UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant

☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

PARKS! AMERICA, INC.

(Name of Registrant as Specified in Its Charter)

FOCUSED COMPOUNDING FUND, LP

ANDREW KUHN

GEOFFREY GANNON

JAMES FORD

(Name of Persons(s) Filing Proxy Statement,

if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange

Act Rules 14a-6(i)(1) and 0-11 |

FOCUSED COMPOUNDING FUND, LP

Dear Fellow Shareholders:

Focused Compounding Fund,

LP, a Delaware limited partnership (together with its affiliates, the “Focused Compounding Group” or “we”),

is the largest shareholder of Parks! America, Inc., a Nevada corporation (“Parks” or the “Company”),

and together with the other participants in this solicitation beneficially owns approximately 39.27% of the issued and outstanding shares

of the Company’s common stock. We are calling a special meeting of the Company (the “Special Meeting”) and seek

your support to, among other related matters, replace the Company’s current Board of Directors (the “Board”)

of seven directors with our new slate of three highly qualified nominees to the Board.

Parks needs to change course

in order to maximize value for its shareholders. We believe Parks would benefit from new leadership starting at the Board level. The Special

Meeting presents an opportunity to install such new leadership. Our goal is to bring increased value to Parks’ shareholders by redirecting

the Company on a thoughtfully planned and carefully executed path toward increased value for its shareholders. We believe Parks has a

lot of potential due to its parks, animals, and customer base. We believe that potential, however, has not been fully realized. It is

time for new leadership.

The Special Meeting will

allow shareholders to elect a new, smaller Board of three directors who are aligned with the notion of fully realizing Parks’ potential

to provide shareholder value. We have nominated a slate of three directors (collectively, the “Focused Nominees”) with

the experience needed to achieve our goal of revitalizing Parks. If elected, the Focused Nominees will remain committed to implementing

a systematic operating plan to improve Parks’ financial condition and results of operation for the benefit of its shareholders.

In connection with the

Special Meeting, shareholders are being asked to vote on proposals to reconstitute the Board by removing the existing Board members and

electing the Focused Nominees. We are soliciting proxies to elect the Focused Nominees to the Board at the Special Meeting.

We urge shareholders to

vote “FOR” the proposal to restore the Company’s bylaws to those in effect as of June 12, 2012, “FOR” the

removal of all seven existing members of the Board, “FOR” the amendment of the bylaws

to provide the shareholders authority to fill Board vacancies, “FOR” the election of each of the three Focused Nominees, and

“FOR” the proposal to adjourn the Special Meeting to solicit additional proxies if there are insufficient proxies at the Special

Meeting to approve the above proposals.

We urge you to carefully

consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed

BLUE proxy card today. The attached Proxy Statement and the enclosed BLUE proxy card are first being furnished to Parks shareholders on

or about January 26, 2024.

If you vote using a

proxy card other than the attached BLUE one and wish to change your vote, you have every right to change your vote by

signing, dating and returning a later dated BLUE proxy card or by voting in person at the Special Meeting.

If you have any questions

or require any assistance with your vote, please contact InvestorCom LLC (“InvestorCom”), which is assisting us, at

its address, toll-free number and e-mail address listed below.

Thank you for your support,

/s/ Andrew Kuhn

Managing Member of General Partner of

Focused Compounding Fund, LP

If you have any questions,

require assistance in voting your BLUE proxy card, or need additional copies of the Focused Compounding Group’s proxy materials,

please contact InvestorCom at the phone numbers or email address listed below.

InvestorCom

19 Old Kings Highway S.

Suite 130

Darien, CT 06820

Shareholders may call toll-free: (877) 972-0090

Banks and brokers call: (203) 972-9300

E-mail: Proxy@investor-com.com

SPECIAL MEETING OF SHAREHOLDERS

OF

PARKS! AMERICA, INC.

PROXY STATEMENT

OF

FOCUSED COMPOUNDING FUND, LP

PLEASE SIGN, DATE AND MAIL THE ENCLOSED BLUE

PROXY CARD TODAY

Focused Compounding Fund,

LP, a Delaware limited partnership (“Focused Compounding” and, together with its affiliates named herein, including

Focused Compounding Capital Management, LLC, Andrew Kuhn, Geoff Gannon and James Ford, the “Focused Compounding Group”

or “we”), is the largest shareholder of Parks! America, Inc., a Nevada corporation (“Parks” or the

“Company”), and together with the participants in this solicitation beneficially owns an aggregate of 29,656,348 shares

of the Company’s common stock, $0.001 par value per share (the “Common Stock”), constituting approximately 39.27%

of the shares of Common Stock outstanding. This Proxy Statement and the enclosed BLUE proxy card are being furnished to Parks shareholders

on or about January 26, 2024.

We are seeking your vote

at the Company’s upcoming special meeting of shareholders on February 26, 2024 at 11:00 a.m. Eastern Time (including any and all adjournments, postponements, continuations or reschedulings

thereof, or any other meeting of shareholders held in lieu thereof, the “Special Meeting”) with respect to the following

proposals:

PROPOSAL 1 (Bylaw

Restoration): Repeal any provision of the Bylaws of Parks! America, Inc. as adopted on January 30, 2004 and as revised as of June

12, 2012 (the “Bylaws”), including any amendments thereto, in effect at the time this Proposal becomes effective, which

was not included in the Bylaws that were in effect as of June 12, 2012 and were filed with the SEC on July 16, 2012 (the “Bylaw

Restoration Proposal”) to restore the Bylaws to their current form if the board of directors (the “Board”)

of the Company attempts to amend them in any manner prior to completion of this proxy solicitation.

PROPOSAL 2 (Removal):

Subject to the concurrent approval of both the Bylaw Amendment Proposal and the Election Proposal (both defined below), remove all seven

(7) members of the Board (Lisa Brady, Todd White, Dale Van Voorhis, John Gannon, Charles Kohnen, Jeffery Lococo and Rick Ruffolo) pursuant

to Section 4.9(a) of the Bylaws (the “Removal Proposal”).

PROPOSAL 3 (Bylaw

Amendment): Subject to the concurrent approval of both the Removal Proposal and the Election Proposal (defined below), amend and restate

Section 4.7 of the Bylaws (the “Bylaw Amendment Proposal”) to read as follows:

“4.7 Vacancy

on Board of Directors. In case of a vacancy on the Board of Directors because of a director’s resignation, removal or other

departure from the board, or because of an increase in the number of directors, the remaining directors, by majority vote, may elect a

successor to hold office for the unexpired term of the director whose position is vacant, and until the election and qualification of

a successor. In the event any directors are removed by a vote of the shareholders, then the shareholders shall have the right to elect

successors to hold office for the unexpired term of the director or directors whose positions are vacant, and until the election and qualification

of their successors.”

PROPOSAL 4 (Election):

Subject to the concurrent approval of both the Removal Proposal and the Bylaw Amendment Proposal, elect as members of the Board each of

the following individuals (each a “Nominee” and collectively the “Focused Nominees”): (i) Andrew

Kuhn, (ii) Geoff Gannon and (iii) James Ford (the “Election Proposal”).

PROPOSAL 5 (Adjournment):

To permit Focus Compounding to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation

and vote of proxies in the event there are insufficient votes for, or otherwise in connection with, any of the Bylaw Restoration Proposal,

the Removal Proposal, the Bylaw Amendment Proposal or the Election Proposal (the “Adjournment Proposal”).

We refer to the Bylaw Restoration

Proposal, the Removal Proposal, the Bylaw Amendment Proposal, the Election Proposal and the Adjournment Proposal collectively as the “Proposals.”

The Company has set February

26, 2024 at 11:00 a.m. Eastern Time as the date and time of the meeting. The Company has advised that the Special Meeting will be held

in a virtual meeting format only, via live audio webcast. Shareholders will be able to attend and participate in the Special Meeting by

visiting the following meeting website:

https://agm.issuerdirect.com/PRKA

Shareholders will not be able

to attend the Special Meeting in person. The Company has set a record date of December 29, 2023 for determining shareholders entitled

to notice of and to vote at the Special Meeting (the “Record Date”). At the Special Meeting, the Company’s shareholders

are being asked to vote on the Proposals. We have nominated the Focused Nominees, three highly qualified director candidates, (i) Andrew

Kuhn, (ii) Geoff Gannon and (iii) James Ford, for election to the Board at the Special Meeting, and we are soliciting proxies to elect

the Focused Nominees to the Board at the Special Meeting, along with the other Proposals.

This Proxy Statement is soliciting

proxies to replace the Company’s seven existing Board members with the Focused Compounding Group’s three Focused Nominees,

as well as to amend the bylaws of the Company as described in the Proposals. As of the date of this Proxy Statement, the Focused Compounding

Group collectively beneficially owns 29,656,348 shares of Common Stock (the “Focused Compounding Group Shares”), representing

approximately 39.27% of the Company’s outstanding shares of Common Stock. Of such shares, a total of 28,553,179 are held of record

in the name of Focused Compounding Fund, LP, with the remainder of the Focused Compounding Group Shares being held in street name. We

intend to vote the Focused Compounding Group Shares “FOR” the Bylaw Restoration Proposal, “FOR” the Removal Proposal,

“FOR” Bylaw Amendment Proposal, “FOR” the election of each of the three Focused Nominee in the Election Proposal,

and “FOR” the Adjournment Proposal.

Shareholders should understand,

however, that all shares of Common Stock represented by the enclosed BLUE proxy card will be voted at the Special Meeting as marked and,

in the absence of specific instructions, will be voted in accordance with the recommendations specified herein.

The mailing address of the

principal executive offices of the Company is 1300 Oak Grove Road, Pine Mountain, Georgia 31822. Shareholders of record at the close of

business on the December 29, 2023 Record Date will be entitled to vote at the Special Meeting. As of the Record Date, there were approximately

75,517,763 shares of Common Stock outstanding at the Special Meeting (which number is included in the Company’s Form 10-K filed

with the SEC on December 12, 2023 (the “Form 10-K”)).

THIS SOLICITATION IS BEING

MADE BY THE FOCUSED COMPOUNDING GROUP AND THE OTHER PARTICIPANTS IN THEIR INDIVIDUAL CAPACITY AND NOT BY OR ON BEHALF OF THE COMPANY.

WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE SPECIAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD

OTHER MATTERS, WHICH THE FOCUSED COMPOUNDING GROUP IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE SPECIAL

MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED BLUE PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

WE URGE YOU TO SIGN, DATE

AND RETURN THE BLUE PROXY CARD IN FAVOR OF THE ELECTION OF THE THREE FOCUSED NOMINEES.

IF YOU VOTE ANOTHER PROXY

BEFORE RETURNING THE ENCLOSED BLUE PROXY CARD, YOU HAVE EVERY RIGHT TO REVOKE SUCH OTHER PROXY AND CHANGE YOUR VOTE BY SIGNING, DATING

AND RETURNING A LATER-DATED BLUE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME

PRIOR TO THE SPECIAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE SPECIAL MEETING OR BY VOTING

IN PERSON AT THE SPECIAL MEETING.

Important Notice Regarding

the Availability of Proxy Materials for the Special Meeting—This Proxy Statement and our BLUE proxy card are available at

www.PRKAproxyfight.com

IMPORTANT

Your vote is important,

no matter how few shares of Common Stock you own. We urge you to sign, date, and return the enclosed BLUE proxy card today to vote “FOR”

the election of each of the three Focused Nominees and in accordance with the Focused Compounding Group’s recommendations on the

other proposals on the agenda for the Special Meeting.

· If

your shares of Common Stock are registered in your own name, please sign and date the enclosed BLUE proxy card and return it to the Focused

Compounding Group, c/o InvestorCom in the enclosed postage-paid envelope today.

· If

your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock,

and these proxy materials, together with a BLUE proxy card, are being forwarded to you by your broker or bank. As a beneficial owner,

you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your

behalf without your instructions.

· If

some of your shares of Common Stock are in your own name and others are in your brokerage account or bank, you should follow instructions

for both types of holdings in order to vote all of your shares.

· Depending

upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed

voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form.

If you have any questions,

require assistance in voting your BLUE proxy card, or need additional copies of the Focused Compounding Group’s proxy materials,

please contact InvestorCom at the phone numbers or email address listed below.

InvestorCom

19 Old Kings Highway S.

Suite 130

Darien, CT 06820

Shareholders may call toll-free: (877) 972-0090

Banks and brokers call: (203) 972-9300

E-mail: Proxy@investor-com.com

REASONS FOR THE SOLICITATION

The Focused Compounding

Group is committed to maximizing value for the Company’s shareholders and believes the Focused Nominees will uphold that commitment

by bringing a value-driven approach to appointment and oversight of executives while continually acting to support the best interest of

the Company and its shareholders.

We believe Parks’

shareholders also desire to maximize the value of their Company common stock and, based on the Company’s historical performance,

will align with the vision that the Focused Nominees support. We believe that Parks’ has more potential than its historical performance

record reflects and that the Focused Nominees will work diligently toward realizing that potential.

PROPOSAL NO. 1

BYLAW RESTORATION PROPOSAL

The Bylaw Restoration Proposal

seeks to prevent the existing Board from making amendments to the Bylaws filed with the SEC on July 16, 2012 through the date of the Special

Meeting and the time voting results of the corresponding vote associated with this Proxy Statement are filed with the SEC. If passed,

the Bylaw Restoration Proposal would repeal any such amendments by the existing Board to the existing bylaws. We are not currently aware

of any specific bylaw provisions that would be repealed by the adoption of the Bylaw Restoration Proposal.

Proposal 1: Repeal any provision of

the Bylaws of Parks! America, Inc. as adopted on January 30, 2004 and as revised as of June 12, 2012 (the “Bylaws”),

including any amendments thereto, in effect at the time this Proposal becomes effective, which was not included in the Bylaws that were

in effect as of June 12, 2012 and were filed with the SEC on July 16, 2012 (the “Bylaw Restoration Proposal”) to restore

the Bylaws to their current form if the board of directors (the “Board”) of the Company attempts to amend them in any

manner prior to completion of this proxy solicitation.

To achieve that result,

thereby avoiding confusion regarding the bylaws, we are soliciting your proxy to vote FOR the Bylaw Restoration Proposal.

WE URGE YOU TO VOTE “FOR” THE

BYLAW RESTORATION PROPOSAL ON THE ENCLOSED BLUE PROXY CARD

PROPOSAL NO. 2

REMOVAL PROPOSAL

The Board is currently

composed of seven (7) directors (Lisa Brady, Todd White, Dale Van Voorhis, John Gannon, Charles Kohnen, Jeffery Lococo and Rick Ruffolo).

Shareholders are being asked to remove, without cause, all seven members of the Board.

The election of the Focused

Nominees at the Special Meeting requires the concurrent approval by shareholders of the Removal Proposal and the Bylaw Amendment Proposal.

Proposal 2: Remove all seven (7) members

of the Board (Lisa Brady, Todd White, Dale Van Voorhis, John Gannon, Charles Kohnen, Jeffery Lococo and Rick Ruffolo) pursuant to Section

4.9(a) of the Bylaws (the “Removal Proposal”).

To that end, we are soliciting

your proxy to vote FOR the Removal Proposal at the Special Meeting.

WE URGE YOU TO VOTE “FOR” THE

REMOVAL PROPOSAL ON THE ENCLOSED BLUE PROXY CARD

PROPOSAL NO. 3

BYLAW AMENDMENT PROPOSAL

Under Section 4.7 of the

Company’s bylaws, the Board retains the power to fill vacancies, including those created as a result of removal by the shareholders,

by the requisite vote. To prevent any confusion upon the approval of the Removal Proposal, the Bylaw Amendment proposal would provide

that to the extent that directors are removed by a vote of the shareholders, then the shareholders shall also have the right, along with

the Board, to elect successors to hold office for the unexpired term of the director or directors whose positions are vacant, and until

the election and qualification of their successors. The Bylaw Amendment Proposal would not, if approved and adopted, displace the Board’s

existing authority to fill vacancies created by shareholder removal of a director.

The Company’s bylaws

state no standard unique to shareholder-filled Board vacancies, and so the bylaw Section 4.5(c) standard for electing directors applies

in that circumstance as well. As a result, if the Bylaw Amendment Proposal is approved, the voting standard applicable to shareholders

voting in the future to fill Board vacancies created by a shareholder removal will be the standard under Section 4.5(c) of the Company’s

bylaws. That standard requires “a majority of votes cast by the shares entitled to vote in the election” in order for shareholders

to fill a vacancy that the shareholders create by removing a director.

Because the Bylaw Proposal

is conditioned upon the concurrent approval of both the Removal Proposal and the Election Proposal, there would be no scenario in which

the existing Board is removed without a new Board concurrently being installed, or without the Bylaw Amendment Proposal being approved.

If the entire Board is removed pursuant to approval of the Removal Proposal, such removal would become immediately effective, thus creating

vacancies, and there would be no ability for the removed directors to act to fill vacancies. Any purported act by the outgoing directors

to fill vacancies after they are removed from the Board would have no authority or effect. In a future scenario where certain directors

remain following a partial removal by shareholders, and the shareholders elect new directors to fill the vacancy created by the removal,

we believe the shareholder vote would control even if the remaining directors attempt to appoint directors to fill the same vacancies

filled by shareholders. But if the Company were to take a contrary position, there could be a legal dispute subject to adjudication.

Proposal 3: Subject to the concurrent

approval of both the Removal Proposal and the Election Proposal, amend and restate Section 4.7 of the Bylaws (the “Bylaw Amendment

Proposal”) to read as follows:

“4.7 Vacancy on Board of Directors.

In case of a vacancy on the Board of Directors because of a director’s resignation, removal or other departure from the board,

or because of an increase in the number of directors, the remaining directors, by majority vote, may elect a successor to hold office

for the unexpired term of the director whose position is vacant, and until the election and qualification of a successor. In the event

any directors are removed by a vote of the shareholders, then the shareholders shall have the right to elect successors to hold office

for the unexpired term of the director or directors whose positions are vacant, and until the election and qualification of their successors.”

We are soliciting your

proxy to vote FOR the Bylaw Restoration Proposal.

WE URGE YOU TO VOTE “FOR” THE

BYLAW AMENDMENT PROPOSAL ON THE ENCLOSED BLUE PROXY CARD

PROPOSAL NO. 4

ELECTION PROPOSAL

Parks’s Bylaws provide

that the Board shall consist of at least one (1) but no more than eleven (11) directors. The Board currently consists of seven (7) directors.

We have nominated three (3) highly qualified Focused Nominees for election to the Board, subject to approval of the Removal Proposal and

the Bylaw Amendment Proposal.

Subject to approval of

both the Removal Proposal and the Bylaw Amendment Proposal, approval of the Election Proposal would elect a new Board (Geoff Gannon, Andrew,

Kuhn, and James Ford). Such new Board would intend to reduce the size of the Board from seven (7) to three (3) directors, pursuant to

Section 4.4 of the Company’s bylaws. The new Board would also reserve the right to subsequently increase the size of the Board and

then to fill any vacancies so created under Section 4.7 of the Company’s bylaws.

THE FOCUSED NOMINEES

The following information

sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices,

or employments for the past five years of each of the Focused Nominees. The nominations of the Focused Nominees were made in a timely

manner and in compliance with the applicable provisions of the Company’s governing instruments. This information has been furnished

to us by the Focused Nominees.

Geoff Gannon, age

38, is the Portfolio Manager at Focused Compounding Fund, LP, and has served in that position since 2020. Mr. Gannon has no relation

to John Gannon, who currently sits on the Board of the Company. The Focused Compounding Fund owns 38.5% of Parks. Prior to launching

the Focused Compounding Fund, LP in 2020, Geoff served as the Portfolio Manager of Focused Compounding Capital Management, a separately

managed accounts firm that was launched in 2018 and is still active today. Neither Focused Compounding Fund, LP nor Focused Compounding

Capital Management is a parent, subsidiary or other affiliate of the Company. Since 2005, Mr. Gannon has been writing and sharing information

on numerous topics surrounding value investing. Since 2018, Mr. Gannon has regularly produced a podcast jointly with Mr. Kuhn on which

they efficiently and effectively explain investment strategy to their followers who look to them for in-depth but understandable advice.

We believe that Mr. Gannon’s experience in managing financial investment organizations, managing portfolios, and his more than

twenty years of experience researching and investing would make him a valuable addition to the Board. Based on his extensive experience

in the area, he would be able to effectively engage with existing company structures and personnel to formulate plans for improvement

and growth, as well as implement strategies as a trusted advisor.

Andrew Kuhn, age

27, is the Managing Member of the General Partner and the Operations Manager at Focused Compounding Fund, LP, and has served in such position

since 2020. The Focused Compounding Fund owns 38.5% of Parks. Prior to launching the Focused Compounding Fund, LP in 2020, Andrew served

as the Operations Manager of Focused Compounding Capital Management, a separately managed accounts firm that was launched in 2018 and

is still active today. Neither Focused Compounding Fund, LP nor Focused Compounding Capital Management is a parent, subsidiary or other

affiliate of Parks! America, Inc. Through his X (formerly known as Twitter) account, Mr. Kuhn regularly engages with over 40,000 users

and provides key insight and thoughts on investment and business strategies. Since 2018, Mr. Kuhn has regularly produced a podcast jointly

with Mr. Gannon on which they efficiently and effectively explain investment strategy to their followers who look to them for in-depth

but understandable advice. We believe that Mr. Kuhn’s experience in managing financial investment organizations, co-founding robust

investment organizations, and his experience researching and sharing investment strategy would make him a valuable addition to the Board.

Based on his experience, he would be able to engage with existing company structures and personnel to formulate and effectively communicate

a plan for continued business health and growth.

James Ford, CFA,

age 43, has served since 2014 as the President and Managing Partner at First Ballantyne, LLC, a registered fixed income broker dealer.

In his capacity at First Ballantyne, LLC, he has successfully restructured several distressed bonds in the corporate and municipal sectors.

He also manages over a dozen investment traders, analysts, and specialists. Mr. Ford also gained extensive experience as a fiduciary while

working for various asset management companies before his time at First Ballantyne, LLC. Mr. Ford has a Bachelor’s of Science in

Business Administration from the University of North Carolina – Chapel Hill and has been a Chartered Financial Analyst charter holder

since 2006. We believe that Mr. Ford’s experience in managing financial investment organizations and key personnel, restructuring

securities, and his fiduciary experience would make him a valuable addition to the Board. Based on his experience, he would be able to

consider existing company financial structures to formulate, implement, and lead effective strategies for financial growth.

The principal business

address of Messrs. Gannon and Kuhn is 3838 Oak Lawn Ave Suite 1000, Dallas, TX 75219-451. The principal business address of Mr. Ford is

13950 Ballantyne Corp. Place, Suite 185, Charlotte, NC 28277.

As of the date of this

Proxy Statement, Focused Compounding Fund, LP, Focused Compounding Capital Management, LLC, Mr. Gannon and Mr. Kuhn beneficially own 29,110,150

shares of Common Stock; Mr. Ford beneficially owns an aggregate of 546,198 shares of Common Stock; and of the 29,110,150 shares of Common

Stock beneficially owned by Focused Compounding Fund, LP, 28,553,179 are held of record. Focused Compounding Capital Management, LLC and

Messrs. Gannon and Kuhn beneficially own the same 29,110,150 shares of Common Stock as Focused Compounding as a result of their shared

voting and dispositive power as contemplated under Rule 13d-3. Mr. Gannon and Mr. Kuhn are both managing members of Focused Compounding

Capital Management, LLC, the general partner of Focused Compounding.

Each of the Focused Nominees

may be deemed to be a member of a “group” with the other participants for the purposes of Section 13(d)(3) of the Exchange

Act, and such group may be deemed to beneficially own the 29,656,348 shares of Common Stock beneficially owned in the aggregate by the

Focused Compounding Group. Each participant disclaims beneficial ownership of the shares of Common Stock that he, she or it does not directly

own. There were no transactions by the participants in the securities of the Company during the past two years except as set forth in

Schedule I.

Each of the Focused Nominees

is a citizen of the United States of America.

Other than as stated herein,

there are no arrangements or understandings between or among the Focused Compounding Group or any other person or persons pursuant to

which the nomination of the Focused Nominees described herein is to be made, other than the consent by each of the Focused Nominees to

be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Special Meeting. Except as described

herein, none of the Focused Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to

the Company or any of its subsidiaries in any material pending legal proceeding.

Each of the Focused Nominees

has consented to being named as a nominee in this solicitation and has confirmed his or her willingness to serve on the Board if elected.

We do not expect that any of the Focused Nominees will be unable to stand for election, but, in the event that any such persons are unable

to serve or for good cause will not serve, the Common Stock represented by the BLUE proxy card will be voted for substitute nominees,

to the extent this is not prohibited under the Bylaws or applicable law, in each case in light of the specific facts and circumstances

surrounding such substitution. We reserve the right to nominate additional persons to fill any additional seats if the Company increases

the size of the Board. In the event that any additional person is nominated by the Focused Compounding Group, then such person will be

named and information regarding such person will be provided to shareholders in a proxy supplement and revised proxy card disseminated

at that time.

The Election Proposal is subject

to the concurrent approval of the Removal Proposal. If the Removal Proposal or the Bylaw Amendment Proposal is not approved, the Election

Proposal will have no effect even if each nominee receives the requisite vote. A shareholder may vote for the election of all or fewer

than all of the Focused Nominees by completing the BLUE proxy card.

WE URGE YOU TO VOTE “FOR”

THE ELECTION OF EACH NOMINEE ON THE ENCLOSED BLUE PROXY CARD

PROPOSAL NO.

5

ADJOURNEMENT PROPOSAL

Shareholders are being

asked to vote on the adjournment of the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation

and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Removal Proposal

or the Election Proposal.

Proposal 5: Authorize Focused Compounding

Fund, LP, or an authorized representative thereof, to adjourn the Special Meeting to a later date or dates, if necessary or appropriate,

to permit further solicitation and vote of proxies in the event there are insufficient votes for, or otherwise in connection with, any

of the Bylaw Restoration Proposal, the Removal Proposal, the Bylaw Amendment Proposal or the Election Proposal (the “Adjournment

Proposal”).

WE URGE YOU TO VOTE “FOR” ON

THE ADJOURNMENT PROPOSAL ON THE ENCLOSED BLUE PROXY CARD

VOTING AND PROXY PROCEDURES

Only shareholders of record

on the Record Date will be entitled to notice of and to vote at the Special Meeting. Shareholders who sell their shares of Common Stock

before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares of Common Stock. Shareholders

of record on the Record Date will retain their voting rights in connection with the Special Meeting even if they sell such shares of Common

Stock after the Record Date. Each share of Common Stock is entitled to one vote on each proposal.

Shares of Common Stock

represented by properly executed BLUE proxy cards will be voted at the Special Meeting as marked and, in the absence of specific instructions,

will be voted in accordance with the Focused Compounding Group’s recommendations.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum

number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business

at the meeting. Section 3.8(a) of the Company’s bylaws specifies that a majority of the votes entitled to be cast at the Special

Meeting, whether in person or by proxy, will constitute a quorum. Shares represented by a proxy that directs that the shares abstain from

or vote against on a matter, as well as broker “non-votes,” will be counted at the Special Meeting for quorum purposes. Because

brokers may cast votes without instruction only on routine matters, and none of the Proposals are routine, we do not expect to receive

any broker non-votes. Shares represented by proxy as to which no voting instructions are given as to matters to be voted upon will also

be counted at the Special Meeting for quorum purposes.

VOTES REQUIRED FOR APPROVAL

Bylaw Restoration Proposal

The voting standard for

the Bylaw Restoration Proposal under Section 3.10(a) of the Company’s bylaws requires approval from more votes cast in favor than

votes cast against the Bylaw Restoration Proposal. A broker non-vote and an abstention count as neither a vote cast in favor nor a vote

cast against. As a result, broker non-votes and abstentions will have no effect on the outcome of the Bylaw Restoration Proposal.

Removal Proposal

Because the standard for

removal of directors under NRS 78.335 requires approval from at least two-thirds of the voting power of the issued and outstanding stock

entitled to vote, anything other than a vote for the Removal Proposal has the same effect as a vote against the proposal. As a result,

a broker non-vote and an abstention would have the same effect as a vote against the Removal Proposal.

Bylaw Amendment Proposal

Because the voting standard

for the Bylaw Amendment Proposal under Section 3.10(a) of the Company’s bylaws is that more votes must be cast in favor than against

the Bylaw Amendment Proposal in order to approve it, and a broker non-vote and an abstention does not count as a vote cast, broker non-votes

and abstentions would have no effect on the outcome of the Bylaw Amendment Proposal.

Election Proposal

The voting standard to

elect directors under Section 4.5(c) of the Company’s bylaws requires a majority of votes cast at the Special Meeting. Neither a

broker non-vote nor an abstention counts as a vote cast, so broker non-votes and abstentions would have no effect on the outcome of the

Bylaw Amendment Proposal.

Adjournment Proposal

The Company’s bylaws

address adjournment of shareholder meetings differently depending on whether a quorum is present. If no quorum is present at the Special

Meeting, then Section 3.3 of the Company’s bylaws will permit the chairman of the Special Meeting to adjourn at any time. The voting

standard under Section 3.3 of the Company’s bylaws for the Adjournment Proposal when a quorum is present requires approval by a

majority of the shares represented in person or by proxy that are entitled to vote at the Special Meeting. Because of this, anything

other than a vote in favor of adjournment, including broker non-votes and abstentions, will have the same effect as a vote against the

Adjournment Proposal.

Brokers, banks or other

nominees who hold shares of our Common Stock for a beneficial owner have the discretion to vote on routine proposals when they have not

received voting instructions from the beneficial owner at least ten days prior to the Special Meeting. A broker non-vote occurs when a

broker, bank or other nominee does not receive voting instructions from the beneficial owner and does not have the discretion to direct

the voting of the shares. A broker or other nominee cannot vote without instructions on non-routine matters. Since none of the proposals

being voted on at the Special Meeting are routine, we do not expect to receive any broker non-votes at the meeting.

If you sign and submit

your BLUE proxy card without specifying how you would like your shares voted, your shares will be voted in accordance with the Focused

Compounding Group’s recommendations specified herein and in accordance with the discretion of the persons named on the BLUE proxy

card with respect to any other matters that may be voted upon at the Special Meeting.

REVOCATION OF

PROXIES

Shareholders of the Company

may revoke their proxies at any time prior to exercise by attending the Special Meeting and voting in person (although attendance at the

Special Meeting will not in and of itself constitute revocation of a proxy; voting is required) or by delivering a written notice of revocation.

The delivery of a subsequently dated proxy that is properly completed will also constitute a revocation of any earlier proxy. The revocation

may be delivered either to the Focused Compounding Group in care of InvestorCom at the address set forth on the back cover of this Proxy

Statement or to the Company at 1300 Oak Grove Road, Pine Mountain, GA 31822 or any other address provided by the Company. Although a revocation

is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to the

Focused Compounding Group in care of InvestorCom at the address set forth on the back cover of this Proxy Statement so that we will be

aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record

Date for a majority of the outstanding shares of Common Stock. Additionally, InvestorCom may use this information to contact shareholders

who have revoked their proxies in order to solicit later dated proxies for the election of the Focused Nominees.

IF YOU WISH TO VOTE FOR

THE ELECTION OF THE FOCUSED NOMINEES AND THE OTHER PROPOSALS, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED BLUE PROXY CARD IN THE

POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION

OF PROXIES

The solicitation of proxies

pursuant to this Proxy Statement is being made by the Focused Compounding Group. Proxies may be solicited by mail, facsimile, telephone,

electronic mail, in person and by advertisements. Solicitations may also be made by certain of the respective directors, officers, members

and employees of the Focused Compounding Group, none of whom will, except as described elsewhere in this Proxy Statement, receive additional

compensation for such solicitation. The Focused Nominees may make solicitations of proxies but, except as described herein, will not receive

compensation for acting as director nominees.

We have retained InvestorCom

for solicitation and advisory services in connection with solicitation relating to the Special Meeting at an estimated fee of $75,000,

and reimbursement of reasonable out-of-pocket expenses for its services to the Focused Compounding Group in connection with the solicitation.

Arrangements will also be made with custodians, nominees and fiduciaries for forwarding proxy solicitation materials to beneficial owners

of Common Stock held as of the Record Date for the Special Meeting. The Focused Compounding Group will reimburse such custodians, nominees

and fiduciaries for reasonable expenses incurred in connection therewith. In addition, directors, officers, members and certain other

employees of the Focused Compounding Group may solicit proxies as part of their duties in the normal course of their employment without

any additional compensation. It is anticipated that InvestorCom will employ approximately 25 persons to solicit shareholders for the Special

Meeting.

The Focused Compounding

Group will pay all costs of the solicitation. The expenses incurred by the Focused Compounding Group to date in furtherance of, or in

connection with, the solicitation is approximately $100,000. The Focused Compounding Group anticipates that its total expenses will be

approximately $200,000. The actual amount could be higher or lower depending on the facts and circumstances arising in connection with

the solicitation. To the extent legally permissible, if the Focused Compounding Group is successful in its proxy solicitation, the Focused

Compounding Group may seek reimbursement from the Company for the expenses it incurs in connection with this solicitation. The Focused

Compounding Group does not intend to submit the question of such reimbursement to a vote of security holders of the Company.

Except as set forth in this

Proxy Statement (including the Schedules hereto), no member of the Focused Compounding Group (i) during the past 10 years, has been convicted

in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) has directly or indirectly beneficially owns any

securities of the Company; (iii) owns any securities of the Company which are owned of record but not beneficially; (iv) has purchased

or sold any securities of the Company during the past two years; (v) borrowed or obtained funds for any part of the purchase price or

market value of the securities of the Company for the purpose of acquiring or holding such securities; (vi) is, or within the past year

was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including,

but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division

of losses or profits, or the giving or withholding of proxies; (vii) is associateed with anyone who owns beneficially, directly or indirectly,

any securities of the Company; (viii) owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company;

(ix) or any of his, her or its associates was a party to any transaction, or series of similar transactions, since the beginning of the

Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the

Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) or any of his, her or its

associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates,

or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; (xi) has a substantial

interest, direct or indirect, by securities holdings or otherwise, in any matter to be acted on at the Special Meeting; (xii) holds any

positions or offices with the Company; (xiii) has a family relationship with any director, executive officer, or person nominated or chosen

by the Company to become a director or executive officer; and (xiv) has been employed by any organization or company that in the past

five years, is a parent, subsidiary or other affiliate of the Company. There are no material proceedings to which any member of the Focused

Compounding Group or any of his, her or its associates is a party adverse to the Company or any of its subsidiaries or has a material

interest adverse to the Company or any of its subsidiaries. Except as disclosed herein, with respect to each of the Focused Nominees,

(a) none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act (“Regulation S-K”) occurred

during the past 10 years, (b) there are no relationships involving any Focused Nominee or any Focused Nominee’s associates that

would have required disclosure under Item 407(e)(4) of Regulation S-K had such Focused Nominee been a director of the Company, and (c)

none of the Focused Nominees nor any of their associates has received any fees earned or paid in cash, stock awards, option awards, non-equity

incentive plan compensation, changes in pension value or nonqualified deferred compensation earnings or any other compensation from the

Company during the Company’s last completed fiscal year, or was subject to any other compensation arrangement described in Item

402 of Regulation S-K.

OTHER MATTERS

AND ADDITIONAL INFORMATION

The Focused Compounding

Group is unaware of any other matters to be considered at the Special Meeting. However, should other matters, which the Focused Compounding

Group is not aware of at a reasonable time before this solicitation, be brought before the Special Meeting, the persons named as proxies

on the enclosed BLUE proxy card will vote on such matters in their discretion.

Some banks, brokers and

other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This

means that only one copy of this Proxy Statement may have been sent to multiple shareholders in your household. We will promptly deliver

a separate copy of the document to you if you write to our proxy solicitor, InvestorCom, at the address set forth on the back cover of

this Proxy Statement, or shareholders may call toll free at (877) 972-0090, and banks and brokers may call collect at (203) 972-9300.

If you want to receive separate copies of our proxy materials in the future, or if you are receiving multiple copies and would like to

receive only one copy for your household, you should contact your bank, broker or other nominee record holder, or you may contact our

proxy solicitor at the above address and phone number.

The information contained

in this Proxy Statement concerning the Company has been taken from, or is based upon, publicly available documents on file with the SEC

and other publicly available information. All information relating to any person other than the Focused Compounding Group is given only

to the knowledge of the Focused Compounding Group.

This Proxy Statement is

dated January 26, 2024. You should not assume that the information contained in this Proxy Statement is accurate as of any date other

than such date, and the mailing of this Proxy Statement to shareholders shall not create any implication to the contrary.

CERTAIN ADDITIONAL INFORMATION

WE HAVE OMITTED FROM THIS

PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS INCLUDED IN THE COMPANY’S FORM 10-K WITH RESPECT TO THE SPECIAL

MEETING AND NOTICE OF MEETING WITH RESPECT TO THE SPECIAL MEETING BASED ON RELIANCE ON RULE 14A-5(C). THIS DISCLOSURE INCLUDES, AMONG

OTHER THINGS, INFORMATION CONCERNING EXECUTIVE COMPENSATION, INFORMATION CONCERNING THE PROCEDURES FOR SUBMITTING SHAREHOLDER PROPOSALS

FOR CONSIDERATION FOR INCLUSION IN THE PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS. SEE SCHEDULE II FOR INFORMATION REGARDING

PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF THE SHARES AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND MANAGEMENT OF THE COMPANY.

The information concerning

the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or is based upon, publicly available

documents on file with the SEC and other publicly available information.

Your vote is important.

No matter how many or how few shares you own, please vote to elect the Focused Nominees by marking, signing, dating and mailing the enclosed

BLUE proxy card promptly.

SCHEDULE I

TRANSACTIONS IN SECURITIES OF THE COMPANY

DURING THE PAST TWO YEARS

None of Focused Compounding

Capital Management, LLP, Geoff Gannon, or Andrew Kuhn have transacted Company Common Stock or other securities of the Company in the past

two years. Other than as listed below, neither James Ford nor Focused Compounding Fund, LP has transacted Company Common Stock or other

securities of the Company in the past two years.

JAMES FORD

| Bought/Sold |

|

Number of Shares |

|

Price per Share |

|

Date |

| Bought |

|

7,100 |

|

$0.29403 |

|

12/5/23 |

| Bought |

|

25,000 |

|

$0.30 |

|

12/5/23 |

| Sold |

|

10,536 |

|

$0.4394 |

|

8/21/23 |

| Bought |

|

64 |

|

$0.42 |

|

7/5/22 |

| Bought |

|

5,424 |

|

$0.354 |

|

5/26/23 |

| Bought |

|

13,600 |

|

$0.43 |

|

5/6/23 |

FOCUSED COMPOUNDING FUND, LP

| Bought/Sold |

|

Number of Shares |

|

Price per Share |

|

Date |

| Bought |

|

16,012,700 |

|

$0.2498 |

|

12/14/2023 |

SCHEDULE II

CERTAIN BENEFICIAL OWNERS AND OFFICERS AND

DIRECTORS

Other than as noted below,

the following information is reprinted from the Company’s Form 10-K and is as of December 7, 2023:

The following table sets

forth certain information relating to the ownership of common stock by (i) each person known by us to be the beneficial owner of more

than five percent of the outstanding shares of our common stock, (ii) each of our directors, (iii) each of our named executive officers,

and (iv) all of our executive officers and directors as a group. Unless otherwise indicated, the information relates to these persons,

beneficial ownership as of December 7, 2023. Except as may be indicated in the footnotes to the table and subject to applicable community

property laws, each person has the sole voting and investment power with respect to the shares owned.

The address of each beneficial

owner is care of Parks! America, Inc., 1300 Oak Grove Road, Pine Mountain, GA 31822, unless otherwise set forth below that person’s

name.

| Name |

|

Number of

Shares Owned |

|

Percent (1) |

|

Title |

| Lisa Brady |

|

157,223 |

|

0.2% |

|

President, Chief Executive Officer and Director |

| Todd R. White (2) |

|

1,308,192 |

|

1.7% |

|

Chief Financial Officer and Director |

| Dale Van Voorhis (4) |

|

16,012,700 |

|

21.2% |

|

Chairman of the Board of Directors |

| Charles Kohnen (3) |

|

22,918,108 |

|

30.3% |

|

Director |

| Jeffery Lococo |

|

619,383 |

|

0.8% |

|

Secretary and Director |

| John Gannon |

|

43,706 |

|

0.1% |

|

Director |

| Rick Ruffolo |

|

35,268 |

|

0.0% |

|

Director |

| Focused Compounding Fund, LP 1700 Alma Drive, Suite 460 Plano, TX 75075 |

|

29,110,150(4) |

|

38.5% |

|

|

| (1) | Based upon shares of common stock issued and outstanding as of

December 7, 2023, except that shares of common stock underlying options and warrants exercisable within 60 days of the date hereof are

deemed to be outstanding. |

| (2) | 410,350 of the Company’s shares owned by Mr. White are

held jointly with his spouse. |

| (3) | 16,032,600 of the Company’s shares owned by Mr. Kohnen

are held jointly with his spouse. |

| (4) | On December 14, 2023 Mr. Van Voorhis entered into a Stock Purchase

Agreement to sell all of his shares to Focused Compounding. The Focused Compounding shares in the table reflects this purchase. After

giving effect to this purchase, Mr. Van Voorhis no longer holds any shares. |

Officers, directors and

their controlled entities, as a group, controlled approximately 54.4% of the outstanding common stock of the Company as of December 7,

2023. Subsequent to Focused Compounding’s acquisition of Mr. Van Voorhis’ shares on December 14, 2023, as described in footnote

4 to the above table, the Company’s officers, directors and their controlled entities, as a group, controlled approximately 33.2%

of the outstanding stock of the Company.

The information as to shares

beneficially owned has been individually furnished by the respective directors, named executive officers and other shareholders, taken

from documents filed with the SEC, or furnished by Focused Compounding with regard to its shares.

IMPORTANT

Tell the Board what you

think! Your vote is important. No matter how many shares of Common Stock you own, please give the Focused Compounding Group your proxy

“FOR” the election of each of the three Focused Nominees and in accordance with the Focused Compounding Group’s recommendations

on the other proposals on the agenda for the Special Meeting by taking these three steps:

· SIGNING

the enclosed BLUE proxy card,

· DATING

the enclosed BLUE proxy card, and

· MAILING

the enclosed BLUE proxy card TODAY in the envelope provided (no postage is required if mailed in the United States).

If any of your shares of

Common Stock are held in the name of a brokerage firm, bank, bank nominee or other institution, only it can vote such shares of Common

Stock and only upon receipt of your specific instructions. Depending upon your broker or custodian, you may be able to vote either by

toll-free telephone or by the Internet. Please refer to the enclosed proxy card for instructions on how to vote electronically. You may

also vote by signing, dating and returning the enclosed BLUE proxy card.

If you have any questions,

require assistance in voting your BLUE proxy card, or need additional copies of the Focused Compounding Group’s proxy materials,

please contact InvestorCom at the phone numbers or email address listed below.

InvestorCom

19 Old Kings Highway S.

Suite 130

Darien, CT 06820

Shareholders may call toll-free: (877) 972-0090

Banks and brokers call: (203) 972-9300

E-mail: Proxy@investor-com.com

BLUE PROXY CARD

PARKS! AMERICA, INC. SPECIAL MEETING OF SHAREHOLDERS

THIS PROXY IS SOLICITED ON BEHALF OF FOCUSED

COMPOUNDING FUND, LP

AND THE OTHER PARTICIPANTS IN ITS PROXY SOLICITATION

THIS SOLICITATION IS NOT BEING MADE BY OR

ON BEHALF OF PARKS! AMERICA, INC.

P R O X Y

The undersigned appoints

Andrew Kuhn and Geoff Gannon, as attorney and agent with full power of substitution to vote all shares of Common Stock of Parks! America,

Inc. (the “Company”) which the undersigned would be entitled to vote if personally present at the special meeting of

shareholders of the Company (including any adjournments or postponements thereof and any meeting called in lieu thereof, the “Special

Meeting”) scheduled to be held on February 26, 2024 at 11:00 a.m. Eastern Time.

The undersigned hereby

revokes any other proxy or proxies heretofore given to vote or act with respect to the shares of common stock of the Company held by the

undersigned, and hereby ratifies and confirms all action the herein named attorneys and proxies, their substitutes, or any of them may

lawfully take by virtue hereof. If properly executed, this Proxy will be voted as directed on the reverse side and in the discretion of

the herein named attorneys and proxies or their substitutes with respect to any other matters as may properly come before the Special

Meeting that are unknown to Focused Compounding Fund, LP (“Focused Compounding”) before the Special Meeting to the

maximum extent that they are permitted to do so under applicable law.

This proxy will be valid

until the completion of the Special Meeting. This proxy will only be valid in connection with Focused Compounding’s solicitation

of proxies for the Special Meeting.

IMPORTANT: PLEASE SIGN, DATE

AND MAIL THIS PROXY CARD PROMPTLY!

CONTINUED AND TO BE SIGNED ON REVERSE SIDE

BLUE PROXY CARD

GENERAL INSTRUCTION: TO VOTE “FOR,”

“AGAINST” OR “ABSTAIN” ON ANY PROPOSAL, MARK THE APPROPRIATE BOX.

☒ Please mark each vote as in this example

FOCUSED COMPOUNDING STRONGLY RECOMMENDS THAT SHAREHOLDERS

VOTE “FOR” PROPOSAL 1, “FOR” PROPOSAL 2, “FOR” PROPOSAL 3, “FOR” THE ELECTION OF EACH

THE THREE FOCUSED NOMINEES LISTED IN PROPOSAL 4 AND “FOR” PROPOSAL 5.

1. Proposal

1: Repeal any provision of the Bylaws of Parks! America, Inc. as adopted on January 30, 2004 and as revised as of June 12, 2012 (the

“Bylaws”), including any amendments thereto, in effect at the time this Proposal becomes effective, which was not included

in the Bylaws that were in effect as of June 12, 2012 and were filed with the SEC on July 16, 2012 (the “Bylaw Restoration Proposal”)

to restore the Bylaws to their current form if the board of directors (the “Board”) of the Company attempts to amend

them in any manner prior to completion of this proxy solicitation.

☐

FOR ☐ AGAINST ☐

ABSTAIN

2. Proposal

2: Subject to the concurrent approval of both the Bylaw Amendment Proposal and the Election Proposal, remove all seven (7) members

of the Board (Lisa Brady, Todd White, Dale Van Voorhis, John Gannon, Charles Kohnen, Jeffery Lococo and Rick Ruffolo) pursuant to Section

4.9(a) of the Bylaws (the “Removal Proposal”).

☐

FOR ☐ AGAINST ☐

ABSTAIN

3. Proposal

3: Subject to the concurrent approval of both the Removal Proposal and the Election Proposal, amend and restate Section 4.7 of the

Bylaws (the “Bylaw Amendment Proposal”) to read as follows:

4.7 Vacancy on Board of Directors.

In case of a vacancy on the Board of Directors because of a director’s resignation, removal or other departure from the board,

or because of an increase in the number of directors, the remaining directors, by majority vote, may elect a successor to hold office

for the unexpired term of the director whose position is vacant, and until the election and qualification of a successor. In the event

any directors are removed by a vote of the shareholders, then the shareholders shall have the right to elect successors to hold office

for the unexpired term of the director or directors whose positions are vacant, and until the election and qualification of their successors.

☐

FOR ☐ AGAINST ☐

ABSTAIN

4. Proposal

4: Subject to the concurrent approval of both the Removal Proposal and the Bylaw Amendment Proposal, elect as members of the Board

each of the following individuals (each a “Nominee” and collectively the “Nominees”): (i) Andrew

Kuhn, (ii) Geoff Gannon and (iii) James Ford (the “Election Proposal”).

Andrew Kuhn

☐

FOR ☐ AGAINST ☐

ABSTAIN

Geoff Gannon

☐

FOR ☐ AGAINST ☐

ABSTAIN

James Ford

☐

FOR ☐ AGAINST ☐

ABSTAIN

INSTRUCTIONS FOR PROPOSAL 4: IF YOU

WISH TO VOTE “FOR” OR “AGAINST” A NOMINEE, CHECK THE APPROPRIATE BOX TO EITHER VOTE “FOR” OR “AGAINST”

THAT NOMINEE. TO ABSTAIN FROM CASTING A VOTE FOR A CERTAIN NOMINEE, MARK THE “ABSTAIN” BOX FOR THAT NONINEE.

5. Proposal

5: Authorize Focused Compounding Fund, LP, or an authorized representative thereof, to adjourn the Special Meeting to a later date

or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event there are insufficient votes for,

or otherwise in connection with, any of the Bylaw Restoration Proposal, the Removal Proposal, the Bylaw Amendment Proposal or the Election

Proposal (the “Adjournment Proposal”).

☐

FOR ☐ AGAINST ☐

ABSTAIN

IF NO BOX IS MARKED FOR ANY OF PROPOSALS

1 THROUGH 3 OR 5 AND THIS CARD IS PROPERLY SIGNED, DATED AND DELIVERED, THIS PROXY WILL BE VOTED “FOR” EACH SUCH PROPOSAL.

WITH RESPECT TO EACH NOMINEE LISTED IN PROPOSAL 4, IF NO BOX IS CHECKED, THEN THIS PROXY WILL BE VOTED “FOR” THE ELECTION

OF THAT NOMINEE, PROVIDED THIS CARD IS PROPERLY SIGNED, DATED AND DELIVERED.

BLUE PROXY CARD

AT THIS TIME, WE KNOW OF NO OTHER MATTERS THAT

WILL BE BROUGHT BEFORE THE SPECIAL MEETING. SHOULD OTHER MATTERS PROPERLY BE BROUGHT BEFORE THE SPECIAL MEETING, INCLUDING ANY PROCEDURAL

MATTERS, THIS BLUE PROXY CARD, WHEN DULY EXECUTED, WILL GIVE THE PROXIES NAMED HEREIN DISCRETIONARY AUTHORITY TO VOTE ON ALL SUCH OTHER

MATTERS AND ON ALL MATTERS INCIDENT TO THE CONDUCT OF THE SPECIAL MEETING TO THE MAXIMUM EXTENT THAT THEY ARE PERMITTED TO DO SO BY APPLICABLE

LAW.

DATED:

(Signature)

(Signature,

if held jointly)

(Title)

WHEN SHARES ARE HELD JOINTLY, JOINT OWNERS

SHOULD EACH SIGN. EXECUTORS, ADMINISTRATORS, TRUSTEES, ETC., SHOULD INDICATE THE CAPACITY IN WHICH SIGNING. PLEASE SIGN EXACTLY AS NAME

APPEARS ON THIS PROXY.

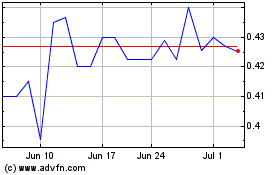

Parks America (PK) (USOTC:PRKA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Parks America (PK) (USOTC:PRKA)

Historical Stock Chart

From Apr 2023 to Apr 2024