false

--06-30

0001593001

0001593001

2024-01-26

2024-01-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): January

26, 2024

NIGHTFOOD

HOLDINGS, INC.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

|

000-55406 |

|

46-3885019 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification

No.) |

520

White Plains Road – Suite 500

Tarrytown,

New York 10591

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number, including area code: (888)

888-6444

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging Growth

Company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Not

applicable |

|

Not

applicable |

|

Not

applicable |

Item

5.03 Amendment to Articles of Incorporation or Bylaws; Change in Fiscal Year

On

January 26, 2024, the Certificate of Designation of Preferences, Rights and Limitations of Series A Super Voting Preferred Stock

(the “Series A Preferred Stock”) of Nightfood Holdings, Inc. (“NGTF”) was amended (the “Amended Series

A COD”) by replacing Section 1 to alter the voting structure of the Series A Preferred Stock. Pursuant to the Amended Series A

COD, the shares of Series A Preferred Stock will have a number of votes equal to (i) the number of votes then held or entitled to be

made by all other equity securities of NGTF plus (ii) one (1). No other changes were made.

Also

on January 26, 2024, NGTF filed a Certificate of Designation of Preferences, Rights and Limitations of Series C Convertible Preferred

Stock (the “Series C COD”), which established 500,000 shares of Series C Convertible Preferred Stock (the “Series C

Preferred Stock”), par value of $0.001 per share, having such designations, rights and preferences as set forth in the Series C

COD. The shares of Series C Preferred Stock are convertible six (6) months after issuance into common stock of NGTF at a rate of six

thousand (6,000) shares of common stock for each share of Series C Preferred Stock. The shares of Series C Preferred Stock do not have

voting rights and rank junior to the Series B Preferred Stock. The holders of Series C Preferred Stock are not entitled to dividends.

NGTF’s

board of directors unanimously approved the Amended Series A COD and the Series C COD. The Amended Series A COD was also approved by the affirmative

vote of NGTF’s majority stockholder entitling it to a majority of the voting power. The forgoing description of the amendment to

the Series A Preferred stock and rights, powers and preferences of the Series C Preferred Stock are each qualified in their entirety

by reference to the Amended Series A COD and the Series C COD, which are filed as Exhibits 3.1 and 3.2, respectively, to this Current

Report on Form 8-K, and are incorporated herein by reference.

Item 9.01

Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

Date: January

30, 2024

| |

NIGHTFOOD HOLDINGS, INC. |

| |

|

| |

By: |

/s/

Sean Folkson |

| |

Name: |

Sean Folkson |

| |

Title: |

Chief Executive Officer |

2

Exhibit 3.1

NIGHTFOOD HOLDINGS, INC.

AMENDMENT

TO

CERTIFICATE OF DESIGNATION OF PREFERENCES,

RIGHTS AND LIMITATIONS

OF

SERIES A SUPER VOTING PREFERRED STOCK

PURSUANT TO SECTION 78 OF THE

NEVADA REVISED STATUTES

The undersigned, Chief Executive Officer of Nightfood

Holdings, Inc., a Nevada corporation (the “Corporation”) DOES HEREBY CERTIFY that the following resolution was (i) duly adopted

by the Board of Directors of the Corporation by unanimous written consent on January [___], 2024 and (ii) approved by the vote of stockholders

holding shares of Series A Super Voting Preferred Stock entitling them to exercise a majority of the voting power pursuant to NRS 78.1955

on January [___], 2024.

NOW, THEREFORE, BE IT RESOLVED:

Section 1 be replaced in its entirety with the following:

| 1. | Voting. The shares of Series A Preferred Stock shall have a number of votes at any time equal to

(i) the number of votes then held or entitled to be made by all other equity securities of the Corporation, including, without limitation,

the common stock, par value $0.001 per share, of the Corporation (the “Common Stock”), debt securities of the Corporation,

or pursuant to any other agreement, contract or understanding of the Corporation, plus (ii) one (1). By way of example and not limitation,

in the event that there are 100 shares of Common Stock issued and outstanding, comprising all of votes then held or entitled to be made

on such matter of the Corporation, the Series A Preferred Stock shall have a total of 101 votes. |

IN WITNESS WHEREOF, the undersigned have executed this Certificate

on January [__], 2024.

| |

NIGHTFOOD HOLDINGS, INC. |

| |

|

| |

|

| |

Sean Folkson |

| |

Chief Executive Officer |

Exhibit 3.2

NIGHTFOOD HOLDINGS, INC.

CERTIFICATE OF DESIGNATION OF PREFERENCES,

RIGHTS AND LIMITATIONS

OF

SERIES C CONVERTIBLE PREFERRED STOCK

PURSUANT TO SECTION 78 OF THE

NEVADA REVISED STATUTES

The undersigned, Chief Executive Officer of Nightfood

Holdings, Inc., a Nevada corporation (the “Corporation”) DOES HEREBY CERTIFY that the following resolutions were duly adopted

by the Board of Directors of the Corporation by unanimous written consent on January [___], 2024.

WHEREAS, the Board of Directors is authorized

within the limitations and restrictions stated in the Articles of Incorporation of the Corporation, as amended, to provide by resolution

or resolutions for the issuance of 1,000,000 shares of preferred stock, par value $0.00l per share (“Preferred Stock”), of

the Corporation, in such series and with such designations, preferences and relative, participating, optional or other special rights

and qualifications, limitations or restrictions as the Corporation’s Board of Directors shall fix by resolution or resolutions providing

for the issuance thereof duly adopted by the Board of Directors; and

WHEREAS, it is the desire of the Board of Directors,

pursuant to its authority as aforesaid, to authorize and fix the terms of a series of Preferred Stock and the number of shares constituting

such series.

NOW, THEREFORE, BE IT RESOLVED:

| A. | Designation and Number. |

Five Hundred Thousand (500,000)

of the One Million (1,000,000) authorized shares of Preferred Stock of the Corporation shall be designated as the Series C Preferred

Stock (the “Series C Preferred Stock”) and shall possess the rights and privileges set forth below.

| B. | Par Value and Purpose of Issuance. |

Each share of Series C Preferred

Stock shall have a par value of $0.001, and the shares of Series C Preferred Stock shall be issued by the Corporation in book-entry form.

The Series C Preferred

Stock shall rank, with regards to dividends, assets and/or any other rights, junior to the Series B Preferred Stock.

The shares of Series

C Preferred Stock shall not be entitled to receive any dividends.

(a) Voting

Rights. Except as set forth herein, the shares of Series C Preferred Stock shall have no voting rights.

(b) Amendment

of Rights of Series C Preferred Stock. The Company shall not, without the affirmative vote of the holders of at least 50.1% of all

outstanding shares of the Series C Preferred Stock, amend, alter or repeal any provision of this Certificate of Designations, provided,

however, that the Company may, by any means authorized by law and without any vote of the holders of the shares of the Series C

Preferred Stock, make technical, corrective, administrative or similar changes in this Certificate of Designations, that do not, individually

or in the aggregate, adversely affect the rights or preferences of the holders of shares of the Series C Preferred Stock.

Upon any liquidation, dissolution

or winding-up of the Corporation, whether voluntary or involuntary, the holders of Series C Preferred Stock shall be entitled to participate

on an as-converted-to-Common Stock basis with holders of the Common Stock in any distribution of assets of the Corporation to the holders

of the Common Stock.

Subject to any limitations on

the right of the holders of the Series C Preferred Stock to convert their shares of Series C Preferred Stock into shares Common Stock,

the holders of Series C Preferred Stock shall have the following conversion rights:

(a) Conversion.

Subject to and upon compliance with the provisions of this Section G, the holder of any shares of Series C Preferred Stock shall have

the right at such holder’s option, six (6) months after issuance, at any time thereafter, to convert any of such shares of Series

C Preferred Stock into fully paid and non-assessable shares of Common Stock at the rate of six thousand shares of Common Stock for each

share of Series C Preferred Stock.

(b) Mechanics

of Conversion. The holder of any shares of Series C Preferred Stock may exercise the conversion right specified in Subsection G(a)

above by submitting a notice of conversion to the Corporation’s transfer agent with a copy to sean@nightfood.com. Conversion shall

be deemed to have been affected on the date when delivery of notice of an election to convert has been made and is referred to herein

as the “Conversion Date.” Subject to the provisions of this Section G, as promptly as practicable thereafter while using Best

Efforts to effectuate a delivery of shares via DTC during the Standard Settlement Period, the Corporation shall cause to be issued and

delivered the number of full shares of Common Stock to which such holder is entitled. Subject to the provisions of Section G, the person

in whose name the Common Stock are to be issued shall be deemed to have become a holder of record of such Common Stock on the applicable

Conversion Date. As used herein, “Standard Settlement Period” means the standard settlement period, expressed in a number

of trading days, on the Corporation’s primary Trading Market with respect to the Common Stock as in effect on the date of delivery

of the Notice of Conversion. For further clarification, Standard Settlement Period is trading plus two (2) days.

(a) No

Fractional Shares. If the number of shares of Common Stock issuable upon the conversion of Series C Preferred Stock results in any

fractional shares, the Corporation shall not be required to issue fractions of shares, upon conversion of the Series C Preferred Stock

or otherwise, or to distribute certificates that evidence fractional shares. With respect to any fraction of a share called for upon any

conversion hereof, the Corporation shall pay to the holder an amount in cash equal to such fraction multiplied by the current market value

of such fractional share, determined as follows: (i) if the Common Stock is listed on a national securities exchange or admitted to unlisted

trading privileges on such exchange or listed for trading on the National Market System (the “NMS”), the current market value

shall be the average of the last reported sale prices of the Common Stock on such exchange for the ten (10) trading days prior to the

date of conversion of Series C Preferred Stock; provided that if no such sale is made on a day within such period or no closing

sale price is quoted, that day’s market value shall be the average of the closing bid and asked prices for such day on such exchange

or system; or (ii) if the Common Stock is listed in the over the counter market (other than on NMS) or admitted to unlisted trading privileges,

the current market value shall be the mean the average of the last reported bid and asked prices reported by the OTC Markets Group Inc.

for the ten (10) trading days prior to the date of the conversion of the Series C Preferred Stock; or if the Common Stock is not so listed

or admitted to unlisted trading privileges and bid and asked prices are not so reported, the current market value shall be an amount determined

in a reasonable manner by the Board of Directors of the Corporation.

(b) Status

of Converted Stock. In the event any shares of Series C Preferred Stock shall be converted as contemplated hereby, the shares so converted

shall be cancelled, shall return to the status of authorized but unissued shares of Preferred Stock of no designated class or series,

and shall not be issuable by the Corporation as Series B Preferred Stock.

IN WITNESS WHEREOF, the undersigned have executed this Certificate

on January [__], 2024.

| |

NIGHTFOOD HOLDINGS, INC. |

| |

|

| |

|

| |

Sean Folkson |

| |

Chief Executive Officer |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

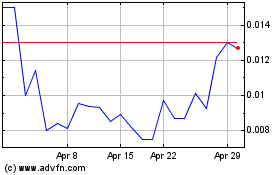

Nightfood (QB) (USOTC:NGTF)

Historical Stock Chart

From Mar 2024 to Apr 2024

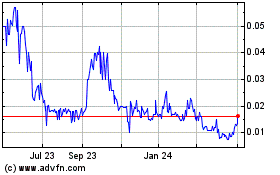

Nightfood (QB) (USOTC:NGTF)

Historical Stock Chart

From Apr 2023 to Apr 2024