Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

January 12 2024 - 9:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January

2024

Commission File Number:

001-39257

WiMi Hologram Cloud Inc.

(Registrant’s Name)

Room#2002, Building A,

Wentley Center,

1st West Dawang Road,

Chaoyang District, Beijing

The People’s Republic

of China, 100020

(Address of Principal

Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Goodwill Impairment Risk

The Company maintains three reporting units with goodwill: (i) Shenzhen

Yidian, (ii) Shenzhen Yitian and (iii) Guoyu, all of which may be subject to significant goodwill impairment. The Company tests

for goodwill impairment on an annual basis on the last day of the fourth quarter of our fiscal year ending in December 31 and

whenever events or changes in circumstances indicate it is more likely than not that the fair value of a reporting unit is less than

its carrying amount. Such events and circumstances could include a sustained decrease in our market capitalization, increased

competition or industry changes, or significant adverse changes in the markets in which we operate. We test reporting units for

impairment by comparing the estimated fair value of each reporting unit with its carrying amount. If the carrying amount of a

reporting unit exceeds its estimated fair value, we record an impairment loss based on the difference between fair value and

carrying amount.

The Company uses the income approach to determine the fair value of

the reporting units because it considers the anticipated future financial performance of the reporting units. Fair value determinations

require considerable judgment and are sensitive to changes in underlying assumptions, estimates, and market factors. Estimating the fair

value of individual reporting units requires us to make assumptions and estimates regarding our future plans, as well as industry,

economic. These assumptions and estimates include estimated future annual net cash flows, discount rates, growth rates, and other

market factors. If current expectations of future growth rates and margins are not met, if market factors outside of our control, such

as discount rates, or if management’s expectations or plans otherwise change, then our reporting units might become impaired

in the future, those reporting units are more susceptible to an impairment risk if there are unfavorable changes in assumptions and estimates,

those amounts are more susceptible to an impairment risk if business operating results or macroeconomic conditions deteriorate.

Due to the sluggish macroeconomic and market conditions and fierce

competition in the industry, the Company's profitability is affected by many factors, and the Company's future operating performance may

be lower than expected, therefore, our reporting unit goodwill maybe at risk at impairment in future periods.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

WiMi Hologram Cloud Inc. |

| |

|

| |

By: |

/s/ Shuo Shi |

| |

Name: |

Shuo Shi |

| |

Title: |

Chief Executive and Operations Officer |

Date: January 12, 2024

2

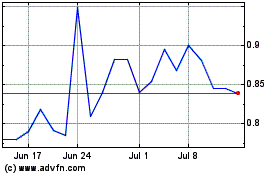

WiMi Hologram Cloud (NASDAQ:WIMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

WiMi Hologram Cloud (NASDAQ:WIMI)

Historical Stock Chart

From Apr 2023 to Apr 2024