Steelmaker ArcelorMittal is likely to benefit from a windfall of

free European Union carbon allowances potentially worth hundreds of

millions of dollars while it installs new technologies to

decarbonize its Dunkirk steel plant with the aid of French

government subsidies, an analysis by OPIS shows.

The windfall will come on top of a surplus in free European

Union carbon permits allocated by the French government to the

installation operator over 2020 to 2022 that were worth

approximately €410 million ($446.13 million) at average benchmark

prices.

Luxembourg-based ArcelorMittal, the world's second-largest

steelmaker, will receive an €850 million grant from the French

government as part of a €1.7 billion investment to cut emissions at

its steel production facilities in Dunkirk and at Fos-sur-Mer in

southern France.

The company's Dunkirk facility, which has two blast furnaces,

will see the construction of a 2.5 million metric ton direct

reduced iron furnace and two electric arc furnaces, slated to be

operational by 2027. An electric furnace will also be installed at

ArcelorMittal's Fos-sur-Mer plant.

These investments are expected to cut ArcelorMittal's total

annual carbon emissions in France by around 7.8 million tons of

carbon by 2030, according to the steelmaker, representing a 40%

drop on 2018 levels. The operator anticipates that the Dunkirk

plant will produce 4 million metric tons of low-carbon liquid steel

per year.

ArcelorMittal said in a statement that the new installations at

both Dunkirk and Fos-sur-Mer are expected to be operational in 2027

and that the two blast furnaces at its Dunkirk site will be

gradually phased out by 2030. The state aid will be doled out in

four payments between 2023 and 2026, the EU Commission said in July

last year.

Representatives from ArcelorMittal and the French government did

not respond to OPIS's requests for comment.

EUAs Surplus During Electric Arc Furnace Installation

In addition to the €850 million grant from the French

government, the steelmaker will benefit from a surplus of EU carbon

allowances (EUAs) as it will still receive free EUAs while the

upgrades are made in the coming years.

Under the EU Emissions Trading System, many industrial operators

must buy and then surrender an EU carbon allowance (EUA) for every

metric ton of carbon dioxide they emit. However, the EU grants

hard-to-abate sectors like steel manufacturing an annual allocation

of free EUAs to stop operators from being undercut by competitors

in countries that do not face equivalent levies on their

emissions.

Operators can convert EUAs into cash if they choose to sell any

surplus allowances on the Intercontinental Exchange (ICE) secondary

market, incentivizing recipients of free allowances to cut their

carbon emissions in low-cost ways. EUAs reached an all-time high

early last year, breaching the €100/mt threshold, but have since

fallen to under €64/mt in the wake of a sharp decline in emissions

across the EU in 2023.

According to EU Commission figures, the Dunkirk installation has

emitted a total of 19,536,531 metric tons of carbon over 2020-2022.

During the same period, the French government issued ArcelorMittal

27,002,671 free EUAs, leaving the company with a surplus of

7,466,140 EUAs over those three years.

Based on the average price of carbon for each of those

respective years, ArcelorMittal was issued a surplus of free

allowances worth €410.2 million in EUAs.

ArcelorMittal Dunkirk Steel Plant Key Data

Year Emissions Free permits Difference

2020 5,851,655 8,291,093 +2,439,438

2021 7,274,573 9,379,705 +2,105,132

2022 6,410,303 9,331,873 +2,921,570

Source: EU Commission

The verified data showing how much carbon EU installations

subject to the EU Emissions Trading System emitted in 2023 will be

uploaded onto the EU Commission's website this spring. The website

shows that the Dunkirk installation operator had a provisional

allocation last year of 9,331,873 free EUAs worth €797.78 million,

using the 2023 average price for EU carbon permits.

The activity level change (ALC) adjustment will reduce the

number of free EUAs that the Dunkirk plant receives because its

carbon emissions will fall while units are offline and the new

technology is installed. If emissions in a calendar year drop more

than 15% compared to the average emissions of the previous two

years, allowance allocations are revised down through the ALC and

some free permits are returned. Nonetheless, the operator will

receive a substantial surplus of EUAs during the transition.

Looming Port Talbot UK Carbon Allowances Surplus

Tata Steel's Port Talbot is another steel plant that is

switching over to an electric arc furnace and will likely receive a

substantial surplus of carbon allowances during the transition. The

U.K. also employs a similar system to the EU ETS and grants free

allowances to hard-to-abate sectors.

The installation is the United Kingdom's largest carbon dioxide

emitting plant and is expected to receive a £500 million government

subsidy as part of a combined £1.25 billion investment in the

plant's decarbonization.

A spokesperson for the India-based company told OPIS last year

that the new technology would reduce annual emissions by 85%,

which, based on the plant's 2022 emissions data, would fall to as

low as 850,000 metric tons of carbon per annum.

British government data shows that the Port Talbot site emitted

6,643,839 mt of carbon dioxide in 2021 and 5,673,654 mt in 2022.

Since 2021, the government has issued Tata 5,768,835 free UKAs

every year.

Port Talbot is also expecting its emissions to fall during its

transition. A Tata spokesperson would not be drawn last year when

asked by OPIS whether any units will be operational while the

electric arc furnace is installed.

This content was created by Oil Price Information Service, which

is operated by Dow Jones & Co. OPIS is run independently from

Dow Jones Newswires and The Wall Street Journal.

--Reporting by Humberto J. Rocha, hrocha@opisnet.com; Editing by

Anthony Lane, alane@opisnet.com

(END) Dow Jones Newswires

January 19, 2024 13:54 ET (18:54 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

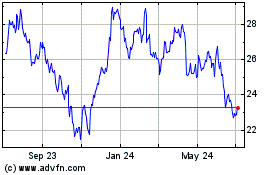

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

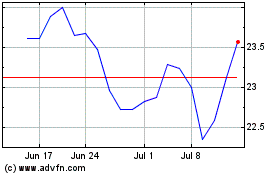

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024