|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

(Amendment No. 1)

Under the Securities Exchange Act of 1934

|

| |

SOBR

SAFE, INC.

(Name of Issuer)

Common

Stock

(Title of Class of Securities)

833592108

(CUSIP Number)

Henry

F. Schlueter, Esq.

Schlueter

& Associates, P.C.

5655

S. Yosemite Street, Suite 350

Greenwood

Village, CO 80111

Tel:

303-292-3883

(Name/Address/Telephone

Number of Person Authorized to Receive Notices and Communications)

September

23, 2020 through April 30, 2023

(Date of Event which

Requires Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box [ ].

Note: Schedules filed in paper

format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties

to whom copies are to be sent.

*The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of

this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| CUSIP No. 833592108 |

13D |

Page 2 of 10 |

| 1 |

NAME OF REPORTING PERSON

IDTEC, LLC

EIN: 83-2472765 |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) [ ]

(b) [ ] |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

[ ] |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Colorado |

| |

7 |

SOLE VOTING POWER

0 |

| Number of shares beneficially owned by each reporting person with |

8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE

INSTRUCTIONS)

[ ] |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0 |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

| CUSIP No. 833592108 |

13D |

Page 3 of 10 |

| 1 |

NAME OF REPORTING PERSON

First Capital Holdings LLC, the successor to IDTEC, LLC and First Capital

Ventures, LLC

EIN:20-3577513 |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) [ ]

(b) [ ] |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

[ ] |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Colorado |

| |

7 |

SOLE VOTING POWER

0 |

| Number of shares beneficially owned by each reporting person with |

8 |

SHARED VOTING POWER

2,424,105(1) |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

2,424,105(1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,424,105(1) |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE

INSTRUCTIONS)

[ ] |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

13.07%(2) |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

| CUSIP No. 833592108 |

13D |

Page 4 of 10 |

| 1 |

NAME OF REPORTING PERSON

SOBR SAFE, LLC

EIN: |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) [ ]

(b) [ ] |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

[ ] |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

| |

7 |

SOLE VOTING POWER

0 |

| Number of shares beneficially owned by each reporting person with |

8 |

SHARED VOTING POWER

0(1)(e) |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

0(1)(e) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0(1)(e) |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE

INSTRUCTIONS)

[ ] |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0 |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

| CUSIP No. 833592108 |

13D |

Page 5 of 10 |

| 1 |

NAME OF REPORTING PERSON

First Capital Ventures, LLC

EIN:36-4878459 |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) [ ]

(b) [ ] |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

[ ] |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Colorado |

| |

7 |

SOLE VOTING POWER

0 |

| Number of shares beneficially owned by each reporting person with |

8 |

SHARED VOTING POWER

0(1)(f) |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

0(1)(f) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0(1)(f) |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE

INSTRUCTIONS)

[ ] |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0% |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

| CUSIP No. 833592108 |

13D |

Page 6 of 10 |

| 1 |

NAME OF REPORTING PERSON

Gary J. Graham |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) [ ]

(b) [ ] |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

[ ] |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Colorado |

| |

7 |

SOLE VOTING POWER

118,511 |

| Number of shares beneficially owned by each reporting person with |

8 |

SHARED VOTING POWER

2,424,105(1) |

| 9 |

SOLE DISPOSITIVE POWER

118,511 |

| 10 |

SHARED DISPOSITIVE POWER

2,424,105(1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,542,616(1) |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE

INSTRUCTIONS)

[ ] |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

13.71%(2) |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

| CUSIP No. 833592108 |

13D |

Page 7 of 10 |

EXPLANATORY NOTES:

| (1) | On December 12, 2019, SOBR SAFE, LLC (“SOBR

SAFE”) purchased 2,700,000 shares of Series A-1 Convertible Preferred Stock of the Issuer and on June 5, 2020, IDTEC, LLC (“IDTEC”)

acquired 12,000,000 shares of the $0.00001 par value common stock of the Issuer, a convertible promissory note in the principal amount

of $1,485,189 and a Warrant to purchase 320,000 shares of common stock of the Issuer pursuant to an asset sale and related transactions.

(See Item 3, below) The transactions described in (a) through (i), below, represent all transactions by the Reporting Persons in those

securities in which the involved securities equal 1% or more of the outstanding securities of that class as of the date of the transaction. |

| (a) | On September 23, 2020, IDTEC, whose successor is First Capital Holdings LLC (“First Capital”),

transferred 1,025,829 shares of common stock of the Issuer to its members. |

| (b) | On December 15, 2020, SOBR SAFE converted its 2,700,000 shares of Series A-1 Convertible Preferred Stock

of the Issuer, plus accrued dividends, to 2,743,169 shares of the Issuer’s common stock. |

| (c) | On December 30, 2020, IDTEC transferred 3,128,896 shares of common stock of the Issuer to 24 individuals

or entities that had assisted IDTEC. |

| (d) | On December 31, 2020, IDTEC converted principal and accrued interest on a convertible

promissory note of the Issuer held by IDTEC to 3,103,028 shares of common stock of the Issuer at $0.50 per share. |

| (e) | On January 20, 2022, IDTEC exercised a portion of a Warrant to Purchase Common

Stock of the Issuer held by IDTEC at an exercise price of $0.50 per share and received 176,938 shares of common stock of the Issuer pursuant

to the Warrant exercise. |

| (f) | On March 1, 2022, IDTEC exchanged 2,000,000 shares

of common stock of the Issuer for 2,000,000 shares of Series B Preferred Stock of the Issuer. |

| (g) | On June 30, 2022, SOBR SAFE engaged in a liquidating distribution to its members

of 888,750 shares of common stock of the Issuer with 25,639 shares retained to cover liquidation expenses. Subsequent to a 1:3 reverse

stock split effected on April 28, 2022. |

| (h) | As of February 5, 2022, First Capital Ventures, LLC was no longer the beneficial

owner of the shares previously owned by IDTEC as a result of IDTEC’s merger with and into First Capital Holdings, LLC and as of

February 10, 2022, First Capital Ventures, LLC was no longer the beneficial owner of the shares previously owned by SOBR SAFE as a result

of First Capital Ventures, LLC's merger with and into First Capital Holdings, LLC. |

| (i) | On April 12, 2023, First Capital Holdings, LLC, the

successor to IDTEC, converted 666,667 shares of Series B Preferred Stock of the Issuer (as adjusted pursuant to a 1:3 reverse stock split

effected on April 28, 2022) into 666,667 shares of common stock of the Issuer. |

| (2) | Based on 18,544,570 shares of common stock of the Issuer issued and outstanding

as of November 8, 2023. |

| CUSIP No. 833592108 |

13D |

Page 8 of 10 |

Item 1. Security and Issuer

This Amendment No. 1 to Schedule

13D (this “Amendment 1”) amends and restates the Schedule 13D originally filed on June 5, 2020 (the “Original Schedule

13D”). Except as amended and restated herein, the information set forth in the Original Schedule 13D remains unchanged. Unless otherwise

indicated, all capitalized terms used but not defined herein shall have the same meaning ascribed to them in the Original Schedule 13D.

This

Amendment 1 relates to the $0.00001 par value shares of common stock of SOBR Safe, Inc., formerly known as TransBioTec, Inc., a corporation

organized under the laws of the State of Colorado (the “Issuer”). The address of the principal executive office of the Issuer

is 6400 S. Fiddlers Green Circle, Suite 1400, Greenwood Village, Colorado 80111.

Item 2. Identity and Background

| (a) | Name: This Amendment 1 is being jointly filed by IDTEC, LLC, First Capital

Holdings, LLC (the successor to IDTEC, LLC and First Capital Ventures, LLC as a result of the merger of those entities with and into First

Capital Holdings, LLC), SOBR SAFE, LLC, First Capital Ventures, LLC and Gary J. Graham (each a “Reporting Person”). First

Capital Ventures, LLC was the managing member of IDTEC, LLC (now First Capital Holdings, LLC) and of SOBR SAFE, LLC, and Gary J. Graham

was the manager of First Capital Ventures, LLC and is the manager of First Capital Holdings, LLC. |

| (b) | The principal business address of each Reporting Person is 6400 S. Fiddlers

Green Circle, Suite 1400, Greenwood Village, Colorado 80111. |

| (c) | Present Principal Occupation: The principal occupation/business of each

Reporting Person is investment. |

| (d) | Convictions: During the last five years, none of the Reporting Persons has

been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors). |

| (e) | Civil Proceeding: During the past five years, none of the Reporting Persons

has been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction as a result of which it was or is

subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal

or state securities laws or finding any violation with respect to such laws. |

| (f) | Citizenship: IDTEC, LLC, First Capital Holdings, LLC, and First Capital

Ventures, LLC are Colorado limited liability companies, SOBR SAFE, LLC is a Delaware limited liability company and Gary J. Graham is a

citizen of the United States of America. |

Item 3. Source and Amount of

Funds or Other Consideration

All of the

transactions reported by IDTEC, LLC and First Capital Holdings, LLC in this Schedule 13D/A involve shares of the Issuer issued to IDTEC,

LLC pursuant to an Asset Purchase Agreement dated May 6, 2019 (and Amendment No. 1 thereto dated March 9, 2020, together the “APA”)

between the Issuer and IDTEC, LLC, and related transactions (together with the asset purchase the “Transaction”), under which

IDTEC, LLC was issued (i) 12,000,000 shares of the Issuer’s common stock, (ii) a convertible promissory note ( the “Note”)

in the principal amount of approximately $1,485,189 with a conversion price of $0.50 per share, and (iii) a Warrant to purchase up to 320,000 shares of the Issuer’s common

stock at an exercise price of $0.50 per share. The 12,000,000 shares were issued in exchange for services and certain assets; the Note

was issued as reimbursement for funds spent by IDTEC, LLC related to the Transaction; the Warrant was issued as a result of $158,000 in

non-permitted liabilities of the Issuer under the APA.

SOBR SAFE,

LLC paid for its shares of Series A-1 Preferred Stock with cash derived from the sale of membership interests pursuant to a private securities

offering conducted pursuant to Regulation D and Section 4(a)(2) of the Securities Act of 1933, as amended.

Gary J. Graham received the

shares held of record by him pursuant to the exercise of options at $1.04 per share, which was paid out of personal funds, and in a distribution

from IDTEC, LLC.

| CUSIP No. 833592108 |

13D |

Page 9 of 10 |

Item 4. Purpose of Transaction

The Reporting Persons hold their securities of the

Issuer for investment purposes. The Reporting Persons may, from time to time, acquire additional shares of common stock and/or retain

and/or sell all or a portion of the shares of common stock held by the Reporting Persons in the open market or in privately negotiated

transactions, and/or may distribute the common stock held by the Reporting Persons to their respective members. The Reporting Persons

intend to evaluate on an ongoing basis this investment in the Issuer and options with respect to such investment. Any actions the Reporting

Persons might undertake will be dependent upon the Reporting Persons’ review of numerous factors, including, among other things,

the price levels of the common stock, general market and economic conditions, ongoing evaluation of the Issuer’s business, financial

condition, operations and prospects, the relative attractiveness of alternative business and investment opportunities, and other future

developments.

The Reporting Persons reserve

the right to change their purpose and to formulate and implement plans or proposals with respect to the Issuer at any time and from time

to time. Any such action may be made by the Reporting Persons alone or in conjunction with other shareholders and/or other third parties

and could include one or more purposes, plans or proposals that relate to or would result in actions required to be reported herein in

accordance with Item 4 of Schedule 13D.

Item 5. Interest in Securities of the

Issuer

(a, b)

For information regarding beneficial ownership, see the information presented

on the cover pages of this Schedule 13D/A. First Capital Holdings, LLC, the successor of IDTEC, LLC, is the holder of record of 2,424,105

of the shares of common stock described on the cover pages of this Schedule 13D/A that report the beneficial ownership of First Capital

Holdings, LLC and Gary J Graham. Mr. Gary J. Graham is the beneficial owner of those shares by virtue of his being the manager of First

Capital Holdings, LLC. Of the 2,424,105 shares, 143,062 shares underlie outstanding Warrants

held by First Capital Holdings, LLC.

First

Capital Holdings LLC and Mr. Graham may be deemed to have shared voting and investment power over the shares of common stock held by First

Capital Holdings, LLC.

(c) The Reporting Persons have

not effected any transactions in securities of the Issuer in the last 60 days.

(d) As of the date of filing this

Schedule 13D/A, no person, other than First Capital Holdings LLC and Gary J. Graham, is known to have the power to direct the receipt

of dividends from, or proceeds from the sale of, any of the shares owned of record by First Capital Holdings LLC.

(e) SOBR SAFE, LLC ceased being

the beneficial owner of more than 5% of the Issuer’s shares as of June 30, 2020. IDTEC, LLC ceased being the beneficial owner of

more than 5% of the Issuer’s shares as of February 5, 2022. First Capital Ventures ceased being the beneficial owner of more than

5% of the Issuer’s shares as of February 10, 2022.

Item 6. Contracts, Arrangements,

Understandings or Relationships with Respect to Securities of the Issuer

Other than as described herein,

there are no contracts, arrangements, understandings or relationships between the Reporting Persons and any other person, with respect

to the securities of the Issuer.

Item 7. Material to Be Filed as Exhibits.

| CUSIP No. 833592108 |

13D |

Page 10 of 10 |

SIGNATURES

After reasonable inquiry and to

the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

January 30, 2024

| |

|

| |

|

|

| |

FIRST CAPITAL HOLDINGS LLC |

| |

|

|

| |

By: |

/s/ Gary J. Graham |

| |

|

Gary J. Graham, Manager |

|

| |

|

| |

|

| |

FIRST CAPITAL HOLDINGS LLC,

AS successor to IDTEC, LLC and

First Capital Ventures, lLC |

| |

|

|

| |

By: |

/s/ Gary J. Graham |

| |

|

Gary J. Graham, Manager |

|

| |

|

|

|

|

|

| |

SOBR SAFE, LLC |

| |

|

| |

by: FIRST

CAPITAL HOLDINGS, LLC |

| |

Managing Member |

| |

|

|

| |

By: |

/s/ Gary J. Graham |

| |

|

Gary J. Graham, Manager |

|

| |

|

|

| |

|

|

| |

|

|

| |

By: |

/s/ Gary J. Graham |

| |

|

Gary J. Graham |

|

| |

|

| |

|

|

|

|

|

EXHIBIT 99.3

JOINT FILING AGREEMENT

PURSUANT TO RULE 13d-1(k)

The undersigned acknowledge and

agree that the foregoing amendment to statement on Schedule 13D is filed on behalf of each of the undersigned and that all subsequent

amendments to this statement on Schedule 13D shall be filed on behalf of each of the undersigned without the necessity of filing additional

joint filing agreements. The undersigned acknowledge that each shall be responsible for the timely filing of such amendments, and for

the completeness and accuracy of the information concerning him or it contained herein and therein, but shall not be responsible for the

completeness and accuracy of the information concerning the others, except to the extent that he or it knows or has reason to believe

that such information is inaccurate.

January 30, 2024

| |

|

| |

|

|

| |

FIRST CAPITAL HOLDINGS LLC |

| |

|

|

| |

By: |

/s/ Gary J. Graham |

| |

|

Gary J. Graham, Manager |

|

| |

|

| |

|

| |

FIRST CAPITAL HOLDINGS LLC,

AS successor to IDTEC, LLC and

First Capital Ventures, lLC |

| |

|

|

| |

By: |

/s/ Gary J. Graham |

| |

|

Gary J. Graham, Manager |

|

| |

|

|

|

|

|

| |

SOBR SAFE, LLC |

| |

|

| |

by: FIRST

CAPITAL HOLDINGS, LLC |

| |

Managing Member |

| |

|

|

| |

By: |

/s/ Gary J. Graham |

| |

|

Gary J. Graham, Manager |

|

| |

|

|

| |

|

|

| |

|

|

| |

By: |

/s/ Gary J. Graham |

| |

|

Gary J. Graham |

|

| |

|

| |

|

|

|

|

|

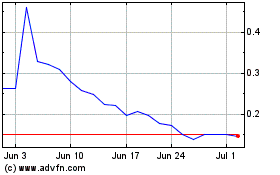

SOBR Safe (NASDAQ:SOBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

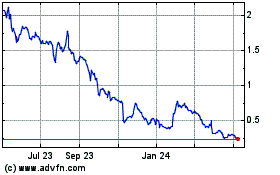

SOBR Safe (NASDAQ:SOBR)

Historical Stock Chart

From Apr 2023 to Apr 2024