false

0001754820

0001754820

2024-01-22

2024-01-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 22, 2024

Desktop Metal, Inc.

(Exact name of Registrant as Specified in

Its Charter)

| Delaware |

|

001-38835 |

|

83-2044042 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

63 3rd

Avenue

Burlington,

MA 01803

(Address of principal

executive offices) (Zip Code)

(978)

224-1244

(Registrant’s telephone number, include

area code)

N/A

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2

below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A common stock, par value $0.0001 per share |

|

DM |

|

The New York Stock Exchange |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.05. Costs Associated with Exit or Disposal Activities

On January 22, 2024, Desktop Metal, Inc. (the

“Company”) committed to a strategic integration and cost optimization initiative that includes a global workforce reduction

of approximately 20%, facilities consolidation, product rationalization and other operational savings measures (the “Initiative”).

The Company has commenced workforce reductions in the United States and is reviewing workforce changes in other countries, the timing

of which will vary according to local regulatory requirements. As a result of the Initiative, the Company anticipates at least $50 million

of aggregate cost savings resulting in sequential cost reductions across the first half of 2024.

The

Company expects it will incur total pre-tax restructuring charges related to the Initiative of between $24.3 million to $31.5

million, which includes between $5.1 million and $6.5 million of estimated one-time termination benefits and associated costs,

between $19.0 million and $24.0 million of estimated inventory write-offs, between $0.1 million and $0.5 million of estimated lease

termination and equipment exit costs, and between $0.1 million and $0.5 million of estimated costs associated with termination of

contracts. The Company estimates that $5.3 million to $7.5 million of these charges will result in future cash expenditures. The

ranges of charges described above are estimates, and actual amounts may be materially different from these estimates.

The Company anticipates that the Initiative will

be substantially complete by the end of 2024.

Item 7.01. Regulation FD Disclosure.

On January 24, 2024, the Company issued a press

release announcing the Initiative. A copy of the press release is attached to this Current Report on Form 8-K (the “Current Report”)

as Exhibit 99.1.

The information in Exhibit 99.1 is furnished and

shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, and such information shall not be deemed to be incorporated by reference

into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act.

Forward-looking Statements

This Current Report contains certain forward-looking

statements within the meaning of the within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained

in this Current Report that do not relate to matters of historical fact should be considered forward-looking statements, including the

anticipated cost savings, the timing of the Initiative, and the estimated costs of the initiative, including future charges and cash expenditures,

and the impact of the Initiative on the Company’s business, finances and operations.

Forward-looking statements generally are

identified by the words such as “believe,” “project,” “expect,” “anticipate,”

“estimate,” “intend,” “strategy,” “future,” “opportunity,”

“plan,” “may,” “should,” “will,” “would,” “will be,”

“will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions,

projections and other statements about future events that are based on current expectations and assumptions and, as a result, are

subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking

statements in this Current Report, including but not limited to, the risks and uncertainties set forth under the heading “Risk

Factors” in the Company’s Quarterly Report on Form 10-Q filed on November 9, 2023 and the Company’s other filings

with the U.S. Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that

could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking

statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements,

and the Company assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result

of new information, future events, or otherwise.

Item 9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: January 24, 2024 |

Desktop Metal, Inc. |

| |

|

|

| |

By: |

/s/ Meg Broderick |

| |

Name: |

Meg Broderick |

| |

Title: |

General Counsel and Corporate Secretary |

Exhibit 99.1

Desktop Metal Intensifies Cost Reduction

Plan and Ongoing Strategic Business Review to Accelerate Path to Profitability

Latest cost-saving program anticipates additional annualized cost

savings of $50 million, with the majority of those savings to be realized by the end of this month

January 24, 2024 8 AM EST

BOSTON--(BUSINESS WIRE)--Desktop Metal, Inc. (NYSE: DM), a global

leader in Additive Manufacturing 2.0 technologies for mass production, today announced an additional $50 million cost-reduction plan

that includes a 20% workforce reduction designed to align its cost structure to current market dynamics.

The effort is part of a broader strategic business review and

other actions, including continued consolidation of facilities and product rationalization, aimed at accelerating DM’s path to

profitability in the midst of a downturn in the additive manufacturing industry.

“The cost-reduction plans announced today, in addition to

the $100 million in cost reductions realized in 2023, will help us generate positive cash flow in light of a softer demand environment,”

said Ric Fulop, Founder and CEO of Desktop Metal. “We are committed to getting profitable during this challenging period.

The vast majority of the cuts will be completed this quarter, resulting in sequential cost

reductions across the first half of 2024.

“While our industry is working through a challenging period,

Desktop Metal’s commitment to its Additive Manufacturing 2.0 vision has not changed. We continue to have a positive long-term outlook

for this industry as it transitions to mass production.”

Desktop Metal is notifying U.S.-based employees impacted by the cuts

today. The Company is continuing to review international workforce changes, the timing of which will vary according to local regulatory

requirements.

This latest action is expected to result in pre-tax restructuring

charges of $24.3 million to $31.5 million. The majority of those estimated charges are non-cash, with an estimated $5.3 million to $7.5 million

of the restructuring charges coming from cash reserves.

DM continues to invest in products and operations in line with near-term

revenue generation, positioning the company to achieve its long-term financial goal of sustainable profitability.

The Company will provide further details about this cost-reduction

effort in its regulatory filings and end-of-year earnings release and conference call, which is expected to be executed by the end of

March 2024.

About Desktop Metal

Desktop Metal (NYSE:DM) is driving Additive Manufacturing 2.0, a new

era of on-demand, digital mass production of industrial, medical, and consumer products. Our innovative 3D printers, materials, and software

deliver the speed, cost, and part quality required for this transformation. We’re the original inventors and world leaders of the

3D printing methods we believe will empower this shift, binder jetting and digital light processing. Today, our systems print metal,

polymer, sand and other ceramics, as well as foam and recycled wood. Manufacturers use our technology worldwide to save time and money,

reduce waste, increase flexibility, and produce designs that solve the world’s toughest problems and enable once-impossible innovations.

Learn more about Desktop Metal and our #TeamDM brands at www.desktopmetal.com.

Forward-looking Statements

This press release contains certain forward-looking statements within

the meaning of the federal securities laws, including statements about Desktop Metal’s strategic integration and cost savings initiatives,

expected restructuring charges, anticipated cost savings, long-term growth, market share, liquidity and profitability, are forward-looking

statements. Forward-looking statements generally are identified by the words “believe,” “project,” “expect,”

“anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,”

“plan,” “may,” “should,” “will,” “would,” “will be,” “will

continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and

other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and

uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document,

including but not limited to, the risks and uncertainties set forth in Desktop Metal, Inc.'s filings with the U.S. Securities and Exchange

Commission. There is no guarantee Desktop Metal will achieve the cost savings it expects. These filings identify and address other important

risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking

statements, and Desktop Metal, Inc. assumes no obligation and does not intend to update or revise these forward-looking statements, whether

as a result of new information, future events, or otherwise.

Contacts

Investor Relations:

(857) 504-1084

DesktopMetalIR@icrinc.com

Media Relations:

Sarah Webster

sarahwebster@desktopmetal.com

(313) 715-6988

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

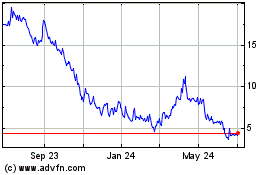

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Mar 2024 to Apr 2024

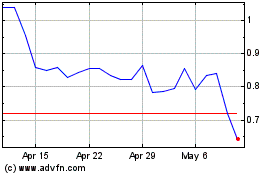

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Apr 2023 to Apr 2024