As filed with the U.S. Securities and Exchange Commission on January 19, 2024

File No. 333-182274

File No.: 811-22310

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

| | | | | |

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | [X] |

Pre-Effective Amendment No. | [ ] |

Post-Effective Amendment No. 156 | [X] |

| and/or | |

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | [X] |

Amendment No. 158 | [X] |

ETF MANAGERS TRUST

(Exact Name of Registrant as Specified in Charter)

350 Springfield Avenue, Suite #200

Summit, New Jersey 07901

(Address of Principal Executive Offices, Zip Code)

(Registrant’s Telephone Number, including Area Code)

(877) 756-7873

Corporation Service Company

2711 Centerville Road, Suite 400

Wilmington, DE 19808

(Name and Address of Agent for Service)

Copy to:

Eric Simanek, Esq

Eversheds Sutherland (US) LLP

700 6th St NW

Washington, DC 20001

This Post-Effective Amendment consists of the following:

1.Facing Sheet of the Registration Statement.

2.Explanatory Note.

3.Part C to the Registration Statement (including signature page) and certain exhibits to the Registration Statement.

Explanatory Note: This Post-Effective Amendment is being filed solely for the purpose of filing exhibits to the Registration Statement on Form N-1A. Parts A and B of Post-Effective Amendment No. 154 to the Registration Statement on Form N-1A filed on January 26, 2023 pursuant to Rule 485(b) under the Securities Act of 1933, as amended, are incorporated by reference herein.

PART C: OTHER INFORMATION

ETF Managers Trust

ITEM 28. EXHIBITS

| | | | | | | | | | | |

| (a) | (1) | | |

| (2) | | |

| (3) | | |

| (4) | | |

| (5) | | Amendment No. 2 dated January 12, 2024 to the Registrant’s Agreement and Declaration of Trust, adopted June 30, 2009. – Filed Herewith. |

| (b) | (1) | | |

| (2) | | Amendment dated January 12, 2024 to the Registrant’s By-Laws, adopted October 1, 2012. – Filed Herewith. |

| (c) | | | Not applicable. |

| (d) | (1) | | |

| (2) | | |

| (3) | | |

| (4) | | |

| (e) | | | Form of ETF Distribution Agreement between the ETF Managers Group LLC and Foreside Fund Services, LLC. – Filed Herewith. |

| (f) | | | Not applicable. |

| (g) | (1) | (a) | |

| | (b) | |

| (h) | (1) | (a) | |

| | (b) | |

| (2) | | |

| | | | | | | | | | | |

| (3) | (a) | |

| | (b) | |

| | (c) | |

| | (d) | |

| | (e) | |

| (i) | (1) | | |

| (2) | | |

| (3) | | |

| (4) | | |

| (5) | | |

| (6) | | |

| (7) | | |

| (8) | | |

| (9) | | |

| (10) | | |

| (j) | | | Consent of independent registered public accounting firm – Not Applicable to This Filing. |

| (k) | | | Not applicable. |

| (l) | | | Not applicable. |

| (m) | | | |

| | | | | | | | | | | |

| (n) | | | Not applicable. |

| (o) | | | Not applicable. |

| (p) | (1) | | |

| (2) | | |

| (3) | | Code of Ethics for Principal Underwriter – not applicable per Rule 17j-1(c)(3). |

| (q) | (1) | | |

| (2) | | |

| (3) | | |

ITEM 29. PERSONS CONTROLLED BY OR UNDER COMMON CONTROL WITH THE REGISTRANT

Not Applicable.

ITEM 30. INDEMNIFICATION

The Trustees shall not be responsible or liable in any event for any neglect or wrongdoing of any officer, agent, employee, adviser or principal underwriter of the Trust, nor shall any Trustee be responsible for the act or omission of any other Trustee, and, subject to the provisions of the By-Laws, the Trust out of its assets may indemnify and hold harmless each and every Trustee and officer of the Trust from and against any and all claims, demands, costs, losses, expenses, and damages whatsoever arising out of or related to such Trustee’s or officer’s performance of his or her duties as a Trustee or officer of the Trust; provided that nothing herein contained shall indemnify, hold harmless or protect any Trustee or officer from or against any liability to the Trust or any Shareholder to which he or she would otherwise be subject by reason of willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his or her office.

Every note, bond, contract, instrument, certificate or undertaking and every other act or thing whatsoever issued, executed or done by or on behalf of the Trust or the Trustees or any of them in connection with the Trust shall be conclusively deemed to have been issued, executed or done only in or with respect to their or his or her capacity as Trustees or Trustee, and such Trustees or Trustee shall not be personally liable thereon.

Insofar as indemnification for liability arising under the Securities Act of 1933 (the “Securities Act”) may be permitted to Trustees, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such Trustee, officer, or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

ITEM 31. BUSINESS AND OTHER CONNECTIONS OF THE INVESTMENT ADVISER

ETF Managers Group LLC (the “Adviser”) serves as the investment adviser for each series of the Trust. The principal address of the Adviser is 30 Maple Street, 2nd Floor, Summit, New Jersey 07901.

EquBot LLC serves as investment sub-adviser for the AI Powered Equity ETF. The principal address of EquBot LLC is 450 Townsend Street, San Francisco, California 94107.

Each of the above entities is an investment adviser registered with the SEC under the Investment Advisers Act of 1940.

This Item incorporates by reference each firm’s Uniform Application for Investment Adviser Registration (“Form ADV”) on file with the SEC, as listed below. The Form ADV may be obtained, free of charge, at the SEC’s website at www.adviserinfo.sec.gov. Additional information as to any other business, profession, vocation or employment of a substantial nature engaged in by each officer and director of the firms below is included in the Trust’s Statement of Additional Information.

| | | | | |

| Investment Adviser | SEC File No. |

| ETF Managers Group LLC | 801-107165 |

| EquBot LLC | 801-110987 |

Item 32. Principal Underwriter.

(a) Foreside Fund Services, LLC (the “Distributor”) serves as principal underwriter for the following investment companies registered under the Investment Company Act of 1940, as amended:

1.AB Active ETFs, Inc.

2.ABS Long/Short Strategies Fund

3.Absolute Shares Trust

4.ActivePassive Core Bond ETF, Series of Trust for Professional Managers

5.ActivePassive Intermediate Municipal Bond ETF, Series of Trust for Professional Managers

6.ActivePassive International Equity ETF, Series of Trust for Professional Managers

7.ActivePassive U.S. Equity ETF, Series of Trust for Professional Managers

8.Adaptive Core ETF, Series of Collaborative Investment Series Trust

9.AdvisorShares Trust

10.AFA Multi-Manager Credit Fund

11.AGF Investments Trust

12.AIM ETF Products Trust

13.Alexis Practical Tactical ETF, Series of Listed Funds Trust

14.AlphaCentric Prime Meridian Income Fund

15.American Century ETF Trust

16.Amplify ETF Trust

17.Applied Finance Core Fund, Series of World Funds Trust

18.Applied Finance Explorer Fund, Series of World Funds Trust

19.Applied Finance Select Fund, Series of World Funds Trust

20.ARK ETF Trust

21.ARK Venture Fund

22.B.A.D. ETF, Series of Listed Funds Trust

23.Bitwise Funds Trust

24.Bluestone Community Development Fund

25.BondBloxx ETF Trust

26.Bramshill Multi-Strategy Income Fund, Series of Investment Managers Series Trust

27.Bridgeway Funds, Inc.

28.Brinker Capital Destinations Trust

29.Brookfield Real Assets Income Fund Inc.

30.Build Funds Trust

31.Calamos Convertible and High Income Fund

32.Calamos Convertible Opportunities and Income Fund

33.Calamos Dynamic Convertible and Income Fund

34.Calamos ETF Trust

35.Calamos Global Dynamic Income Fund

36.Calamos Global Total Return Fund

37.Calamos Strategic Total Return Fund

38.Carlyle Tactical Private Credit Fund

39.Cboe Vest Bitcoin Strategy Managed Volatility Fund, Series of World Funds Trust

40.Cboe Vest S&P 500® Dividend Aristocrats Target Income Fund, Series of World Funds Trust

41.Cboe Vest US Large Cap 10% Buffer Strategies Fund, Series of World Funds Trust

42.Cboe Vest US Large Cap 10% Buffer VI Fund, Series of World Funds Trust

43.Cboe Vest US Large Cap 20% Buffer Strategies Fund, Series of World Funds Trust

44.Cboe Vest US Large Cap 20% Buffer VI Fund, Series of World Funds Trust

45.Center Coast Brookfield MLP & Energy Infrastructure Fund

46.Clifford Capital Focused Small Cap Value Fund, Series of World Funds Trust

47.Clifford Capital International Value Fund, Series of World Funds Trust

48.Clifford Capital Partners Fund, Series of World Funds Trust

49.Cliffwater Corporate Lending Fund

50.Cliffwater Enhanced Lending Fund

51.Cohen & Steers Infrastructure Fund, Inc.

52.Convergence Long/Short Equity ETF, Series of Trust for Professional Managers

53.CornerCap Small-Cap Value Fund, Series of Managed Portfolio Series

54.CrossingBridge Pre-Merger SPAC ETF, Series of Trust for Professional Managers

55.Curasset Capital Management Core Bond Fund, Series of World Funds Trust

56.Curasset Capital Management Limited Term Income Fund, Series of World Funds Trust

57.Davis Fundamental ETF Trust

58.Defiance Daily Short Digitizing the Economy ETF, Series of ETF Series Solutions

59.Defiance Hotel, Airline, and Cruise ETF, Series of ETF Series Solutions

60.Defiance Next Gen Connectivity ETF, Series of ETF Series Solutions

61.Defiance Next Gen H2 ETF, Series of ETF Series Solutions

62.Defiance Pure Electric Vehicle ETF, Series of ETF Series Solutions

63.Defiance Quantum ETF, Series of ETF Series Solutions

64.Direxion Funds

65.Direxion Shares ETF Trust

66.Dividend Performers ETF, Series of Listed Funds Trust

67.Dodge & Cox Funds

68.DoubleLine ETF Trust

69.DoubleLine Income Solutions Fund

70.DoubleLine Opportunistic Credit Fund

71.DoubleLine Yield Opportunities Fund

72.DriveWealth ETF Trust

73.EIP Investment Trust

74.Ellington Income Opportunities Fund

75.ETF Managers Trust

76.ETF Opportunities Trust

77.Evanston Alternative Opportunities Fund

78.Exchange Listed Funds Trust

79.FlexShares Trust

80.Forum Funds

81.Forum Funds II

82.Forum Real Estate Income Fund

83.Goose Hollow Enhanced Equity ETF, Series of Collaborative Investment Series Trust

84.Goose Hollow Multi-Strategy Income ETF, Series of Collaborative Investment Series Trust

85.Goose Hollow Tactical Allocation ETF, Series of Collaborative Investment Series Trust

86.Grayscale Future of Finance ETF, Series of ETF Series Solutions

87.Guinness Atkinson Funds

88.Harbor ETF Trust

89.Horizon Kinetics Blockchain Development ETF, Series of Listed Funds Trust

90.Horizon Kinetics Energy and Remediation ETF, Series of Listed Funds Trust

91.Horizon Kinetics Inflation Beneficiaries ETF, Series of Listed Funds Trust

92.Horizon Kinetics Medical ETF, Series of Listed Funds Trust

93.Horizon Kinetics SPAC Active ETF, Series of Listed Funds Trust

94.IDX Funds

95.Innovator ETFs Trust

96.Ironwood Institutional Multi-Strategy Fund LLC

97.Ironwood Multi-Strategy Fund LLC

98.John Hancock Exchange-Traded Fund Trust

99.LDR Real Estate Value-Opportunity Fund, Series of World Funds Trust

100.Mairs & Power Balanced Fund, Series of Trust for Professional Managers

101.Mairs & Power Growth Fund, Series of Trust for Professional Managers

102.Mairs & Power Minnesota Municipal Bond ETF, Series of Trust for Professional Managers

103.Mairs & Power Small Cap Fund, Series of Trust for Professional Managers

104.Manor Investment Funds

105.Merk Stagflation ETF, Series of Listed Funds Trust

106.Milliman Variable Insurance Trust

107.Mindful Conservative ETF, Series of Collaborative Investment Series Trust

108.Moerus Worldwide Value Fund, Series of Northern Lights Fund Trust IV

109.Mohr Growth ETF, Series of Collaborative Investment Series Trust

110.Mohr Sector Nav ETF, Series of Collaborative Investment Series Trust

111.Morgan Stanley ETF Trust

112.Morningstar Funds Trust

113.Mutual of America Investment Corporation

114.NEOS ETF Trust

115.North Square Investments Trust

116.OTG Latin American Fund, Series of World Funds Trust

117.Overlay Shares Core Bond ETF, Series of Listed Funds Trust

118.Overlay Shares Foreign Equity ETF, Series of Listed Funds Trust

119.Overlay Shares Hedged Large Cap Equity ETF, Series of Listed Funds Trust

120.Overlay Shares Large Cap Equity ETF, Series of Listed Funds Trust

121.Overlay Shares Municipal Bond ETF, Series of Listed Funds Trust

122.Overlay Shares Short Term Bond ETF, Series of Listed Funds Trust

123.Overlay Shares Small Cap Equity ETF, Series of Listed Funds Trust

124.Palmer Square Opportunistic Income Fund

125.Partners Group Private Income Opportunities, LLC

126.Performance Trust Mutual Funds, Series of Trust for Professional Managers

127.Perkins Discovery Fund, Series of World Funds Trust

128.Philotimo Focused Growth and Income Fund, Series of World Funds Trust

129.Plan Investment Fund, Inc.

130.PMC Core Fixed Income Fund, Series of Trust for Professional Managers

131.PMC Diversified Equity Fund, Series of Trust for Professional Managers

132.Point Bridge America First ETF, Series of ETF Series Solutions

133.Preferred-Plus ETF, Series of Listed Funds Trust

134.Putnam ETF Trust

135.Quaker Investment Trust

136.Rareview Dynamic Fixed Income ETF, Series of Collaborative Investment Series Trust

137.Rareview Inflation/Deflation ETF, Series of Collaborative Investment Series Trust

138.Rareview Systematic Equity ETF, Series of Collaborative Investment Series Trust

139.Rareview Tax Advantaged Income ETF, Series of Collaborative Investment Series Trust

140.Renaissance Capital Greenwich Funds

141.Reynolds Funds, Inc.

142.RiverNorth Enhanced Pre-Merger SPAC ETF, Series of Listed Funds Trust

143.RiverNorth Patriot ETF, Series of Listed Funds Trust

144.RMB Investors Trust

145.Robinson Opportunistic Income Fund, Series of Investment Managers Series Trust

146.Robinson Tax Advantaged Income Fund, Series of Investment Managers Series Trust

147.Roundhill Alerian LNG ETF, Series of Listed Funds Trust

148.Roundhill Ball Metaverse ETF, Series of Listed Funds Trust

149.Roundhill BIG Bank ETF, Series of Listed Funds Trust

150.Roundhill Cannabis ETF, Series of Listed Funds Trust

151.Roundhill ETF Trust

152.Roundhill IO Digital Infrastructure ETF, Series of Listed Funds Trust

153.Roundhill Magnificent Seven ETF, Series of Listed Funds Trust

154.Roundhill MEME ETF, Series of Listed Funds Trust

155.Roundhill S&P Global Luxury ETF, Series of Listed Funds Trust

156.Roundhill Sports Betting & iGaming ETF, Series of Listed Funds Trust

157.Roundhill Video Games ETF, Series of Listed Funds Trust

158.Rule One Fund, Series of World Funds Trust

159.Securian AM Real Asset Income Fund, Series of Investment Managers Series Trust

160.Six Circles Trust

161.Sound Shore Fund, Inc.

162.SP Funds Trust

163.Sparrow Funds

164.Spear Alpha ETF, Series of Listed Funds Trust

165.STF Tactical Growth & Income ETF, Series of Listed Funds Trust

166.STF Tactical Growth ETF, Series of Listed Funds Trust

167.Strategic Trust

168.Strategy Shares

169.Swan Hedged Equity US Large Cap ETF, Series of Listed Funds Trust

170.Syntax ETF Trust

171.Tekla World Healthcare Fund

172.Tema ETF Trust

173.Teucrium Agricultural Strategy No K-1 ETF, Series of Listed Funds Trust

174.Teucrium AiLA Long-Short Agriculture Strategy ETF, Series of Listed Funds Trust

175.Teucrium AiLA Long-Short Base Metals Strategy ETF, Series of Listed Funds Trust

176.The 2023 ETF Series Trust

177.The 2023 ETF Series Trust II

178.The Community Development Fund

179.The Finite Solar Finance Fund

180.The Private Shares Fund

181.The SPAC and New Issue ETF, Series of Collaborative Investment Series Trust

182.Third Avenue Trust

183.Third Avenue Variable Series Trust

184.Tidal ETF Trust

185.Tidal Trust II

186.TIFF Investment Program

187.Timothy Plan High Dividend Stock Enhanced ETF, Series of The Timothy Plan

188.Timothy Plan High Dividend Stock ETF, Series of The Timothy Plan

189.Timothy Plan International ETF, Series of The Timothy Plan

190.Timothy Plan Market Neutral ETF, Series of The Timothy Plan

191.Timothy Plan US Large/Mid Cap Core ETF, Series of The Timothy Plan

192.Timothy Plan US Large/Mid Core Enhanced ETF, Series of The Timothy Plan

193.Timothy Plan US Small Cap Core ETF, Series of The Timothy Plan

194.Total Fund Solution

195.Touchstone ETF Trust

196.TrueShares Eagle Global Renewable Energy Income ETF, Series of Listed Funds Trust

197.TrueShares Low Volatility Equity Income ETF, Series of Listed Funds Trust

198.TrueShares Structured Outcome (April) ETF, Series of Listed Funds Trust

199.TrueShares Structured Outcome (August) ETF, Series of Listed Funds Trust

200.TrueShares Structured Outcome (December) ETF, Series of Listed Funds Trust

201.TrueShares Structured Outcome (February) ETF, Series of Listed Funds Trust

202.TrueShares Structured Outcome (January) ETF, Series of Listed Funds Trust

203.TrueShares Structured Outcome (July) ETF, Series of Listed Funds Trust

204.TrueShares Structured Outcome (June) ETF, Series of Listed Funds Trust

205.TrueShares Structured Outcome (March) ETF, Series of Listed Funds Trust

206.TrueShares Structured Outcome (May) ETF, Listed Funds Trust

207.TrueShares Structured Outcome (November) ETF, Series of Listed Funds Trust

208.TrueShares Structured Outcome (October) ETF, Series of Listed Funds Trust

209.TrueShares Structured Outcome (September) ETF, Series of Listed Funds Trust

210.TrueShares Technology, AI & Deep Learning ETF, Series of Listed Funds Trust

211.U.S. Global Investors Funds

212.Union Street Partners Value Fund, Series of World Funds Trust

213.Variant Alternative Income Fund

214.Variant Impact Fund

215.VictoryShares Core Intermediate Bond ETF, Series of Victory Portfolios II

216.VictoryShares Core Plus Intermediate Bond ETF, Series of Victory Portfolios II

217.VictoryShares Corporate Bond ETF, Series of Victory Portfolios II

218.VictoryShares Developed Enhanced Volatility Wtd ETF, Series of Victory Portfolios II

219.VictoryShares Dividend Accelerator ETF, Series of Victory Portfolios II

220.VictoryShares Emerging Markets Value Momentum ETF, Series of Victory Portfolios II

221.VictoryShares Free Cash Flow ETF, Series of Victory Portfolios II

222.VictoryShares International High Div Volatility Wtd ETF, Series of Victory Portfolios II

223.VictoryShares International Value Momentum ETF, Series of Victory Portfolios II

224.VictoryShares International Volatility Wtd ETF, Series of Victory Portfolios II

225.VictoryShares NASDAQ Next 50 ETF, Series of Victory Portfolios II

226.VictoryShares Short-Term Bond ETF, Series of Victory Portfolios II

227.VictoryShares THB Mid Cap ESG ETF, Series of Victory Portfolios II

228.VictoryShares US 500 Enhanced Volatility Wtd ETF, Series of Victory Portfolios II

229.VictoryShares US 500 Volatility Wtd ETF, Series of Victory Portfolios II

230.VictoryShares US Discovery Enhanced Volatility Wtd ETF, Series of Victory Portfolios II

231.VictoryShares US EQ Income Enhanced Volatility Wtd ETF, Series of Victory Portfolios II

232.VictoryShares US Large Cap High Div Volatility Wtd ETF, Series of Victory Portfolios II

233.VictoryShares US Multi-Factor Minimum Volatility ETF, Series of Victory Portfolios II

234.VictoryShares US Small Cap High Div Volatility Wtd ETF, Series of Victory Portfolios II

235.VictoryShares US Small Cap Volatility Wtd ETF, Series of Victory Portfolios II

236.VictoryShares US Small Mid Cap Value Momentum ETF, Series of Victory Portfolios II

237.VictoryShares US Value Momentum ETF, Series of Victory Portfolios II

238.VictoryShares WestEnd US Sector ETF, Series of Victory Portfolios II

239.Volatility Shares Trust

240.West Loop Realty Fund, Series of Investment Managers Series Trust

241.Wilshire Mutual Funds, Inc.

242.Wilshire Variable Insurance Trust

243.WisdomTree Digital Trust

244.WisdomTree Trust

245.WST Investment Trust

246.XAI Octagon Floating Rate & Alternative Income Term Trust

(b) The following are the Officers and Manager of the Distributor, the Registrant’s underwriter. The Distributor’s main business address is Three Canal Plaza, Suite 100, Portland, Maine 04101.

| | | | | | | | | | | |

| Name | Address | Position with Underwriter | Position with Registrant |

| Teresa Cowan | 111 E. Kilbourn Ave, Suite 2200, Milwaukee, WI 53202 | President/Manager | None |

Chris Lanza | Three Canal Plaza, Suite 100, Portland, ME 04101 | Vice President | None |

| Kate Macchia | Three Canal Plaza, Suite 100, Portland, ME 04101 | Vice President | None |

| Nanette K. Chern | Three Canal Plaza, Suite 100, Portland, ME 04101 | Vice President and Chief Compliance Officer | None |

Kelly B. Whetstone | Three Canal Plaza, Suite 100, Portland, ME 04101 | Secretary | None |

| Susan L. LaFond | 111 E. Kilbourn Ave, Suite 2200, Milwaukee, WI 53202 | Treasurer | None |

| Weston Sommers | Three Canal Plaza, Suite 100, Portland, ME 04101 | Financial and Operations Principal and Chief Financial Officer | None |

(c) Not applicable.

ITEM 33. LOCATION OF ACCOUNTS AND RECORDS:

State the name and address of each person maintaining principal possession of each account, book or other document required to be maintained by section 31(a) of the 1940 Act Section 15 U.S.C. 80a-30(a) and the rules under that section.

All accounts, books, and other documents required to be maintained by Section 31(a) of the Investment Company Act of 1940, as amended, and the rules promulgated thereunder are maintained at the following offices:

| | | | | |

(a) Registrant: | ETF Managers Trust 30 Maple Street, 2nd Floor Summit, New Jersey 07901

|

(b) Adviser: | ETF Managers Group 30 Maple Street, 2nd Floor Summit, New Jersey 07901

|

(c) Sub-Adviser | EquBot, Inc. 450 Townsend Street San Francisco, California 94107

|

(e) Principal Underwriter: | Foreside Fund Services, LLC Three Canal Plaza, Suite 100, Portland, Maine 04101

|

(f) Custodian: | U.S. Bank National Association Custody Operations 1555 North Rivercenter Drive, Suite 302 Milwaukee, Wisconsin 53212 |

ITEM 34. MANAGEMENT SERVICES

Not Applicable.

ITEM 35. UNDERTAKINGS

Not Applicable.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933 and the Investment Company Act of 1940, the Trust has duly caused this Amendment to be signed below on its behalf by the undersigned, duly authorized, in the City of Summit, State of New Jersey, on January 19, 2024.

| | | | | | | | | | | |

| ETF Managers Trust |

| | |

| By: | /s/ Michael Minella | |

| | Michael Minella |

| | President |

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed below by the following persons in the capacity indicated on January 19, 2024.

| | | | | | | | | | | |

| Signature | | Title | |

| | |

| /s/ Michael Minella | | President (principal executive officer) |

| Michael Minella | | |

| | |

| /s/ John A. Flanagan | | Treasurer (principal financial officer and principal accounting officer) |

| John A. Flanagan | | |

| | |

| Terry Loebs* | | Trustee |

| Terry Loebs | | |

| | |

| Eric Weigel* | | Trustee |

| Eric Weigel | | |

| | | | | |

| /s/ Matthew Bromberg | |

| *Matthew Bromberg, Power of Attorney |

|

INDEX TO EXHIBITS

| | | | | |

| Exhibit Number | Description |

| (a)(5) | |

| (b)(2) | |

| (e) | |

| (m) | |

AMENDMENT NO. 2 TO

AGREEMENT AND DECLARATION OF TRUST OF

ETF MANAGERS TRUST

This Amendment No. 2 dated as of January 12, 2024 (herein called the “Amendment”) to that certain Agreement and Declaration of Trust of ETF Managers Trust, a Delaware statutory trust formerly known as FactorShares Trust (the “Trust”), adopted June 30, 2009, as amended as of September 24, 2009 and June 20, 2016 (as amended, supplemented, or otherwise modified, the “Trust Agreement”), by the Trustees thereunder, and by the holders of Shares to be issued by the Trust, is hereby made and entered into by the undersigned Board of Trustees. Capitalized terms used herein without definition shall have the meanings given to them in the Trust Agreement.

RECITALS

WHEREAS, the Board of Trustees desires to amend the Trust Agreement upon the terms and conditions set forth below;

WHEREAS, the Trust Agreement may be restated and/or amended at any time by an instrument in writing signed by not less than a majority of the Board of Trustees, and, to the extent required by the Trust Agreement, the 1940 Act or the requirements of any securities exchange on which Shares are listed for trading, by approval of such amendment by the Shareholders in accordance with Article III, Section 6 and Article V of the Trust agreement; and

WHEREAS, none of the Trust Agreement, the 1940 Act nor the securities exchange on which the Shares are listed for trading require approval of the Amendment by the Shareholders.

NOW, THEREFORE, the Board of Trustees hereby amends the Trust Agreement, pursuant to Article IX, Section 1 thereof, as hereinafter set forth.

1.Amendment to the Trust Agreement.

Article V, Section 4(a) of the Trust Agreement is hereby amended and restated in its entirety to read as follows:

“(a) For purposes of determining the Shareholders entitled to notice of, and to vote at, any meeting of Shareholders, the Board of Trustees may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted by the Board of Trustees, and which record date shall not be more than one hundred and twenty (120) days nor less than ten (10) days before the date of any such meeting. A determination of Shareholders of record entitled to notice of or to vote at a meeting of Shareholders shall continue to apply to any adjournment of the meeting. Any meeting of Shareholders may be adjourned from time to time, provided that any adjournment of such meeting does not result in the meeting being held later than one hundred and eighty (180) days from the initial record date adopted by the Board of Trustees in connection with the original meeting. The Board of Trustees may fix a new record date for the adjourned meeting, and shall fix a new record date for any meeting that is adjourned for more than one hundred and eighty (180) days from the initial record date. For purposes of determining the Shareholders entitled to vote on any action without a meeting, the Board of Trustees may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted by the Board of Trustees, and which record date shall not be more than thirty (30) days after the date upon which the resolution fixing the record date is adopted by the Board of Trustees.”

2.Novation. This Amendment shall in no way be construed as a novation of the Trust Agreement. Nothing herein is intended to be or shall constitute a release, cancellation or extinguishment of the obligations, rights or duties of any party under the Trust Agreement, and such obligations, rights and duties of all such parties shall continue in full force and effect, as supplemented, modified and amended by this Amendment.

3.Counterparts. This Amendment may be executed in any number of counterparts, each of which shall be an original, but which counterparts shall together constitute but one and the same instrument. This Amendment shall be valid, binding, and enforceable against a party only when executed and delivered by an authorized individual on behalf of the party by means of (i) any electronic signature permitted by the federal Electronic Signatures in Global and National Commerce Act, state enactments of the Uniform Electronic Transactions Act, and/or any other relevant electronic signatures law, including relevant provisions of the UCC (collectively, “Signature Law”); (ii) an original manual signature; or (iii) a faxed, scanned, or photocopied manual signature. Each electronic signature or faxed, scanned, or photocopied manual signature shall for all purposes have the same validity, legal effect, and admissibility in evidence as an original manual signature.

4.Governing Law. This Amendment shall in all respects be governed by, and construed in accordance with, the laws of the State of Delaware (excluding conflict of law rules), including all matters of construction, validity and performance.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK.]

IN WITNESS WHEREOF, this Amendment has been executed and delivered by the Board of Trustees as of the date first written above.

BOARD OF TRUSTEES

/s/ Terry Loebs___________________

Name: Terry Loebs

Title: Trustee

/s/ Eric Weigel____________________

Name: Eric Weigel

Title: Trustee

Rider for Amendment to the By-Laws of ETF Managers Trust

(Effective as of January 12, 2024)

Replace the current Article II, Section 5 in its entirety with:

Section 5. ADJOURNED MEETING; NOTICE. Any Shareholders’ meeting, whether or not a quorum is present, may be adjourned from time to time for any reason whatsoever by vote of the holders of Shares entitled to vote holding not less than a majority of the Shares present in person or by proxy at the meeting, or by the chairperson of the Board, or, in the absence of the chairperson of the Board, by the president of the Trust, or, in the absence of the president, by any vice president or other authorized officer of the Trust. Any adjournment may be made with respect to any business which may have been transacted at such meeting and any adjournment will not delay or otherwise affect the effectiveness and validity of any business transacted at the Shareholders’ meeting prior to adjournment.

When any Shareholders’ meeting is adjourned to another time or place, written notice need not be given of the adjourned meeting if the time and place thereof are announced at the meeting at which the adjournment is taken, unless after the adjournment, a new record date is fixed for the adjourned meeting, or unless the meeting is adjourned for more than one hundred and eighty (180) days from the initial record date that was fixed in connection with the original meeting, in which case, the Board of Trustees shall set a new record date as provided in Article V of the Declaration of Trust and give written notice to each Shareholder of record entitled to vote at the adjourned meeting in accordance with the provisions of Sections 3 and 4 of this Article II. At any adjourned meeting, any business may be transacted that might have been transacted at the original meeting.

FORM OF

ETF DISTRIBUTION AGREEMENT

This distribution agreement (the “Agreement”) is effective this __ day of _________ 2023, and made by ETF Managers Trust, a Delaware statutory trust (the “Trust”), having its principal place of business at 30 Maple Street, Suite 2, Summit, NJ 07901, and Foreside Fund Services, LLC, a Delaware limited liability company (the “Distributor”) having its principal place of business at Three Canal Plaza, Suite 100, Portland, ME 04101.

WHEREAS, the Trust is a registered open-end management investment company organized under the Investment Company Act of 1940, as amended (the “1940 Act”) with separate and distinct series (each series a “Fund”) registered with the United States Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “1933 Act”);

WHEREAS, the Trust intends to create and redeem shares of beneficial interest (the “Shares”) of each Fund on a continuous basis and list the Shares on one or more national securities exchanges (together, the “Listing Exchanges”);

WHEREAS, the Distributor is registered with the SEC as a broker-dealer under the Securities Exchange Act of 1934, as amended (the “1934 Act”), and is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”);

WHEREAS, the Trust desires to retain the Distributor to (i) act as the principal underwriter of the Funds with respect to the creation and redemption of Creation Units of each Fund, and (ii) hold itself available to review and approve orders for such Creation Units in the manner set forth in the Trust’s Prospectus; and

WHEREAS, the Distributor desires to provide the services described herein to the Trust subject to the terms and conditions set forth below.

NOW THEREFORE, in consideration of the mutual promises and undertakings herein contained, the parties agree as follows:

1. Appointment. The Trust hereby appoints the Distributor to serve as the principal underwriter of the Funds with respect to the creation and redemption of Creation Units of each Fund listed in Exhibit A hereto (as may be amended by the Trust from time to time on written notice to the Distributor) on the terms and for the period set forth in this Agreement and subject to the registration requirements of the federal securities laws and of the laws governing the sale of securities in the various states, and the Distributor hereby accepts such appointment and agrees to act in such capacity hereunder.

2. Definitions. Wherever they are used herein, the following terms have the following respective meanings:

(a) “Prospectus” means the Prospectus and Statement of Additional Information constituting parts of the Registration Statement of the Trust under the 1933 Act and the 1940 Act as such Prospectus and Statement of Additional Information may be amended or supplemented and filed with the SEC from time to time;

(b) “Registration Statement” means the registration statement most recently filed from time to time by the Trust with the SEC and effective under the 1933 Act and the 1940 Act, as such registration statement is amended by any amendments thereto at the time in effect;

(c) All other capitalized terms used but not defined in this Agreement shall have the meanings ascribed to such terms in the Registration Statement and the Prospectus.

3. Duties of the Distributor

(a) The Distributor agrees to serve as the principal underwriter of the Funds in connection with the review and approval of all Purchase and Redemption Orders of Creation Units of each Fund by Authorized Participants that have executed an Authorized Participant Agreement with the Distributor and Transfer Agent/ Index Receipt Agent. Nothing herein shall affect or limit the right and ability of the Transfer Agent/ Index Receipt Agent to accept Fund Securities, Deposit Securities, and related Cash Components through or outside the Clearing Process, and as provided in and in accordance with the Registration Statement and Prospectus. The Trust acknowledges that the Distributor shall not be obligated to approve any certain number of orders for Creation Units.

(b) The Distributor agrees to use commercially reasonable efforts to provide the following services to the Trust with respect to the continuous distribution of Creation Units of each Fund: (i) at the request of the Trust, the Distributor shall enter into Authorized Participant Agreements between and among Authorized Participants, the Distributor and the Transfer Agent/Index Receipt Agent, for the purchase and redemption of Creation Units of the Funds, (ii) the Distributor shall approve and maintain copies of confirmations of Creation Unit purchase and redemption order acceptances; (iii) upon request, the Distributor will make available copies of the Prospectus to purchasers of such Creation Units and, upon request, the Statement of Additional Information; and (iv) the Distributor shall maintain telephonic, facsimile and/or access to direct computer communications links with the Transfer Agent.

(c) The Distributor shall ensure that all direct requests to Distributor for Prospectuses, Statements of Additional Information, product descriptions and periodic fund reports, as applicable, are fulfilled.

(d) The Distributor agrees to make available, at the Trust’s request, one or more members of its staff to attend, either via telephone or in person, Board meetings of the Trust in order to provide information with regard to the Distributor’s services hereunder and for such other purposes as may be requested by the Board of Trustees of the Trust.

(e) Distributor shall review and approve, prior to use, all Trust marketing materials (“Marketing Materials”) for compliance with SEC and FINRA advertising rules and will file all Marketing Materials required to filed with FINRA. The Distributor agrees to furnish to the Trust’s investment adviser any comments provided by FINRA with respect to such materials.

(f) The Distributor shall not offer any Shares and shall not approve any creation or redemption order hereunder if and so long as the effectiveness of the Registration Statement then in effect or any necessary amendments thereto shall be suspended under any of the provisions of

the 1933 Act or if and so long as a current prospectus as required by Section 10 of the 1933 Act is not on file with the SEC; provided, however, that nothing contained in this paragraph shall in any way restrict or have any application to or bearing upon the Trust’s obligation to redeem or repurchase any Shares from any shareholder in accordance with provisions of the Prospectus or Registration Statement.

(g) The Distributor shall work with the Index Receipt Agent to review and approve orders placed by Authorized Participants and transmitted to the Index Receipt Agent.

(h) The Distributor agrees to maintain, and preserve for the periods prescribed by Rule 31a-2 under the 1940 Act, such records as are required to be maintained by Rule 31a-1(d) under the 1940 Act. The Distributor agrees that all records which it maintains pursuant to the 1940 Act for the Trust shall at all times remain the property of the Trust, shall be readily accessible during normal business hours, and shall be promptly surrendered upon the termination of the Agreement or otherwise on written request; provided, however, that Distributor may retain all such records required to be maintained by Distributor pursuant to applicable FINRA or SEC rules and regulations.

(i) The Distributor agrees to maintain compliance policies and procedures (a “Compliance Program”) that are reasonably designed to prevent violations of the Federal Securities Laws (as defined in Rule 38a-1 of the 1940 Act) with respect to the Distributor’s services under this Agreement, and to provide any and all information with respect to the Compliance Program, including without limitation, information and certifications with respect to material violations of the Compliance Program and any material deficiencies or changes therein, as may be reasonably requested by the Trust’s Chief Compliance Officer or Board of Trustees.

4. Duties of the Trust.

(a) The Trust agrees to create, issue, and redeem Creation Units of each Fund in accordance with the procedures described in the Prospectus. Upon reasonable notice to the Distributor and in accordance with the procedures described in the Prospectus, the Trust reserves the right to reject any order for Creation Units or to stop all receipts of such orders at any time.

(b) The Trust agrees that it will take all actions necessary to register an indefinite number of Shares under the 1933 Act.

(c) The Trust will make available to the Distributor such number of copies as Distributor may reasonably request of (i) its then currently effective Prospectus and Statement of Additional Information and product description, (ii) copies of semi-annual reports and annual audited reports of the Trust’s books and accounts made by independent public accountants regularly retained by the Trust, and (iii) such other publicly available information for use in connection with the distribution of Creation Units.

(d) The Trust shall inform the Distributor of any such jurisdictions in which the Trust has filed notice filings for Shares for sale under the securities laws thereof and shall promptly notify the Distributor of any change in this information. The Distributor shall not be liable for damages resulting from the sale of Shares in authorized jurisdictions where the Distributor had

no information from the Trust that such sale or sales were unauthorized at the time of such sale or sales.

(e) The Distributor acknowledges and agrees that the Trust reserves the right to suspend sales and the Distributor’s authority to review and approve orders for Creation Units on behalf of the Trust. Upon due notice to the Distributor, the Trust shall suspend the Distributor’s authority to review and approve Creation Units if, in the judgment of the Trust, it is in the best interests of the Trust to do so. Suspension will continue for such period as may be determined by the Trust.

(f) The Trust shall arrange to provide the Listing Exchanges with copies of Prospectuses, Statements of Additional Information, and product descriptions to be provided to purchasers in the secondary market.

(g) The Trust will make it known that Prospectuses and Statements of Additional Information and product descriptions are available by making sure such disclosures are in all marketing and advertising materials prepared by or at the direction of the Trust.

5. Fees and Expenses.

(a) The Distributor shall be entitled to no compensation or reimbursement of expenses from the Trust for the services provided by the Distributor pursuant to this Agreement. The Distributor may receive compensation from the Investment Adviser related to its services hereunder or for additional services as may be agreed to between the Investment Adviser and Distributor.

(b) The Trust shall bear the cost and expenses of: (i) the registration of the Shares for sale under the 1933 Act; and (ii) the registration or qualification of the Shares for sale under the securities laws of the various States.

(c) The Distributor shall pay (i) all expenses relating to Distributor’s broker-dealer qualification and registration under the 1934 Act; and (ii) the expenses incurred by the Distributor in connection with routine FINRA filing fees.

(d) Notwithstanding anything in this Agreement to the contrary, the Distributor and its affiliates may receive compensation or reimbursement from the Trust’s Investment Adviser with respect to any services performed under this Agreement, as may be agreed upon by the parties from time to time.

(e) The Trust shall bear any costs associated with printing Prospectuses, Statements of Additional Information and all other such materials.

6. Indemnification.

(a) The Trust agrees to indemnify and hold harmless the Distributor, its affiliates and each of their respective directors, officers and employees and agents and any person who controls the Distributor within the meaning of Section 15 of the 1933 Act (any of the Distributor, its officers, employees, agents and directors or such control persons, for purposes of this

paragraph, a “Distributor Indemnitee”) against any loss, liability, claim, damages or expense (including the reasonable cost of investigating or defending any alleged loss, liability, claim, damages or expense and reasonable counsel fees incurred in connection therewith) (“Losses”) that a Distributor Indemnitee may incur arising out of or based upon: (i) Distributor serving as distributor for the Trust pursuant to this Agreement; (ii) the allegation of any wrongful act of the Trust or any of its directors, officers, employees or affiliates in connection with its duties, representations, and responsibilities in this Agreement; (iii) any claim that the Registration Statement, Prospectus, Statement of Additional Information, product description, shareholder reports, Marketing Materials and advertisements specifically approved by the Trust and Investment Adviser or other information filed or made public by the Trust (as from time to time amended) included an untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary in order to make the statements therein (and in the case of the Prospectus, Statement of Additional Information and product description, in light of the circumstances under which they were made) not misleading under the 1933 Act, or any other statute or the common law; (iv) the breach by the Trust of any obligation, representation or warranty contained in this Agreement; or (v) the Trust’s failure to comply in any material respect with applicable securities laws.

(b) The Distributor agrees to indemnify and hold harmless the Trust and each of its Trustees and officers and any person who controls the Trust within the meaning of Section 15 of the 1933 Act (for purposes of this paragraph, the Trust and each of its Trustees and officers and its controlling persons are collectively referred to as the “Trust Indemnitees”) against any Losses arising out of or based upon (i) the allegation of any wrongful act of the Distributor or any of its directors, officers, employees or affiliates in connection with its activities as Distributor pursuant to this Agreement; (ii) the breach of any obligation, representation or warranty contained in this Agreement by the Distributor; (iii) the Distributor’s failure to comply in any material respect with applicable securities laws, including applicable FINRA regulations; or (iv) any allegation that the Registration Statement, Prospectus, Statement of Additional Information, product description, shareholder reports, any information or materials relating to the Funds (as described in section 3(g)) or other information filed or made public by the Trust (as from time to time amended) included an untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary in order to make the statements not misleading, insofar as such statement or omission was made in reasonable reliance upon, and in conformity with information furnished to the Trust, in writing, by the Distributor.

In no case (i) is the indemnification provided by an indemnifying party to be deemed to protect against any liability the indemnified party would otherwise be subject to by reason of willful misfeasance, bad faith or gross negligence in the performance of its duties or by reason of its reckless disregard of its obligations and duties under this Agreement, or (ii) is the indemnifying party to be liable under this Section with respect to any claim made against any indemnified party unless the indemnified party notifies the indemnifying party in writing of the claim within a reasonable time after the summons or other first written notification giving information of the nature of the claim shall have been served upon the indemnified party (or after the indemnified party shall have received notice of service on any designated agent).

Failure to notify the indemnifying party of any claim shall not relieve the indemnifying party from any liability that it may have to the indemnified party against whom such action is brought, on account of this Section, unless failure or delay to so notify the indemnifying party prejudices

the indemnifying party’s ability to defend against such claim. The indemnifying party shall be entitled to participate at its own expense in the defense or, if it so elects, to assume the defense of any suit brought to enforce the claim, but if the indemnifying party elects to assume the defense, the defense shall be conducted by counsel chosen by it and satisfactory to the indemnified party. In the event that indemnifying party elects to assume the defense of any suit and retain counsel, the indemnified party shall bear the fees and expenses of any additional counsel retained by them. If the indemnifying party does not elect to assume the defense of any suit, it will reimburse the indemnified party for the reasonable fees and expenses of any counsel retained by them. The indemnifying party agrees to notify the indemnified party promptly of the commencement of any litigation or proceedings against it or any of its officers or directors in connection with the purchase or redemption of any of the Creation Units or the Shares.

(c) No indemnified party shall settle any claim against it for which it intends to seek indemnification from the indemnifying party, under the terms of section 6(a) or 6(b) above, without prior written notice to and consent from the indemnifying party, which consent shall not be unreasonably withheld. No indemnified or indemnifying party shall settle any claim unless the settlement contains a full release of liability with respect to the other party in respect of such action. This section 6 shall survive the termination of this Agreement.

(d) The Trust acknowledges and agrees that as part of its duties, Distributor will enter into agreements with certain authorized participants (each an “AP”) for the purchase and redemption of Creation Units (each such agreement an “AP Agreement”). The APs may insert and require that Distributor agree to certain provisions in the AP Agreements that contain certain representations, undertakings and indemnification that are not included in the form-of AP Agreement (each such modified AP Agreement a “Non-Standard AP Agreement”).

To the extent that Distributor is requested or required to make any such representations mentioned above, the Trust shall indemnify, defend and hold the Distributor Indemnitees free and harmless from and against any and all Losses that any Distributor Indemnitee may incur arising out of or relating to (a) the Distributor’s actions or failures to act pursuant to any Non-Standard AP Agreement; (b) any representations made by the Distributor in any Non-Standard AP Agreement to the extent that the Distributor is not required to make such representations in the form-of AP Agreement; or (c) any indemnification provided by the Distributor under a Non-Standard AP Agreement. In no event shall anything contained herein be so construed as to protect the Distributor Indemnitees against any liability to the Trust or its shareholders to which the Distributor Indemnitees would otherwise be subject by reason of willful misfeasance, bad faith, or gross negligence in the performance of Distributor’s obligations or duties under the Non-Standard AP Agreement or by reason of Distributor’s reckless disregard of its obligations or duties under the Non-Standard AP Agreement.

7. Representations.

a.The Distributor represents and warrants that:

a. (i) it is duly organized as a Delaware limited liability company and is and at all times will remain duly authorized and licensed under applicable law to carry out its services as contemplated herein; (ii) the execution, delivery and performance of this Agreement are within its power and have been duly authorized by all

necessary action; (iii) its entering into this Agreement or providing the services contemplated hereby does not conflict with or constitute a default or require a consent under or breach of any provision of any agreement or document to which the Distributor is a party or by which it is bound; (iv) it is registered as a broker-dealer under the 1934 Act and is a member of FINRA; and (v) it has in place compliance policies and procedures reasonably designed to prevent violations of the Federal Securities Laws as that term is defined in Rule 38a-1 under the 1940 Act.

a.All activities by the Distributor and its agents and employees in connection with the services provided in this Agreement shall comply with the Registration Statement and Prospectus, the instructions of the Trust, and all applicable laws, rules and regulations including, without limitation, all rules and regulations made or adopted pursuant to the 1940 Act by the SEC or any securities association registered under the 1934 Act, including FINRA and the Listing Exchanges.

(b) The Distributor and the Trust each individually represent that its anti-money laundering program (“AML Program”), at a minimum, (i) designates a compliance officer to administer and oversee the AML Program, (ii) provides ongoing employee training, (iii) includes an independent audit function to test the effectiveness of the AML Program, (iv) establishes internal policies, procedures, and controls that are tailored to its particular business, (v) provides for the filing of all necessary anti-money laundering reports including, but not limited to, currency transaction reports and suspicious activity reports, and (vi) allows for appropriate regulators to examine its anti-money laundering books and records. Notwithstanding the foregoing, the Trust acknowledges that the Authorized Participants are not “customers” for the purposes of 31 CFR 103.

(c) The Distributor and the Trust each individually represent and warrant that: (i) it has procedures in place reasonably designed to protect the privacy of non-public personal consumer/customer financial information to the extent required by applicable law, rule and regulation; and (ii) it will comply with all of the applicable terms and provisions of the 1934 Act.

(d) The Trust represents and warrants that:

1.(i) it is duly organized as a Delaware statutory trust and is and at all times will remain duly authorized to carry out its obligations as contemplated herein; (ii) it is registered as an investment company under the 1940 Act; (iii) the execution, delivery and performance of this Agreement are within its power and have been duly authorized by all necessary action; (iv) entering into this Agreement does not conflict with or constitute a default or require a consent under or breach of any provision of any agreement or document to which the Trust is a party or by which it is bound; (v) the Registration Statement and each Fund’s Prospectus have been prepared, and all Marketing Materials have been prepared by or at the direction of the Trust and have been approved by the Trust and shall be prepared, in all material respects, in conformity with all applicable law, including without limitation, the 1933 Act, the 1940 Act and the rules and regulations of the SEC (the “Rules and Regulations”); (vi) the Registration Statement and each Fund’s Prospectus contain, and all Marketing Materials shall contain, all statements required to be stated therein in accordance with the 1933 Act, the 1940 Act and the Rules and Regulations;

(vii) all statements of fact contained therein, or to be contained in all Marketing Materials, are or will be true and correct in all material respects at the time indicated or the effective date, as the case may be, and none of the Registration Statement, any Fund’s Prospectus, nor any Marketing Materials shall include any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein, in the case of each Fund’s Prospectus in light of the circumstances in which made, not misleading; (viii) except as otherwise noted in the Registration Statement and Prospectus, the offering price for all Creation Units will be the aggregate net asset value of the Shares per Creation Unit of the relevant Fund, as determined in the manner described in the Registration Statement and Prospectus; (ix) the Prospectus is effective, no stop order of the SEC or any other federal, state or foreign regulatory authority, with respect thereto has been issued, no proceedings for such purpose have been instituted, or to its knowledge are being contemplated; (x) the Fund Shares, when issued and delivered against payment of consideration will be duly and validly authorized, issued fully paid and non-assessable and free of statutory and contractual preemptive rights, rights of first refusal and similar rights; (xi) no consent, approval, authorization, order, registration or qualification of or with any court or governmental agency or body is required for the issuance and sale of Fund shares, except the registration of the Fund Shares under the 1933 Act; (xii) Fund Shares will be listed on Listing Exchanges; (xiii) it will not lend securities pursuant to any securities lending arrangement that would prevent any Fund from settling a Redemption Order when due; (xiv) it will not name the Authorized Participant as an authorized participant and/or as underwriter in the Prospectus, Marketing Materials or on its or any Fund’s website without prior written consent of the Authorized Participant, unless such naming is required by law, rule or regulation; and

2.it shall file such amendment or amendments to the Registration Statement and each Fund’s Prospectus as, in the light of future developments, shall, in the opinion of the Trust’s counsel, be necessary in order to have the Registration Statement and each Fund’s Prospectus at all times contain all material facts required to be stated therein or necessary to make the statements therein, in light of the circumstances in which made, not misleading. The Trust shall not file any amendment to the Registration Statement or each Fund’s Prospectus without giving the Distributor reasonable notice thereof in advance, provided that nothing in this Agreement shall in any way limit the Trust’s right to file at any time such amendments to the Registration Statement or any Fund’s Prospectus as the Trust may deem advisable. The Trust will also promptly notify the Distributor in writing in the event of any stop order suspending the effectiveness of the Registration Statement. Notwithstanding the foregoing, the Trust shall not be deemed to make any representation or warranty as to any information or statement provided by the Distributor for inclusion in the Registration Statement or any Fund’s Prospectus; and

3.upon delivery of Deposit or Fund Securities to an Authorized Participant in connection with a purchase or redemption of Creation Units, the Authorized Participant will acquire good and unencumbered title to such securities, free and clear of all liens, restrictions, charges and encumbrances, and not subject to any adverse claims and that such Fund and Deposit Securities will not be “restricted securities” as such term is used in Rule 144(a)(3)(i) under the 1933 Act.

8. Duration, Termination and Amendment.

(a) This Agreement shall be effective on the date set forth above, and unless terminated as provided herein, shall continue for two years from its effective date, and thereafter from year to year, provided such continuance is approved annually (i) by vote of a majority of the Trustees or by the vote of a majority of the outstanding voting securities of the Fund and (ii) by the vote of a majority of those Trustees who are not parties to this Agreement or interested persons of any such party cast in person at a meeting called for the purpose of voting on such approval. This Agreement may be terminated at any time, without the payment of any penalty, as to each Fund (i) by vote of a majority of those Trustees who are not parties to this Agreement or interested persons of any such party or (ii) by vote of a majority of the outstanding voting securities of the Fund, or by the Distributor, on at least sixty (60) days prior written notice. This Agreement shall automatically terminate without the payment of any penalty in the event of its assignment. As used in this paragraph, the terms “vote of a majority of the outstanding voting securities,” “assignment,” “affiliated person” and “interested person” shall have the respective meanings specified in the 1940 Act.

(b) No provision of this Agreement may be changed, waived, discharged or terminated except by an instrument in writing signed by both parties.

9. Notice. Any notice or other communication authorized or required by this Agreement to be given to either party shall be in writing and deemed to have been given when delivered in person or by email, or posted by certified mail, return receipt requested, to the following address (or such other address as a party may specify by written notice to the other):

| | | | | |

(i) To Foreside | (ii) If to the Trust |

Foreside Fund Services, LLC Attn: Legal Departmen Three Canal Plaza, Suite 100 Portland, ME 04101 Telephone: (207) 553-7110 Email: legal@foreside.com

With a copy to: etp-services@foreside.com

| ETF Managers Trust

Attn: Matthew Bromberg

30 Maple Street, Suite 2

Summit, NJ 07901

Telephone:

Email: matt@etfmg.com |

10. Choice of Law. This Agreement shall be governed by, and construed in accordance with, the laws of the state of Delaware, without giving effect to the choice of laws provisions thereof.

11. Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

12. Severability. If any provisions of this Agreement shall be held or made invalid, in whole or in part, then the other provisions of this Agreement shall remain in force. Invalid provisions

shall, in accordance with this Agreement’s intent and purpose, be amended, to the extent legally possible, in order to effectuate the intended results of such invalid provisions.

13. Insurance. The Distributor will maintain at its expense an errors and omissions insurance policy adequate to cover services provided by the Distributor hereunder.

14. Confidentiality. During the term of this Agreement, the Distributor and the Trust may have access to confidential information relating to such matters as either party’s business, trade secrets, systems, procedures, manuals, products, contracts, personnel, and clients. As used in this Agreement, “Confidential Information” means information belonging to one of the parties that is of value to such party and the disclosure of which could result in a competitive or other disadvantage to such party. Confidential Information includes, without limitation, financial information, proposal and presentations, reports, forecasts, inventions, improvements and other intellectual property; trade secrets; know-how; designs, processes or formulae; software; market or sales information or plans; customer lists; and business plans, prospects and opportunities (such as possible acquisitions or dispositions of businesses or facilities). Confidential Information includes information developed by either party in the course of engaging in the activities provided for in this Agreement, unless: (i) the information is or becomes publicly known through lawful means; (ii) the information is disclosed to the other party without a confidential restriction by a third party who rightfully possesses the information and did not obtain it, either directly or indirectly, from one of the parties, as the case may be, or any of their respective principals, employees, affiliated persons, or affiliated entities. The parties understand and agree that all Confidential Information shall be kept confidential by the other both during and after the term of this Agreement. Each party shall maintain commercially reasonable information security policies and procedures for protecting Confidential Information. The parties further agree that they will not, without the prior written approval by the other party, disclose such Confidential Information, or use such Confidential Information in any way, either during the term of this Agreement or at any time thereafter, except as required in the course of this Agreement and as provided by the other party or as required by law. Upon termination of this Agreement for any reason, or as otherwise requested by the Trust, all Confidential Information held by or on behalf of Trust shall be promptly returned to the Trust, or an authorized officer of the Distributor will certify to the Trust in writing that all such Confidential Information has been destroyed. This section 14 shall survive the termination of this Agreement. Notwithstanding the foregoing, a party may disclose the other’s Confidential Information if (i) required by law, regulation or legal process or if requested by the SEC or other governmental regulatory agency with jurisdiction over the parties hereto or (ii) requested to do so by the other party.

15. Limitation of Liability. This Agreement is executed by or on behalf of the Trust with respect to each of the Trust Funds and the obligations hereunder are not binding upon any of the trustees, officers or shareholders of the Trust individually but are binding only upon the Fund to which such obligations pertain and the assets and property of such Fund. Separate and distinct records are maintained for each Fund and the assets associated with any such Fund are held and accounted for separately from the other assets of the Trust, or any other Fund of the Trust. The debts, liabilities, obligations, and expenses incurred, contracted for, or otherwise existing with respect to a particular Fund of the Trust shall be enforceable against the assets of that Fund only, and not against the assets of the Trust generally or any other Fund, and none of the debts, liabilities, obligations, and expenses incurred, contracted for, or otherwise existing with respect

to the Trust generally or any other Fund shall be enforceable against the assets of that Fund. The Trust’s Agreement and Declaration of Trust is on file with the Trust.

16. Use of Names; Publicity. The Trust shall not use the Distributor’s name in any offering material, shareholder report, advertisement or other material relating to the Trust, in a manner not approved by the Distributor in writing prior to such use, such approval not to be unreasonably withheld. The Distributor hereby consents to all uses of its name required by the SEC, any state securities commission, or any federal or state regulatory authority.

The Distributor shall not use the name “__________” in any offering material, shareholder report, advertisement or other material relating to the Distributor, other than for the purpose of merely identifying the Trust as a client of Distributor hereunder, in a manner not approved by the Trust in writing prior to such use; provided, however, that the Trust shall consent to all uses of its name required by the SEC, any state securities commission, or any federal or state regulatory authority; and provided, further, that in no case shall such approval be unreasonably withheld.

The Distributor will not issue any press releases or make any public announcements regarding the existence of this Agreement without the express written consent of the Trust. Neither the Trust nor the Distributor will disclose any of the economic terms of this Agreement, except as may be required by law.

17. Exclusivity. Nothing herein contained shall prevent the Distributor from entering into similar distribution arrangements or from providing the services contemplated hereunder to other investment companies or investment vehicles.

18. Governing Language. This Agreement has been negotiated and executed by the parties in English. In the event any translation of this Agreement is prepared for convenience or any other purpose, the provisions of the English version shall prevail.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed by their officers designated below as of the date first set forth above.

| | | | | |

| Foreside Fund Services, LLC | ETF Managers Trust |

| |

| By: _________________________________ | By: _________________________________ |

| |

| Name/Title: | Name/Title: |

| |

| Date: | Date: |

EXHIBIT A

[please list Funds here]

ETF MANAGERS TRUST

SECOND AMENDED AND RESTATED

DISTRIBUTION PLAN

(12b-1 Plan)

The following Distribution Plan (the “Plan”) has been adopted pursuant to Rule 12b‑1 under the Investment Company Act of 1940, as amended (the “Act”), by ETF Managers Trust (the “Trust”), a Delaware statutory trust, on behalf of the series of the Trust listed on Schedule A as may be amended from time to time (each, a “Fund”). The Plan has been approved by a majority of the Trust’s Board of Trustees (the “Board”), including a majority of the Trustees who are not interested persons of the Trust and who have no direct or indirect financial interest in the operation of the Plan or in any Rule 12b-1 Agreement (as defined below) (the “Disinterested Trustees”), cast in person at a meeting called for the purpose of voting on such Plan.

In approving the Plan, the Board determined that adoption of the Plan would be prudent and in the best interests of each Fund and its shareholders. Such approval by the Board of Trustees included a determination, in the exercise of its reasonable business judgment and in light of its fiduciary duties, that there is a reasonable likelihood that the Plan will benefit the Fund and its shareholders.

The provisions of the Plan are as follows:

1. PAYMENTS BY THE FUND TO PROMOTE THE SALE OF FUND SHARES

The Trust, on behalf of each Fund, will pay Foreside Fund Services LLC (the “Distributor”), as principal distributor of each Fund’s shares, a distribution fee and shareholder servicing fee equal to a percentage of the average daily net assets of each Fund as shown on Schedule A in connection with the promotion and distribution of Fund shares and the provision of personal services to shareholders, including, but not necessarily limited to, advertising, compensation to underwriters, dealers and selling personnel, the printing and mailing of prospectuses to other than current Fund shareholders, and the printing and mailing of sales literature. The Distributor may pay all or a portion of these fees to any registered securities dealer, financial institution or any other person (the “Recipient”) who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement (the “Rule 12b-1 Agreement”), a form of which is attached hereto as Appendix A with respect to each Fund. To the extent not so paid by the Distributor, such amounts may be retained by the Distributor. Payment of these fees shall be made monthly promptly following the close of the month.

2. RULE 12B-1 AGREEMENTS

a.No Rule 12b-1 Agreement shall be entered into with respect to the Fund and no payments shall be made pursuant to any Rule 12b-1 Agreement, unless such Rule 12b-1 Agreement is in writing and the form of which has first been delivered to and approved by a vote of a majority of the Board, and of the Disinterested Trustees, cast in person at a meeting called for the purpose of voting on such Rule 12b-1 Agreement. The form of Rule 12b-1 Agreement relating to the Fund attached hereto as Appendix A has been approved by the Board as specified above.

b.Any Rule 12b-1 Agreement shall describe the services to be performed by the Recipient and shall specify the amount of, or the method for determining, the compensation to the Recipient.

c.No Rule 12b-1 Agreement may be entered into unless it provides (i) that it may be terminated with respect to the Fund at any time, without the payment of any penalty, by vote of a majority of the shareholders of the Fund, or by vote of a majority of the Disinterested Trustees, on not more than 60 days’ written notice to the other party to the Rule 12b-1 Agreement, and (ii) that it shall automatically terminate in the event of its assignment.

d.Any Rule 12b-1 Agreement shall continue in effect for a period of more than one year from the date of its execution only if such continuance is specifically approved at least annually by a vote of a majority of the Board, and of the Disinterested Trustees, cast in person at a meeting called for the purpose of voting on such Rule 12b-1 Agreement.

3. QUARTERLY REPORTS

The Distributor shall provide to the Board, and the Board shall review at least quarterly, a written report of all amounts expended pursuant to the Plan. This report shall include the identity of the recipient of each payment and the purpose for which the amounts were expended and such other information as the Board may reasonably request.

4. EFFECTIVE DATE AND DURATION OF THE PLAN

The Plan shall become effective immediately upon approval by the vote of a majority of the Board, and of the Disinterested Trustees, cast in person at a meeting called for the purpose of voting on the approval of the Plan. The Plan shall continue in effect with respect to the Fund for a period of one year from its effective date unless terminated pursuant to its terms. Thereafter, the Plan shall continue with respect to each Fund from year to year, provided that such continuance is approved at least annually by a vote of a majority of the Board of Trustees, and of the Disinterested Trustees, cast in person at a meeting called for the purpose of voting on such continuance. The Plan, or any Rule 12b-1 agreement, may be terminated with respect to each Fund at any time, without penalty, on not more than 60 days’ written notice by a majority vote of shareholders of the Fund, or by vote of a majority of the Disinterested Trustees.

5. SELECTION OF DISINTERESTED TRUSTEES

During the period in which the Plan is effective, the selection and nomination of those Trustees who are Disinterested Trustees of the Trust shall be committed to the discretion of the Disinterested Trustees.

6. AMENDMENTS

All material amendments of the Plan shall be in writing and shall be approved by a vote of a majority of the Board, and of the Disinterested Trustees, cast in person at a meeting called for the purpose of voting on such amendment. In addition, the Plan may not be amended to increase materially the amount to be expended by the Fund hereunder without the approval by a majority vote of shareholders of the Fund.

7. RECORDKEEPING

The Trust shall preserve copies of the Plan, any Rule 12b-1 Agreement and all reports made pursuant to Section 3 for a period of not less than six years from the date of this Plan, any such Rule 12b‑1 Agreement or such reports, as the case may be, the first two years in an easily accessible place.

SCHEDULE A

| | | | | |

| Series of ETF Managers Trust | Rule 12b-1 Fee |

| |

| ETFMG Prime Cyber Security ETF | 0.25% of average daily net assets |

| ETFMG Prime Mobile Payments ETF | 0.25% of average daily net assets |

| Blue Star Israel Technology ETF | 0.25% of average daily net assets |

| Etho Climate Leadership U.S. ETF | 0.25% of average daily net assets |

| ETFMG Alternative Harvest ETF | 0.25% of average daily net assets |

| Wedbush ETFMG Global Cloud Technology ETF | 0.25% of average daily net assets |

| Wedbush ETFMG Video Game Tech ETF | 0.25% of average daily net assets |

| AI Powered Equity ETF | 0.25% of average daily net assets |

| ETFMG Sit Ultra Short ETF | 0.25% of average daily net assets |

| ETFMG Travel Tech ETF | 0.25% of average daily net assets |

| ETFMG Treatments, Testing and Advancements ETF | 0.25% of average daily net assets |

| ETFMG U.S. Alternative Harvest ETF | 0.25% of average daily net assets |

Appendix A

Rule 12b-1 Agreement

[To Be Provided]

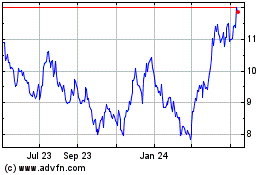

Amplify Junior Silver Mi... (AMEX:SILJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

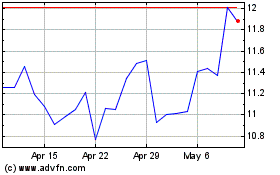

Amplify Junior Silver Mi... (AMEX:SILJ)

Historical Stock Chart

From Apr 2023 to Apr 2024