As filed with the Securities and Exchange Commission on January 9, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

TASEKO MINES LIMITED

(Exact name of registrant as specified in its charter)

|

British Columbia

(State or other jurisdiction of

incorporation or organization)

|

|

None

(I.R.S. Employer Identification No.)

|

Taseko Mines Limited

12th Floor, 1040 West Georgia Street

Vancouver, British Columbia

Canada V6E 4H1

(Address of principal executive offices)

2021 Share Option Plan of Taseko Mines Limited

(Full title of the plan)

Florence Copper LLC

1575 West Hunt Highway

Florence, Arizona

United States 85132

(Name and address of agent of service)

(520) 374-3984

(Telephone number, including are code, of agent of service)

Copies of communications to:

Michael H. Taylor

McMillan LLP

Royal Centre, 1055 West Georgia Street, Suite 1500

Vancouver, BC, Canada V6E 4N7

Telephone: (604) 691-7410

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

|

|

Accelerated filer

|

X |

|

|

|

|

|

|

|

Non-accelerated filer

|

|

|

Smaller reporting company

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financing accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

EXPLANATORY NOTE

This Registration Statement on Form S-8 (the “Registration Statement”) is being filed to register (a) an aggregate of 27,549,961 common shares of Taseko Mines Limited (the “Company” or the “Registrant”) issuable pursuant to grants of options under the Company’s 2021 Share Option Plan, as amended (the “Share Option Plan”), and (b) pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), any additional common shares that become issuable under the Share Option Plan by reason of any stock dividend, stock split, or other similar transaction.

PART I - INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information. *

Item 2. Registrant Information and Employee Plan Annual Information. *

* The documents containing the information specified in "Item 1. Plan Information" and "Item 2. Registrant Information and Employee Plan Annual Information" of Form S-8 will be sent or given to participants, as specified by Rule 428(b)(1) under the Securities Act. Such documents are not required to be, and are not, filed with the United States Securities and Exchange Commission (the "Commission") either as part of this Registration Statement or as a prospectus or prospectus supplement pursuant to Rule 424 under the Securities Act. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of Form S-8, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II - INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of the Documents by Reference.

The following documents filed by the Registrant with the Commission are incorporated herein by reference:

|

|

(a)

|

Annual information form of the Registrant for the year ended December 31, 2022, dated as at March 31, 2023 and filed on March 31 2023 (incorporated by reference to Exhibit 99.1 of the Company's Annual Report on Form 40-F for the fiscal year ended December 31, 2022 filed on March 31, 2023);

|

| |

|

|

|

|

(b)

|

Consolidated financial statements of the Registrant for the fiscal years ended December 31, 2022 and 2021 comprised of the consolidated balance sheets as of December 31, 2022 and 2021 and the consolidated statements of comprehensive income (loss), changes in equity and cash flows for the years then ended, and the notes thereto and the reports of the Company’s independent registered public accounting firm thereon and on the effectiveness of the Company’s internal control over financial reporting as of December 31, 2022 (incorporated by reference to Exhibit 99.2 of the Company’s Annual Report on Form 40-F for the fiscal year ended December 31, 2022 filed on March 31, 2023);

|

|

|

(c)

|

Management's discussion and analysis of the Registrant for the year ended December 31, 2022 (incorporated by reference to Exhibit 99.3 of the Company's Annual Report on Form 40-F for the fiscal year ended December 31, 2022 filed on March 31, 2023);

|

| |

|

|

|

|

(d)

|

Unaudited condensed consolidated financial statements for the three and nine months ended September 30, 2023 and 2022 (filed as Exhibit 99.1 to the Registrant's current report on Form 6-K furnished to the SEC on November 2, 2023)

|

| |

|

|

|

|

(e)

|

Management's discussion and analysis for the nine months ended September 30, 2023 (filed as Exhibit 99.2 to the Registrant's current report on Form 6-K furnished to the SEC on November 2, 2023)

|

| |

|

|

|

|

(f)

|

Management information circular and notice of meeting of the Registrant dated April 27, 2023 distributed in connection with the annual meeting of shareholders held on June 15, 2023 (filed as Exhibit 99.3 to the Registrant's current report on Form 6-K furnished to the SEC on May 11, 2023); and

|

| |

|

|

|

|

(g)

|

Material change report of the Registrant dated March 3, 2023 (filed as Exhibit 99.1 to our current report on Form 6-K furnished to the SEC on April 5, 2023).

|

The common shares of the Registrant are described in its Annual Information Form for the year ended December 31, 2022, dated as at March 31, 2023 under the heading Description of Capital Structure – Share Capital, which is incorporated into this Registration Statement.

All reports or other documents filed by the Registrant pursuant to Section 13(a), 13(c), 14 or 15(d) of the United States Securities Exchange Act of 1934, as amended (the "Exchange Act"), subsequent to the date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof commencing on the respective dates on which such documents are filed.

Any statement contained in a document incorporated by reference into this Registration Statement shall be deemed to be modified or superseded for purposes hereof to the extent that a statement contained herein (or in any other subsequently filed document which also is or is deemed incorporated herein) modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed to constitute a part hereof, except as so modified or superseded.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

No expert or counsel named in this Registration Statement as having prepared or certified any part of this Registration Statement or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of such securities was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in our Company, nor was any such person connected with us as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Item 6. Indemnification of Directors and Officers.

Indemnification of Directors and Officers.

Taseko Mines Limited (the "Registrant") is subject to the provisions of the Business Corporations Act (British Columbia) (the "BCBCA").

Under Section 160 of the BCBCA, an individual who:

-

is or was a director or officer of the Registrant,

-

is or was a director or officer of another corporation (i) at a time when the corporation is or was an affiliate of the Registrant, or (ii) at the request of the Registrant, or

-

at the request of the Registrant, is or was, or holds or held a position equivalent to that of, a director or officer of a partnership, trust, joint venture or other unincorporated entity,

and includes, the heirs and personal or other legal representatives of that individual (collectively, an "eligible party"), may be indemnified by the Registrant against a judgment, penalty or fine awarded or imposed in, or an amount paid in settlement of, a proceeding (an "eligible penalty") in which, by reason of the eligible party being or having been a director or officer of, or holding or having held a position equivalent to that of a director or officer of, the Registrant or an associated corporation, (a) the eligible party is or may be joined as a party, or (b) the eligible party is or may be liable for or in respect of a judgment, penalty or fine in, or expenses related to, the proceeding ("eligible proceeding") to which the eligible party is or may be liable. Section 160 of the BCBCA also permits the Registrant to pay the expenses actually and reasonably incurred by an eligible party after the final disposition of the eligible proceeding.

Under Section 161 of the BCBCA, the Registrant must, after the final disposition of an eligible proceeding, pay the expenses actually and reasonably incurred by the eligible party in respect of that proceeding if the eligible party (a) has not been reimbursed for those expenses, and (b) is wholly successful, on the merits or otherwise, in the outcome of the proceeding or is substantially successful on the merits in the outcome of the proceeding.

Under Section 162 of the BCBCA, the Registrant may pay, as they are incurred in advance of the final disposition of an eligible proceeding, the expenses actually and reasonably incurred by an eligible party in respect of that proceeding; provided the Registrant must not make such payments unless it first receives from the eligible party a written undertaking that, if it is ultimately determined that the payment of expenses is prohibited by Section 163, the eligible party will repay the amounts advanced.

Under Section 163 of the BCBCA, the Registrant must not indemnify an eligible party against eligible penalties to which the eligible party is or may be liable or pay the expenses of an eligible party in respect of that proceeding under Sections 160, 161 or 162 of the BCBCA, as the case may be, if any of the following circumstances apply:

- if the indemnity or payment is made under an earlier agreement to indemnify or pay expenses and, at the time that the agreement to indemnify or pay expenses was made, the Registrant was prohibited from giving the indemnity or paying the expenses by its memorandum or articles;

-

if the indemnity or payment is made otherwise than under an earlier agreement to indemnify or pay expenses and, at the time that the indemnity or payment is made, the Registrant is prohibited from giving the indemnity or paying the expenses by its memorandum or articles;

-

if, in relation to the subject matter of the eligible proceeding, the eligible party did not act honestly and in good faith with a view to the best interests of the Registrant or the associated corporation, as the case may be; or

-

in the case of an eligible proceeding other than a civil proceeding, if the eligible party did not have reasonable grounds for believing that the eligible party's conduct in respect of which the proceeding was brought was lawful.

If an eligible proceeding is brought against an eligible party by or on behalf of the Registrant or by or on behalf of an associated corporation, the Registrant must not either indemnify the eligible party against eligible penalties to which the eligible party is or may be liable in respect of the proceeding, or, after the final disposition of an eligible proceeding, pay the expenses of the eligible party under Sections 160, 161 or 162 of the BCBCA in respect of the proceeding.

Under Section 164 of the BCBCA, the Supreme Court of British Columbia may, on application of the Registrant or an eligible party, order the Registrant to indemnify the eligible party or to pay the eligible party's expenses, despite Sections 160 to 163 of the BCBCA.

The articles of a company may affect its power or obligation to give an indemnity or pay expenses. As indicated above, this is subject to the overriding power of the Supreme Court of British Columbia under Section 164 of the BCBCA.

Under the articles of the Registrant, subject to the provisions of the BCBCA, the Registrant must indemnify a director or former director of the Registrant and the heirs and legal personal representatives of all such persons against all eligible penalties to which such person is or may be liable, and the Registrant must, after the final disposition of an eligible proceeding, pay the expenses actually and reasonably incurred by such person in respect of that proceeding. Each director and officer is deemed to have contracted with the Registrant on the terms of the indemnity contained in the Registrant's articles. The failure of a director or officer of the Registrant to comply with the BCBCA or the articles of the Registrant does not invalidate any indemnity to which such person is entitled under the Registrant's articles.

Under the articles of the Registrant, the Registrant may purchase and maintain insurance for the benefit of any eligible party against any liability incurred by such party as a director, officer or person who holds or held an equivalent position.

Indemnification for Liabilities under the U.S. Securities Act

Insofar as indemnification for liabilities arising under the U.S. Securities Act, may be permitted to directors, officers or persons controlling the Registrant pursuant to the foregoing provisions, the Registrant has been informed that in the opinion of the U.S. Securities and Exchange Commission such indemnification is against public policy as expressed in the U.S. Securities Act and is therefore unenforceable.

Item 7. Exemptions from Registration Claimed.

Not applicable

Item 8. Exhibits.

The following is a complete list of exhibits filed as a part of this Registration Statement, which Exhibits are incorporated herein.

Item 9. Undertakings.

(a) The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in the volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in the volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the "Calculation of Registration Fee" table in the effective registration statement; and

(iii) to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement;

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant's annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan's annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Vancouver, British Columbia, on January 9, 2024.

|

|

TASEKO MINES LIMITED

|

| |

|

| |

/s/ Bryce Hamming

|

|

|

By: Bryce Hamming

|

|

|

Title: Chief Financial Officer

|

SIGNATURES AND POWERS OF ATTORNEY

Each person whose signature appears below constitutes and appoints Stuart McDonald, Chief Executive Officer, or Bryce Hamming, Chief Financial Officer, or any of them, as his or her true and lawful attorneys-in-fact and agents, each of whom may act alone, with full powers of substitution and re-substitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any or all amendments to this registration statement, including post-effective amendments to this Registration Statement, Registration Statements filed pursuant to Rule 429 under the Securities Act, and any related Registration Statements necessary to register additional securities, and to file the same, with all exhibits thereto, and other documents and in connection therewith, with the Commission, granting unto said attorneys-in-fact and agents, and each of them full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, and hereby ratifies and confirms all his or her said attorneys-in-fact and agents or any of them or his or her substitute or substitutes may lawfully do or cause to be done by virtue hereof.

This Power of Attorney may be executed in multiple counterparts, each of which shall be deemed an original, but which taken together shall constitute one instrument.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities indicated on January 9, 2024.

|

Signature

|

Title

|

| |

|

|

/s/ Stuart McDonald

____________________________________

Stuart McDonald

|

Chief Executive Officer and Director

(Principal Executive Officer)

|

| |

|

|

/s/ Bryce Hamming

____________________________________

Bryce Hamming

|

Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer)

|

| |

|

|

/s/ Ronald W. Thiessen

____________________________________

Ronald W. Thiessen

|

Director and Chairman

|

| |

|

|

/s/ Russell Hallbauer

____________________________________

Russell Hallbauer

|

Director

|

| |

|

|

/s/ Anu Dhir

____________________________________

Anu Dhir

|

Director

|

| |

|

|

/s/ Rita Maguire

____________________________________

Rita Maguire

|

Director

|

|

/s/ Robert A. Dickinson

____________________________________

Robert A. Dickinson

|

Director

|

| |

|

|

/s/ Peter Mitchell

____________________________________

Peter Mitchell

|

Director

|

| |

|

|

/s/ Kenneth Pickering

____________________________________

Kenneth Pickering

|

Director

|

AUTHORIZED REPRESENTATIVE

Pursuant to the requirements of Section 6(a) of the Securities Act of 1933, as amended, the undersigned has signed this Registration Statement on Form S-8, solely in its capacity as the duly authorized representative of the Registrants in the United States, on January 9, 2024.

| |

Florence Copper LLC |

| |

|

| |

By: |

/s/ Bryce Hamming |

| |

Name: |

Bryce Hamming |

| |

Title: |

Treasurer |

TASEKO MINES LIMITED

(the "Company")

SHARE OPTION PLAN

Effective April 26, 2021

ARTICLE 1

PURPOSE AND INTERPRETATION

Purpose

1.1 The purpose of this Plan is to advance the interests of the Company by encouraging equity participation in the Company through the acquisition of Common Shares of the Company. It is the intention of the Company that this Plan will at all times be in compliance with the Company Manual of the Toronto Stock Exchange (the "TSX") (the "TSX Policies") and any inconsistencies between this Plan and the TSX Policies, whether due to inadvertence or changes in TSX Policies, will be resolved in favour of the latter. For United States tax purposes, this Plan provides for both the grant of Incentive Stock Options and Options that do not qualify as Incentive Stock Options.

Definitions

1.2 In this Plan

(a) Affiliate means a company that is a parent or subsidiary of the Company, or that is controlled by the same entity as the Company;

(b) Associate has the meaning set out in the Securities Act;

(c) Blackout Period means any period of time during which a participant in the Plan is unable to trade securities of the Company as a consequence of the implementation of a general restriction on such trading by an authorized Officer or Director pursuant to the Company's governance policies that authorize general and/or specific restrictions on trading by Service Providers in circumstances where there may exist undisclosed material changes or undisclosed material facts in connection with the Company's affairs.

(d) Board means the board of directors of the Company or any committee thereof duly empowered or authorized to grant Options under this Plan;

(e) Business Day means a day that the TSX is open for trading;

(f) Change of Control includes situations where after giving effect to the contemplated transaction and as a result of such transaction:

(i) any one Person holds a sufficient number of voting shares of the Company or resulting company to affect materially the control of the Company or resulting company, or,

(ii) any combination of Persons, acting in concert by virtue of an agreement, arrangement, commitment or understanding, holds in total a sufficient number of voting shares of the Company or its successor to affect materially the control of the Company or its successor,

where such Person or combination of Persons did not previously hold a sufficient number of voting shares to affect materially control of the Company or its successor. In the absence of evidence to the contrary, any Person or combination of Persons acting in concert by virtue of an agreement, arrangement, commitment or understanding, holding more than 20% of the voting shares of the Company or resulting company is deemed to materially affect control of the Company or resulting company;

(g) Common Shares means common shares without par value in the capital of the Company;

(h) Company means the company named at the top hereof and includes, unless the context otherwise requires, all of its Affiliates and successors according to law;

(i) Consultant means a Person or Consultant Company, other than an Employee, Officer or Director that:

(i) provides on an ongoing bona fide basis, consulting, technical, managerial or like services to the Company or an Affiliate of the Company, other than services provided in relation to a Distribution;

(ii) provides the services under a written contract between the Company or an Affiliate and the Person or the Consultant Company;

(iii) in the reasonable opinion of the Company, spends or will spend a significant amount of time and attention on the business and affairs of the Company or an Affiliate of the Company; and

(iv) has a relationship to provide services to the Company or an Affiliate of the Company that enables the Person or Consultant Company to be knowledgeable about the business and affairs of the Company;

(j) Consultant Company means for a Person consultant, a company or partnership of which the Person is an employee, shareholder or partner;

(k) Directors means the directors of the Company as may be elected from time to time;

(l) Disinterested Shareholder Approval means approval by a majority of the votes cast by all the Company's shareholders at a duly constituted shareholders' meeting, excluding votes attached to Common Shares beneficially owned by Insiders who are Service Providers or their Associates;

(m) Distribution has the meaning assigned by the Securities Act, and generally refers to a distribution of securities by the Company from treasury;

(n) Effective Date for an Option means the date of grant thereof by the Board;

(o) Employee means:

(i) a Person who is considered an employee under the Income Tax Act (i.e. for whom income tax, employment insurance and Canada Pension Plan deductions must be made at source);

(ii) a Person who is considered an employee under the Internal Revenue Code of 1986 (United States), that is, for whom federal, state and local income taxes and deductions, as applicable, are made at source;

(iii) a Person who works full-time for the Company or a subsidiary thereof providing services normally provided by an employee and who is subject to the same control and direction by the Company over the details and methods of work as an employee of the Company, but for whom income tax deductions are not made at source; or

(iv) a Person who works for the Company or its subsidiary on a continuing and regular basis for a minimum amount of time per week providing services normally provided by an employee and who is subject to the same control and direction by the Company over the details and methods of work as an employee of the Company, but for whom income tax deductions need not be made at source;

(p) Exercise Price means the amount payable per Common Share on the exercise of an Option, as determined in accordance with the terms hereof;

(q) Expiry Date means the day on which an Option lapses as specified in the Option Commitment therefor or in accordance with the terms of this Plan;

(r) Incentive Stock Option means an Option granted in accordance with Section 422 of the Internal Revenue Code of 1986 (United States) to an Employee described in Section 1.2(o)(ii) above;

(s) Insider means

(i) an insider as defined in the TSX Policies or as defined in the Securities Act;

(ii) an Associate of any person who is an Insider by virtue of §(i) above;

(t) Investor Relations Activities means generally any activities or communications that can reasonably be seen to be intended to or be primarily intended to promote the merits or awareness of or the purchase or sale of securities of the Company;

(u) Listed Shares means the number of issued and Outstanding Shares of the Company that have been accepted for listing on the TSX, but excluding dilutive securities not yet converted into Listed Shares;

(v) Management Company Employee means a Person employed by another Person or a corporation providing management services to the Company which are required for the ongoing successful operation of the business enterprise of the Company, but excluding a corporation or Person engaged primarily in Investor Relations Activities;

(w) Market Price means the 5-day volume weighted average trading price as calculated pursuant to TSX Policies;

(x) Officer means a duly appointed senior officer of the Company;

(y) Option means the right to purchase Common Shares granted hereunder to a Service Provider;

(z) Option Commitment means the notice of grant of an Option delivered by the Company hereunder to a Service Provider and substantially in the form of Schedule A attached hereto;

(aa) Optioned Shares means Common Shares that may be issued in the future to a Service Provider upon the exercise of an Option;

(bb) Optionee means the recipient of an Option hereunder;

(cc) Outstanding Shares means at the relevant time, the number of issued and outstanding Common Shares of the Company from time to time;

(dd) Participant means a Service Provider that becomes an Optionee;

(ee) Person means a company or an individual;

(ff) Plan means this share option plan, the terms of which are set out herein or as may be amended;

(gg) Plan Shares means the total number of Common Shares which may be reserved for issuance as Optioned Shares under the Plan as provided in §2.2;

(hh) Regulatory Approval means any approval required under TSX Policies and any other approval of any other stock exchange where the Company's shares may be listed;

(ii) Securities Act means the Securities Act, R.S.B.C. 1996, c. 418, or any successor legislation;

(jj) Service Provider means a Person who is a bona fide Director, Officer, Employee, Management Company Employee, Consultant or Consultant Company, and also includes a company, of which 100% of the share capital of which is beneficially owned by one or more Service Providers;

(kk) Share Compensation Arrangement means any Option under this Plan but also includes any other stock option, stock option plan, employee stock purchase plan, performance share unit plan or any other compensation or incentive mechanism involving the issuance or potential issuance of Common Shares to a Service Provider;

(ll) Shareholder Approval means approval by a majority of the votes cast by eligible shareholders of the Company at a duly constituted shareholders' meeting;

(mm) Take Over Bid means a take-over bid as defined in Multilateral Instrument 62-104 (Take-over Bids and Issuer Bids) or the analogous provisions of any other securities legislation applicable to the Outstanding Shares;

(nn) TSX means the Toronto Stock Exchange and any successor thereto; and

(oo) TSX Policies means the rules and policies of the TSX as amended from time to time.

Other Words and Phrases

1.3 Words and phrases used in this Plan but which are not defined in the Plan, but are defined in the TSX Policies, will have the meaning assigned to them in the TSX Policies.

Gender

1.4 Words importing the masculine gender include the feminine or neuter, words in the singular include the plural, words importing a corporate entity include individuals, and vice versa.

ARTICLE 2

SHARE OPTION PLAN

Establishment of Share Option Plan

2.1 The Plan is hereby established to recognize contributions made by Service Providers and to create an incentive for their continuing assistance to the Company and its Affiliates.

Maximum Plan Shares

2.2 The maximum aggregate number of Plan Shares that may be reserved for issuance under the Plan at any point in time is 9.5% of the Outstanding Shares at the time Plan Shares are reserved for issuance as a result of the grant of an Option, less any Common Shares reserved for issuance under all Share Compensation Arrangements other than this Plan, unless this Plan is amended pursuant to the requirements of the TSX Policies.

Eligibility

2.3 Options to purchase Common Shares may be granted hereunder to Service Providers from time to time by the Board. Service Providers that are not individuals will be required to undertake in writing not to effect or permit any transfer of ownership or option of any of its securities, or to issue more of its securities (so as to indirectly transfer the benefits of an Option), as long as such Option remains outstanding, unless the written permission of the Company is obtained.

Options Granted Under the Plan.

2.4 All Options granted under the Plan will be evidenced by an Option Commitment in the form attached as Schedule A, showing the number of Optioned Shares, the term of the Option, a reference to vesting terms, if any, and the Exercise Price. The Option Commitment will also specify whether or not any of the Options granted are intended to be Incentive Stock Options for US tax purposes.

2.5 Subject to specific variations approved by the Board, all terms and conditions set out herein will be deemed to be incorporated into and form part of an Option Commitment made hereunder.

Options Not Exercised

2.6 In the event an Option granted under the Plan expires unexercised or is terminated by reason of dismissal of the Optionee for cause or is otherwise lawfully cancelled prior to exercise of the Option, the Optioned Shares that were issuable thereunder will be returned to the Plan and will be eligible for re-issue. For greater certainty, Options which are exercised thereupon increase the number available to the Plan by the relevant percentage of Outstanding Shares as provided hereunder.

Powers of the Board

2.7 The Board will be responsible for the general administration of the Plan and the proper execution of its provisions, the interpretation of the Plan and the determination of all questions arising hereunder. Without limiting the generality of the foregoing, the Board has the power to

(a) allot Common Shares for issuance in connection with the exercise of Options;

(b) grant Options hereunder;

(c) subject to any necessary Regulatory Approval, amend, suspend, terminate or discontinue the Plan, or revoke or alter any action taken in connection therewith, except that no general amendment or suspension of the Plan will, without the prior written consent of all Optionees, alter or impair any Option previously granted under the Plan unless the alteration or impairment occurred as a result of a change in the TSX Policies or other applicable legal requirements; and

(d) delegate all or such portion of its powers hereunder as it may determine to one or more committees of the Board, either indefinitely or for such period of time as it may specify, and thereafter each such committee may exercise the powers and discharge the duties of the Board in respect of the Plan so delegated to the same extent as the Board is hereby authorized so to do.

Restrictions on Option Grants to Insiders

2.8 The Plan is subject to restrictions that:

(a) the number of Common Shares issued to Insiders as a group pursuant to Options granted under the Plan, when combined with Common Shares issued to Insiders under all the Company's other Share Compensation Arrangements shall not exceed 2% of the issued Common Shares within any 12 month period;

(b) the number of Common Shares issuable to Insiders at any time as a group under the Plan, when combined with Common Shares issuable to Insiders under all the Company's other Share Compensation Arrangements, shall not exceed 9.5% of the Company's issued Common Shares;

(c) Common Shares issuable to directors who are independent directors (as defined in §§1.4 and 1.5 of National Instrument 52-110) of the Company, which when combined with all of the Company's other Share Compensation Arrangements currently in effect for their benefit (for avoidance of doubt excluding any previously exercised Options or other Share Compensation Arrangement already paid), not to exceed 1% of the Outstanding Shares; provided as well that Common Shares issuable under Options and other Share Compensation Arrangements currently in effect which have been granted to:

(i) any director who was non-independent at the time of grant of Options but who subsequently became an independent director; and

(ii) any director who was an independent director at the time of grant of Options but subsequently becomes a non-independent director;

shall in either such case, be excluded from the calculation of 1% of the Outstanding Shares issuable under the Plan;

(d) the aggregate annual value of Options that may be granted to each independent director under this Plan and any other security based compensation arrangements established or maintained by the Company, may not exceed $100,000 as calculated by the Black Scholes option pricing model;

(e) no Incentive Stock Options may be granted to any Employee described in Section 1.2(o)(ii) above who owns, at the time of such grant, more than 10% of the voting stock in the Company, unless those Incentive Stock Options are granted at an Exercise Price of at least 110% of the fair market value of the underlying Common Shares and such Incentive Stock Options cannot be exercised more than five years from the time of such grant;

(f) no exercise price of an Option granted to an Insider may be reduced nor an extension to the term of an Option granted to an Insider extended without further approval of the disinterested shareholders of the Company; and

(g) The aggregate number of Incentive Stock Options shall not exceed 1,000,000.

Amendments to the Plan

2.9 In addition to the approval of the Board and the TSX, shareholder approval is required for any of the following amendments:

(a) any amendment to the percentage of Common Shares reserved and issuable under the Plan;

(b) any reduction in the exercise price of an Option (other than for standard anti-dilution purposes), or any cancellation and re-issue, within three months of cancellation, of an Option to the same Optionee at a lower exercise price than the Option cancelled provided the Optionee is not an Insider;

(c) an extension of the term of the original expiry date of an Option unless the Optionee is an Insider;

(d) any change to the definition of Participant under the Plan;

(e) any amendment which would allow the transfer or assignment of an Option except in the case of the death of an Optionee as contemplated by the Plan;

(f) any amendment to eligible Participants that may permit an increase to the proposed limit on independent director participation;

(g) any amendment to the transferability or assign-ability of an Option;

(h) any amendments required to be approved by shareholders under applicable law; and

(i) any amendment to this Section 2.9 or Section 2.10 that will increase the Company's ability to amend the Plan without shareholder approval.

Amendment of the Plan by Disinterested Shareholder Approval

2.10 Subject to the requirements of the TSX Policies and the prior receipt of any necessary Regulatory Approval, the Board may amend or modify the Plan or any Option granted pursuant to the Plan, as follows, only by approval of the Disinterested Shareholders:

(a) any amendment which reduces the Exercise Price of an Option granted to an Insider;

(b) any amendment to extend the term of an Option granted to an Insider; and

(c) amendments to increase any of the limits on the number of Options that may be granted to Insiders, beyond prevailing TSX requirements or such limitations.

Amendment of the Plan by the Board of Directors

2.11 Subject to the requirements of the TSX Policies and the prior receipt of any necessary Regulatory Approval, the Board may in its absolute discretion, without shareholder approval, amend or modify the Plan or any Option granted, without limitation, as follows:

(a) it may make amendments which are of a typographical, grammatical or clerical nature;

(b) it may change the vesting provisions of an Option granted hereunder or the Plan;

(c) it may change the termination provision of an Option granted hereunder or the Plan, which does not entail an extension beyond the original Expiry Date of such Option;

(d) it may add a cashless exercise feature payable in cash or Common Shares to the Plan;

(e) it may make amendments necessary as a result of changes in securities laws applicable to the Company;

(f) if the Company becomes listed or quoted on a stock exchange or stock market senior to the TSX, it may make such amendments as may be required by the policies of such senior stock exchange or stock market; and

(g) it may make such amendments as reduce, and do not increase, the benefits of this Plan to Service Providers.

ARTICLE 3

TERMS AND CONDITIONS OF OPTIONS

Exercise Price

3.1 The Exercise Price of an Option will be set by the Board at the time such Option is allocated under the Plan, and cannot be less than the Market Price calculated the day before the grant. The exercise price of Incentive Stock Options must be equal to or greater than the fair market value of the Common Shares on the date of the grant of such Incentive Stock Options.

Term of Option

3.2 An Option can be exercisable for a maximum of 5 years from the Effective Date.

3.3 If the Expiry Date for an Option occurs during a Blackout Period applicable to the relevant Service Provider, or within five business days after the expiry of a Blackout Period applicable to the relevant Service Provider, then the Expiry Date for that Option will be the date that is the tenth business day after the expiry date of the Blackout Period.

Vesting of Options

3.4 Vesting of Options shall be at the discretion of the Board, and will generally be subject to:

(a) the Service Provider remaining employed by or continuing to provide services to the Company or any of its subsidiaries and Affiliates as well as, at the discretion of the Board, achieving certain milestones which may be defined by the Board from time to time or receiving a satisfactory performance review by the Company or any of its subsidiaries and Affiliates during the vesting period; or

(b) the Service Provider remaining as a Director of the Company or any of its Affiliates during the vesting period.

Optionee Ceasing to be Director, Employee or Service Provider

3.5 No Option may be exercised after the Service Provider has left his employ/office or has been advised by the Company that his services are no longer required or his service contract has expired, except as follows:

(a) in the case of the death of an Optionee, any vested Option held by him at the date of death will become exercisable by the Optionee's lawful personal representatives, heirs or executors until the earlier of one year after the date of death of such Optionee and the date of expiration of the term otherwise applicable to such Option;

(b) subject to the other provisions of this §3.4, an Option granted to any Service Provider will expire the earlier of the date of expiration of the term or 90 days after the date the Optionee ceases to be employed by or provide services to the Company, but only to the extent that such Option has vested at the date the Optionee ceased to be so employed by or to provide services to the Company;

(c) in the case of an Optionee being dismissed from employment or service for cause, such Optionee's Options, whether or not vested at the date of dismissal, will immediately terminate without right to exercise same.

(d) in the event of a Change of Control occurring, Options which are subject to vesting provisions shall be deemed to have immediately vested upon the occurrence of the Change of Control; and

(e) in the event of a Director not being nominated for re-election as a Director of the Company, although consenting to act and being under no legal incapacity which would prevent the Director from being a member of the Board, Options granted which are subject to a vesting provision shall be deemed to have vested on the date of Meeting upon which the Director is not re-elected.

Non Assignable

3.6 Subject to §3.4(a), all Options will be exercisable only by the Optionee to whom they are granted and will not be assignable or transferable.

Adjustment of the Number of Optioned Shares

3.7 The number of Common Shares subject to an Option will be subject to adjustment in the events and in the manner following:

(a) in the event of a subdivision of Common Shares as constituted on the date hereof, at any time while an Option is in effect, into a greater number of Common Shares, the Company will thereafter deliver at the time of purchase of Optioned Shares hereunder, in addition to the number of Optioned Shares in respect of which the right to purchase is then being exercised, such additional number of Common Shares as result from the subdivision without an Optionee making any additional payment or giving any other consideration therefor;

(b) in the event of a consolidation of the Common Shares as constituted on the date hereof, at any time while an Option is in effect, into a lesser number of Common Shares, the Company will thereafter deliver and an Optionee will accept, at the time of purchase of Optioned Shares hereunder, in lieu of the number of Optioned Shares in respect of which the right to purchase is then being exercised, the lesser number of Common Shares as result from the consolidation;

(c) in the event of any change of the Common Shares as constituted on the date hereof, at any time while an Option is in effect, the Company will thereafter deliver at the time of purchase of Optioned Shares hereunder the number of shares of the appropriate class resulting from the said change as an Optionee would have been entitled to receive in respect of the number of Common Shares so purchased had the right to purchase been exercised before such change;

(d) in the event of a capital reorganization, reclassification or change of outstanding equity shares (other than a change in the par value thereof) of the Company, a consolidation, merger or amalgamation of the Company with or into any other company or a sale of the property of the Company as or substantially as an entirety at any time while an Option is in effect, an Optionee will thereafter have the right to purchase and receive, in lieu of the Optioned Shares immediately theretofore purchasable and receivable upon the exercise of the Option, the kind and amount of shares and other securities and property receivable upon such capital reorganization, reclassification, change, consolidation, merger, amalgamation or sale which the holder of a number of Common Shares equal to the number of Optioned Shares immediately theretofore purchasable and receivable upon the exercise of the Option would have received as a result thereof. The subdivision or consolidation of Common Shares at any time outstanding (whether with or without par value) will not be deemed to be a capital reorganization or a reclassification of the capital of the Company for the purposes of this §3.6;

(e) an adjustment will take effect at the time of the event giving rise to the adjustment, and the adjustments provided for in this section are cumulative;

(f) the Company will not be required to issue fractional shares in satisfaction of its obligations hereunder. Any fractional interest in a Common Share that would, except for the provisions of this §3.6, be deliverable upon the exercise of an Option will be cancelled and not be deliverable by the Company; and

(g) if any questions arise at any time with respect to the Exercise Price or number of Optioned Shares deliverable upon exercise of an Option in any of the events set out in this §3.6, such questions will be conclusively determined by the Company's auditors, or, if they decline to so act, any other firm of Chartered Accountants, in Vancouver, British Columbia (or in the city of the Company's principal executive office) that the Company may designate and who will be granted access to all appropriate records. Such determination will be binding upon the Company and all Optionees.

Effect of Take Over Bid

3.8 If a Take Over Bid is made to the shareholders generally then the Company shall, immediately upon receipt of notice of the Take Over Bid, notify each Optionee currently holding an Option of the Take Over Bid, with full particulars thereof whereupon such Option may, notwithstanding any vesting requirements set out in any Option Commitment, be permitted to exercise in whole or in part by the Optionee, provided that the Board considers the Take Over Bid to be successful. A Take Over Bid will be deemed successful in the event that:

(a) a competing bid emerges with superior terms or conditions;

(b) the Board endorses the Take Over Bid and recommends that shareholders tender into it;

(c) holders of at least 20% of the Company's Listed Shares, or Insiders who hold at least 50% of Listed Shares held by Insiders, agree to, or announce their intention to, tender such shares to the Take Over Bid; but

provided always that the Board may also consider other criteria to be adequate evidence that the Take Over Bid is a successful one.

Notice of Disqualifying Disposition of Incentive Stock Option

3.9 If a Participant or a Participant's beneficiary sells or otherwise disposes of any Common Shares acquired pursuant to the exercise of an Incentive Stock Option on or before the later of (a) the date that is two years after the date of grant of such Inventive Stock Option, or (b) the date that is one year after the date of exercise of such Incentive Stock Option, the Participant (or beneficiary) shall immediately notify the Company in writing of such disposition and may be subject to income tax withholding by the Company on the compensation income.

ARTICLE 4

COMMITMENT AND EXERCISE PROCEDURES

Option Commitment

4.1 Upon grant of an Option hereunder, an authorized officer of the Company will deliver to the Optionee an Option Commitment detailing the terms of such Options and upon such delivery the Optionee will be subject to the Plan and have the right to purchase the Optioned Shares at the Exercise Price set out therein subject to the terms and conditions hereof.

Manner of Exercise

4.2 An Optionee who wishes to exercise his Option may do so by delivering:

(a) a written notice to the Company specifying the number of Optioned Shares being acquired pursuant to the Option; and

(b) cash or a certified cheque, wire transfer or bank draft payable to the Company for the aggregate Exercise Price by the Optioned Shares being acquired, plus any required withholding tax amount subject to §4.3.

Tax Withholding and Procedures

4.3 Notwithstanding anything else contained in this Plan, the Company may, from time to time, implement such procedures and conditions as it determines appropriate with respect to the withholding and remittance of taxes imposed under applicable law, or the funding of related amounts for which liability may arise under such applicable law. Without limiting the generality of the foregoing, an Optionee who wishes to exercise an Option must, in addition to following the procedures set out in §4.2 and elsewhere in this Plan, and as a condition of exercise:

(a) deliver a certified cheque, wire transfer or bank draft payable to the Company for the amount determined by the Company to be the appropriate amount on account of such taxes or related amounts; or

(b) otherwise ensure, in a manner acceptable to the Company (if at all) in its sole and unfettered discretion, that the amount will be securely funded;

and must in all other respects follow any related procedures and conditions imposed by the Company.

The Company may appoint a share compensation administrative service at the Company's discretion and expense, to co-ordinate and administer the exercise of Optioned Shares and to co-ordinate the payment of the Exercise Price therefor, including establishment of a web-based exercise and accounting function.

Delivery of Optioned Shares and Hold Periods

4.4 As soon as practicable after receipt of the notice of exercise described in §4.2 and payment in full for the Optioned Shares being acquired, the Company will direct its transfer agent, or a share compensation administrative service ("administrative service") chosen by the Company, to issue to the Optionee the appropriate number of Optioned Shares. The transfer agent or administrative service will either issue a certificate representing the Optioned Shares or a written notice in the case of uncertificated shares. Such certificate or written notice, as the case may be, will bear a legend stipulating any resale restrictions required under applicable securities laws.

ARTICLE 5

GENERAL

Employment and Services

5.1 Nothing contained in the Plan will confer upon or imply in favour of any Optionee any right with respect to office, employment or provision of services with the Company, or interfere in any way with the right of the Company to lawfully terminate the Optionee's office, employment or service at any time pursuant to the arrangements pertaining to same. Participation in the Plan by an Optionee will be voluntary.

No Representation or Warranty

5.2 The Company makes no representation or warranty as to the future market value of Common Shares issued in accordance with the provisions of the Plan or to the effect of the Income Tax Act (Canada), Internal Revenue Code (United States) or any other taxing statute governing the Options or the Common shares issuable thereunder or the tax consequences to a Service Provider. Compliance with applicable securities laws as to the disclosure and resale obligations of each Participant is the responsibility of such Participant and not the Company.

Interpretation

5.3 The Plan will be governed and construed in accordance with the laws of the Province of British Columbia.

Continuation of the Plan

5.4 This Plan will become effective from and after the date hereof, subject to any required Regulatory Approval, and will remain effective provided that the Plan, or any amended version thereof, receives Shareholder Approval on or before each third annual general meeting of the Company.

Termination

5.5 The Board reserves the right in its absolute discretion to terminate the Plan with respect to all Plan Shares in respect of Options which have not yet been granted hereunder.

SCHEDULE A

SHARE OPTION PLAN

OPTION COMMITMENT

Notice is hereby given that, effective this ________ day of ________________, __________ (the "Effective Date") TASEKO MINES LIMITED (the "Company") has granted to ___________________________________________ (the "Optionee"), an Option to acquire ______________ Common Shares ("Optioned Shares") up to 5:00 p.m. Vancouver Time on the __________ day of ____________________, ______ (the "Expiry Date") at an Exercise Price of Cdn$____________ per share.

Optioned Shares will vest and may be exercised as follows:

{COMPLETE ONE}

____________ In accordance with Section 3.3 of the Plan

or

____________ As follows:

The grant of the Option evidenced hereby is made subject to the terms and conditions of the Plan, which are hereby incorporated herein and forms part hereof. The Option cannot be transferred by the Optionee other than by will or by the laws of descent and the Option cannot be exercised by anyone other than the Optionee.

[Note: if the Option is granted to a US employee and is intended to qualify as an ISO, include the following statement:

"The Option qualifies as an Incentive Stock Option, except to the extent that the aggregate fair market value of the common shares with respect to which such Option (together with any other Incentive Stock Options that have been granted to you) is exercisable for the first time in any calendar year, exceeds US$100,000."]

To exercise your Option, deliver a written notice specifying the number of Optioned Shares you wish to acquire, together with cash or a certified cheque, wire transfer or bank draft payable to the Company for the aggregate Exercise Price to the Company. A certificate, or written notice, for the Optioned Shares so acquired will be issued by the transfer agent as soon as practicable thereafter.

The Company and the Optionee represent that the Optionee under the terms and conditions of the Plan is a bona fide Service Provider (as defined in the Plan), entitled to receive Options under TSX Policies.

TASEKO MINES LIMITED

___________________________________________

Authorized Signatory

January 9, 2024

Taseko Mines Limited

12th Floor, 1040 West Georgia Street

Vancouver, British Columbia

Canada V6E 4H1

Dear Sirs/Mesdames:

Re: Taseko Mines Limited (the "Company")

Form S-8 Registration Statement

We have acted as legal counsel for the Company in connection with the preparation of a registration statement on Form S-8 (the "Registration Statement") to be filed with the Securities and Exchange Commission pursuant to the United States Securities Act of 1933, as amended.

The Registration Statement relates to the registration of 27,549,961 common shares of the Company (the "Shares") reserved for issuance with respect to the exercise of stock options (the "Options") that have been or will be granted pursuant to and in accordance with the Company's Stock Option Plan dated effective April 26, 2021 (the "Plan").

In rendering the opinion set forth below, we have reviewed:

(a) the Registration Statement and the exhibits thereto;

(b) the Notice of Articles of the Company (the "Notice of Articles") and Articles of the Company (the "Articles") as in effect on the date hereof (together, the "Charter Documents");

(c) certain records of the Company's corporate proceedings as reflected in its minute book, including resolutions of the board of directors approving the Stock Option Plan and the Options granted to date;

(d) the Plan; and

(e) such other documents as we have deemed relevant.

Subject to the foregoing and the assumptions, limitations and qualifications set forth in this letter, it is our opinion that the Shares will be validly issued and fully paid and non-assessable common shares in the capital of the Company when issued upon exercise of the Options, provided that:

(a) such Options have been granted in accordance with the terms and conditions of the Plan; and

McMillan LLP | Royal Centre, 1055 W. Georgia St., Suite 1500, Vancouver, BC, Canada V6E 4N7 | t 604.689.9111 | f 604.685.7084

Lawyers | Patent & Trademark Agents | Avocats | Agents de brevets et de marques de commerce

Vancouver | Calgary | Toronto | Ottawa | Montréal | Hong Kong | mcmillan.ca

(b) the holders of the Options perform their respective obligations to the Company in accordance with the terms and conditions of the Plan and any agreement or commitment evidencing the Options, including the payment of the required exercise price of such Options.

Our opinion expressed herein is subject in all respects to the following assumptions, limitations and qualifications:

(a) the foregoing opinion is limited to the laws of the Province of British Columbia and the federal laws of Canada applicable therein, including all applicable provisions of the Business Corporations Act (British Columbia), as amended (the "BC Business Corporations Act");

(b) we have assumed (i) the genuineness of all signatures on documents examined by us, (ii) the legal capacity of the officers of the Company, (iii) the authenticity of all documents submitted to us as originals, (iv) the conformity to authentic originals of all documents submitted to us as certified, conformed, photostatic or other copies, and (v) that the documents, in the forms submitted to us for our review, have not been and will not be altered or amended in any respect;

(c) we have assumed that each agreement or commitment governing an Option has been or will be duly executed by each party thereto and constitutes or will constitute the legal, valid and binding obligations of the parties thereto, and that such agreements or commitments are or will be enforceable against each of the parties thereto in accordance with their respective terms;

(d) we have assumed that at the time the Company is or becomes obligated to issue any Shares upon exercise of Options, the Company (i) will have adequate authorized and unissued Shares to fulfill such obligations, and (ii) will be in good standing with the British Columbia Registrar of Companies; and

(e) we have assumed the absence of fraud in any transaction pursuant to which Shares may be issued pursuant to any Option, and that the consideration authorized by the board of directors for the Shares will have been received by the Company prior to their issuance.

The opinion expressed in this letter is rendered as of the date hereof and is based on our understandings and assumptions as to present facts and on the application of the laws of the Province of British Columbia and the federal laws of Canada applicable therein as the same exists on the date hereof. We assume no obligation to update or supplement this opinion letter after the date hereof with respect to any facts or circumstances that may hereafter come to our attention or to reflect any changes in the facts or law that may hereafter occur or take effect.

We consent to the use of this opinion as an exhibit to the Registration Statement and further consent to the use of our name wherever appearing in the Registration Statement and in any amendment thereto.

Yours truly,

/s/ McMillan LLP

Consent of Independent Registered Public Accounting Firm

The Board of Directors

Taseko Mines Limited

We, KPMG LLP, consent to the use of our report dated February 23, 2023, on the consolidated financial statements of Taseko Mines Limited, which comprise the consolidated balance sheets as of December 31, 2022 and December 31, 2021, the related consolidated statements of comprehensive income (loss), changes in equity and cash flows for each of the years in the two-year period ended December 31, 2022, and the related notes, and our report dated February 23, 2023 on the effectiveness of internal control over financial reporting as of December 31, 2022, which are incorporated by reference in this registration statement on Form S-8 dated January 8, 2024 of Taseko Mines Limited.

/s/ KPMG LLP

January 9, 2024

Vancouver, Canada

Exhibit 107

Calculation of Filing Fee Table

Form S-8

(Form Type)

TASEKO MINES LIMITED

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

In US Dollars

|

|

Security Type

|

Security Class Title

|

Fee Calculation

Rule or

Instruction

|

Amount

Registered (1)

|

Proposed

Maximum Offering

Price Per Unit

|

Maximum

Aggregate

Offering Price

|

Fee Rate

|

Amount of

Registration

Fee

|

|

Fees to Be Paid

|

Equity

|

Common Shares, without par value

|

457(h)

|

8,799,666 (2)

|

$1.40 (3)

|

$12,319,532

|

0.0001476 (6)

|

$1,818.36

|

|

|

Equity

|

Common Shares, without par value

|

457(h) and 457(c)

|

18,750,295 (4)

|

$1.35 (5)

|

$25,312,898

|

0.0001476 (6)

|

$3,736.19

|

|

|

|

Total Offering Amounts

|

|

|

|

$37,632,430

|

0.0001476 (6)

|

$5,554.55

|

|

|

|

Total Fees Previously Paid

|

|

|

|

|

|

N/A

|

|

|

|

Total Fee Offsets

|

|

|

|

|

|

$0

|

|

|

|

Net Fee Due

|

|

|

|

|

|

$5,554.55 (7)

|

III-12

|

(1)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the "Securities Act" ), this registration statement covers as indeterminate number of additional Common Shares (as defined below) that may be offered and issued to prevent dilution resulting from share dividends, share splits, reverse share splits, combinations of shares, spin-offs, recapitalizations, mergers or similar capital adjustments as provided in the 2021 Share Option Plan, as amended (the "Share Option Plan") of Taseko Mines Limited (the "Registrant")

|

| |

|

|

(2)

|

Represents the total number of common shares without par value (the “Common Shares”) of the Registrant issuable upon the exercise of stock options granted pursuant to the Share Option Plan that are outstanding as of December 28, 2023.

|

| |

|

|

(3)

|

Estimated solely for the purpose of calculating the registration fee pursuant to 457(h) under the Securities Act and based upon the $1.40 per share (CDN$1.85 per share) weighted average exercise price of the outstanding stock options under the Share Option Plan (calculated using an exchange rate of CDN$1.3205 per US$1.00 as of December 27, 2023)

|

| |

|

|

(4)

|

Represents the total number of Common Shares of the Registrant issuable upon the exercise of stock options that may be granted pursuant to the Share Option Plan, but which stock options are not outstanding as of the date of this Registration Statement.

|

| |

|

|

(5)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rules 457(c) and 457(h) under the Securities Act and based upon the average of the high and low prices of the Common Shares, as reported on the NYSE American on January 4, 2024, which date is within five business days prior to the filing of this Registration Statement, which was $1.35 per share

|

| |

|

|

(6)

|

Based on the SEC's registration fee of $147.60 per $1,000,000 of securities registered.

|

| |

|

|

(7)

|

The estimated registration fee for the securities has been calculated pursuant to Rule 457(o) of the U.S. Securities Act.

|

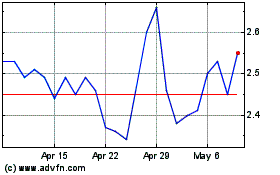

Taseko Mines (AMEX:TGB)

Historical Stock Chart

From Mar 2024 to Apr 2024

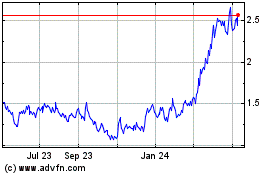

Taseko Mines (AMEX:TGB)

Historical Stock Chart

From Apr 2023 to Apr 2024