FORM

6-K

U.S.

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES

EXCHANGE ACT OF 1934

dated

January 31, 2024

Commission

File Number 0-51504

GENETIC

TECHNOLOGIES LIMITED

(Exact

Name as Specified in its Charter)

N/A

(Translation

of Registrant’s Name)

60-66

Hanover Street

Fitzroy

Victoria

3065 Australia

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate

by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

☐ No ☒

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused the Report to be signed on its behalf by the

undersigned, thereunto duly authorized.

Date:

January 31, 2024

| |

GENETIC

TECHNOLOGIES LIMITED |

| |

|

| |

By: |

/s/

Tony Di Pietro |

| |

Name: |

Tony

Di Pietro |

| |

Title: |

Company

Secretary |

EXHIBIT

INDEX

Exhibit

99.1

Appendix

4C & Quarterly Business Update – December 2023

Launching

our most comprehensive test and expanding into new global markets

Melbourne,

Australia, 31 January 2024: Genetic Technologies Limited (ASX:GTG; NASDAQ:GENE, “Company”, “GTG”), a global

leader in guideline-driven genomics-based testing in health, wellness and serious diseases, releases its Appendix 4C and Quarterly business

update for the quarter ending 31 December 2023 (Q2 FY24).

Key

highlights:

| ● |

Cash Receipts totalling

A$3.6m for the Qtr ending December 2023 |

|

● |

Commenced Precision Medicine Pilot with

the Gold Coast Private Hospital, a member of Healthscope. |

| |

● Receipts from customers

A$1.85m |

|

|

|

| |

● R&D Tax Incentive

of A$1.75 million received. |

|

|

|

| |

|

|

|

|

| ● |

Appointment of 2 experienced commercial

advisors to accelerate our Direct to Consumer (‘DTC’) plans for Genetype in the U.S., capitalising on the burgeoning

consumer personalised health and wellness sector. |

|

● |

Expanding Global Footprint South East

Asia. Discussions continue with potential partners to access Indonesia’s healthcare market, with the geneType Multi-Risk

test |

| |

|

|

|

|

| ● |

Record number of geneType tests processed,

with six times more commercial samples received compared to the prior corresponding period. |

|

● |

Expanding Global Footprint UK. In

April 2024 the Company’s branded tests are to be offered to subscribers of the UK National Pharmacies Association (NPA) via

a targetted campaign. |

| |

|

|

|

|

| ● |

Launched Hereditary Breast & Ovarian

Cancer Risk Assessment Test (HBOC) via an exclusive Santa Monica event for a select group of clinicians. |

|

● |

Commenced Activities associated with

CASSOWARY Trial. MRFF Grant named GTG as sole industry partner for the $2.4 million clinical trial. Results will inform how cancer

risk is assessed and has the potential to reshape care in General Practice. |

Commenting

on the Company’s quarterly performance, Chief Executive Officer Simon Morriss said:

“In

the past quarter, we achieved further significant milestones in the business starting with a record number of geneType test processed.

Additionally, the team have successully recruited many new healthcare professionals, setting up a strong base for increased adoption

of our tests in our key markets, Australia and the U.S. Other achievements include the launch of the geneType HBOC test in the U.S.,

continued partnering discussions for the the rapidly expanding healthcare sector in Indonesia and we are excited about the upcoming launch

of our branded tests in the UK through the National Pharmacies Association (NPA).

“Locally

our Precision Medicine Clinic pilot at Gold Coast Private Hospital (GCPH), a member of Healthscope, is getting under way utilising GTG’s

geneType Multi Risk test combined with Pharmacogenomics (PGx) tests with the ultimate objective of improving outcomes for GCPH’s

patients. Additionally, being named the sole industry partner for a Medical Research Future Fund (MRFF) Genomics Health Futures Mission

Grant further underscores our commitment to groundbreaking research.

“Finally

I want to thank our shareholders for their support at the 2023 Annual General meeting on the share consolidation and enhancing our ability

to raise capital and pursue future growth opportunities”.

| Genetic

Technologies Limited |

60-66

Hanover Street |

| www.geneType.com |

Fitzroy

Victoria 3065 |

| info@gtglabs.com |

Australia |

| ABN

17 009 212 328 |

+61

3 8412 7000 |

Operational

Highlights

GeneType

Tests

A

record number of geneType tests were processed during the quarter, with a sixfold increase in commercial samples received in comparison

to the prior quarter. The geneType sales team is on-boarding new Health Care Professionals (HCPs) on a weekly basis, providing a solid

foundation for ongoing growth in adoption of geneType in the U.S. and Australia.

Launch

of Comprehensive Hereditary Breast & Ovarian Cancer Risk Assessment Test

In

November, the geneType Comprehensive HBOC test was launched to a selected group of clinicians at an exclusive launch event in Santa Monica,

California, hosted by Dr Ora Gordon, the Medical Director of the Integrative Medicine & Genetics/Hereditary Cancer Prevention division

of the Providence Medical Institute. Dr Gordon is one of GTG’s Clinical Advisors. Dr Gordon was supported at the launch by GTG’s

Director of Medical & Scientific Affairs, Dr Erika Spaeth.

Exploring

New Markets

South

East Asia

Engagement

continues with potential partners in the rapidly growing Indonesian healthcare market. Government spending in Indonesia’s healthcare

sector is expected grow to US$78 billion by 20271. GTG anticipates executing a Memorandum of Understanding (MoU) in the coming

months to cement a long-term partnership and expansion of the groundbreaking geneType Multi-Risk test in this key market.

United

Kingdom

Launch

of the Company’s branded tests, EasyDNA, Affinity DNA, and geneType, via a targeted campaign with U.K. National Pharmacies Association

(NPA), will be launched in April 2024, providing unprecedented access to a wide range of critical tests to consumers in the UK via the

NPA network.

Precision

Medicine Pilot Partnership commences with The Gold Coast Private Hospital

The

partnership with the Gold Coast Private Hospital (GCPH), a member of Healthscope, is an exciting initiative. The pilot is well underway

with several patients already recruited for this ground-breaking study in preventative health. The goal of precision medicine is to target

the right treatments to the right patients at the right time. Utilising GTG’s geneType Multi-test and Pharmacogenomics (PGx) tests

is a major step in improving health outcomes for GCPH’s patients.

The

partnership was initiated with a 50-patient pilot study to establish workflow and patient reporting, utilising geneType multi-risk test

combined with PGx tests, provide a comprehensive wellness profile for GCPH patients. Positive outcomes from the study will enable the

rollout of additional Precision Medicine Clinics throughout the Healthscope network. Healthscope is Australia’s only national private

hospital operation and healthcare provider with a network of thirty-eight hospitals that service every state and territory with approximately

19,000 employees. GTG believes this is an exciting opportunity to prove the clinical and predictive utility of geneType.

1https://www.trade.gov/healthcare-resource-guide-indonesia#:~:text=2%20trillion%20(%2447.1%20billion,10.0%25%20in%20U.S.%20dollar%20terms.

| Genetic

Technologies Limited |

60-66

Hanover Street |

| www.geneType.com |

Fitzroy

Victoria 3065 |

| info@gtglabs.com |

Australia |

| ABN

17 009 212 328 |

+61

3 8412 7000 |

MRFF

Grant

During

the quarter, activities connected with the CASSOWARY Trial, a randomised controlled trial of the clinical utility and cost-effectiveness

of a multi-cancer polygenic risk score in general practice, commenced. GTG were named as sole industry partner for a Medical Research

Future Fund (MRFF) Genomics Health Futures Mission Grant supporting the trial. Results from the trial are expected to change the way

risk is assessed and reshape the standard of care in general practice for serious disease. The trial results will inform future policy

including the 5-year goal for the Australian Cancer Plan to use genomics for risk-stratified cancer screening. Six hundred patients from

eight general practices across Victoria will be recruiting for participation in the trial. Patient recruitment and clinician selection

for the pilot has commenced. GTG believes results from this trial will form an important step in introducing risk assessments test such

as geneType into routine general practice.

Capital

Management Initiatives

At

the Company’s AGM shareholders approved by resolution the refreshing of the capacity to raise additional capital up to 15% of GTG’s

existing capital, per the ASX listing rules.

During

the quarter, a share consolidation of the ordinary shares was undertaken, based on one share for each parcel of one hundred shares held,

reducing the total number of shares on issue from approximately 11.5 billion to approximately 115 million.

Connected

with the listing of Genetic Technologies’ ADR on the NASDAQ in the United States, the Company submitted a F-3 shelf prospectus

with the Securities and Exchange Commission (SEC). The prospectus was accepted by the SEC and became effective on 4 January 2024. The

prospectus has a three-year life and provides a basis from which to raise capital from U.S. investors when required over the three-year

period.

Section

8 of the Appendix 4C attached to this announcement provides a calculation of the estimated cash available for future operating activities.

The calculation provides an estimate of the number of quarters of funding available. Based on the cash outflow from operating activities

for the December quarter, the calculation indicates GTG has an estimated 3.4 quarters of cash to fund operations, see section 8.5. The

calculation for the December quarter was skewed by the receipt of the R & D Tax Incentive refund. To support the Company’s

continued investment in its core brands, GeneType, EasyDNA and AffinityDNA, and to secure further revenue growth, the Company will be

undertaking capital raising initiatives in the near term. Further details of these initiatives will be provided to the market in the

coming weeks.

Financial

and Cashflow Overview

At

the end of December 2023, GTG had A$3.7 million in cash and cash equivalents. Cash receipts from customers for the quarter were A$1.84

million and the Company received A$1.75 million from the R&D Tax Incentive refund for the 2023 financial year. Cash outflow for operating

activities was A$1.14 million.

During

the quarter, the Company made A$96k of payments to related parties of the entity, and their associates, disclosed at item 6.1 of the

Appendix 4C. The payments related to director and consulting fees (inclusive of GST) on normal commercial terms.

Authorised

for release by the Board of Genetic Technologies Limited

-END-

| Genetic

Technologies Limited |

60-66

Hanover Street |

| www.geneType.com |

Fitzroy

Victoria 3065 |

| info@gtglabs.com |

Australia |

| ABN

17 009 212 328 |

+61

3 8412 7000 |

Enquiries

Investor

Relations

Adrian Mulcahy

Automic Markets

M: +61 438 630 411

E: Adrian.mulcahy@automicgroup.com.au

About

Genetic Technologies Limited

Genetic

Technologies Limited (ASX: GTG; Nasdaq: GENE) is a diversified molecular diagnostics company. A global leader in genomics-based tests

in health, wellness and serious disease through its geneType and EasyDNA brands. GTG offers cancer predictive testing and assessment

tools to help physicians to improve health outcomes for people around the world. The company has a proprietary risk stratification platform

that has been developed over the past decade and integrates clinical and genetic risk to deliver actionable outcomes to physicians and

individuals. Leading the world in risk prediction in oncology, cardiovascular and metabolic diseases, Genetic Technologies continues

to develop risk assessment products. For more information, please visit www.geneType.com

Forward

Looking Statements

This

announcement may contain forward-looking statements about the Company’s expectations, beliefs or intentions regarding, among other

things, statements regarding the expected use of proceeds. In addition, from time to time, the Company or its representatives have made

or may make forward-looking statements, orally or in writing. Forward-looking statements can be identified by the use of forward-looking

words such as “believe,” “expect,” “intend,” “plan,” “may,” “should”

or “anticipate” or their negatives or other variations of these words or other comparable words or by the fact that these

statements do not relate strictly to historical or current matters. These forward-looking statements may be included in, but are not

limited to, various filings made by the Company with the U.S. Securities and Exchange Commission, press releases or oral statements made

by or with the approval of one of the Company’s authorized executive officers. Forward-looking statements relate to anticipated

or expected events, activities, trends or results as of the date they are made. As forward-looking statements relate to matters that

have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause the Company’s actual

results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause

the Company’s actual activities or results to differ materially from the activities and results anticipated in such forward-looking

statements as detailed in the Company’s filings with the Securities and Exchange Commission and in its periodic filings with the

ASX in Australia and the risks and risk factors included therein. In addition, the Company operates in an industry sector where securities

values are highly volatile and may be influenced by economic and other factors beyond its control. The Company does not undertake any

obligation to publicly update these forward-looking statements, whether as a result of new information, future events or otherwise, except

as required by law.

| Genetic

Technologies Limited |

60-66

Hanover Street |

| www.geneType.com |

Fitzroy

Victoria 3065 |

| info@gtglabs.com |

Australia |

| ABN

17 009 212 328 |

+61

3 8412 7000 |

Appendix

4C

Quarterly

cash flow report for entities

subject to Listing Rule 4.7B

Name

of entity

Genetic

Technologies Limited

| ABN |

|

Quarter

ended (“current quarter”) |

| 17

009 212 328 |

|

31

December 2023 |

| Consolidated statement of cash flows | |

Current quarter

$A’000 | | |

Year to date

(6 months) $A’000 | |

| 1. | |

Cash flows from operating activities | |

| | |

| |

| 1.1 | |

Receipts from customers | |

| 1,843 | | |

| 3,880 | |

| 1.2 | |

Payments for | |

| | | |

| | |

| | |

(a) research and development | |

| (391 | ) | |

| (502 | ) |

| | |

(b) product manufacturing and operating costs | |

| (931 | ) | |

| (1,881 | ) |

| | |

(c) advertising and marketing | |

| (703 | ) | |

| (1,115 | ) |

| | |

(d) leased assets | |

| (86 | ) | |

| (173 | ) |

| | |

(e) staff costs | |

| (1,827 | ) | |

| (3,685 | ) |

| | |

(f) administration and corporate costs | |

| (866 | ) | |

| (2,460 | ) |

| 1.3 | |

Dividends received (see note 3) | |

| - | | |

| - | |

| 1.4 | |

Interest received | |

| 82 | | |

| 119 | |

| 1.5 | |

Interest and other costs of finance paid | |

| (2 | ) | |

| (2 | ) |

| 1.6 | |

Income taxes paid | |

| - | | |

| - | |

| 1.7 | |

Government grants and tax incentives | |

| 1,748 | | |

| 1,748 | |

| 1.8 | |

Other (provide details if material) | |

| - | | |

| - | |

| 1.9 | |

Net cash from / (used in) operating activities | |

| (1,133 | ) | |

| (4,071 | ) |

| 2. | |

Cash flows from investing activities | |

| | |

| |

| 2.1 | |

Payments to acquire or for: | |

| | | |

| | |

| | |

(a) entities | |

| - | | |

| - | |

| | |

(b) businesses | |

| - | | |

| - | |

| | |

(c) property, plant and equipment | |

| (7 | ) | |

| (28 | ) |

| | |

(d) investments | |

| - | | |

| - | |

| | |

(e) intellectual property | |

| - | | |

| - | |

| | |

(f) other non-current assets | |

| - | | |

| - | |

ASX Listing Rules Appendix 4C (17/07/20) | Page 1 |

| + See chapter 19 of the ASX Listing Rules for defined terms. | |

Appendix

4C

Quarterly cash flow report for entities subject to Listing Rule 4.7B

| | |

Consolidated statement of cash flows | |

Current quarter

$A’000 | | |

Year to date

(6 months)$A’000 | |

| 2.2 | |

Proceeds from disposal of: | |

| | | |

| | |

| | |

(a) entities | |

| - | | |

| - | |

| | |

(b) businesses | |

| - | | |

| - | |

| | |

(c) property, plant and equipment | |

| - | | |

| - | |

| | |

(d) investments | |

| - | | |

| - | |

| | |

(e) intellectual property | |

| - | | |

| - | |

| | |

(f) other non-current assets | |

| - | | |

| - | |

| 2.3 | |

Cash flows from loans to other entities | |

| - | | |

| - | |

| 2.4 | |

Dividends received (see note 3) | |

| - | | |

| - | |

| 2.5 | |

Other (provide details if material) | |

| - | | |

| - | |

| 2.6 | |

Net cash from / (used in) investing activities | |

| (7 | ) | |

| (28 | ) |

| 3. | |

Cash flows from financing activities | |

| | |

| |

| 3.1 | |

Proceeds from issues of equity securities (excluding convertible debt securities) | |

| - | | |

| - | |

| 3.2 | |

Proceeds from issue of convertible debt securities | |

| - | | |

| - | |

| 3.3 | |

Proceeds from exercise of options | |

| - | | |

| - | |

| 3.4 | |

Transaction costs related to issues of equity securities or convertible debt securities | |

| - | | |

| - | |

| 3.5 | |

Proceeds from borrowings | |

| - | | |

| - | |

| 3.6 | |

Repayment of borrowings | |

| - | | |

| - | |

| 3.7 | |

Transaction costs related to loans and borrowings | |

| - | | |

| - | |

| 3.8 | |

Dividends paid | |

| - | | |

| - | |

| 3.9 | |

Other (provide details if material) | |

| - | | |

| - | |

| 3.10 | |

Net cash from / (used in) financing activities | |

| - | | |

| - | |

| 4. | |

Net increase / (decrease) in cash and cash equivalents for the period | |

| | |

| |

| 4.1 | |

Cash and cash equivalents at beginning of period | |

| 4,898 | | |

| 7,853 | |

| 4.2 | |

Net cash from / (used in) operating activities (item 1.9 above) | |

| (1,133 | ) | |

| (4,071 | ) |

| 4.3 | |

Net cash from / (used in) investing activities (item 2.6 above) | |

| (7 | ) | |

| (28 | ) |

| 4.4 | |

Net cash from / (used in) financing activities (item 3.10 above) | |

| - | | |

| - | |

| 4.5 | |

Effect of movement in exchange rates on cash held | |

| (29 | ) | |

| (25 | ) |

| 4.6 | |

Cash and cash equivalents at end of period | |

| 3,729 | | |

| 3,729 | |

ASX Listing Rules Appendix 4C (17/07/20) | Page 2 |

| + See chapter 19 of the ASX Listing Rules for defined terms. | |

Appendix

4C

Quarterly cash flow report for entities subject to Listing Rule 4.7B

| 5. | |

Reconciliation of cash and cash equivalents

at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts | |

Current quarter

$A’000 | | |

Previous quarter

$A’000 | |

| 5.1 | |

Bank balances | |

| 1,229 | | |

| 1,898 | |

| 5.2 | |

Call deposits | |

| 2,500 | | |

| 3,000 | |

| 5.3 | |

Bank overdrafts | |

| - | | |

| - | |

| 5.4 | |

Other (provide details) | |

| - | | |

| - | |

| 5.5 | |

Cash and cash equivalents at end of quarter (should equal item 4.6 above) | |

| 3,729 | | |

| 4,898 | |

| 6. | |

Payments to related parties of the entity and their associates | |

Current quarter

$A’000 | |

| 6.1 | |

Aggregate amount of payments to related parties and their associates included in item 1 | |

| 96 | |

| 6.2 | |

Aggregate amount of payments to related parties and their associates included in item 2 | |

| - | |

Note:

if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include

a description of, and an explanation for, such payments.

During

the quarter, the Company made payments to related parties of the entity and their associates as disclosed in Item 6.1 of the Appendix

4C amounting to $96k. The payments related to the director fees and consulting fees (inclusive of GST) on normal commercial terms. |

| 7. | |

Financing facilities

Note: the term “facility’ includes all forms of financing arrangements available to the entity. Add notes as necessary for an understanding of the sources of finance available to the entity. | |

Total facility amount at quarter end

$A’000 | | |

Amount drawn at quarter end

$A’000 | |

| 7.1 | |

Loan facilities | |

| - | | |

| - | |

| 7.2 | |

Credit standby arrangements | |

| - | | |

| - | |

| 7.3 | |

Other (please specify) | |

| 188 | | |

| 54 | |

| 7.4 | |

Total financing facilities | |

| 188 | | |

| 54 | |

| | |

| |

| | | |

| | |

| 7.5 | |

Unused financing facilities available at quarter end | |

| | | |

| 134 | |

| 7.6 |

Include

in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured

or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end,

include a note providing details of those facilities as well. |

| |

|

| |

1.

Secured – Bank of America, US$25,000 facility with interest at 9.25%

2.

Unsecured – National Australia Bank, $150,000 facility with interest at 15.5%

|

ASX Listing Rules Appendix 4C (17/07/20) | Page 3 |

| + See chapter 19 of the ASX Listing Rules for defined terms. | |

Appendix

4C

Quarterly cash flow report for entities subject to Listing Rule 4.7B

| 8. | |

Estimated cash available for future operating activities | |

$A’000 |

| 8.1 | |

Net cash from / (used in) operating activities (item 1.9) | |

| (1,133 | ) |

| 8.2 | |

Cash and cash equivalents at quarter end (item 4.6) | |

| 3,729 | |

| 8.3 | |

Unused finance facilities available at quarter end (item 7.5) | |

| 134 | |

| 8.4 | |

Total available funding (item 8.2 + item 8.3) | |

| 3,863 | |

| | |

| |

| | |

| 8.5 | |

Estimated quarters of funding available (item 8.4 divided by item 8.1) | |

| 3.4 | |

| |

Note: if

the entity has reported positive net operating cash flows in item 1.9, answer item 8.5 as “N/A”. Otherwise, a figure

for the estimated quarters of funding available must be included in item 8.5. |

| |

|

| 8.6 |

If item 8.5 is less than 2 quarters, please provide

answers to the following questions: |

| |

|

| |

8.6.1 Does the entity expect

that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? |

| |

|

| |

Answer:

N/A |

| |

|

| |

8.6.2 Has the entity taken

any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and

how likely does it believe that they will be successful? |

| |

|

| |

Answer: N/A |

| |

|

| |

8.6.3 Does the entity expect

to be able to continue its operations and to meet its business objectives and, if so, on what basis? |

| |

|

| |

Answer:

N/A |

| |

|

| |

Note: where item 8.5

is less than 2 quarters, all of questions 8.6.1, 8.6.2 and 8.6.3 above must be answered. |

ASX Listing Rules Appendix 4C (17/07/20) | Page 4 |

| + See chapter 19 of the ASX Listing Rules for defined terms. | |

Appendix

4C

Quarterly cash flow report for entities subject to Listing Rule 4.7B

Compliance

statement

| 1 |

This statement has been prepared

in accordance with accounting standards and policies which comply with Listing Rule 19.11A. |

| |

|

| 2 |

This statement gives a true

and fair view of the matters disclosed. |

| Date: |

31 January 2024 |

| |

|

| Authorised by: |

Tony Di Pietro |

| |

Company Secretary |

Notes

| 1. |

This quarterly cash flow

report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past

quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional

information over and above the minimum required under the Listing Rules is encouraged to do so. |

| |

|

| 2. |

If this quarterly cash flow

report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 107: Statement

of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards

agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standard applies to this report. |

| |

|

| 3. |

Dividends received may be

classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy

of the entity. |

| |

|

|

4.

|

If this report has been authorised

for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for

release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee

– eg Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee,

you can insert here: “By the Disclosure Committee”. |

| |

|

| 5. |

If

this report has been authorised for release to the market by your board of directors and you wish to

hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s

Corporate Governance Principles and Recommendations, the board should have received a declaration

from its CEO and CFO that, in their opinion, the financial records of the entity have been properly

maintained, that this report complies with the appropriate accounting standards and gives a true and

fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a

sound system of risk management and internal control which is operating effectively.

|

ASX Listing Rules Appendix 4C (17/07/20) | Page 5 |

| + See chapter 19 of the ASX Listing Rules for defined terms. | |

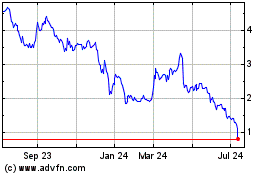

Genetic Technologies (NASDAQ:GENE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Genetic Technologies (NASDAQ:GENE)

Historical Stock Chart

From Apr 2023 to Apr 2024