false0001595097NONE00015950972024-01-082024-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 08, 2024 |

CORBUS PHARMACEUTICALS HOLDINGS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37348 |

46-4348039 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

500 River Ridge Drive |

|

Norwood, Massachusetts |

|

02062 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (617) 963-0100 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

CRBP |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As previously disclosed on the Current Report on Form 8-K filed on November 13, 2023, Corbus Pharmaceuticals Holdings, Inc. (the “Company”) received a letter (the “Letter”) from the Listing Qualifications Department of the Nasdaq Stock Market LLC (the “Staff”) indicating that the Company was not in compliance with the minimum stockholders’ equity requirement for continued listing on The Nasdaq Capital Market, under Listing Rule 5550(b)(1), because the Company’s stockholders’ equity of $311,016, as reported in the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2023, was below the required minimum of $2.5 million, and because, as of November 9, 2023, the Company did not meet the alternative compliance standards, relating to the market value of listed securities of $35 million or net income from continuing operations of $500,000 in the most recently completed fiscal year or in two of the last three most recently completed fiscal years.

On January 8, 2024, the Staff notified the Company that it granted an extension until May 8, 2024 to regain compliance, conditioned upon achievement of certain milestones included in the plan of compliance previously submitted to the Staff, including a plan to raise additional capital. If the Company fails to evidence compliance by May 8, 2024 and upon filing its periodic report for the quarter ending June 30, 2024, it may be subject to delisting. If the Staff determines to delist the Company’s common stock, the Company will have the right to appeal to a Nasdaq hearings panel. There can be no assurance that the Company will regain compliance with the minimum stockholders’ equity requirement during the extension period.

Item 7.01 Regulation FD Disclosure.

On January 9, 2024, the Company issued a press release announcing that the U.S. Food and Drug Administration (the “FDA”) has cleared the investigational new drug application of CRB-601, a TGFβ blocking monoclonal antibody targeting the integrin αvβ8. A copy of the press release is attached hereto as Exhibit 99.1.

The information in this Current Report on Form 8-K under Item 7.01, including the information contained in Exhibit 99.1, is being furnished to the Securities and Exchange Commission (the “SEC”), and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by a specific reference in such filing.

Item 8.01 Other Events.

FDA Clearance of Investigational New Drug application of CRB-601

On January 9, 2024, the Company announced that the FDA cleared the investigational new drug application of CRB-601, a TGFβ blocking monoclonal antibody targeting the integrin αvβ8. Pre-clinical data presented at the 38th Annual Meeting of the Society for Immunotherapy of Cancer (SITC) demonstrates CRB-601 overcame tumor immune exclusion and enhanced the activity of immune checkpoint inhibitors in vivo. The Company expects to enroll the first patient in a Phase 1 study in the first half of 2024.

Risk Factors

The Company is including the below update to its risk factors, for the purpose of supplementing and updating the disclosure contained in its Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 7, 2023 and its Quarterly Reports on Form 10-Q for the period ended March 31, 2023, filed with the SEC on May 9, 2023, for the period ended June 30, 2023, filed with the SEC on August 8, 2023, and for the period ended September 30, 2023, filed with the SEC on November 7, 2023.

Our failure to maintain compliance with Nasdaq’s continued listing requirements could result in the delisting of our common stock.

Our common stock is currently listed for trading on The Nasdaq Capital Market. We must satisfy the continued listing requirements of The Nasdaq Stock Market LLC (or Nasdaq) to maintain the listing of our common stock on The Nasdaq Capital Market.

On November 10, 2023, we received notice from the Listing Qualifications Staff (the “Staff”) of Nasdaq indicating that we were not in compliance with the $2.5 million minimum stockholders’ equity requirement for continued listing of our common stock on The Nasdaq Capital Market, as set forth in Nasdaq Listing Rule 5550(b)(1) (the “Minimum Stockholders’ Equity Rule”). In that regard, we reported stockholders’ equity of $311,016 in our Quarterly Report on Form 10-Q for the period ended September 30, 2023 (we did not then, and do not now, meet the alternative compliance standards relating to the market value of listed securities of $35 million or net income from continuing operations of $500,000 in the most recently completed fiscal year or in two of the last three most recently completed fiscal years).

We submitted a plan of compliance to Nasdaq on December 26, 2023. On January 8, 2024, Nasdaq notified us that that it granted an extension until May 8, 2024 to regain compliance with the minimum stockholders’ equity requirement, conditioned upon achievement of certain milestones included in the plan of compliance previously submitted to Nasdaq, including a plan to raise additional capital. If

we fail to evidence compliance by May 8, 2024 and upon filing our periodic report for the quarter ending June 30, 2024, we may be subject to delisting. If Nasdaq determines to delist our securities, we will have the right to appeal to a Nasdaq hearings panel. There can be no assurance that we will be able to regain compliance with the Minimum Stockholders’ Equity Rule or maintain compliance with any other Nasdaq requirement in the future.

If our common stock were delisted from The Nasdaq Capital Market, trading of our common stock would most likely take place on an over-the-counter market established for unlisted securities, such as the OTCQB or the Pink Market maintained by OTC Markets Group Inc. An investor would likely find it less convenient to sell, or to obtain accurate quotations in seeking to buy, our common stock on an over-the-counter market, and many investors would likely not buy or sell our common stock due to difficulty in accessing over-the-counter markets, policies preventing them from trading in securities not listed on a national exchange or other reasons. In addition, as a delisted security, our common stock would be subject to SEC rules as a “penny stock,” which impose additional disclosure requirements on broker-dealers. The regulations relating to penny stocks, coupled with the typically higher cost per trade to the investor of penny stocks due to factors such as broker commissions generally representing a higher percentage of the price of a penny stock than of a higher-priced stock, would further limit the ability of investors to trade in our common stock. In addition, delisting would materially and adversely affect our ability to raise capital on terms acceptable to us, or at all, and may result in the potential loss of confidence by investors, suppliers, customers and employees and fewer business development opportunities. For these reasons and others, delisting would adversely affect the liquidity, trading volume and price of our common stock, causing the value of an investment in us to decrease and having an adverse effect on our business, financial condition and results of operations, including our ability to attract and retain qualified employees and to raise capital.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Corbus Pharmaceuticals Holdings, Inc. |

|

|

|

|

Date: |

January 9, 2024 |

By: |

/s/ Yuval Cohen |

|

|

|

Name: Yuval Cohen

Title: Chief Executive Officer |

Corbus Pharmaceuticals Announces FDA Clearance of IND Application for its anti-αvβ8 monoclonal antibody (CRB-601)

•CRB-601 is designed to block the activation of latent TGFβ in the tumor microenvironment

•Phase 1 clinical study set to commence H1 2024

•Pre-clinical data presented demonstrates robust anti-tumor activity in solid tumor models

Norwood, MA, January 9, 2024 (GLOBE NEWSWIRE) -- Corbus Pharmaceuticals Holdings, Inc. (NASDAQ: CRBP) (“Corbus” or the “Company”), a precision oncology company with a diversified portfolio, today announced the U.S. Food and Drug Administration (FDA) has cleared the investigational new drug application of CRB-601, a potentially best-in-class TGFβ blocking monoclonal antibody targeting the integrin αVβ8. Pre-clinical data presented at the 38th Annual Meeting of the Society for Immunotherapy of Cancer (SITC) demonstrates CRB-601 overcame tumor immune exclusion and enhanced the activity of immune checkpoint inhibitors in vivo. The Company expects to enroll the first participant in a Phase 1 study in the first half of 2024.

“Pre-clinical data generated to-date demonstrates that CRB-601 has robust anti-tumor activity as monotherapy and in combination with anti-PD-1 therapy in a variety of solid tumors exhibiting a range of sensitivities to PD(L)-1 targeted therapy,” said Yuval Cohen Ph.D., Chief Executive Officer of Corbus. “CRB-601 blocked latent TGFβ activation and enhanced immune cell penetration into the tumor microenvironment in pre-clinical models. We believe this mechanism of action is complimentary to the effects of anti PD(L)-1 therapy leading to enhanced combinatorial efficacy. We look forward to initiating our Phase 1 First-in-Human trial of CRB-601 and anticipate enrolling the first participant in the first half of this year.”

About Corbus

Corbus Pharmaceuticals Holdings, Inc. is a precision oncology company with a diversified portfolio and is committed to helping people defeat serious illness by bringing innovative scientific approaches to well understood biological pathways. Corbus’ pipeline includes CRB-701, a next generation antibody drug conjugate that targets the expression of Nectin-4 on cancer cells to release a cytotoxic payload, CRB-601, an anti-integrin monoclonal antibody which blocks the activation of TGFβ expressed on cancer cells, and CRB-913, a highly peripherally restricted CB1 inverse agonist for the treatment of obesity. Corbus is headquartered in Norwood, Massachusetts. For more information on Corbus, visit corbuspharma.com. Connect with us on Twitter, LinkedIn and Facebook.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and Private Securities Litigation Reform Act, as amended, including those relating to the Company's restructuring, trial results, product development, clinical and regulatory timelines, market opportunity, competitive position, possible or assumed future results of operations, business strategies, potential growth opportunities and other statement that are predictive in nature. These forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry and markets in which we operate and management's current beliefs and assumptions.

These statements may be identified by the use of forward-looking expressions, including, but not limited to, "expect," "anticipate," "intend," "plan," "believe," "estimate," "potential,” "predict," "project," "should," "would" and similar expressions and the negatives of those terms. These statements relate to future events or our financial performance and involve known and unknown risks, uncertainties, and other factors on our operations, clinical development plans and timelines, which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include those set forth in the Company's filings with the Securities and Exchange Commission. Prospective investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

INVESTOR CONTACT:

Sean Moran

Chief Financial Officer

Corbus Pharmaceuticals

smoran@corbuspharma.com

Bruce Mackle

Managing Director

LifeSci Advisors, LLC

bmackle@lifesciadvisors.com

v3.23.4

Document And Entity Information

|

Jan. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 08, 2024

|

| Entity Registrant Name |

CORBUS PHARMACEUTICALS HOLDINGS, INC.

|

| Entity Central Index Key |

0001595097

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-37348

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

46-4348039

|

| Entity Address, Address Line One |

500 River Ridge Drive

|

| Entity Address, City or Town |

Norwood

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02062

|

| City Area Code |

(617)

|

| Local Phone Number |

963-0100

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

CRBP

|

| Security Exchange Name |

NONE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

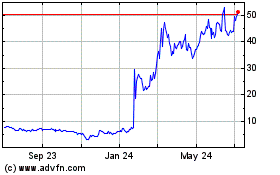

Corbus Pharmaceuticals (NASDAQ:CRBP)

Historical Stock Chart

From Mar 2024 to Apr 2024

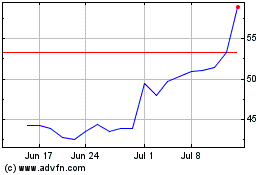

Corbus Pharmaceuticals (NASDAQ:CRBP)

Historical Stock Chart

From Apr 2023 to Apr 2024