Seagate Technology Holdings plc0001137789false00011377892024-01-242024-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

____________________________

FORM 8-K

____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 24, 2024

____________________________

SEAGATE TECHNOLOGY HOLDINGS PUBLIC LIMITED COMPANY

(Exact name of registrant as specified in its charter)

____________________________ | | | | | | | | |

| Ireland | 001-31560 | 98-1597419 |

| (State or other jurisdiction of | (Commission File Number) | (I.R.S. Employer |

| incorporation or organization) | | Identification Number) |

| | | | | |

| 121 Woodlands Avenue 5 | 739009 |

|

| Singapore |

| (Address of principal executive office) | (Zip Code) |

Registrant’s telephone number, including area code: (65) 6018-2562

38/39 Fitzwilliam Square

Dublin 2, Ireland

D02 NX53

(Former name or former address, if changed since last report)

_______________________________________________________________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Ordinary Shares, par value $0.00001 per share | | STX | | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 24, 2024, Seagate Technology Holdings plc (the “Company” or “Seagate”) issued a press release reporting its financial results for the fiscal second quarter ended December 29, 2023. The press release is attached to this Current Report on Form 8-K as Exhibit 99.1.

The information in this Item 2.02 and the exhibit hereto are “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of such section.

Item 7.01 Regulation FD Disclosure.

On January 24, 2024, the Board of Directors of the Company declared a quarterly cash dividend of $0.70 per share, which will be payable on April 4, 2024 to shareholders of record as of the close of business on March 21, 2024.

Seagate has issued a Supplemental Financial Information document. The Supplemental Financial Information is available on Seagate’s Investor Relations website at investors.seagate.com.

Seagate management will hold a public webcast on January 24, 2024 at 2:00 p.m. Pacific / 5:00 p.m. Eastern that can be accessed on its Investor Relations website at investors.seagate.com. During the webcast, the Company will provide an outlook for its fiscal third quarter of 2024 including key underlying assumptions. A replay will be available on Seagate’s Investor Relations website at investors.seagate.com shortly following the conclusion of the event and will be archived for approximately one year. Investors and others should note that the Company routinely uses the Investor Relations section of its corporate website to announce material information to investors and the marketplace. While not all of the information that the Company posts on its corporate website is of a material nature, some information could be deemed to be material. Accordingly, the Company encourages investors, the media, and others interested in the Company to review the information that it shares on investors.seagate.com.

The information in this Item 7.01 is “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of such section.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibit is attached to this Current Report on Form 8-K:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | |

| | SEAGATE TECHNOLOGY HOLDINGS PUBLIC LIMITED COMPANY |

| | |

| Date: | January 24, 2024 | By: | /s/ Gianluca Romano |

| | Name: | Gianluca Romano |

| | | |

| | Title: | Executive Vice President and Chief Financial Officer (Principal Financial and Accounting Officer) |

Exhibit 99.1

Investor Relations Contact:

Shanye Hudson, (510) 661-1600

shanye.hudson@seagate.com

Media Contact:

Gregory Belloni, (415) 235-9092

gregory.belloni@seagate.com

SEAGATE TECHNOLOGY REPORTS FISCAL SECOND QUARTER 2024 FINANCIAL RESULTS

Fiscal Q2 2024 Highlights

•Revenue of $1.56 billion

•GAAP (loss) per share of $(0.09); non-GAAP diluted earnings per share (EPS) of $0.12

•Cash flow from operations of $169 million and free cash flow of $99 million

•Declared cash dividend of $0.70 per share

•Launch of Mozaic platform marking a major inflection point in mass capacity storage

FREMONT, CA – January 24, 2024 - Seagate Technology Holdings plc (NASDAQ: STX) (the “Company” or “Seagate”) today reported financial results for its fiscal second quarter ended December 29, 2023.

"Seagate delivered strong financial results in the December quarter, marked by 7% sequential revenue growth and non-GAAP EPS returning to profitability and exceeding the high end of our guidance range," said Dave Mosley, Seagate’s chief executive officer. “Results were led by improving cloud nearline demand as early signs of market recovery emerge.”

“Seagate has consistently balanced financial discipline with execution on our areal density-leading product roadmap. Last week’s launch of our Mozaic platform delivers a combination of technology advances, including HAMR, that collectively address data center operators’ most important challenges: cost, power and space. Volume ramp for our first Mozaic product is underway, positioning Seagate to capture attractive Mass Capacity storage opportunities," Mosley concluded.

Quarterly Financial Results

| | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | | Non-GAAP | | |

| FQ2 2024 | | FQ2 2023 | | FQ2 2024 | | FQ2 2023 | | |

| Revenue ($M) | $ | 1,555 | | | $ | 1,887 | | $ | 1,555 | | $ | 1,887 | | |

| Gross Margin | 23.3% | | 13.0% | | 23.6% | | 21.4% | | |

| Operating Margin | 8.0% | | (8.5%) | | 8.2% | | 5.8% | | |

| Net (Loss) Income ($M) | $ | (19) | | $ | (33) | | $ | 25 | | $ | 34 | | |

| Diluted (Loss) Earnings Per Share | $ | (0.09) | | $ | (0.16) | | $ | 0.12 | | $ | 0.16 | | |

During the fiscal second quarter the Company generated $169 million in cash flow from operations, $99 million in free cash flow, and returned $146 million of capital to shareholders through its quarterly dividend. As of the end of the quarter, cash and cash equivalents totaled $787 million, and there were 210 million ordinary shares issued and outstanding.

For a detailed reconciliation of GAAP to non-GAAP results, see accompanying financial tables.

Seagate has issued a Supplemental Financial Information document, which is available on Seagate’s Investor Relations website at investors.seagate.com.

Quarterly Cash Dividend

The Board of Directors of the Company (the "Board") declared a quarterly cash dividend of $0.70 per share, which will be payable on April 4, 2024 to shareholders of record as of the close of business on March 21, 2024. The payment of any future quarterly dividends will be at the discretion of the Board and will be dependent upon Seagate’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the Board.

Business Outlook

The business outlook for the fiscal third quarter 2024 is based on our current assumptions and expectations; actual results may differ materially as a result of, among other things, the important factors discussed in the Cautionary Note Regarding Forward-Looking Statements section of this release.

The Company is providing the following guidance for its fiscal third quarter 2024:

•Revenue of $1.65 billion, plus or minus $150 million

•Non-GAAP diluted EPS of $0.25, plus or minus $0.20

Guidance regarding non-GAAP diluted EPS excludes known pre-tax charges related to estimated share-based compensation expenses of $0.15 per share.

We have not reconciled our non-GAAP diluted EPS guidance for fiscal third quarter 2024 to the most directly comparable GAAP measure, other than estimated share-based compensation expenses, because material items that may impact these measures are out of our control and/or cannot be reasonably predicted, including, but not limited to, accelerated depreciation, impairment and other charges related to cost saving efforts, net (gain) loss recognized from early redemption of debt, purchase order cancellation fees, strategic investment losses (gains) or impairment charges, income tax adjustments on these measures, and other charges or benefits that may arise. The amounts of these measures are not currently available but may be material to future results. A reconciliation of the non-GAAP diluted EPS guidance for fiscal third quarter 2024 to the corresponding GAAP measures is not available without unreasonable effort. A reconciliation of our historical non-GAAP financial measures to their nearest GAAP equivalent is contained in this release.

Investor Communications

Seagate management will hold a public webcast today at 2:00 PM PT / 5:00 PM ET that can be accessed on its Investor Relations website at investors.seagate.com.

An archived audio webcast of this event will be available on Seagate’s Investor Relations website at investors.seagate.com shortly following the event conclusion.

About Seagate

Seagate Technology is the leading innovator of mass-capacity data storage solutions. We create breakthrough technology so you can confidently store your data and easily unlock its value. Founded over 45 years ago, Seagate has shipped over four billion terabytes of data capacity and offers a full portfolio of storage devices, systems, and services from edge to cloud. To learn more about how Seagate leads storage innovation, visit www.seagate.com and our blog, or follow us on Twitter, Facebook, LinkedIn, and YouTube.

© 2024 Seagate Technology LLC. All rights reserved. Seagate, Seagate Technology, and the Spiral logo are registered trademarks of Seagate Technology LLC in the United States and/or other countries.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical fact. Forward-looking statements include, among other things, statements about the Company’s plans, programs, strategies, prospects, and opportunities; financial outlook for future periods, including the fiscal third quarter 2024; expectations regarding our ability to service debt and continue to generate free cash flow; expectations regarding our ability to make timely quarterly payments under the settlement agreement with the U.S. Department of Commerce’s Bureau of Industry and Security; expectations regarding logistical, macroeconomic, or other factors affecting the Company; expectations regarding market demand for the Company’s products and our ability to optimize our level of production and meet market and industry expectations and the effects of these future trends on Company’s performance; anticipated shifts in technology and storage industry trends, and anticipated demand and performance of new storage product introductions, including HAMR-based products; and expectations regarding the Company’s business strategy and performance, as well as dividend issuance plans for the fiscal quarter ending March 29, 2024 and beyond. Forward-looking statements generally can be identified by words such as “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “should,” “may,” “will,” “will continue,” “can,” “could” or the negative of these words, variations of these words and comparable terminology, in each case, intended to refer to future events or circumstances. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are subject to various uncertainties and risks that could cause our actual results to differ materially from historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to, those described under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s latest periodic report on Form 10-Q or Form 10-K filed with the U.S. Securities and Exchange Commission. Undue reliance should not be placed on the forward-looking statements in this press release, which are based on information available to us on, and which speak only as of, the date hereof. The Company undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date they were made, unless required by applicable law.

The inclusion of Seagate’s website addresses in this press release are provided for convenience only. The information contained in, or that can be accessed through, Seagate’s websites and social media channels are not part of this press release.

SEAGATE TECHNOLOGY HOLDINGS PLC

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions)

| | | | | | | | | | | |

| December 29, 2023 | | June 30, 2023 |

| (unaudited) | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 787 | | | $ | 786 | |

| Accounts receivable, net | 471 | | | 621 | |

| Inventories | 1,053 | | | 1,140 | |

| Other current assets | 317 | | | 358 | |

| Total current assets | 2,628 | | | 2,905 | |

| Property, equipment and leasehold improvements, net | 1,642 | | | 1,706 | |

| Goodwill | 1,237 | | | 1,237 | |

| Deferred income taxes | 1,074 | | | 1,117 | |

| Other assets, net | 568 | | | 591 | |

| Total Assets | $ | 7,149 | | | $ | 7,556 | |

| LIABILITIES AND SHAREHOLDERS' DEFICIT | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 1,619 | | | $ | 1,603 | |

| Accrued employee compensation | 86 | | | 100 | |

| Accrued warranty | 81 | | | 78 | |

| Current portion of long-term debt | — | | | 63 | |

| Accrued expenses | 743 | | | 748 | |

| Total current liabilities | 2,529 | | | 2,592 | |

| Long-term accrued warranty | 86 | | | 90 | |

| Other non-current liabilities | 679 | | | 685 | |

| Long-term debt, less current portion | 5,669 | | | 5,388 | |

| Total Liabilities | 8,963 | | | 8,755 | |

| | | |

| Total Shareholders’ Deficit | (1,814) | | | (1,199) | |

| Total Liabilities and Shareholders’ Deficit | $ | 7,149 | | | $ | 7,556 | |

SEAGATE TECHNOLOGY HOLDINGS PLC

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended | | For the Six Months Ended |

| | December 29, 2023 | | December 30, 2022 | | December 29,

2023 | | December 30,

2022 |

| Revenue | $ | 1,555 | | | $ | 1,887 | | | $ | 3,009 | | | $ | 3,922 | |

| | | | | | | |

| Cost of revenue | 1,193 | | | 1,641 | | | 2,498 | | | 3,194 | |

| Product development | 161 | | | 200 | | | 332 | | | 434 | |

| Marketing and administrative | 108 | | | 125 | | | 213 | | | 254 | |

| Amortization of intangibles | — | | | — | | | — | | | 3 | |

| Restructuring and other, net | (31) | | | 81 | | | (29) | | | 90 | |

| Total operating expenses | 1,431 | | | 2,047 | | | 3,014 | | | 3,975 | |

| | | | | | | |

| Income (loss) from operations | 124 | | | (160) | | | (5) | | | (53) | |

| | | | | | | |

| Interest income | 3 | | | 1 | | | 5 | | | 2 | |

| Interest expense | (84) | | | (77) | | | (168) | | | (148) | |

| Net gain recognized from termination of interest rate swap | — | | | — | | | 104 | | | — | |

| Net gain (loss) recognized from early redemption of debt | — | | | 204 | | | (29) | | | 204 | |

| Other, net | (47) | | | (6) | | | (58) | | | (16) | |

| Other (expense) income, net | (128) | | | 122 | | | (146) | | | 42 | |

| | | | | | | |

| Loss before income taxes | (4) | | | (38) | | | (151) | | | (11) | |

| Provision for (benefit from) income taxes | 15 | | | (5) | | | 52 | | | (7) | |

| Net loss | $ | (19) | | | $ | (33) | | | $ | (203) | | | $ | (4) | |

| | | | | | | |

| Net loss per share: | | | | | | | |

| Basic | $ | (0.09) | | | $ | (0.16) | | | $ | (0.97) | | | $ | (0.02) | |

| Diluted | $ | (0.09) | | | $ | (0.16) | | | $ | (0.97) | | | $ | (0.02) | |

| Number of shares used in per share calculations: | | | | | | | |

| Basic | 209 | | | 206 | | | 209 | | | 207 | |

| Diluted | 209 | | | 206 | | | 209 | | | 207 | |

| | | | | | | |

| Cash dividends declared per ordinary share | $ | 0.70 | | | $ | 0.70 | | | $ | 1.40 | | | $ | 1.40 | |

SEAGATE TECHNOLOGY HOLDINGS PLC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

| | | | | | | | | | | |

| | For the Six Months Ended |

| | December 29, 2023 | | December 30, 2022 |

| OPERATING ACTIVITIES | | | |

| Net loss | $ | (203) | | | $ | (4) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 138 | | | 283 | |

| Share-based compensation | 55 | | | 62 | |

| Deferred income taxes | 41 | | | (4) | |

| Net loss (gain) on redemption and repurchase of debt | 7 | | | (204) | |

| Other non-cash operating activities, net | (12) | | | 28 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable, net | 150 | | | 692 | |

| Inventories | 87 | | | 371 | |

| Accounts payable | 54 | | | (919) | |

| Accrued employee compensation | (14) | | | (145) | |

| BIS settlement penalty | (15) | | | — | |

| Accrued expenses, income taxes and warranty | (13) | | | 228 | |

| Other assets and liabilities | 21 | | | 108 | |

| Net cash provided by operating activities | 296 | | | 496 | |

| INVESTING ACTIVITIES | | | |

| Acquisition of property, equipment and leasehold improvements | (140) | | | (212) | |

| Proceeds from the sale of assets | 35 | | | 3 | |

| Purchases of investments | — | | | (1) | |

| Net cash used in investing activities | (105) | | | (210) | |

| FINANCING ACTIVITIES | | | |

| Redemption and repurchase of debt | (1,288) | | | — | |

| Dividends to shareholders | (291) | | | (292) | |

| Repurchases of ordinary shares | — | | | (408) | |

| Taxes paid related to net share settlement of equity awards | (28) | | | (39) | |

| Proceeds from issuance of long-term debt | 1,500 | | | 600 | |

| Proceeds from issuance of ordinary shares under employee stock plans | 44 | | | 29 | |

| Other financing activities, net | (128) | | | (21) | |

| Net cash used in financing activities | (191) | | | (131) | |

| Effect of foreign currency exchange rate changes on cash, cash equivalents and restricted cash | 1 | | | — | |

| Increase in cash, cash equivalents and restricted cash | 1 | | | 155 | |

| Cash, cash equivalents and restricted cash at the beginning of the period | 788 | | | 617 | |

| Cash, cash equivalents and restricted cash at the end of the period | $ | 789 | | | $ | 772 | |

Use of non-GAAP financial information

The Company uses non-GAAP measures of gross profit, gross margin, operating expenses, income from operations, operating margin, net income, diluted EPS, free cash flow, EBITDA, adjusted EBITDA and last twelve months adjusted EBITDA, which are adjusted from results based on GAAP to exclude certain benefits, expenses, gains and losses. These non-GAAP financial measures are provided to enhance the user’s overall understanding of the Company’s current financial performance and its prospects for the future. Specifically, the Company believes non-GAAP results provide useful information to both management and investors as these non-GAAP results exclude certain benefits, expenses, gains and losses that it believes are not indicative of its core operating results and because it is similar to the approach used in connection with the financial models and estimates published by financial analysts who follow the Company.

These non-GAAP results are some of the measurements management uses to assess the Company’s performance, allocate resources and plan for future periods. Reported non-GAAP results should only be considered as supplemental to results prepared in accordance with GAAP, and not considered as a substitute or replacement for, or superior to, GAAP results. These non-GAAP measures may differ from the non-GAAP measures reported by other companies in its industry.

SEAGATE TECHNOLOGY HOLDINGS PLC

RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES

(In millions, except per share amounts, gross margin and operating margin)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | For the Six Months Ended |

| December 29, 2023 | | December 30, 2022 | | December 29,

2023 | | December 30,

2022 |

| GAAP Gross Profit | $ | 362 | | $ | 246 | | $ | 511 | | $ | 728 |

| Accelerated depreciation, impairment and other charges related to cost saving efforts | — | | 39 | | 13 | | 39 |

| Amortization of acquired intangible assets | — | | 1 | | — | | 2 |

| Pandemic-related lockdown charges | — | | — | | — | | 7 |

| Purchase order cancellation fees | (4) | | 108 | | 114 | | 108 |

| Share-based compensation | 8 | | 8 | | 15 | | 16 |

| Other charges | 1 | | 1 | | 2 | | 1 |

| Non-GAAP Gross Profit | $ | 367 | | $ | 403 | | $ | 655 | | $ | 901 |

| | | | | | | |

| GAAP Gross Margin | 23.3% | | 13.0% | | 17.0% | | 18.6% |

| Non-GAAP Gross Margin | 23.6% | | 21.4% | | 21.8% | | 23.0% |

| | | | | | | |

| GAAP Operating Expenses | $ | 238 | | $ | 406 | | $ | 516 | | $ | 781 |

| Accelerated depreciation, impairment and other charges related to cost saving efforts | — | | — | | — | | (22) |

| Amortization of acquired intangible assets | — | | — | | — | | (3) |

| Restructuring and other, net | 31 | | (81) | | 29 | | (90) |

| Share-based compensation | (22) | | (25) | | (40) | | (46) |

| Other charges | (7) | | (6) | | (17) | | (12) |

| Non-GAAP Operating Expenses | $ | 240 | | $ | 294 | | $ | 488 | | $ | 608 |

| | | | | | | |

| GAAP Income (Loss) From Operations | $ | 124 | | $ | (160) | | $ | (5) | | $ | (53) |

| Accelerated depreciation, impairment and other charges related to cost saving efforts | — | | 39 | | 13 | | 61 |

| Amortization of acquired intangible assets | — | | 1 | | — | | 5 |

| Pandemic-related lockdown charges | — | | — | | — | | 7 |

| Purchase order cancellation fees | (4) | | 108 | | 114 | | 108 |

| Restructuring and other, net | (31) | | 81 | | (29) | | 90 |

| Share-based compensation | 30 | | 33 | | 55 | | 62 |

| Other charges | 8 | | 7 | | 19 | | 13 |

| Non-GAAP Income From Operations | $ | 127 | | $ | 109 | | $ | 167 | | $ | 293 |

| | | | | | | |

| GAAP Operating Margin | 8.0% | | (8.5%) | | (0.2%) | | (1.4%) |

| Non-GAAP Operating Margin | 8.2% | | 5.8% | | 5.6% | | 7.5% |

SEAGATE TECHNOLOGY HOLDINGS PLC

RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES

(In millions, except per share amounts, gross margin and operating margin)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | For the Six Months Ended |

| December 29, 2023 | | December 30, 2022 | | December 29,

2023 | | December 30,

2022 |

| GAAP Net Loss | $ | (19) | | $ | (33) | | $ | (203) | | $ | (4) |

| Accelerated depreciation, impairment and other charges related to cost saving efforts | — | | 39 | | 13 | | 61 |

| Amortization of acquired intangible assets | — | | 1 | | — | | 5 |

| Net gain recognized from termination of interest rate swap | — | | — | | (104) | | — |

| Net (gain) loss recognized from early redemption of debt and debt modification costs | — | | (204) | | 29 | | (204) |

| Pandemic-related lockdown charges | — | | — | | — | | 7 |

| Purchase order cancellation fees | (4) | | 108 | | 114 | | 108 |

| Restructuring and other, net | (31) | | 81 | | (29) | | 90 |

| Share-based compensation | 30 | | 33 | | 55 | | 62 |

| Strategic investment losses or impairment charges | 43 | | — | | 43 | | — |

| Other charges | 8 | | 7 | | 19 | | 13 |

| Income tax adjustments | (2) | | 2 | | 42 | | (3) |

| Non-GAAP Net Income (Loss) | $ | 25 | | $ | 34 | | $ | (21) | | $ | 135 |

| | | | | | | |

| GAAP Diluted Net Loss Per Share | $ | (0.09) | | | $ | (0.16) | | | $ | (0.97) | | | $ | (0.02) | |

| Accelerated depreciation, impairment and other charges related to cost saving efforts | — | | | 0.19 | | | 0.06 | | | 0.29 | |

| Amortization of acquired intangible assets | — | | | — | | | — | | | 0.02 | |

| Net gain recognized from termination of interest rate swap | — | | | — | | | (0.50) | | | — | |

| Net (gain) loss recognized from early redemption of debt and debt modification costs | — | | | (0.99) | | | 0.14 | | | (0.98) | |

| Pandemic-related lockdown charges | — | | | — | | | — | | | 0.03 | |

| Purchase order cancellation fees | (0.02) | | | 0.52 | | | 0.55 | | | 0.52 | |

| Restructuring and other, net | (0.15) | | | 0.39 | | | (0.14) | | | 0.43 | |

| Share-based compensation | 0.14 | | | 0.16 | | | 0.26 | | | 0.30 | |

| Strategic investment losses or impairment charges | 0.20 | | | — | | | 0.21 | | | — | |

| Other charges | 0.04 | | | 0.04 | | | 0.09 | | | 0.07 | |

| Income tax adjustments | — | | | 0.01 | | | 0.20 | | | (0.01) | |

Non-GAAP Diluted Net Income (Loss) Per Share1 | $ | 0.12 | | | $ | 0.16 | | | $ | (0.10) | | | $ | 0.65 | |

| | | | | | | |

| Shares used in diluted net income (loss) per share calculation | | | | | | | |

| GAAP | 209 | | | 206 | | | 209 | | | 207 | |

| Non-GAAP | 211 | | | 207 | | | 209 | | | 209 | |

| | | | | | | |

| GAAP Net Cash Provided by Operating Activities | $ | 169 | | | $ | 251 | | | $ | 296 | | $ | 496 |

| Acquisition of property, equipment and leasehold improvements | 70 | | | 79 | | | 140 | | | 212 | |

| Free Cash Flow | $ | 99 | | | $ | 172 | | | $ | 156 | | | $ | 284 | |

____________________________________________________________

1As a result of the net loss reported during the period, GAAP diluted net loss per share for the three months ended December 29, 2023 and December 30, 2022, were computed using weighted average basic shares of 209 million and 206 million, respectively; both GAAP and non-GAAP diluted net loss per share for the six months ended December 29, 2023 were computed using weighted average basic shares of 209 million; and GAAP diluted net loss per share for the six months ended December 30, 2022 were computed using weighted average basic shares of 207 million.

SEAGATE TECHNOLOGY HOLDINGS PLC

RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES

(In millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | |

| December 29,

2023 | | September 29,

2023 | | June 30,

2023 | | March 31,

2023 | | Last Twelve Months |

| GAAP Net Loss | $ | (19) | | | $ | (184) | | | $ | (92) | | | $ | (433) | | | $ | (728) | |

| Depreciation and amortization | 62 | | | 76 | | | 104 | | | 126 | | | 368 | |

| Interest expense | 84 | | | 84 | | | 84 | | | 81 | | | 333 | |

| Interest income | (3) | | | (2) | | | (6) | | | (2) | | | (13) | |

| Income tax expense | 15 | | | 37 | | | 7 | | | 33 | | | 92 | |

| Non-GAAP EBITDA | 139 | | | 11 | | | 97 | | | (195) | | | 52 | |

| | | | | | | | | |

| BIS settlement penalty | — | | | — | | | — | | | 300 | | | 300 | |

| Net loss (gain) recognized from early redemption of debt | — | | | 29 | | | 17 | | | (3) | | | 43 | |

| Net gain recognized from termination of interest rate swap | — | | | (104) | | | — | | | — | | | (104) | |

| Purchase order cancellation fees | (4) | | | 118 | | | — | | | — | | | 114 | |

| Restructuring and other, net | (31) | | | 2 | | | (8) | | | 20 | | | (17) | |

| Share-based compensation | 30 | | | 25 | | | 22 | | | 31 | | | 108 | |

| Strategic investment losses or impairment charges | 43 | | | — | | | 9 | | | 1 | | | 53 | |

| Underutilization charges, net of depreciation and amortization | 31 | | | 51 | | | 29 | | | 60 | | | 171 | |

| Other charges | 8 | | | 11 | | | 12 | | | 7 | | | 38 | |

| Non-GAAP Adjusted EBITDA | $ | 216 | | | $ | 143 | | | $ | 178 | | | $ | 221 | | | $ | 758 | |

The Company’s Non-GAAP measures are adjusted for the following items:

Accelerated depreciation, impairment and other charges related to cost saving efforts

These expenses are excluded in the non-GAAP measures due to the inconsistency in amount and frequency and are excluded to facilitate a more meaningful evaluation of the Company’s current operating performance and comparison to its past periods' operating performance.

Amortization of acquired intangible assets

The Company records expense from amortization of intangible assets that were acquired in connection with its business combinations over their estimated useful lives. Such charges are inconsistent in size and are significantly impacted by the timing and magnitude of the Company’s acquisitions. Consequently, these expenses are excluded in the non-GAAP measures to facilitate a more meaningful evaluation of its current operating performance and comparison to its past periods’ operating performance.

BIS settlement penalty

The Company accrued a settlement penalty of $300 million for the fiscal third quarter of 2023 related to the alleged violations of the U.S. Export Administration Regulations between August 17, 2020 and September 29, 2021 by the U.S. Department of Commerce’s Bureau of Industry and Security (“BIS”), which were subsequently resolved by a settlement agreement on April 18, 2023. This settlement penalty is excluded from the non-GAAP measures to facilitate a more meaningful evaluation of the Company's current operating performance and comparison to its past periods' operating performance.

Net loss (gain) recognized from early redemption of debt and termination of interest rate swap

From time to time, the Company incurs gains, losses and fees from the early redemption and repurchase of certain long-term debt instruments and termination of related interest rate swap agreements. The amount of these charges may be inconsistent in size and varies depending on the timing of the early redemption of debt and/or termination of interest rate swap and consequently is excluded from the non-GAAP measures to facilitate a more meaningful evaluation of its current operating performance and comparison to its past periods' operating performance.

Pandemic-related lockdown charges

Pandemic-related lockdown charges are factory under-utilization costs incurred due to the pandemic-related lockdown measures at our factory in Wuxi, China. These charges are inconsistent in amount and frequency and are excluded in the non-GAAP measures to facilitate a more meaningful evaluation of its current operating performance and comparison to its past periods’ operating performance.

Purchase order cancellation fees

Purchase order cancellation fees are the costs incurred to cancel certain purchase commitments made with the Company's suppliers for component and equipment purchases that will not be received due to change in forecasted demand. These charges are inconsistent in amount and frequency and are excluded in the non-GAAP measures to facilitate a more meaningful evaluation of its current operating performance and comparison to its past periods’ operating performance.

Restructuring and other, net

Restructuring and other, net are costs associated with restructuring plans that are primarily related to costs associated with reduction in the Company’s workforce, exiting certain facilities and other related costs, as well as charges or gains from sale of properties. These costs or benefits do not reflect the Company’s ongoing operating performance and consequently are excluded from the non-GAAP measures to facilitate a more meaningful evaluation of its current operating performance and comparison to its past periods’ operating performance.

Share-based compensation

These expenses consist primarily of expenses for employee share-based compensation. Given the variety of equity awards used by companies, the varying methodologies for determining share-based compensation expense, the subjective assumptions involved in those determinations, and the volatility in valuations that can be driven by market conditions outside the Company’s control, the Company believes excluding share-based compensation expense enhances the ability of management and investors to understand and assess the underlying performance of its business over time and compare it against the Company’s peers, a majority of whom also exclude share-based compensation expense from their non-GAAP results.

Strategic investment gains, losses and impairment charges

From time to time, the Company incurs gains, losses or impairment charges from strategic investments that are measured and accounted at fair value, under the equity method of accounting, as available-for-sale debt securities or adjust for downward or upward adjustments to the carrying value under the measurement alternative if an impairment or observable price adjustment is recognized in the current period that are not considered as part of its ongoing operating performance. The resulting expense, gain or impairment loss is inconsistent in amount and frequency and consequently is excluded from the non-GAAP measures to facilitate a more meaningful evaluation of its current operating performance and comparison to its past periods’ operating performance.

Other charges

The other charges primarily include IT transformation costs. These charges are inconsistent in amount and frequency and are excluded in the non-GAAP measures to facilitate a more meaningful evaluation of its current operating performance and comparison to its past periods’ operating performance.

Income tax adjustments

Provision or benefit for income taxes represents the tax effects of non-GAAP adjustments determined using a hybrid with and without method and effective tax rate for the applicable adjustment and jurisdiction.

Free cash flow

Free cash flow is a non-GAAP measure defined as net cash provided by operating activities less acquisition of property, equipment and leasehold improvements. Free cash flow does not reflect non-cash items, net cash used or provided by financing activities and net cash used or provided by investing activities, other than acquisition of property, equipment and leasehold improvements. This non-GAAP financial measure is used by management to assess the Company's sources of liquidity, capital structure and operating performance.

EBITDA, adjusted EBITDA and last twelve months (LTM) adjusted EBITDA

EBITDA is defined as net income (loss) before income tax expense, interest expense, interest income, depreciation and amortization. Adjusted EBITDA excludes certain expenses, gains and losses that the Company believes are not indicative of its core operating results. These adjustments primarily include impairment and other charges related to cost saving efforts, net loss (gain) recognized from early redemption of debt, net gain recognized from termination of interest rate swap, pandemic-related lockdown charges, purchase order cancellation fees, restructuring and other, net, share-based compensation, strategic investment losses or impairment charges, other extraordinary charges such as factory underutilization charges and BIS settlement penalty. LTM adjusted EBITDA is defined as the total of last twelve months adjusted EBITDA. These non-GAAP financial measures are used by management to evaluate the Company’s debt portfolio and structure to comply with its financial debt covenants.

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

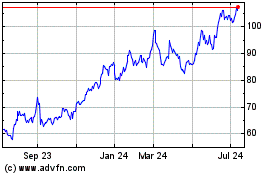

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Mar 2024 to Apr 2024

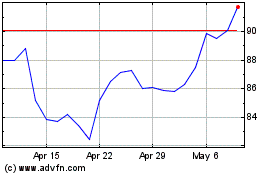

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Apr 2023 to Apr 2024