| Filed pursuant to rule 424(b)(4) |

| Registration No. 333-276427 |

| |

| PROSPECTUS |

162,548 Common Shares

Altamira Therapeutics Ltd.

This prospectus relates to

the disposition from time to time of up to 162,548 common shares, par value $0.002 per share (“Common Shares”), of Altamira

Therapeutics Ltd., an exempted company limited by shares incorporated in Bermuda (“Altamira”, “we”, “us”,

the “Borrower” or the “Company”). Reference is hereby made to the existing warrants (the “Existing Warrants”)

to purchase up to 81,274 Common Shares, issued by the Company to the holder (the “Holder”) on May 1, 2023. The Common Shares

registered hereby consist of shares that may be acquired upon the exercise of certain warrants issued in connection with that certain

letter agreement dated December 7, 2023 (the “Warrant Inducement Agreement”) between the Company and the Holder, pursuant

to which the Company issued and delivered, on December 15, 2023, to the Holder additional warrants using the same form as the Existing

Warrants (the “New Warrants”) to purchase 2 Common Shares for each Common Share that the Holder received upon exercises for

cash of Existing Warrants exercised prior to December 14, 2023 (for a total of 162,548 Common Shares), provided that (i) the initial exercise

price of such New Warrants is CHF 6.656 (equal to the volume weighted average of the reduced exercise prices paid by the Holder upon such

exercises), (ii) equal portions (i.e. two portions of 50% each) of such New Warrants are exercisable for (A) six months from their date

of issuance and (B) two years from their date of issuance, respectively and (iii) such New Warrants contain a customary beneficial ownership

blocker at the 9.99% ownership level.

We will bear all of the expenses

incurred in connection with the registration of these shares. The selling shareholders will pay any underwriting discounts and selling

commissions and/or similar charges incurred in connection with the sale of the shares. See “Plan of Distribution.”

The selling shareholders (including

their pledgees, donees, transferees, assignees or other successors-in-interest) may offer the Common Shares from time to time through

public or private transactions at prevailing market prices or at privately negotiated prices.

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY

OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Investing in our securities

involves a high degree of risk. Before making any decision to invest in our securities, you should carefully consider the information

disclosed under “Risk Factors” beginning on page 3 of this prospectus, as well as those risk factors contained or incorporated

by reference into this prospectus and in the applicable prospectus supplements.

Currently, the Common Shares are traded on the NASDAQ Capital Market,

or the NASDAQ, under the symbol “CYTO”. The closing price of the Common Shares on the NASDAQ on January 5, 2024 was $3.12

per Common Share.

Consent under the Exchange

Control Act 1972 (and its related regulations) from the Bermuda Monetary Authority for the issue and transfer of our common shares to

and between residents and non-residents of Bermuda for exchange control purposes has been obtained for so long as our common shares remain

listed on an “appointed stock exchange,” which includes the NASDAQ. In granting such consent, neither the Bermuda Monetary

Authority nor the Registrar of Companies in Bermuda accepts any responsibility for our financial soundness or the correctness of any of

the statements made or opinions expressed herein.

The date of this prospectus is January 19,

2024

TABLE OF CONTENTS

Unless otherwise indicated or the context otherwise

requires, all references in this prospectus to “Altamira Therapeutics Ltd.”, or “Altamira”, the “Company,”

“we,” “our,” “ours,” “us” or similar terms refer to (i) Auris Medical Holding Ltd. a Bermuda

company, or Auris Medical (Bermuda), the successor issuer to Auris Medical Holding AG (“Auris Medical (Switzerland)”) under

Rule 12g-3(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), after the effective time at which Auris

Medical (Switzerland) continued its corporate existence from Switzerland to Bermuda (the “Redomestication”), which occurred

on March 18, 2019, and (ii) to Altamira Therapeutics Ltd. after adoption of the new company name by resolution of Special General Meeting

of Shareholders held on July 21, 2021. The trademarks, trade names and service marks appearing in this prospectus are property of their

respective owners.

On May 1, 2019, the Company effected a one-for-twenty

reverse share split (the “2019 Reverse Share Split”) of the Company’s issued and outstanding common shares. On October

25, 2022, the Company effected a one-for-twenty reverse share split (the “2022 Reverse Share Split”) of the Company’s

issued and outstanding common shares. On November 2, 2023, the Company changed the currency denomination of the Company’s authorised share capital from CHF to USD, reduced

the issued share capital by reducing the par value of each common share in issue to USD 0.0001 and reduced the authorised share capital

to USD 12,000 divided into 100,000,000 common shares of USD 0.0001 par value each and 20,000,000 preference shares of USD 0.0001 par value

each. On December 13, 2023, the Company effected a one-for-twenty reverse share split (the “2023

Reverse Share Split”) of the Company’s issued and outstanding common shares. Unless indicated or the context otherwise requires,

all per share amounts and numbers of common shares in this prospectus have been retrospectively adjusted for the 2019 Reverse Share Split,

the 2022 Reverse Share Split and the 2023 Reverse Share Split.

The terms “dollar,” “USD”

or “$” refer to U.S. dollars and the term “Swiss Franc” and “CHF” refer to the legal currency of Switzerland.

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement on Form F-3 that we filed with the Securities and Exchange Commission (the “SEC”) under the Securities

Act of 1933, as amended, or the Securities Act. This prospectus and any accompanying prospectus supplement do not contain all of the information

included in the registration statement. For further information, we refer you to the registration statement, including its exhibits, filed

with the SEC. Statements contained in this prospectus and any accompanying prospectus supplement about the contents of any document are

not necessarily complete. If SEC rules require that a document be filed as an exhibit to the registration statement, please see such document

for a complete description of these matters.

This prospectus only provides

you with a general description of the securities being offered. Each time the selling shareholders sell any of the offered securities,

the selling shareholders will provide this prospectus and a prospectus supplement, if applicable, that will contain specific information

about the terms of the offering. The prospectus supplement may also add, update or change any information contained in this prospectus.

You should carefully read this prospectus, any prospectus supplement and any free writing prospectus related to the applicable securities

that is prepared by us or on our behalf or that is otherwise authorized by us, together with the additional information described under

the headings “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

You should rely only on the

information contained or incorporated by reference in this prospectus, any prospectus supplement and any free writing prospectus related

to these securities that is prepared by us or on our behalf or that is otherwise authorized by us. We have not authorized any other person

to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it.

You should assume that the information contained in this prospectus, any prospectus supplement, any free writing prospectus and the documents

incorporated by reference herein and therein is accurate only as of their respective dates. Our business, financial condition, results

of operations and prospects may have changed since those dates. To the extent there is a conflict between the information contained in

this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement, provided that if any statement

in one of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated

by reference into this prospectus or any prospectus supplement — the statement in the document having the later date modifies or

supersedes the earlier statement.

We are not making an offer

to sell the offered securities in any jurisdiction where the offer or sale is not permitted. This offering is being made in the United

States and elsewhere solely on the basis of the information contained in this prospectus.

References to “selling

shareholders” refer to the shareholders listed herein under “Selling Shareholders,” and their transferees.

PROSPECTUS SUMMARY

This summary highlights

selected information about us, this offering and information contained in greater detail elsewhere in this prospectus and in the documents

incorporated by reference herein. This summary is not complete and does not contain all of the information that you should consider before

investing in our securities. You should carefully read and consider this entire prospectus and the documents, including financial statements

and related notes, and information incorporated by reference into this prospectus, including the financial statements and “Risk

Factors” in this prospectus, before making an investment decision. If you invest in our securities, you are assuming a high degree

of risk.

Our Company

We are a clinical- and commercial-stage

biopharmaceutical company developing therapeutics that address important unmet medical needs. We are currently active in two areas: the

development of RNA delivery technology for extrahepatic therapeutic targets (OligoPhore™ / SemaPhore™ platforms; AM-401 for

the treatment of KRAS driven cancer, AM-411 for the treatment of rheumatoid arthritis; preclinical), and nasal sprays for protection against

airborne allergens, and where approved, viruses (Bentrio®; commercial) or the treatment of vertigo (AM-125; Phase 2). We have announced

our intention to reposition the Company around RNA delivery technology while exploring strategic options to either divest our non-RNA

traditional businesses or partner them with one or several other companies. In particular, we have announced that we are seeking to divest

or partner our legacy assets, including Bentrio® for North America, Europe and other key markets and our inner ear therapeutics assets.

On November 21, 2023, we closed the transaction for the partial spin-off of our Bentrio® business, selling a 51% stake in our subsidiary

Altamira Medica AG for cash consideration of CHF 2,040,000 and certain rights to future gross licensing income.

Corporate Information

We are an exempted company

incorporated under the laws of Bermuda. We began our current operations in 2003. On April 22, 2014, we changed our name from Auris Medical

AG to Auris Medical Holding AG and transferred our operational business to our newly incorporated subsidiary Auris Medical AG, which is

now our main operating subsidiary. On March 13, 2018, we effected a corporate reorganization through a merger into a newly formed holding

company for the purpose of effecting the equivalent of a 10-1 “reverse share split.” Following shareholder approval at an

extraordinary general meeting of shareholders held on March 8, 2019 and upon the issuance of a certificate of continuance by the Registrar

of Companies in Bermuda on March 18, 2019, the Company discontinued as a Swiss company and, pursuant to Article 163 of the Swiss Federal

Act on Private International Law and pursuant to Section 132C of the Companies Act 1981 of Bermuda (the “Companies Act”),

continued existence under the Companies Act as a Bermuda company with the name “Auris Medical Holding Ltd.” (the “Redomestication”).

Following shareholders’ approval at a special general meeting of shareholders held on July 21, 2021 we changed our name to Altamira

Therapeutics Ltd. Our registered office is located at Clarendon House, 2 Church Street, Hamilton HM11, Bermuda, telephone number +1 (441)

295 5950.

We maintain a website at www.altamiratherapeutics.com

where general information about us is available. Investors can obtain copies of our filings with the SEC or the Commission, from this

site free of charge, as well as from the SEC website at www.sec.gov. We are not incorporating the contents of our website into this prospectus.

Implications of Being a Foreign Private Issuer

We currently report under

the Exchange Act as a non-U.S. company with foreign private issuer, or FPI, status. Although we no longer qualify as an emerging growth

company, as long as we qualify as a foreign private issuer under the Exchange Act we will continue to be exempt from certain provisions

of the Exchange Act that are applicable to U.S. domestic public companies, including:

| ● | the

sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under

the Exchange Act; |

| ● | the

sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability

for insiders who profit from trades made in a short period of time; and |

| ● | the

rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other

specified information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

This Offering

We are registering for resale by the selling shareholders

named herein the 162,548 Common Shares as described below.

| Securities being offered: |

|

Up to 162,548 of our Common Shares that may be acquired upon the exercise of the New Warrants issued in connection with the Warrant Inducement Agreement. |

| |

|

| Use of proceeds: |

|

We will not receive any of the proceeds from the sale or other disposition of our Common Shares by the selling shareholders. |

| |

|

| NASDAQ Capital Market symbol: |

|

CYTO |

| |

|

| Risk factors: |

|

See “Risk Factors” beginning on page 3 for risks you should consider before investing in our shares. |

RISK FACTORS

Investing in our securities

involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described in this prospectus,

any applicable prospectus supplement and any related free writing prospectus and under the captions “Risk Factors” in any

of our filings with the SEC, including the item captioned “Risk Factors” in our most recent Annual Report on Form 20-F and

our Reports on Form 6-K furnished to the SEC including our unaudited interim consolidated financial statements and corresponding management’s

discussion and analysis. For additional information, please see the sources described in “Where You Can Find More Information.”

These risks are not the only

risks we face. Additional risks not presently known to us, or that we currently view as immaterial, may also impair our business, if any

of the risks described in our SEC filings or any Prospectus Supplement or any additional risks actually occur, our business, financial

condition, results of operations and cash flows could be materially and adversely affected. In that case, the value of our securities

could decline substantially and you could lose all or part of your investment.

SPECIAL NOTE ON FORWARD-LOOKING STATEMENTS

This

prospectus contains statements that constitute forward-looking statements, including statements concerning our industry, our operations,

our anticipated financial performance and financial condition, and our business plans and growth strategy and product development efforts.

These statements constitute forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the

Exchange Act. The words “may,” “might,” “will,” “should,” “estimate,” “project,”

“plan,” “anticipate,” “expect,” “intend,” “outlook,” “believe”

and other similar expressions are intended to identify forward-looking statements. Readers are cautioned not to place undue reliance

on these forward-looking statements, which speak only as of their dates. These forward-looking statements are based on estimates and

assumptions by our management that, although we believe to be reasonable, are inherently uncertain and subject to a number of risks and

uncertainties.

Forward-looking

statements appear in a number of places in this prospectus and include, but are not limited to, statements regarding our intent, belief

or current expectations. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently

available to our management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those

expressed or implied in the forward-looking statements due to various factors, including, but not limited to:

| ● | our

operation as a drug development-stage company with limited operating history and a history of operating losses; |

| ● | our

ability to continue as a going concern, about which there is currently substantial doubt due to our recurring losses and negative cash

flows from operations, our expectation to generate losses from operations for the foreseeable future and our cash position; |

| ● | our

ability to remediate our current material weaknesses in our internal controls over financial reporting; |

| ● | our

ability to timely and successfully reposition our Company around RNA therapeutics and to divest or partner our business in neurotology; |

| ● | the

COVID-19 pandemic, which continues to evolve, and which could significantly disrupt our preclinical studies and clinical trials, and

therefore our receipt of necessary regulatory approvals; |

| ● | our

need for substantial additional funding to continue the development of our product candidates before we can expect to become profitable

from sales of our products and the possibility that we may be unable to raise additional capital when needed; |

| ● | the

timing, scope, terms and conditions of a potential divestiture or partnering of the Company’s inner ear assets as well as the cash

such transaction(s) may generate; |

| ● | our

dependence on the success of OligoPhoreTM, SemaPhoreTM, AM-401 and AM-411, which are still in preclinical development,

and may eventually prove to be unsuccessful; |

| ● | the

chance that we may become exposed to costly and damaging liability claims resulting from the testing of our product candidates in the

clinic; |

| ● | the

chance our clinical trials may not be completed on schedule, or at all, as a result of factors such as delayed enrollment or the identification

of adverse effects; |

| ● | uncertainty

surrounding whether any of our product candidates will receive regulatory approval or clearance, which is necessary before they can be

commercialized; |

| ● | if

our product candidates obtain regulatory approval or clearance, our product candidates being subject to expensive, ongoing obligations

and continued regulatory overview; |

| |

● |

enacted and future legislation may increase the difficulty and cost for us to obtain marketing approval and commercialization; |

| |

● |

our reliance on our current strategic relationship with Washington University, or Nuance Pharma and the potential success or failure of strategic relationships, joint ventures or mergers and acquisitions transactions; |

| |

● |

our reliance on third parties to conduct our nonclinical and clinical trials and on third-party, single-source suppliers to supply or produce our product candidates; |

| |

● |

our ability to obtain, maintain and protect our intellectual property rights and operate our business without infringing or otherwise violating the intellectual property rights of others; |

| |

● |

our ability to meet the continuing listing requirements of Nasdaq and remain listed on The Nasdaq Capital Market; |

| |

● |

the chance that certain intangible assets related to our product candidates will be impaired; and |

| |

● |

other risk factors discussed under “Risk Factors” on page 3 and in our most recent Annual Report on Form 20-F. |

Our actual results or performance

could differ materially from those expressed in, or implied by, any forward-looking statements relating to those matters. Accordingly,

no assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of

them do so, what impact they will have on our results of operations, cash flows or financial condition. Except as required by law, we

are under no obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement, whether

written or oral, that may be made from time to time, whether as a result of new information, future events or otherwise.

USE OF PROCEEDS

The selling shareholders will

receive all of the net proceeds from the sales of our Common Shares offered by the selling shareholders pursuant to this prospectus.

SELLING SHAREHOLDERS

Warrant Inducement Agreement

On December 7, 2023, Altamira

Therapeutics Ltd., an exempted company limited by shares incorporated in Bermuda (the “Company”) entered into a letter

agreement (the “Warrant Inducement Agreement”) with the holder (the “Holder”) of certain warrants

(the “Existing Warrants”) to purchase an aggregate of 81,274 of the Company’s common shares, par value $0.002

per share (the “Common Shares”) dated May 1, 2023 in order to provide the Holder with a limited opportunity to exercise

such Existing Warrants at a reduced exercise price and receive additional warrants upon any such exercise.

Under the Warrant Inducement

Agreement, effective from the date and time of execution thereof until 12:59 PM ET on December 14, 2023 (such period, the “Exercise

Window”), the Existing Warrants were temporarily amended by reducing the Exercise Price (as defined therein; at that time CHF

30.76 per common share) of the Existing Warrants from time to time during such period to an amount with respect to each exercise of Existing

Warrants during such Exercise Window (the “Reduced Exercise Price”) equal to 90% of the daily trading volume weighted

average price for Common Shares on the NASDAQ stock exchange on the trading day following the date of each such exercise upon which settlement

of such exercise occurred (a “Settlement Day”) measured commencing at the time of such settlement, in each case converted

into Swiss Francs at the midpoint of the interbank exchange rate shown by UBS on such Settlement Day at 4:00 pm Central European Time

per Common Share (the “Warrant Amendment”). The Holder exercised all of such Existing Warrants during the Exercise

Window at the Reduced Exercise Price of CHF 6.656 per share.

In addition, on December 15,

2023, the Company issued and delivered to the Holder additional warrants using the same form as the Existing Warrants (the “New

Warrants”) to purchase 2 Common Shares for each Common Share that the Holder received upon the exercises for cash of Existing

Warrants during the Exercise Window (for a total of 162,548 Common Shares), provided that the initial exercise price of such New Warrants

is CHF 6.656 (equal to Reduced Exercise Price), and equal portions (i.e. two portions of 50% each) of such New Warrants are exercisable

for (A) six months from their date of issuance and (B) two years from their date of issuance, respectively.

The Company also agreed to

file a registration statement to register for resale the Common Shares issuable upon exercise of the New Warrants within 15 calendar days

after the end of the Exercise Window.

Information about Selling Shareholders Offering

We are registering the resale

of the above-referenced Common Shares to permit the selling shareholders identified below, or their permitted transferees or other successors-in-interest

that may be identified in a supplement to this prospectus or, if required, a post-effective amendment to the registration statement of

which this prospectus is a part, to resell or otherwise dispose of the Common Shares in the manner contemplated under “Plan of Distribution”

in this prospectus (as may be supplemented and amended). This prospectus covers the sale or other disposition by the selling shareholders

of up to the total number of Common Shares issuable upon cash exercise of the New Warrants, which are held by the selling shareholders.

Throughout this prospectus, when we refer to the Common Shares being registered on behalf of the selling shareholders, we are referring

to the Common Shares issuable upon exercise of the New Warrants, and when we refer to the selling shareholders in this prospectus, we

are referring to the Holder and its permitted transferees or other successors-in-interest that may be identified in a supplement to this

prospectus or, if required, a post-effective amendment to the registration statement of which this prospectus is a part.

The selling shareholders may

sell some, all or none of their Common Shares. We do not know when or whether any of the selling shareholders will exercise their New

Warrants, nor do we know how long the selling shareholders will hold their Common Shares before selling them, and we currently have no

agreements, arrangements or understandings with the Holder regarding the sale or other disposition of any of the Common Shares. The Common

Shares covered hereby may be offered from time to time by the selling shareholders.

The following table sets forth

the names of the selling shareholders, the number and percentage of our Common Shares beneficially owned by the selling shareholders as

of December 20, 2023, the number of our Common Shares issuable upon exercise of the New Warrants that may be offered under this prospectus,

and the number and percentage of our Common Shares beneficially owned by the selling shareholders assuming all of the Common Shares registered

hereunder are sold. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power

with respect to our Common Shares. Generally, a person “beneficially owns” Common Shares if the person has or shares with

others the right to vote those shares or to dispose of them, or if the person has the right to acquire voting or disposition rights within

60 days. The number of Common Shares in the column “Number of Shares Offered” represents all of the Common Shares that the

selling shareholders may offer and sell from time to time under this prospectus.

The information in the table

below and the footnotes thereto regarding Common Shares to be beneficially owned after the offering assumes (i) that the selling shareholders

have exercised their New Warrants in full pursuant to cash exercises, and (ii) the sale of all Common Shares being offered by the selling

shareholders under this prospectus.

Unless otherwise indicated,

all information contained in the table below and the footnotes thereto is based upon information provided to us by the selling shareholders.

The percentage of shares owned prior to and after the offering is based on 1,417,824 of our Common Shares outstanding as of December

20, 2023. Unless otherwise indicated in the footnotes to this table, we believe that the selling shareholders named in this table have

sole voting and investment power with respect to the Common Shares indicated as beneficially owned. Except as otherwise indicated in

this section, based on the information provided to us by the selling shareholders, and to the best of our knowledge, the selling shareholders

are not broker-dealers or affiliates of broker-dealers.

| | |

Number of

Common Shares

Beneficially Owned

Prior to the

Offering | | |

Number of

Common Shares

Registered

Hereby for Sale | | |

Number of

Common Shares

Beneficially

Owned After

the Offering | | |

Percent | |

| FiveT Investment Management Ltd.(1) | |

| 162,548 | | |

| 162,548 | | |

| - | | |

| - | |

|

(1) |

The number of Common Shares in the second column includes 162,548 Common Shares underlying the New Warrants, without giving effect to limitations on beneficial ownership set forth therein. Wieland Kreuder (“Mr. Kreuder”) has voting control and investment discretion over the securities reported herein that are held by the Holder. As a result, Mr. Kreuder may be deemed to have beneficial ownership (as determined under Section 13(d) of the Exchange Act of the securities reported herein that are held by the Holder. The registered address of FiveT Investment Management is Suite 5B201, 2nd Floor, One Nexus Way, Camana Bay, Grand Cayman KY1-1108 Cayman Islands. |

DESCRIPTION OF SHARE CAPITAL

As of December 20, 2023, our authorized share capital consisted of

5,000,000 common shares, par value $0.002 per share, and 20,000,000 preference shares, par value $0.0001 per share, and there were 1,477,824

common shares issued and outstanding, excluding 145,317 common shares issuable upon exercise of options and 596,619 common shares issuable

upon exercise of warrants, and no preference shares issued and outstanding. See Item 10.B. of our most recent Annual Report on Form 20-F,

which is incorporated herein by reference.

PLAN OF DISTRIBUTION

We are registering the Common

Shares issued and issuable upon exercise of the New Warrants to permit the resale of these Common Shares by the Holder from time to time

after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling shareholders of the Common Shares.

We will bear all fees and expenses incident to our obligation to register the Common Shares.

The selling shareholders may

sell all or a portion of the Common Shares beneficially owned by them and offered hereby from time to time directly or through one or

more underwriters, broker-dealers or agents. If the Common Shares are sold through underwriters or broker-dealers, the selling shareholders

will be responsible for underwriting discounts or commissions or agent’s commissions. The Common Shares may be sold in one or more

transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or

at negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions,

| ● | on

any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale; |

| ● | in

the over-the-counter market; |

| ● | in

transactions otherwise than on these exchanges or systems or in the over-the-counter market; |

| ● | through

the writing of options, whether such options are listed on an options exchange or otherwise; |

| ● | ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| ● | block

trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal

to facilitate the transaction; |

| ● | purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| ● | an

exchange distribution in accordance with the rules of the applicable exchange; |

| ● | privately

negotiated transactions; |

| ● | sales

pursuant to Rule 144; |

| ● | broker-dealers

may agree with the selling shareholders to sell a specified number of such shares at a stipulated price per share; |

| ● | a

combination of any such methods of sale; and |

| ● | any

other method permitted pursuant to applicable law. |

If the selling shareholders

effect such transactions by selling Common Shares to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers

or agents may receive commissions in the form of discounts, concessions or commissions from the selling shareholders or commissions from

purchasers of the Common Shares for whom they may act as agent or to whom they may sell as principal (which discounts, concessions or

commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions involved).

In connection with sales of the Common Shares or otherwise, the selling shareholders may enter into hedging transactions with broker-dealers,

which may in turn engage in short sales of the Common Shares in the course of hedging in positions they assume. The selling shareholders

may also sell Common Shares short and deliver Common Shares covered by this prospectus to close out short positions and to return borrowed

shares in connection with such short sales. The selling shareholders may also loan or pledge Common Shares to broker-dealers that in turn

may sell such shares. The selling shareholders may pledge or grant a security interest in some or all of the Common Shares owned by it

and, if it defaults in the performance of its secured obligations, the pledgees or secured parties may offer and sell the Common Shares

from time to time pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable provision of

the Securities Act, amending, if necessary, the list of selling shareholders to include the pledgee, transferee or other successors in

interest as selling shareholders under this prospectus. The selling shareholders also may transfer and donate the Common Shares in other

circumstances in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners for

purposes of this prospectus.

The selling shareholders and

any broker-dealer participating in the distribution of the Common Shares may be deemed to be “underwriters” within the meaning

of the Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be

underwriting commissions or discounts under the Securities Act. At the time a particular offering of the Common Shares is made, a prospectus

supplement, if required, will be distributed which will set forth the aggregate amount of Common Shares being offered and the terms of

the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation

from the selling shareholders and any discounts, commissions or concessions allowed or reallowed or paid to broker-dealers.

Under the securities laws

of some states, the Common Shares may be sold in such states only through registered or licensed brokers or dealers. In addition, in some

states the Common Shares may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from

registration or qualification is available and is complied with. There can be no assurance that any selling shareholder will sell any

or all of the Common Shares registered pursuant to the registration statement, of which this prospectus is a part.

The selling shareholders and

any other person participating in such distribution will be subject to applicable provisions of the Exchange Act, and the rules and regulations

thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any

of the Common Shares by the selling shareholders and any other participating person. Regulation M may also restrict the ability of any

person engaged in the distribution of the Common Shares to engage in market making activities with respect to the Common Shares. All of

the foregoing may affect the marketability of the Common Shares and the ability of any person or entity to engage in market-making activities

with respect to the Common Shares. We will pay all expenses of the registration of the Common Shares, estimated to be $30,945 in total,

including, without limitation, SEC filing fees and expenses of compliance with state securities or “blue sky” laws; provided,

however, that the selling shareholders will pay all underwriting discounts and selling commissions, if any. We will indemnify the selling

shareholders against liabilities, including some liabilities under the Securities Act, or the selling shareholders will be entitled to

contribution. We may be indemnified by the selling shareholders against civil liabilities, including liabilities under the Securities

Act, that may arise from any written information furnished to us by the selling shareholders specifically for use in this prospectus,

in accordance with the related agreement, or we may be entitled to contribution. Once sold under the registration statement of which this

prospectus forms a part, the Common Shares will be freely tradable in the hands of persons other than our affiliates.

EXPENSES OF THE OFFERING

The following is a statement of estimated expenses

to be incurred by us in connection with the registration of the securities registered hereby, all of which will be borne by us. All amounts

shown are estimates except the SEC registration fee.

| SEC registration fee |

|

$ |

78 |

|

| Legal fees and expenses |

|

$ |

20,000 |

|

| Accountant’s fees and expenses |

|

$ |

10,867 |

|

| Total |

|

$ |

30,945 |

|

LEGAL MATTERS

The validity of the Common

Shares and certain other matters of Bermuda law will be passed upon for us by Conyers Dill & Pearman Limited, special Bermuda counsel

to the Company.

EXPERTS

The financial statements of

Altamira Therapeutics Ltd. as of December 31, 2022 and 2021, and for each of the three years in the period ended December 31, 2022, incorporated

by reference in this prospectus, have been audited by Deloitte AG, an independent registered public accounting firm, as stated in their

report. Such financial statements are incorporated by reference in reliance upon the report of such firm given their authority as experts

in accounting and auditing.

SERVICE OF PROCESS AND

ENFORCEABILITY OF CIVIL LIABILITIES

Altamira Therapeutics Ltd.

is a Bermuda exempted company limited by shares. As a result, the rights of holders of our common shares will be governed by Bermuda law

and its memorandum of continuation and bye-laws. The rights of shareholders under Bermuda law may differ from the rights of shareholders

of companies incorporated in other jurisdictions. Many of our directors and some of the named experts referred to in this prospectus are

not residents of the United States, and a substantial portion of our assets are located outside the United States. As a result, it may

be difficult for investors to effect service of process on those persons in the United States or to enforce in the United States judgments

obtained in U.S. courts against us or those persons based on the civil liability provisions of the U.S. securities laws. It is doubtful

whether courts in Bermuda will enforce judgments obtained in other jurisdictions, including the United States, against us or our directors

or officers under the securities laws of those jurisdictions or entertain actions in Bermuda against us or our directors or officers under

the securities laws of other jurisdictions.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational

requirements of the Exchange Act. Accordingly, we are required to file reports and other information with the SEC, including annual reports

on Form 20-F and reports on Form 6-K. The materials we file with or furnish to the SEC are available to the public on the SEC’s

Internet website at www.sec.gov. Those filings are also available to the public on our corporate website at www.altamiratherapeutics.com.

Information contained on our website is not a part of this prospectus and the inclusion of our website address in this prospectus is an

inactive textual reference only.

As a foreign private issuer,

we are exempt under the Exchange Act from, among other things, the rules prescribing the furnishing and content of proxy statements, and

our directors, executive officers and principal shareholders are exempt from the reporting and short-swing profit recovery provisions

contained in Section 16 of the Exchange Act.

This prospectus forms part

of a registration statement that we filed with the SEC. The registration statement contains more information than this Prospectus regarding

us and our securities, including certain exhibits and schedules. You can obtain a copy of the registration statement from the SEC at the

address listed above or electronically at www.sec.gov.

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to incorporate

by reference information into this document. This means that we can disclose important information to you by referring you to another

document filed separately with the SEC. The information incorporated by reference is considered to be a part of this document, except

for any information superseded by information that is included directly in this prospectus or incorporated by reference subsequent to

the date of this prospectus.

We incorporate by reference

the following documents or information that we have filed or furnished with the SEC:

| |

● |

our Annual Report on Form 20-F for the fiscal year ended December 31, 2022, filed with the SEC on May 16, 2023; and |

| |

|

|

| |

● |

our Reports on Form 6-K furnished on June 15, 2023, June 27, 2023, July 11, 2023, July 28, 2023, August 21, 2023, September 12, 2023, October 31, 2023, November 21, 2023, November 22, 2023, December 8, 2023 and December 11, 2023; and |

| ● | the

description of our common shares contained in our Report on Form

6-K furnished on March 18, 2019, including

any subsequent amendment or reports filed for the purpose of updating such description. |

All subsequent annual reports

on Form 20-F filed by us and all subsequent reports on Form 6-K furnished by us that are identified by us as being incorporated by reference

shall be deemed to be incorporated by reference into this prospectus and deemed to be a part hereof after the date of this prospectus

but before the termination of the offering by this prospectus.

We will provide each person

to whom this prospectus is delivered a copy of the information that has been incorporated into this prospectus by reference but not delivered

with the prospectus (except exhibits, unless they are specifically incorporated into this prospectus by reference). You may obtain copies

of these documents, at no cost, by writing or telephoning us at:

Altamira Therapeutics Ltd.

Clarendon House

2 Church Street

Hamilton HM 11, Bermuda

(441) 295-5950

Any statement contained in

this prospectus or in a document incorporated or deemed to be incorporated herein by reference shall be deemed to be modified or superseded,

for the purposes of this prospectus, to the extent that a statement contained herein or in any other subsequently filed document which

also is or is deemed to be incorporated herein by reference modifies or supersedes such statement. The modifying or superseding statement

need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it

modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the

modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to

state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances

in which it was made. Any statement so modified or superseded shall not constitute a part of this prospectus, except as so modified or

superseded.

Upon a new annual information

form or annual report on Form 20-F and the related audited annual consolidated financial statements together with the auditors’

report thereon and management’s discussion and analysis related thereto being filed by us with the applicable securities regulatory

authorities during the currency of this prospectus, the previous annual information form or annual report on Form 20-F, the previous audited

annual consolidated financial statements and all unaudited interim financial statements, annual and semi-annual management’s discussion

and analyses, material change reports and business acquisition reports filed by us prior to the commencement of our financial year in

which the new annual information form or annual report on Form 20-F was filed, no longer shall be deemed to be incorporated by reference

into this prospectus for the purpose of future offers and sales of securities hereunder.

One or more prospectus supplements

containing the terms of an offering of securities hereunder and other information in relation to such securities will be delivered to

purchasers of such securities together with this prospectus and shall be deemed to be incorporated by reference into this prospectus as

of the date of such prospectus supplement solely for the purposes of the offering of the securities covered by any such prospectus supplement.

A prospectus supplement containing

any additional or updated information that we elect to include therein will be delivered with this prospectus to purchasers of securities

who purchase such securities after the filing of this prospectus and shall be deemed to be incorporated into this Prospectus as of the

date of such prospectus supplement.

13

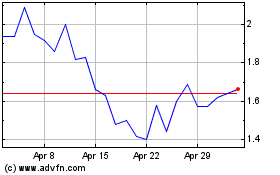

Altamira Therapeutics (NASDAQ:CYTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Altamira Therapeutics (NASDAQ:CYTO)

Historical Stock Chart

From Apr 2023 to Apr 2024