NASDAQ false 0001369568 0001369568 2024-01-08 2024-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): January 8, 2024

CATALYST PHARMACEUTICALS, INC.

(Exact Name Of Registrant As Specified In Its Charter)

|

|

|

|

|

| Delaware |

|

001-33057 |

|

76-0837053 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 355 Alhambra Circle |

|

|

| Suite 801 |

|

|

| Coral Gables, Florida |

|

33134 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (305) 420-3200

Not Applicable

Former Name or Former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of Each Class |

|

Name of Exchange on Which Registered |

|

Ticker Symbol |

| Common Stock, par value $0.001 per share |

|

NASDAQ Capital Market |

|

CPRX |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this Chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure |

On January 8, 2024, the Company posted a corporate presentation to its website that representatives of the Company may use from time to time in presentations or discussions with investors, analysts, or other parties.

The information in this Item 7.01, including Exhibit 99.1, is furnished pursuant to Exhibit 7.01 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the limitations of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing. The Company’s submission of this Form 8-K shall not be deemed as an admission as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

Forward-Looking Statements

This Form 8-K, the presentation, and the slide deck contain forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties, which may cause Catalyst’s actual results in future periods to differ materially from forecasted results. A number of factors, including those factors described in the Company’s Annual Report on Form 10-K for the fiscal year 2022 and its other filings with the U.S. Securities and Exchange Commission (“SEC”), could adversely affect the Company. Copies of the Company’s filings with the SEC are available from the SEC, may be found on the Company’s website, or may be obtained upon request from the Company. The Company does not undertake any obligation to update the information contained herein or therein, which speak only as of this date.

| Item 9.01 |

Financial Statements and Exhibits. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

| Catalyst Pharmaceuticals, Inc. |

|

|

| By: |

|

/s/ Richard J. Daly |

|

|

Richard J. Daly |

|

|

President and CEO |

Dated: January 8, 2024

3

NASDAQ: CPRX Dedicated to Making a

Meaningful Difference in the Lives of Patients Suffering from Rare and Difficult to Treat Diseases January 2024 Exhibit 99.1

Safe Harbor This presentation contains

forward-looking statements that are subject to a number of risks and uncertainties, many of which are outside our control. All statements regarding our strategy, future operations, financial position, estimated revenues or losses, projected costs,

prospects, plans, and objectives, other than statements of historical fact included in our filings with the U.S. Securities and Exchange Commission (“SEC”), are forward-looking statements. The language reflected in these statements only

speaks as of the date that appears on the front cover of the presentation; the words “may,” “will,” “could,” “would,” “expect,” “intend,” “plan,”

“anticipate,” “believe,” “estimate,” “project,” “potential,” “continue,” and similar expressions are intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. You should not place undue reliance on forward-looking statements. While we believe that we have a reasonable basis for each forward-looking statement that we make, we caution you that

these statements are based on a combination of facts and factors currently known by us and projections of future events or conditions, about which we cannot be certain. Forward-looking statements in this presentation should be evaluated together

with the many uncertainties that affect our business, particularly those mentioned in the “Risk Factors” section of our Annual Report on Form 10-K filed with the SEC, reporting our financial position and results of operations as of and

for the year ended December 31, 2022, as well as our subsequent reports filed with the SEC. In addition, market and industry statistics contained in this presentation are based on information available to us that we believe is accurate. This

information is generally based on publications that are not produced for purposes of securities offerings or economic analysis. All forward-looking statements speak only as of the date that appears on the front cover of the presentation or the date

of this presentation. Except as required by law, we assume no obligation to update these forward-looking statements publicly or to update the factors that could cause actual results to differ materially, even if new information becomes available in

the future.

Catalyst Pharmaceuticals Commercial

Excellence Strategic Portfolio Expansion Highly Qualified Leadership Team Strong Financial Position Decades of combined industry experience, with extensive expertise spanning neurology, rare disease, and new product launches Demonstrated

success acquiring and integrating high-value, complimentary neurological assets to drive strong and sustained growth Positive cash flow and strong revenue growth enable continued execution against strategic priorities including neurological

portfolio expansion to further drive growth Proven track record commercializing innovative, rare, and best-in-class neurological medicines A Differentiated Growth Rare Disease Company

Growing Revenues with a Diversified

Portfolio Neuromuscular FIRDAPSE® - rare neuromuscular disease AGAMREE® - rare muscular dystrophy disease Epilepsy FYCOMPA® - epileptic seizures Proprietary Portfolio Epilepsy Neuromuscular Product Franchises Focus on Rare

Neurological and Epileptic Disorders Proven U.S. Commercial Capabilities

Neuromuscular Franchise

FIRDAPSE: Proprietary Flagship Product

FIRDAPSE® (amifampridine) Tablets 10mg Flagship product; approved in the U.S. in November 2018 Product launched - Q1 2019 Approved in people ≥6 years of age Orphan Drug Exclusivity through 2025 Strong intellectual property estate

enhances durability IP protection to 2037 Total of 8 patents: 6 Listed in the Orange Book and 2 pending Only U.S. Approved Treatment for Lambert Eaton Myasthenic Syndrome (LEMS) Clinically Proven to Maintain Muscle Strength and Mobility Most

Patients Respond and Remain on Treatment Orally Delivered Potassium Channel Blocker

Lambert Eaton Myasthenic Syndrome

(LEMS) A Rare Neuromuscular Autoimmune Disease Affects Nerve-Muscle Communication May cause: Weakening of upper arms and shoulders muscles Severe, debilitating, and progressive weakness in the upper legs and hips Life-threatening weakness in

respiratory muscles Most affected Sometimes affected Least affected 50% of people with LEMS have underlying cancer Observed in 3% of small cell lung cancer patients Affects both women and men Causes Debilitating, Progressive Muscle Weakness

and Fatigue *O'Neill, J H, Murry, N M, Newson-Davis, J: (1988): The Lambert-Eaton myasthenic syndrome. A review of 50 cases: doi: 10.1093/brain/111.3.577

FIRDAPSE: U.S. LEMS Market Opportunity

Significant Unmet Need >1,100 LEMS-diagnosed patients ever treated with FIRDAPSE 2 ˜800 LEMS patients diagnosed but not yet treated with FIRDAPSE > 2,900 LEMS undiagnosed patients Making A Meaningful Difference In Patients’ Lives

Affects ˜3,600 - 5,600 people (U.S.)1 1 Lambert Eaton Myasthenic Syndrome is Underrecognized in Small Cell Lung Cancer: An Analysis of Real-World Data; presented IASLC 2023 World Conference on Lung Cancer; authors: David Morrell, Benjamin

Drapkin, Guy Shechter, Regina Grebla;2 Includes 225 patients now deceased Expanded educational programs to SCLC LEMS HCP’s 100mg label expansion – assigned PDUFA date of June 4, 2024 Seek to expand global footprint Multiple Growth

Drivers

Many SCLC LEMS patients are

undiagnosed with LEMS and are being treated by oncologists Oncologists typically refer SCLC patients diagnosed with LEMS to neurologists or neuromuscular specialists ~ 1,000 new potential SCLC LEMS patients each year (includes diagnosed and

undiagnosed) FIRDAPSE: Small Cell Lung Cancer Tumor LEMS Patient prevalence Lung Cancer Small Cell Lung Cancer (SCLC) (10% - 15% of Lung Cancer – midpoint 12.5%) Lambert Eaton Myasthenic Syndrome SCLC patients (˜3% of SCLC) Represents a

Significant Growth Opportunity 1,500 400,000 50,000

FIRDAPSE: Expanding the Global

Reach Global Expansion Initiatives Underway Canada Japan *DyDo, our partner in Japan, has submitted their NDA for FIRDAPSE (amifampridine) to the Pharmaceuticals and Medical Devices Agency (“PMDA”). Upon acceptance of the

submission of the NDA for FIRDAPSE in Japan, our territorial rights to develop and market FIRDAPSE under the license agreement with SERB will expand to include key markets in Asia, as well as in Central and South America.

AGAMREE: Novel Corticosteroid

Approved in the U.S. for treatment in DMD patients ≥ 2yrs - October 2023 May increase ambulation duration and mobility, improving QoL Product launch expected in Q1 2024 Optimize neuromuscular franchise capabilities with minimal expansion

Comprehensive Patient Assistance Program available upon launch Orphan drug designation offers 7 years of market exclusivity Pending patents out to 2040 Treatment for Duchenne Muscular Dystrophy (DMD) *Acquired North America* License from Santhera

Pharmaceuticals, July 2023. North American territories consist of the U.S., Canada, and Mexico †Santhera Pharmaceuticals to commercialize in European Union. Germany launch expected 1Q 2024. Potential to Deliver Meaningful Near & Long-term

Value, Adding to Continued Growth Momentum Designations: Orphan Drug Rare Pediatric Disease

AGAMREE: Addresses Need for

Tolerable Steroid Currently treated DMD patients receive concomitant steroid treatment DMD patients treated with corticosteroids at some point DMD diagnosis rate; typically occurs at ages 2 - 5 years ~ 95% ˜ 90% ˜ 70% U.S. DMD patient

prevalence: ˜ 11,000 to 13,000 Proven efficacy, tolerability, safety, and ease of use Equivalent efficacy to prednisone Potential of significant reduction of steroid associated side effect burden when compared with another corticosteroid, with

benefits for: Bone Health Growth Behavior Steroids are the Backbone of DMD Therapy 1Guglieri M et al (2022). JAMA Neurol. 2022;79(10):1005-1014.doi:10.1001/jamaneurol.2022.2480; Mah JK et al (2022). JAMA NetwOpen.2022;

e2144178.doi:10.1001/jamanetworkopen.2021.44178.; Guglieri M et al (2022) JAMA. doi:10.1001/jama.2022.4315;Heier CR et al (2019); Life Science Alliance DOI: 10.26508; Liu X et al (2020). Proc Natl Acad Sci USA 117:24285-24293 AGAMREE

- Compelling Safety Profile In Clinical Studies, Demonstrated1

Epilepsy Franchise

Established, First-in-Class

Commercial Epilepsy Asset FYCOMPA® (perampanel) CIII Synergistic Neurology Expansion Acquired U.S. rights in January 2023 Franchise teams fully engaged - May 2023 Franchise physician call points overlap - 45% Compelling product net revenue

contribution Seek to expand into rare epilepsy or other neuroscience adjacencies

FYCOMPA: Broad Spectrum Efficacy

Only Non-Competitive AMPA Receptor Antagonist Simple once-a-day dosing Long half-life, relieving the anxiety of breakthrough seizures if a dose is missed >70% retention rate for adult patients Seizure-freedom rate is ˜ 72% when used

adjunctively Patent exclusivity until at least May 2025 FYCOMPA has been designated in the U.S. as a federally-controlled substance (CIII). For Full Prescribing Information, including Boxed WARNING for FYCOMPA®, please

visit www.fycompa.com. Well-tolerated, minimal drug-to-drug interactions, and no contraindications

FYCOMPA: Significant Market

Opportunity Epilepsy - High Unmet Medical Need 1England MJ, Liverman CT, Schultz AM, Strawbridge LM, eds. Epilepsy Across the Spectrum: Promoting Health and Understanding. Washington, DC: National Academies Press (US); 2012. 2CDC Epilepsy Data and

Statistics; Epilepsy Prevalence in the US (data as of 2015); 3Examining the Economic Impact and Implications of Epilepsy, AJMC (US); 2020 Epilepsy is 4th most common neurological disorder after migraine, stroke and Alzheimer’s disease1

˜3.4M patients in the U.S. with active epilepsy and ~470K children2 ˜150,000 new patients per year in U.S.3 ˜30 - 40% of all people with epilepsy still fail to respond to treatment despite the availability of a wide variety of

anti-seizure medications Evolving into a precision medicine composed of a variety of well-defined rare epilepsies of genetic origin

Catalyst Pipeline

*FIRDAPSE is currently approved in

the U.S. for the treatment of LEMS in patients 6 years of age and older

Corporate Highlights

Sustained Product Portfolio Growth

Demonstrated Commercial Execution 3Q 22 vs 3Q 23 Net Revenue Performance Q3 22 Q3 23 Q3 22 Q3 23 Q3 22 Q3 23

Q3 2023 Financial Highlights FY

2023 Total Revenue of Between $390M - $395M * Non-GAAP net income excludes from the calculation of net income (i) the expense associated with non-cash stock-based compensation, (ii) non-cash depreciation expense, (iii) non-cash

amortization of intangible assets expense, (iv) the provision (benefit) for income taxes and (v) acquired in-process research & development costs. Non-GAAP financial measures are provided as additional information and not as an alternative to

Catalyst’s financial statements presented in accordance with U.S. generally accepted accounting principles (GAAP). These non-GAAP financial measures are intended to enhance an overall understanding of Catalyst’s current financial

performance. For the Three Months Ended September 30th 2023 2022 % Change Total Net Product Revenues $102,617 $57,173 79.5% FIRDAPSE Net Product Revenues $66,224 $57,173 15.8% FYCOMPA Net Product Revenues $36,393 N/A N/A

GAAP Net Income (Loss) $(30,764) $22,748 (235.2)% Non-GAAP Net Income * $55,870 $28,615 95.2% GAAP Net Income (Loss) Per Share – Diluted $(0.29) $0.20 (242.1)% Non-GAAP Net Income Per Share – Diluted* $ 0.49

$0.26 88.5%

Underscores Successful Execution

(In $ Millions) FY Dec-19 FY Dec-20 FY Dec-21 Cash & Cash Equivalents 55.2 130.0 171.1 Firdapse 100.8 117.6 138.2 Revenue 101.6 118.3 140.7 Strong Financial Position (In Millions) Q3 23 Results Cash Position as of Sept 30, 2023 $121.0

Total Revenues for the three months ended Sept 30, 2023 $102.7 Total Revenue Growth compared to Q3 2022 79.4% Net Product Revenue Growth Increase FIRDAPSE 2023 YTD, as of Sept 30, 2023 23.1% FYCOMPA compared to Q2 2023 5.2%

Continued Drivers to Deliver

Long-Term Value 2023 Accomplishments Anticipated 2024 Milestones Launched inaugural ESG report Continue to pursue synergistic rare CNS opportunities Appointed new CEO and CFO effective 2024 Expanded focus to SCLC patients comorbid with LEMS Pursuing

global expansion of FIRDAPSE as a treatment for LEMS sNDA for 100mg maximum daily dose accepted June 4, 2024: assigned U.S. PDUFA date NDA submission in Japan complete Approximately 10-month PMDA review period in Japan: Submitted by partner DyDo

Pharma Received two new patent allowances Q1 2024: Expect patents to be listed in Orange Book Received FDA approval Q1 2024: Expect U.S. commercial launch Completed U.S. commercial and MSL team integration

Strategic Growth Initiatives Expand

Commercial Footprint Invest in Portfolio Diversification Expand Portfolio in Rare & Orphan Diseases Explore commercial add-on assets both in the U.S. and globally Synergistic expertise to foster innovations Harness operational capabilities and

industry expertise Strong balance sheet reinforces delivering attractive opportunities Well-positioned to achieve long-term growth Seek partnerships to accelerate growth into new therapeutic areas and global markets focused on rare neurological and

epileptic disease opportunities Geographical expansion of our portfolio products Building on the Momentum

NASDAQ: CPRX *Market Cap as of Dec

28, 2023

NASDAQ: CPRX

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

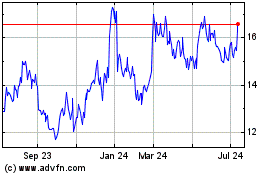

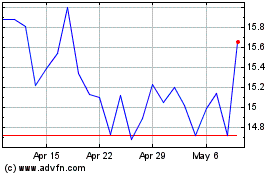

Catalyst Pharmaceuticals (NASDAQ:CPRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Catalyst Pharmaceuticals (NASDAQ:CPRX)

Historical Stock Chart

From Apr 2023 to Apr 2024