false

0001066923

0001066923

2024-01-05

2024-01-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 5, 2024

Future

FinTech Group Inc.

(Exact

name of registrant as specified in its charter)

| Florida |

|

001-34502 |

|

98-0222013 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

Americas

Tower, 1177 Avenue of The Americas,

Suite 5100, New York, NY 10036

(Address

of principal executive offices, including zip code)

888-622-1218

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Common Stock, par value

$0.001 per share |

|

FTFT |

|

Nasdaq Stock Market |

Item

1.01 Entry into a Material Definitive Agreement

On

January 5, 2024, Future FinTech Group Inc. (the “Company”) entered into a Securities Purchase Agreement (the “Agreement”)

with certain purchasers identified on the signature page thereto (the “Purchasers”), pursuant to which the Company agreed

to sell to the Purchasers in a private placement 2,150,536 shares (the “Shares”) of the Company’s common stock, par

value $0.001 per share (the “Common Stock”), at a purchase price of $1.20 per share for an aggregate price of $2,580,644

(the “Private Placement”). The Private Placement will be completed pursuant to the exemption from registration provided by

Regulation S promulgated under the Securities Act of 1933, as amended.

The

Agreement is filed as Exhibits 10.1 to this Current Report on Form 8-K. The foregoing summary of the terms of the Agreement are subject

to, and qualified in its entirety by, the Agreement, which are incorporated herein by reference.

Item

3.02 Unregistered Sales of Equity Securities

Please

see the disclosure set forth under Item 1.01, which is incorporated by reference into this Item 3.02.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Future FinTech Group Inc. |

| |

|

| Date: January 8, 2024 |

By: |

/s/

Shanchun Huang |

| |

Name: |

Shanchun Huang |

| |

Title: |

Chief Executive Officer and President |

2

Exhibit 10.1

SECURITIES PURCHASE AGREEMENT

This SECURITIES PURCHASE AGREEMENT

(the “Agreement”) is dated as of January [ 5 ], 2024 by and among Future FinTech Group Inc., a Florida corporation,

(the “Company”), and individuals listed in Exhibit B hereto and each affixes its signature on the signature

page of this Agreement (each, a “Purchaser”; collectively, the “Purchasers”).

RECITALS

WHEREAS, the Company and the

Purchasers are executing and delivering this Agreement in accordance with and in reliance upon the exemption from securities registration

afforded by Section 4(2) of the Securities Act of 1933 (the “Securities Act”) and/or Regulation S (“Regulation S”)

as promulgated under the Securities Act;

WHEREAS, the Company is offering

certain shares of its common stock, par value $0.001 per share, (the “Common Stock”) at price of $1.20 per share to the Purchasers;

WHEREAS, the Company is offering

up to 2,150,536 shares of Common Stock to the Purchasers listed in Exhibit B, who severally but not jointly enters into this Agreement

and makes representations and warranties hereunder;

WHEREAS, the Purchaser is

a “non-US person” as defined in Regulation S, acquiring the Shares solely for its own account for the purpose of investment;

NOW, THEREFORE, IN CONSIDERATION

of the mutual covenants contained in this Agreement, and for other good and valuable consideration, the receipt and adequacy of which

are hereby acknowledged, the Company and the Purchaser hereby agree as follows:

ARTICLE I

Purchase and Sale of the Shares

Section 1.1 Purchase

Price and Closing.

(a) Subject

to the terms and conditions hereof, the Company agrees to issue and sell to the Purchaser and, in consideration of and in express reliance

upon the representations, warranties, covenants, terms and conditions of this Agreement, the Purchaser agrees to purchase for $ 1.20 per

Share, such number of shares

of Common Stock (each a “Share” and collectively the “Shares”) for an aggregate price of listed

on the signature page hereto (the “Purchase Price”).

(b) Subject

to all conditions to closing being satisfied or waived, the closing of the purchase and sale of the Shares (the “Closing”)

shall take place at the office of the Company, on the date of the occurrence of completion of and receipt by the Company of the Purchase

Price (the “Closing Date”).

(c) Subject

to the terms and conditions of this Agreement, at the Closing the Company shall deliver or cause to be delivered to the Purchaser (i)

a certificate for such number of Shares, and (ii) any other documents required to be delivered pursuant to this Agreement. At the time

of the Closing, the Purchaser shall have delivered its Purchase Price by wire transfer pursuant to the wire information provided by the

Company.

(d) Subject

to all conditions to Closing being satisfied or waived, the Closing shall take place with the number of Shares no more than 19.9% of the

outstanding number of shares of Common Stock of the Company on the Closing Date (the “19.9% Limit”). Any number of Shares

not purchased as a result of the 19.9% Limit shall be purchased by the Purchaser within three (3) business days after shareholders of

the Company shall have approved the transactions contained herein as required by the rules and regulation of the NASDAQ Stock Market (the

“Shareholder Approval”)

ARTICLE II

Representations and Warranties

Section 2.1 Representations

and Warranties of the Company. The Company hereby represents and warrants to the Purchaser on behalf of itself, its subsidiaries (as

hereinafter defined), as of the date hereof, as follows:

(a) Organization,

Good Standing and Power. The Company is a corporation or other entity duly incorporated or otherwise organized, validly existing and

in good standing under the laws of its jurisdiction of incorporation or organization (as applicable) and respectively, has the requisite

corporate power to own, lease and operate its properties and assets and to conduct its business as it is now being conducted. The Company

and each of its subsidiaries is duly qualified to do business and is in good standing in every jurisdiction in which the nature of the

business conducted or property owned by it makes such qualification necessary except for any jurisdiction(s) (alone or in the aggregate)

in which the failure to be so qualified will not have a Material Adverse Effect (as defined in Section 2.1(e) hereof).

(b) Corporate Power;

Authority and Enforcement. The Company has the requisite corporate power and authority to enter into and perform its obligations under

this Agreement, and to issue and sell the Shares in accordance with the terms hereof. The execution, delivery and performance of this

Agreement by the Company and the consummation by it of the transactions contemplated hereby and thereby have been duly and validly authorized

by all necessary corporate action, and no further consent or authorization of the Company or its Board of Directors or stockholders is

required. This Agreement constitutes, or shall constitute when executed and delivered, a valid and binding obligation of the Company enforceable

against the Company in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization,

moratorium, liquidation, conservator ship, receiver ship or similar laws relating to, or affecting generally the enforcement of, creditor’s

rights and remedies or by other equitable principles of general application.

(c) Capitalization.

The authorized capital stock of the Company and the shares thereof currently issued and outstanding as of January 5, 2024 is 17,834,874,

and, is the authorized and issued and outstanding capital stock of the Company as at the date hereof.

(d) Issuance of Shares.

The Shares to be issued at the Closing have been duly authorized by all necessary corporate action, when paid for or issued in accordance

with the terms hereof, shall be validly issued and outstanding, fully paid and non-assessable.

(e) Compliance with

Law. The Company and its subsidiaries have all material permits, licenses, consents and other governmental or regulatory authorizations

and approvals necessary for the conduct of their respective business as now being conducted by it unless the failure to possess such permits,

licenses, consents and other governmental or regulatory authorizations and approvals, individually or in the aggregate, could not reasonably

be expected to have a Material Adverse Effect. “Material Adverse Effect” shall mean (i) any material adverse effect upon the

assets, properties, financial condition, business or prospects of the Company, and its subsidiaries, when taken as a consolidated whole,

and/or (ii) any condition, circumstance, or situation that would prohibit or otherwise materially interfere with the ability of the Company

to perform any of its material covenants, agreements and obligations under this Agreement.

(f) No Conflicts.

The execution, delivery and performance of this Agreement by the Company and the consummation by the Company of the transactions contemplated

herein and therein do not and will not (i) violate any provision of the Company’s Certificate or Bylaws, (ii) conflict with, or

constitute a default (or an event which with notice or lapse of time or both would become a default) under, or give to others any rights

of termination, amendment, acceleration or cancellation of, any agreement, mortgage, deed of trust, indenture, note, bond, license, lease

agreement, instrument or obligation to which the Company is a party or by which it or its properties or assets are bound, (iii) create

or impose a lien, mortgage, security interest, pledge, charge or encumbrance (collectively, “Lien”) of any nature on

any property of the Company under any agreement or any commitment to which the Company is a party or by which the Company is bound or

by which any of its respective properties or assets are bound, or (iv) result in a violation of any federal, state, local or foreign statute,

rule, regulation, order, judgment or decree (including Federal and state securities laws and regulations) applicable to the Company or

any of its subsidiaries or by which any property or asset of the Company or any of its subsidiaries are bound or affected, provided,

however, that, excluded from the foregoing in all cases are such conflicts, defaults, terminations, amendments, accelerations,

cancellations and violations as would not, individually or in the aggregate, have a Material Adverse Effect.

(g) Certain Fees.

No brokers fees, finders fees or financial advisory fees or commissions will be payable by the Company with respect to the transactions

contemplated by this Agreement.

Section 2.2 Representations

and Warranties of the Purchaser. Each Purchaser, severally but not jointly, hereby makes the following representations and warranties

to the Company as of the date hereof:

(a) No Conflicts.

The execution, delivery and performance of this Agreement and the consummation by such Purchaser of the transactions contemplated hereby

and thereby or relating hereto do not and will not conflict with, or constitute a default (or an event which with notice or lapse of time

or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of any agreement,

indenture or instrument or obligation to which such Purchaser is a party or by which its properties or assets are bound, or result in

a violation of any law, rule, or regulation, or any order, judgment or decree of any court or governmental agency applicable to such Purchaser

or its properties (except for such conflicts, defaults and violations as would not, individually or in the aggregate, have a material

adverse effect on such Purchaser). Such Purchaser is not required to obtain any consent, authorization or order of, or make any filing

or registration with, any court or governmental agency in order for it to execute, deliver or perform any of its obligations under this

Agreement, provided, that for purposes of the representation made in this sentence, such Purchaser is assuming and relying upon the accuracy

of the relevant representations and agreements of the Company herein.

(b) Status of Purchaser.

The Purchaser is a “non-US person” as defined in Regulation S. The Purchaser further makes the representations and warranties

to the Company set forth on Exhibit A. Such Purchaser is not required to be registered as a broker-dealer under Section 15 of the

Exchange Act and such Purchaser is not a broker-dealer, nor an affiliate of a broker-dealer.

(c) Reliance

on Exemptions. The Purchaser understands that the Shares are being offered and sold to it in reliance upon specific exemptions from

the registration requirements of United States federal and state securities laws and that the Company is relying upon the truth and accuracy

of, and the Purchaser’s compliance with, the representations, warranties, agreements, acknowledgments and understandings of the

Purchaser set forth herein in order to determine the availability of such exemptions and the eligibility of the Purchaser to acquire the

Shares.

(d) Information.

The Purchaser and its advisors, if any, have had the opportunity to ask questions of management of the Company and its subsidiaries and

have been furnished with all information relating to the business, finances and operations of the Company and information relating to

the offer and sale of the Shares which have been requested by the Purchaser or its advisors. Neither such inquiries nor any other due

diligence investigation conducted by the Purchaser or any of its advisors or representatives shall modify, amend or affect the Purchaser’s

right to rely on the representations and warranties of the Company contained herein. The Purchaser understands that its investment in

the Shares involves a significant degree of risk. The Purchaser further represents to the Company that the Purchaser’s decision

to enter into this Agreement has been based solely on the independent evaluation of the Purchaser and its representatives.

(e)

Governmental Review. The Purchaser understands that no United States federal or state agency or any other government or governmental

agency has passed upon or made any recommendation or endorsement of the Shares.

(f) Transfer

or Re-sale. The Purchaser understands that the sale or re-sale of the Shares has not been and is not being registered under the Securities

Act or any applicable state securities laws, and the Shares may not be transferred unless (i) the Shares are sold pursuant to an effective

registration statement under the Securities Act, (ii) the Purchaser shall have delivered to the Company an opinion of counsel that shall

be in form, substance and scope customary for opinions of counsel in comparable transactions to the effect that the Shares to be sold

or transferred may be sold or transferred pursuant to an exemption from such registration, which opinion shall be reasonably acceptable

to the Company, (iii) the Shares are sold or transferred to an “affiliate” (as defined in Rule 144 promulgated under the Securities

Act (or a successor rule) (“Rule 144”)) of the Purchaser who agrees to sell or otherwise transfer the Shares only in

accordance with this Section 2.2(f) and who is a non-US person, (iv) the Shares are sold pursuant to Rule 144, or (v) the Shares are sold

pursuant to Regulation S under the Securities Act (or a successor rule) (“Regulation S”).

(g)

Legends. The Purchaser understands that the Shares shall bear a restrictive legend in the form as set forth under Section 5.1 of

this Agreement. The Purchaser understands that, until such time the Shares may be sold pursuant to Rule 144 or Regulation S without any

restriction as to the number of securities as of a particular date that can then be immediately sold, the Shares may bear a restrictive

legend in substantially the form set forth under Section 5.1 (and a stop-transfer order may be placed against transfer of the certificates

evidencing such Securities).

(h)

Residency. The Purchaser is a resident of the jurisdiction set forth immediately below such Purchaser’s name on the signature

pages hereto.

(i) No General Solicitation.

The Purchaser acknowledges that the Shares were not offered to such Purchaser by means of any form of general or public solicitation or

general advertising, or publicly disseminated advertisements or sales literature, including (i) any advertisement, article, notice or

other communication published in any newspaper, magazine, or similar media, or broadcast over television or radio, or (ii) any seminar

or meeting to which such Purchaser was invited by any of the foregoing means of communications.

(j) Rule 144. Such

Purchaser understands that the Shares must be held indefinitely unless such Shares are registered under the Securities Act or an exemption

from registration is available. Such Purchaser acknowledges that such Purchaser is familiar with Rule 144 and Rule 144A, of the rules

and regulations of the Commission, as amended, promulgated pursuant to the Securities Act (“Rule 144”), and that such

person has been advised that Rule 144 and Rule 144A, as applicable, permits resales only under certain circumstances. Such Purchaser understands

that to the extent that Rule 144 or Rule 144A is not available, such Purchaser will be unable to sell any Shares without either registration

under the Securities Act or the existence of another exemption from such registration requirement.

(k) Brokers. Purchaser

does not have any knowledge of any brokerage or finder’s fees or commissions that are or will be payable by the Company to any broker,

financial advisor or consultant, finder, placement agent, investment banker, bank or other person or entity with respect to the transactions

contemplated by this Agreement.

(l) Acquisition for

Investment. The Purchaser is a “non-US person” as defined in Regulation S, acquiring the Shares solely for the its own

account for the purpose of investment and not with a view to or for sale in connection with a distribution to anyone.

(m) Independent Investment

Decision. Such Purchaser has independently evaluated the merits of its decision to purchase Shares pursuant to this Agreement, and

such Purchaser confirms that it has not relied on the advice of any other person’s business and/or legal counsel in making such

decision. Such Purchaser understands that nothing in this Agreement or any other materials presented by or on behalf of the Company to

the Purchaser in connection with the purchase of the Shares constitutes legal, tax or investment advice. Such Purchaser has consulted

such legal, tax and investment advisors as it, in its sole discretion, has deemed necessary or appropriate in connection with its purchase

of the Securities.

ARTICLE III

Covenants

Section 3.1 Confidential

Information. The Purchaser agrees that such Purchaser and its employees, agents and representatives will keep confidential and will

not disclose, divulge or use (other than for purposes of monitoring its investment in the Company) any confidential information which

such Purchaser may obtain from the Company pursuant to financial statements, reports and other materials submitted by the Company to such

Purchaser pursuant to this Agreement, unless such information is known to the public through no fault of such Purchaser or his or its

employees or representatives; provided, however, that a Purchaser may disclose such information (i) to its attorneys, accountants and

other professionals in connection with their representation of such Purchaser in connection with such Purchaser’s investment in

the Company, (ii) to any prospective permitted transferee of the Shares, so long as the prospective transferee agrees to be bound by the

provisions of this Section 3.1, or (iii) to any general partner or affiliate of such Purchaser.

ARTICLE IV

CONDITIONS

Section 4.1 Conditions

Precedent to the Obligation of the Company to Sell the Shares. The obligation hereunder of the Company to issue and sell the Shares

is subject to the satisfaction or waiver, at or before the Closing, of each of the conditions set forth below. These conditions are for

the Company’s sole benefit and may be waived by the Company at any time in its sole discretion.

(a) Accuracy of the

Purchaser’s Representations and Warranties. The representations and warranties of the Purchaser in this Agreement shall be true

and correct in all material respects as of the date when made and as of the Closing Date as though made at that time, except for representations

and warranties that are expressly made as of a particular date, which shall be true and correct in all material respects as of such date.

(b) Performance by the

Purchaser. The Purchaser shall have performed, satisfied and complied in all respects with all covenants, agreements and conditions

required by this Agreement to be performed, satisfied or complied with by such Purchaser at or prior to the Closing.

(c) No Injunction.

No statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated or endorsed

by any court or governmental authority of competent jurisdiction which prohibits the consummation of any of the transactions contemplated

by this Agreement.

(d) Delivery of Purchase

Price. The Purchase Price for the Shares shall have been delivered to the Company.

(e) Delivery of this

Agreement. This Agreement shall have been duly executed and delivered by the Purchaser to the Company.

Section 4.2 Conditions

Precedent to the Obligation of the Purchaser to Purchase the Shares. The obligation hereunder of the Purchaser to acquire and pay

for the Shares offered in this Agreement is subject to the satisfaction or waiver, at or before the Closing, of each of the conditions

set forth below. These conditions are for the Purchaser’s sole benefit and may be waived by such Purchaser at any time in its sole

discretion.

(a) Accuracy

of the Company’s Representations and Warranties. Each of the representations and warranties of the Company in this Agreement

shall be true and correct in all respects as of the date when made and as of the Closing Date as though made at that time, except for

representations and warranties that are expressly made as of a particular date, which shall be true and correct in all respects as of

such date.

(b) Performance

by the Company. The Company shall have performed, satisfied and complied in all respects with all covenants, agreements and conditions

required by this Agreement to be performed, satisfied or complied with by the Company at or prior to the Closing.

(c) No

Injunction. No statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated

or endorsed by any court or governmental authority of competent jurisdiction which prohibits the consummation of any of the transactions

contemplated by this Agreement.

(d)

Certificates. The Company shall have executed and delivered to the Purchaser the certificates for the Shares being acquired by

such Purchaser immediately after the Closing to such address set forth next to the Purchaser with respect to the Closing.

(e) Resolutions.

The Board of Directors of the Company shall have adopted resolution consistent with Section 2.1 hereof in a form reasonably acceptable

to such Purchaser (the “Resolution”).

ARTICLE V

Stock Certificate Legend

Section 5.1 Legend.

Each certificate representing the Shares shall be stamped or otherwise imprinted with a legend substantially in the following form (in

addition to any legend required by applicable state securities or “blue sky” laws):

THESE SECURITIES

REPRESENTED BY THIS CERTIFICATE (THE “SECURITIES”) HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE

“SECURITIES ACT”). THE SECURITIES WERE ISSUED IN A TRANSACTION EXEMPT FROM THE REGISTRATION REDISTRICTIREMENTS OF THE SECURITIES

ACT PURSUANT TO REGULATION S PROMULGATED UNDER IT. THE SECURITIES MAY NOT BE SOLD, TRANSFERRED OR OTHERWISE DISPOSED OF IN THE UNITED

STATES UNLESS PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR

IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES

LAWS. FURTHER, HEDGING TRANSACTIONS WITH REGARD TO THE SECURITIES MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE SECURITIES ACT.

ARTICLE VI

Indemnification

Section 6.1 General

Indemnity. The Company agrees to indemnify and hold harmless the Purchaser (and their respective directors, officers, managers, partners,

members, shareholders, affiliates, agents, successors and assigns) from and against any and all losses, liabilities, costs, damages and

expenses (including, without limitation, reasonable attorneys’ fees, charges and disbursements) incurred by the Purchaser as a result

of any breach of the representations, warranties or covenants made by the Company herein. The Purchaser, severally but not jointly, agrees

to indemnify and hold harmless the Company and its directors, officers, affiliates, agents, successors and assigns from and against any

and all losses, liabilities, costs, damages and expenses (including, without limitation, reasonable attorneys’ fees, charges and

disbursements) incurred by the Company as a result of any breach of the representations, warranties or covenants made by such Purchaser

herein. The maximum aggregate liability of the Purchaser pursuant to its indemnification obligations under this Article VI shall not exceed

the portion of the Purchase Price paid by the Purchaser hereunder. In no event shall any “Indemnified Party” (as defined below)

be entitled to recover consequential or punitive damages resulting from a breach or violation of this Agreement.

ARTICLE VII

Miscellaneous

Section 7.1 Fees and

Expenses. Except as otherwise set forth in this Agreement, each party shall pay the fees and expenses of its advisors, counsel, accountants

and other experts, if any, and all other expenses, incurred by such party incident to the negotiation, preparation, execution, delivery

and performance of this Agreement.

Section 7.2 Specific

Enforcement, Consent to Jurisdiction.

(a) The Company and the

Purchaser acknowledge and agree that irreparable damage would occur in the event that any of the provisions of this Agreement were not

performed in accordance with their specific terms or were otherwise breached. It is accordingly agreed that the parties shall be entitled

to an injunction or injunctions to prevent or cure breaches of the provisions of this Agreement and to enforce specifically the terms

and provisions hereof or thereof, this being in addition to any other remedy to which any of them may be entitled by law or equity.

(b) Each

of the Company and the Purchaser (i) hereby irrevocably submits to the jurisdiction of the United States District Court sitting in the

Southern District of New York and the courts of the State of New York located in New York county for the purposes of any suit, action

or proceeding arising out of or relating to this Agreement or the transactions contemplated hereby or thereby and (ii) hereby waives,

and agrees not to assert in any such suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of such

court, that the suit, action or proceeding is brought in an inconvenient forum or that the venue of the suit, action or proceeding is

improper. Each of the Company and the Purchaser consents to process being served in any such suit, action or proceeding by mailing a copy

thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address in effect for

notices to it under this Agreement and agrees that such service shall constitute good and sufficient service of process and notice thereof.

Nothing in this Section 7.2 shall affect or limit any right to serve process in any other manner permitted by law. Each party hereby irrevocably

waives personal service of process and consents to process being served in any such suit, action or proceeding by mailing a copy thereof

to such party at the address for such notices to it under this Agreement and agrees that such service shall constitute good and sufficient

service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any

manner permitted by law.

Section 7.3 Entire Agreement;

Amendment. This Agreement contains the entire understanding and agreement of the parties with respect to the matters covered hereby

and, except as specifically set forth herein, neither the Company nor any of the Purchaser makes any representations, warranty, covenant

or undertaking with respect to such matters and they supersede all prior understandings and agreements with respect to said subject matter,

all of which are merged herein. No provision of this Agreement may be waived or amended other than by a written instrument signed by the

Company and the Purchaser, and no provision hereof may be waived other than by a written instrument signed by the party against whom enforcement

of any such waiver is sought.

Section 7.4 Notices.

All notices, demands, consents, requests, instructions and other communications to be given or delivered or permitted under or by reason

of the provisions of this Agreement or in connection with the transactions contemplated hereby shall be in writing and shall be deemed

to be delivered and received by the intended recipient as follows: (i) if personally delivered, on the business day of such delivery (as

evidenced by the receipt of the personal delivery service), (ii) if mailed certified or registered mail return receipt requested, two

(2) business days after being mailed, (iii) if delivered by overnight courier (with all charges having been prepaid), on the business

day of such delivery (as evidenced by the receipt of the overnight courier service of recognized standing), or (iv) if delivered by facsimile

transmission, on the business day of such delivery if sent by 6:00 p.m. in the time zone of the recipient, or if sent after that time,

on the next succeeding business day (as evidenced by the printed confirmation of delivery generated by the sending party’s telecopier

machine). If any notice, demand, consent, request, instruction or other communication cannot be delivered because of a changed address

of which no notice was given (in accordance with this Section 7.4), or the refusal to accept same, the notice, demand, consent, request,

instruction or other communication shall be deemed received on the second business day the notice is sent (as evidenced by a sworn affidavit

of the sender). All such notices, demands, consents, requests, instructions and other communications will be sent to the following addresses

or facsimile numbers as applicable:

If to the Company:

Americas Tower, 1177 Avenue of The Americas,

Suite 5100, New York, NY 10036

If to Purchaser:

The address listed on Exhibit

B

Any party hereto may from

time to time change its address for notices by giving at least ten (10) days written notice of such changed address to the other party

hereto.

Section 7.5 Waivers.

No waiver by any party of any default with respect to any provision, condition or requirement of this Agreement shall be deemed to be

a continuing waiver in the future or a waiver of any other provisions, condition or requirement hereof, nor shall any delay or omission

of any party to exercise any right hereunder in any manner impair the exercise of any such right accruing to it thereafter.

Section 7.6 Headings.

The section headings contained in this Agreement (including, without limitation, section headings and headings in the exhibits and schedules)

are inserted for reference purposes only and shall not affect in any way the meaning, construction or interpretation of this Agreement.

Any reference to the masculine, feminine, or neuter gender shall be a reference to such other gender as is appropriate. References to

the singular shall include the plural and vice versa.

Section 7.7 Successors

and Assigns. This Agreement may not be assigned by a party hereto without the prior written consent of the Company or the Purchaser,

as applicable. The provisions of this Agreement shall inure to the benefit of and be binding upon the respective permitted successors

and permitted assigns of the parties. Nothing in this Agreement, express or implied, is intended to confer upon any party other than the

parties hereto or their respective successors and permitted assigns any rights, remedies, obligations or liabilities under or by reason

of this Agreement, except as expressly provided in this Agreement.

Section 7.8 Governing

Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of New York, without giving

effect to any of the conflicts of law principles which would result in the application of the substantive law of another jurisdiction.

This Agreement shall not be interpreted or construed with any presumption against the party causing this Agreement to be drafted.

Section 7.9 Survival.

The representations and warranties of the Company and the Purchaser shall survive the execution and delivery hereof and the Closing hereunder

for a period of three (3) years following the Closing Date.

Section 7.10 Counterparts.

This Agreement may be executed in any number of counterparts, each of which when so executed shall be deemed to be an original and, all

of which taken together shall constitute one and the same Agreement and shall become effective when counterparts have been signed by each

party and delivered to the other parties hereto, it being understood that all parties need not sign the same counterpart. In the event

that any signature is delivered by facsimile transmission or .pdf scanned copy, such signature shall create a valid binding obligation

of the party executing (or on whose behalf such signature is executed) the same with the same force and effect as if such facsimile or

..pdf scanned copy signature were the original thereof.

Section 7.11 Severability.

The provisions of this Agreement are severable and, in the event that any court of competent jurisdiction shall determine that any one

or more of the provisions or part of the provisions contained in this Agreement shall, for any reason, be held to be invalid, illegal

or unenforceable in any respect, such invalidity, illegality or unenforceability shall not affect any other provision or part of a provision

of this Agreement and such provision shall be reformed and construed as if such invalid or illegal or unenforceable provision, or part

of such provision, had never been contained herein, so that such provisions would be valid, legal and enforceable to the maximum extent

possible.

Section 7.12 Individual Capacity.

Each Purchaser enters into this Agreement on its own capacity, and not as a group with other Purchasers. Each Purchaser, severally but

not jointly, makes representations and warranties contained under this Agreement.

Section 7.13 Termination. This Agreement

may be terminated prior to Closing by mutual written agreement of the Purchaser and the Company.

Section 7.14. Language.

The Agreement is in both English and Chinese, which both have binding effects. If there is any conflict between the English and Chinese

language, English language prevails.

[Remainder of Page Intentionally Left Blank;

Signature Pages Follow]

IN WITNESS WHEREOF, the parties

hereto have caused this Agreement to be duly executed by their respective authorized officer as of the date first above written.

The Company:

| |

By: |

/s/

ShanChun Huang |

| |

|

Name: ShanChun Huang |

| |

|

Title: Chief Executive Officer |

[Signature Page of the Company]

Signature Page of

the Purchaser

IN WITNESS WHEREOF, the Purchaser

has caused this Agreement to be duly executed individually or by its authorized officer or member as of the date first above written.

购买人在此确认和同意协议的条款,并有效签署该协议。

The Purchaser:

Number of Shares Purchased :

Total Purchase Price: ($ 1.2 x 1,075,268 ) $ 1,290,322

Address and Contacts

of Purchaser

Telephone:

Email:

Signature Page of

the Purchaser

IN WITNESS WHEREOF, the Purchaser

has caused this Agreement to be duly executed individually or by its authorized officer or member as of the date first above written.

The Purchaser:

Number of Shares Purchased :

Total Purchase Price: ($ 1.2 x 1,075,268) $1,290,322

Address and Contacts

of Purchaser

Telephone:

Email:

EXHIBIT A TO

THE SECURITIES PURCHASE

AGREEMENT

NON U.S. PERSON REPRESENTATIONS

The Purchaser indicating that it is not a U.S. person, severally and

not jointly, further represents and warrants to the Company as follows:

| 1. | At the time of (a) the offer by the Company and (b) the acceptance of the offer by the Purchase, of the

Shares, such Purchaser was outside the United States. |

| 2. | The Purchaser is acquiring the Shares for such Purchaser r’s own account, for investment and not

for distribution or resale to others and is not purchasing the Shares for the account or benefit of any U.S. person, or with a view towards

distribution to any U.S. person, in violation of the registration requirements of the Securities Act. |

| 3. | The Purchaser will make all subsequent offers and sales of the Shares either (x) outside of the United

States in compliance with Regulation S; (y) pursuant to a registration under the Securities Act; or (z) pursuant to an available exemption

from registration under the Securities Act. Specifically, the Purchaser will not resell the Shares to any U.S. person or within the United

States prior to the expiration of a period commencing on the Closing Date and ending on the date that is one year thereafter (the “Distribution

Compliance Period”), except pursuant to registration under the Securities Act or an exemption from registration under the Securities

Act. |

| 4. | The Purchaser has no present plan or intention to sell the Shares in the United States or to a U.S. person

at any predetermined time, has made no predetermined arrangements to sell the Shares and is not acting as a Distributor of such securities. |

| 5. | Neither the Purchaser, its Affiliates nor any Person acting on behalf of the Purchaser, has entered into,

has the intention of entering into, or will enter into any put option, short position or other similar instrument or position in the U.S.

with respect to the Shares at any time after the Closing Date through the Distribution Compliance Period except in compliance with the

Securities Act. |

| 6. | The Purchaser consents to the placement of a legend on any certificate or other document evidencing the

Shares substantially in the form set forth in Section 5.1. |

| 7. | The Purchaser is not acquiring the Shares in a transaction (or an element of a series of transactions)

that is part of any plan or scheme to evade the registration provisions of the Securities Act. |

| 8. | The Purchaser has sufficient knowledge and experience in finance, securities, investments and other business

matters to be able to protect such person’s or entity’s interests in connection with the transactions contemplated by this

Agreement. |

| 9. | The Purchaser has consulted, to the extent that it has deemed necessary, with its tax, legal, accounting

and financial advisors concerning its investment in the Shares. |

| 10. | The Purchaser understands the various risks of an investment in the Shares and can afford to bear such

risks for an indefinite period of time, including, without limitation, the risk of losing its entire investment in the Shares. |

| 11. | The Purchaser has had access to the Company’s publicly filed reports with the SEC and has been furnished

during the course of the transactions contemplated by this Agreement with all other public information regarding the Company that The

Purchaser has requested and all such public information is sufficient for such person or entity to evaluate the risks of investing in

the Shares. |

| 12. | The Purchaser has been afforded the opportunity to ask questions of and receive answers concerning the

Company and the terms and conditions of the issuance of the Shares. |

| 13. | The Purchaser is not relying on any representations and warranties concerning the Company made by the

Company or any officer, employee or agent of the Company, other than those contained in this Agreement. |

| 14. | The Purchaser will not sell or otherwise transfer the Shares unless either (A) the transfer of such

securities is registered under the Securities Act or (B) an exemption from registration of such securities is available. |

| 15. | The Purchaser represents that the address furnished on its signature page to this Agreement is the principal

residence if he/she is an individual or its principal business address if it is a corporation or other entity. |

| 16. | The Purchaser understands and acknowledges that the Shares have not been recommended by any federal or

state securities commission or regulatory authority, that the foregoing authorities have not confirmed the accuracy or determined the

adequacy of any information concerning the Company that has been supplied to the Purchaser and that any representation to the contrary

is a criminal offense. |

Exhibit

B

List

of Purchasers

| No. |

|

Shares |

|

Name |

|

Address |

| 1 |

|

1,075,268 |

|

|

|

|

| 2 |

|

1,075,268 |

|

|

|

|

| |

|

Total: 2,150,536 |

|

|

|

|

17

v3.23.4

Cover

|

Jan. 05, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 05, 2024

|

| Entity File Number |

001-34502

|

| Entity Registrant Name |

Future

FinTech Group Inc.

|

| Entity Central Index Key |

0001066923

|

| Entity Tax Identification Number |

98-0222013

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity Address, Address Line One |

Americas

Tower

|

| Entity Address, Address Line Two |

1177 Avenue of The Americas

|

| Entity Address, Address Line Three |

Suite 5100

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10036

|

| City Area Code |

888

|

| Local Phone Number |

622-1218

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value

$0.001 per share

|

| Trading Symbol |

FTFT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

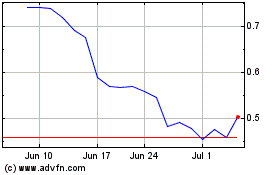

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Apr 2023 to Apr 2024