Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-269225

This

preliminary prospectus supplement relates to an effective registration statement under the Securities Act of 1933, as amended, but the

information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and

the accompanying prospectus are not an offer to sell these securities, and we are not soliciting offers to buy these securities in any

state or other jurisdiction where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS SUPPLEMENT |

|

SUBJECT

TO COMPLETION |

|

DATED

JANUARY 16, 2024 |

(To

Prospectus dated January 25, 2023)

Shares

of Common Stock

Pre-Funded

Warrants to Purchase Common Stock

Oragenics,

Inc.

We

are offering shares of our

common stock, $0.001 par value per share (the “common stock”), at an offering price of $ per share, pursuant to this

prospectus supplement and the accompanying base prospectus.

We

are also offering pre-funded

warrants (each a “Pre-funded Warrant”) to purchase

shares of our common stock,

exercisable at an exercise price of $0.001 per share, to those purchasers whose purchase of common stock in this offering would

otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99%

(or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this

offering. The purchase price of each Pre-funded Warrant is equal to the price per share of common stock being sold to the public in

this offering, minus $0.001. The Pre-funded Warrants will be immediately exercisable and may be exercised at any time until all of

the Pre-funded Warrants are exercised in full.

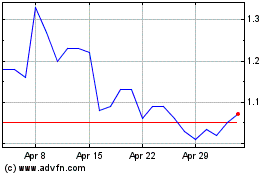

Our

common stock is listed on the NYSE American under the symbol “OGEN”. The last reported sale price of our common stock on

the NYSE American on January 12, 2024 was $6.06 per share. There is no established

trading market for the Pre-funded Warrants and we do not intend to list the Pre-funded Warrants on any securities exchange or nationally

recognized trading system.

As

of January 3, 2024, the aggregate market value of our outstanding common stock held by non-affiliates, or the public float, was

approximately $4,701,675, which was calculated based on 2,062,138 shares of our outstanding common stock held by non-affiliates

and on a price of $6.84 per share, which is the highest closing price of our common stock

on the NYSE American within the prior 60 days. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our

securities in a public primary offering with a value exceeding one-third of our public float in any 12-month period unless our public

float subsequently rises to $75.0 million or more. During the 12-calendar month period that ends

on, and includes, the date of this prospectus supplement (but excluding this offering), we have not offered and sold any of our securities

pursuant to General Instruction I.B.6 of Form S-3.

Investing

in our securities involves significant risks. Please read the information contained in or incorporated by reference under the heading

“Risk Factors” beginning on page S-16 of this prospectus supplement, and under similar headings in other documents filed

after the date hereof and incorporated by reference into this prospectus supplement and the accompanying prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

| | |

Per Share | | |

Per Pre-funded Warrant | | |

Total | |

| Public offering price | |

$ | | | |

$ | | | |

$ | | |

| Underwriting discount(1) | |

$ | | | |

$ | | | |

$ | | |

| Proceeds, before expenses, to us | |

$ | | | |

$ | | | |

$ | | |

| (1) | See

“Underwriting” beginning on page S-28 for additional information regarding underwriting compensation. |

We

have granted a 45-day option to the representative of the underwriters to purchase up to

additional shares of common stock and/or additional Pre-funded Warrants to purchase up to

additional shares of common stock solely

to cover over-allotments, if any.

The

underwriter expects to deliver the securities to purchasers on or about , 2024.

ThinkEquity

The

date of this prospectus supplement is , 2024

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is part of the registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, using

a “shelf” registration process (Registration File No. 333-265995) and consists of two parts. The first part is this prospectus

supplement, which describes the specific terms of this offering. The second part, the accompanying prospectus, gives more general information,

some of which may not apply to this offering. Generally, when we refer only to the “prospectus,” we are referring to both

parts combined. This prospectus supplement may add to, update or change information in the accompanying prospectus and the documents

incorporated by reference into this prospectus supplement or the accompanying prospectus.

If

information in this prospectus supplement is inconsistent with the accompanying prospectus or with any document incorporated by reference

that was filed with the SEC before the date of this prospectus supplement, you should rely on this prospectus supplement. This prospectus

supplement, the accompanying prospectus and the documents incorporated into each by reference include important information about us,

the securities being offered and other information you should know before investing in our securities. You should also read and consider

information in the documents we have referred you to in the sections of this prospectus supplement entitled “Where You Can Find

More Information” and “Incorporation of Certain Information by Reference”.

You

should rely only on this prospectus supplement, the accompanying prospectus, the documents incorporated or deemed to be incorporated

by reference herein or therein and any free writing prospectus prepared by us or on our behalf. We have not authorized anyone to provide

you with information that is in addition to or different from that contained or incorporated by reference in this prospectus supplement

and the accompanying prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are

not offering to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information

contained in this prospectus supplement, the accompanying prospectus or any free writing prospectus, or incorporated by reference herein,

is accurate as of any date other than as of the date of this prospectus supplement or the accompanying prospectus or any free writing

prospectus, as the case may be, or in the case of the documents incorporated by reference, the date of such documents regardless of the

time of delivery of this prospectus supplement and the accompanying prospectus or any sale of our securities. Our business, financial

condition, liquidity, results of operations and prospects may have changed since those dates.

References

to, “we,” “us,” “our company,” “Oragenics,” the “Company,” and similar terms

refer to Oragenics, Inc., a Florida corporation, unless the context otherwise requires.

No

action is being taken in any jurisdiction outside the United States to permit a public offering of the securities or possession or distribution

of this prospectus supplement or the accompanying prospectus in that jurisdiction. Persons who come into possession of this prospectus

supplement or the accompanying prospectus in jurisdictions outside the United States are required to inform themselves about, and to

observe, any restrictions as to this offering and the distribution of this prospectus supplement or the accompanying prospectus applicable

to that jurisdiction.

The

industry and market data and other statistical information contained in this prospectus supplement, the accompanying prospectus and the

documents we incorporate by reference are based on management’s estimates, independent publications, government publications, reports

by market research firms or other published independent sources, and, in each case, are believed by management to be reasonable estimates.

Although we believe these sources are reliable, we have not independently verified the information. None of the independent industry

publications used in this prospectus supplement, the accompanying prospectus or the documents we incorporate by reference were prepared

on our or our affiliates’ behalf and none of the sources cited by us consented to the inclusion of any data from its reports, nor

have we sought their consent.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or

covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such

representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

CAUTIONARY

STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

Certain

statements in this prospectus supplement, the accompanying prospectus and documents incorporated by reference herein that look forward

in time or express management’s expectations or beliefs with respect to the occurrence of future events are forward-looking statements

as defined under within the meaning of Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the

Securities Exchange Act of 1934, as amended, or Exchange Act, as amended, and are subject to the safe harbor created therein for forward-looking

statements. Such statements include, but are not limited to, (i) projections of revenue, earnings, capital structure and other financial

items, (ii) statements of our plans and objectives, (iii) statements of expected future economic performance, and (iv) assumptions underlying

statements regarding us or our business. Forward-looking statements can be identified by, among other things, the use of forward-looking

language, such as “believes,” “expects,” “estimates,” “may,” “will,” “should,”

“could,” “seeks,” “plans,” “intends,” “anticipates” or “scheduled to”

or the negatives of those terms, or other variations of those terms or comparable language, including discussions of strategy or other

intentions, particularly as they relate to the development and funding of our product candidates.

We

caution investors that actual results or business conditions may differ materially from those projected or suggested in forward-looking

statements as a result of various factors including, but not limited to, the following risks and the other factors described in the Risk

Factors section of this prospectus supplement, our annual report on Form 10-K, in our quarterly reports on Form 10-Q and in our Current

Reports on Form 8-K incorporated by reference. These factors include:

| |

● |

Our

significant operating losses, which we have incurred since our inception, and our inability to assure you that we will generate revenues

or achieve profitability in the future; |

| |

|

|

| |

● |

Our

need for, and ability to raise, additional capital; |

| |

|

|

| |

● |

Our

expectations related to the use of proceeds from this Offering; |

| |

|

|

| |

● |

The

timing, progress and results of clinical trials of our product candidates, including statements regarding the timing of initiation

and completion of pre-clinical studies or clinical trials or related preparatory work, the period during which the results of the

trials will become available and our research and development programs; |

| |

|

|

| |

● |

Our

ability to timely and successfully achieve the anticipated benefits of acquiring the assets that we recently acquired from Odyssey

Health, Inc., including ONP-002, which is a unique neurosteroid drug compound intended to treat mild traumatic brain injuries also

known as concussions; |

| |

|

|

| |

● |

Our

expectations regarding the potential benefits, activity, effectiveness and safety of our product candidates including as to administration,

distribution and storage; |

| |

|

|

| |

● |

Our

expectations regarding the size of the patient populations, market acceptance and opportunity for and clinical utility of our product

candidates, if approved for commercial use; |

| |

|

|

| |

● |

Our

manufacturing capabilities and strategy, including the scalability and commercial viability of our manufacturing methods and processes,

and those of our contractual partners; |

| |

|

|

| |

● |

Our

expectations regarding the scope of any approved indications for our product candidates; |

| |

|

|

| |

● |

Our

ability to successfully commercialize our product candidates; |

| |

|

|

| |

● |

The

potential benefits of, and our ability to maintain, our relationships and collaborations

with the NIAID, the NIH, the NRC and other potential collaboration or strategic relationships;

|

|

● |

Our

estimates of our expenses, ongoing losses, future revenue, capital requirements and our needs for or ability to obtain additional

funding, including any application for future grants or funding; |

| |

|

|

| |

● |

Our

ability to identify, recruit and retain key personnel and consultants; |

| |

● |

Our

ability to obtain, retain, protect and enforce our intellectual property position for our product candidates, and the scope of such

protection; |

| |

|

|

| |

● |

Our

ability to advance the development of our product candidates under the timelines and in accord with the milestones projected; |

| |

|

|

| |

● |

Our

need to comply with extensive and costly regulation by worldwide health authorities, who must approve our product candidates prior

to substantial research and development and could restrict or delay the future commercialization of certain of our product candidates; |

| |

|

|

| |

● |

Our

ability to successfully complete pre-clinical and clinical development of, and obtain regulatory approval of our product candidates

and commercialize any approved products on our expected timeframes or at all; |

| |

|

|

| |

● |

The

content and timing of submissions to and decisions made by the FDA, other regulatory agencies and nongovernmental bodies and actors,

such as investigational review boards; |

| |

|

|

| |

● |

The

effects of government regulation and regulatory developments, and our ability and the ability of the third parties with whom we engage

to comply with applicable regulatory requirements; |

| |

|

|

| |

● |

The

capacities and performance of our suppliers and manufacturers and other third parties over whom we have limited control; |

| |

|

|

| |

● |

Our

ability to maintain our listing on the NYSE American and the effects of our recently completed acquisition of assets from Odyssey

Health, Inc.; |

| |

|

|

| |

● |

The

impact of the COVID-19 pandemic on our financial condition and business operations and our ability to continue research and development

for existing product candidates on previously-projected timelines or in accord with ordinary practices, as well as the broader governmental,

global health and macro- and microeconomic responses to and consequences of the pandemic; |

| |

|

|

| |

● |

We

may be adversely impacted by any significant broad-based financial crises and its impact on consumers, retailers and equity and debt

markets as well as our inability to obtain required additional funding to conduct our business; |

| |

|

|

| |

● |

As

a public company, we must implement additional and expensive finance and accounting systems, procedures and controls as we grow our

business and organization to satisfy reporting requirements, which add to our costs and require additional management time and resources; |

| |

|

|

| |

● |

Our

competitive position and the development of and projections relating to our competitors or our industry; and |

| |

|

|

| |

● |

The

impact of laws and regulations, including those that may not yet exist. |

We

cannot assure you that we have identified all the factors that create uncertainties. Moreover, new risks emerge from time to time and

it is not possible for our management to predict all risks, nor can we assess the impact of all risks on our business or the extent to

which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking statements.

We

urge you to consider these factors before investing in our common stock. The forward-looking statements included in this prospectus supplement,

the accompanying prospectus and any other offering material, or in the documents incorporated by reference into this prospectus supplement,

the accompanying prospectus and any other offering material, are made only as of the date of the prospectus supplement, the accompanying

prospectus, any other offering material or the incorporated document. Except as required by law, we undertake no obligation to publicly

release the result of any revision of these forward-looking statements to reflect events or circumstances after the date of this prospectus

or the respective dates of documents incorporated by reference herein or therein that include forward-looking statements.

This

prospectus supplement also contains estimates, projections and other information concerning our industry, the market and our business.

Information that is based on estimates, forecasts, projections or similar methodologies is inherently subject to uncertainties and actual

events or circumstances may differ materially from events and circumstances reflected in this information. We obtained the industry,

market and competitive position data in this prospectus from our own internal estimates and research as well as from industry and general

publications and research surveys and studies conducted by third parties.

You

should consider all risks and uncertainties disclosed in our filings with the SEC described in the sections of this prospectus supplement

entitled “Risk Factors,” “Where You Can Find Additional Information” and “Incorporation of Certain Information

by Reference,” all of which are accessible on the SEC’s website at www.sec.gov.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information contained elsewhere or incorporated by reference in this prospectus supplement and the accompanying

prospectus. This summary may not contain all of the information that may be important to you. You should read this prospectus supplement,

the accompanying prospectus, the information incorporated by reference in each, and any related free writing prospectus before making

an investment decision. You should pay special attention to the “Risk Factors” section beginning on page S-16 of this prospectus

supplement and “Risk Factors” set forth in our most recent annual report on Form 10-K for the year ended December 31, 2022,

our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023, respectively and

in the other documents which are incorporated by reference in this prospectus supplement and the accompanying prospectus in their entirety

to determine whether an investment in our common stock is appropriate for you.

The

Offering

| Common

stock we are offering |

|

shares of common stock |

| Pre-funded

Warrants we are offering |

|

We

are also offering

Pre-funded Warrants to purchase up to

shares of common stock, to those purchasers whose purchase of common stock in this offering would otherwise result in the purchaser,

together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser,

9.99%) of our outstanding common stock immediately following the consummation of this offering. Each Pre-Funded Warrant entitles

the holder to purchase one share of common stock at an exercise price of $0.001 per share. The purchase price of each Pre-Funded

Warrant is equal to the price per share of common stock being sold to the public in this offering minus $0.001. The Pre-Funded Warrants

will be immediately exercisable and may be exercised at any time until exercised in full. |

| Underwriter’s

over-allotment option |

|

We

have granted a 45-day option to the underwriters to purchase up to an

additional shares of common stock and/or

up to an additional Pre-Funded Warrants,

representing 15% of the shares of common stock and/or Pre-Funded Warrants sold in the offering, in each case, solely to cover

over-allotments, if any. |

| Common

stock outstanding prior to this offering |

|

3,080,693

shares of common stock. |

| Common

stock to be outstanding after this offering |

|

shares of common stock, assuming the full exercise of the Pre-funded Warrants. |

| NYSE

American Symbol and Listing |

|

Our

common stock is listed on the NYSE American under the symbol “OGEN”. There is no

established trading market for the Pre-funded Warrants and we do not intend to list the Pre-funded Warrants on any securities exchange

or nationally recognized trading system. |

| Use

of Proceeds |

|

We

estimate that the net proceeds from this offering, after payment of estimated offering expenses payable by us and underwriting discounts

will be approximately $ million. We intend to use the net proceeds from this offering to fund the continued development of ONP-002,

which is a unique neurosteroid drug compound intended to treat mild traumatic brain injuries also known as concussions, and

for general corporate purposes and working capital. See “Use of Proceeds”. |

| Lock-up

Agreements |

|

Our

executive officers and directors have agreed with the underwriters not to sell, transfer or dispose of any shares or similar securities

for a period of three months from the date of this prospectus supplement. For additional information regarding our arrangement with

the underwriters, please see “Underwriting”. |

| Risk

Factors |

|

Investing

in our securities involves significant risks. Please read the information contained in or incorporated by reference under the

heading “Risk Factors” beginning on page S-16 of this prospectus supplement, and under similar headings in other

documents filed after the date hereof and incorporated by reference into this prospectus supplement and the accompanying

prospectus. |

The

number of shares of common stock shown above to be outstanding after this offering is based on 3,080,693 shares outstanding as of January

16, 2024 and excludes:

| ● | 271,194

shares of our common stock issuable upon the exercise of outstanding options under our equity

incentive plans at a weighted average exercise price of $18.83 per

share; |

| ● | 260,995

shares of common stock reserved for issuance under outstanding warrants with a weighted average exercise price of $79.04 per share; |

| ● | 1,004,235

additional shares of common stock reserved for future issuance under our 2021 equity incentive

plan; |

| ● | approximately

9,028 shares of common stock reserved for issuance under conversion of our outstanding shares

of Series A Non-Voting, Convertible Preferred Stock; |

| ● | approximately

13,500 shares of common stock reserved for issuance under conversion of our outstanding shares

of Series B Non-Voting, Convertible Preferred Stock; and |

| ● | approximately

7,488,692 shares of common stock reserved for issuance under conversion of 7,488,692 outstanding

shares of Series F Non-Voting, Convertible Preferred Stock. |

Except

as otherwise indicated, all information in this prospectus supplement assumes no exercise by the underwriter of its option to purchase

additional shares.

Overview

We

are a development-stage biotechnology company focused on nasal delivery of pharmaceutical medications in neurology and fighting infectious

diseases. On December 28, 2023, we successfully consummated our previously announced Asset Purchase Agreement with Odyssey Health, Inc.

(“Odyssey”), pursuant to which we purchased all of Odyssey’s assets related to

the segment of Odyssey’s business focused on developing medical products that treat brain related illnesses and diseases (the “Neurology

Assets”).

The

Neurology Assets include drug candidates for treating mild traumatic brain injury (mTBI), also known as concussion, and for treating

Niemann Pick Disease Type C (NPC), as well as Odyssey’s proprietary powder formulation and its intranasal delivery device.

As

a result of the acquisition of the Neurology Assets, we expect that, in the near- and mid-terms, we will focus our resources and efforts

on the continued development of the Neurology Assets and primarily ONP-002, which, as discussed further below, has successfully completed

phase 1 clinical trials. The acquisition is expected to build on our expertise in intranasal platforms and expand our portfolio into

more areas of unmet medical needs. Nasal delivery offers many advantages over standard systemic delivery systems, such as its non-invasive

character, a fast onset of action and in many cases reduced side effects due to a more targeted delivery.

We

will concurrently determine how best to proceed with the development of our nasal COVID-19 product candidate, given our limited resources,

and for the time being, we anticipate placing our lantibiotics program on hold.

In

conjunction with the Neurology Asset acquisition, we paid Odyssey a total of $1,000,000 in cash, $500,000 of which was paid in October,

2023 and $500,000 of which was paid on December 11, 2023. In addition, at the closing, we issued Odyssey 8,000,000 shares of our newly

created Series F Non-Voting Convertible Preferred Stock, which are convertible into our common stock on a one-to-one basis (subject to

certain adjustments). Odyssey converted 511,308 of those shares into our common stock on December 28, 2023. Our Certificate of

Designation creating the Series F Preferred Stock specifies that the remainder of the shares are not convertible until the

occurrence of all of the following: (i) Oragenic’s shall have applied for and been approved for initial listing on the NYSE American

or another national securities exchange or shall have been delisted from the NYSE American, which Oragenic’s does not anticipate

undertaking until it meets the NYSE American’s initial listing standards, and (ii) if required by the rules of the NYSE American,

Oragenic’s shareholders shall have approved any change of control that could be deemed to occur upon the conversion of the Series

F Preferred Stock into common stock, based on the fact and circumstances existing at such time.

Upon

the closing of the Neurology Asset acquisition, Michael Redmond, who has served as President and CEO of Odyssey since 2018, was named

President of Oragenics. Mr. Redmond has 35 years of commercial experience with medical device companies, having held various sales and

marketing leadership positions that helped accelerate growth at companies to multiples of their previous revenue and valuation. Mr. Redmond

also has significant experience in raising capital and securing licensing and distribution deals with major biotech and pharmaceutical

companies. In his new position, Mr. Redmond will oversee the growth of Oragenics’ neurology product pipeline and intranasal drug

delivery technologies. Additionally, the Odyssey management and development team that led the ONP-002 clinical trial design and implementation

for the treatment of concussion, will continue to oversee research and development of the newly acquired Neurology Assets at Oragenics.

The team has experience in conducting clinical trials, developing drug formulations and commercializing pharmaceutical products across

a broad range of indications.

About

Mild Traumatic Brain Injury (mTBI)

Concussions

are an unmet medical need that affects millions worldwide. Repetitive concussions can increase the risk of developing chronic traumatic

encephalopathy and other neuropsychiatric disorders. It is estimated there is upwards of 3.8M million sports-related concussions alone

in the U.S. annually and that up to 50% go unreported (Hallock et al., 2023). The worldwide incidence is estimated at 69 million per

year (Dewan et al., 2018). The global market for concussion treatment was valued at $6.9 billion in 2020 and is forecast to reach $8.9

billion by 2027, according to Grandview Research. Common settings for concussion include contact sports, military training and operations,

motor vehicle accidents, children at play and elderly assistive-living facilities due to falls.

About

ONP-002

The

Neurology Assets acquired from Odyssey include ONP-002 and a unique nasal delivery device, Odyssey’s lead concussion assets, believed

to be a first-in-class intranasal drug under development for the treatment of moderate-to-severe concussion in the acute through subacute

phases (mTBI (concussion)).

ONP-002

is a fully synthetic, non-naturally occurring neurosteroid, is lipophilic, and can cross the blood-brain

barrier to rapidly eliminate swelling, oxidative stress and inflammation while restoring proper blood flow through gene amplification.

ONP-002

to date has been shown to be stable up to 104 degrees for 18-months. The drug candidate is spray-dry manufactured into a powder and filled

into the novel intranasal device. The drug is then administered through the nasal passage from the device. The novel intranasal device

is lightweight and easy to use in the field.

The

proprietary powder formulation and intranasal administration allows for rapid and direct accessibility to the brain. The device is breath

propelled and Oragenics expects it to allow patients to blow into the device which closes the soft palate in the back of the nasopharynx,

preventing the flow of drug to the lungs or esophagus, minimizes system exposure and side effects, and easily crosses the blood brain

barrier. This mechanism traps ONP-002 in the nasal cavity

allowing for more abundant and faster drug availability in the traumatized brain.

Expected

ONP-002 Product Development Timeline:

| Pre-clinical

Animal Studies |

|

Phase

1 |

|

Phase

2a |

|

Phase

2b |

|

Phase

3 |

| Complete |

|

Complete |

|

Estimated

May 2024 start |

|

Estimated

November 2024 start |

|

Estimated

November 2026 start |

This

product development plan is an estimate and is subject to change based on funding, technical risks and regulatory approvals.

ONP-002

Structure and Synthesis. Pharmaron, Inc. is our current partner in the development of synthetic chemistry and manufacturing of

the ONP-002 (Molecular Formula: C20H28O2, Molecular Weight: 300.14 g/mol). ONP-002 is the enantiomer (mirror image) of 19-Norprogesterone,

a novel chemical entity based on its chiral purity and optical rotation. There are two components to this synthesis. The synthesis of

PH-PRV-1302-GLP-23 (in blue) and the synthesis making use of PH-PRV-1302-GLP-23 to append the side chain necessary in ONP-002 production.

ONP-002 is red in Figure 1 and defined as the De-methyl- analog. The current API was made under GMP standards.

Figure

1

Validation

and Stability of ONP-002. Pharmaron issued a Certificate of Analysis (CoA, Appendix A-1). Testing methods were standard and include

appearance, identification by 1H NMR, identification by Mass Spectroscopy (MS), optical purity by HPLC, residual solvent analysis, elemental

impurities, percent water, and residue on ignition. Pharmaron has shown both the specifications and the results, indicating that the

material supplied passes all criteria. ONP-002 is supplied by Pharmaron in pure form. As such, no excipients are present. Stability studies

were performed by storing samples under carefully controlled conditions with respect to temperature and humidity. Pharmaron’s stability

testing protocol included storage at 25 °C± 2 °C at 60% relative humidity ± 5% relative humidity for 24 months and

40 °C± 2 °C at 75% relative humidity ± 5% for 18 months (Appendix A-2). Samples are pulled at the scheduled time

and analyzed for appearance, purity, assay, optical purity, and water content. No changes in ONP-002 were seen.

Formulation.

The ONP-002 drug product formulation contains the active drug substance, ent-19-Norprogesterone with hydroxypropyl beta cyclodextrin

(HPβCD) creating nanoparticles. Formulation of the product is achieved through solubilization of ONP-002 with HPβCD followed

by spray drying and packaging into a breath-propelled intranasal delivery device. The spray-dried powder provides for a particle size

between 11 and 12 microns upon dispersion from the device. For placebo dosing, the breath-propelled intranasal delivery device is pre-packaged

with HPβCD only with no ONP-002 active drug substance. The highest achieved concentration of ONP-002 per dose is currently at 8%

or 8mg/100mg given each intranasal dose is designed to deliver 100mg of the spray-dried formula. Studies have been designed to improve

the final % of API as high as 32%.

Intellectual

Property. Patents on ONP-002 have been filed and/or issued and a patent has been filed on the nasal delivery device as follows:

| ● | New

chemical entity IP filing– USPTO pending, approved Europe and Canada |

| ○ | C-20

steroid compounds, composition and uses thereof to treat traumatic brain injury (TBI), including

concussion. |

| ○ | The

invention relates to ONP-002 composition and methods of use thereof to treat, minimize and/or

prevent traumatic brain injury (TBI), including severe TBI, moderate TBI, and mild TBI, including

concussions. |

| ○ | Patent

expiration with max patent term extension – 9/17/2040 |

| ○ | Patent

expiration with no patent term extension – 9/17/2035 |

| ● | Method

of intranasal delivery and device components – USPTO pending |

ONP-002

Pre-Clinical Trials

The

drug has completed toxicology studies in rats and dogs. Studies show that ONP-002 has a safety margin over 90X its predicted efficacious

dose. In preclinical animal studies, the asset demonstrated rapid and broad biodistribution throughout the brain while simultaneously

reducing swelling, inflammation and oxidative stress, along with an excellent safety profile.

Results

from the preclinical studies suggest that ONP-002 has an equivalent, and potentially superior, neuroprotective effect compared to related

neurosteroids. The animals treated with the drug post-concussion showed positive behavioral outcomes using various testing platforms

including improved memory and sensory-motor performance, and reduced depression/anxiety like behavior.

Below

is a detailed analysis of our pre-clinical data.

ONP-002

Induction of PXR. The induction of the human CYP450 enzymes, CYP2B6, and CYP3A4 by ONP-002, as measured by mRNA expression, was

tested in human hepatocytes from 3 donors at 3 concentrations: 1 μM, 10 μM and 100 μM. (Table 1). We show that ONP-002 through

the known PXR-mechanism produced a modest induction of CYP3A4, up to 17% of the positive control, and a greater induction of CYP2B6,

of up to 59% of the positive control, both at a concentration of 100 μM. Past data shows that ONP-001 (ent-Progesterone) and

Progesterone induce the PXR receptor (1). Receptor binding studies have been performed showing neither ONP-001 or -002 activate the classical

Progesterone Receptor.

Table

1

| Compound |

|

Concentration μM |

|

CYP2B6

Fold induction |

|

% Of positive control |

|

CYP3A4 Fold induction |

|

% Of positive control |

| |

|

Mean |

|

SD |

|

Mean |

|

Mean |

|

SD |

|

Mean |

| Rifampicin |

|

30 |

|

- |

|

- |

|

- |

|

18 |

|

9.9 |

|

100 |

| Phenobarbital |

|

1000 |

|

5.1 |

|

2.9 |

|

100 |

|

- |

|

- |

|

- |

| Omeprazole |

|

50 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

| Flumazenil (neg control) |

|

30 |

|

1.1 |

|

0.1 |

|

21 |

|

1.1 |

|

0.3 |

|

6 |

| ONP-002 |

|

1 |

|

1 |

|

0.2 |

|

19 |

|

1.3 |

|

0.3 |

|

7 |

| |

10 |

|

1.6 |

|

0.6 |

|

31 |

|

2.4 |

|

0.6 |

|

13 |

| |

100 |

|

3.0 |

|

2.6 |

|

59 |

|

3.0 |

|

2.1 |

|

17 |

ONP-002

Animal Studies. All surgical animals (male Sprague-Dawley rats approx. 250 grams) were anesthetized with an initial isoflurane

induction for 4 min-the minimum time necessary to sedate the animal. The scalp was shaved and cleaned with isopropanol and betadine.

During the stereotaxic surgery, anesthesia was maintained with isoflurane. A medial incision was made, and the scalp was pulled back

over the medial frontal cortex. A 6-mm diameter craniotomy was performed exposing the brain tissue. An electrically controlled injury

device using a 5 mm metal impactor was positioned over the exposed brain. An impact speed of 1.6 m/s at a 90-degree angle from vertical

was used to produce an open head injury at a depth of 1mm to create a milder TBI. All treatments were given intranasal (IN) as a liquid

solution with a micro atomizer. Vehicle for all administrations was 22.5% Hydroxy-Propyl-β-cyclodextrin (HPβCD).

Molecular

Studies - Brain tissue was taken from the penumbral region of injury.

Figure

2

Cerebral

Edema. In Figure 2, we show that ONP-002 reduces swelling in rats compared to vehicle-treated at 24-hrs after brain

injury by measure of brain water content through speed-vacuum dehydration and tissue weight comparisons. ONP-002-treated (4mg/kg) and

vehicle-treated were compared to sham which was set at zero. Local edema can occur after mTBI. Severe cerebral edema is associated with

poor outcomes including increased mortality after mTBI with Second Impact Syndrome (2). *Denotes significance at p<0.05, n=6

Figure

3

Inflammation.

mTBI causes vascular and neuronal stress. Microglia and reactive astrocytes infiltrate the areas of injury and release inflammatory mediators,

like TNF-alpha (3). In Figure 3, we show that ONP-002 (4mg/kg) reduces TNF-alpha-mediated neuroinflammation in brain tissue of

rats compared to vehicle at 24-hrs after mTBI (ELISA). *denotes significance at p<0.05, n=6

Figure

4

Oxidative

Stress. Brain trauma causes Diffuse Axonal Injury (DAI) leading to elevated production of Reactive Oxygen Species (ROS), which

causes neuronal damage (4). In Figure 4, we show that early treatment with ONP-002 (4mg/kg) improves antioxidant capacity in

rats compared to vehicle-treated following mTBI by increasing protein expression of GST (ELISA) at 24hrs post-injury. *Denotes significance

at p<0.05, n=6

Figure

5

Autophagy.

Brain trauma leads to neuronal damage with both intra and extracellular debris accumulation, which reduces cellular function and can

lead to cell death (5). In Figure 5, we show that treatment with ONP-002 (4mg/kg) increases P-glycoprotein (PGP, ELISA), a molecule

involved in macro-autophagy needed for intra and extracellular cleaning, in rats compared to vehicle-treated following mTBI at

24hr post-injury. *Denotes significance at p<0.05, n=6

Behavioral

Studies

Neuroscore.

In Figure 6, we show that treatment with ONP-002 (aka PRV-002) in rats enhances re-acquisition of motor skills by 24-hrs

following mTBI when compared to vehicle-treated. Vestibular and visual motor dysfunction are hallmark signs of grade 3, severe mTBI where

discoordination, dizziness and brain fog are seen and correlated to a greater incidence of Post-Concussion Syndrome (PCS) (6). A dose-response

effect was seen with ONP-002 treatment at 4mg/kg producing the most desired effects. There were no statistical differences between ONP-002

treatments and sham. Data was analyzed using Kruskall-Wallis’s test to evaluate group differences. Pair-wise comparisons were carried

out using the Mann-Whitney U Test. * denotes significance at p<0.05.

Figure

7

Short-Term

Memory. Using the Morris Water Maze (MWM) method to assess shorter-term memory function we show in Figure 7 a dose-response

effect at 48-hrs post-injury. ONP-002-treated rats had improved memory with significance seen between ONP-002 at 4mg/kg and vehicle-treated

animals. Short-term memory deficits are often seen immediately following mTBI. Short-term memory impairment is a hallmark sign of PCS

where deficits are seen for weeks or even longer (7). A one-way analysis of variance (ANOVA) was used to evaluate group differences in

MWM memory score. Post-hoc analysis of pair-wise comparisons was carried out using Fisher’s Protected Least Significant Differences

(PLSD) test. * denotes significance from vehicle at p<0,05, **denotes significance at p<0.005 from all groups. n=11

Figure

8

Thigmotaxic

Behavior. Using the MWM tank to assess depression/anxiety-like behavior we show in Figure 8 a dose response effect on

thigmotaxic behavior and that ONP-002 (4mg/kg)-treated rats had reduced thigmotaxis at 48-hrs post-injury compared to vehicle-treated.

Depression and anxiety are commonly seen in patients diagnosed with PCS (8). ANOVA was used to evaluate group differences in thigmotaxis.

* Denotes significance at p<0.005, n=8

Cell

Culture Studies

Figure

9

Neuronal

Cell Viability. In a neuronal cell culture model (SH-SY5Y) of hypoxia-ischemia (oxygen-glucose deprivation (OGD), 24hrs), ONP-002

(5μM) reduces cell damage (Figure 9) as a measure of lactate dehydrogenase (membrane disruption) in cultured media. * Denotes

significance at p<0.005

Figure

10

Neuronal

Cell Recovery. Neurite outgrowth, indicative of cellular health and re-connectivity, was enhanced with the administration of

ONP-002 (1μM) following exposure to hypoxia-ischemia (OGD) for 24hrs in a SH-SY5Y neurons compared to no treatment in cultured

media.

Figure

11

Neuronal

Survival. Significant increases in esterase activity (Figure 11), a measure of cell viability, were observed in SH-SY5Y

neurons treated with ONP-002 (1µM) following 24hrs of OGD in cultured media. * Indicates a significant difference from untreated

OGD cells, p < 0.05.

Brain

Biodistribution Studies. Table 2 below represents a comparison of ONP-002 levels in various parts of the brain, blood plasma

and cerebrospinal fluid (CSF) in dogs (n=3) that were dosed intranasal (IN) 3 times; time 0, 4-hr and 8-hr. Dogs were sacrificed, and

tissues were harvested at 30 minutes after the 8-hr final dose. Using a micro atomizer, dogs were given 23mg in each nostril dissolved

in a 1ml of 22.5% HPβCD vehicle solution at each dosing interval for a total dose of 46 mg/dog per dosing interval. IN delivery

increases direct drug flow into the brain in shorter periods of time through the peri axonal space of the olfactory nerves that innervate

the superior chambers of the nasal cavity. The utility of IN dosing as a clinical route to achieve greater drug targeting of the brain

and less systemic exposure was confirmed in this study whereby IN dosing of ONP-002 achieved up to 3.1-fold higher exposure in whole

brain tissue (1888 ng/g) compared to systemic plasma (607 ng/ml). Further supporting the IN route of delivery these results show

a total of 93% of the recovered drug was found in the brain. Only 5% of the drug was found in the circulating plasma and only 2% was

found in the CSF. Comparable levels of ONP-002 were found throughout the brain at 30-min after the 8-hr treatment.

Table

2. Comparative exposure of ONP-002 in brain tissue, CSF and plasma following IN dosing in dogs

| Tissue |

|

Subregion |

|

Mean_ONP-002 concentration

(ng/g brain) or (ng/ml CSF and plasma) |

|

Fold difference tissue

exposure/plasma exposure |

| Brain

tissue section |

|

Frontal

lobe |

|

2403 |

|

3.9 |

| |

Occipital

lobe |

|

2332 |

|

3.8 |

| |

Olfactory

lobe |

|

2049 |

|

3.4 |

| |

Parietal

lobe |

|

2386 |

|

3.9 |

| |

Temporal

lobe |

|

2368 |

|

3.9 |

| |

Whole

brain |

|

1888 |

|

3.1 |

| CSF |

|

33.2 |

|

0.05 |

| Plasma |

|

607 |

|

1 |

ONP-002

Toxicology and Safety Program

Early

Work in Pharmacokinetics. ONP-002 was evaluated in IND-enabling studies to uncover any potential safety liabilities associated

with this treatment. Initially, several dose-range studies were performed in rats to determine the maximum tolerated systemic dose and

to compare relative exposure/tolerability following multiple routes of administration, including the route intended for human dosing

which is IN. These studies were used to guide dosing for the pivotal (GLP) 14-day repeat dose toxicology studies in dogs. A single and

7-day repeat dose of 38.5 mg/kg was well tolerated in rats and deemed to be the maximum tolerated dose (MTD). The resulting ONP-002 plasma

exposure in these animals was very high (Cmax 120863 ng/ml), which exceeded exposure following IN administration of ONP-002

at a dose of 4.6 mg/kg (63.8 ng/ml), just above the dose of 4 mg/kg at which maximum efficacy was observed in the rat TBI model. Absorption

following IN dosing was more rapid, as was clearance, with minimal drug evident in plasma by 24-hrs post dose compared to IV.

Pharmacokinetics

and Safety of IN ONP-002 in Dog. This pivotal GLP 14-day study used repeat dosing of ONP-002, 3X a day, approximately 4 hours

apart, for 14 consecutive days at concentrations of 0, 3, 10 or 23 mg/mL at a volume of 1 mL/nostril to beagle dogs (both nostrils had

drug administered). The IN treatment was given as a liquid solution using a micro atomizer using 22.5% HPβCD as the vehicle. IN

ONP-002 dosing revealed that ONP-002 was well tolerated up to the highest dose of 23 mg/ml or 46mg in total per dosing. Clinical observations

were limited to increased salivation in dogs which occurred in a dose-dependent manner. There were no effects on body weight, food consumption,

ophthalmic parameters, clinical chemistry, haematology, or organ weights at any of the doses tested. Microscopic analysis revealed purulent

exudates in the nasal turbinate and evidence of inflammatory infiltrates and fibrin deposition in the lungs. All of these events were

classified as mild, reversed during the recovery period, and did not appear to show any dose dependency. Similar findings were evident

in vehicle control treated dogs indicating the findings were vehicle related. The highest dose of 23 mg/ml was thus determined to be

the NOAEL which is equivalent to a ONP-002 dose of 1.5mg/kg and 2.3mg/kg in male and female dogs, respectively. Table 3 shows

the dose-dependent increase in plasma exposure of ONP-002 in male and female dogs following IN administration. Plasma exposure levels

were similar in males and females and there did not appear to be any evidence of drug accumulation following multiple doses.

| Table

3 - Dogs |

|

|

|

Mean

systemic exposure parameters |

| |

|

|

|

Males

(15kg weight) |

|

Females

(10kg weight) |

| |

|

|

|

|

|

|

| IN

ONP-002 Dose concentration (mg/ml) |

|

|

|

3 |

|

10 |

|

23

(1.5mg/kg) |

|

3 |

|

10 |

|

23

(2.3mg/kg) |

| Cmax

(ng/ml) |

|

D1 |

|

103 |

|

225 |

|

751 |

|

61.8 |

|

468 |

|

744 |

| |

D14 |

|

85.7 |

|

235 |

|

591 |

|

82.3 |

|

408 |

|

681 |

| AUC

(ng*h/ml) |

|

D1 |

|

1100 |

|

2470 |

|

7410 |

|

804 |

|

3400 |

|

8260 |

| |

D14 |

|

1090 |

|

3490 |

|

9140 |

|

1010 |

|

5250 |

|

10100 |

Cardiopulmonary

Safety Pharmacology. The effect of ONP-002 on the human ether-a-go-go related gene (hERG) tail currents was assessed in a non-Good

Laboratory Practice (GLP) study using manual whole-cell patch clamp (Table 4). ONP-002 tested at a single concentration of 10

μM inhibited hERG tail currents by 42.6% (n=3). In order to achieve a safety factor of 30-fold between in vitro hERG IC50

and free plasma levels of ONP-002 in clinical studies, Cmax should not exceed a free drug concentration of 0.33 μM (99

ng/ml). ONP-002 is 97.2% human plasma protein bound and is estimated to reach a plasma Cmax of 12.5 nM, the highest dose of

0.533 mg/kg to be administered in the planned first in human (FIH) study, which provides a safety factor of 800-fold. A GLP study is

planned at Charles River, Inc. and will be performed prior to IND submission.

Table

4. Inhibition of hERG tail currents by ONP-002

| Compound

ID |

|

Client

compound ID |

|

Batch

# |

|

Concentration

(μM) |

|

%

Inhibition |

|

Mean |

| |

|

|

|

|

|

|

|

N1 |

|

N2 |

|

N3 |

|

| US034-0012558-1 |

|

ONP-002 |

|

4 |

|

10 |

|

36.58 |

|

37.25 |

|

53.85 |

|

42.56 |

Positive

reference

control |

|

Cisapride |

|

|

|

1 |

|

96.99 |

|

- |

|

- |

|

96.99 |

ONP-002

did not exert any effects on cardiac safety parameters evaluated by telemetry in male and female dogs as part of a 14-day repeat dose

GLP toxicology study. Intranasal doses of 3, 10 and 23 mg/ml ONP-002 administered 3 times daily for 14 days did not have any significant

effects on heart rate, pulse rate (PR), QRS and QT/QTc intervals or respiratory rate (RR) interval when compared to pre-dose values and

vehicle control animals. An atrial depolarization was noted pre-dose in 1 animal which is occasionally observed in dogs and was not considered

to be related to test article. The NOAEL for cardiac related effects in dogs was thus determined to be ≤ 23 mg/ml (equivalent to 4.8

mg/kg in male dogs and 7.2 mg/kg in female dogs). ONP-002 was also evaluated for potential central nervous system (CNS) toxicity in rats

using a standard functional observational battery that was included as part of the 14-day repeat dose GLP toxicology study. IN administration

of ONP-002 at 3, 10 and 23 mg/ml 3 times daily for 14 days was well tolerated with excess salivation and nares staining being the only

observations occurring in 2 rats (one female in the 10 mg/ml group and 1 male in the 23 mg/ml group). Both incidences were not evident

by the end of the 14-day recovery period.

As

the intended clinical route of administration of ONP-002 is IN, the effects of ONP-002 on respiratory function were evaluated in a stand-alone

GLP safety pharmacology study in male rats using whole-body plethysmography. ONP-002 administered as a single IN dose of 0.04, 0.4 or

4 mg/kg had no significant effect on respiratory rate, tidal volume (TV) or minute volume (MV) compared to vehicle treated animals and

pre-dose values. In addition, there were no observations of respiratory distress following IN dosing of ONP-002 in repeat-dose GLP toxicology

studies in rats and dogs. Tachypnea was however, observed in a dose range finding and 7-day repeat dose study in rats following intravenous

(IV) administration of ONP-002, where systemic exposure of ONP-002 was almost 300-fold higher that that reached by the IN route.

Absorption,

Distribution and Metabolism. Caco-2 permeability which was used as a surrogate for potential BBB permeability, was high with

little evidence of PGP or breast cancer resistant protein mediated efflux. Cytochrome P450 mediated metabolism of ONP-002 is predominantly

via CYP3A4. No significant inhibition, including time-dependent inhibition, was observed against major cytochrome P450 isoforms when

ONP-002 was tested at a single concentration of 10 μM. There was some evidence of CYP2D6 and CYP3A4 induction (up to 3-fold) at a

ONP-002 concentration of 100 μM. ONP-002 (10 μM) also exhibited minimal activity against a panel of major solute carriers and ATP-binding

cassette (ABC) transporters, with inhibition of organic cation transporter 2 (OCT2) (89%) being the only result of note.

Genotoxicity.

ONP-002 did not exhibit mutagenic activity in the bacterial AMES test or clastogenic activity in the mammalian in vitro micronucleus

assay up to a maximum concentration of 100 μM. We have scheduled the In Vivo Micronucleus testing which is required for an IND with

the FDA. We expect it will be completed by the end of Q3 2024.

Summary

| |

● |

The

drug has completed toxicology studies in rats and dogs. Studies show that ONP-002 has a safety margin over 90X its predicted efficacious

dose. |

| |

● |

In

preclinical animal studies, the asset demonstrated rapid and broad biodistribution throughout the brain while simultaneously reducing

swelling, inflammation, and oxidative stress. |

| |

● |

We

believe ONP-002 has an equivalent, and potentially

superior, neuroprotective effect compared to related neurosteroids. |

| |

● |

Animals

treated with the ONP-002 post-concussion showed positive behavioral outcomes using various testing platforms including improved memory

and sensory-motor performance, and reduced depression/anxiety like behavior. |

ONP-002

Clinical Trials

ONP-002

has completed a Phase 1 clinical trial in healthy human subjects showing it is safe and well tolerated.

Safety

studies have established a dosing regimen of 2X/day for fourteen days. The Phase I clinical trial was performed in Melbourne, Australia

with a Contract Research Organization (CRO), Avance Clinical Pty Ltd and Nucleus Network Pty Ltd. The country of Australia provides a

greater than 26% currency exchange advantage and a 43.5% rebate at the end of our fiscal year from the Australian government on all Research

and Development performed in Australia. A comprehensive Investigator’s Brochure was created and approved by the Alfred Ethics Committee

in Australia.

The

Phase 1 study was double-blinded, randomized and placebo controlled (3:1, drug:placebo). Phase 1 used a Single Ascending/Multiple Ascending

(SAD/MAD) drug administration design. The SAD component was a 1X treatment (low, medium, or high dose) and the MAD component was a 1X/day

treatment for five consecutive days (low and medium dose). Blood and urine samples were collected at multiple time points for safety

pharmacokinetics. Standard safety monitoring was provided for each body system.

Forty

human subjects (31 males, 9 females) were successfully enrolled in Phase I. The Safety Review Board, made up of medical doctors, has

reviewed the trial data and has determined the drug is safe and well tolerated at all dosing levels.

Oragenics

anticipates preparing for Phase 2 clinical trials to further evaluate ONP-002’s safety and efficacy.

Based on the Phase I data, we plan to apply for an Investigational New Drug application with the FDA and conduct a Phase II trial in

the United States.

We

anticipate a Phase 2 clinical trial will be performed administering ONP-002 intranasally in concussed patients 2x a day for up to fourteen

days. The Phase 2a feasibility study will be performed in AUS with a target initiation date in the second quarter of 2024 to be followed

closely by a Phase 2b proof of concept study in the US following IND approval in the fourth quarter of 2024.

Planned

Phase 2a Feasibility study

| |

● |

n

(40) – 20 patients per arm. |

| |

● |

Two

arms – Low dose or placebo/High dose or placebo. |

| |

● |

Evaluating

enrollment methods, safety and pharmacokinetics in concussed patients |

Planned

Phase 2b Proof of concept (POC) with Early Efficacy

| |

● |

n

(120) – 60 patients per arm. |

| |

● |

One

arm receives placebo – One arm receives highest safe dose from feasibility study. |

| |

● |

POC measurements; blood biomarkers, neurocognitive and

visual-vestibular measures, symptom severity and incidence of developing Post-Concussion Syndrome (PCS), time to return to normal

activities. |

Product

Candidates

| Product/Candidate |

|

Description |

|

Status |

| ONP-002 |

|

Intranasal

drug for the treatment of moderate-to-severe concussion in the acute through subacute phases (mTBI) |

|

Completed

Phase I |

| |

|

|

|

|

| ONP-001(*) |

|

Neurosteroid

being developed for the treatment of Niemann Pick Type-C Disease (NPC) |

|

Pre-clinical |

| |

|

|

|

|

| NT-CoV2-1 |

|

Intranasal

vaccine candidate (plasmid + adjuvant) to provide long lasting immunity against SARS-CoV-2 |

|

Pre-clinical |

| |

|

|

|

|

| Antibiotics |

|

For

the treatment of healthcare-associated infections. Semi-synthetic analogs of MU1140: Member of lantibiotic class of antibiotics. |

|

Pre-clinical

– Inactive |

*

We currently own only 50% of the intellectual property related to ONP-001. The other 50% is owned by a third party. We anticipate this

product candidate will be developed through a joint venture with a third party. However, the joint venture with that third party has

not been finalized.

Recent

Developments

On

December 4, 2023, we filed a Certificate of Designation in the form of Articles of Amendment to our Articles of Incorporation to create

the Series F Non-Voting Convertible Preferred Stock issued to Odyssey as partial consideration for the purchase of the Neurology

Assets.

On

December 14, 2023, as a result of the approval by our shareholders at our annual meeting of the increase in our authorized common stock,

(i) we filed Articles of Amendment to increase our authorized shares of common stock to 350,000,000, and (ii) our Series

E Preferred Stock expired and is no longer issued and outstanding.

On

December 28, 2023, we successfully consummated our previously announced Asset Purchase Agreement with Odyssey, pursuant to which we purchased

all of Odyssey’s assets (and assumed certain related liabilities) related to the segment of Odyssey’s business focused on

developing medical products that treat brain related illnesses and diseases (the “Neurology Assets”). The Neurology Assets

include drug candidates for treating mild traumatic brain injury (mTBI), also known as concussion, and for treating Niemann Pick Disease

Type C (NPC), as well as Odyssey’s proprietary powder formulation and its nasal delivery device.

We

have made several changes to reduce cash used in operations until additional capital can be obtained. As

previously announced, we recently exercised our option under our lease with Hawley-Wiggins, LLC (the “Landlord”), for the

building located in Progress Park and known as 13700 Progress Boulevard, Alachua, Florida 32615 (the “Lease”) to terminate

the Lease by paying nine (9) months of advance rent, plus prorated rent for the month of September, 2023, plus applicable sales tax.

In addition to the termination of the Lease, the Company eliminated two staff positions and Dr. Martin Handfield transitioned from an

employee of the Company to a consultant. Dr. Handfield continues to be available to provide support services on an hourly basis through

a consulting agreement. Dr. Handfield’s employment agreement was terminated in accordance with its terms. The Alachua lease contained

the laboratory where some of the research and development for the lantibiotic program was undertaken. Currently, research and

development activities related to the lantibiotic program are inactive. We intend to evaluate opportunities for this program moving forward

as we continue to strengthen our focus and expertise on our intranasal drug delivery platform and drug candidates.

Corporate

and Other Information

We

were incorporated in November 1996 and commenced operations in 1999. We consummated our initial public offering in June 2003. Our executive

office is located at, 4902 Eisenhower Boulevard, Suite 125 Tampa, Florida, 33634 and our research facilities are located at 13700 Progress

Boulevard, Alachua, Florida 32615. Our telephone number is (813) 286-7900 and our website is http://www.oragenics.com. We make available

free of charge on our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments

to those reports as soon as reasonably practicable after we electronically file or furnish such materials to the Securities and Exchange

Commission (the “SEC”). The reports are also available at www.sec.gov. We do not incorporate by reference into this prospectus

the information on, or accessible through, our website, and you should not consider it as part of this prospectus and it should not be

relied on in connection with this offering. We have included our website address as an inactive textual reference only.

RISK

FACTORS

Before

purchasing our securities you should carefully consider the risk factors set forth below and under the heading “Risk Factors”

included in our most recent Annual Report on Form 10-K as revised or supplemented by our subsequent Quarterly Reports on Form 10-Q, each

of which are on file with the SEC and are incorporated herein by reference, as well as all other information contained in this prospectus

supplement and the accompanying prospectus and incorporated by reference and any free writing prospectus that we have authorized for

use in connection with this offering. The risks and uncertainties described below and in our most recent Annual Report on Form 10-K,

as revised or supplemented by our subsequent Quarterly Reports on Form 10-Q, are not the only risks and uncertainties we face. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. Our business,

financial condition and results of operations could suffer as a result of these risks. As a result, the trading price of our stock could

decline, and you could lose all or part of your investment. The risks discussed below and in most recent Annual Report on Form 10-K,

as revised or supplemented by our subsequent Quarterly Reports on Form 10-Q, also include forward-looking statements and our actual results

may differ substantially from those discussed in these forward-looking statements. See the section entitled “Forward-Looking Information”.

Risk

Related to Purchase of Neurology Assets from Odyssey

We

may have difficulty raising additional capital, which could deprive us of the resources necessary to implement our business plan, which

would adversely affect our business, results of operation and financial condition.

We

need to raise additional capital to fund the development and commercialization of our product candidates and to operate our business,

including ONP-002. The need to raise additional capital is expected to increase as a result of our purchase or the Neurology Assets.

Part of the purchase price we paid Odyssey is $1,000,000 in cash. Additionally, we expect our operating expenses to increase, both due

to additional employment costs and operating costs required to pursue the development of the Neurology Assets. In order to support the

initiatives envisioned in our business plan, we will need to raise additional funds through the sale of assets, public or private debt

or equity financing, collaborative relationships or other arrangements. If our operations expand faster or at a higher rate than currently

anticipated, we may require additional capital sooner than we expect. We are unable to provide any assurance or guarantee that additional

capital will be available when needed by our company or that such capital will be available under terms acceptable to our company or

on a timely basis.

Our

ability to raise additional financing depends on many factors beyond our control, including the state of capital markets, the market

price of our common stock and the development or prospects for development of competitive products by others. If additional funds are

raised through the issuance of equity, convertible debt or similar securities of our company, the percentage of ownership of our company

by our company’s stockholders will be reduced, our company’s stockholders may experience additional dilution upon conversion,

and such securities may have rights or preferences senior to those of our common stock. The preferential rights granted to the providers

of such additional financing may include preferential rights to payments of dividends, super voting rights, a liquidation preference,

protective provisions preventing certain corporate actions without the consent of the fund providers, or a combination thereof. We are

unable to provide any assurance that additional financing will be available on terms favorable to us or at all.

If

adequate funds are not available or are not available on acceptable terms, our ability to take advantage of the Neurology Assets acquired

from Odyssey will be limited significantly. With limited capital, we expect to continue to scale back or delay implementation of research

and development of our Covid programs and to put our lantibiotics on hold, and we may choose instead to focus the limited capital on

the concussion asset purchased from Odyssey. Thus, the unavailability of capital could substantially harm our business, results of operations

and financial condition.

Our

success with regard to the Neurology Assets depends on the viability of our business strategy with regard to those assets, which is unproven

and may be unfeasible.

Our

revenue and income potential with regard to the Neurology Assets, in particular the concussion asset, are unproven, and we continue to

develop our strategy for such assets. Our anticipated business model is based on a variety of assumptions based on a growing trend in

the healthcare systems in the United States and many other countries. These assumptions may not reflect the business and market conditions

we actually face. As a result, our operating results could differ materially from those projected under our business model, and our business

model may prove to be unprofitable. The product candidate ONP-002 (the concussion asset) being developed is in its early stages and will

require extensive testing and clinical trials before it is commercialized. There is no guarantee that ONP-002 will be approved for commercial

use. The product candidate ONP-001 (the potential treatment for Niemann Pick Disease Type C) is in its early stages and will require

extensive testing and clinical trials before it is commercialized. There is no guarantee that ONP-001 will be approved for commercial

use. Further, we own 50% of the the rights to this product candidate, with the other 50% owner by a third party. We anticipate this product

candidate will be developed through a joint venture with a third party. However, the joint venture with that third party has not been

finalized. If we fail to obtain marketing authorization for these product candidates, our business, financial condition, and results

of operations will be materially adversely affected.

There

are substantial inherent risks in attempting to commercialize newly developed products, and, as a result, we may not be able to successfully

develop the new products acquired from Odyssey.

We

hope to conduct research and development of the purchased Neurology Assets. However, commercial feasibility and acceptance of such product

candidates are unknown. Scientific research and development require significant amounts of capital and takes an extremely long time to

reach commercial viability, if at all. During the research and development process, we may experience technological barriers that we

may be unable to overcome. Because of these uncertainties, it is possible that some or all of our future product candidates will never

be successfully developed. If we are unable to successfully develop new products, we may be unable to generate new revenue sources or

build a sustainable or profitable business. Additionally, as a result of the Odyssey transaction, since we operate with limited resources

and staff, our attention and resources will be diverted away from our existing lantibiotic and Covid programs, resulting in further delays

in the development and commercialization of such programs.

We

will need to achieve commercial acceptance of our products, if cleared or approved, to generate revenues and achieve profitability.

Superior

products may be introduced that compete with the Neurology Assets, which would diminish or extinguish the uses for the products candidates

acquired from Odyssey, if cleared or approved. We cannot predict when significant commercial market acceptance for such products, if

cleared or approved, will develop, if at all, and we cannot reliably estimate the projected size of any such potential market. If markets

fail to accept such products, then we may not be able to generate revenue from them. Our revenue growth and achievement of profitability

will depend substantially on our ability to introduce new products that are accepted by customers. Our competitors in the industry are

predominantly large companies with longer operating histories, with significantly easier access to capital and other resources and an

established product pipeline than us. There can be no assurance that we will be able to establish ourselves in our targeted markets,

or, if established, that we will be able to maintain our market position, if any. Our commercial opportunity may be reduced if our competitors

develop new or improved products that are more convenient, more effective or less expensive than our product candidates are. Competitors

also may obtain FDA or other regulatory marketing authorization for their products more rapidly or earlier than we may obtain marketing

authorization for ours, which could result in our competitors establishing a strong market position before we are able to enter the market.

If we are unable to cost-effectively achieve acceptance of our products by customers, or if our products do not achieve wide market acceptance,

then our business will be materially and adversely affected.

The

products candidates included in the Neurology Assets are still in development and we have not obtained authorization from any regulatory

agency to commercially distribute such products in any country and we may never obtain such authorizations.

We

currently have no products authorized for commercial distribution in either the United States, Europe or any other country. Similarly,

the products candidates we acquired from Odyssey are still in development. Like the product candidates we are developing, the Neurology

Assets require regulatory clearance or approvals. We cannot begin marketing and selling product candidates until we obtain applicable

authorizations from the applicable regulatory agencies. The process of obtaining regulatory authorization is expensive and time-consuming

and can vary substantially based upon, among other things, the type, complexity and novelty of a product candidate. Changes in regulatory

policy, changes in or the enactment of additional statutes or regulations, or changes in regulatory review for each submitted product

application may cause delays in the authorization of a product candidate or rejection of a regulatory application altogether.

The

FDA has substantial discretion in the review process and may refuse to accept our application or may decide that data are insufficient

to grant the request and require additional pre-clinical, clinical, or other studies. In addition, varying interpretations of the data

obtained from pre-clinical and clinical testing could delay, limit, or prevent marketing authorization from the FDA or other regulatory

authorities. Any marketing authorization from the FDA we ultimately obtain may be limited or subject to restrictions or post-market commitments

that render the product candidate not commercially viable. If our attempts to obtain marketing authorization are unsuccessful, we may

be unable to generate sufficient revenue to sustain and grow our business, and our business, financial condition, and results of operations

will be materially adversely affected.

We