PrivatePlacementMemberus-gaap:RestrictedStockMember2019-11-220001114936umewf:RubyHuiMemberus-gaap:PrivatePlacementMemberus-gaap:RestrictedStockMember2020-09-160001114936umewf:FebruaryOneTwentyEightteenMembersrt:ChiefFinancialOfficerMember2022-09-300001114936umewf:FebruaryOneTwentyEightteenMembersrt:ChiefFinancialOfficerMember2022-10-012023-09-300001114936umewf:JulyOneTwentThridteenMember2022-10-012023-09-300001114936srt:MaximumMemberus-gaap:StockOptionMember2022-09-300001114936us-gaap:StockOptionMembersrt:MinimumMember2022-09-300001114936us-gaap:StockOptionMembersrt:MinimumMember2023-09-300001114936srt:MaximumMemberus-gaap:StockOptionMember2021-09-300001114936srt:MaximumMemberus-gaap:StockOptionMember2023-09-300001114936us-gaap:StockOptionMembersrt:MinimumMember2021-09-300001114936srt:MaximumMemberus-gaap:StockOptionMember2020-10-012021-09-300001114936srt:MaximumMemberus-gaap:StockOptionMember2021-10-012022-09-300001114936srt:MaximumMemberus-gaap:StockOptionMember2022-10-012023-09-300001114936us-gaap:StockOptionMembersrt:MinimumMember2020-10-012021-09-300001114936us-gaap:StockOptionMembersrt:MinimumMember2021-10-012022-09-300001114936us-gaap:StockOptionMembersrt:MinimumMember2022-10-012023-09-300001114936umewf:StockOptionsMember2023-09-300001114936umewf:StockOptionsMember2022-09-300001114936umewf:StockOptionsMember2021-09-300001114936umewf:MainlandChinaMember2022-10-012023-09-300001114936srt:AsiaMember2022-10-012023-09-300001114936umewf:CAMember2022-10-012023-09-300001114936srt:AsiaPacificMember2022-10-012023-09-300001114936srt:AsiaMembersrt:MaximumMember2022-10-012023-09-300001114936srt:AsiaMembersrt:MinimumMember2022-10-012023-09-300001114936srt:AsiaPacificMember2022-09-300001114936srt:AsiaPacificMember2021-09-300001114936srt:AsiaPacificMember2023-09-300001114936srt:AsiaMember2022-09-300001114936srt:AsiaMember2023-09-300001114936srt:AsiaMember2021-09-300001114936umewf:CAMember2021-09-300001114936umewf:CAMember2023-09-300001114936umewf:CAMember2022-09-300001114936umewf:WinfieldYongbiaoDingMember2021-02-012021-02-230001114936umewf:RubyHuiMemberMember2021-02-230001114936umewf:ArmslengthinvestorMember2021-04-300001114936umewf:ArmslengthinvestorMember2021-04-120001114936umewf:ArmslengthinvestorMember2021-04-090001114936umewf:ArmslengthinvestorMember2021-03-300001114936umewf:ArmslengthinvestorMember2021-03-290001114936umewf:WinfieldYongbiaoDingMember2021-02-230001114936umewf:RubyHuiMemberMember2020-10-280001114936umewf:FinancialConsultingServiceMember2023-04-250001114936umewf:RubyHuiMemberMember2020-08-270001114936umewf:FordMooreMember2020-04-130001114936umewf:ArmslengthinvestorMember2023-05-190001114936umewf:ArmslengthinvestorMember2019-12-310001114936umewf:YongbiaoDingMember2019-11-220001114936us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2022-10-012023-09-300001114936us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2022-10-012023-09-300001114936us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2022-10-012023-09-300001114936us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2022-10-012023-09-300001114936umewf:StockOptionsMember2022-10-012023-09-300001114936umewf:StockOptionsMember2020-10-012021-09-300001114936umewf:StockOptionsMember2021-10-012022-09-300001114936umewf:AnnualAverageMemberumewf:HkdMember2023-09-300001114936umewf:AnnualAverageMemberumewf:HkdMember2021-09-300001114936umewf:AnnualAverageMemberumewf:HkdMember2022-09-300001114936umewf:YearEndMemberumewf:HkdMember2023-09-300001114936umewf:YearEndMemberumewf:HkdMember2021-09-300001114936umewf:YearEndMemberumewf:HkdMember2022-09-300001114936umewf:AnnualAverageMemberumewf:CnyMember2023-09-300001114936umewf:AnnualAverageMemberumewf:CnyMember2021-09-300001114936umewf:AnnualAverageMemberumewf:CnyMember2022-09-300001114936umewf:YearEndMemberumewf:RmbMember2023-09-300001114936umewf:YearEndMemberumewf:RmbMember2022-09-300001114936umewf:YearEndMemberumewf:RmbMember2021-09-300001114936umewf:AnnualAverageMemberumewf:CadMember2023-09-300001114936umewf:YearEndMemberumewf:CadMember2021-09-300001114936umewf:AnnualAverageMemberumewf:CadMember2021-09-300001114936umewf:AnnualAverageMemberumewf:CadMember2022-09-300001114936umewf:YearEndMemberumewf:CadMember2023-09-300001114936umewf:YearEndMemberumewf:CadMember2022-09-300001114936umewf:UMeLookLimitedMember2012-02-230001114936umewf:UMeLookLimitedMember2022-10-012023-09-300001114936umewf:DagolaIncMember2023-09-300001114936umewf:DagolaIncMember2022-10-012023-09-300001114936srt:ConsolidatedEntityExcludingVariableInterestEntitiesVIEMember2022-09-300001114936srt:ConsolidatedEntityExcludingVariableInterestEntitiesVIEMember2023-09-300001114936us-gaap:RetainedEarningsMember2023-09-300001114936us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001114936us-gaap:AdditionalPaidInCapitalMember2023-09-300001114936umewf:OrdinarySharesMember2023-09-300001114936us-gaap:RetainedEarningsMember2022-10-012023-09-300001114936us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-012023-09-300001114936us-gaap:AdditionalPaidInCapitalMember2022-10-012023-09-300001114936umewf:OrdinarySharesMember2022-10-012023-09-300001114936us-gaap:RetainedEarningsMember2022-09-300001114936us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001114936us-gaap:AdditionalPaidInCapitalMember2022-09-300001114936umewf:OrdinarySharesMember2022-09-300001114936us-gaap:RetainedEarningsMember2021-10-012022-09-300001114936us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-10-012022-09-300001114936us-gaap:AdditionalPaidInCapitalMember2021-10-012022-09-300001114936umewf:OrdinarySharesMember2021-10-012022-09-3000011149362021-09-300001114936us-gaap:RetainedEarningsMember2021-09-300001114936us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-300001114936us-gaap:AdditionalPaidInCapitalMember2021-09-300001114936umewf:OrdinarySharesMember2021-09-300001114936us-gaap:RetainedEarningsMember2020-10-012021-09-300001114936us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-10-012021-09-300001114936us-gaap:AdditionalPaidInCapitalMember2020-10-012021-09-300001114936umewf:OrdinarySharesMember2020-10-012021-09-3000011149362020-09-300001114936us-gaap:RetainedEarningsMember2020-09-300001114936us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-300001114936us-gaap:AdditionalPaidInCapitalMember2020-09-300001114936umewf:OrdinarySharesMember2020-09-3000011149362020-10-012021-09-3000011149362021-10-012022-09-3000011149362022-09-3000011149362023-09-300001114936dei:BusinessContactMember2022-10-012023-09-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR (G) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

OR |

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the fiscal year ended: September 30, 2023 |

| |

OR |

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

| |

OR |

| |

☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

| |

| Date of event requiring this shell company report |

For the transition period from ___________ to ____________

Commission File Number: 000-30813

UMeWorld Limited |

(Exact name of Registrant as specified in its charter) |

N/A

(Translation of Registrant’s name into English)

British Virgin Islands

(Jurisdiction of incorporation or organization)

66 West Flagler Street, 9th Floor, Miami, Florida 33130

(Address of principal executive offices)

Michael Lee, (786) 791 0483, info@umeworld.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class | | Trading Symbol (s) | | Name of each exchange on which registered |

Ordinary Shares, par value $0.0001 per share | | N/A | | N/A |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Title of Class

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Title of Class

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of September 30, 2023, there were 110,545,005 shares outstanding of the issuer’s ordinary shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If the report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Security Exchange Act of 1934. Yes ☐ No ☒

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Security Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Security Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definitions of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one).

Large accelerated filer | ☐ | Non-accelerated filer | ☒ |

Accelerated filer | ☐ | Emerging growth company | ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP | ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board | ☐ | Other | ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

FORM 20-F

For the Years Ended September 30, 2023, 2022 and 2021

INDEX

PRELIMINARY NOTES

INTRODUCTION

In this annual report, except where the context otherwise requires and for purposes of this annual report only:

| · | “we”, “us”, “our company”, “our” and “the Company” and similar words refer to UMeWorld Limited, a British Virgin Islands company, and its consolidated subsidiaries and affiliated entities, as appropriate, including its consolidated variable interest entity (“VIE”); |

| | |

| · | “China” or “PRC” refers to People’s Republic of China, and for the purpose of this annual report, excludes Taiwan, Hong Kong and Macau; |

| | |

| · | “shares”, or “ordinary shares” refers to our ordinary shares, par value US$0.0001 per share; |

| | |

| · | “RMB” or “Renminbi” refers to the legal currency of China, “HK$” refers to the legal currency of Hong Kong and “$,” “dollars,” “US$” or “U.S. dollars” refers to the legal currency of the United States; |

| | |

| · | “U.S. GAAP” refers to generally accepted accounting principles in the United States; and |

| | |

| · | “VIE” refers to Guangzhou XinYiXun Network Technology Co. Ltd., a domestic PRC company in which we do not have equity interests but its financial results have been consolidated into our consolidated financial statements in accordance with U.S. GAAP. |

Our financial statements are expressed in U.S. dollars, which is our reporting currency. Certain of our financial data in this annual report on Form 20-F are translated into U.S. dollars solely for the reader’s convenience. Unless otherwise noted, all foreign currency translations in this annual report on Form 20-F can be found on Note 2 of our audited consolidated financial statements on page F-10. We make no representation that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi, as the case may be, at any particular rate, at the rate stated above, or at all.

FORWARD-LOOKING INFORMAITON

This annual report contains forward-looking statements that reflect our current expectations and views of future events. These forward looking statements are made under the “safe-harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by these forward-looking statements.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to” or other similar expressions. These forward-looking statements include statements relating to:

| · | our mission, goals and strategies; |

| · | competition in our industry; |

| · | our future business development, results of operations and financial condition; |

| · | expected changes in our revenues and certain cost and expense items; |

| · | our expectations regarding demand for and market acceptance of our products; |

| · | our expectations regarding our relationships with consumers, suppliers, local distributors, and our other business partners; and |

| · | relevant government policies and regulations relating to our business and our industry. |

You should read this annual report and the documents that we refer to in this annual report and have filed as exhibits to this annual report completely and with the understanding that our actual future results may be materially different from what we expect. Other sections of this annual report discuss factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

We are a holding company that is incorporated in the British Virgin Islands. As a holding company with no operations, we conduct all of our operations through our subsidiary Dagola Inc. in the United States. Holders of our Ordinary Shares are shares of the holding company that is incorporated in the British Virgin Islands and should be aware that they may never directly hold equity interests in our subsidiary. Prior to January 2022, we conducted substantially all of our operations through our VIE, Guangzhou XinYiXun Network Technology Co. Ltd and its wholly owned subsidiary, in China. The VIE structure was terminated and the education business in China was dissolved in December 2021.

A. | Selected Financial Data |

The following selected financial information should be read in connection with, and is qualified by reference to, our consolidated financial statements and their related notes and the section entitled “Operating and Financial Review and Prospects” included elsewhere in this annual report. The consolidated statements of operations and other comprehensive loss data for the fiscal years ended September 30, 2023, 2022 and 2021 and the consolidated balance sheets data as of September 30, 2023, 2022 and 2021 are derived from audited consolidated financial statements included elsewhere in this annual report. Our historical results for any prior period are not necessarily indicative of results to be expected in any future period.

Selected Consolidated Statements of Operations and Other Comprehensive Loss Data:

| | For the Years Ended September 30, | |

| | 2023 | | | 2022 | | | 2021 | |

Revenues | | | 1,401 | | | | 93 | | | | 2,832 | |

Gross (loss) income | | | (3,145 | ) | | | (766 | ) | | | (16,809 | ) |

Operating expenses | | | (303,195 | ) | | | (85,686 | ) | | | (86,848 | ) |

Loss from continuing operations | | | (306,340 | ) | | | (86,452 | ) | | | (103,657 | ) |

Other income (expense), net | | | - | | | | 2,850 | | | | (3,779 | ) |

Net loss from continuing operations | | | - | | | | (83,602 | ) | | | (107,436 | ) |

Net loss from discontinued operations, net of tax | | | - | | | | (64,084 | ) | | | - | |

Net loss | | | (306,340 | ) | | | (147,686 | ) | | | (107,436 | ) |

Selected Consolidated Balance Sheets Data:

| | As of September 30, | |

| | 2023 | | | 2022 | | | 2021 | |

Current assets | | | 59,003 | | | | 27,726 | | | | 36,963 | |

Total assets | | | 59,003 | | | | 27,726 | | | | 56,203 | |

Current liabilities | | | 434,873 | | | | 382,176 | | | | 262,969 | |

Total liabilities | | | 434,873 | | | | 382,176 | | | | 262,969 | |

Total stockholders’ deficit | | | (375,870 | ) | | | (354,450 | ) | | | (206,766 | ) |

Selected Consolidated Statements of Cash Flows Data:

| | For the Years Ended September 30, | |

| | 2023 | | | 2022 | | | 2021 | |

Net cash used in operating activities | | | (66,848 | ) | | | (113,757 | ) | | | (120,144 | ) |

Net cash used in investing activities | | | - | | | | - | | | | (20,687 | ) |

Net cash provided by financing activities | | | 121,840 | | | | 105,552 | | | | 120,634 | |

Effect of exchange rate changes on cash and cash equivalents | | | - | | | | 2,828 | | | | 11,127 | |

Net (decrease) increase in cash | | | 54,992 | | | | (5,377 | ) | | | (9,070 | ) |

Cash and cash equivalents, beginning of the year | | | 2,443 | | | | 7,820 | | | | 16,890 | |

Cash and cash equivalents, end of the year | | | 57,435 | | | | 2,443 | | | | 7,820 | |

B. | Capitalization and Indebtedness |

| |

| Not applicable. |

| |

C. | Reasons for the Offer and Use of Proceeds |

| |

| Not applicable. |

Investment in our ordinary shares involves a high degree of risk. You should carefully consider, among other matters, the following risk factors in addition to the other information in this annual report on Form 20-F when evaluating our business because these risk factors may have a significant impact on our business, financial condition, operating results or cash flow. If any of the material risks described below or in subsequent reports we file with the Securities and Exchange Commission (“SEC”) actually occur, they may materially harm our business, financial condition, operating results or cash flow. Additional risks and uncertainties that we have not yet identified or that we presently consider to be immaterial may also materially harm our business, financial condition, operating results or cash flow.

Risks Related to Our Company, Business and Industry

A pandemic, epidemic or outbreak of an infectious disease in the United States or elsewhere may adversely affect our business.

If a pandemic, epidemic or outbreak of an infectious disease occurs in the United States or elsewhere, our business may be adversely affected. COVID-19 has spread worldwide and has resulted in government authorities implementing numerous measures to try to contain it, such as travel bans and restrictions, quarantines, shelter-in-place orders and shutdowns. These measures have impacted our workforce and operations, the operations of our customers and our partners, and those of our respective vendors and suppliers.

The spread of COVID-19 has caused us to modify our business practices, as we comply with mandated requirements for safety in the workplace to ensure the health, safety and well-being of our employees. These measures may include personal protective equipment, social distancing, cleanliness of the facilities and daily monitoring of the health of employees in our facilities, as well as modifying our policies on employee travel and the cancellation of physical participation in meetings, events and conferences. We may take further actions as required by government authorities or that we determine are in the best interests of our employees, customers, partners and suppliers. However, we do not currently have a specific and/or comprehensive contingency plan in place that is designed to address the challenges and risks presented by the COVID-19 pandemic or similar outbreak and, even if and when we do develop such a plan, there can be no assurance that such plan will be effective in mitigating the potential adverse effects on our business, financial condition and results of operations.

We may fail to successfully execute our business plan.

Our shareholders may lose their entire investment if we fail to execute our business plan. Our prospects must be considered in light of the following risks and uncertainties, including but not limited to, competition, the erosion of ongoing revenue streams, the ability to retain experienced personnel and general economic conditions. We cannot guarantee that we will be successful in executing our business plan. If we fail to successfully execute our business plan, we may be forced to cease operations, in which case our shareholders may lose their entire investment.

Our acquisition strategy creates risks for our business.

We expect that we will pursue acquisitions of other businesses, assets, or technologies to grow our business. We may fail to identify attractive acquisition candidates, or we may be unable to reach acceptable terms for future acquisitions. We might not be able to raise enough cash to compete for attractive acquisition targets. If we are unable to complete acquisitions in the future, our ability to grow our business at our anticipated rate will be impaired.

We may pay for acquisitions by issuing additional shares of our common stock, which would dilute our stockholders, or by issuing debt, which could include terms that restrict our ability to operate our business or pursue other opportunities and subject us to meaningful debt service obligations. We may also use significant amounts of cash to complete acquisitions. To the extent that we complete acquisitions in the future, we likely will incur future depreciation and amortization expenses associated with the acquired assets. We may also record significant amounts of intangible assets, including goodwill, which could become impaired in the future. Acquisitions involve numerous other risks, including:

| · | difficulties integrating the operations, technologies, services, and personnel of the acquired companies; |

| · | challenges maintaining our internal standards, controls, procedures, and policies; |

| · | diversion of management’s attention from other business concerns; |

| · | over-valuation by us of acquired companies; |

| · | litigation resulting from activities of the acquired company, including claims from terminated employees, customers, former stockholders and other third parties; |

| · | insufficient revenues to offset increased expenses associated with the acquisitions and unanticipated liabilities of the acquired companies; |

| · | insufficient indemnification or security from the selling parties for legal liabilities that we may assume in connection with our acquisitions; |

| · | entering markets in which we have no prior experience and may not succeed; |

| · | risks associated with foreign acquisitions, such as communication and integration problems resulting from geographic dispersion and language and cultural differences, compliance with foreign laws and regulations and general economic or political conditions in other countries or regions; |

| · | potential loss of key employees of the acquired companies; and |

| · | impairment of relationships with clients and employees of the acquired companies or our clients and employees as a result of the integration of acquired operations and new management personnel. |

Our management team’s attention may be diverted by recent acquisitions and searches for new acquisition targets, and our business and operations may suffer adverse consequences as a result.

Mergers and acquisitions are time intensive, requiring significant commitment of our management team’s focus and resources. If our management team spends too much time focused on recent acquisitions or on potential acquisition targets, our management team may not have sufficient time to focus on our existing business and operations. This diversion of attention could have material and adverse consequences on our operations and our ability to be profitable.

We may be unable to complete key acquisitions.

The completion of key acquisitions may rest upon factors outside of our control, and may, notwithstanding the stage of negotiation, end up failing before completion. In such event key acquisitions are left incomplete, the Company may be materially adversely affected, owing to the significant devotion of resources thereto.

We may be unable to scale our operations successfully.

Our growth strategy will place significant demands on our management and financial, administrative, and other resources. Operating results will depend substantially on the ability of our officers and key employees to manage changing business conditions and to implement and improve our financial, administrative, and other resources. If the Company is unable to respond to and manage changing business conditions, or the scale of its operations, then the quality of its services, its ability to retain key personnel, and its business could be harmed.

We have significant historical losses and may continue to incur losses in the future.

We have incurred annual operating losses since our inception. Consequently, as of September 30, 2023, we had an accumulated deficit of $31,447,003. Our revenues for the years ended September 30, 2023, 2022, and 2021 were $1,401, $93, and $2,832, respectively. Our revenues have not been sufficient to sustain our operations. In order to achieve profitability our revenue streams will have to increase and there is no assurance that revenues can increase to such a level. We may never be profitable. Our ability to achieve profitability is affected by various factors, including:

| - | growth of the health and wellness market; |

| - | Our ability to develop and maintain our brand and reputation for our product offerings; |

| - | our efforts to sell and market our products through local distributors and business partners; |

| - | our ability to establish partnerships arrangements; |

| - | the time and costs involved in obtaining regulatory approvals if any; |

| - | our ability to control our costs and expenses; and |

| - | the continued ability to source investments from our investors. |

Many of these factors are beyond our control. We may continue to incur net losses in the future due to our continued investments in content, bandwidth and technology. If we cannot successfully offset our increased costs with an increase in net revenues, our gross margin, financial condition and results of operations could be materially and adversely affected. We may also continue to incur net losses in the future due to changes in the macroeconomic and regulatory environment, competitive dynamics and our inability to respond to these changes in a timely and effective manner.

The Company has limited cash resources and a history of operating losses. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. We believe we have developed a viable plan to continue as a going concern. However, the plan relies upon our ability to obtain additional sources of capital and financing. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, we may be required to cease operations.

Our auditors have indicated that there is substantial doubt about our ability to continue as a going concern.

Our financial statements have been prepared assuming that we will continue as a going concern, which contemplates realization of assets and the satisfaction of liabilities in the normal course of business for the twelve-month period following the date of the financial statements for the Company included elsewhere in this report. We have incurred significant operating losses since inception. Because we do not expect that existing operational cash flow will be sufficient to fund presently anticipated operations, this raises substantial doubt about our ability to continue as a going concern. Therefore, we will need to raise additional funds and is currently exploring alternative sources of financing. Our continuation as a going concern is dependent upon the ability to raise financing from third parties and generating revenues from operations. There is no assurance that we will be successful in doing so.

We will require additional financing to sustain our operations, and our ability to secure additional financing is uncertain.

We may be unable to raise on acceptable terms, if at all, the substantial capital resources necessary to conduct our operations. If we are unable to raise the required capital, we may be forced to curtail business development activities and, ultimately, cease operations. As at September 30, 2023, we had working capital deficiency of $375,870 as compared to working capital deficiency of $354,450 as at September 30, 2022. The independent auditor’s report for the year ended September 30, 2022 includes an explanatory paragraph stating that our recurring losses from operations and working capital levels raise substantial doubt about our ability to continue as a going concern.

We may be unable to retain key employees or recruit additional qualified personnel.

Our success depends to a significant extent on the continued services of our senior management and other members of management.

If members of our senior management team do not continue in their present positions, our business may suffer. Because of the nature of our business, we are highly dependent upon attracting and retaining qualified personnel. There is significant competition for qualified personnel in our industry. Therefore, we may not be able to attract and retain the qualified personnel necessary for the development of our business. The loss of the services of existing personnel, as well as the failure to recruit additional key technical and managerial personnel in a timely manner, could harm our business.

The Company’s success depends upon the ability to adapt to a changing market and continued development of additional products and services.

Although we expect to provide a broad and competitive range of products and services, there can be no assurance of acceptance by the marketplace. The procurement of new contracts by the Company may be dependent upon the continuing results achieved, upon pricing and operational considerations, as well as the potential need for continuing improvement to existing products and services. Moreover, the markets for such products and services may not develop as expected nor can there be any assurance that we will be successful in our marketing of any such services.

Our products may not meet health and safety standards or could become contaminated.

We do not have control over all of the third parties involved in the manufacturing of our products and their compliance with government health and safety standards. Even if our products meet these standards, they could otherwise become contaminated. A failure to meet these standards or contamination could occur in our operations or those of our manufacturers, distributors or suppliers. This could result in expensive production interruptions, recalls and liability claims. Moreover, negative publicity could be generated from false, unfounded or nominal liability claims or limited recalls. Any of these failures or occurrences could negatively affect our business and financial performance.

The sale of our products involves product liability and related risks that may have a material adverse effect on us.

We face an inherent risk of exposure to product liability claims if the use of our products results in, or is believed to have resulted in, illness or injury. Our products contain combinations of ingredients, and there is little long-term experience with the effect of these combinations. In addition, interactions of these products with other products, prescription medicines and over-the-counter treatments have not been fully explored or understood and may have unintended consequences. Any product liability claims could have a material adverse effect on us. We do not currently have any product liability insurance. Although we will apply for product liability insurance when it deems it appropriate, there can be no assurance that: a) we will be able to obtain or maintain product liability insurance on acceptable terms; b) we will be able to secure increased coverage if requested; or c) any insurance will provide adequate protection against potential liabilities.

The success of our business will depend upon our ability to create and expand our brand awareness.

The edible oil markets we compete in, and the nutritional supplement markets we intend to compete in, are highly competitive, with many well-known brands leading the industry. Our ability to compete effectively and generate revenue will be based upon our ability to create and expand awareness of our products distinct from those of our competitors. It is imperative that we are able to convey to consumers the benefits of our products. However, advertising and packaging and labeling of such products will be limited by various regulations. Our success will be dependent upon our ability to convey to consumers that our products are superior to those of our competitors.

The requirements of remaining a public company may strain our resources and distract our management, which could make it difficult to manage our business.

We are required to comply with various regulatory and reporting requirements, including those required by the SEC. Complying with these reporting and other regulatory requirements are time-consuming and expensive and could have a negative effect on our business, results of operations and financial condition.

The commercial success of our products and services is dependent, in part, on factors outside our control.

The commercial success of our products and services is dependent upon unpredictable and volatile factors beyond our control, such as the success of our competitors’ products and services. Our failure to attract market acceptance and a sustainable competitive advantage over our competitors would materially harm our business.

We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses to us.

As discussed above, we are a foreign private issuer, and therefore, we are not required to comply with all of the periodic disclosure and current reporting requirements of the Exchange Act. The determination of foreign private issuer status is made annually on the last Business Day of an issuer’s most recently completed second fiscal quarter, and, accordingly, the next determination will be made with respect to us on March 31, 2024. In the future, we would lose our foreign private issuer status if (1) more than 50% of our outstanding voting securities are owned by U.S. residents and (2) a majority of our directors or executive officers are U.S. citizens or residents, or we fail to meet additional requirements necessary to avoid the loss of foreign private issuer status. If we lose our foreign private issuer status, we will be required to file with the SEC periodic reports and registration statements on U.S. domestic issuer forms, which are more detailed and extensive than the forms available to a foreign private issuer.

You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under British Virgin Islands law.

We are an exempted company incorporated under the laws of the British Virgin Islands with limited liability. Our corporate affairs are governed by our memorandum and articles of association, as amended from time to time, the Companies Act and the common law of the British Virgin Islands. The rights of our shareholders to take action against our directors and us, actions by minority shareholders and the fiduciary duties of our directors to our Company under British Virgin Islands law are to a large extent governed by the common law of the British Virgin Islands. The common law of the British Virgin Islands is derived in part from comparatively limited judicial precedent in the British Virgin Islands as well as from the common law of England, the decisions of whose courts are of persuasive authority, but are not binding, on a court in the British Virgin Islands. The rights of our shareholders and the fiduciary duties of our directors under the laws of the British Virgin Islands are not as clearly established as they would be under statutes or judicial precedent in some jurisdictions in the United States. In particular, the British Virgin Islands has a different body of securities laws than the United States, which may provide significantly less protection to investors. In addition, British Virgin Islands companies may not have the standing to initiate a shareholder derivative action in a federal court of the United States.

Shareholders of British Virgin Islands exempted companies like us have no general rights under British Virgin Islands law to inspect corporate records (other than the Memorandum and Articles of Association) or to obtain copies of lists of shareholders of these companies. Our directors are not required under our Memorandum and Articles of Association to make our corporate records available for inspection by our shareholders. This may make it more difficult for you to obtain the information needed to establish any facts necessary for a shareholder resolution or to solicit proxies from other shareholders in connection with a proxy contest.

Certain corporate governance practices in the British Virgin Islands, which is our home country, differ significantly from requirements for companies incorporated in other jurisdictions such as U.S. states. Currently, we do not plan to rely on home country practice with respect to any corporate governance matter. In the event we opt to do so in the future, our shareholders may be afforded less protection than they otherwise would under rules and regulations applicable to U.S. domestic issuers.

As a result of all of the above, shareholders may have more difficulty in protecting their interests in the face of actions taken by our management, members of the board of directors or controlling shareholders than they would as shareholders of a company incorporated in a U.S. state.

Certain judgments obtained against us by our shareholders may not be enforceable.

We are a British Virgin Islands exempted company and substantially all of our assets are located outside of the United States. In addition, all of our current directors and officers are nationals and residents of countries other than the United States and substantially all of the assets of these persons are located outside the United States. As a result, it may be difficult for a shareholder to effect service of process within the United States upon these persons or to enforce against us or them judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States. Even if you are successful in bringing an action of this kind, the laws of the British Virgin Islands may render you unable to enforce a judgment against our assets or the assets of our directors and officers. As a result of all of the above, our shareholders may have more difficulties in protecting their interests through actions against us or our officers, directors or major shareholders than would shareholders of a corporation incorporated in a jurisdiction in the United States.

We are required to comply with certain provisions of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”) and if we fail to continue to comply, our business could be harmed, and the price of our securities could decline.

Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act require an annual assessment of internal control over financial reporting, and for certain issuers an attestation of this assessment by the issuer’s independent registered public accounting firm. The standards that must be met for management to assess the internal control over financial reporting as effective are evolving and complex, and require significant documentation, testing, and possible remediation to meet the detailed standards. We expect to incur significant expenses and to devote resources to Section 404 compliance on an ongoing basis. It is difficult for us to predict how long it will take or costly it will be to complete the assessment of the effectiveness of our internal control over financial reporting for each year and to remediate any deficiencies in our internal control over financial reporting. As a result, we may not be able to complete the assessment and remediation process on a timely basis. In the event that our Chief Executive Officer or Chief Financial Officer determines that our internal control over financial reporting is not effective as defined under Section 404, we cannot predict how regulators will react or how the market prices of our securities will be affected; however, we believe that there is a risk that investor confidence and the market value of our securities may be negatively affected.

Compliance with changing corporate governance regulations and public disclosures may result in additional risks and exposures.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and new regulations from the SEC, have created uncertainty for public companies such as ours. These laws, regulations, and standards are subject to varying interpretations in many cases, and as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. As a result, our efforts to comply with evolving laws, regulations, and standards have resulted in, and are likely to continue to result in, increased expense and significant management time and attention.

Risks Related to Our Ordinary Shares

The market price of our ordinary shares is volatile.

The market price of our ordinary shares has been, and we expect it to continue to be, highly unstable. Factors, including our announcement of technological improvements or announcements by other companies, regulatory matters, research and development activities, new or existing products or procedures, signing or termination of licensing agreements, concerns about our financial condition, operating results, litigation, government regulation, developments or disputes relating to agreements, patents or proprietary rights, and public concern over the safety of activities or products have had a significant impact on the market price of our stock. We expect such factors to continue to impact our market price for the foreseeable future.

Our ordinary shares are classified as “penny stock” under SEC rules that may make it more difficult for our shareholders to resell our ordinary shares.

Our ordinary shares are traded on the OTC Market. As a result, the holders of our ordinary shares may find it more difficult to obtain accurate quotations concerning the market value of the ordinary shares. Shareholders also may experience greater difficulties in attempting to sell the shares than if there were listed on or quoted on a national stock exchange. Because our ordinary shares are not traded on a national stock exchange , and the market price of our ordinary shares is less than $5.00 per share, our ordinary shares are classified as “penny stock.” Rule 15g-9 of the Securities Exchange Act of 1934 imposes additional sales practice requirements on broker-dealers that recommend the purchase or sale of penny stocks to persons other than those who qualify as an “established customer” or an “accredited investor.” This includes the requirement that a broker-dealer must make a determination that investments in penny stocks are suitable for the customer and must make special disclosures to the customer concerning the risks of penny stocks. Application of the penny stock rules to our ordinary shares could adversely affect the market liquidity of the shares, which in turn may affect the ability of holders of our ordinary shareholders to resell the shares. We have a significant number of options and warrants outstanding that could be exercised in the future. Subsequent resales of these and other shares could cause our share price to decline. This could also make it more difficult to raise funds at acceptable levels, via future securities offerings.

We have identified material weaknesses in our internal control over financial reporting. If we fail to develop and maintain an effective system of internal control over financial reporting, we may be unable to accurately report our financial results or prevent fraud, and investor confidence and the market price of our ordinary shares may be materially and adversely affected.

We have identified “material weaknesses” and other control deficiencies including significant deficiencies in our internal control over financial reporting. As defined in the standards established by the Public Company Accounting Oversight Board of the United States, or PCAOB, a “material weakness” is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis.

One material weakness that has been identified related to our lack of sufficient financial reporting and accounting personnel with appropriate knowledge of U.S. GAAP and SEC reporting requirements to properly address complex U.S. GAAP accounting issues and to prepare and review our consolidated financial statements and related disclosures to fulfill U.S. GAAP and SEC financial reporting requirements. As our operations continue to expand, we plan to hire additional accounting and finance staff to increase segregation of duties and also invest in technology infrastructure to support our financial reporting function. Despite all these remedial measures, we might efficiently address the weaknesses we have identified.

During the course of documenting and testing our internal control procedures, in order to satisfy the requirements of Section 404, we may identify other weaknesses and deficiencies in our internal control over financial reporting. In addition, if we fail to maintain the adequacy of our internal control over financial reporting, as these standards are modified, supplemented or amended from time to time, we may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404. If we fail to achieve and maintain an effective internal control environment, we could suffer material misstatements in our financial statements and fail to meet our reporting obligations, which would likely cause investors to lose confidence in our reported financial information. This could in turn limit our access to capital markets, harm our results of operations, and lead to a decline in the trading price of our ordinary shares. Additionally, ineffective internal control over financial reporting could expose us to increased risk of fraud or misuse of corporate assets and subject us to potential delisting from the stock exchange on which we list, regulatory investigations and civil or criminal sanctions. We may also be required to restate our financial statements from prior periods.

Lack of independent directors

We cannot guarantee that our Board of Directors will have a majority of independent directors in the future. In the absence of a majority of independent directors, our executive officers, who are also shareholders and directors, could establish policies and enter into transactions without independent review and approval thereof. This could present the potential for a conflict of interest between us and our shareholders generally and the controlling officers, stockholders or directors.

Ownership of our ordinary shares by current officers and directors.

The present officers and directors own approximately 15.29% of our issued and outstanding ordinary shares, and are therefore no longer in a position to elect all of our directors and otherwise control the Company. As of the date of this annual report, Vago International Limited controlled by Yee W. Chu beneficially owned approximately 47.98% of our outstanding capital stock. Chu therefore has significant influence over management and affairs and over all matters requiring shareholder approval, including the election of directors and significant corporate transactions, such as a merger or other sale of our company or our assets, for the foreseeable future. This concentrated control limits or severely restricts our shareholders’ ability to influence corporate matters and, as a result, we may take actions that our shareholders do not view as beneficial. As a result, the market price of our ordinary shares could be adversely affected.

We do not expect to pay dividends, and any return on your investment will likely be limited to the appreciation of our common stock.

We currently intend to retain our future earnings, if any, for the foreseeable future, to repay indebtedness and to fund the development and growth of our business. We do not intend to pay any dividends to holders of our ordinary shares and the agreements governing our credit facility significantly restrict our ability to pay dividends. As a result, capital appreciation in the price of our ordinary shares, if any, will be your only source of gain or income on an investment in our ordinary shares.

Certain judgments obtained against us by our shareholders may not be enforceable.

We are a British Virgin Islands company and most of our directors and officers are nationals and residents of countries other than the United States. A substantial portion of the assets of these persons are located outside the United States. As a result, it may be difficult to effect service of process within the United States upon these persons. It may also be difficult to enforce in U.S. court judgments obtained in U.S. courts based on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, most of whom are residents of countries other than the United States and the substantial majority of whose assets are located outside of the United States. In addition, there is uncertainty as to whether the courts of the British Virgin Islands would recognize or enforce judgments of U.S. courts against us or such persons predicated upon the civil liability provisions of the securities laws of the United States or any state. In addition, there is uncertainty as to whether such British Virgin Islands courts would be competent to hear original actions brought in the British Virgin Islands against us or such persons predicated upon the securities laws of the United States or any state.

ITEM 4. INFORMATION OF THE COMPANY

A. | History and Development of the Company |

| |

| Introduction and History |

We were originally incorporated as AlphaRx Inc. (“AlphaRx”) under the laws of the State of Delaware in 1997 as a pharmaceutical research & development company. We were domiciled in the British Virgin Islands (the “BVI”) and continued as a BVI registered company in January 2013. On March 8, 2013, AlphaRx changed its name to UMeWorld Limited.

AlphaRx was a specialty pharmaceutical company dedicated to developing therapies to treat and manage pain. Prior to November 2011, the business of the Company was focused on reformulating FDA approved and marketed drugs using its proprietary site-specific nano drug delivery technology. From 2000 until June 2011, substantial efforts and resources were devoted to understanding our nano drug delivery technology and establishing a product development pipeline that incorporated this technology with selected molecules.

On November 4, 2011, we ceased all operations in the drug development business and adopted a new corporate development strategy that changed the business operation of the Company to digital media and digital education with an intense focus on China.

On August 30, 2012, we acquired all of the issued and outstanding shares of UMeLook Holdings Limited (“UMeLook”), a digital media & education startup with an intense focus on China. The acquisition of UMeLook was completed as a share exchange through the issuance of 70,000,000 common shares of AlphaRx to the shareholders of UMeLook in exchange for all of the issued and outstanding shares in UMeLook. There were no changes of control of our officers and Board of Directors as a result of the UMeLook acquisition. Due to PRC’s legal restrictions on foreign ownership and investment in the value-added telecommunications market, we operated our online platform through Guangzhou XinYiXun Technology Co. Ltd (“Guangzhou XinYiXun”), our consolidated variable interest entity, or VIE, in the PRC. Guangzhou XinYiXun held our VATS (“Value-Added Telecommunication Services”) license necessary to operate our online platform in China, our registered trademarks in China and three of our registered software copyright that are essential to the Company's operation in PRC.

As a holding company with no material operations of our own. We relied on a series of contractual arrangements among UMeLook (Guangzhou) Information Technology Co., Ltd (“UMeLook Guangzhou”), Guangzhou XinYiXun and its shareholders to operate our business in China. Neither we nor our subsidiaries owned any share in Guangzhou XinYiXun. However, as a result of these contractual arrangements, we were the primary beneficiary of Guangzhou XinYiXun and treated it as our consolidated VIE under U.S. GAAP.

In 2017, we launched a day-care & private tutoring product trial targeting Grade 1 to Grade 6 students under the UMTang brand, this UMTang product trail was terminated in 2017 due to government regulations and licensing issues.

On November 4, 2019, the Company entered into an acquisition agreement with Beijing Radish Green Vegetable Education Technology Co., Ltd. (“Proud Kids”) in an all-stock transaction. Pursuant to the agreement, Proud Kids’ shareholders will receive up to 37,500,000 ordinary shares of the Company upon closing. The acquisition agreement, as amended, was terminated by the Company on April 30, 2020.

On May 20, 2021, we entered into a Platform Usage Agreement for Easy Learn English with Beijing Deyibai Education Technology Co., Ltd. Easy Learn English combines artificial intelligence with human tutors to deliver personalized one on one English learning for Grade 5 to University level students. Under the terms of this Agreement, the Company setup both corporate-owned and franchised centers surrounding the Greater Bay area in Guangdong province.

In December 2021, we terminated the contractual arrangements among UMeLook Guangzhou, Guangzhou XinYiXun and its shareholder and dissolved our education business in China. Due to the termination of the VIE structure, we no longer own the VATS license, registered trademarks, and registered software copyrights which were held by Guangzhou XinYiXun. Please refer to Note 11 - Discontinued Operations to our consolidated financial statements.

In June 2022, we launched DAGola brand DAG (diacylglycerol) cooking oil into the U.S. market through Amazon.com. DAGola oil is a revolutionary cooking oil scientifically shown to promote lower triglycerides and uric acid levels. The Company is transitioning itself into a health and wellness company through its DAGola brand cooking oil business unit and nutritional supplement distribution business unit.

On September 30, 2022, the Company entered into two sale and purchase agreements with an individual to dispose UMeLook HK and UMeZone Adaptive Learning Technology Limited (“UMeZone”) for a consideration of $0.13 (equivalent to HK$1) each.

By the end of 2022, we began negotiations with third parties in Malaysia to discuss the potential acquisition of three distinct palm oil mills within the country. In furtherance thereof, we worked towards a letter of intent with the associated parties. We expect that the transaction will be completed via execution of a definitive joint venture agreement in 2024. In consideration of the prior, we intend to make a significant pivot towards becoming a fully integrated edible oils company, capable of the manufacturing, refining, packaging and sale of palm oil, palm oil derivative products, and other vegetable oils.

UMeWorld Limited is a holding company with an operating subsidiary Dagola Inc. located in Miami, Florida. We are a health and wellness company with a mission to help our customers live healthier, and seek to become an integrated edible oils company through a series of significant acquisitions expected to be completed in the latter half of 2023, going into 2024. The Company, through its subsidiary, plans to operate in the sales and marketing of DAG (Diacylglycerol) cooking oils and nutritional supplements, and intends to acquire and form additional subsidiaries operating within the edible oils industry, producing, refining and preparing for sale our own distinct brands of vegetable oils to consumers located internationally. Our management team brings deep expertise in heavily regulated industries, operating, brand identity and services, and raising capital to the public market. We seek synergistic and complementary mergers and acquisition opportunities, implementing operational efficiencies to eliminate duplicative measures and centralize administrative operations to achieve more significant revenues and profitability. Additionally, we expect to leverage our network of retail relationships, as well as acquire and manage brands and services cultivated in the health and wellness industry to secure sales in major retailers in the United States and globally. Our management team monitors a variety of trends and factors that follow which could impact our operating performance.

On December 31, 2021, UMeLook Guangzhou, Guangzhou XinYiXun, and the shareholders of Guangzhou XinYiXun mutually agreed to terminate the series of contractual arrangements, which consisted of the Exclusive Management Service Agreement, the Proxy Agreement, the Equity Pledge Agreement, the Exclusive Technology Consultation and Services Agreement, and the Call Option Agreement, due to the education policy chang in the PRC. As a result, the education business of the Company was dissolved.

Our Revenue Strategy

Our revenue growth strategy follows a dual buy and build model in which we acquire brands and related infrastructure, as well as develop brands and related infrastructure in-house. In addition to scaling the Company’s wholly-owned subsidiary, Dagola Inc, which currently owns and operates our DAGola brand cooking oil, we have executed a definitive agreement to acquire a nutritional supplement retailer in Florida, U.S, and have begun negotiation for a letter of intent and execution of a definitive joint venture agreement with a palm oil mill operator in Malaysia. The closing of these transactions is dependent on numerous factors including but not limited to satisfactory completion of due diligence, capital constraints, and more. These contemplated transactions will likely have a material impact on the Company’s operating performance.

Our Principal Product

DAGola DAG Cooking and Salad Oil -- a revolutionary cooking and salad oil clinically shown to help in the fight against body fat, obesity and promotes lowering of serum triglycerides and uric acid levels.

What is DAG (Diacylglycerol) Oil? All conventional cooking oils currently in the market (vegetable, corn, soy, canola, olive, etc.) are triglyceride-based oils (TAG) and contain some small amounts of diacylglycerols. High levels of triglycerides in the bloodstream, a condition referred to as hypertriglyceridemia, occurs in many different populations in the world today and is strongly correlated to the quantity of fat consumed in the diet. An excess of triglycerides in the body results in it being stored in the liver or in fat cells in reserve to supply energy when needed. Unlike triglycerides, DAG is metabolized (broken down) directly by the body as energy, rather than stored as fat. According to clinical studies, DAG oil may help individuals maintain or lose weight when included as part of a sensible diet.

DAG oil was developed by a Japanese multinational company as a substitute for fat and sugary oils currently in the market. It became the most popular cooking oil in Japan, following its introduction in 1999. In 2009, DAG oil was pulled from the worldwide market voluntarily, due to concerns about adverse health reactions to glycidyl ester, one of the ingredients in vegetable oils. The Company’s strategic partner has solved this problem so that DAG oil’s health benefits can now be safely available to help enhance people’s health.

The FDA has designated DAG oil as a GRAS (“Generally Regarded as Safe”) substance, while other countries such as Canada, Australia, China and the European Union have recognized DAG oil as a novel food and can be marketed to consumers freely. It is worth noting that in order to have medical benefits, DAG oil should contain at least 27% DAG according to clinical studies. In China, a cooking oil must contain at least 40% DAG in order to make the DAG oil claim on its product label. The Company’s DAG oils have been the subject of an ongoing clinical trial with 400 type 2 diabetic patients, showing a significant reduction in body weight, body mass index, total serum cholesterol and a significant reduction in serum uric acid.

The Company’s DAG oil is made from all natural canola, it has less saturated fat than conventional cooking and salad oils, has zero grams of trans fat per serving, no cholesterol and is a source of polyunsaturated and monounsaturated fatty acids. DAG oil fits within the dietary guidelines of many medical associations and might be an effective tool for the reduction of lifestyle-related diseases such as obesity, visceral obesity, postprandial hyperlipidemia, insulin resistance, and atherosclerosis.

Market Opportunity

We aim to become a major participant in the $1.5 trillion global wellness industry. We see great potential to grow and generate revenues in this expanding market. We expect consumer trends towards adoption of a healthier lifestyle to continue. Furthermore, we see significant potential within the edible oils industry, and see potential to leverage synergies with DAG oil production methods to create widely available and healthier alternatives to many edible oils as currently exist.

Competition

We compete with companies that operate in the health and wellness market, and in the edible oils industry. Many of our competitors have substantially greater financial resources, broader market presence, longer-standing relationships with distributors, retailers, and suppliers, longer operating histories, more extensive production and distribution capabilities, more robust brand recognition, more significant marketing resources, and more comprehensive product lines than us. We believe that principal competitive factors in this category include, among others, quality ingredients, wellness profile, cost, convenience, branding, and marketing.

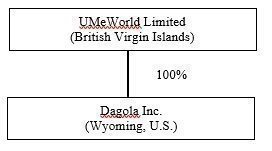

C. | Organizational Structure |

UMeWorld Limited is a holding company without substantive operations and we conduct our businesses through our wholly-owned subsidiary in the U.S. The chart below summarizes our corporate legal structure as of the date of this annual report:

Deconsolidation of VIE and Subsidiaries

Prior to January 2022, we conducted substantially all of our operations through our VIE, Guangzhou XinYiXun Network Technology Co. Ltd and its wholly owned subsidiary Guangzhou Youmanfen Education Technology Co. Ltd, in China. The VIE structure was dissolved in December 31 2021. Please refer to our Discontinued Operations in Note 11 to our consolidated financial statements.

D. | Properties, Plants & Equipment |

We do not own any real property. We do not lease any office space at this time. We currently use office space provided by an unrelated party free of charge.

Our servers are primarily hosted at internet data centers owned by major domestic internet data center providers. The hosting services agreements typically have terms of one year. We believe that we will be able to obtain adequate facilities, principally through leasing, to accommodate our future expansion plans.

E. | Smaller Reporting Company |

We qualify as a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended, and have elected to take advantage of certain of the scaled disclosure available to smaller reporting companies. There are certain exemptions available to us as a smaller reporting company, including: (1) not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes Oxley Act; (2) scaled executive compensation disclosures; and (3) the requirement to provide only two years of audited financial statements, instead of three years. As long as we maintain our status as a “smaller reporting company”, these exemptions will continue to be available to us.

ITEM 4A. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

You should read the following discussion and analysis of our financial condition and results of operations in conjunction with the consolidated financial statements and the related notes included elsewhere in this annual report on Form 20-F. This discussion contains forward-looking statements based upon current expectations that involve risks and uncertainties. Our actual results and the timing of selected events could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth under “Item 3.D. Key Information—Risk Factors” and elsewhere in this annual report on Form 20-F.

Overview

We are a holding company that is incorporated in the British Virgin Islands. As a holding company with no operations, we conduct all of our operations through our subsidiary in the United States. Prior to January 2022, we conducted substantially all of our operations through our VIE, Guangzhou XinYiXun, in China. The VIE structure was terminated and the education business was dissolved in December 2021.

We are a health and wellness company with a mission to help our customers live healthier. The Company, through its subsidiary, operates in the sales and marketing of DAG (Diacylglycerol) cooking oils and nutritional supplements, and intends to, through a series of acquisitions expected to occur in the first half of 2024 going into 2025, enter into the palm oil industry through the manufacturing, refining and sale thereof. Our management team brings deep expertise in heavily regulated industries, operating, brand identity and services, and raising capital to the public market. We seek synergistic and complementary mergers and acquisition opportunities, implementing operational efficiencies to eliminate duplicative measures and centralize administrative operations to achieve more significant revenues and profitability. Additionally, we expect to leverage our network of retail relationships, as well as acquire and manage brands and services cultivated in the health and wellness industry to secure sales in major retailers in the United States and globally. Our management team monitors a variety of trends and factors that follow which could impact our operating performance.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. We have limited cash resources, recurring cash used in operations and operating losses history. As shown in the accompanying consolidated financial statements, we have an accumulated deficit of approximately $31.45 million as of September 30, 2023, net loss of $0.31 million, and net cash used in operating activities of $0.07 million for the year ended September 30, 2023. These factors, among others, raise substantial doubt about the Company’s ability to continue as a going concern.

Results of Operations

The following tables summarize the results of operations for the years ended September 30, 2023, 2022 and 2021 and the annual results of operations for the past three years:

Years Ended September 30 | | 2023 | | | 2022 | | | 2021 | |

| | $ | | | $ | | | $ | |

Revenue | | | 1,401 | | | | 93 | | | | 2,832 | |

Cost of revenue | | | (4,546 | ) | | | (859 | ) | | | (19,641 | ) |

Selling, general and administrative expenses | | | (303,195 | ) | | | (85,686 | ) | | | (86,848 | ) |

Other income | | | - | | | | 2,850 | | | | - | |

Interest income | | | - | | | | - | | | | 31 | |

Other expense | | | - | | | | - | | | | (3,810 | ) |

Income tax expense | | | - | | | | - | | | | - | |

Net loss from continuing operations | | | (306,340 | ) | | | (83,602 | ) | | | (107,436 | ) |

Net loss from discontinued operations | | | - | | | | (64,084 | ) | | | - | |

Net loss | | | (306,340 | ) | | | (147,686 | ) | | | (107,436 | ) |

RESULTS OF OPERATIONS

The Year Ended September 30, 2023 Compared to the Year Ended September 30, 2022

Revenues

Our revenues increased from $93 in 2022 to $1,401 in 2023. This increase was related to the revenue stream from the sales of DAG Oil and a calcium product.

Cost of Revenues

Our cost of revenues increased from $859 in 2022 to $4,546 in 2023. The increase was due to the sales of DAG Oil.

Selling, General and Administrative Expenses

Our selling, general and administrative expenses increased from $85,686 in 2022 to $303,195 in 2023.

Other Income

Other Income decreased from $2,850 in 2022 to $0 in 2023.

Income Tax Expense

There was no income tax expense incurred for the years ended September 30, 2023 and 2022.

Net Loss From Discontinued Operations

Net loss from discontinued operation decreased from $64,084 in 2022 to $0 in 2023.

Net Loss

As a result of the cumulative effect of the foregoing factors, we incurred a net loss of $306,340 for the year ended September 30, 2023 as compared to net loss of $147,686 for the year ended September 30, 2022, an increase of $158,654 or about 107%. The increase was mainly attributed from the loss from discontinued operations.

The Year Ended September 30, 2022 Compared to the Year Ended September 30, 2021

Revenues

Our revenues decreased from $2,832 in 2021 to $93 in 2022.

Cost of Revenues

Our cost of revenues decreased from $19,641 in 2021 to $859 in 2022. The decrease was due to headcount-related expenses to serve Easy Learn English product.

Selling, General and Administrative Expenses

Our selling, general and administrative expenses have a relatively small decrease from $86,848 in 2021 to $85,686 in 2022.

Other Income

We had $0 other income in 2021, as compared to other income of $2,850 in 2022.

Other Expense

We had $0 other expense in 2022, as compared to other expense of $3,810 in 2021.

Income Tax Expense

There was no income tax expense incurred for the years ended September 30, 2022 and 2021.

Net loss

As a result of the cumulative effect of the foregoing factors, we incurred a net loss of $147,686 for the year ended September 30, 2022 as compared to net loss of $107,436 for the year ended September 30, 2021, an increase of $40,250 or about 37.46%. The increase was mainly attributable to the termination of the VIE structure and the dissolution of the education business in China.

Liquidity and Capital Resources

Our principal sources of liquidity have been proceeds from the issuance of our ordinary shares and promissory notes to our CEO, directors and shareholders. We intend to finance our future working capital requirements and capital expenditures from cash generated from operating activities and funds raised from financing activities. However, we may require additional cash resources due to changing business conditions or other future developments, including any investments or acquisitions we may decide to selectively pursue. If our existing cash resources are insufficient to meet our requirements, we may seek to sell equity, sell debt securities or borrow from banks. We cannot assure you that financing will be available in the amounts we need or on terms acceptable to us, if at all. The sale of additional equity securities would result in additional dilution to our shareholders. The incurrence of indebtedness and issuance of debt securities would result in debt service obligations and could result in operating and financial covenants that restrict our operations and our ability to pay dividends to our shareholders.

Going Concern

In assessing the Company’s liquidity and its ability to continue as a going concern, the Company monitors and analyzes its cash and cash equivalents and its operating and capital expenditure commitments. The Company’s liquidity needs are to meet its working capital requirements, operating expenses and capital expenditure obligations. If the Company is unable to obtain the additional funding in the immediate future, it will have to cease all operations on a permanent basis.

Working Capital

As of September 30, 2023 and 2022, we had cash balances of $57,435 and $2,443 respectively. These funds are primarily located in various financial institutions located in Canada and USA.

As of September 30, 2023, we had working capital deficiency of approximately $375,870 as compared to a working capital deficiency of $354,450 as of September 30, 2022. Since inception, we have financed operations primarily from the issuance of ordinary shares and promissory notes. We expect to continue ordinary share issuances and issuance of promissory notes to fund our ongoing activities.