false

0000822663

0000822663

2024-01-23

2024-01-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): January 23, 2024

Inter

Parfums, Inc.

(Exact

name of Registrant as specified in its charter)

| Delaware

|

|

0-16469 |

|

13-3275609 |

| (State or other jurisdiction

of incorporation or organization) |

|

Commission

File Number |

|

(I.R.S. Employer

Identification No.) |

| |

551

Fifth Avenue, New

York, NY

10176 |

|

| |

(Address of Principal Executive

Offices) |

|

| |

|

|

| |

212.983.2640 |

|

| |

(Registrant’s Telephone

number, including area code) |

|

| |

|

|

| (Former name or

former address, if changed since last report) |

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligations of the registrant under any of

the following provisions (see General Instruction A.2 below):

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting Material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which registered |

| |

|

|

|

|

| Common

Stock, $.001 par value per share |

|

IPAR |

|

The

Nasdaq Stock Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Conditions

Certain

portions of our press release dated January 23, 2024, a copy of which is annexed hereto as Exhibit no. 99.1, are incorporated by reference

herein, and are filed pursuant to this Item 2.02. They are as follows:

•

The 1st through 7th paragraphs relating to net sales for the fourth quarter of 2023 and/or the full year ended

December 31, 2023.

Item

7.01. Regulation FD Disclosure.

Certain

portions of our press release dated January 23, 2024, a copy of which is annexed hereto as Exhibit no. 99.1, are incorporated by reference

herein and are filed pursuant to this Item 7.01 and Regulation FD.

| • | The

8th paragraph relating to portfolio innovations for 2024. |

| • | The

9th paragraph relating to 2024 guidance and plans to release 2023 fourth quarter

results. |

| • | The

12th paragraph relating to forward-looking information. |

| • | The

balance of such press release not otherwise incorporated by reference in Item 2.02. |

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused and authorized this report to be signed

on its behalf by the undersigned.

Dated:

January 23, 2024

| |

Inter Parfums, Inc. |

| |

|

| |

By: |

/s/

Michel Atwood |

| |

|

Michel Atwood |

| |

|

Chief Financial Officer |

Exhibit

99.1

FOR

IMMEDIATE RELEASE

INTER

PARFUMS, INC. REPORTS RECORD 2023 FOURTH QUARTER AND FULL YEAR NET SALES

New

York, New York, January 23, 2024, Inter Parfums, Inc. (NASDAQ GS: IPAR) (“Inter Parfums” or the “Company”) today

announced that for the three months and full year ended December 31, 2023, net sales rose 6% to $329 million and 21% to $1.32 billion,

from the same periods in 2022, respectively.

Net

Sales:

($

in millions; data may not foot due to rounding) |

Three

Months Ended

December

31, |

Year

Ended

December

31, |

| |

2023 |

2022 |

%

Change |

2023 |

2022 |

%

Change |

| Total

Inter Parfums, Inc. |

$329 |

$311 |

6% |

$1,318 |

$1,087 |

21% |

| European

based product sales |

$200 |

$197 |

2% |

$862 |

$744 |

16% |

| United

States based product sales |

$128 |

$114 |

13% |

$456 |

$343 |

33% |

| At

comparable foreign currency exchange rates, consolidated net sales for the three months and year ended December 31, 2023, increased

4% and 20%, respectively, compared to the same periods in 2022. Of note, the average dollar/euro exchange rate for the 2023 fourth

quarter was 1.08 compared to 1.02 in the fourth quarter of 2022, while for the full year, the average dollar/euro exchange rate for

2023 was 1.08 compared to 1.05 in 2022, leading to a positive 2% foreign exchange impact for the fourth quarter and 1% for the full

year. |

Management

Commentary:

Jean

Madar, Chairman & Chief Executive Officer of Inter Parfums, stated, “With ongoing strength in the overall fragrance market

and our successful distribution execution, we grew sales by 6% during the quarter. The better-than-expected performance in the final

quarter culminated in 21% sales growth for the year, surpassing our guidance of $1.3 billion. Of note, the quarterly growth rate in comparison

to the full year reflects the elevated sales baseline from the preceding year. Furthermore, compared to 2019, our sales were up 85% for

both the fourth quarter and full year 2023.

“Our

European based operations grew sales by 2%, primarily due to Coach brand sales which rose 17% in the fourth quarter. Considering Jimmy

Choo and Montblanc sales growth of 78% and 50%, respectively, in the closing quarter of 2022, a modest decline in net sales for those

two brands during the fourth quarter of 2023 was expected.

“For

the full year, European based operations grew sales by 16%, led by the Coach, Jimmy Choo and Montblanc brands, which were up 25%, 19%

and 15% growth, respectively.”

Mr.

Madar continued, “For U.S. based operations, our 13% sales growth in the fourth quarter was primarily driven by Donna Karan/DKNY

with comparable quarter sales growing 21%. GUESS and Ferragamo also saw mid-single-digit sales growth during the quarter, relative to

the very high base in the prior year period. The Phase 1 roll-out of the iconic Abercrombie & Fitch Fierce fragrance, in select

markets, boosted fourth quarter sales with further gains expected as we launch Phase 2 in the spring.

“For

the full year, U.S. based operations grew sales by 33%, led by Donna Karan/DKNY, GUESS, and Ferragamo achieving gains of 205%, 23% and

21%, respectively. Of note, Donna Karan/DKNY joined our portfolio in July of 2022, which helps explain the exceptional year-over-year

performance.”

Mr.

Madar concluded, “Our stimulating pipeline of innovative products across our portfolio of brands, now inclusive of Lacoste and

Roberto Cavalli, a fully operational Italian affiliate in Florence, Italy, and our dynamic positioning within the industry, strengthen

our confidence in gaining further market share in the years ahead and deliver another record year in 2024."

The

Company’s full year 2024 guidance will be addressed in conjunction with the issuance of the 2023 fourth quarter and full year consolidated

earnings results.

About

Inter Parfums, Inc.:

Operating

in the global fragrance business since 1982, Inter Parfums, Inc. produces and distributes a wide array of prestige fragrance and fragrance-related

products under license agreements with brand owners. The Company manages its business in two operating segments, European based operations,

through their 72% owned subsidiary, Interparfums SA, and United States based operations, through wholly owned subsidiaries in the United

States and Italy.

The

portfolio of prestige brands includes Abercrombie & Fitch, Anna Sui, Boucheron, Coach, Donna Karan/DKNY, Emanuel Ungaro, Ferragamo,

Graff, GUESS, Hollister, Jimmy Choo, Karl Lagerfeld, Kate Spade, Lacoste, MCM, Moncler, Montblanc, Oscar de la Renta, Roberto Cavalli,

and Van Cleef & Arpels, whose products are distributed in over 120 countries around the world through an extensive and diverse network

of distributors. Inter Parfums, Inc. is also the registered owner of several trademarks including Lanvin and Rochas.

Forward-Looking

Statements:

Statements

in this release which are not historical in nature are forward-looking statements. Although we believe that our plans, intentions, and

expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such plans, intentions, or expectations

will be achieved. In some cases, you can identify forward-looking statements by forward-looking words such as "anticipate,"

"believe," "could," "estimate," "expect," "intend," "may," "should,"

"will," and "would," or similar words. You should not rely on forward-looking statements, because actual events or

results may differ materially from those indicated by these forward-looking statements as a result of a number of important factors.

These factors include, but are not limited to, the risks and uncertainties discussed under the headings “Forward Looking Statements”

and "Risk Factors" in Inter Parfums' annual report on Form 10-K for the fiscal year ended December 31, 2022 and the reports

Inter Parfums files from time to time with the Securities and Exchange Commission. Inter Parfums does not intend to and undertakes no

duty to update the information contained in this press release.

Contact

Information:

| Inter Parfums, Inc. |

or |

The Equity Group Inc. |

| Michel Atwood |

|

Karin Daly |

| Chief Financial Officer |

|

Investor Relations Counsel |

| (212) 983-2640 |

|

(212) 836-9623 / kdaly@equityny.com |

| www.interparfumsinc.com |

|

www.theequitygroup.com |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

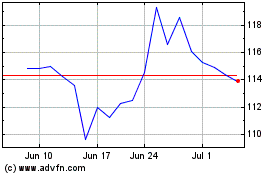

Inter Parfums (NASDAQ:IPAR)

Historical Stock Chart

From Apr 2024 to May 2024

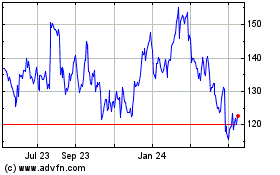

Inter Parfums (NASDAQ:IPAR)

Historical Stock Chart

From May 2023 to May 2024