false

0001553788

0001553788

2023-12-20

2023-12-20

0001553788

SBEV:CommonStockParValue0.001PerShareMember

2023-12-20

2023-12-20

0001553788

SBEV:WarrantsToPurchaseSharesOfCommonStockMember

2023-12-20

2023-12-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

December 20, 2023

| SPLASH

BEVERAGE GROUP, INC. |

| (Exact Name of Registrant as Specified in Its Charter) |

| |

| Nevada |

| (State or Other Jurisdiction of Incorporation) |

| 001-40471 |

|

34-1720075 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| |

1314 East Las Olas Blvd, Suite 221

Fort Lauderdale, Florida 33316 |

|

| (Address of Principal Executive Offices) |

| |

| (954) 745-5815 |

| (Registrant’s Telephone Number, Including Area Code) |

| |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Common Stock, par value $0.001 per share |

|

SBEV |

|

NYSE American LLC |

| Warrants to purchase shares of common stock |

|

SBEV-WT |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued

Listing Rule or Standard; Transfer of Listing.

On October 6, 2023, the Splash Beverage Group,

Inc. (the “Company”) received a notification (the “Deficiency Letter”) from the staff at NYSE American

LLC (“NYSE American”) that it was not in compliance with Section 1003(a)(i) of the continued listing standards set

forth in the NYSE American Company Guide (the “Company Guide”), requiring a listed company to have stockholders’

equity of (i) at least $2.0 million if it has reported losses from continuing operations or net losses in two of its three most

recent fiscal years. The Company submitted a proposed compliance plan to the NYSE American. Advising it of the actions it has or

will take to regain compliance by April 6, 2025.

On December 20, 2023, the Company received

a notification (the “Plan Letter”), with NYSE acceptance of the proposed plan and further deficiency notice. In the

Plan Letter the NYSE indicated that in addition to Section 1003(a)(i) of the Company Guide, the Company was also not in compliance

with Section 1003(a)(ii) of the Company Guide, requiring a listed company to have stockholders’ equity of at least $4.0 million

if it has reported losses from continuing operations or net losses in three of its four most recent fiscal years.

If the Company is not in compliance with the

continued listing standards by April 6, 2025 or if the Company does not make progress consistent with the Plan during the plan

period, the NYSE American may commence delisting procedures.

Item 8.01 Other Events.

On January 26, 2024, the Company issued a press

release relating to the matters described in Item 3.01 of this Current Report on Form 8-K, a copy of which is attached hereto as

Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

Forward-Looking Statements

The Company cautions you that statements included

in this Current Report on Form 8-K that are not a description of historical facts are forward-looking statements. Words such as

“believes,” “anticipates,” “plans,” “expects,” “indicates,” “will,”

“intends,” “potential,” “suggests,” “assuming,” “designed” and similar

expressions are intended to identify forward-looking statements. These statements are based on the Company’s current beliefs

and expectations. These forward-looking statements include statements regarding the Company’s expectations regarding a period

to comply with the Plan and applicable Exchange requirements, and actions of the Company and/or the Exchange to be taken with respect

to matters discussed in the Deficiency Letter and the Plan Letter. The inclusion of forward-looking statements should not be regarded

as a representation by the Company that any of its plans will be achieved. Actual results may differ from those set forth in this

release due to the risks and uncertainties associated with continued listing on the Exchange, risks and uncertainties inherent

in the Company’s business, and other risks described in the Company’s filings with the U.S. Securities and Exchange

Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date

hereof, and the Company undertakes no obligation to revise or update this report to reflect events or circumstances after the date

hereof. This caution is made under the safe harbor provisions of Section 21E of the Private Securities Litigation Reform Act of

1995.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

SPLASH BEVERAGE GROUP, INC. |

| |

|

|

| Dated: January 29, 2024 |

By: |

/s/ Robert Nistico |

| |

Name: |

Robert Nistico |

| |

Title: |

Chief Executive Officer |

EXHIBIT 99.1

Splash

Beverage Group Receives

Notice of Plan

Acceptance

Fort Lauderdale, Florida – January

26th, 2024 - Splash Beverage

Group, Inc. (NYSE American: SBEV) (“Splash”

or the “Company”), a portfolio company of leading beverage brands, today announced that it received notification

from the New

York Stock Exchange

(NYSE) regarding its

non-compliance with listing

standards, as outlined in section 1009(e) of the NYSE Company Guide, outlined

in the company’s 8-K disclosure and listed below.

While this news was expected due to market conditions

affecting SBEV’s stock price, Splash is pleased to share that

the NYSE has

approved its comprehensive

plan to regain

compliance. We view

this as a

proactive step to ensure the long-term success of our company and enhance value for our shareholders.

The NYSE has granted Splash an extension until April 6, 2025,

allowing for unencumbered trading on the NYSE and ample time to implement and execute the outlined measures. This extension reflects

the acceptance of the NYSE in the company’s strategic approach and commitment to compliance in the near term. The NYSE will

monitor Splash’s progress on the plan during this time.

Speaking of the plan’s approval, Robert Nistico,

Chief Executive Officer of Splash Beverage Group, said “We are fully

committed to meeting

and exceeding the

NYSE listing standards,

and the approval

of our compliance plan is a positive

step forward for Splash and its shareholders. This extension provides us with the necessary time to continue to implement our strategic

initiatives and positions us well for sustained performance.”

Splash remains

focused on delivering

value to our

shareholders and stakeholders.

We appreciate the

ongoing support of our investors and look forward to updating them on our progress as we work towards achieving full compliance

by the extended deadline.

Key Details

from the 1/29/2024

Splash Beverage Group

8-K:

| ● | The

noncompliance letter was sent on 6-October-23 |

| ● | The

letter notified Splash that it was not in compliance with Section 1003(a)(i) of the continued

listing standards set forth in the NYSE American Company Guide. Upon submission of the plan

to the NYSE the Company was also notified that it was not in compliance with Section 1003(a)(ii)

of the Company Guide. |

| ● | The

acceptance letter from the NYSE was sent on 20-December-2023 |

About

Splash Beverage Group,

Inc.

Splash

Beverage Group, an

innovator in the

beverage industry, owns

a growing portfolio

of alcoholic and

non- alcoholic beverage brands

including Copa di

Vino wine by

the glass, SALT

flavored tequilas, Pulpoloco

sangria, and TapouT performance hydration and recovery drink. Splash’s strategy is to rapidly develop early-stage

brands already in its portfolio as well as acquire and then accelerate brands that have high visibility or are innovators

in their categories.

Led by a

management team that

has built and

managed some of

the top brands in the beverage industry

and led sales from product launch into the billions, Splash is rapidly expanding its brand portfolio and global distribution.

For more information visit: www.SplashBeverageGroup.com

Forward-Looking

Statement

This

press release includes “forward-looking statements” within the meaning of U.S. federal securities laws. Words such

as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,”

“intend,” “plan,” “may,” “will,” “could,”

“should,” “believes,” “predicts,”

“potential,” “continue”

and similar expressions

are intended to identify such forward-looking statements. These forward-looking

statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected

results and, consequently, you should

not rely on

these forward-looking statements

as predictions of

future events. These forward-looking

statements and factors

that may cause

such differences include,

without limitation, the

risks disclosed in the Company’s Annual Report on Form 10-K filed with the SEC on March 31, 2022, and in the Company’s

other filings with the SEC. Readers are cautioned not to place undue reliance upon any forward- looking

statements, which speak

only as of

the date made.

Except as required

by law, the

Company disclaims any obligation to update or publicly announce any revisions

to any of the forward-looking statements contained in this press release.

Contact

Information:

Splash Beverage Group

Info@SplashBeverageGroup.com

954-745-5815

v3.24.0.1

Cover

|

Dec. 20, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 20, 2023

|

| Entity File Number |

001-40471

|

| Entity Registrant Name |

SPLASH

BEVERAGE GROUP, INC.

|

| Entity Central Index Key |

0001553788

|

| Entity Tax Identification Number |

34-1720075

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

1314 East Las Olas Blvd

|

| Entity Address, Address Line Two |

Suite 221

|

| Entity Address, City or Town |

Fort Lauderdale

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33316

|

| City Area Code |

(954)

|

| Local Phone Number |

745-5815

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

SBEV

|

| Security Exchange Name |

NYSEAMER

|

| Warrants to purchase shares of common stock |

|

| Title of 12(b) Security |

Warrants to purchase shares of common stock

|

| Trading Symbol |

SBEV-WT

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SBEV_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SBEV_WarrantsToPurchaseSharesOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

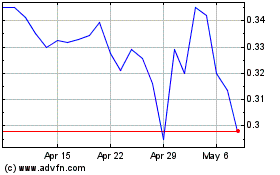

Splash Beverage (AMEX:SBEV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Splash Beverage (AMEX:SBEV)

Historical Stock Chart

From Apr 2023 to Apr 2024