0001810019FALSE00018100192024-01-092024-01-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 9, 2024

RACKSPACE TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | 001-39420 | 81-3369925 |

(State of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1 Fanatical Place

City of Windcrest

San Antonio, Texas 78218

(Address of principal executive offices, including zip code)

1-800-961-4454

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | RXT | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Resignation of Chief Financial Officer

On January 9, 2024, Mr. Naushaza "Bobby" Molu informed the Company of his intention to resign as Executive Vice President and Chief Financial Officer of Rackspace Technology, Inc. (the "Company"). The Company accepted his resignation effective January 12, 2024 and Mr. Molu has agreed to remain with the Company in an advisory capacity through February 23, 2024. Mr. Molu's resignation is not the result of any dispute or disagreement with the Company or the Board on any matter relating to the operations, policies or practices of the Company.

The Company currently expects to enter into a separation agreement with Mr. Molu, the terms of which are being negotiated, including the amount of his bonus for the fiscal year ended December 31, 2023. The separation agreement is also expected to include customary releases and restrictive covenants.

Appointment of New Chief Financial Officer

Effective January 12, 2024, the Company appointed Mr. Mark Marino as Chief Financial Officer. Mr. Marino will immediately assume the duties of the Company's principal financial officer and will continue his responsibilities as the Company's principal accounting officer. He will report directly to Amar Maletira, the Company's Chief Executive Officer.

Mr. Marino, age 47, joined Rackspace Technology as Vice President, Americas Chief Financial Officer in 2020 and was promoted to Chief Accounting Officer in late 2021. Prior to joining the Company, Mr. Marino served as Vice President of Finance for Acelity, a leading global medical technology company acquired by 3M, from 2015 to 2020. Prior to Acelity, Mr. Marino was Vice President, Finance at iHeartMedia and head of Corporate FP&A at SunEdison. He began his career at General Electric as a graduate of the Financial Management Program (FMP) and spent nearly 10 years there in a variety of key financial leadership roles across manufacturing, supply chain, business development, FP&A and as Segment CFO for GE Aviation. Mr. Marino holds a BA from DePauw University and an MBA from Baylor University.

In connection with his appointment as Chief Financial Officer, Mr. Marino and the Company entered into an amended and restated employment agreement (the "Employment Agreement"). Pursuant to the terms of the Employment Agreement, Mr. Marino will receive (i) an annual base salary of $530,000, (ii) a signing bonus in the amount of $200,000, and (iii) retention equity grants in the form of restricted stock units ("RSUs") and performance stock units ("PSUs") valued at $3,000,000 and $1,000,000, respectively. The number of shares subject to the RSUs and PSUs shall be determined by dividing each value by a 30-trading day volume-weighted average market closing price. The equity awards are expected to vest over three years, subject to Mr. Marino's continued employment and the additional terms and conditions in the applicable award agreements and the 2020 Rackspace Technology, Inc. Equity Incentive Plan. Mr. Marino will be eligible for annual equity awards beginning in 2025. Mr. Marino will also be eligible to participate in the Company's annual cash bonus plan with a target annual bonus amount equal to 85% of his annual base salary.

If the Company terminates Mr. Marino without Cause and not by reason of death or disability or if Mr. Marino terminates for Good Reason (each as defined in the Employment Agreement) and provided that he signs a separation agreement and release of claims, he will receive (i) continuation of current base salary for 12 months, (ii) 12-months of his target bonus, (iii) a pro-rata portion of his target bonus for the fiscal year in which his termination occurs, paid at the same time bonuses are paid to similarly situated employees, and (iv) a lump sum cash payment equal to twelve months of continued company health care coverage.

The foregoing description of Mr. Marino's employment agreement does not purport to be complete and is qualified in its entirety by reference to the employment agreement itself which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Mr. Marino is also party to an indemnification agreement with the Company, the form of which was previously filed as Exhibit 10.32 to the Company's Amendment No. 2 to Registration Statement on Form S-1/A filed with the SEC on July 27, 2020.

There are no arrangements or understandings between Mr. Marino and any other persons pursuant to which he was selected as an officer of the Company. There are no family relationships between Mr. Marino and any other director or executive officer of the Company and he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Item 7.01. Regulation FD Disclosure.

On January 12, 2022, the Company issued a press release announcing the foregoing CFO transition and reaffirmed the fourth quarter 2023 financial guidance provided by the Company in a previous press release dated November 7, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated into this Item 7.01 by reference.

The information in this Current Report on Form 8-K is being “furnished” pursuant to Item 7.01 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and is not incorporated by reference into any Company filing, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in such filing and regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | |

| Exhibit Number | | Exhibit Description | | |

| 10.1 | | | | |

| 99.1 | | | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| | | RACKSPACE TECHNOLOGY, INC. |

| | | | |

| | | | |

| Date: | January 12, 2024 | | By: | /s/ Amar Maletira |

| | | | Amar Maletira |

| | | | Chief Executive Officer |

EMPLOYMENT AGREEMENT

This Amended and Restated Employment Agreement ("Agreement") is effective as of January 12, 2024 (the "Effective Date") is made by and between Rackspace US, Inc. ("Company") and Mark Marino ("Employee").

WHEREAS, the Company currently employs Employee pursuant to that certain Employment Agreement dated as of July 13, 2020 (the "Prior Agreement");

WHEREAS, certain terms of the 2020 Agreement should be amended to be consistent with the Company's current standard template;

WHEREAS, except as explicitly provided herein, the Company and Employee desire to amend and restate the Prior Agreement in its entirety and replace it with this Agreement;

WHEREAS, effective as of the Effective Date, the Company desires to continue to employ Employee and Employee desires to continue to be so employed with the Company, upon and subject to the terms and conditions set forth herein;

NOW, THEREFORE, in consideration of foregoing and for other good and valuable consideration and intending to be legally bound as of the Effective Date, the Company and Employee agree as follows:

1.TERM OF EMPLOYMENT

The term of employment under this Agreement shall commence on the Effective Date and shall continue until terminated as provided in Section 8 below (the "Employment Period").

2.TITLE AND EXCLUSIVE SERVICES

(a)Title and Duties. Employee's title is Chief Financial Officer, and Employee will perform job duties that are usual and customary for this position. This position will be based in San Antonio, Texas. The Company reserves the right to assign to the Employee duties of a different nature, either additional to, or instead of, those referred to above, it being understood that Employee will not be assigned duties which Employee cannot reasonably perform. Such additional or different duties shall be discussed and agreed to by Employee.

(b) Exclusive Services. Employee shall not be employed or render services elsewhere during the Employment Period. Notwithstanding the foregoing provision of this Section, during the Employment Period, Employee may devote reasonable time to activities other than those required under this Agreement, including activities of a charitable, educational, religious or similar nature (including professional associations), or activities related to corporate board or advisory board positions for non-competitive companies, subject to the company's standard approval policy, and the management of the Employee's personal investments, to the extent such activities do not compete in a material way with the business of the Company.

3.COMPENSATION AND BENEFITS

(a) Base Salary. Employee shall be paid an annual base salary of $530,000 and shall be eligible for increases in base salary consistent with Company's ordinary compensation cycles and process. The Company shall review Employee's Base Salary on an annual basis and may provide for increases as it may deem appropriate in its discretion. Any such modification shall be communicated to Employee in writing and will be deemed the Base Salary for purposes of this Agreement as of the effective date of the increase. The Base Salary shall not be decreased during the Employment Period without the written consent of the Employee.

(b) Annual Corporate Bonus. With respect to each calendar year that ends during the Employment Period, Employee shall be eligible to receive an annual cash bonus (the "Annual Bonus"), with a target Annual Bonus amount equal to 85% of Annual Base Salary ("Target Bonus"), with the actual bonus determined pursuant to the Rackspace Corporate Cash Bonus Plan (or any successor plan) and as approved by the Board or Compensation Committee of the Board ("Compensation Committee"). From time to time the Company will review Employee's Target Bonus percentage and may provide for an increase as it may deem appropriate at its discretion; any such increase shall be deemed thereafter the Target Bonus percentage for purposes of this agreement.

(c) Signing Bonus. Employee will be paid a Signing Bonus of $200,000 within 30 days from the Effective Date of this agreement, subject to the following claw-back provisions. The bonus is an advance payment that is actually earned over a two-year period. Therefore, entitlement to the bonus is contingent upon Employee's continued employment with the Company through the second anniversary of the Effective Date. If, prior to the second anniversary of the Effective Date, Employee voluntarily terminates Employee's employment (other than as a result of Employee's death or disability) without Good Reason, or in the event Employee's employment is terminated by the Company for Cause, Employee agrees that Employee is legally obligated to and will reimburse Rackspace for the unearned pro rata portion of the Signing Bonus based on Employee's actual length of employment.

(d) Promotion Equity Awards. In consideration for signing this Agreement, promptly following the Effective Date, the Company will grant Employee one-time equity grants pursuant to the Rackspace Technology, Inc. 2020 Equity Incentive Plan (or any successor plan) in the form of (i) 75% restricted stock units ("RSUs") and (ii) 25% performance stock units ("PSUs"), in each case, of the Company's common stock, par value $.01 per share ("Common Stock"). Each of the number of RSUs and target number of PSUs granted to Employee shall be determined by dividing $3,000,000 for the RSUs and $1,000,000 for the PSUs (i.e., $4,000,000 in the aggregate) by a 30-trading day volume weighted average market closing price of the Company's NASDAQ-traded Common Stock immediately prior to the Effective Date (the "Signing Equity Grants"). The Signing Equity Grants will be issued pursuant and subject to the terms and conditions set forth in the 2020 Rackspace Technology, Inc. Equity Incentive Plan and the applicable grant agreements.

(e) Annual Equity Awards. Subject to approval of the Compensation Committee (or its delegee), Employee will be eligible to receive annual equity awards during the annual equity award grant cycle on the same basis, terms, and timing no less favorable than those applicable to other similarly situated employees, subject to Employee's continued employment through the applicable date of grant. Notwithstanding the foregoing, Employee will not be eligible for annual equity awards in March 2024.

(f)PTO. Employee is eligible for PTO (paid time off) subject to the Company's policies.

(g) Employment Benefit Plans. Employee may participate in employee benefit plans in which other similarly situated employees may participate, according to the terms of applicable policies and as stated in the Employee Handbook. Employee acknowledges receipt of the Employee Handbook available on the intercompany website and will review and abide by its terms.

(h) Expenses. Company will reimburse Employee for business expenses pursuant to Company policy. Company shall also directly pay, or reimburse Employee for, Employee's legal and fees incurred in negotiating and drafting this Agreement up to a maximum of $5,000.

4.NONDISCLOSURE OF CONFIDENTIAL INFORMATION

(a) Company has provided and will continue to provide to Employee confidential information and trade secrets including but not limited to Company's operational, sales, marketing, personally identifiable information about employees, employee contact information and/or materials used for training and or/employee development, and engineering information, customer lists, business contracts, partner agreements, pricing and strategy information, product and cost or pricing data, compensation information, strategic business plans, budgets, financial statements, and other information Company treats as confidential or proprietary (collectively the "Confidential Information"). This section is not intended to limit Employee's rights to discuss Employee's compensation or other terms and conditions of employment as allowed by law. Employee will not be liable under any Federal or State trade secret law for the disclosure of a trade secret that is made in confidence to a Federal, State or local government official, either directly or indirectly, or to an attorney, solely for the purpose of reporting or investigating a suspected violation of law or that is made in a document filed in a lawsuit so long as it is filed under seal. Employee acknowledges that such Confidential Information is proprietary and agrees not to disclose it to anyone outside Company except to the extent that (i) it is necessary in connection with performing Employee's duties; (ii) Employee is required by court order to disclose the Confidential Information, provided that Employee shall promptly inform Company, shall cooperate with Company to obtain a protective order or otherwise restrict disclosure, and shall only disclose Confidential Information to the minimum extent necessary to comply with the court order. Employee agrees to never use Confidential Information in competing, directly or indirectly, with Company. When employment ends, Employee will immediately return all Confidential Information to Company.

(b) The terms of this Section 4 shall survive the expiration or termination of this Agreement for any reason.

5.NON-HIRE OF COMPANY EMPLOYEES

(a) To further preserve the Confidential Information, during employment and for twelve (12) months after employment ends, Employee will not, directly or indirectly, (i) hire or engage any current employee of Company; (ii) solicit or encourage any employee to terminate employment or services with Company; or (iii) solicit or encourage any employee to accept employment with or provide services to Employee or any business associated with Employee.

(a) The terms of this Section 5 shall survive the expiration or termination of this Agreement for any reason.

6.NON-SOLICITATION OF CUSTOMERS AND SUPPLIERS

(a) To further preserve the Confidential Information, for twelve (12) months after employment ends, Employee agrees not to directly or indirectly, on Employee's own behalf or on behalf of any other person or entity, recruit or otherwise solicit or induce any customer or supplier of the Company, to terminate its employment or arrangement with the Company, otherwise change its relationship with the Company or establish any relationship with Employee or any of Employee's affiliates for any business purpose deemed competitive with the business of the Company.

(b) The terms of this Section 6 shall survive the expiration or termination of this Agreement for any reason.

7.NON-COMPETITION AGREEMENT

(a) To further preserve the Confidential Information, Employee agrees that during employment and for twelve (12) months after employment ends (the "Restricted Period"), Employee will not work, as an employee, contractor, officer, owner, consultant, or director, in any business anywhere in the world that sells managed, dedicated or cloud computing services substantially similar to those services provided by the Company. including but not limited to (i) professional advisory services for the migration, deployment or management of cloud technologies; (ii) provisioning, hosting, management, monitoring, supporting, or maintenance of applications, computer servers (whether dedicated, shared or virtual) and network connectivity in a datacenter for remote use via the Internet; (iii) hosted or managed email, storage, collaboration, compute, virtual networking, applications, and similar services, or (iv) any related IT services or products substantially similar to the Company's products or services, all of the foregoing being defined for the purposes of this Agreement as "Competitive IT Services." Notwithstanding the foregoing, Employee shall be permitted to acquire a passive stock or equity interest in such a business, provided that the stock or other equity interest acquired is not more than two percent (2%) of the outstanding interest in such business. Provided, that the forgoing restriction shall not prevent Employee from becoming an employee of or contractor for a division of any Competitive IT Services company so long as the division for which Employee will work does not provide Competitive IT Services, and as long as Employee does not, during the Restricted Period,

perform services (including but not limited to providing information, advice, strategy, recruiting or any other interaction with regard to business matters) for any division of such company that provides Competitive IT Services.

(b) The terms of this Section 7 shall survive the expiration or termination of this Agreement for any reason.

8.TERMINATION

Employee's employment may be terminated prior to the end of this Agreement only by mutual written agreement or:

(a)Death. The date of Employee's death shall be the termination date.

(b)Disability. Company may terminate this Agreement and/or Employee's employment if Employee is unable to perform the essential functions of Employee's full-time position for more than 180 days in any 6-month period, subject to applicable law.

(c) Termination By Employee For Good Reason. Employee may terminate Employee's employment at any time for "Good Reason," which is: (i) Company's repeated failure to comply with a material term of this Agreement after written notice by Employee specifying the alleged failure; (ii) a material reduction in responsibilities and authority; (iii) a requirement to work substantially at a location more than 50 miles from San Antonio, Texas; (iv) a reduction in Annual Base Salary or Target Bonus unless agreed to by the parties in writing; or (v) a material change in Employee's reporting structure. If Employee elects to terminate Employee's employment for "Good Reason," Employee must first provide Company written notice within thirty (30) days, after which Company shall have thirty (30) days to cure. If Company has not cured and Employee elects to terminate employment, Employee must do so within ten (10) days after the end of the cure period.

(d) Termination by Employee Without Good Reason. Employee may resign Employee's employment without Good Reason any time upon 60 days' advance written notice. Employee's termination of Employee's employment in accordance with this Section 8(d) shall not be deemed a breach of this Agreement.

(e)Termination By Company. Company may terminate Employee's employment with or without Cause and determine the termination date. "Cause" means:

(i)willful misconduct, including, without limitation, violation of sexual or other harassment policy, gross negligence, misappropriation of or material misrepresentation regarding property of Company, other than customary and de minimis use of Company property for personal purposes, or willful failure to take reasonable and appropriate action to prevent material injury to the financial condition, business or reputation of the Company;

(ii)Employee's continuous failure to substantially perform Employee's duties after a written demand for substantial performance is delivered to Employee that specifically identifies the manner in which Company believes that Employee has not substantially

performed his duties, and Employee has failed to demonstrate substantial efforts to resume substantial performance of Employee's duties on a continuous basis within thirty (30) calendar days after receiving such demand (other than by reason of disability);

(iii)failure to follow lawful directives of the Company (other than a failure resulting from incapacity due to physical or mental illness);

(iv)a felony conviction or indictment, a plea of guilty or nolo contendere by Employee, or other conduct by Employee that has or would result in material injury to Company's reputation, including indictment or conviction of fraud, theft, embezzlement, or a crime involving moral turpitude;

(v)a material breach of this Agreement by Employee after a written notice of such breach is delivered to Employee that specifically identifies the manner in which Company believes that Employee has breached this Agreement, and Employee has failed to cure such breach within thirty (30) calendar days after receiving such demand; provided, however, that no cure period shall be required for conduct under Section 8(e)(i), (iv), or (vi); or

(vi)a significant violation of Company's employment and management policies.

Unsatisfactory business performance of the Company, or mere inefficiency, or good faith errors in judgment or discretion by Employee shall not constitute grounds for termination for Cause hereunder.

9.COMPENSATION UPON TERMINATION

(a) Death or Disability. Company shall, within 30 days of the termination date, (i) pay to Employee's designee or, if no person is designated, to Employee's estate, Employee's accrued and unpaid base salary and bonus, subject to the terms of any applicable bonus plan, through the date of termination, and any payments required under applicable employee benefit plans, and (ii) accelerate the vesting of any equity awards that would have, but for the Employee's termination of employment, vested within six (6) months of the termination date.

(b)Termination By Company For Cause: Company shall, within 30 days, pay to Employee, Employee's accrued and unpaid base salary through the termination date and any payments required under applicable employee benefit plans (other than plans which provide for severance or termination payments or benefits).

(c)Termination With Severance.

(d) Termination By Company Without Cause. Termination by Employee for Good Reason: If Company terminates Employee's employment without Cause and not by reason of death or disability or if Employee terminates for Good Reason, Company will pay the accrued and unpaid base salary through the termination date and any payments required under applicable employee benefit plans (other than plans which provide for severance or termination payments). In addition, if Employee signs and does not revoke a Severance

Agreement and General Release of claims in a form satisfactory to Company, Company will pay Employee, in periodic payments in accordance with ordinary payroll practices and deductions, (i) Employee's current base salary for 12 months, (ii) 12-months of Employee's Target Bonus, (iii) a pro rata portion of Employee's Target Bonus for the fiscal year in which Employee's termination occurs paid in a lump sum at the same time bonuses are paid to Company's other similarly situated employees, and (iv) a lump sum cash payment, less applicable withholdings and other ordinary payroll deductions, which is equal to the applicable premium cost for twelve (12) months of continued Company group health coverage for Employee and any spouse and dependents ("Family Members") pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1986, as amended ("COBRA"), based on Employee's elections with respect to health coverage for Employee and Employee's Family Members in effect immediately prior to Employees termination (which amount will be based on the premium for the first month of COBRA coverage). The lump sum COBRA payment will be made on the same date that the first severance payment is paid and will be paid regardless of whether Employee elects COBRA continuation coverage. If Employees chooses to elect COBRA, Employee must do so within 60 days of the later of: (i) the date Employee is furnished the election notice or (ii) the date Employee loses coverage, and Employee shall be solely responsible for payment of any premiums due with respect to such coverage. The payments made pursuant to this section are referred to as (the "Severance Payments" or "Severance Pay Period").

(e)Change of Control: Upon a change of control, as defined in the Rackspace Technology, Inc. Executive Change in Control Severance Plan adopted and effective March 16, 2021 (the "Plan"), Employee will receive the severance benefits as outlined in the Plan.

(f)Employment by Competitor or Re-hire During Severance Pay Period:

(i)If Employee competes with Company, or is hired or engaged in any capacity by any competitor of Company, during any Severance Pay Period, then the Severance Payments shall cease. The foregoing shall not affect Company's right to enforce the Non-Compete pursuant to Section 7. For purposes of this sub-section, a "competitor" of Company means: any business anywhere in the world that sells Competitive IT Services as defined in Section 7.

(ii)If Employee is rehired by Company during any Severance Pay Period, the Severance Payments shall cease.

10.OWNERSHIP OF MATERIALS

Employee agrees that all inventions, improvements, discoveries, designs, technology, and works of authorship (including but not limited to computer software) made, created, conceived, or reduced to practice by Employee, whether alone or in cooperation with others, during employment, together with all patent, trademark, copyright, trade secret, and other intellectual property rights related to any of the foregoing throughout the world, are among other things works made for hire and belong exclusively to the Company, and Employee hereby assigns all such rights to the Company. Employee agrees to execute any documents, testify in any legal proceedings, and do all things necessary or desirable to secure Company's rights to the foregoing, including without

limitation executing inventors' declarations and assignment forms. If there is a separate signed agreement between Employee and the Company including terms directly related to intellectual property rights, then the intellectual property terms of that agreement shall control.

11.PARTIES BENEFITED; ASSIGNMENTS

This Agreement shall be binding upon Employee, Employee's heirs and Employee's personal representative or representatives, and upon Company and its respective successors and assigns. Neither this Agreement nor any rights or obligations hereunder may be assigned by Employee, other than by will or by the laws of descent and distribution. The Company may assign its rights and obligation under this Agreement to any entity, including any successor to all or substantially all the assets of the Company, by merger or otherwise.

12.GOVERNING LAW

This Agreement shall be governed, construed, interpreted, and enforced in accordance with the substantive laws of the State of Texas, without reference to the principles of conflicts of law of Texas or any other jurisdiction, and where applicable, the laws of the United States. Each of the Company and Employee (on behalf of itself and its affiliates) expressly consents to the personal jurisdiction of the Texas state and federal courts for any lawsuit relating to this Agreement, waives any other requirement (whether imposed by statute, rule of court, or otherwise) with respect to such personal jurisdiction or service of process, and waives any objection to jurisdiction based on improper venue or improper jurisdiction.

Each party hereto hereby waives, to the fullest extent permitted by applicable law, any right it may have to a trial by jury in respect of any suit, action, or proceeding arising out of or relating to this Agreement. Each party hereto (i) certifies that no representative, agent, or attorney of any other party has represented, expressly or otherwise, that such party would not, in the event of any action, suit, or proceeding, seek to enforce the foregoing waiver and (ii) acknowledges that it and the other party hereto have been induced to enter into this Agreement by, among other things, the mutual waiver and certifications in this section.

Employee acknowledges that it is advisable to be represented by counsel in connection with Employee's review and agreement to all terms and conditions of this Agreement.

Employee acknowledges and agrees that entering into this Agreement is not a condition of Employee's employment with the Company or its affiliates.

13.DEFINITION OF COMPANY

"Company" shall include Rackspace US, Inc., and its past, present and future divisions, operating companies, subsidiaries, affiliates and successors.

14.LITIGATION AND REGULATORY COOPERATION

During and after employment, Employee shall reasonably cooperate in the defense or prosecution of claims, investigations, or other actions which relate to events or occurrences during employment. Employee agrees, unless precluded by law, to promptly inform the Company if Employee is asked to participate (or otherwise become involved) in any such claim, investigation or action. Employee's cooperation shall include being available to prepare for discovery or trial and to act as a witness. Company will pay an hourly rate (based on base salary as of the last day of employment) for cooperation that occurs after employment, and reimburse for reasonable expenses, including travel expenses, reasonable attorneys' fees and costs.

15.DISPUTE RESOLUTION

(a) Injunctive Relief: Employee agrees that irreparable damages to Company will result from Employee's breach of this Agreement, including loss of revenue, loss of goodwill associated with Employee as a result of employment, and/or loss of the benefit to Company of any training, confidential, and/or trade secret information provided to Employee, and any other tangible and intangible investments made to and on behalf of Employee. A breach or threat of breach of this Agreement shall give the non-breaching party the right to seek a temporary restraining order and a preliminary or permanent injunction enjoining the breaching party from violating this Agreement in order to prevent immediate and irreparable harm. The breaching party (to the extent same is determined by a court of competent jurisdiction) shall pay to the non-breaching party reasonable attorneys' fees and costs associated with enforcement of this Agreement, including any appeals. Pursuit of equitable relief under this Agreement shall have no effect regarding the continued enforceability of the Arbitration Section below. Remedies for breach under this Section are cumulative and not exclusive; the parties may elect to pursue any remedies available under this Agreement.

(b) Arbitration: The parties agree that any dispute or claim, that could be brought in court including discrimination or retaliation claims, relating to this Agreement or arising out of Employee's employment or termination of employment, shall, upon timely written request of either party, be submitted to binding arbitration, except claims regarding: (i) workers' compensation benefits; (ii) unemployment benefits; (iii) Company's employee welfare benefit plans, if the plan contains a final and binding appeal procedure for the resolution of disputes under the plan; (iv) wage and hour disputes within the jurisdiction of any state Labor Commissioner; and (v) issues that could be brought before the National Labor Relations Board or covered by the National Labor Relations Act. This Agreement is not intended to prohibit the Employee from filing a claim or communicating with any governmental agency including the Equal Employment Opportunity Commission, the National Labor Relations Board or the Department of Labor. The arbitration shall be conducted in San Antonio, Texas. The arbitration shall proceed in accordance with the National Rules for Resolution of Employment Disputes of the American Arbitration Association ("AAA") in effect at the time the claim or dispute arose, unless other rules are agreed upon by the parties. Unless agreed to in writing, the arbitration shall be conducted by one arbitrator from AAA or a comparable arbitration service, and who is selected pursuant to the National Rules for Resolution of Employment Disputes of the AAA, or other rules as the parties may agree to in writing. Any claims received after the applicable statute of limitations period shall be deemed null and void. The parties further agree that

by entering into this Agreement, the right to participate in a class or collective action is waived. CLAIMS MAY BE ASSERTED AGAINST THE OTHER PARTY ONLY IN AN INDIVIDUAL CAPACITY AND NOT AS A PLAINTIFF OR CLASS MEMBER IN ANY PURPORTED CLASS OR REPRESENTATIVE PROCEEDING. Further, unless the parties agree otherwise, the arbitrator may not consolidate more than one person's claims, and may not otherwise preside over any form of a representative, collective or class proceeding. If this specific provision is found to be unenforceable, then the entirety of this arbitration provision shall be null and void. The arbitrator shall issue a reasoned award with findings of fact and conclusions of law. Either party may bring an action in any court of competent jurisdiction to compel arbitration under this Agreement, or to enforce or vacate an arbitration award. However, in actions seeking to vacate an award, the standard of review to be applied by said court to the arbitrator's findings of fact and conclusions of law will be the same as that applied by an appellate court reviewing a decision of a trial court sitting without a jury, unless state law requires otherwise. Company will pay the actual fee for the arbitrator and the claimant's filing fee; unless otherwise provided by law and awarded by the arbitrator, each party will pay their own attorneys' fees and other expenses.

16.REPRESENTATIONS AND WARRANTIES OF EMPLOYEE

Employee shall keep all terms of this Agreement confidential, except as may be disclosed to Employee's spouse, accountants or attorneys, each of whom shall agree to keep all terms of this Agreement confidential. Employee represents that Employee is under no contractual or other restriction inconsistent with the execution of this Agreement, the performance of Employee's duties hereunder, or the rights of Company. Employee authorizes the Company to inform any prospective employer of the existence and terms of this Agreement without liability for interference with Employee's prospective employment. Employee represents that Employee is under no disability that prevents Employee from performing the essential functions of Employee's position, with or without reasonable accommodation.

17.SECTION 409A COMPLIANCE

(a) General. The parties hereto acknowledge and agree that, to the extent applicable, this Agreement shall be interpreted in accordance with, and incorporate the terms and conditions required by, Section 409A of the Internal Revenue Code of 1986, as amended (the "Code") and the Department of Treasury Regulations and other interpretive guidance issued thereunder, including without limitation any such regulations or other guidance that may be issued after the date hereof. Notwithstanding any provision of this Agreement to the contrary, in the event that the Company determines that any amounts payable hereunder will be taxable currently to the Employee under Section 409A(a)(l)(A) of the Code and related Department of Treasury guidance, the Company and the Employee shall cooperate in good faith to (i) adopt such amendments to this Agreement and appropriate policies and procedures, including amendments and policies with retroactive effect, that they mutually determine to be necessary or appropriate to preserve the intended tax treatment of the benefits provided by this Agreement, to preserve the economic benefits of this Agreement, and to avoid less-favorable accounting or tax consequences for the Company, and/or (ii) take such other actions as mutually determined to be necessary or appropriate to exempt

the amounts payable hereunder from Section 409A of the Code or to comply with the requirements of Section 409A of the Code and thereby avoid the application of penalty taxes thereunder; provided, however, that this Section does not create an obligation on the part of the Company to modify this Agreement or any other agreement, arrangement or plan and does not guarantee that the amounts payable hereunder will not be subject to interest or penalties under Section 409A, and in no event whatsoever shall the Company or any of its affiliates be liable for any additional tax, interest, or penalties that may be imposed on Employee as a result of Section 409A of the Code or any damages for failing to comply with Section 409A of the Code.

(b) Separation from Service under Section 409A. Notwithstanding any provision to the contrary in this Agreement: (i) no Severance Payments shall be payable unless the termination of the Employee's employment constitutes a "separation from service" within the meaning of Section 1.409A-l(h) of the Department of Treasury Regulations; (ii) if the Employee is deemed at the time of Employee's separation from service to be a "specified employee" for purposes of Section 409A(a)(2)(B)(i) of the Code, to the extent that delayed commencement of any portion of the Severance Payments (after taking into account all exclusions applicable to such Severance Payment under Section 409A) is required in order to avoid a prohibited distribution under Section 409A(a)(2)(B)(i) of the Code, such portion of the Severance Payments shall not be provided to the Employee prior to the earlier of (A) the expiration of the six-month period measured from the date of the Employee's "separation from service" with the Company (as such term is defined in the Department of Treasury Regulations issued under Section 409A) and (B) the date of the Employee's death; provided, that upon the earlier of such dates, all payments deferred pursuant to this section shall be paid to the Employee in a lump sum, and any remaining Severance Payments shall be paid as otherwise provided herein; (iii) the determination of whether the Employee is a "specified employee" for purposes of Section 409A(a)(2)(B)(i) of the Code as of the time of Employee's separation from service shall be made by the Company in accordance with the terms of Section 409A of the Code and applicable guidance thereunder (including, without limitation, Section 1.409A-l(i) of the Department of Treasury Regulations and any successor provision thereto); (iv) for purposes of Section 409A of the Code, the Employee's right to receive installment payments of the Severance Payments shall be treated as a right to receive a series of separate and distinct payments; and (v) to the extent that any reimbursement of expenses or in-kind benefits constitutes "deferred compensation" under Section 409A, such reimbursement or benefit shall be provided no later than December 31 of the year following the year in which the expense was incurred. The amount of expenses reimbursed in one year shall not affect the amount eligible for reimbursement in any subsequent year. The amount of any in-kind benefits provided in one year shall not affect the amount of in-kind benefits provided in any other year. Reimbursements and in-kind benefits are not subject to liquidation or exchange for another benefit.

18.WITHHOLDING

The Company shall be entitled to withhold from any amounts payable under this Agreement any federal, state, local, and foreign withholding and other taxes and charges that the Company is

required to withhold. The Company shall be entitled to rely on an opinion of counsel if any questions as to the amount or requirement of withholding shall arise.

19.EXCESS PARACHUTE PAYMENTS

If it is determined (as hereafter provided) that any payment or distribution by the Company to or for the benefit of Employee, whether paid or payable or distributed or distributable pursuant to the terms of this Agreement or otherwise pursuant to or by reason of any other agreement, policy, plan, program, or arrangement, including without limitation any stock option, stock appreciation right, or similar right, or the lapse or termination of any restriction on or the vesting or exercisability of any of the foregoing (a "Payment"), would be subject to the excise tax imposed by Section 4999 of the Code (or any successor provision thereto) by reason of being contingent on a change in ownership or effective control of the Company or of a substantial portion of the assets of the Company, within the meaning of Section 280G of the Code (or any successor provision thereto), or to any similar tax imposed by state or local law, or any interest or penalties with respect to such excise tax (such tax or taxes, together with any such interest or penalties, are hereafter collectively referred to as the "Excise Tax"), then, in the event that the after-tax value of all Payments to Employee (such after-tax value to reflect the reduction for the Excise Tax and all federal, state, and local income, employment, and other taxes on such Payments) would, in the aggregate, be less than the after-tax value to Employee (reflecting a reduction for all such taxes in a like manner) of the amount that is 2.99 times Employee's "base amount" within the meaning of Section 280G(b)(3) of the Code (the "Safe Harbor Amount"), (a) the cash portions of the Payments payable to Employee under this Agreement shall be reduced, in the reverse order in which they are due to be paid commencing with the latest such payment, until the Parachute Value (as defined below) of all Payments paid to Employee, in the aggregate, equals the Safe Harbor Amount, and (b) if the reduction of the cash portions of the Payments, payable under this Agreement, to zero would not be sufficient to reduce the Parachute Value of all Payments to the Safe Harbor Amount, then any cash portions of the Payments payable to Employee under any other agreements, policies, plans, programs, or arrangements shall be reduced, in the reverse order in which they are due to be paid commencing with the latest such payment, until the Parachute Value of all Payments paid to Employee, in the aggregate, equals the Safe Harbor Amount, and (c) if the reduction of all cash portions of the Payments, payable pursuant to this Agreement or otherwise, to zero would not be sufficient to reduce the Parachute Value of all Payments to the Safe Harbor Amount, then non cash portions of the Payments shall be reduced, in the reverse order in which they are due to be paid commencing with the latest such payment, until the Parachute Value of all Payments paid to Employee, in the aggregate, equals the Safe Harbor Amount. All calculations under this Section shall be determined by a national accounting firm selected by the Company (which may include the Company's outside auditors). The Company shall pay all costs to obtain and provide such calculations to Employee and the Company. For purposes of this Agreement, the "Parachute Value" of a Payment shall mean the present value as of the date of the change in ownership or effective control, within the meaning of Section 280G of the Code, of the portion of such Payment that constitutes a "parachute payment" under Section 280G(b)(2) of the Code, as determined for purposes of determining whether and to what extent the Excise Tax will apply to such Payment.

20.MISCELLANEOUS

This Agreement is not effective unless fully executed by all parties, including the CEO or authorized officer of the Company, and approved by the Executive Committee as required by Company or its affiliates. This Agreement may not be modified, amended, or terminated except by an instrument in writing signed by Employee and the CEO or authorized officer of the Company that expressly identifies the amended provision of this Agreement. This Agreement contains the entire agreement of the parties on the subject matters in this agreement and supersedes any prior written or oral agreements or understandings between the parties except as noted in Section 10 above, and with the exception of that certain Indemnification Agreement dated as of March 31, 2023 between the Company and Employee, which agreement shall remain in full force and effect. No modification shall be valid unless in writing and signed by the parties. This Agreement may be executed in counterparts, a counterpart transmitted via electronic means, and all executed counterparts, when taken together, shall constitute sufficient proof of the parties' entry into this Agreement. The parties agree to execute any further or future documents which may be necessary to allow the full performance of this Agreement. The failure of a party to require performance of any provision of this Agreement shall not affect the right of such party to later enforce any provision. A waiver of the breach of any term or condition of this Agreement shall not be deemed a waiver of any subsequent breach of the same or any other term or condition. The headings in this Agreement are inserted for convenience of reference only and shall not control the meaning of any provision hereof.

If any provision of this Agreement shall, for any reason, be held unenforceable, such unenforceability shall not affect the remaining provisions hereof, except as specifically noted in this Agreement, or the application of such provisions to other persons or circumstances, all of which shall be enforced to the greatest extent permitted by law. Company and Employee agree that the restrictions contained in Section 4, 5, 6, and 7, are reasonable in scope and duration and are necessary to protect Confidential Information. If any restrictive covenant is held to be unenforceable because of the scope, duration or geographic area of such restrictive covenant, the parties agree that a court or arbitrator may reduce the scope, duration, or geographic area, and in its reduced form, such provision shall be enforceable. Should Employee violate the provisions of Sections 5, 6, or 7, then in addition to all other remedies available to Company, the duration of these covenants shall be extended for the period of time when Employee began such violation until Employee permanently ceases such violation.

If any provision of this Agreement is held to be illegal, invalid, or unenforceable under present or future laws effective during the term of this Agreement, such provision shall be fully severable, this Agreement shall be construed and enforced as if such illegal, invalid, or unenforceable provision were never a part of this Agreement, and the remaining provisions of this Agreement shall remain in full force and effect and shall not be affected by the illegal, invalid, or unenforceable provision or by its severance from this Agreement. Furthermore, in lieu of such illegal, invalid, or unenforceable provision, there shall be added automatically as part of this Agreement a provision as similar in terms to such illegal, invalid, or unenforceable provision as may be possible and be legal, valid, and enforceable.

[SIGNATURE PAGE FOLLOWS]

Upon full execution by all parties, this Agreement shall be effective on the later date of the two signature dates below.

EMPLOYEE:

/s/ Mark Marino

Mark Marino

COMPANY:

Rackspace US, Inc.

By: /s/ Kelly Teal Guess

Its: Executive Vice President & Chief Human Resources Officer

Rackspace Technology Promotes Mark Marino to Chief Financial Officer

SAN ANTONIO, TX – January 12, 2024 – Rackspace Technology® (NASDAQ: RXT), a leading end-to-end, hybrid multicloud technology solutions company, today announced the appointment of Mark Marino as Chief Financial Officer (CFO), effective immediately. Marino previously served as the Company’s Chief Accounting Officer and succeeds Naushaza “Bobby” Molu. Molu resigned his position to pursue a new opportunity in the UK, where he resides. He will remain with Rackspace Technology in an advisory role through late February to ensure a seamless transition.

“I am delighted to welcome Mark as our CFO,” said Amar Maletira, Chief Executive Officer. “Having worked with Mark since I joined Rackspace, I have witnessed firsthand what a strong asset he is to our company. Mark’s comprehensive understanding of the business and extensive financial leadership experience will continue to be instrumental as we strengthen our position in an attractive and growing hybrid multicloud and AI market. I look forward to collaborating with Mark as we continue to execute on our strategy and deliver value to our shareholders.”

Marino joined Rackspace Technology as Vice President, Americas CFO in 2020 and was promoted to Chief Accounting Officer in late 2021. Prior to joining the company, Marino served as Vice President of Finance for Acelity, a leading global medical technology company acquired by 3M, from 2015 to 2020. Prior to Acelity, Marino was Vice President, Finance at iHeartMedia and head of Corporate FP&A at SunEdison, Inc. He began his career at General Electric as a graduate of the Financial Management Program (FMP) and spent nearly 10 years there in a variety of key financial leadership roles across manufacturing, supply chain, business development, FP&A and as Segment CFO for GE Aviation. Marino holds a BA from DePauw University and an MBA from Baylor University.

“It is a privilege to move into the role of CFO at this exciting time for Rackspace Technology,” said Marino. “We have made significant progress on our transformation, having fully implemented a new operating model over the past year, unveiled innovative AI capabilities and rolled out unique, tailored solutions for customers across our Private Cloud and Public Cloud businesses. I look forward to working more closely with Amar and the leadership team to execute on our strategy and continuing to drive operating efficiency and profitable growth.”

"The Board and management team would like to thank Bobby for his leadership over the past year,” added Maletira. “I am personally grateful for his partnership and contributions, and we wish him the best in his future endeavors.”

Molu’s resignation is not the result of any dispute or disagreement with the Company or the Board on any matter relating to the operations, policies, or practices of the Company.

Outlook

Concurrently with the foregoing announcement, Rackspace Technology reaffirms its financial guidance for the fourth quarter 2023, as provided in a press release issued on November 7, 2023.

About Rackspace Technology

Rackspace Technology is a leading end-to-end, hybrid multicloud technology services company. We can design, build, and operate our customers' cloud environments across all major technology platforms, irrespective of technology stack or deployment model. We partner with our customers at every stage of their cloud journey, enabling them to modernize applications, build new products, and adopt innovative technologies.

Forward-looking Statements

Rackspace Technology has made statements in this press release and other reports, filings, and other public written and verbal announcements that are forward-looking and therefore subject to risks and uncertainties. All statements, other than statements of historical fact, included in this document are, or could be, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are made in reliance on the safe harbor protections provided thereunder. These forward-looking statements relate to anticipated financial performance, management’s plans and objectives for future operations, business prospects, outcome of regulatory proceedings, market conditions, and other matters. Any forward-looking statement made in this presentation speaks only as of the date on which it is made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Forward-looking statements can be identified by various words such as “expects,” “intends,” “will,” “anticipates,” “believes,” “confident,” “continue,” “propose,” “seeks,” “could,” “may,” “should,” “estimates,” “forecasts,” “might,” “goals,” “objectives,” “targets,” “planned,” “projects,” and similar expressions. These forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to management. Rackspace Technology cautions that these statements are subject to risks and uncertainties, many of which are outside of our control, and could cause future events or results to be materially different from those stated or implied in this document, including among others, risk factors that are described in Rackspace Technology, Inc.’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein.

IR Contact

Sagar Hebbar

ir@rackspace.com

PR Contact

Natalie Silva

publicrelations@rackspace.com

v3.23.4

Cover

|

Jan. 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 09, 2024

|

| Entity Registrant Name |

RACKSPACE TECHNOLOGY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39420

|

| Entity Tax Identification Number |

81-3369925

|

| Entity Address, Address Line One |

1 Fanatical Place

|

| Entity Address, Address Line Two |

City of Windcrest

|

| Entity Address, City or Town |

San Antonio

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78218

|

| City Area Code |

800

|

| Local Phone Number |

961-4454

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

RXT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001810019

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

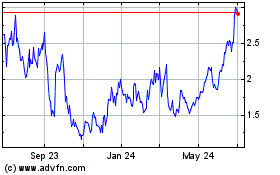

Rackspace Technology (NASDAQ:RXT)

Historical Stock Chart

From Mar 2024 to Apr 2024

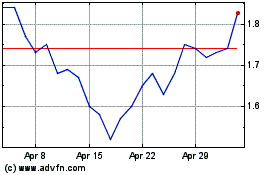

Rackspace Technology (NASDAQ:RXT)

Historical Stock Chart

From Apr 2023 to Apr 2024