false

0001472012

0001472012

2024-01-11

2024-01-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 11, 2024

Immunome,

Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-39580 |

|

77-0694340 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification

No.) |

665

Stockton Drive, Suite 300

Exton, Pennsylvania |

|

19342 |

| (Address of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (610)

321-3700

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which registered |

| Common

Stock, $0.0001 par value per share |

|

IMNM |

|

The Nasdaq

Capital Market |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation

FD Disclosure.

On January 11, 2024, Immunome,

Inc. (the “Company”) updated its corporate presentation for use in meetings with investors, analysts and others. The presentation

is available through the Company’s website and a copy is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated

by reference herein.

The information in this

Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that section or Section 11 and 12(a)(2) of the Securities

Act of 1933, as amended. The information shall not be deemed incorporated by reference into any other filing with the Securities and Exchange

Commission made by the Company, whether made before or after today’s date, regardless of any general incorporation language in such

filing, except as shall be expressly set forth by specific references in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

IMMUNOME, INC. |

| |

|

|

| Date: January 11, 2024 |

By: |

/s/ Max Rosett |

| |

|

Max Rosett |

| |

|

Interim Chief Financial Officer |

Exhibit 99.1

Immunome Corporate Presentation January 11, 2024

2 IMMUNOME Disclaimer and Forward - Looking Statements Disclosures For the purposes of this notice, the “presentation” that follows shall mean and include the slides that follow, the oral pres ent ation of the slides by members of management of Immunome, Inc. (“Immunome”) or any person on its behalf, any question - and - answer session that follows that oral presentation, hard copies of this document and any materials distributed at, or in connection with, that presentation. References to “we,” “our,” and “us” refers to Imm uno me and its subsidiaries. Forward - Looking Statements This presentation contains “forward - looking statements” under the meaning of the “safe harbor” provisions of the Private Securit ies Litigation Reform Act of 1995. Our actual results may differ from our expectations, estimates and projections and consequ ent ly, you should not rely on these forward - looking statements as predictions of future events. Words such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “an tic ipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “projected,” “first step,” “ongoing,” or the negative of t hes e terms, or other comparable terminology intended to identify statements about the future. Forward - looking statements contained in this presentation include, but are not limited to, statements about: the expansion and a dvancement of our platform and pipeline and our approach and strategy related to the platform and pipeline; the potential of ou r current and future pipeline to produce first - in - class and/or best - in - class drugs; our expectations with respect to future performance and anticipated financial impacts of our strategic transactions an d t he closing of those transactions; our timeline for filing INDs and seeking regulatory approval for one or more of our current or future programs and product candidates and other anticipated milestones; our expected cash runway, including receipt of certain collaboration payments; our ability to expand our platform and establish a br oad pipeline and advance it through efficient clinical development decisions; our intention to continue expanding our pipelin e t hrough strategic transactions; our intent to expand our intellectual property portfolio; and other statements regarding our intentions, plans, beliefs, expectations or forecasts for the future. These for war d - looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from t hose projected or implied in these forward - looking statements. Most of these factors are outside our control and are difficult to predict. Factors that may cause such differences include, but are not limited to: th e i nability to recognize the anticipated benefits of our completed strategic transactions and collaborations, which may be affec ted by, among other things, competition and our ability to grow and successfully execute on our business plan; the risk that we may not identify or progress to the clinic any product candidate, or to the extent we do, that such product candidate may not be best - in - class or first - in - class; changes in the applicable laws or regulations; our timi ng for achieving milestones, if at all, and the corresponding receipt of milestone or collaboration payments; our ability to identify, negotiate and consummate strategic transactions on terms acceptable to us th at will expand our platform or pipeline or provide us access to non - dilutive capital; the possibility that we may be adversely affected by other economic, bus iness, and/or competitive factors; the risk that regulatory approvals for our programs and product candidates are not obtained, are delayed or are subject to unanticipated co ndi tions that could adversely affect us or the expected benefits of our completed strategic transactions; our ability to manage fut ure growth; our ability to manage clinical trials or studies; the risk that pre - clinical data may not be predictive of clinical data; the complexity of numerous regulatory and legal requirements that we ne ed to comply with to operate its business; the reliance on our management; the prior experience and successes of our management tea m are not indicative of any future success; the failure to obtain, adequately protect, maintain or enforce our intellectual property rights; our ability to raise additional capital to support our operati ons and, to the extent trigger, to pay milestone obligations; and other risks and uncertainties described in our Annual Report on F orm 10 - K for the year ended December 31, 2022, our 10 - Q for the quarter ended September 30, 2023, and in our other filings subsequently made with the U.S. Securities and Exchange Commission. We caution t hat the foregoing list of factors is not exclusive and not to place undue reliance upon any forward - looking statements, including p rojections, which speak only as of the date made. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. Except as required by law, we do not u nde rtake any obligation to update publicly any forward - looking statements for any reason after the date of this presentation to con form these statements to actual results or to changes in their expectations. Product Candidates In this presentation, we may discuss current and potential future product candidates that have not yet undergone clinical tri als or been approved for marketing by the U.S. Food and Drug Administration or other governmental authority. No representation is m ade as to the safety or effectiveness of these current or potential future product candidates for the use for which such product candidates are being studied. Industry and Market Data In this presentation, we rely on and refer to publicly available information and statistics regarding market participants in the sectors in which we compete and other industry data. Any comparison of us to the industry or to any of our competitors is based on this publicly available information and statistics and such comparisons assume the reliability of the information available to us. We obtained this information and statistics from third - party sources, includ ing reports by market research firms and company filings. While we believe such third - party information is reliable, there can b e no assurance as to the accuracy or completeness of the indicated information. We have not independently verified the information provided by the third - party sources. Trademarks This presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the propert y o f their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, SM © or ® symbols, but we will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, se rvice marks, trade names and copyrights.

3 IMMUNOME Establishing a Premier Targeted Oncology Company • Develop first - in - class and best - in - class oncology therapies • Organic pipeline expansion driven by internal discovery programs • Additional platform and pipeline expansion driven by disciplined M&A • Strong biotech investor syndicate supportive of corporate vision • Strategic partnering to access non - dilutive capital Strong Foundation for Long - Term Success • Experienced, successful leadership team whose members have developed approved oncology therapeutics across multiple modalities • Three programs with first - in - class or best - in - class potential and INDs planned for 1Q 2025: • FAP radioligand therapy (RLT) • ROR1 antibody - drug conjugate (ADC) • IL - 38 immunotherapy • Pipeline and toolbox expansion through recent Zentalis transaction and signed Atreca agreement • Target - driven ADC and RLT strategy with broad toolbox • Headquarters in Bothell, WA with a capital - efficient laboratory in Exton, PA Long - Term Corporate Vision JH0 JH1 2

4 IMMUNOME • Purchase of assets related to over 25 preclinical antibodies • Opportunity to pursue ADCs against novel or underexplored targest • $5.5 million cash up front • $7 million in development milestones • Closing subject to Atreca shareholder approval and customary conditions • Exclusive license of ADC assets • Preclinical ROR1 ADC with best - in - class potential • Differentiated ADC platform technology • Potential to advance ROR1 ADC in multiple solid tumor indications with large market size • Opportunity to develop multiple programs with proprietary linker - payload unit • Financial Terms: • $35 million up front (cash and stock) • $275 million in milestones • Mid - to - high single digit royalties Recent Business Development Activity Expanded Pipeline and Toolbox With Moderate Investment

5 IMMUNOME Pipeline and Discovery Overview Target Candidate Modality Discovery Lead Optimization Development Candidate IND - Enabling Anticipated IND Filing FAP Undisclosed RLT 1Q2025 ROR1 IM - 1021 1 ADC 1Q2025 IL - 38 IM - 4320 2 Immunotherapy 1Q2025 Undisclosed - ADC TBD Undisclosed - RLT TBD 1. Formerly known as ZPC - 21. 2. Formerly known as IMM - ONC - 01 or IMM20320.

6 IMMUNOME ADC Strategy

7 IMMUNOME Target - Driven Development For the Next Generation of ADCs Systematic Development Through Clinical Proof of Concept Early go/no - go decisions via well - designed clinical trials Optimization for binding & internalization Incorporation of proven or novel linkers Select payload for consistent cytotoxic effect Optimize pharmacology for clinical activity Immunome Approach • Focus on oncology indications with high unmet need • Identify novel or underexplored targets that are suitable for ADCs and advance first - in - class compounds • Identify clinically validated targets where existing programs show limitations and advance best - in - class ADCs • Deeply understand target biology • Deploy broad toolbox of antibodies, linkers, and payloads to match target biology Establish a broad pipeline and advance it through efficient clinical development decisions

8 IMMUNOME Top 10 Targets Account for 54% of Active Clinical ADC Programs ADC Activity is Concentrated in a Small Number of Targets 34 17 8 6 15 10 8 8 4 4 Active Clinical ADC Programs Approved ADC No Approved ADC 1.: Immunome Analysis of Beacon ADC data. from Hanson Wade as of November 10, 2023 Downsides of Pursuing Most Popular Targets • Limitations of existing drugs may be difficult to overcome • Performance of current drugs may be limited by heterogeneity of target expression on tumors • Changes in payload and linker technology are likely to make only incremental gains • Challenging development and commercialization path • Lower unmet patient need Identifying appropriate targets is a key challenge of ADC development

9 IMMUNOME Sources of Novel Targets and Antibodies Systematically Evaluate Novel Targets for First - in - Class ADC Potential Tumor Expression Normal Tissue Expression Solid Tumor ADCs Approved Drugs Clinical Stage Programs Immunome Internal Targets Tivdak Elahere Trodelvy Padcev Targets are evaluated for differential tumor expression and additional considerations Immunome Discovery Platform >30 identified targets Licensing/Acquisition >25 antibodies from Atreca 1 Expression Screening Public and proprietary databases 1. Subject to satisfaction of closing conditions Enhertu, Kadcyla

10 IMMUNOME Proprietary Payload Provides Opportunity to Develop Best - in - Class ADCs 67.3% 90.3% 91.6% 106.0% TGI When conjugated to the same antibody, IMNM payload shows improved efficacy compared to DXd Proprietary ADC Payload • Camptothecin derivative/TOPO1 inhibitor • Same class as Enhertu payload deruxtecan (DXd) • Developed by Zentalis and exclusively licensed to Immunome • Designed to have enhanced ADME properties compared to DXd • Greater in vitro potency • Increased permeability may lead to superior bystander effect • Faster clearance may improve tolerability after cleavage DXd IMNM Payload EC 50 11.6 nM 8.3 nM PAMPA (Permeability) 21.9 * 10 - 6 cm/s 69.0 * 10 - 6 cm/s Human hepatocyte intrinsic clearance T 1/2 148 min 51.1 min HER2 ADC Constructed with IMNM Proprietary Payload Outperforms Enhertu in JIMT - 1 Breast Cancer Model 0 500 1000 1500 2000 2500 3000 0 7 14 21 28 35 42 49 Study Day Vehicle control, i.v., QWx3 Her2-3-DXd (Enhertu), 3mg/kg, i.v., QWx3 Her2-3-DXd (Enhertu), 10mg/kg, i.v., QWx3w Her2-1-5379, 3mg/kg, i.v., QWx3 Her2-1-5379, 10mg/kg, i.v., QWx3 Tumor Volume (mm³) Vehicle HER2 - DXd (Enhertu), 3mg/kg HER2 - DXd (Enhertu), 10mg/kg HER2 - IMNM Payload, 3mg/kg HER2 - IMNM Payload, 10mg/kg All arms of JIMT - 1 study dosed QWx3

11 IMMUNOME Camptothecin Derivatives Are Well - Suited for ADCs Targeting Solid Tumors $175m Enhertu (With Camptothecin Derivative Payload) Outperforms Kadcyla in Breast Cancer 3 ADCs Containing Camptothecins Achieve Higher DARs and Higher Clinical Doses 1.8 1.25 2 3.6 2.5 5.4 10 0 2 4 6 8 10 12 Polivy® Padcev® Tivdak® Kadcyla® MK-2140 Enhertu® Trodelvy® Clinical dose (mg/kg) Clinical Doses of Selected ADCs 1 Microtubule Inhibitor TOPO1 Inhibitor (TOPO1i) Payload MOA • Enhertu and Kadcyla are both trastuzumab ADCs • Enhertu’s payload, deruxtecan, allows for higher DAR and higher clinical dosage • Clinical data shows Enhertu is more effective, notably in HER2 - low patients 3.5 3.8 4 3.5 4 8 7.6 0 2 4 6 8 10 Polivy® Padcev® Tivdak® Kadcyla® MK-2140 Enhertu® Trodelvy® DAR Drug - Antibody Ratios of Selected ADCs 2 Microtubule Inhibitor TOPO1 Inhibitor (TOPO1i) Payload MOA 1. Respective D 2. Tong JTW, Harris PWR, Brimble MA, Kavianinia I. An Insight into FDA Approved Antibody - Drug Conjugates for Ca ncer Therapy. Molecules. 2021 Sep 27;26(19):5847. doi: 10.3390/molecules26195847. PMID: 34641391; PMCID: PMC8510272. 3. Cortés et. al. N Engl J Med (2022); 386:1143 - 1154 Enhertu (Trastuzumab deruxtecan) n=261 Kadcyla (Trastuzumab emtansine) n=263 Progression - Free Survival Percentage of patients

12 IMMUNOME Strong Demand for ADCs Provides Strategic Flexibility Opportunities to Transact at Value Inflection Points $2 billion total 1 $170 million upfront 3 $1.5 billion+ in milestones $85 million upfront 4 $1.4 billion in milestones $175 million upfront $9.3 billion 2 in milestones Preclinical Early Clinical Late Clinical Commercial $4 billion upfront $22 billion in milestones 5 $43 billion acquisition 7 Recent ADC Transactions 1. https://synaffix.com/synaffix - enters - license - agreement - with - amgen - to - build - next - generation - adcs 2 .. https://www.biospace.com/article/merck - expands - adc - footprint - with - 9 - 3b - kelun - licensing - deal 3 . https://www.globenewswire.com/news - release/2023/04/03/2639380/0/en/BioNTech - and - DualityBio - Form - Global - Strategic - Partnership - to - Accelerate - Development - of - Differentiated - Antibody - Drug - Conjugate - Therapeutics - for - Solid - Tum ors.html 4 . https://www.fiercebiotech.com/biotech/2nd - big - adc - deal - day - gsk - inks - 2b - pact - hansoh - gynecology - cancer - asset 5 . https://www.fiercebiotech.com/biotech/merck - pays - 4b - upfront - rights - 3 - daiichi - adcs - huge - bet - post - keytruda - future 6 . https://www.globenewswire.com/news - release/2024/01/08/2805344/0/en/Ambrx - Announces - Sale - to - Johnson - Johnson.html 7. https://www.pfizer.com/news/press - release/press - release - detail/pfizer - invests - 43 - billion - battle - cancer $2 billion acquisition 6

13 IMMUNOME Immunome Discovery Platform

14 IMMUNOME Antibody and Target Discovery Engine 04 03 02 01 Patients with cancer generate memory B cells that produce autoantibodies against cancer - associated antigens Memory B cells are isolated, and immortalized using proprietary hybridoma technology , generating novel antibodies Patient responses unveil novel disease targets Antibodies are selected using proprietary high - throughput technology with functional and sequence - based screens Novel antibody - target pairs are evaluated for development as antibodies, bispecifics, or ADCs Patient Tissue Sampling Antibody Generation Antibody - Target Pair Identification Harnessing the Immune System to Inform the Next Generation of Cancer Therapy

15 IMMUNOME Immunome Approach Identifies Both Validated and Novel Cancer Targets Immunome Technology Enhances Power of Antibody Screens • Memory B - cell response generated across course of disease ‒ Competitor B - cell platforms restrict scope to active immune response • Direct antibody production by B cells supports extensive, unbiased functional screening • Different sources of B cells (lymph nodes, tumor, blood) may yield unique targets • Materially expands opportunity to identify underexplored and novel targets Identification of Clinically Validated Cancer Targets Validates Immunome Approach Targets Identified by Discovery Engine IL - 38 HER2

16 IMMUNOME Strategic Discovery Collaboration with AbbVie Key Financial Terms • AbbVie option to purchase worldwide rights for up to 10 novel target - antibody pairs arising from three specified tumor types • $30M upfront payment • Eligible for additional payments up to: ‒ $70M platform access payments (in addition to low single - digit millions per target option payments) ‒ $120M per target development and first commercial sale milestones ‒ $150M per target further sales - based milestones ‒ Tiered royalties on global sales

17 IMMUNOME Programs: ROR1 ADC

18 IMMUNOME ROR1 ADC Achieved Objective Responses in Clinical Trial 12% 41% 43% 18% 12% 14% 0% 10% 20% 30% 40% 50% 60% Diffuse Large B-Cell Lymphoma (n=17) Mantle Cell Lymphoma (n=17) Richter's Transformation (n=7) ORR PR CR 1. Hojjat - Farsangi M, Moshfegh A, Daneshmanesh AH, Khan AS, Mikaelsson E, Osterborg A, Mellstedt H. The receptor tyrosine kinase RO R1 -- an oncofetal antigen for targeted cancer therapy. Semin Cancer Biol. 2014 Dec;29:21 - 31. doi: 10.1016/j.semcancer.2014.07.005 . Epub 2014 Jul 25. PMID: 25068995 2. Wang, et al. Hemat Oncol, 41:S2 , Lugano Lymphoma Conference Supplement Supplement: 17th International Conference on Malignant Lymphoma, 13 - 17 June, 202 3 MK - 2140 Objective Response Rate In Three Pretreated Lymphoma Indications ROR1 • Receptor with oncofetal expression pattern 1 • Little or no expression in healthy tissue • Expressed on solid and liquid tumors MK - 2140 • MK - 2140 (formerly known as VLS - 101) is a ROR1 - targeted ADC • Merck acquired Velos Bio for $2.75 billion to obtain VLS - 101 • Currently being evaluated in four phase 2 trials for B - cell malignancies • Solid tumor phase 2 trial enrolled 102 patients and completed in June 2023, but no data has been shared

19 IMMUNOME Significant Opportunity for ROR1 in Solid Tumors Potential ROR1 indications include diseases with large patient population and high unmet need ROR1 target biology presents challenges to developing a successful ADC for ROR1 positive solid tumors • Moderate to low expression levels • Slow internalization Approach to overcome challenges • Select antibody that promotes internalization • Design linker - payload for improved therapeutic index, allowing for higher clinical dose • Use payload that maximizes bystander effect and supports drug - antibody ratio (DAR) of 8 1. Wang, et al. Hemat Oncol, 41:S2 , Lugano Lymphoma Conference Supplement Supplement: 17th International Conference on Malignant Lymphoma, 13 - 17 June, 202 3

20 IMMUNOME IM - 1021 is a ROR1 ADC with Potential for Improved Therapeutic Index Name Linker / DAR Payload Development Status Zilovertamab Vedotin (MK - 2140 / VLS - 101) MC - VC - PAB Cysteine conjugation Cleavable through Val - Cit DAR 4 MMAE : Tubulin Inhibitor Phase 2 completed; no further updates NBE - 002 Peptide linker containing GGGG Sortase - mediated conjugation Cleavable DAR 4 PNU (Anthracycline derivative): DNA intercalator Discontinued CS5001 (LCB71) Glucuronidase cleavable linker Farnesyltransferase conjugation Cleavable DAR 2 Pyrrolobenzodiazepine (PBD - dimer) prodrug: DNA crosslinker Phase 1 Ongoing IM - 1021 (Formerly ZPC - 21) Undisclosed linker Cysteine conjugation Cleavable DAR 8 Camptothecin Derivative: Topoisomerase I inhibitor IND expected 1Q 2025 N H O N H N N N H N N H N O O O Et OMeO H N OMeO OH O O O NH NH 2 O O O H S Monomethyl Auristatin E (MMAE) UC961 cysteine random N H H N N H H N N H OMeO OOH OH O HO O O N O O O O O O H N O HN MeO LPET PNU-159682 (anthracycline derivative) sortase mediated site-specific bioconjugation Structure Omitted O N H O O O CO 2 H OH OH OH O O N N O O MeO OMe N N O O H H HO PBD dimers Farnesyltransferase mediated site-specific bioconjugation HO O O O O HN MeO O CO 2 H OH OH OH O N 5 S M I V C

21 IMMUNOME IM - 1021 Shows Sustained Tumor Regression in TNBC Mouse Model 0 7 14 21 28 35 42 49 0 400 800 1200 Days Post Treatment Initiation T u m o r V o l u m e ( m m 3 ) Vehicle qw × 3 ATX875-1-5379 (2.5 mg/kg qw×3) ATX875-1-5379 (5.0 mg/kg qw×3) VLS-101 (2.5 mg/kg qw×3) VLS-101 (5.0 mg/kg qw×3) No Weight Loss Observed IM - 1021 Inhibits Tumor Growth in MDA - MB - 468 Model (Triple Negative Breast Cancer) IM - 1021 Demonstrates Superior Efficacy at Both Dose Levels Compared to MK - 2140 D0 D7 D14 Dose: QWx3, i.v. Terminate Monitor growth 0 7 14 21 28 35 42 49 -30 -20 -10 0 10 20 30 Days Post Treatment Initiation % B W C h a n g e Vehicle IM - 1021 2.5 mg/kg IM - 1021 5.0 mg/kg MK - 2140 2.5 mg/kg MK - 2140 5.0 mg/kg

22 IMMUNOME Clinical Development Plan: Rapid Evaluation of Clinical PoC Followed by Pivotal Studies Across Multiple Indications Rapid dose escalation in solid tumors and lymphoma Non - clinical evaluation of combination therapies, particularly in B - cell malignancies Companion diagnostic development and evaluation Solid tumor expansion Indications including NSCLC, breast cancer, prostate cancer, pancreatic cancer, and gastric cancer 1 B - cell malignancy expansion Diffuse large B - cell lymphoma, mantle cell lymphoma 1. Clinical development plan subject to further refinement and addition or removal of indications.. NSCLC = non - small cell lung cancer Pivotal studies as indicated • Compelling clinical outcomes • Significant commercial opportunities • Enhanced outcomes with companion diagnostic • Potential for Accelerated Approval

23 IMMUNOME Programs: FAP RLT

24 IMMUNOME FAP Is a Promising RLT Target with Pan - Cancer Potential • Fibroblast Activation Protein (FAP) is a cell surface protease with low expression in normal tissue • FAP is overexpressed on cancer - associated fibroblasts, the most common tumor stromal cell, with expression in 75% of solid tumors • FAP - Lu radioligand therapy delivers radioactive 177 Lu directly to FAP - expressing cells, with bystander effect targeting tumor cells • RLT approach expected to overcome limitations that make FAP unsuitable for ADCs (poor internalization and low expression on tumor cells) Source: Kratochwil C, Flechsig P, Lindner T, et al. 68Ga - FAPI PET/CT: Tracer Uptake in 28 Different Kinds of Cancer. J Nucl Med. 2019;60(6):801 - 805. FAP imaging shows high expression across 15 distinct tumor types

25 IMMUNOME Immunome 177 Lu - FAP Candidates are Rationally Designed and Systematically Screened Immunome Approach Example Structure: FAP binding and specificity optimized Proven structure used by Pluvicto and Lutathera to deliver Lu - 177 isotope Albumin binding domain selected to maximize tumor retention Optimized linker reduces non - specific uptake Optimized ligand leads to: • Increased tumor uptake and retention • Superior efficacy • Stability and ease of manufacture Incorporating albumin binder extends circulating half - life and increases tumor residence time, leading to superior tumor absorbed dose in vivo FAP Ligand Linker Chelator Albumin Binder Immunome has systematically selected a ligand, linker, albumin binding domain, and payload to optimize: • Binding and specificity • Stability • Phamacokinetics • Tumor absorbed dose • Efficacy • Tolerability

26 IMMUNOME Incorporating Albumin Binders into Radioligand Therapies Improves In Vivo PK Profile and Biodistribution Left panel: unpublished preclinical biodistribution data in 4T1 mouse tumor model. Right panel: Single dose (1 mg/kg) iv rat PK study. Total Absorbed Dose Albumin Binding 0 100 200 300 400 500 600 Liver Kidneys Tumor Weak Moderate Strong mGy/MBq Rat IV PK 0 20 40 60 0.1 1 10 100 1000 10000 100000 Time (h) P l a s m a c o n c e n t r a t i o n ( n g / m L ) Plasma concentration (ng/mL) Time (Hours) Weak Moderate Strong Albumin Binding Enhanced pharmacokinetics may lead to superior tumor absorbed dose

27 IMMUNOME Developing 177 Lu - FAP Candidates with Best - in - Class Potential In vivo data show single dose antitumor activity and tolerability Tumor Regression in U87MG Model No Weight Loss Observed Stab Potential Best - in - Class Characteristics Development Status: IND filing anticipated 1Q25 In Vivo Radiotherapy Studies GLP/GMP Manufacturing Prepare IND package ✓ Clinical Formulation Development ✓ x Sub - nanomolar affinity x High specificity x Radiostability x Superior tumor retention and tumor absorbed dose x Preclinical efficacy and tolerability 0 3 6 9 12 15 18 21 24 27 0% 500% 1000% 1500% Day R e l a t i v e t u m o r v o l u m e 177 Lu-Mi-003 Radiotherapy in U87MG tumors Vehicle Undisclosed Candidate #1 (High Lu-177 Dose) Undisclosed Candidate #1 (Low Lu-177 Dose) Undisclosed Candidate #1 (High Lu-177 Dose) Undisclosed Candidate #1 (Low Lu-177 Dose) 0 3 6 9 12 15 18 21 24 27 70% 80% 90% 100% 110% 120% Day R e l a t i v e b o d y w e i g h t 177 Lu-Mi-003 Radiotherapy in U87MG tumors Vehicle Undisclosed Candidate #1 (High Lu-177 Dose) Undisclosed Candidate #1 (Low Lu-177 Dose) Undisclosed Candidate #2 (High Lu-177 Dose) Undisclosed Candidate #2 (Low Lu-177 Dose) No Weight Loss Observed Vehicle Candidate #1, High Lu - 177 Dose Candidate #1, Low Lu - 177 Dose Candidate #2, High Lu - 177 Dose Candidate #2, Low Lu - 177 Dose Vehicle Candidate #1, High Lu - 177 Dose Candidate #1, Low Lu - 177 Dose Candidate #2, High Lu - 177 Dose Candidate #2, Low Lu - 177 Dose JH0

28 IMMUNOME Programs: IL - 38 ImmunotherapyJH0

29 IMMUNOME IL - 38 Is an Immunosuppressive Cytokine with I/O Potential IL - 38 Function: Inhibits pro - inflammatory IL - 36/IL - 36R pathway 1 1 . Iznardo 2021 doi : 10.3390/ijms22094344 IL1R1 and IL1RAPL1 are also IL - 38 cognate receptors 2. Han 2019, doi : 10.1016/j.celrep.2019.03.082 3. Han 2018: doi 10.2139/ssrn.3213912 4. SPEVIGO® ( spesolimab - sbzo ) package insert. 5 . Mercurio 2018 doi : 10.1038/s41419 - 018 - 1143 - 3 Pathway Validation in Autoimmune Disease : IL - 36R is a proven target for treating psoriasis • Spevigo (Boehringer Ingelheim) antibody approved in 2022 for generalized pustular psoriasis ▪ Binds IL36R ▪ Prevents cognate ligands from inducing downstream immune activation 4 • Low levels of IL - 38 in psoriasis patients promote a pro - inflammatory immune state 5 Scientific Rationale : Downregulation of IL - 38 promotes innate immune activation • IL - 38 knockout mice exhibit increased pro - inflammatory cytokine levels 2 and delayed tumor growth 3 JH0 JH1

30 IMMUNOME Reduced Immune Cell Infiltration in IL - 38 High Tumors Poor Overall Survival i n IL - 38 High Lung Cancer Poor Survival for Cancer Patients with Tumors Expressing High IL - 38 - 0 . 6 - 0 . 4 - 0 . 2 0 . 0 0 . 2 0 . 4 0 . 6 SKCM CESC LUAD ESCA LUSC HNSC T Cells - 0 . 3 - 0 . 2 - 0 . 1 0 . 0 0 . 1 0 . 2 0 . 3 SKCM CESC LUAD ESCA LUSC HNSC B Cells - 0 . 6 - 0 . 4 - 0 . 2 0 . 0 0 . 2 0 . 4 0 . 6 SKCM CESC LUAD ESCA LUSC HNSC Macrophages - 0 . 5 0 - 0 . 2 5 0 . 0 0 0 . 2 5 0 . 5 0 SKCM CESC LUAD ESCA LUSC HNSC Monocytes - 0 . 2 - 0 . 1 0 . 0 0 . 1 0 . 2 SKCM CESC LUAD ESCA LUSC HNSC NK Cells SKCM CESC LUAD ESCA LUSC HNSC Key D e c r e a s e d i n I L - 3 8 H i g h T u m o r s I n c r e a s e d i n I L - 3 8 H i g h T u m o r s ImSig Score Difference (IL-38 High minus IL-38 low) IL - 38 high tumor samples show reduced infiltration of multiple immune subsets, particularly in lung, head & neck, and gastroesophageal cancers Left panel: Immunome analysis of the Cancer Genome Atlas (TCGA) data from Firehouse Legacy dataset. Similar findings were also confirmed in real - world data (Tempus). Right panel: Adapted from Takada 2017 doi: 10.1371/journal.pone.0181598 Kaplan - Meier curves according to IL - 38 expression in patients with primary lung adenocarcinoma IL - 38 IHC Stain Intensity Low Medium High Checkpoint inhibition of IL - 38 presents a novel immunotherapy approach for cancer

31 IMMUNOME IM - 4320: Platform - Derived, Potential First - in - Class IL - 38 mAb Inhibits IL - 38 - mediated immunosuppression Selectively binds IL - 38 in array of 20,000 human proteins IM - 4320 Selectively Binds IL - 38 IM - 4320 Inhibits IL - 38 Binding Inhibits IL - 38 binding to ILRAPL1 and IL - 36R IM - 4320 Inhibits Tumor Growth in Mice Monotherapy activity in immune cold melanoma model Note: IM - 4320 is a humanized version of IMM20324. Mean Tumor Volume ± SEM (mm3) Mice dosed iv Q2Wx4 n=10/arm 0.01 0.1 1 10 100 0 1000 2000 3000 4000 5000 Concentration of antibodies (ug/mL) B i n d i n g o f I L - 3 8 Isotype control, IL1RAPL1 IMM20324, IL1RAPL1 IMM20324, IL-36R Isotype control, IL-36R Binding of IL - 38 Concentration of antibodies (ug/mL) 0 20000 40000 60000 0 20 40 60 80 100 Binding Signal S - S c o r e IL-38 S - Score Binding Signal p<0.05 IM - 4320 shows in vivo antitumor activity consistent with an active immuno - oncology agent

32 IMMUNOME IP, Business Development, and Leadership

33 IMMUNOME Prosecuting a Multi - Layered IP Strategy COMPOSITION OF MATTER • Over 100 patents and patent applications across more than 20 families as of November 2023 • Covers Immunome’s proprietary antibody sequences • Covers proprietary targeting ligands and effectors, and lead conjugates for ligand - based therapy candidates PLATFORM & DISCOVERY • Platform technologies and discovery engines are protected using a combination of patent filings and trade secrets IP EXPANSION OPPORTUNITY • Active ongoing research expected to generate additional company - owned trade secrets and patent filings around platforms and pipeline • Goodwin Procter and Morrison Foerster retained as IP counsel

34 IMMUNOME Management Team with a Demonstrated Track Record of Success Bob Lechleider, M.D . CHIEF MEDICAL OFFICER Sandra Stoneman CHIEF LEGAL OFFICER • Chief Executive Officer and Founder, Seagen (1998 - 2022) • Grew company to $2B+ revenue (2022) leading to $43B acquisition • Led development of 4 FDA - approved therapeutics • Raised over $1B in public and private capital • Oversaw acquisition and integration of Cascadian Therapeutics • Generated >$3B in partnership and licensing revenue Bruce Turner, M.D., Ph.D. CHIEF STRATEGY OFFICER Jack Higgins, Ph.D. CHIEF SCIENTIFIC OFFICER Clay Siegall, Ph.D. President & Chief Executive Officer Max Rosett INTERIM CHIEF FINANCIAL OFFICER & SVP, OPERATIONS Phil Roberts CHIEF TECHNICAL OFFICERBL0

35 IMMUNOME Building the Foundation of a Premier Targeted Oncology Company • Experienced management team with headquarters in Bothell, WA • Focused on developing best - in - class or first - in - class targeted oncology therapies including next - generation ADCs and RLTs • Three lead programs with best - in - class or first - in - class potential and IND filings anticipated in 1Q 2025: • FAP RLT • ROR1 ADC • IL - 38 immunotherapy • Pipeline and toolbox expansion through recent Zentalis transaction and signed Atreca agreement • Opportunities for platform - driven pipeline expansion • $125m PIPE, completed in October 2023 with participation from leading healthcare investors, expected to fund key clinical inflection points Combining successful management, powerful discovery platforms, and high - potential assets JH0 JH1 JH2

v3.23.4

Cover

|

Jan. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 11, 2024

|

| Entity File Number |

001-39580

|

| Entity Registrant Name |

Immunome,

Inc.

|

| Entity Central Index Key |

0001472012

|

| Entity Tax Identification Number |

77-0694340

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

665

Stockton Drive, Suite 300

|

| Entity Address, City or Town |

Exton

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19342

|

| City Area Code |

610

|

| Local Phone Number |

321-3700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value per share

|

| Trading Symbol |

IMNM

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

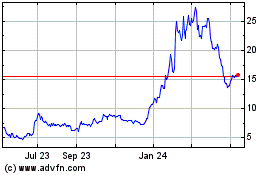

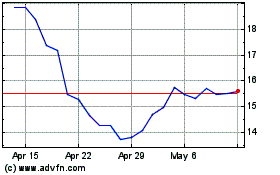

Immunome (NASDAQ:IMNM)

Historical Stock Chart

From Apr 2024 to May 2024

Immunome (NASDAQ:IMNM)

Historical Stock Chart

From May 2023 to May 2024