Filed Pursuant to Rule 424(b)(5)

Registration No. 333-261127

Prospectus Supplement

(To Prospectus dated December 8, 2021)

Altamira Therapeutics Ltd.

Up to $1,660,000 of Common Shares

We have entered into an At The Market Offering Agreement (the “Sales

Agreement”) with H.C. Wainwright & Co., LLC, as sales agent (“Wainwright”), dated January 19, 2024, relating to

the offer and sale of our common shares, par value USD 0.002 per share, from time to time through Wainwright acting as sales agent or

principal. In accordance with the terms of the Sales Agreement, under this prospectus supplement and the accompanying prospectus, we may

offer and sell our common shares having a maximum aggregate offering price of up to $1,660,000 from time to time through Wainwright in

this offering.

Sales of our common shares, if any, under this prospectus supplement

and the accompanying prospectus may be made in sales deemed to be “at the market offerings” as defined in Rule 415(a)(4) under

the Securities Act of 1933, as amended (the “Securities Act”), including sales made directly on or through The Nasdaq Capital

Market or any other existing trading market in the United States for our common shares, sales made to or through a market maker other

than on an exchange or otherwise, directly to Wainwright as principal, in negotiated transactions at market prices prevailing at the time

of sale or at prices related to such prevailing market prices and/or in any other method permitted by law. If we and Wainwright agree

on a method of distribution other than sales of our common shares on or through The Nasdaq Capital Market or another existing trading

market in the United States at market prices, we will file a further prospectus supplement providing all information about such offering

as required by Rule 424(b) under the Securities Act. Under the Sales Agreement, Wainwright is not required to sell any specific number

or dollar amount of our common shares, but as instructed by us it will act as sales agent on a commercially reasonable efforts basis consistent

with its normal trading and sales practices and applicable laws and regulations, subject to the terms and conditions of the Sales Agreement

on mutually agreed terms. There is no arrangement for funds to be received in any escrow, trust or similar arrangement. This offering

pursuant to this prospectus supplement will terminate upon the earlier of (1) the sale of common shares pursuant to this prospectus supplement

having an aggregate sales price of $1,660,000 and (2) the termination by us or Wainwright of the Sales Agreement pursuant to its terms.

We provide more information about how the common shares will be sold in the section entitled “Plan of Distribution.”

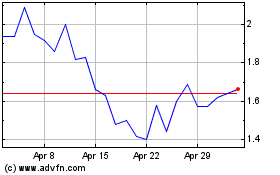

Our common shares are listed on The Nasdaq Capital Market under the

symbol “CYTO.” On January 12, 2024, the last sale price of our common shares as reported by The Nasdaq Capital Market was

$2.71 per common share.

Wainwright will be entitled

to cash compensation at a fixed commission rate equal to 3.0% of the gross sales price of the common shares sold through it under the

Sales Agreement. In connection with the sale of common shares on our behalf, Wainwright will be deemed to be an “underwriter”

within the meaning of the Securities Act and the compensation of Wainwright will be deemed to be underwriting commissions or discounts.

We have also agreed to provide indemnification and contribution to Wainwright with respect to certain liabilities, including liabilities

under the Securities Act. We have also agreed to reimburse certain of Wainwright’s expenses in connection with the offering as

further described in the “Plan of Distribution” section beginning on page S-17 of this prospectus supplement.

In offering common shares by the means of this prospectus supplement

and the accompanying prospectus, we are relying on General Instruction I.B.5 of Form F-3, which limits the amount of common shares we

can sell pursuant to the registration statement, of which this prospectus supplement and the accompanying prospectus are a part, to one-third

of the market value of our common shares held by non-affiliates, or our public float, during the 12 calendar months prior to and including

the date of this prospectus supplement so long as our public float remains below $75.0 million. As of the date of this prospectus supplement,

our public float was $20,303,490, which was calculated based on 1,575,135 of our common shares outstanding and held by non-affiliates

and a price of $12.89 per share, the closing price of our common shares on the Nasdaq Capital Market on November 29, 2023. During

the 12 calendar month period that ends on and includes the date of this prospectus supplement, the aggregate value of common shares we

have sold pursuant to General Instruction I.B.5 of Form F-3 was $5,106,090.

Investing in our common

shares involves a high degree of risk. Before making any decision to invest in our common shares, you should carefully consider the information

disclosed under “Risk Factors” beginning on page S-3 of this prospectus supplement, on page 2 of the accompanying prospectus,

any related free writing prospectus as well as those risk factors contained under similar headings in the other documents that are incorporated

by reference to this prospectus supplement and the accompanying prospectus.

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY

OR ACCURACY OF THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Consent under the Exchange

Control Act 1972 (and its related regulations) from the Bermuda Monetary Authority for the issue and transfer of our common shares to

and between residents and non-residents of Bermuda for exchange control purposes has been obtained for so long as our common shares remain

listed on an “appointed stock exchange,” which includes the Nasdaq Capital Market. In granting such consent, neither the

Bermuda Monetary Authority nor the Registrar of Companies in Bermuda accepts any responsibility for our financial soundness or the correctness

of any of the statements made or opinions expressed herein.

H.C.

Wainwright & Co.

The date of this prospectus supplement is January

19, 2024.

TABLE OF CONTENTS

PROSPECTUS

Unless otherwise indicated

or the context otherwise requires, all references in this prospectus supplement to “Altamira Therapeutics Ltd.”, or “Altamira,”

the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to (i) Auris

Medical Holding AG (formerly Auris Medical AG), or Auris Medical (Switzerland), together with its subsidiaries, prior to our corporate

reorganization by way of the merger of Auris Medical Holding AG into Auris Medical NewCo Holding AG (the “Merger”), a newly

incorporated, wholly-owned Swiss subsidiary on March 13, 2018 (i.e. to the transferring entity), (ii) Auris Medical Holding AG (formerly

Auris Medical NewCo Holding AG), together with its subsidiaries after the Merger (i.e. to the surviving entity) and prior to the Redomestication

(as defined below) and (iii) to Auris Medical Holding Ltd., a Bermuda company, or Auris Medical (Bermuda), the successor issuer to Auris

Medical (Switzerland) under Rule 12g-3(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

after the effective time at which Auris Medical (Switzerland) continued its corporate existence from Switzerland to Bermuda (the “Redomestication”),

which occurred March 18, 2019. The trademarks, trade names and service marks appearing in this prospectus supplement are property of

their respective owners.

On October 25, 2022,

the Company effected a one-for-twenty reverse share split (the “2022 Reverse Share Split”) of the Company’s issued

and outstanding common shares. Effective as of November 2, 2023, the Company changed the currency denomination of the

Company’s authorized share capital from CHF to USD, reduced the issued share capital by reducing the par value of each common

share in issue to USD 0.0001 (pre- 2023 Reverse Share Split (as defined below)) and reduced the authorized share capital to USD

12,000 divided into 100,000,000 (pre- 2023 Reverse Share Split) common shares of USD 0.0001 (pre-2023 Reverse Share Split) par value

each and 20,000,000 preference shares of USD 0.0001 par value each. On December 13, 2023, the Company effected a one-for-twenty

reverse share split (the “2023 Reverse Share Split”) of the Company’s issued and outstanding common shares. Unless

indicated or the context otherwise requires, all per share amounts and numbers of common shares in this prospectus supplement have

been retrospectively adjusted for the 2022 Reverse Share Split and the 2023 Reverse Share Split. Documents incorporated by reference

into this prospectus supplement and the accompanying prospectus that were filed prior to October 25, 2022 and December 11, 2023, do

not give effect to the 2022 Reverse Share Split or the 2023 Reverse Share Split, as applicable.

The terms “dollar,”

“USD” or “$” refer to U.S. dollars and the term “Swiss Franc” and “CHF” refer to the

legal currency of Switzerland.

You should rely only on the information contained in or incorporated

by reference in this prospectus supplement and the accompanying prospectus. We have not, and Wainwright has not, authorized any other

person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely

on it. We are not, and the sales agent is not, making an offer to sell these securities in any jurisdiction where the offer or sale is

not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus or in any documents

incorporated by reference herein or therein is accurate only as of the date of the applicable document. Our business, financial condition,

results of operations and prospects may have changed since that date.

This prospectus supplement

is not an offer to sell or a solicitation of an offer to buy securities in any jurisdiction in which such offer or solicitation is illegal.

ABOUT THIS PROSPECTUS SUPPLEMENT

All references to the terms

“Altamira,” the “Company,” “we,” “us” or “our” in this prospectus supplement

refer to Altamira Therapeutics Ltd., an exempted company limited by shares incorporated in Bermuda, and its consolidated subsidiaries,

unless the context requires otherwise.

This prospectus supplement

and the accompanying prospectus are part of a registration statement on Form F-3 (File No. 333-261127) that we filed with the Securities

and Exchange Commission (“SEC”), utilizing the SEC’s “shelf” registration rules, on November 16, 2021,

and that was declared effective on December 8, 2021. This document consists of two parts. The first part is this prospectus supplement,

which describes the terms of this offering of our common shares and supplements information contained in the accompanying prospectus

and the documents incorporated by reference into the accompanying prospectus. The second part is the accompanying prospectus, which gives

more general information about us and the securities we may offer from time to time under our shelf registration statement, some of which

may not apply to this offering.

This prospectus supplement

and the documents incorporated by reference herein may add, update or change information contained in the accompanying prospectus. To

the extent that any statement that we make in this prospectus supplement is inconsistent with statements made in the accompanying prospectus,

the statements in this prospectus supplement will be deemed to modify or supersede those made in the accompanying prospectus. You should

read carefully this prospectus supplement, the accompanying prospectus, the documents incorporated by reference herein and therein, the

additional detailed information described under the headings “Where You Can Find More Information” and “Incorporation

of Certain Documents by Reference,” and any free writing prospectus that we have authorized for use in connection with this offering

before making an investment decision.

You should rely on only

the information contained in or incorporated by reference to this prospectus supplement and the accompanying prospectus relating to the

offering described in this prospectus supplement. We have not, and Wainwright has not, authorized any person to provide you with different

or additional information. If anyone provides you with different or additional information, you should not rely on it.

You should not assume that

the information in this prospectus supplement, the accompanying prospectus or any documents we incorporate by reference herein or therein

is accurate as of any date other than the respective dates on the front cover of those documents. Our business, financial condition,

results of operations and prospects may have changed since those dates.

We further note that the

representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated

by reference into this prospectus supplement and the accompanying prospectus were made solely for the benefit of the parties to such

agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed

to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of

the date when made. Accordingly, such representations, warranties or covenants should not be relied on as accurately representing the

current state of our affairs.

The financial statements

included in or incorporated by reference into this prospectus supplement and the accompanying prospectus have been prepared in accordance

with International Financial Reporting Standards as issued by the International Accounting Standards Board. Our consolidated financial

statements are subject to the standards of the Public Company Accounting Oversight Board (United States) and the SEC independence standards.

This may not be comparable to financial statements of United States (“U.S.”) companies.

We are not, and Wainwright

is not, offering or selling the common shares offered herby in any jurisdiction or to any person if such offer or sale is not permitted

by applicable law, rule or regulation.

SPECIAL NOTE ON FORWARD-LOOKING

STATEMENTS

This prospectus supplement,

the accompanying prospectus and our SEC filings that are incorporated by reference into this prospectus supplement contain statements

that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the

Exchange Act, and include statements concerning our industry, our operations, our anticipated financial performance and financial condition,

and our business plans and growth strategy and product development efforts. The words “may,” “might,” “will,”

“should,” “estimate,” “project,” “plan,” “anticipate,” “expect,”

“intend,” “outlook,” “believe” and other similar expressions are intended to identify forward-looking

statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates.

Forward-looking statements

appear in a number of places in this prospectus supplement, the accompanying prospectus and our SEC filings incorporated by reference

herein and therein, and include, but are not limited to, statements regarding our intent, belief or current expectations. Forward-looking

statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such

statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking

statements due to various factors, including, but not limited to:

| ● | our

ability to continue as a going concern, about which there is currently substantial doubt due to our recurring losses and negative cash

flows from operations, our expectation to generate losses from operations for the foreseeable future and our cash position; |

| ● | our

ability to remediate our current material weaknesses in our internal controls over financial reporting; |

| |

● |

our ability

to timely and successfully reposition our Company around RNA therapeutics and to divest or partner our business in neurotology; |

| |

|

|

| |

● |

our ability to meet the

continuing listing requirements of The Nasdaq Stock Market LLC (“Nasdaq”) and remain listed on The Nasdaq Capital Market; |

| |

● |

our need for

substantial additional funding to continue the development of our product candidates before we can expect to become profitable from

sales of our products and the possibility that we may be unable to raise additional capital when needed; |

| |

● |

the timing,

scope, terms and conditions of a potential divestiture or partnering of the Company’s inner ear assets as well as the cash

such transaction(s) may generate; |

| |

● |

our dependence

on the success of OligoPhoreTM, SemaPhoreTM, AM-401 and AM-411, which are still in preclinical development,

and may eventually prove to be unsuccessful; |

| |

● |

the chance

that we may become exposed to costly and damaging liability claims resulting from the testing of our product candidates in the clinic; |

| |

● |

the chance

our clinical trials may not be completed on schedule, or at all, as a result of factors such as delayed enrollment or the identification

of adverse effects; |

| |

● |

uncertainty

surrounding whether any of our product candidates will receive regulatory approval or clearance, which is necessary before they can

be commercialized; |

| |

● |

if our product

candidates obtain regulatory approval or clearance, our product candidates being subject to expensive, ongoing obligations and continued

regulatory overview; |

| |

● |

enacted and

future legislation may increase the difficulty and cost for us to obtain marketing approval and commercialization; |

| |

● |

our reliance

on our current strategic relationship with Washington University, or Nuance Pharma and the potential success or failure of strategic

relationships, joint ventures or mergers and acquisitions transactions; |

| |

● |

our reliance

on third parties to conduct our nonclinical and clinical trials and on third-party, single-source suppliers to supply or produce

our product candidates; |

| |

● |

our ability

to obtain, maintain and protect our intellectual property rights and operate our business without infringing or otherwise violating

the intellectual property rights of others; |

| |

● |

the chance

that certain intangible assets related to our product candidates will be impaired; and |

| |

|

|

| |

● |

other risk factors discussed

under “Risk Factors” on page 1 and in our most recent Annual Report on Form 20-F and under “Risk Factors”

beginning on page S-3 of this prospectus supplement. |

More detailed information

about these and other factors is included under “Risk Factors” in this prospectus supplement, the accompanying prospectus

and in other documents incorporated herein and therein by reference. Many of these factors are beyond our control. Future events may

vary substantially from what we currently foresee. You should not place undue reliance on such forward-looking statements. We disavow

and are under no obligation to update or alter such forward-looking statements whether as a result of new information, future results,

events, developments or otherwise, unless required to do so by a governmental authority or applicable law. We advise you, however, to

review any further disclosures we make on related subjects in our Annual Report on Form 20-F and Reports of Foreign Private Issuer on

Form 6-K filed or furnished to the SEC.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary

highlights selected information contained elsewhere in this prospectus supplement, the accompanying prospectus and the documents we incorporate

by reference herein and therein. The summary may not contain all of the information that you should consider before investing in our

common shares. You should read this entire prospectus supplement and the accompanying prospectus carefully, including “Risk Factors”

contained in this prospectus supplement beginning on page S-3 and the accompanying prospectus, and the documents incorporated by reference

into this prospectus supplement and the accompanying prospectus, for a discussion of the risks involved in investing in our common shares

before making an investment decision. This prospectus supplement may add to, update or change information in the accompanying prospectus.

Our Company

We are a company developing

and supplying peptide-based nanoparticle technologies for efficient RNA delivery to extrahepatic tissues (OligoPhore™ / SemaPhore™

platforms). Altamira currently has two flagship siRNA programs using its proprietary delivery technology: AM-401 for KRAS driven cancer

and AM-411 for rheumatoid arthritis, both in preclinical development beyond in vivo proof of concept. The versatile delivery platform

is also suited for mRNA and other RNA modalities and made available to pharma or biotech companies through out-licensing. In addition,

Altamira holds a 49% stake (with additional economic rights) in its commercial-stage legacy asset Bentrio®, an OTC nasal spray for

allergic rhinitis. Further, the Company is in the process of partnering / divesting its inner ear legacy assets (AM-125 nasal spray for

vertigo; post Phase 2; Keyzilen® and Sonsuvi® for tinnitus and hearing loss; Phase 3).

On November 21, 2023, we closed our partial spin-off of its Bentrio

business. Our pro forma financial statements as of June 30, 2023, are included as Exhibit 99.1 to our Report of Foreign Private Issuer

on Form 6-K, dated January 19, 2024, incorporated herein by reference.

Implications of Being a Foreign Private Issuer

We currently report under

the Exchange Act as a non-U.S. company with foreign private issuer status. Although we no longer qualify as an emerging growth company,

as long as we qualify as a foreign private issuer under the Exchange Act, we will continue to be exempt from certain provisions of the

Exchange Act that are applicable to U.S. domestic public companies, including:

| |

● |

the sections

of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under

the Exchange Act; |

| |

● |

the sections

of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders

who profit from trades made in a short period of time; and |

| |

● |

the rules under

the Exchange Act requiring the filing with the Securities and Exchange Commission, or SEC, of quarterly reports on Form 10-Q containing

unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant

events. |

Corporate Information

We are an exempted company

incorporated under the laws of Bermuda. We began our current operations in 2003. On April 22, 2014, we changed our name from Auris Medical

AG to Auris Medical Holding AG and transferred our operational business to our newly incorporated subsidiary Auris Medical AG, which

is now our main operating subsidiary. On March 13, 2018, we effected a corporate reorganization through a merger into a newly formed

holding company for the purpose of effecting the equivalent of a 10-1 “reverse share split.” Following shareholder approval

at an extraordinary general meeting of shareholders held on March 8, 2019 and upon the issuance of a certificate of continuance by the

Registrar of Companies in Bermuda on March 18, 2019, the Company discontinued as a Swiss company and, pursuant to Article 163 of the

Swiss Federal Act on Private International Law and pursuant to Section 132C of the Companies Act 1981 of Bermuda (the “Companies

Act”), continued existence under the Companies Act as a Bermuda company with the name “Auris Medical Holding Ltd.”

Following shareholders’ approval at a special general meeting of shareholders held on July 21, 2021, we changed our name to Altamira

Therapeutics Ltd. Our registered office is located at Clarendon House, 2 Church Street, Hamilton HM11, Bermuda, telephone number +1 (441)

295 5950.

We maintain a website at www.altamiratherapeutics.com where general

information about us is available. Investors can obtain copies of our filings with the SEC, from this site free of charge, as well as

from the SEC website at www.sec.gov. We are not incorporating the contents of our website into this prospectus supplement or the accompanying

prospectus.

THE OFFERING

| Common

shares offered by us pursuant to this prospectus supplement: |

|

Common shares, par value USD 0.002 per share, having an aggregate offering

price of up to $1,660,000. |

| |

|

|

| Plan

of Distribution: |

|

“At

the market offering” as defined in Rule 415(a)(4) under the Securities Act, that may be made from time to time on The Nasdaq

Capital Market through our sales agent, Wainwright. Wainwright will make all sales using commercially reasonable efforts consistent

with its normal trading and sales practices and applicable laws and regulations, on mutually agreeable terms between Wainwright and

us. See “Plan of Distribution” on page S-17 of this prospectus supplement |

| |

|

|

| Common

shares outstanding before this offering: |

|

1,577,785 common shares(1) |

| |

|

|

| Common

shares outstanding after this offering: |

|

Up to 2,190,331 common shares, assuming a sales price of $2.71 per

share, which was the closing price of our common shares as reported on The Nasdaq Capital Market on January 12, 2024. The actual number

of common shares issued will vary depending on the sales price at which shares may be sold from time to time during this offering. |

| |

|

|

| Use

of proceeds: |

|

We

intend to use the net proceeds, if any, from the sale of our common shares under this prospectus supplement for working capital and

general corporate purposes. Such purposes may include research and development expenditures and capital expenditures. Please see

the section entitled “Use of Proceeds” on page S-8 of this prospectus supplement for a more detailed discussion. |

| |

|

|

| Risk

factors: |

|

An

investment in our common shares involve a high degree of risk. Please see the section entitled “Risk Factors” beginning

on page S-3 of this prospectus supplement, on page 2 of the accompanying prospectus and under “Item 3. Key Information—D.

Risk factors” in our Annual Report on Form 20-F for the year ended December 31, 2022, incorporated by reference herein, and

other information included or incorporated by reference in this prospectus for a discussion of factors you should carefully consider

before investing in our common shares. |

| |

|

|

| Nasdaq

Capital Market symbol: |

|

CYTO |

| (1) | The number of common shares outstanding before and after this offering

is based on 1,577,785 shares outstanding as of January 12, 2024, which excludes: |

| |

● |

145,317 common shares issuable upon the exercise of options issued

pursuant to the Company’s equity incentive plan, outstanding as of January 12, 2024 at a weighted average exercise price of $26.35

per common share; and |

| |

|

|

| |

● |

759,167 common shares issuable upon exercise of warrants outstanding

as of January 12, 2024 at a weighted average exercise price of $14.91 per common share. |

On December 13, 2023, we effected the 2023 Reverse Share Split.

The table above is presented on post-reverse split basis.

RISK FACTORS

Before making an investment

decision, you should carefully consider the risks described in this prospectus supplement, the accompanying prospectus, together with

all of the other information and documents incorporated by reference into this prospectus supplement and the accompanying prospectus,

including the risks described in our most recent Annual Report on Form 20-F and subsequent Reports of Foreign Private Issuer on Form

6-K filed or furnished to the SEC, including our audited consolidated financial statements and corresponding management’s discussion

and analysis. The risks mentioned below are presented as of the date of this prospectus supplement. For additional information, please

see the sources described in “Where You Can Find More Information” and “Incorporation of Certain Documents By Reference.”

Our business, financial

condition or results of operations could be materially adversely affected by any of these risks. Additional risks not presently known

to us or that we currently deem immaterial may also impair our business operations. The trading price of our common shares could decline

due to any of these risks, and you may lose all or part of your investment. This prospectus supplement, the accompanying prospectus and

the incorporated documents also contain forward-looking statements that involve risks and uncertainties. Our actual results could differ

materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks mentioned below.

Forward-looking statements included in this prospectus supplement are based on information available to us on the date hereof, and all

forward-looking statements in documents incorporated by reference are based on information available to us as of the date of each such

document. We disavow and are under no obligation to update or alter such forward-looking statements whether as a result of new information,

future events or otherwise, other than as required by applicable securities legislation.

Risks Relating to This Offering

We need to raise capital in this offering

to support our operations, and there is substantial doubt about our ability to continue as a going concern. If we are unable to raise

capital when needed, we could be forced to delay, reduce or eliminate our product development programs.

We have incurred substantial losses since our inception. Net losses

and negative cash flows have had, and will continue to have, an adverse effect on our shareholders’ equity and working capital.

We incurred net losses (defined as net loss attributable to owners of the Company) of CHF 26.5 million, CHF 17.1 million and CHF 8.2 million

for the years ended December 31, 2022, 2021 and 2020, respectively. As of December 31, 2022, we had an accumulated deficit of CHF 201.4

million and as of June 30, 2023, we had an accumulated deficit of CHF 19,847,641. We expect our research and development expenses to remain

significant as we advance or initiate the pre-clinical and clinical development of AM-401, AM-411 or any other product candidate.

We expect our total additional cash need in 2024

to be in the range of CHF 6.5 to CHF 7.5 million, prior to the receipt of any proceeds from this offering. Our assumptions may prove

to be wrong, and we may have to use our capital resources sooner than we currently expect. To the extent that we may be unable to generate

sufficient cash proceeds from partnering of our legacy assets or other partnering activities, we may need substantial additional financing

to meet these funding requirements. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

The financial statements incorporated by reference in this prospectus have been prepared on a going concern basis, which contemplates

the continuity of normal activities and realization of assets and settlement of liabilities in the normal course of business. The financial

statements do not include any adjustments that might result from the outcome of this uncertainty. The lack of a going concern assessment

may negatively affect the valuation of the Company’s investments in its subsidiaries and result in a revaluation of these holdings.

The board of directors will need to consider the interests of our creditors and take appropriate action to restructure the business if

it appears that we are insolvent or likely to become insolvent. Our future funding requirements will depend on many factors, including

but not limited to:

| |

● |

the scope,

rate of progress, results and cost of our clinical trials, nonclinical testing, and other related activities; |

| |

● |

the cost of

manufacturing clinical supplies of our product candidates and any products that we may develop; |

| |

● |

the number

and characteristics of product candidates that we pursue; |

| |

● |

the cost, timing,

and outcomes of regulatory approvals; and |

| |

|

|

| |

● |

the terms and timing of

any collaborative, licensing, and other arrangements that we may establish, including any required milestone and royalty payments

thereunder. |

We expect that we will require additional funding

to continue the development of our OligoPhore/SemaPhore platform technology as well as our product candidates AM-401 and AM-411 and commercialize

it through out-licensing to pharma or biotech companies. We also expect to continue to incur significant costs associated with operating

as a public company. Additional funds may not be available on a timely basis, on favorable terms, or at all, and such funds, if raised,

may not be sufficient to enable us to continue to implement our long-term business strategy. If we are not able to raise capital when

needed, we could be forced to delay, reduce or eliminate our product development programs or commercialization efforts, which could materially

harm our business, prospects, financial condition and operating results. This could then result in bankruptcy, or the liquidation of

the Company.

Management will have broad discretion as to the use of the net

proceeds from this offering, and we may not use the proceeds effectively.

We intend to use the net proceeds, if any, from

the sale of common shares by us in this offering for working capital and general corporate purposes. Such purposes may include research

and development expenditures and capital expenditures. Our management will have broad discretion as to the application of the net proceeds

from this offering and could use them for purposes other than those contemplated at the time of this offering, as described below in

the section entitled “Use of Proceeds,” or in ways that do not necessarily improve our operating results or enhance the value

of our common shares. Our shareholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds.

Our failure to use these funds effectively could have a material adverse effect on our business and could cause the price of our common

shares to decline.

If you purchase our common shares in this

offering, you may suffer immediate and substantial dilution of your investment.

The shares sold in this offering, if any, will be sold from time to

time at various prices. As a result, you may incur substantial dilution as a result of this offering. Our net tangible book value (deficit)

as of June 30, 2023, was approximately $(6.4) million, or approximately $(16.07) per common share and our pro forma net tangible book

value (deficit) as of June 30, 2023 after giving effect to the pro forma events (as defined herein), was approximately $0.4 million, or

$0.26 per common share. Assuming that an aggregate of 612,546 common shares are sold at an assumed offering price of $2.71 per share,

the closing price of our common shares on The Nasdaq Capital Market on January 12, 2024, for aggregate net proceeds of approximately $1.5

million, after deducting sales commissions and estimated expenses payable by us, new investors in this offering will experience immediate

dilution of $1.82 per share, representing the difference between the assumed offering price per share and our pro forma as adjusted net

tangible book value per share after giving effect to this offering. See the section entitled “Dilution” for a more detailed

discussion of the dilution you will incur if you purchase common shares in this offering.

If you purchase our common shares in this

offering, you may experience future dilution as a result of future equity offerings or other equity issuances.

In order to raise additional capital, we believe

that we will offer and issue additional common shares or other securities convertible or exercisable into or exchangeable for common

shares in the future. We cannot assure you that we will be able to sell common shares or other securities in any other offering at a

price per common share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing

other securities in the future could have rights superior to existing shareholders. The price per common share at which we sell additional

common shares or other securities convertible or exercisable into or exchangeable for common shares in future transactions may be higher

or lower than the price per common share in this offering.

In addition, we have a significant number of

warrants and options outstanding. To the extent that outstanding options or warrants have been or may be exercised or converted or other

common shares are issued, you may experience further dilution. Further, we may choose to raise additional capital due to market conditions

or strategic considerations even if we believe we have sufficient funds for our current or future operating plans, which may lead to

further dilution.

Sales of our common shares in this offering, or the perception

that such sales may occur, could cause the market price of our common shares to fall.

We may issue and sell common shares for aggregate gross proceeds of

up to $1,660,000 from time to time in connection with this offering. The issuance and sale from time to time of these new common shares,

or our ability to issue these new common shares in this offering, could have the effect of depressing the market price of our common shares

and impair our ability to raise capital through the sale of additional equity securities.

The common shares offered hereby will be

sold in “at-the-market” offerings, and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering

at different times will likely pay different prices, and so may experience different outcomes in their investment results. We will have

discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold, and there is no minimum or maximum sales

price. Investors may experience a decline in the value of their shares as a result of share sales made at prices lower than the prices

they paid.

The actual number of shares we may sell

and the aggregate proceeds resulting from sales under the Sales Agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the Sales Agreement and compliance

with applicable laws, we have the discretion to deliver a sales notice to Wainwright at any time throughout the term of the Sales Agreement.

The number of shares that are sold by Wainwright after we deliver a sales notice will fluctuate based on the market price of the common

shares during the sales period and limits we set with Wainwright. Because the price per share of each share sold will fluctuate based

on the market price of and demand for our common shares during the sales period, it is not possible at this stage to predict the number

of shares, if any, that will ultimately be issued.

Our common shares may be involuntarily

delisted from trading on Nasdaq if we fail to comply with the continued listing requirements. A delisting of our common shares is likely

to reduce the liquidity of our common shares and may inhibit or preclude our ability to raise additional financing.

We are required to comply with certain Nasdaq

continued listing requirements, including a series of financial tests relating to shareholder equity, market value of listed securities

and number of market makers and shareholders. If we fail to maintain compliance with any of those requirements, our common shares could

be delisted from Nasdaq.

On May 25, 2023, we received written notification from the Listing

Qualifications Department of Nasdaq (the “Staff”) indicating that based on our shareholders’ equity of $(9.0) million

for the period ended December 31, 2022, we were no longer in compliance with the minimum shareholders’ equity requirement of $2.5

million as set forth in Nasdaq Listing Rule 5550(b)(1) for continued listing on Nasdaq. On July 10, 2022, the Company submitted a plan

to the Staff to regain compliance with the minimum stockholders’ equity requirement, and on July 25, 2023, the Staff notified the

Company that it would be granted an extension until November 21, 2023, to demonstrate compliance with Listing Rule 5550(b)(1). On November

21, 2023, the Company announced the closing of its partial spin-off of its Bentrio business, increasing its shareholder equity, and, also

on November 21, 2023, received a letter from the Staff indicating that the Staff had determined that the Company complies with Nasdaq

Listing Rule 5550(b)(1).

In addition, on June

26, 2023 the Company received a letter from the Staff notifying the Company that the minimum bid price per share for its common shares

was below $1.00 for a period of 30 consecutive business days and that the Company did not meet the minimum bid price requirement set

forth in Nasdaq Listing Rule 5550(a)(2). The Company had a compliance period of 180 calendar days (the “Compliance Period”)

to regain compliance with Nasdaq’s minimum bid price requirement.

On December 11, 2023, the Company announced that

its Board of Directors has approved a reverse stock split of its common shares at a ratio of 1-for-20, effective December 13, 2023, effected

primarily to regain compliance with the $1.00 minimum bid price requirement for continued listing on Nasdaq. On December 28, 2023, the

Company received a letter from the Staff indicating that the Staff had determined that the Company complies with Nasdaq Listing Rule

5550(a)(2).

Further, in 2017, 2019, 2020 and 2022, we failed

to maintain compliance with the minimum bid price requirement. To address non-compliance in 2017, on March 13, 2018, we effected a reverse

share split at a ratio of 10-for-1. To address non-compliance in 2019 and 2022, we effected a reverse share split at a ratio of one-for-twenty

and the 2022 Reverse Share Split, respectively. In 2020, we regained compliance as our share price increased. Additionally, on January

11, 2018, we received a letter from Nasdaq indicating that we were not in compliance with Nasdaq’s market value of listed securities

requirement. As a result of our registered offering of common shares in July 2018, we resolved the non-compliance with the market value

of listed securities requirement by complying with Nasdaq’s minimum shareholders’ equity standard. However, there can be

no assurance that we will be able to successfully maintain compliance with the several Nasdaq continued listing requirements.

If, for any reason, Nasdaq should delist our

common shares from trading on its exchange and we are unable to obtain listing on another national securities exchange or take action

to restore our compliance with Nasdaq’s continued listing requirements, a reduction in some or all of the following may occur,

each of which could have a material adverse effect on our shareholders:

| |

● |

the liquidity

of our common shares; |

| |

● |

the market

price of our common shares; |

| |

● |

our ability

to obtain financing for the continuation of our operations; |

| |

● |

the number

of institutional and general investors that will consider investing in our common shares; |

| |

● |

the number

of market makers in our common shares; |

| |

● |

the availability

of information concerning the trading prices and volume of our common shares; and |

| |

● |

the number

of broker-dealers willing to execute trades in shares of our common shares. |

Moreover, delisting may make unavailable a tax

election that could affect the U.S. federal income tax treatment of holding, and disposing of, our common shares. See “Taxation—Material

U.S. Federal Income Tax Considerations for U.S. Holders” below.

If we are or become classified as a passive

foreign investment company (“PFIC”), our U.S. shareholders may suffer adverse tax consequences as a result.

A non-U.S. corporation, such as our Company,

will be considered a PFIC for any taxable year if either (i) at least 75% of its gross income is passive income or (ii) at least 50%

of the value of its assets (based on an average of the quarterly values of the assets during a taxable year) is attributable to assets

that produce or are held for the production of passive income.

Based upon our current and projected income and

assets, and projections as to the value of our assets, we do not anticipate that we will be a PFIC for the 2024 taxable year or the foreseeable

future. However, no assurance can be given in this regard because the determination of whether we will be or become a PFIC is a factual

determination made annually that will depend, in part, upon the composition of our income and assets, and we have not and will not obtain

an opinion of counsel regarding our classification as a PFIC. Fluctuations in the market price of our common shares may cause us to be

classified as a PFIC in any taxable year because the value of our assets for purposes of the asset test, including the value of our goodwill

and unbooked intangibles, may be determined by reference to the market price of our common shares from time to time (which may be volatile).

If our market capitalization subsequently declines, we may be or become classified as a PFIC for the 2024 taxable year or future taxable

years. Furthermore, the composition of our income and assets may also be affected by how, and how quickly, we use our liquid assets and

any future fundraising activity. Under circumstances where our revenues from activities that produce passive income significantly increases

relative to our revenues from activities that produce non-passive income, or where we determine not to deploy significant amounts of

cash for active purposes, our risk of becoming classified as a PFIC may substantially increase. It is also possible that the Internal

Revenue Service (the “IRS”) may challenge the classification or valuation of our Company’s assets, including its goodwill

and other unbooked intangibles, or the classification of certain amounts received by our Company, which may result in our Company being,

or becoming classified as, a PFIC for the 2024 taxable year or future taxable years. Accordingly, there can be no assurance that we will

not be a PFIC in the current or for any future taxable year and U.S. investors should invest in our common shares only if they are willing

to bear the U.S. federal income tax consequences associated with investments in PFICs.

If we were a PFIC for any taxable year during

which a U.S. investor held our common shares, certain adverse U.S. federal income tax consequences could apply to the U.S. Holder. See “Taxation—Material

U.S. Federal Income Tax Considerations for U.S. Holders.”

USE OF PROCEEDS

We may issue and sell common

shares having aggregate sales proceeds of up to $1,660,000 from time to time, before deducting sales commissions and estimated offering

expenses payable by us. The amount of proceeds from this offering, if any, will depend upon the number of our common shares sold and the

market price at which they are sold. There can be no assurance that we will be able to sell any shares under or fully utilize the Sales

Agreement with Wainwright. Because there is no minimum offering amount required as a condition to close this offering, the net proceeds

to us, if any, are not determinable at this time.

Except as otherwise provided

in any free writing prospectus that we may authorize to be provided to you, we will retain broad discretion over the use of the net proceeds,

if any, from the sale of the common shares offered by this prospectus supplement, and we may not use these proceeds in a manner desired

by our shareholders. We intend to use the net proceeds of our sale of common shares under this prospectus supplement, if any, for working

capital and general corporate purposes. Such purposes may include research and development expenditures and capital expenditures.

We may temporarily invest

funds that we do not immediately need for these purposes in investment securities or use them to make payments on our borrowings. All

expenses relating to an offering of common shares and any compensation paid to the sales agent, dealers or agents, as the case may be,

will be paid out of our general funds or from the proceeds of any offering under this prospectus supplement or the accompanying prospectus.

DIVIDEND POLICY

We have never paid a dividend,

and we do not anticipate paying dividends in the foreseeable future. We intend to retain all available funds and any future earnings

to fund the development and expansion of our business. As a result, investors in our common shares will benefit in the foreseeable future

only if our common shares appreciate in value.

Any future determination

to declare and pay dividends to holders of our common shares will be made at the discretion of our board of directors, which may take

into account several factors, including general economic conditions, our financial condition and results of operations, available cash

and current and anticipated cash needs, capital requirements, contractual, legal, tax and regulatory restrictions, the implications of

the payment of dividends by us to our shareholders and any other factors that our board of directors may deem relevant. In addition,

pursuant to the Companies Act, a company may not declare or pay dividends if there are reasonable grounds for believing that (1) the

company is, or would after the payment be, unable to pay its liabilities as they become due or (2) that the realizable value of its assets

would thereby be less than its liabilities. Under our bye-laws (the “Bye-laws”), each of our common shares is entitled to

dividends if, as and when dividends are declared by our board of directors, subject to any preferred dividend right of the holders of

any preferred shares.

We are a holding company

with no material direct operations. As a result, we would be dependent on dividends, other payments or loans from our subsidiaries in

order to pay a dividend. Our subsidiaries are subject to legal requirements of their respective jurisdictions of organization that may

restrict their paying dividends or other payments, or making loans, to us.

CONSOLIDATED CAPITALIZATION

The following table presents the number of our

issued and outstanding common shares and our consolidated cash and cash equivalents and capitalization (defined as loans, lease liabilities

and shareholders’ equity) as at June 30, 2023:

| |

● |

on

an actual basis; |

| |

|

|

| |

● |

on a pro forma basis to give effect to (i) the issuance and sale of

555,556 common shares or prefunded warrants (all of which were exercised as of November 16, 2023) for net proceeds of $4.1 million, pursuant

to a “reasonable best efforts offering” which closed on July 10, 2023; (ii) the repayment of the full balance of an aggregate

of CHF 950,000 of a loan we received pursuant to the loan agreement, as amended, among FiveT Investment Management Ltd. (“FiveT

IM”), Dominik Lysek and Thomas Meyer, the Company’s CEO, and the Company, dated September 9, 2022 (“September 2022 Loan”)

and the two separate loan agreements, as amended, entered into by the Company and, in each case, a private investor, dated December 28,

2022 (collectively, the “December 2022 Loans”), including accrued interest, in July 2023, (iii) the repayment of a convertible

loan we received pursuant to the loan agreement entered into by the Company with FiveT IM, dated May 1, 2023 (the “May 2023 Loan”),

including accrued interest, through cash amortizations of CHF 387,045.38 and the issuance of 443,294 common shares at a weighted average

conversion price of CHF 5.074; (iv) the issuance of 81,274 common shares in December 2023 to holders of certain of our common warrants

upon the exercise of such warrants at an exercise price of CHF 6.657 per share for aggregate net proceeds of CHF 541,034; and (v) the

issuance of an aggregate of 100,000 common shares at an average purchase price of $2.825 per share in January 2024 for aggregate net proceeds

of $282,500 under our equity line purchase agreement, dated December 5, 2022, with Lincoln Park Capital Fund, LLC (collectively, the “pro

forma events”); and |

| |

|

|

| |

● |

on a pro forma as adjusted basis to give effect to our issuance and

sale of $1,660,000 of common shares in this offering, at an assumed offering price of $2.71 per common share, which is the last reported

sale price of our common shares on The Nasdaq Capital Market on January 12, 2024, after deducting sales commissions and estimated offering

expenses payable by us. |

The amounts shown above

and below are unaudited. Investors should read this table in conjunction with our audited consolidated financial statements and related

notes as of and for the year ended December 31, 2022 and management’s discussion and analysis thereon, and with our unaudited consolidated

financial statements for the six-month periods ended June 30, 2023 and 2022, and management’s discussion and analysis thereon,

each as incorporated by reference into this prospectus supplement, as well as “Use of Proceeds” in this prospectus supplement.

U.S. dollar amounts have

been translated into Swiss Francs at a rate of CHF 0.8947 to USD 1.00, the official exchange rate quoted as of June 30, 2023 by the U.S.

Federal Reserve Bank. Such Swiss Franc amounts are not necessarily indicative of the amounts of Swiss Francs that could actually have

been purchased upon exchange of U.S. dollars on June 30, 2023 and have been provided solely for the convenience of the reader. On January

12, 2024, the exchange rate as reported by the U.S. Federal Reserve Bank was CHF 0.8523 to USD 1.00.

| | |

As of June 30, 2023 | |

| | |

Actual | | |

Pro Forma* | | |

Pro Forma*

As Adjusted | |

| | |

(in CHF, except for share amounts) | |

| Cash and cash equivalents | |

| 49,569 | | |

| 3,327,818 | | |

| 4,698,623 | |

| Loans | |

| 3,060,901 (1) | | |

| - | (2) | |

| - | (2) |

| Lease liabilities | |

| 406,037 | | |

| 406,037 | | |

| 406,037 | |

| Shareholders’ equity: | |

| | | |

| | | |

| | |

| Common shares, par value CHF 0.20 per share; 7,954,004 common

shares issued and outstanding on an actual basis (corresponding to 397,700 common shares post 2023 Reverse Share Split), 1,577,785

common shares issued and outstanding on a pro forma basis, 2,190,331 common shares issued and outstanding on a pro forma as adjusted

basis | |

| 1,590,801 | | |

| 2,823 | | |

| 3,919 | |

| Share premium | |

| 15,560,642 | | |

| 20,091,410 | | |

| 21,461,119 | |

| Other reserves | |

| 871,633 | | |

| 4,793,280 | | |

| 4,793,280 | |

| Accumulated deficit | |

| (19,847,641 | ) | |

| (20,372,928 | ) | |

| (20,372,928 | ) |

| Total shareholders’ (deficit)/equity attributable to owners of the company | |

| (1,824,565 | ) | |

| 4,514,585 | | |

| 5,885,390 | |

| Total capitalization | |

| 1,642,373 | | |

| 4,920,622 | | |

| 6,291,427 | |

| * | The above table does not include the impact of the partial spin-off

of the Company’s Bentrio business on November 21, 2023, which was realized through the sale of a 51% stake in the Company’s

subsidiary Altamira Medica AG (“Medica”). The Company received a cash consideration of CHF 2,040,000 and retained 49% of Medica’s

share capital. The transaction also included a cash contribution of CHF 1,000,000 by the two shareholders of Medica in proportion of their

shareholdings after closing. The transaction resulted in an accounting gain of approximately $5.2 million. Please reference our pro forma

financial statements as of June 30, 2023 included as Exhibit 99.1 to our Report of Foreign Private Issuer on Form 6-K, dated January 19,

2024, incorporated herein by reference. |

| (1) | Represents

the aggregate amounts outstanding under the September 2022 Loan, December 2022 Loans and May 2023 Loan as of June 30, 2023. |

| (2) | Represents

the repayment and termination of the September 2022 Loan, December 2022 Loans and May 2023 Loan subsequent to June 30, 2023. |

The above discussion and table are based on 397,700

common shares outstanding as of June 30, 2023 and excludes as of such date:

| |

● |

32,698 common shares issuable upon the exercise of options issued pursuant

to the Company’s equity incentive plan, outstanding as of June 30, 2023 at a weighted average exercise price of $108.28 per

common share; and |

| |

|

|

| |

● |

4,967 common shares issuable upon exercise of warrants outstanding

as of June 30, 2023 at a weighted average exercise price of $1,090.51 per common share. |

On December 13, 2023, we effected the 2023 Reverse Share Split. The

table above is presented on post-reverse split basis, except as otherwise noted.

DILUTION

If you invest in our common

shares, your interest will be diluted immediately to the extent of the difference between the price per share you pay in this offering

and the pro forma as-adjusted net tangible book value per common share after this offering.

The net tangible book value

(deficit) of our common shares as of June 30, 2023 was approximately $(6.4) million, or approximately $(16.07) per common share. Net

tangible book value per share represents the amount of our total tangible assets less total liabilities divided by the total number of

our common shares outstanding as of June 30, 2023.

After giving effect to the

pro forma events that occurred subsequent to June 30, 2023, our pro forma net tangible book value as of June 30, 2023, would have been

approximately $0.4 million, or approximately $0.26 per common share.

After giving further effect

to the assumed sale of our common shares in the aggregate amount of $1,660,000 in this offering at an assumed offering price of $2.71

per share, the last reported sale price of our common shares on the Nasdaq Capital Market on January 12, 2024 and after deducting sales

commissions and estimated offering expenses payable by us, our pro forma as adjusted net tangible book value as of June 30, 2023, would

have been approximately $1.9 million, or approximately $0.89 per share. This represents an immediate increase in net tangible book value

of $0.63 per share to our existing shareholders and an immediate dilution of approximately $1.82 per share to new investors participating

in this offering, as illustrated by the following table:

| Assumed offering price per share | |

| | | |

$ | 2.71 | |

| Net tangible book value per common share as of June 30, 2023 | |

$ | (16.07 | ) | |

| | |

| Increase in net tangible book value per common share attributable to the pro forma events | |

$ | 16.33 | | |

| | |

| Pro forma net tangible book value per share as of June 30, 2023 | |

$ | 0.26 | | |

| | |

| Increase in pro forma net tangible book value per share attributable to this offering | |

$ | 0.63 | | |

| | |

| Pro forma as adjusted net tangible book value per share as of June 30, 2023, after giving effect to this offering | |

| | | |

$ | 0.89 | |

| Dilution in net tangible book value per share to new investors participating in this offering | |

| | | |

$ | 1.82 | |

| * |

The above table does not include the impact of the partial spin-off of the Company’s Bentrio business on November 21, 2023, which was realized through the sale of a 51% stake in the Company’s subsidiary Altamira Medica AG (“Medica”). The Company received a cash consideration of CHF 2,040,000 and retained 49% of Medica’s share capital. The transaction also included a cash contribution of CHF 1,000,000 by the two shareholders of Medica in proportion of their shareholdings after closing. The transaction resulted in an accounting gain of approximately $5.2 million. Please reference our pro forma financial statements as of June 30, 2023 included as Exhibit 99.1 to our Report of Foreign Private Issuer on Form 6-K, dated January 19, 2024, incorporated herein by reference. |

The pro forma as adjusted

information is illustrative only and will adjust based on the actual price per share at the time of the sale, the actual number of shares

sold and other terms of the offering determined at the time common shares are sold pursuant to this prospectus supplement and the accompanying

prospectus. The pro forma as adjusted information assumes that all of our common shares in the aggregate amount of $1,660,000 are sold

at the assumed offering price of $2.71 per share, the last reported sale price of our common shares on the Nasdaq Capital Market on January

12, 2024. The shares sold in this offering, if any, will be sold from time to time at various prices.

The above discussion and

table are based on 397,700 common shares outstanding as of June 30, 2023 and excludes:

| |

● |

32,698 common shares issuable upon the exercise of options issued pursuant

to the Company’s equity incentive plan, outstanding as of June 30, 2023 at a weighted average exercise price of $108.28 per

common share; and |

| |

|

|

| |

● |

4,967 common shares issuable upon exercise of warrants outstanding

as of June 30, 2023 at a weighted average exercise price of $1,090.51 per common share. |

To the extent that outstanding

options or warrants are exercised, you may experience further dilution. In addition, we may choose to raise additional capital due to

market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans.

To the extent that additional capital is raised through the sale of equity exercisable into common shares or convertible debt securities,

the issuance of these securities may result in further dilution to our shareholders.

Swiss Franc amounts have

been translated into U.S. dollars at a rate of CHF 0.8947 to USD 1.00, the official exchange rate quoted as of June 30, 2023 by the U.S.

Federal Reserve Bank. Such U.S. dollar amounts are not necessarily indicative of the amounts of U.S. dollars that could actually have

been purchased upon exchange of Swiss Francs on June 30, 2023 and have been provided solely for the convenience of the reader. On January

12, 2024, the exchange rate as reported by the U.S. Federal Reserve Bank was CHF 0.8523 to USD 1.00.

On December 13, 2023, we effected the 2023 Reverse Share Split. The

above table and discussion are presented on post-2023 Reverse Share Split.

TAXATION

The following summary contains a description

of the material Bermuda and U.S. federal income tax consequences of the acquisition, ownership and disposition of common shares, but

it does not purport to be a comprehensive description of all the tax considerations that may be relevant to a decision to purchase common

shares. The summary is based upon the tax laws of Bermuda and regulations thereunder and on the tax laws of the United States and regulations

thereunder as of the date hereof, which are subject to change.

Bermuda Tax Considerations

At the present time, there

is no Bermuda income or profits tax, withholding tax, capital gains tax, capital transfer tax, estate duty or inheritance tax payable

by us or by our shareholders in respect of our shares. On December 27, 2023, Bermuda enacted the Corporate Income Tax Act 2023 (the “CIT

Act”). The CIT Act provides for the taxation of the Bermuda constituent entities of multi-national groups that have in excess of

EUR 750 million revenue for at least two of the last four fiscal years beginning on or after January 1, 2025. We have obtained an assurance

from the Minister of Finance of Bermuda under the Exempted Undertakings Tax Protection Act 1966 that, in the event that any legislation

is enacted in Bermuda imposing any tax computed on profits or income, or computed on any capital asset, gain or appreciation or any tax

in the nature of estate duty or inheritance tax, such tax shall not, until March 31, 2035, be applicable to us or to any of our operations

or to our shares, debentures or other obligations except insofar as such tax applies to persons ordinarily resident in Bermuda or is payable

by us in respect of real property owned or leased by us in Bermuda.

Material U.S. Federal Income Tax Considerations

for U.S. Holders

The following is a description of the material

U.S. federal income tax consequences relating to the acquisition, ownership and disposition of our common shares by a U.S. Holder (defined

below), but it does not purport to be a comprehensive description of all tax considerations that may be relevant to a particular person’s

decision to acquire the common shares. This discussion addresses only the U.S. federal income tax consequences to U.S. Holders that are

initial purchasers of our common shares and that will hold such common shares as capital assets for U.S. federal income tax purposes.

In addition, it does not describe all of the tax consequences that may be relevant in light of a U.S. Holder’s particular circumstances,

including alternative minimum tax consequences, the potential application of certain provisions of the Internal Revenue Code of 1986,

as amended (the “Code”) and tax consequences applicable to U.S. Holders subject to special rules, including, without limitation:

| |

● |

banks, certain

financial institutions and insurance companies; |

| |

● |

brokers, dealers or traders in securities or persons who use a mark-to-market method of tax accounting;

|

| |

● |

persons holding common

shares as part of a straddle, wash sale, or conversion transaction or persons entering into a constructive sale with respect to the

common shares; |

| |

● |

persons whose

functional currency for U.S. federal income tax purposes is not the U.S. dollar; |

| |

● |

entities classified

as partnerships for U.S. federal income tax purposes and other pass-through entities, and investors in such pass-through entities; |

| |

● |

tax-exempt

entities, including an “individual retirement account” or “Roth IRA”; |

| |

● |

persons that

own or are deemed to own ten percent or more of the vote or value of our shares; |

| |

● |

persons who

acquired our common shares pursuant to the exercise of an employee stock option or otherwise as compensation; or |

| |

● |

persons holding

common shares in connection with a trade or business conducted outside of the United States. |

If an entity that is classified as a partnership

for U.S. federal income tax purposes holds common shares, the U.S. federal income tax treatment of a partner will generally depend on

the status of the partner and the activities of the partnership. Partnerships or other pass-through entities holding common shares and

partners in such partnerships or other pass-through entities should consult their tax advisers as to their particular U.S. federal income

tax consequences of holding and disposing of the common shares through a partnership or other pass-through entity, as applicable.

This discussion is based on the Code, administrative

pronouncements, judicial decisions and final, temporary and proposed Treasury regulations, all as of the date hereof, any of which is

subject to change, possibly with retroactive effect.

A “U.S. Holder” is a beneficial owner

of common shares that is, for U.S. federal income tax purposes:

| |

● |

an individual

who is a citizen or resident of the United States; |

| |

● |

a corporation,

or other entity taxable as a corporation for U.S. federal income tax purposes, created or organized in or under the laws of the United

States, any state therein or the District of Columbia; or |

| |

● |

an estate,

the income of which is subject to U.S. federal income taxation regardless of its source; or |

| |

● |

a trust with

respect to which a U.S. court is able to exercise primary supervision over its administration and one or more U.S. persons have the

authority to control all of its substantial decisions, or that has a valid election in effect to be treated as a U.S. person under

applicable U.S. Treasury Regulations. |

U.S. Holders should consult their tax advisers

concerning the U.S. federal, state, local and non-U.S. tax consequences of purchasing, owning and disposing of common shares in their

particular circumstances.

Passive Foreign Investment Company Rules

Special U.S. tax rules apply to U.S. Holders

of stock in a company that is considered to be a PFIC. In general, a non-U.S. corporation will be considered a PFIC for any taxable year

in which (i) 75% or more of its gross income consists of passive income or (ii) 50% or more of the average quarterly value of its assets

consists of assets that produce, or are held for the production of, passive income. For purposes of the above calculations, a non-U.S.

corporation that directly or indirectly owns at least 25% by value of the shares of another corporation is treated as if it held its

proportionate share of the assets of the other corporation and received directly its proportionate share of the income of the other corporation.

Passive income generally includes dividends, interest, rents, royalties and capital gains. Cash is a passive asset for PFIC purposes.

Based upon our current and projected income and

assets, and projections as to the value of our assets, we do not anticipate that we will be a PFIC for the 2024 taxable year. However,

there can be no assurance that the IRS will agree with our conclusion and that the IRS would not successfully challenge our position.

Furthermore, there can be no assurance regarding our PFIC status for the current year or any particular year in the future because PFIC

status is factual in nature, depends upon factors not wholly within our control, generally cannot be determined until the close of the

taxable year in question and is determined annually. Our status as a PFIC will depend on the nature and composition of our income and

the nature, composition and value of our assets (which may be determined based on the fair market value of each asset, with the value

of goodwill and going concern value being determined in large part by reference to the market value of our common shares, which may be

volatile). Our status may also depend, in part, on how quickly we utilize the cash proceeds from our fundraising activities in our business.

Accordingly, there can be no assurance that we will not be a PFIC in the current year or for any future taxable year. Therefore, U.S.

Holders should invest in our common shares only if they are willing to bear the U.S. federal income tax consequences associated with

investments in PFICs.

If we are a PFIC for any taxable year and any

of our non-U.S. subsidiaries or other companies in which we own equity interests were also a PFIC (any such entity, a “Lower-tier

PFIC”), under attribution rules, U.S. Holders will be deemed to own their proportionate shares of each Lower-tier PFIC and will

be subject to U.S. federal income tax according to the rules described in the following paragraphs on (i) certain distributions by a

Lower-tier PFIC and (ii) a disposition of shares of a Lower-tier PFIC, in each case as if the U.S. Holder held such shares directly,

even if the U.S. Holder has not received the proceeds of those distributions or dispositions.

Generally, if we are a PFIC for any taxable year

during which a U.S. Holder holds our common shares, the U.S. Holder may be subject to certain adverse tax consequences. Unless a U.S.

Holder makes a timely “mark-to-market” election or “qualified electing fund” election, each as discussed below,

gain recognized on a disposition (including, under certain circumstances, a pledge) of common shares by the U.S. Holder, or on an indirect

disposition of shares of a Lower-tier PFIC, will be allocated ratably over the U.S. Holder’s holding period for the common shares.

The amounts allocated to the taxable year of disposition and to the years before we became a PFIC, if any, will be taxed as ordinary

income. The amounts allocated to each other taxable year will be subject to tax at the highest rate in effect for that taxable year for

individuals or corporations, as appropriate, and an interest charge will be imposed on the tax attributable to the allocated amounts.

Further, to the extent that any distribution received by a U.S. Holder on our common shares, to the extent applicable, (or a distribution

by a Lower-tier PFIC to its shareholder that is deemed to be received by a U.S. Holder) exceeds 125% of the average of the annual distributions

on the shares received during the preceding three years or the U.S. Holder’s holding period, whichever is shorter, the distribution

will be subject to taxation in the same manner as gain, described immediately above.

If we are a PFIC for any year during which a

U.S. Holder holds common shares, we generally will continue to be treated as a PFIC with respect to such U.S. Holder for all succeeding

years during which the U.S. Holder holds common shares, even if we cease to meet the threshold requirements for PFIC status. U.S. Holders

should consult their tax advisers regarding the potential availability of a “deemed sale” election that would allow them

to eliminate this continuing PFIC status under certain circumstances.

If we are a PFIC and our common shares are “regularly

traded” on a “qualified exchange,” a U.S. Holder may make a mark-to-market election with respect to the shares that

would result in tax treatment different from the general tax treatment for PFICs described above. Our common shares will be treated as

“regularly traded” in any calendar year in which more than a de minimis quantity of the common shares is traded on a qualified

exchange on at least 15 days during each calendar quarter. Nasdaq, on which the common shares are currently listed, is a qualified exchange