false

0000894627

0000894627

2024-01-17

2024-01-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 17, 2024

VAALCO Energy, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-32167

|

|

76-0274813

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

9800 Richmond Avenue, Suite 700

Houston, Texas

|

|

77042

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (713) 623-0801

Not Applicable

(Former Name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.10

|

EGY

|

New York Stock Exchange

|

|

Common Stock, par value $0.10

|

EGY

|

London Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 17, 2024, VAALCO Energy, Inc. (the “Company”) issued a press release providing an operational update including annual and fourth quarter production and sales volumes, a summary of dividends returned to shareholders for 2023 and an update on the share buyback program.

The information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended (the "Securities Act"), except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| |

|

|

|

|

Exhibit No.

|

|

Description of Exhibit

|

|

|

|

|

Press Release, dated January 17, 2024

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

| |

VAALCO Energy, Inc.

|

|

| |

(Registrant)

|

|

| |

|

|

|

| |

|

|

|

|

Date: January 17, 2024

|

|

|

|

| |

By:

|

/s/ Jason Doornik

|

|

| |

Name:

|

Jason Doornik

|

|

| |

Title:

|

Chief Accounting Officer

|

|

Exhibit 99.1

THIS ANNOUCEMENT CONTAINS INSIDE INFORMATION

VAALCO ENERGY, INC. PROVIDES OPERATIONAL AND FINANCIAL UPDATE INCLUDING PRODUCTION AND SALES VOLUMES FOR FOURTH QUARTER 2023

HOUSTON – January 17, 2024 – VAALCO Energy, Inc. (NYSE: EGY; LSE: EGY) (“VAALCO” or the “Company”) today provided an operational and financial update with production and sales volumes for the fourth quarter and full year of 2023 as well as its increased cash and cash equivalents balance as of December 31, 2023.

Highlights and Key Items:

| |

●

|

Continued solid operational performance in Gabon, Egypt and Canada drove production and sales volumes in Q4 2023;

|

| |

●

|

Recorded full year 2023 sales volumes of 23,900 to 24,000 working interest (“WI”) barrels of oil equivalent per day (“BOEPD”) at the top of its guidance range of 23,050 to 24,000 WI BOEPD;

|

| |

o

|

Full year 2023 sales volumes were 18,700 to 18,800 net revenue interest (“NRI”) BOEPD above the top end of the Company’s guidance range of 17,900 to 18,500 NRI BOEPD;

|

| |

●

|

Generated sales volumes of about 27,400 to 27,550 WI BOEPD in Q4 2023 or 21,725 to 22,125 NRI BOEPD;

|

| |

●

|

Produced between 23,900 and 24,000 WI BOEPD for full year 2023, above the midpoint of its full year guidance range of 23,450 to 24,400 WI BOEPD;

|

| |

o

|

Full year 2023 production volumes were 18,700 to 18,800 NRI BOEPD at the top end of the Company’s guidance range of 18,300 to 18,900 NRI BOEPD;

|

| |

●

|

Delivered Q4 2023 production of 23,100 to 23,500 WI BOEPD or 17,900 to 18,200 NRI BOEPD; and

|

| |

●

|

Grew cash and cash equivalents to over $120 million at December 31, 2023 after returning $12.5 million in dividends and share buybacks in Q4 2023.

|

George Maxwell, VAALCO’s Chief Executive Officer commented, “We finished 2023 with solid production driven by our capital programs in Egypt and Canada and the continued strong operational uptime in Gabon. In 2023, we raised our full year production and sales guidance following excellent first half 2023 results and our continued outstanding performance has allowed us to achieve the top end of our sales guidance and our production was also above the midpoint of the increased guidance range. Our high-quality asset base, combined with our exceptional operational and financial teams, have helped us to deliver this strong performance that exceeded expectations. We have grown our cash by more than $80 million in 2023 and ended the year with over $120 million in cash. VAALCO was able to accomplish this even after funding our capital program, paying out $27 million in dividends and repurchasing $21 million of VAALCO stock. We remain committed to maximizing shareholder value, generating meaningful cash flow and growing our production and reserves across a larger, diversified portfolio. We have entered 2024 with a clean balance sheet, growing cash position and robust operational performance, underpinning management’s confidence in achieving our strategic objectives.”

About VAALCO

VAALCO, founded in 1985 and incorporated under the laws of Delaware, is a Houston, Texas, USA based, independent energy company with production, development and exploration assets in Africa and Canada.

Following its business combination with TransGlobe Energy Corporation (“TransGlobe”) in October 2022, VAALCO owns a diverse portfolio of operated production, development and exploration assets across Gabon, Egypt, Equatorial Guinea and Canada.

For Further Information

| |

|

|

VAALCO Energy, Inc. (General and Investor Enquiries)

|

+00 1 713 623 0801

|

|

Website:

|

www.vaalco.com

|

| |

|

|

Al Petrie Advisors (US Investor Relations)

|

+00 1 713 543 3422

|

|

Al Petrie / Chris Delange

|

|

| |

|

|

Buchanan (UK Financial PR)

|

+44 (0) 207 466 5000

|

|

Ben Romney / Barry Archer

|

VAALCO@buchanan.uk.com

|

Forward Looking Statements

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created by those laws and other applicable laws and “forward-looking information” within the meaning of applicable Canadian securities laws. Where a forward-looking statement expresses or implies an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. All statements other than statements of historical fact may be forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “forecast,” “outlook,” “aim,” “target,” “will,” “could,” “should,” “may,” “likely,” “plan” and “probably” or similar words may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this press release include, but are not limited to, statements relating to (i) estimates of production and sales volumes and cash position as of, and for the quarter ended December 31, 2023; (ii) estimates of future drilling, production, sales and costs of acquiring crude oil, natural gas and natural gas liquids; (iii) expectations of future commodity prices; (iii) expectations on future capital expenditures; and (iv) expectations regarding future exploration and the development, growth and potential of VAALCO’s operations, project pipeline and investments, and schedule and anticipated benefits to be derived therefrom. Such forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to: risks relating to any unforeseen liabilities of VAALCO or TransGlobe; the ability to generate cash flows that, along with cash on hand, will be sufficient to support operations and cash requirements; the impact and costs of compliance with laws and regulations governing oil and gas operations; the risks described under the caption “Risk Factors” in VAALCO’s 2022 Annual Report on Form 10-K filed with the SEC on April 6, 2023.

Inside Information

This announcement contains inside information as defined in Regulation (EU) No. 596/2014 on market abuse which is part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“MAR”) and is made in accordance with the Company’s obligations under article 17 of MAR. The person responsible for arranging the release of this announcement on behalf of VAALCO is Matthew Powers, Corporate Secretary of VAALCO.

v3.23.4

Document And Entity Information

|

Jan. 17, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

VAALCO Energy, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 17, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-32167

|

| Entity, Tax Identification Number |

76-0274813

|

| Entity, Address, Address Line One |

9800 Richmond Avenue, Suite 700

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77042

|

| City Area Code |

713

|

| Local Phone Number |

623-0801

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

EGY

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000894627

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

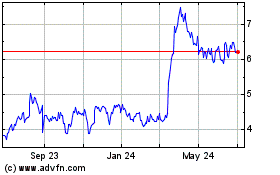

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

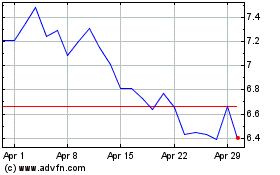

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Apr 2023 to Apr 2024