Form 8-K - Current report

January 29 2024 - 8:59AM

Edgar (US Regulatory)

0000886346false00008863462024-01-292024-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

______________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 29, 2024

KADANT INC.

(Exact name of registrant as specified in its charter)

Commission file number 001-11406

| | | | | | | | | | | |

| Delaware | | 52-1762325 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

One Technology Park Drive

Westford, Massachusetts 01886

(Address of principal executive offices, including zip code)

(978) 776-2000

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $.01 par value | | KAI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On January 29, 2024, Kadant Inc. (“Kadant” or the “Company”) will hold its previously announced webcast and conference call to discuss its acquisition of KWS Manufacturing Company, Ltd. (“KWS”) (the “Acquisition”) at 1:00 p.m. eastern time. A copy of our investor presentation with an overview of the Acquisition that will be presented on the webcast and discussed in the conference call is furnished as Exhibit 99 to this Current Report on Form 8-K and is posted to the “Investors” section of the Company's website at www.kadant.com.

The information contained in this Item 7.01 (including Exhibit 99) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Safe Harbor Statement

The following constitutes a “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: This Current Report on Form 8-K contains forward-looking statements that involve a number of risks and uncertainties, including forward-looking statements about the financial and operating performance of KWS, the benefits of the Acquisition, and the expected future business and financial performance of KWS and Kadant. These forward-looking statements represent our expectations as of the date of this Current Report on Form 8-K. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise. These forward-looking statements are subject to known and unknown risks and uncertainties that may cause our actual results to differ materially from these forward-looking statements as a result of various important factors, including those set forth under the heading “Risk Factors” in Kadant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and subsequent filings with the Securities and Exchange Commission. These include risks and uncertainties relating to Kadant’s ability to successfully integrate KWS and its operations and employees and realize anticipated benefits from the Acquisition; unanticipated disruptions to the business, general and regional economic conditions, and the future performance of KWS; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement of the Acquisition; competitive, investor or customer responses to the Acquisition; the ability to realize anticipated synergies and cost savings; unexpected costs, charges or expenses resulting from the Acquisition; adverse changes in global and local economic conditions; the variability and difficulty in accurately predicting revenues from large capital equipment and systems projects; health epidemics and pandemics; our acquisition strategy; levels of residential construction activity; reductions by our wood processing customers of their capital spending or production of oriented strand board; changes to the global timber supply; development and use of digital media; cyclical economic conditions affecting the global mining industry; demand for coal, including economic and environmental risks associated with coal; failure of our information systems or breaches of data security and cybertheft; implementation of our internal growth strategy; supply chain constraints, inflationary pressure, price increases and shortages in raw materials; competition; changes in our tax provision or exposure to additional tax liabilities; our ability to successfully manage our manufacturing operations; disruption in production; future restructurings; loss of key personnel and effective succession planning; protection of intellectual property; climate change; adequacy of our insurance coverage; global operations; policies of the Chinese government; the variability and uncertainties in sales of capital equipment in China; currency fluctuations; changes to government regulations and policies around the world; compliance with government regulations and policies and compliance with laws; environmental laws and regulations; environmental, health and safety laws and regulations impacting the mining industry; our debt obligations; restrictions in our credit agreement and note purchase agreement; soundness of financial institutions; fluctuations in our share price; and anti-takeover provisions.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| (d) Exhibits |

|

| The following exhibits relating to Item 7.01 shall be deemed to be furnished and not filed. |

| | |

| Exhibit | |

| No. | Description of Exhibits |

| | |

| 99 | |

| | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | KADANT INC.

|

| | |

| Date: January 29, 2024 | By | /s/ Michael J. McKenney |

| | Michael J. McKenney Executive Vice President and Chief Financial Officer |

JANUARY 29, 2024 Acquisition of KWS Manufacturing Company, Ltd. Exhibit 99

Forward-Looking Statements The following constitutes a “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: This presentation and the accompanying remarks contain forward- looking statements that involve a number of risks and uncertainties, including forward- looking statements about the financial and operating performance of KWS Manufacturing Company, Ltd. (“KWS”), the benefits of the acquisition of KWS (the “Acquisition”), and the expected future business and financial performance of KWS and Kadant. These forward- looking statements represent our expectations as of the date of this presentation. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise. These forward-looking statements are subject to known and unknown risks and uncertainties that may cause our actual results to differ materially from these forward-looking statements as a result of various important factors, including those set forth under the heading “Risk Factors” in Kadant’s annual report on Form 10-K for the fiscal year ended December 31, 2022 and subsequent filings with the Securities and Exchange Commission. These include risks and uncertainties relating to Kadant's ability to successfully integrate KWS and its operations and employees and realize anticipated benefits from the Acquisition; unanticipated disruptions to the business, general and regional economic conditions, and the future performance of KWS; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement of the Acquisition; competitive, investor or customer responses to the Acquisition; the ability to realize anticipated synergies and cost savings; unexpected costs, charges or expenses resulting from the Acquisition; adverse changes in global and local economic conditions; the variability and difficulty in accurately predicting revenues from large capital equipment and systems projects; health epidemics and pandemics; our acquisition strategy; levels of residential construction activity; reductions by our wood processing customers of their capital spending or production of oriented strand board; changes to the global timber supply; development and use of digital media; cyclical economic conditions affecting the global mining industry; demand for coal, including economic and environmental risks associated with coal; failure of our information systems or breaches of data security and cybertheft; implementation of our internal growth strategy; supply chain constraints, inflationary pressure, price increases and shortages in raw materials; competition; changes in our tax provision or exposure to additional tax liabilities; our ability to successfully manage our manufacturing operations; disruption in production; future restructurings; loss of key personnel and effective succession planning; protection of intellectual property; climate change; adequacy of our insurance coverage; global operations; policies of the Chinese government; the variability and uncertainties in sales of capital equipment in China; currency fluctuations; changes to government regulations and policies around the world; compliance with government regulations and policies and compliance with laws; environmental laws and regulations; environmental, health and safety laws and regulations impacting the mining industry; our debt obligations; restrictions in our credit agreement and note purchase agreement; soundness of financial institutions; fluctuations in our share price; and anti-takeover provisions. KADANT ACQUISITION UPDATE – JANUARY 2024 | © 2024 KADANT INC. 2

Acquisition of KWS Manufacturing Company, Ltd. KADANT ACQUISITION UPDATE – JANUARY 2024 | © 2024 KADANT INC. 3

Acquisition Overview • Manufacturer of material handling equipment, including screw conveyors, screw feeders, slide gates, and bucket elevators • Founded in 1972 • Based in Burleson, Texas, with 165 employees • Market leading position in the screw conveyor market • Revenue for the trailing twelve months ended September 30, 2023 was $45 million • Purchase price was approximately $84 million* • Favorable tax attributes KADANT ACQUISITION UPDATE – JANUARY 2024 | © 2024 KADANT INC. 4 * Subject to customary adjustments

Primary Product Offerings • Screw conveyors used to transport and blend bulk material in processing plants • Screw feeders used in a broad range of bulk material metering applications • Slide gates used to control the flow into and out of a screw conveyor • Custom solutions designed to solve complex material handling challenges KADANT ACQUISITION UPDATE – JANUARY 2024 | © 2024 KADANT INC. 5

Industries Served KADANT ACQUISITION UPDATE – JANUARY 2024 | © 2024 KADANT INC. 6 Agriculture Alternative Fuels Chemicals Lumber & Wood Pulp & Paper Recycling Food Products Refuse Systems

Acquisition Rationale • Market leading position in the screw conveyor market • 60% parts & consumables revenue • Complementary product offering to Kadant’s Material Handling segment; historical collaboration with Kadant Black Clawson • Strong leadership with long tenure in industry • Solid financial metrics and market position • Well-established brand in our core and adjacent markets • Cost-competitive manufacturing location KADANT ACQUISITION UPDATE – JANUARY 2024 | © 2024 KADANT INC. 7

• Opportunity for our other businesses to leverage KWS relationship with key distribution partners • Broadened product portfolio to provide additional solutions to our customers • Potential for KWS to leverage Kadant’s global sales network • Strengthens our position in material handling markets 8 Kadant and KWS Together KADANT ACQUISITION UPDATE – JANUARY 2024 | © 2024 KADANT INC.

Integration • Manufacturing operations will continue in the current location as part of our decentralized operating structure • Continue to build on the strength of the KWS brand • Opportunities for collaboration and sharing best practices • KWS will be included in our Material Handling reporting segment KADANT ACQUISITION UPDATE – JANUARY 2024 | © 2024 KADANT INC. 9

Financial Metrics • $84 million purchase price* • Revenue for the trailing twelve months ended September 30, 2023 was $45 million • Favorable tax attributes • Borrowed $82 million • Borrowing rate estimated at 6.4% to 6.7% KADANT ACQUISITION UPDATE – JANUARY 2024 | © 2024 KADANT INC. 10 * Subject to customary adjustments

Questions & Answers To participate in the live Q&A session, please go to investor.kadant.com and click on the Q&A session link to receive a dial-in number and unique PIN. Please mute the audio on your computer. KADANT ACQUISITION UPDATE – JANUARY 2024 | © 2024 KADANT INC. 11

INVESTOR RELATIONS CONTACT Michael McKenney, 978-776-2000 IR@kadant.com MEDIA RELATIONS CONTACT Wes Martz, 269-278-1715 media@kadant.com January 29, 2024

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

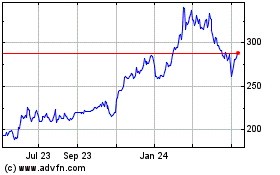

Kadant (NYSE:KAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

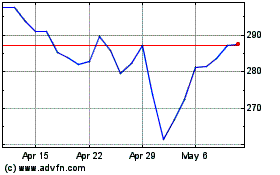

Kadant (NYSE:KAI)

Historical Stock Chart

From Apr 2023 to Apr 2024