In the pre-market on Wednesday, U.S. index futures are showing

positive performance, boosted by favorable results presented by

Netflix (NASDAQ:NFLX). This optimism also anticipates the financial

announcements expected from IBM (NYSE:IBM) and Tesla

(NASDAQ:TSLA).

At 05:38 AM, the futures of the Dow Jones (DOWI:DJI) rose 49

points, or 0.13%. S&P 500 futures rose 0.41% and Nasdaq-100

futures rose 0.69%. The yield rate of the 10-year Treasury bonds

was at 4.111%.

In the commodities market, West Texas Intermediate crude oil for

March rose 0.42% to $74.68 per barrel. Brent crude oil for March

rose 0.21%, near $79.72 per barrel. Iron ore with a concentration

grade of 62%, traded on the Dalian exchange, rose 1.77% to $138.17

per metric ton.

On Wednesday’s economic agenda, investors await, at 09:45 AM,

the U.S. industry and services indicators for January. At 10:00 AM,

the oil inventories of the week until 01/19.

In the Asian market, Hong Kong’s Hang Seng index recorded a

significant rise of 3.56% this Wednesday, led by technology sector

stocks. Notably, Alibaba’s shares rose up to 6.57% after Jack Ma

acquired $50 million in shares. The Chinese Shanghai SE and the

Australian ASX 200 gained 1.80% and 0.06%, respectively. In

contrast, Japan’s Nikkei fell 0.80% and South Korea’s Kospi dropped

0.36%.

European stock markets are on the rise, focused on the initial

indicators of the Purchasing Managers’ Index (PMI) of the Eurozone,

France, and Germany. These data are crucial for a more accurate

understanding of the regional economic scenario before the European

Central Bank (ECB) meeting on Thursday. There are expectations that

the ECB will keep interest rates unchanged at tomorrow’s meeting.

However, market operators are already considering possible cuts of

approximately 130 basis points over the year, with almost a 97%

chance of a first decrease as early as June.

The U.S. stock market closed Tuesday with mixed results. The Dow

Jones fell 0.25%, influenced by losses from 3M

(NYSE:MMM) and Johnson & Johnson (NYSE:JNJ),

despite better-than-expected outcomes. In contrast, the S&P 500

hit a new record, rising 0.29%, while the Nasdaq advanced 0.43%.

The mixed corporate results and anticipation of significant

economic reports contributed to the volatile trading. Sector-wise,

airline and gold mining company stocks stood out positively, while

the real estate sector suffered notable losses.

For the quarterly results front this Wednesday, scheduled to

present financial reports are AT&T (NYSE:T),

ASML (NASDAQ:ASML), Abbott

(NYSE:ABT), Progressive (NYSE:PGR),

Amphenol (NYSE:APH),

Kimberly-Clark (NYSE:KMB), SAP

(NYSE:SAP), Textron (NYSE:TXT), among others,

before the market opens. After the close, the results of

Tesla (NASDAQ:TSLA), IBM

(NYSE:IBM), ServiceNow (NYSE:NOW), Las

Vegas Sands (NYSE:LVS), Lam Research

(NASDAQ:LRCX), Seagate (NASDAQ:STX), Crown

Castle (NYSE:CCI), and more are awaited.

Wall Street corporate highlights for today

Apple (NASDAQ:AAPL) – Apple is seeking to

dismiss a lawsuit of about $1 billion brought by over 1,500 app

developers in the UK over App Store fees. The developers claim

unfair commissions, while Apple argues that 85% of developers pay

no commission and that the case is “unsustainable.” The dispute

focuses on applying UK law to the case. Apple already faces other

lawsuits related to App Store commissions and defective iPhone

batteries.

Netflix (NASDAQ:NFLX) – Netflix exceeded

subscriber estimates in the fourth quarter, with 13.1 million new

subscribers, bringing the total to 260 million. The company

reported a lower earnings per share due to currency losses, but

revenue exceeded expectations. Investors were optimistic, and the

shares rose 9.3% in Wednesday’s pre-market. Netflix plans to invest

in content, advertising, gaming, and live programming to continue

growing. Additionally, it announced a deal worth over $5 billion

with WWE to bring exclusive content to the platform in January

2025.

eBay (NASDAQ:EBAY) – eBay will cut about 1,000

jobs, equivalent to about 9% of its workforce, due to increasing

expenses relative to business growth. Additionally, the company

plans to reduce the number of contracts with its alternative

workforce in the coming months.

Alibaba (NYSE:BABA) – Jack Ma and Joe Tsai

acquired millions of shares of Alibaba in the fourth quarter,

boosting the company’s shares. Ma bought $50 million in shares in

Hong Kong, while Tsai acquired about $151 million in U.S.-traded

shares through his family investment. The move comes amid Alibaba’s

ongoing reshaping. Additionally, Southeast Asian online retailer

Daraz Group, part of Alibaba, appointed James Dong, CEO of Lazada

Group SA, as its new interim CEO, replacing founder Bjarke

Mikkelsen. Mikkelsen is the latest executive to leave Alibaba,

which faces competition challenges and post-Covid impacts. Dong

will work on integrating Daraz with other companies of Alibaba’s

international online shopping unit.

SAP (NYSE:SAP) – German software company SAP SE

announced a $2.2 billion restructuring program through 2024,

affecting 8,000 positions, focusing on artificial intelligence, and

committed to supporting AI startups with over $1 billion.

Additionally, the company expects double-digit growth in cloud

revenue and operating profit in 2024, maintaining a strong

outlook.

ASML (NASDAQ:ASML) – ASML Holding, a leader in

chip manufacturing equipment, announced fourth-quarter earnings

that exceeded expectations, with record quarterly orders. However,

they maintained a cautious outlook for 2024 due to export

restrictions to China, despite strong demand for AI chips. Net

profit increased 9% to 2.0 billion euros on sales of 7.2 billion

euros in the fourth quarter. Orders exceeded 9 billion euros in the

quarter.

BlackBerry (NYSE:BB) – BlackBerry’s shares fell

11% in Wednesday’s pre-market following the announcement that the

company plans to conduct a private offering of $160 million in

convertible notes due in 2029, as part of its financing

strategy.

Nokia (NYSE:NOK) – Oppo and Nokia settled a

patent dispute with a cross-licensing agreement, allowing Oppo to

freely sell its devices in European markets, including Germany. The

agreement covers essential patents for 5G and other cellular

communication technologies, benefiting Nokia’s IP licensing

revenue. Oppo sold over 100 million smartphones in 2023, becoming

the fourth largest global manufacturer.

Tesla (NASDAQ:TSLA) – Tesla plans to launch a

mass electric vehicle called “Redwood” around 2025. The model aims

to compete with more affordable gasoline cars and challenge rivals

like BYD. Large-scale production may not start before 2026 due to

production challenges. Tesla is committed to making electric

vehicles more affordable, exploring different manufacturing

locations, such as Texas, Berlin, and potentially India.

Fisker (NYSE:FSR) – Fisker plans to sell all of

the nearly 5,000 vehicles manufactured last year by the end of the

first quarter, with over 100 dealers in the U.S., Canada, and

Europe interested in partnerships. The company seeks to generate

cash and reduced its debt by $185.5 million.

Stellantis (NYSE:STLA) – Stellantis CEO Carlos

Tavares said the lack of incentives for electric vehicles in Italy

resulted in months of reduced automotive production, urging the

Italian government to implement support measures to protect its

factories and boost electric vehicle sales. Stellantis aims to

become a global leader in commercial vehicles by 2030.

Plug Power (NASDAQ:PLUG) – Plug Power announced

a $1.6 billion government loan from the Department of Energy to

support the construction of hydrogen production facilities. This is

good news following an 80% drop in shares and stock sale agreements

that concerned investors. The company focuses on managing financial

challenges and announced the inauguration of a hydrogen plant in

Georgia.

Boeing (NYSE:BA) – Boeing will conduct a

quality stop at its Renton plant in the Seattle area, halting

production and deliveries for one day. Employees will participate

in quality workshops to assess and recommend improvements following

recent incidents with the 737 MAX 9. Other facilities will also

have stoppages in the coming weeks. Boeing also issued guidelines

to suppliers to ensure the correct fastening of screws following

incidents with the 737 MAX 9. Additionally, Boeing CEO Dave Calhoun

will meet with U.S. senators to discuss issues related to the 737

MAX 9 and MAX 10 orders.

Alaska Airlines (NYSE:ALK) – During inspections

following an incident on January 5, Alaska Airlines identified

“some loose bolts on many” of the Boeing 737 MAX 9 planes, revealed

CEO Ben Minicucci.

United Airlines (NASDAQ:UAL) – United Airlines

is reevaluating its commitment to the Boeing 737 Max 10 due to the

suspension of dozens of Max 9s by the government, raising concerns

about Boeing’s ability to meet delivery deadlines. United maintains

its orders but removes the Max 10 from its internal plans and seeks

alternatives.

Southwest Airlines (NYSE:LUV) – Southwest

Airlines flight attendants voted overwhelmingly in favor of a

strike, with over 98% of members supporting the measure. They seek

higher wages and better working conditions, contrasting with a new

labor agreement offering a significant salary increase for

pilots.

Lockheed Martin (NYSE:LMT) – Lockheed Martin

lowered its profit forecast for 2024, with estimates ranging from

$25.65 to $26.35 per share, below Wall Street’s expectation of

$26.62. In the fourth quarter, net profit was $1.87 billion, while

the company’s total sales reached $18.87 billion.

BP (NYSE:BP) – BP anticipates that the

deep-water natural gas field, Calypso, in Trinidad and Tobago,

shared with Woodside Energy, will receive investment approval

earlier than expected, possibly by the end of next year. Initially,

the FID (Final Investment Decision) was expected in 2026. Woodside

continues to progress with the project, while the government of

Trinidad pressures to increase gas production due to shortages. BP

and Shell (NYSE:SHEL) also have potential to find

hydrocarbons in areas explored by Exxon Mobil

(NYSE:XOM).

General Electric (NYSE:GE) – General Electric

exceeded expectations with a quarterly profit of $1.03 per share,

compared to estimates of $0.91 per share. Its total revenue

increased 15% to $19.42 billion. However, the company forecasts

next quarter’s profits below expectations, with an adjusted profit

range of 60 to 65 cents per share, compared to analyst estimates of

72 cents per share. GE also announced the separation of its

renewable energy unit, GE Vernova, and provided separate estimates

for its energy and aerospace units in 2024.

Baker Hughes (NASDAQ:BKR) – In the fourth

quarter, Baker Hughes exceeded Wall Street’s expectations with an

adjusted net income of 51 cents per share. International growth,

especially in demand for oilfield services and LNG equipment, drove

its positive results, offsetting a slowdown in the U.S.

International revenue grew by 15%, while revenue from the

industrial and energy technology segment increased by 24%. Future

LNG projects also contributed to the company’s success.

3M (NYSE:MMM) – 3M forecasted earnings per

share of $9.35 to $9.75 for the fiscal year 2024, below analysts’

estimates of $9.81. In the fourth quarter of 2023, the company

reported an adjusted earnings of $2.42 per share, surpassing the

$2.31 estimate. Adjusted revenue in the same period was $7.69

billion, slightly below the $7.70 billion estimate. The company is

facing challenges due to a weak macroeconomic environment and

lawsuits related to chemicals.

Texas Instruments (NASDAQ:TXN) – Texas

Instruments projected revenues for the first quarter between $3.45

billion and $3.75 billion, below the average analyst estimate of

$4.06 billion. The earnings per share forecast for the current

quarter also fell short of estimates. TI earned $1.49 per share on

sales of $4.08 billion in the December quarter. Analysts surveyed

by FactSet expected TI’s earnings to be $1.47 per share on sales of

$4.12 billion. Year-over-year, TI’s profits fell 30%, while sales

dropped 13%.

Unilever (NYSE:UL) – Unilever struggled to

maintain market share in supermarkets in the U.S. and Europe in the

fourth quarter due to price increases and growth of private labels.

The company lost market share in various categories, including ice

cream and mayonnaise, but is reducing product variety to focus on

innovating its 14 “key billion-euro brands.” Analysts and investors

expressed concerns about the market share drop and the need to

recover it in the long term.

Procter & Gamble (NYSE:PG) – Procter &

Gamble (P&G) revised its annual profit forecast downward after

a $1.3 billion charge related to the Gillette business. Net sales

reached $21.44 billion for the quarter, with a 3.2% increase. The

company’s core profit was $1.84 per share, exceeding estimates of

$1.70.

Walgreens Boots Alliance (NASDAQ:WBA) –

Walgreens Boots Alliance is considering the sale of the specialty

pharmacy company Shields Health Solutions, potentially valued at

over $4 billion. Advisors are assessing interest from private

equity and healthcare companies, but no final decision has been

made. Walgreens previously acquired stakes in Shields in 2022 and

2021.

Johnson & Johnson (NYSE:JNJ) – Johnson

& Johnson reached a provisional agreement to resolve

investigations in 42 U.S. states and Washington, DC, about the

safety of its talc products, agreeing to pay about $700 million.

The settlement does not cover ongoing lawsuits from private

plaintiffs. In the fourth quarter, Johnson & Johnson announced

a quarterly profit of $2.29 per share, beating expectations by a

cent. Quarterly revenue reached $21.40 billion, slightly above the

$21.01 billion estimate. The company reaffirmed its adjusted

operational profit forecast for 2024 between $10.55 and $10.75 per

share.

Intuitive Surgical (NASDAQ:ISRG) – Intuitive

Surgical exceeded predictions with a 21% increase in procedures in

the 4th quarter, leading to a 17% growth in sales to $1.93 billion.

Adjusted earnings were $1.60 per share, 30% more than the previous

year. The shares rose over 8% in Wednesday’s pre-market

trading.

Wayfair (NYSE:W) – Wayfair, an online furniture

retailer, favored on-site work over remote in its latest round of

layoffs, affecting 13% of the global workforce. Executives claimed

remote workers were more likely to be laid off. The company also

encouraged more effort from employees before the layoffs due to a

period of crisis and overhiring during the pandemic.

UBS (NYSE:UBS) – UBS launched its biggest

branding campaign since 2016, investing tens of millions of dollars

to revamp its image following the acquisition of Credit Suisse. The

Swiss bank will use the slogan “Banking is our craft” to attract

new clients to its wealth management, asset management, and

investment banking franchises. The campaign will include online and

print ads, sponsorships, events, social media, and billboards.

Additionally, UBS announced changes to its executive board, with

Aleksandar Ivanovic leading the $1.6 trillion asset management

business and Beatriz Martin Jimenez taking the role of Global

Leader of Sustainability and Impact. These changes aim to support

the integration with Credit Suisse, acquired last year. The changes

will take effect on March 1st.

Bank of America (NYSE:BAC) – Bank of America

announced cuts of about 20 bankers in Asia due to declining markets

in China and Hong Kong, mainly affecting those involved in

China-related businesses. The reduction reflects geopolitical

uncertainties and economic slowdown in the region.

Santander (NYSE:SAN) – Santander Mexico plans

to launch its digital banking service, Openbank, in the coming

months. The institution aims to compete with the growth of digital

banks in a market where competition is rapidly increasing.

Nasdaq (NASDAQ:NDAQ) – Adena Friedman, CEO of

Nasdaq, seeks to transform it into a tech giant, focusing on

combating financial crime. Recent acquisitions have raised

concerns, but the opportunity to solve a trillion-dollar problem is

significant. Analysts have a positive view and believe Nasdaq can

achieve significant valuation if it convinces the market of its

transformation into a fintech.

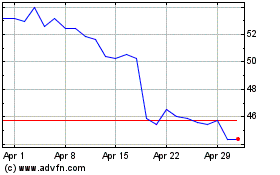

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

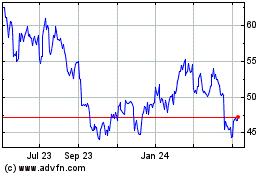

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Apr 2023 to Apr 2024