Free Writing Prospectus

Filed Pursuant to Rule 433

Registration No. 333-267520

January 19, 2024

Transcript of SSGA Advisor Playbook Session 2024

[00:00:00] Natalie Noel: This session is with Maxwell Gold, CFA, Head of Gold Strategy at State Street Global Advisors, SPDR. Thank you for joining us, Max, and I'll turn it over to you to dive right in.

[00:00:10] Maxwell Gold: Great, thanks, and thanks everyone for taking the time today. I want to spend the next 30 minute session going over our outlook for gold and what we see the gold market doing in 2024 and beyond.

[00:00:22] Maxwell Gold: But more importantly, what are the key themes to pay attention to in terms of gold's prospect both for performance, demand, as well as its function and role in a diversified portfolio? I think coming into this year, 2024, I think there's a lot of difference in terms of the backdrop where gold was this time last year at the start of 2023.

[00:00:42] Maxwell Gold: And really, I think I want to highlight some of these key trends that are going to be very supportive, in our view, for gold this year and beyond, but really, before we jump into it, I do want to put into context that you know gold in 2023 did very well, was very resilient performance in calendar year. In fact, gold spot price in US dollar terms was up about 13 percent for the calendar year 2023. That's the first positive return for gold in a calendar year since 2020. So certainly a remarkable year for gold, as well as we saw the price hit a new all-time high of over 2$,100 per ounce at the end of last year. So certainly a lot in the mix in terms of gold's performance, and I'll dive into in a moment of what's been driving that and what we expect to continue for this year, but didn't want to overshadow the fact that gold did very well last year.

[00:01:32] Maxwell Gold: It outperformed global bonds, outperformed broad commodities globally, and did underperform global equities. But again, had a very strong year on its own. And I do think when you look into next year, into this year for 2024, the gold outlook I think will be supported and buoyed by the turning of three key macroeconomic trends or tides for 2024.

[00:01:54] Maxwell Gold: The first being a shift from more hawkish or neutral monetary policy for central banks, such as the Fed and elsewhere globally, into more of a dovish monetary policy led by the U. S. as the potential risk of the U. S. consumer led economic growth that we saw over the last year or so begin to fade and certainly some more concerns about slowing growth will lead into the potential for the Federal Reserve and other monetary policy makers out there look to become much more dovish in their monetary policy in face of slowing growth, slowing economic indicators, slowing consumption activity. And I do think that overall, that should be a good positive result for gold given the fact that will likely result in lower interest rates by the Federal Reserve, and certainly that could be a supportive action for gold throughout 2024. The second turning tide from a macroeconomic perspective that we expect for 2024 is a softening U. S. Dollar. If you flashback to 2022, the U.S. dollar hit a 20 year high. Certainly it was about flat last year, I believe was up about 1 percent or so on the year for 2023. However, when you put into context looking ahead, you know, where we saw the U.S. be a standout in terms of financial market performance, in terms of economic growth, and certainly rising interest rates in the U.S., the rest of the world sort of was not moving in the same direction as the U.S. on those fronts. In fact, we expect the global economy to close the gap in terms of growth, in relative to the U.S. And that could certainly be a bit of a headwind for dollar demand and the trajectory for the U.S. Dollar as well as we're seeing central banks continue to be net buyers of gold physically globally throughout the world.

[00:03:41] Maxwell Gold: And I do think that that is an important trend to pay attention to is that may continue to put a bit of a headwind for the dollars prospects more longer term beyond 2024. But when you put it to these few pieces together, the outlook for a softer dollar from where it was coming from a period of strength the last couple years for I do think is important for gold.

[00:04:00] Maxwell Gold: Given that traditional negative relation between gold and the US dollar, we tend to see gold do well on average historically, when the dollar is weaker. And I think that in the environment we're in today, are heading into, with the expectation for monetary policy and economic direction, that could be certainly a situation to pay attention to that may be favorable towards gold's prospects in 2024.

[00:04:21] Maxwell Gold: And then finally, the third changing theme is an actual increase, or rising of investor sentiment towards gold against the heightened risk, you know, backdrop that we're seeing both on an economic front, financial market front, as well as a geopolitical front. And I think these are important aspects to pay attention to as investors, particularly large investors through products such as exchange traded funds globally and demand for gold from an investment perspective has been very tepid and weak over the last couple of years in fact. It's interesting that even though we saw the gold price be very strong last year, up 13 percent in 2023, you know, if you look at flows of gold funds and demand from investors, particularly institutional investors, we actually saw net outflows on the year globally.

[00:05:05] Maxwell Gold: And I do think that's an important trend to pay attention to as beginning of emerging of some of these risks out there, whether it be market driven or elsewhere, that could be certainly a change in the tune towards investor sentiment, turning more bearish or neutral to much more bullish. And I do think that's something that's going to continue to support gold throughout 2024.

[00:05:26] Maxwell Gold: So with those three, three themes highlighted, I want to do a deeper dive into why we think that some of these trends will continue and what's more important to pay attention to from your perspective as investors and portfolio managers out there. But just putting in the context, as I mentioned at the start, you know, 2023 was a very strong year for gold.

[00:05:45] Maxwell Gold: And in fact, when you look at where gold stands over the last trailing three year basis or trailing 10 year basis, sort of a medium term and long term perspective. You can see that the current 10 year rolling 10 year return as well as the rolling three year return is below the historical annualized return for gold going back to 1971 over 50 years ago.

[00:06:06] Maxwell Gold: And when you look at that annualized return, since gold became unpegged the dollar in August of 1971, you see that's annualized returns about 7 to 8 percent annualized. And when you look at where we are today rolling three year basis, rolling 10 year basis. You know, not only is the current gold return below that historical average, but you could see that the bottoming of some of these cyclical trends or these behaviors of the gold price historically over the last 50 plus years as sort of indicating that, you know, we may see an inflection point or turning point for gold just purely from a performance cycle perspective.

[00:06:41] Maxwell Gold: So again, for those investors that are concerned that maybe gold has run up too much or that we've seen too much of an increase the price for gold last year, particularly at the end of last year in 2023. I would say that, you know, gold has the potential for more room to run, especially just given where it stands and what some of its behaviors have been historically in terms of longer term cycles on a three year and 10 year basis.

[00:07:04] Maxwell Gold: So I do think that's important to pay attention to. And as I mentioned, you know, gold did very well in 2023 - first calendar year of a positive gain for first spot price gold last year since 2020 and on a trailing five calendar year basis. So from 2023 through 2019, annualized return is up 10%. So again, it's been very strong over the last few years, but I think that's gone unrecognized by a lot of investors.

[00:07:28] Maxwell Gold: And that's certainly an area of opportunity to look towards for this year. I mentioned the big theme for you know, anticipating from this year in 2024, is a shift towards more dovish monetary policy for gold and the rationale being led by the Federal Reserve and interest rates beginning to fall off the strength that we've seen and certainly the tightening of your policies, the aggressive you know, tightening cycle by the U.S. Federal Reserve that we saw begin in 2022 and continue throughout last year. Over 500 base points of increase of their base benchmark rate. The Fed discount rate was a bit of a headwind for gold. But what's interesting is that we saw begin to emerge last year, particularly 2023, is that breakdown between the traditional negative relationship of U.S. real interest rates and the gold price. And when you look at the chart in front of you here, it's a very telling picture. If you look at long term, the inverted U.S.rReal interest rates, which are represented here by the tips implied yield. This is a market based indicator of real interest rates for the U.S. And you can see that on an inverted basis as real yields rise, it's you know, that you would see the gold price fall and vice versa when U.S. real yields fall, effectively an increase of the blue line here, you would expect gold price to do well in given that negative relationship between gold and real interest rates, especially. What's interesting is that as we've seen real yields increase over the last year and a year or two.

[00:09:02] Maxwell Gold: The gold price has been very strong and actually has risen. Resiliency has been, you know, certainly the big surprise for gold market participants last year. And the reason being is that we saw strong demand in other sectors of the gold market led by central bank buying, and I'll get to more of that in a moment, but I do want to highlight that this breakdown between the traditional relationship between gold and U.S. real yields is an important indicator that, you know, the gold prices sort of weathered the storm of the tightening cycle and increase of interest rates by the Fed. So to date, and the Fed has remained paused for the last couple of meetings in the end of 2023. And I do think that if the Fed looks to begin to, you know, become much more dovish, you'll begin to look to cut interest rates.

[00:09:47] Maxwell Gold: That could be certainly a signal that the worst is over in terms of the aggressive tightening cycle, which you would think would be very bad for gold. But in fact, gold weathered the storm quite well throughout last year. And after focusing on the market rates here, shifting more towards what's been happening with the Federal Reserve's interest rates and what's referred to as the Fed funds rate on the slide in front of you here, it's an interesting relationship that we've seen evolve and emerge between gold and its performance, you know, long term versus more recent period since 2008 in the financial crisis and the implementation of what's referred to as Z.I. R. P. Zero Interest Rate Policy or ZERP. And if you look at gold's performance and responses and responsive behavior to different interest rate environments, you know, whether the Fed is cutting, increasing or keeping rates flat, it's been a very different behavior for gold since 2008 today, since the implementation of zero interest rate policies versus its behavior historically since the 1970s.

[00:10:49] Maxwell Gold: And it's interesting when you look at that, because the overall gold's performance, you know, since the 2008 period to today, has actually been very much more sensitive and much more responsive to falling interest rates when the federal funds rate begins to be cut or is reduced. Vice versa, if you look at the right side of the chart here, gold's average return since 2008 when we saw the Federal Reserve increase its Fed funds rate, gold's average performance was much lower compared to the historical average of rising fed funds rate periods. So, overall, net net, the important takeaway here is that gold price has become much more sensitive to movements and changes of the Fed funds rate since 2008 compared to the historical average.

[00:11:33] Maxwell Gold: And if based on our view, if we expect the Fed to begin to cut rates at some point this year in 2024, this could prove very beneficial to gold, given that strengthened increased relationship between Fed funds rate, whether it's rising, that would be, you know, on average, a headwind for gold or more likely in our anticipation that the Fed begins to cut rates that could be proving a very strong dovetail to gold's performance in response to what's happening with the Fed's interest rate policies in 2024 and beyond.

[00:12:05] Maxwell Gold: And shifting gears to that second theme that I mentioned, focusing on a softer or weaker dollar environment for 2024. It's important to call this out just given the historical relationship between gold and the U.S. dollar. As the chart in front of you shows, the average correlation going back to 1971 for over 50 years has been a very strong negative correlation between gold and the U.S. dollar. In fact, that correlation has been about negative 0. 4 on average historically. But there have been periods where we've seen a rising of that correlation, or in fact, a synchronization between gold and the U.S. dollar, where their correlation was briefly slightly positive. And you may be asking, what are those periods historically where the gold and the dollar exhibited a positive correlation, moving in the same direction?

[00:12:53] Maxwell Gold: And in fact, on average, that's most likely indicative of periods of significant market turmoil, volatility, economic recession, or geopolitical turmoil. And so we tend to see, you know, when the risk appetite for investors begins to fade and they shift to more defensive positions, we tend to see that be supportive of the U.S. dollar as well as other reserve currencies and cash as well as gold, given its historical ability to serve as a low correlating asset to financial assets like stocks and bonds. So during periods of significant turmoil and volatility, we tend to see gold and dollar on the shorter term period you know, move in tandem.

[00:13:33] Maxwell Gold: And again, that's something to keep an eye on, given the potential you know, rising risk environment that we expect for 2024 on several different fronts. But more importantly, when you look at the long term average between US dollar and the gold price, we tend to see that negative correlation persist and given our anticipation of a flat to weaker, softer dollar as the rest of the world begins to catch up to the U.S.’s growth post pandemic, that could prove a very much a strong supportive factor for gold as a strong, strongly appreciating dollar in 2024 is not part of our base case view. And so likely a rising or strengthening dollar will not likely be a factor that could be impeding the outlook for gold this year.

[00:14:15] Maxwell Gold: And so I do think that's an important factor to keep an eye on as another turning tide. And on the topic of the dollar, it's interesting to note that, you know, another area of more longer term sustained you know headwinds or softness for the dollar demand is, is really certainly focusing on what's happening with central banks globally and their activity of gold purchases.

[00:14:38] Maxwell Gold: In fact, global central banks have been net purchasers of gold since 2010 and every year since, and they're on pace to be net buyers this year, last year in 2023. So again, the fact that central banks have been buying gold to diversify their reserves, to diversify away from dollars, away from Euros, Yens, other reserve currencies, and similar currency assets, is an important factor to pay attention to. While it may not be a significant driver in the short term, this can certainly continue to add marginal pressure longer term towards the dollars prospects as central banks continue to diversify their reserves into other assets like gold for liquidity purposes for diversification purposes, as well as for needs of, you know, of great reserve assets such as gold, which is highly liquid and accepted everywhere globally.

[00:15:30] Maxwell Gold: And in fact, when you look at the net buyers of the net holders of gold amongst central banks, it's predominantly led by developed markets where they hold certainly about 58 percent of their reserves denominated and in gold in terms of how much gold makes up of their total reserve assets as they don't typically keep a lot of their own currency on inventory. Vice versa, when you look at emerging markets, particularly emerging markets in Asia, Middle East, Latin America, as well as South America and other areas, you can see that, you know, certainly gold has been a much lower weighting in terms of their total reserves outstanding. So there's a lot more room to run. In terms of gold purchases by central banks, particularly in emerging markets, which have been the net buyers over the last decade of gold for central banks.

[00:16:16] Maxwell Gold: I think there's more room to run to catch up to their developed market peers. And again, that could be supportive of gold for the long term and may add some, some pressure or some headwinds for, for the dollar more longer term. So again, as part of that theme of, you know, the dollar and gold relationship, something to pay attention to as certainly it's been a very strong period of central bank demand for gold not just last year in 2023, but 2022 as well, which saw a record year of over 1000 metric tons of gold purchased by central banks globally and aggregate, but that's been a continuing trend for 13 now going on 14 consecutive years, and we expect that trend to continue into the foreseeable future.

[00:16:57] Maxwell Gold: Shifting to the next slide and really highlighting the last of those three themes that I mentioned, you know, more of an increase or increased sentiment towards gold by investors. It's interesting because investors have been very much on the sidelines given the recent rally we've seen gold in 2023. And that's, you know, fairly unusual, particularly when you look at global gold holdings and where ETFs or exchange traded funds, you know, investors that are buying physical gold and storing physical gold and involved globally through through products that trade on the market.

[00:17:28] Maxwell Gold: And when you look at that relationship between global holdings of gold ETFs and investor ETFs versus the gold price, it tends to move very, you know, very tightly. You know, there's a certainly coincides, you know, very high correlation, positive correlation between the two. And what we've seen emerge last year, especially, was a breakdown of that relationship where we saw the gold price remain very strong, resilient and robust throughout 2023.

[00:17:53] Maxwell Gold: Again, outperforming other major global asset classes like broad commodities and global fixed income. Yet despite that strong price performance, investors continue to reduce their, their holdings through products like gold ETFs globally. And that is a very interesting breakdown between that, you know, that relationship and doesn't tend to sort of, you know, be the, the average experience of how you would expect investor flows to move versus the gold price.

[00:18:21] Maxwell Gold: Again, what has been driving the gold price? There's been other sectors of demand supporting the gold market, you know, such as jewelry demand globally, technology and industrial demand, other forms of investment that are not gold fund holdings as well as, you know, central banks have been the biggest, you know, marginal driver there, you know, supporting and driving the gold price given the strong demand we've seen of that sector in the last two years, as well as that ongoing trend of net buying. So I do think this is important to take, you know, keep in mind because investors have been on the sidelines for gold. They've not been really active in the gold asset class, and I do think that will likely change as the, you know, concerning risks of uncertainty from an economic financial market as well as geopolitical standpoint, continue to weigh on investors throughout 2024. And as we're beginning to see indications of slowing growth, slowing earnings growth for U.S. companies for 2024, that could certainly weigh on the prospect for risk assets. You know, where we are right now, valuations seem very rich in risk assets like equities, the potential for increased volatility or some kind of correction in the short to medium term is certainly, you know, can't be dismissed.

[00:19:31] Maxwell Gold: And I do think that may benefit gold as again, that view of it as a defensive asset as a source diversification and portfolio protection potentially could be very valuable to investors. So where the sentiment has certainly been lackluster in the last year, I do think that will begin to change as the overall macroeconomic backdrop begins to be much more uncertain.

[00:19:53] Maxwell Gold: And I do think that overall gold will fare well as investors look to further diversify. Their portfolios away from risk assets that may be valued much more richly and where gold has sort of been performing well, but certainly been out of favor from a sentiment perspective for a lot of investors, particularly large institutional investors investing directly into gold funds and gold ETFs.

[00:20:16] Maxwell Gold: And just to highlight that, that breakdown of that relationship, when you look at the change or the correlation between gold holdings and the gold price, which is shown here in the chart in front of you. Again, the average correlation historically over the last 20 years, has been about 0. 6 where that correlation currently stands is actually negative and certainly well below the average correlation.

[00:20:37] Maxwell Gold: So we do expect that this will, this relationship will mean revert closer to the average correlation between gold ETF holdings and the gold price. And when we think that will happen by investors moving back into the market as interest rates begin to you know you know, fall back in as we see the Fed potentially look to cut interest rates that will, I think you'll reduce the attractiveness of a lot of high yielding investment options out there like cash, fixed income bonds, et cetera, as interest rates begin to fall or soften.

[00:21:09] Maxwell Gold: And I think gold, given again, it's strong event diversification properties and benefits historically may be you know, part of that mix. And I do think investors will be looking and reevaluating gold, which has sort of been out of, out of sight, out of mind for 2023 and looking at 2024 given the risks at hand, given I think the increased need for diversification, I think gold is, is, is very much set to be you know very much primed to do well in 2024, as investors sentiment begins to improve, again, going from very strongly bearish to I think much more bullish and, and much more positive view for gold from an investor standpoint and sentiment standpoint for 2024. So I do think that, you know, that is another key changing trend that will be indicative and supportive of the gold market this year, alongside again, those other two being a shift to more dovish monetary policy, likely led by interest rate cuts by the U.S. Federal Reserve, as well as a softer dollar, sort of that being removed from the table as a potential headwind for gold from an investment case standpoint.

[00:22:13] Maxwell Gold: I do want to highlight, however, you know, beyond purely the tactical outlook or the shorter term market outlook for gold, you know, gold is a strategic asset, has tremendous potential benefit for investors of all types and all portfolios. When you look at gold's behavior, it is very unique asset class in terms of its behavior and its functions by having what is referred to as a dual nature.

[00:22:37] Maxwell Gold: When you look at the demand sectors of gold, which are summarized below in front of you, that could be summarized as: jewelry demand, which makes up on average about 50 percent of global demand for gold every year, industrial demand, making up about 8 to 10 percent on average investment demand about, you know, 25 to 30 percent on average demand globally and central banks, which again is a new source of demand, which, you know, emerged in 2010, where previously they were net sellers of gold to the market, but they've been net buyers since 2010 to today. And on average, they account for about 10 to 10 to 13 percent of global demand every year for gold. And when you look at the nature of these different demand sectors for the global gold market, you know, they are both cyclical and counter cyclical in nature. Cyclical in the form of jewelry and industrial demand - we tend to see demand for gold and jewelry farm or industrial or electronic form you know, again, gold is a great conductor of electricity, it's used in electronics such as smartphones, computers and a whole slew of other electronics out there. When you put those two segments together, it's about 60 percent of annual demand for gold is cyclical in nature, as you know, we tend to see expansionary periods, you know, global growth increase or expand GDP rise, we tend to see these sectors of demand increase as you know, as consumers and individuals tend to be a little bit better off. They're looking to spend more on more consumer and discretionary purchases like jewelry or industrial you know products or electronics. And so that tends to be very much a cyclical driver of gold.

[00:24:05] Maxwell Gold: On the flip side, we have investment demand, which tend to be on average, you know, a counter cyclical in nature. You know, we tend to see investment demand pick up during periods of slowdown, recession uncertainty or economic turmoil or overall financial market volatility. And in that nature, gold being counter cyclical for investment purposes on average, you know, tends to be a very offsetting factor for that cyclical driver.

[00:24:28] Maxwell Gold: And so what ends up being is that over a full economic cycle, these cyclical and counter cyclical source of demand, they come online at different stages of a full economic cycle, but the end result over that full cycle is very much a low correlation to what's happening to the global economy and the global financial markets.

[00:24:44] Maxwell Gold: So, gold remains a fairly well low correlating asset that serves several different utilities for investors and portfolios. But in my mind, the first, biggest and foremost is that of risk management and potential diversification for that gold offers for investors and portfolios. And the way it achieves that is again, through those cyclical and counter cyclical source of demand for gold every year, they, you know, they support a low correlation to financial assets, both stocks and bonds globally.

[00:25:15] Maxwell Gold: And in fact, when you look at the trailing 30 year period and look at pretty much every major equity and fixed income region and market segment out there through indices listed below, you can see that the average correlation over a 30 year period, long term period for between these markets, these indices, these asset classes and gold, whether they be international equities, US equities, international fixed income, US fixed income credit, you know small cap equities, large cap equities, et cetera, the correlation is very low to gold, regardless of what asset class you're looking here, what segment you're looking here at global, at global markets. And I think that's an important takeaway of why gold is such a great diversifier for portfolios. It lies in its persistent low correlation to both stocks, bonds and other asset classes out there over time.

[00:26:01] Maxwell Gold: And again, that low correlation is supported and driven by its diverse demand sectors that are both cyclical and counter cyclical in nature. And so I do think this is an important takeaway, especially for investors considering adding gold to their portfolios from more of a strategic long term allocation perspective to keep in mind that regardless of where gold goes in the short term for 2024, I do think it has, you know, significant impact to improve your portfolio risk taking to help manage your risk taking in portfolios and asset allocations over the long run over the strategic long term period.

[00:26:34] Maxwell Gold: And just to highlight this in a different perspective, you know, gold does have a great track record historically of performing well during significant drawdowns of market events or U.S. Equity market events. And what I've highlighted here on this chart is looking at peak the trough drawdowns on a total return basis for the S&P 500, over the last 35 years, and you can see that when we see these significant market events, whether they be driven by financial factors, health related factors, this was the case during the pandemic in 2020, market events, recessions certainly you know other factors such as credit events, mortgage events et cetera.

[00:27:16] Maxwell Gold: The end result is certainly a drawdown or a pullback of, of risk assets, particularly U.S. equities and U.S. equity markets. And you can see that during these drawdowns, these peak to trough drawdowns of the U.S. Equity market again measured by the S&P 500 total return. During these periods, gold is provided a fairly strong offset or a ballast against periods of the most turmoil, the largest drawdowns we've seen over the last 35 years in U.S. markets. And you can see that every single period listed here, gold doesn't necessarily provide an offsetting positive return, but it certainly provides a relative outperformance relative to the U.S. equity market during these significant you know, left tail events with these significant tail risk events occurring fairly infrequently.

[00:28:01] Maxwell Gold: So when you look at the average performance for gold over these periods, you know, cumulatively, it's done very well, providing a potential offset ballast. To protect against the severe equity market drawdowns, these periods of significant market volatility market turmoil when you really need something in your portfolio to provide that low correlation, provide that diversification. Again, gold has historically proven to do the service as that great role as a portfolio diversifier and what I refer to it as a risk management tool protecting against significant drawdowns in the market as well as providing ongoing portfolio diversification through its low correlation. So I do think that gold offers a tremendous, important role to your portfolios and certainly should be taking a look at given sort of the increased uncertainty of the market direction where we're seeing for not just this year, but longer term as well. So I do think that gold can provide a lot to portfolios from a strategic asset allocation standpoint. And a question may be, how do you, how do you gain exposure to gold as an investment?

[00:29:06] Maxwell Gold: And again, from our perspective at State Street, we have two gold ETFs that are physically backed by gold bars stored in vaults in London. And again, I think this is a great way to gain exposure, especially if you're looking to track the spot price of gold, the price of gold directly with the least minimal amount of tracking error in a highly liquid vehicle, a physical gold backed ETF, like our two products in our suite here at State Street being GLD and GLDM, you know, are great options.

[00:29:33] Maxwell Gold: Both are physically backed by gold. They track the spot price of gold. Again, GLD we launched you know, about 20 years ago in 2004. You know, it does have a tremendous amount of liquidity. It is the largest gold fund in the world in terms of assets under management, and certainly provides tremendous liquidity and a great vehicle for investors looking to gain exposure to the gold market.

[00:29:55] Maxwell Gold: Additionally, we have GLDM, which is the mini version of GLD is a lower expense ratio product, has about 6 billion in assets under management compared to about 55 to 60 billion dollars in assets for GLD. So it's a smaller product in terms of assets, but still provides a low expense ratio option for investors out there, at 10 basis points versus 40 basis points for GLD. So again, something to take a look at. If you're interested in looking at how to implement your exposure to gold, I do think that gold backed ETFs are a great option for investors to evaluate as a way to gain exposure to the gold market directly through owning physical gold through the funds and the trust themselves.

[00:30:37] Maxwell Gold: And just covering off some additional disclosures here as we wrap up my conversation about the gold market outlook, as well as why I do think gold is a great source of diversification, serves a great role in diversified portfolios of all types. I do think it's important to highlight, you know, that I do think gold is certainly weathered the storm of 2023.

[00:30:57] Maxwell Gold: Very strong, very resilient period for gold in 2023, despite macro headwinds, which you would expect gold to do you know, just to suffer certainly a lackluster performance. Despite the fact that gold weathered the most aggressive tightening cycle by the Federal Reserve in several decades, if not on record, I do think is a testament to that gold has certainly a bright spot, a bright outlook for this year and in longer term as well as there are a lot of factors out there that may be turning the tides to favor gold, particularly on the front of monetary policy, the U.S. dollar outlook, as well as overall investor sentiment. I think when you put those three pieces together, I do think that gold has a lot favoring it this year, and I think that there are a lot of tailwinds supporting the outlook for gold demand globally, as well as the outlook for gold from a performance perspective.

[00:31:50] Maxwell Gold: So thank you for joining me today. And as I outlined my views, the gold market for 2024 with that, I'll turn it back and open up to any questions on the line.

[00:32:01] Natalie Noel: Max. Thank you so much for such an informative presentation. We've had quite a few questions come in so far. In the event you have a question and have not yet submitted it, you can do so by submitting it in the Q and A box to the right of your slides.

[00:32:14] Natalie Noel: So let's start with this 1st question. An advisor is asking Central banks have been net buyers of gold for over a decade now. Do you anticipate this trend continuing?

[00:32:24] Maxwell Gold: I do. And there's been a lot of survey information and indications from central banks themselves, publicly, where they've stated they want to continue to buy gold.

[00:32:33] Maxwell Gold: So I do think that we expect, anticipate, you know, central banks, not only to be net buyers in 2024, but I do think the trend of central banks globally in aggregate being net buyers for the foreseeable future has certainly a lot of support to it. And as I mentioned, this has not always been the trend.

[00:32:49] Maxwell Gold: Central banks historically, particularly during the decades of the eighties, the nineties and the two thousands, they were actually a source of supply to the gold market. They were selling their existing gold holdings during that 30 year period. And you have to go back really to the sixties, early seventies to see a period when central banks were continuous net buyers of gold.

[00:33:08] Maxwell Gold: But really since 2010, that shifted where, you know, central banks in aggregate shifted from being net sellers to net buyers of gold. In 2010 following the financial crisis and the European sovereign debt crisis of that period from 08 to 2010. And every single year since then, from 2010 through now, potentially through 2013, as we await final data through the end of through the end of 2023, sorry.

[00:33:34] Maxwell Gold: We do expect central banks to be net buyers of gold for that, 13 now going on 14 year consecutive period from 2010 to 2023. And I do think that's important because that's been an increasing and supportive segment for the gold market that is in its nature, not really cyclical, not really counter cyclical.

[00:33:50] Maxwell Gold: And central banks are buying gold for their own purposes, long term strategic purposes of reserve diversification, liquidity management and other factors out there. So I do think that it's, it's an important segment that is again, not the largest, but certainly has been very predominant in terms of gold's performance really at the end of 2022, all throughout 2023.

[00:34:11] Maxwell Gold: And I do think it's an important sector to pay attention to as I do think that can support gold, even if other, other net buyers of gold, such as investors, are not in the market actively.

[00:34:24] Natalie Noel: And I believe we have time for one final question. Which drivers are most important for gold performance in 2024?

[00:34:32] Maxwell Gold: I do think there's a lot of factors that are always driving gold.

[00:34:35] Maxwell Gold: There's no one single factor that's going to be the sole driver of the gold outlook and gold's performance, especially in the short term. But I do think longer term, especially for 2024, what to be paying attention to is the direction of monetary policy. That's why it's number one of those three themes I highlighted for what where we think the gold outlook is going to go in 2024, certainly given that synchronization, that increased sensitivity between gold and market real rates and as well as gold and the federal funds rate, we've seen that that negative relationship between those both of those types of interest rates and policy benchmark rates, you know, increase in recent years, I do think that's something to be paying attention to. You know, I do think, in my opinion, it's not a matter of if, but when the Fed begins to cut interest rates to, you know, respond to the, you know, success that it's seen in terms of managing economic slowdown to date. But I do think there's a tremendous amount of tightening in the financial market.

[00:35:30] Maxwell Gold: And the Fed will likely look to, you know, you know, current continuance pause, but look to cut throughout at some point this year in 2024. And I do think that could be very supportive of gold's current expectations of the market right now based on today. But I do think throughout 2024, paying attention to the direction of monetary policy and what the Federal Reserve is saying, but not just the Federal Reserve, but other central banks as well, the European Central Bank, The Bank of Japan and others globally. It's important to pay attention to monetary policy at the global level from that perspective. But I do think that that in the direction of interest rates and monetary policy will be a strong driver of what's happening with gold this year in 2024.

[00:36:14] Natalie Noel: Max, thank you again for your insights and thank you to our audience for joining us.

[00:36:19] Maxwell Gold: Thank you.

Important Disclosures

For Investment Professional Use Only.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA's express written consent.

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

Investing involves risk, and you could lose money on an investment in each of SPDR® Gold Shares Trust (“GLD®” or “GLD”) and SPDR® Gold MiniShares® Trust (“GLDM®” or “GLDM”), a series of the World Gold Trust (together, the “Funds”).

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs’ net asset value. Brokerage commissions and ETF expenses will reduce returns.

Commodities and commodity-index linked securities may be affected by changes in overall market movements, changes in interest rates, and other factors such as weather, disease, embargoes, or political and regulatory developments, as well as trading activity of speculators and arbitrageurs in the underlying commodities.

Frequent trading of ETFs could significantly increase commissions and other costs such that they may offset any savings from low fees or costs.

Diversification does not ensure a profit or guarantee against loss.

There can be no assurance that a liquid market will be maintained for ETF shares.

There are risks associated with investing in Real Assets and the Real Assets sector, including real estate, precious metals and natural resources. Investments can be significantly affected by events relating to these industries.

Currency Risk is a form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged.

Hedging involves taking offsetting positions intended to reduce the volatility of an asset. If the hedging position behaves differently than expected, the volatility of the strategy as a whole may increase and even exceed the volatility of the asset being hedged.

Asset Allocation is a method of diversification which positions assets among major investment categories. Asset Allocation may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss.

Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

Investing in commodities entails significant risk and is not appropriate for all investors.

Important Information Relating to GLD® and GLDM®:

GLD and the World Gold Trust have each filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) for GLD and GLDM, respectively. Before you invest, you should read the prospectus in the registration statement and other documents each Fund has filed with the SEC for more complete information about each Fund and these offerings. Please see each Fund’s prospectus for a detailed discussion of the risks of investing in each Fund’s shares. The GLD prospectus is available by clicking here, and the GLDM prospectus is available by clickings here. You may get these documents for free by visiting EDGAR on the SEC website at sec.gov or by visiting spdrgoldshares.com. Alternatively, the Funds or any authorized participant will arrange to send you the prospectus if you request it by calling 866.320.4053.

None of the Funds is an investment company registered under the Investment Company Act of 1940 (the “1940 Act”). As a result, shareholders of each Fund do not have the protections associated with ownership of shares in an investment company registered under the 1940 Act. GLD and GLDM are not subject to regulation under the Commodity Exchange Act of 1936 (the “CEA”). As a result, shareholders of each of GLD and GLDM do not have the protections afforded by the CEA.

Shares of each Fund trade like stocks, are subject to investment risk and will fluctuate in market value.

The values of GLD shares and GLDM shares relate directly to the value of the gold held by each Fund (less its expenses), respectively. Fluctuations in the price of gold could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the gold represented by them.

None of the Funds generate any income, and as each Fund regularly sells gold to pay for its ongoing expenses, the amount of gold represented by each Fund share will decline over time to that extent.

The World Gold Council name and logo are a registered trademark and used with the permission of the World Gold Council pursuant to a license agreement. The World Gold Council is not responsible for the content of, and is not liable for the use of or reliance on, this material. World Gold Council is an affiliate of the Sponsor of each of GLD and GLDM.

MiniShares® is a registered trademark of WGC USA Asset Management Company, LLC used with the permission of WGC USA Asset Management Company, LLC. GLD® and GLDM® are registered trademarks of World Gold Trust Services, LLC used with the permission of World Gold Trust Services, LLC.

State Street Global Advisors and its affiliates have not taken into consideration the circumstances of any particular investor in producing this material and are not making an investment recommendation or acting in fiduciary capacity in connection with the provision of the information contained herein.

The S&P 500® Index is a product of S&P Dow Jones Indices LLC or its affiliates (“S&P DJI”) and have been licensed for use by State Street Global Advisors. S&P®, SPDR®, S&P 500®, US 500 and the 500 are trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and has been licensed for use by S&P Dow Jones Indices; and these trademarks have been licensed for use by S&P DJI and sublicensed for certain purposes by State Street Global Advisors. The fund is not sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of these indices.

For more information, please contact the Marketing Agent for GLD and GLDM: State Street Global Advisors Funds Distributors, LLC, One Iron Street, Boston, MA, 02210;

T: +1 866 320 4053 spdrgoldshares.com

COPYRIGHT AND OTHER RIGHTS

© 2024 World Gold Council. All rights reserved. World Gold Council and the Circle device are trade marks of the World Gold Council or its affiliates. No part of this presentation may be copied, reproduced, republished, sold, distributed, transmitted, circulated, modified, displayed or otherwise used for any purpose whatsoever, including, without limitation, as a basis for preparing derivative works, without the prior written authorization of the World Gold Council.

Thomson Reuters and GFMS, Thomson Reuters content is the intellectual property of Thomson Reuters. Any copying, republication or redistribution of Thomson Reuters content, including by framing or similar means, is expressly prohibited without the prior written consent of Thomson Reuters. Thomson Reuters shall not be liable for any errors or delays in its content, or for any actions taken in reliance thereon.

“Thomson Reuters” is a trademark of Thomson Reuters and its affiliated companies.

All references to LBMA Gold Price have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced.

Other third party content is the intellectual property of the respective third party and all rights are reserved to them. All rights reserved. No organization or individual is permitted to reproduce, distribute or otherwise use the statistics and information in this report without the written agreement of the copyright owners.

© 2024 State Street Corporation. All Rights Reserved.

State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC. One Iron Street, Boston, MA 02210

Tracking Code: 6204449.1.1.AM.INST

Exp Date: 1/31/2024

Information Classification: Limited Access

Not FDIC Insured - No Bank Guarantee - May Lose Value

SPDR® GOLD TRUST (the "Trust") has filed a registration statement (including a prospectus) with the Securities and Exchange Commission ("SEC") for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Trust has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov or by visiting www.spdrgoldshares.com. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus if you request it by calling 1-866-320-4053.

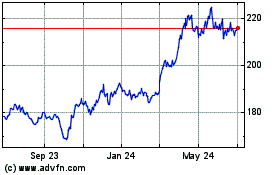

SPDR Gold (AMEX:GLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

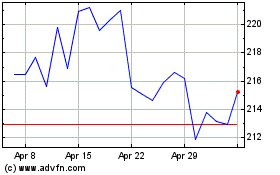

SPDR Gold (AMEX:GLD)

Historical Stock Chart

From Apr 2023 to Apr 2024