January 2024 23andMe Therapeutics EXHIBIT 99.2

2Copyright © 2024 23andMe, Inc. Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the future performance of 23andMe’s businesses in consumer genetics and therapeutics and the growth and potential of its proprietary research platform. All statements, other than statements of historical fact, included or incorporated in this presentation, including statements regarding 23andMe’s strategy, financial position, funding for continued operations, cash reserves, projected costs, plans, database growth, future collaborations, future development of therapeutic programs or products and objectives of management, are forward-looking statements. The words "believes," "anticipates," "estimates," "plans," "expects," "intends," "may," "could," "should," "potential," "likely," "projects," "continue," "will," “schedule,” and "would" or, in each case, their negative or other variations or comparable terminology, are intended to identify forward- looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are predictions based on 23andMe’s current expectations and projections about future events and various assumptions. 23andMe cannot guarantee that it will actually achieve the plans, intentions, or expectations disclosed in its forward-looking statements and you should not place undue reliance on 23andMe’s forward-looking statements. The forward-looking statements contained herein are also subject generally to other risks and uncertainties that are described from time to time in the Company’s filings with the Securities and Exchange Commission, including under Item 1A, “Risk Factors” in the Company’s most recent Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, and as revised and updated by our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. These forward-looking statements involve a number of risks, uncertainties (many of which are beyond the control of 23andMe), or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward- looking statements. Investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made. Except as required by law, 23andMe does not undertake any obligation to update or revise any forward-looking statements whether as a result of new information, future events, or otherwise.

3Copyright © 2024 23andMe, Inc. 23andMe Therapeutics: Genetics Reimagining R&D Our credo: Every Day Matters Forward-thinking expert team Higher probability of success in the clinic Our Value Proposition ● Indication selection informed by lifetime genetic risk based on world’s largest human genotypic & phenotypic data platform ● Genetics (e.g. GWAS, PRS) and biomarkers to optimize target- indication-patient clusters ● Current focus: Oncology Development, Immunology Discovery ● Fast timelines and early kill decisions from discovery through clinical development to approval ● Experienced, innovative genetics researchers and clinical development team with track record for innovative approvals ● Genetics and clinical development scientists to identify higher success programs to bring into the clinic G EN ET IC S

4Copyright © 2024 23andMe, Inc. Using Human Genetics to Create Meaningful Therapeutics for Diseases with High Unmet Need in Oncology and Immunology NEED Creative use of pleiotropy Translational assays to address unmet medical needs Patients SPEED Antibody and protein engineering Pleiotropy informs clinical development and safety POWER Largest human genetics-based discovery platform 1000+ traits World's largest pleiotropy map

The Power of Our Approach

6Copyright © 2024 23andMe, Inc. Largest, most diverse recontactable database of genotyped + phenotyped individuals 23andMe Has the Largest Recontactable Genetic Database for Target Discovery in the World *Publications supporting human genetic evidence for approved drug indications Nelson et al., 2015 (Nature Genetics); King et al., 2019 (PLOS Genetics) ~80% consent to research • Target discovery • Target validation • Patient selection • Clinical trial recruitment Pharma partnerships leverage the database for research and recruitment Leaders in Data 1 As of September 30, 2023.

7Copyright © 2024 23andMe, Inc. 7 “O” Oncology phenotypes Cases BCC 410,104 Bladder 15,663 Brain 4,586 Breast 118,632 Colorectal 25,398 Endometrial 17,912 Esophageal 1,134 Head and Neck 8,596 Kidney' 14,934 Leukemia 13,763 Liver 3,077 Lung 12,367 Melanoma 125,364 Myeloma 7,127 NH lymphoma 17,643 Ovarian 13,044 Pancreatic 2,910 Prostate 71,616 SCC 218,805 Stomach 3,508 Thyroid 27,259Total: 1,133,442 IO phenotypes of interest (examples) 1Biological processes of interest captured in “I” phenotypes, not targeted in the clinic yet Autoimmunity Immune Polarization Atopy Inflammation Chronic Infection Tissue Repair “I” Immune phenotypes Cases Vitiligo 60,701 Alopecia areata 56,233 Hashimoto's 186,069 IBD 116,788 Atopic dermatitis 716,447 Poison oak rash 783,604 Allergy 2,053,011 Food allergy 213,185 Asthma 1,128,292 Tonsillectomy 270,499 Toenail Fungus 276,405 Psoriasis 277,525 Hidradenitis suppurativa 31,008 Lupus 58,414 POWER: Combining Our “I” and “O” Phenotypes Gives Us Broad Statistical Power to Drive Unique Immunological Insights for Oncology Development

8Copyright © 2024 23andMe, Inc. POWER: 23andMe Database Contains >150 Immune Disease Phenotypes With Up To 100s of Novel Genetic Insights Per Disease for Immunology Discovery Skin Respiratory Bowel Disease 23andMe GWAS cases Public GWAS cases 23andMe hits beyond largest public GWAS Asthma 1.1M 65k 716 COPD 83k 36k 171 Atopic dermatitis 716k 84k 399 Psoriasis 278k 19k 319 Severe acne 535k 34k 735 Urticaria 461k 41k 386 Hidradenitis 31k 1.6k 148 Rosacea 352k 73k 421 Alopecia areata 56k 3k 67 Vitiligo 61k 4.7k 75 IBD 117k 60k 54 1 23andMe multi-ancestry meta-analysis GWAS as of October 2023 Drugs with human genetic support are more likely to succeed1 2x-3x Nelson et al., 2015 (Nature Genetics); King et al., 2019 (PLOS Genetics)

9Copyright © 2024 23andMe, Inc. SNPs are tested across the genome and disease associations mapped to specific regions Cases Controls GGCCAGCTGGACGAGG GGCCAGCTGGATGAGG Single Nucleotide Polymorphism (SNP) GWAS = Genome-Wide Association Study SNPs associated with disease found at different frequencies in case vs controls Extensive know-how required to get from association to therapeutic target GWAS: The Initial Foundation for Genome Analysis

10Copyright © 2024 23andMe, Inc. PheWAS: Breadth of Phenotyping Elucidates Critical Disease Drivers TSLP PheWAS • We observe a clear genetic signal linking TSLP to asthma • We do not observe signals in phenotypes that would point to safety issues • Amgen clinical trials of anti-TSLP mAb as eczema target failed. We do not observe a statistically significant genetic signal linking TSLP to eczema • We observe a strong genetic signal linking TSLP to eosinophilic esophagitis → potential indication expansion in a rare disease 23andMe runs GWAS in >1,000 phenotypes PheWAS (Phenome-Wide Association Study) captures pleiotropic effects of genetic variants and points to possible unwanted toxicities or potential indication expansions

11Copyright © 2024 23andMe, Inc. ~15 months ~26 months N~150 HR~0.62 Phase 3 trial failure → Withdrawal of triple-negative breast cancer indication Atezo (PD-L1) + Chemotherapy Germline genetic score (PRS) for hypothyroidism risk separates survival probability N~900 HR~0.84 PMID: 30345906; PMID: 34099659 POWER: Immune Genetics Implemented as an IO Clinical Biomarker

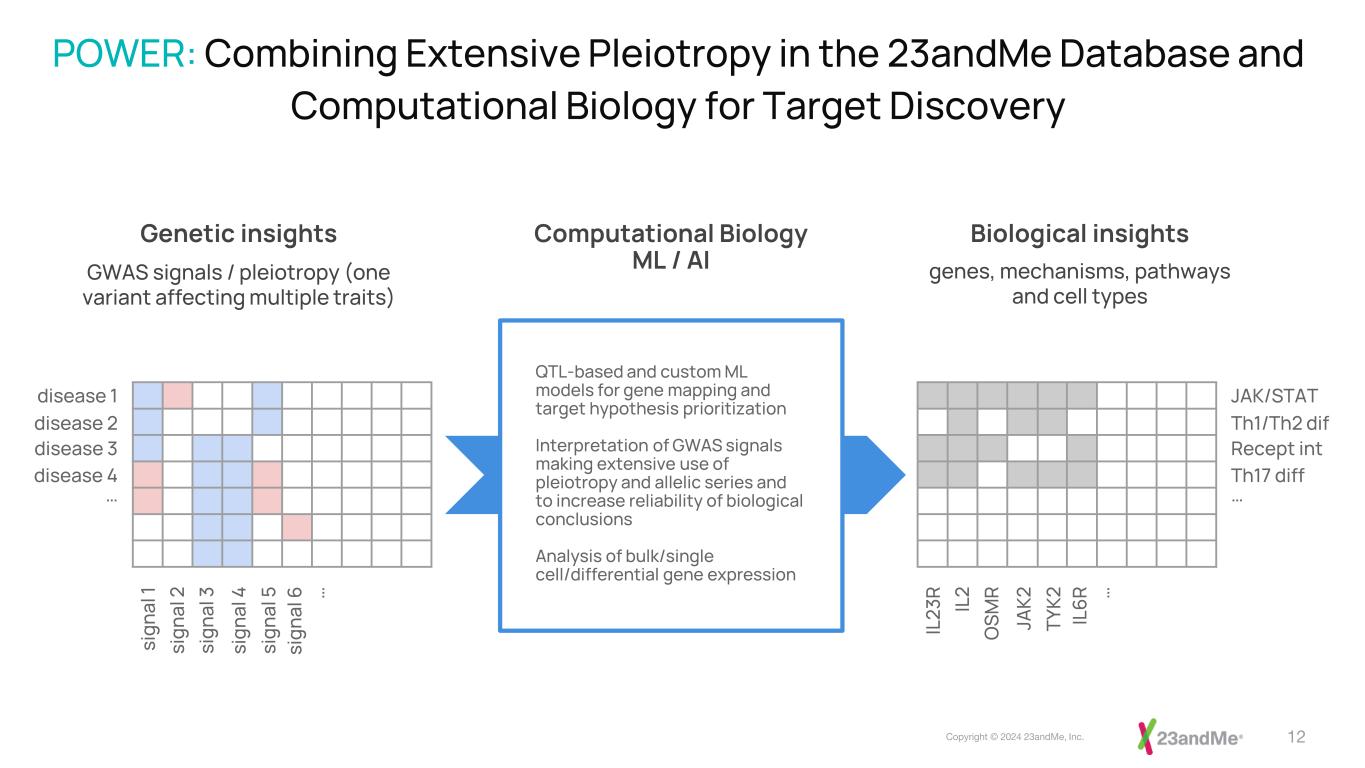

12Copyright © 2024 23andMe, Inc. QTL-based and custom ML models for gene mapping and target hypothesis prioritization Interpretation of GWAS signals making extensive use of pleiotropy and allelic series and to increase reliability of biological conclusions Analysis of bulk/single cell/differential gene expression POWER: Combining Extensive Pleiotropy in the 23andMe Database and Computational Biology for Target Discovery Computational Biology ML / AI Biological insights genes, mechanisms, pathways and cell types Genetic insights GWAS signals / pleiotropy (one variant affecting multiple traits) si gn al 1 si gn al 2 si gn al 3 si gn al 4 si gn al 5 si gn al 6 … disease 1 … disease 2 disease 3 disease 4 IL 23 R IL 2 O SM R JA K2 TY K2 IL 6R … JAK/STAT … Th1/Th2 dif Recept int Th17 diff

Utilizing the World’s Largest Human Pleiotropy Map to Address Unmet Medical Need

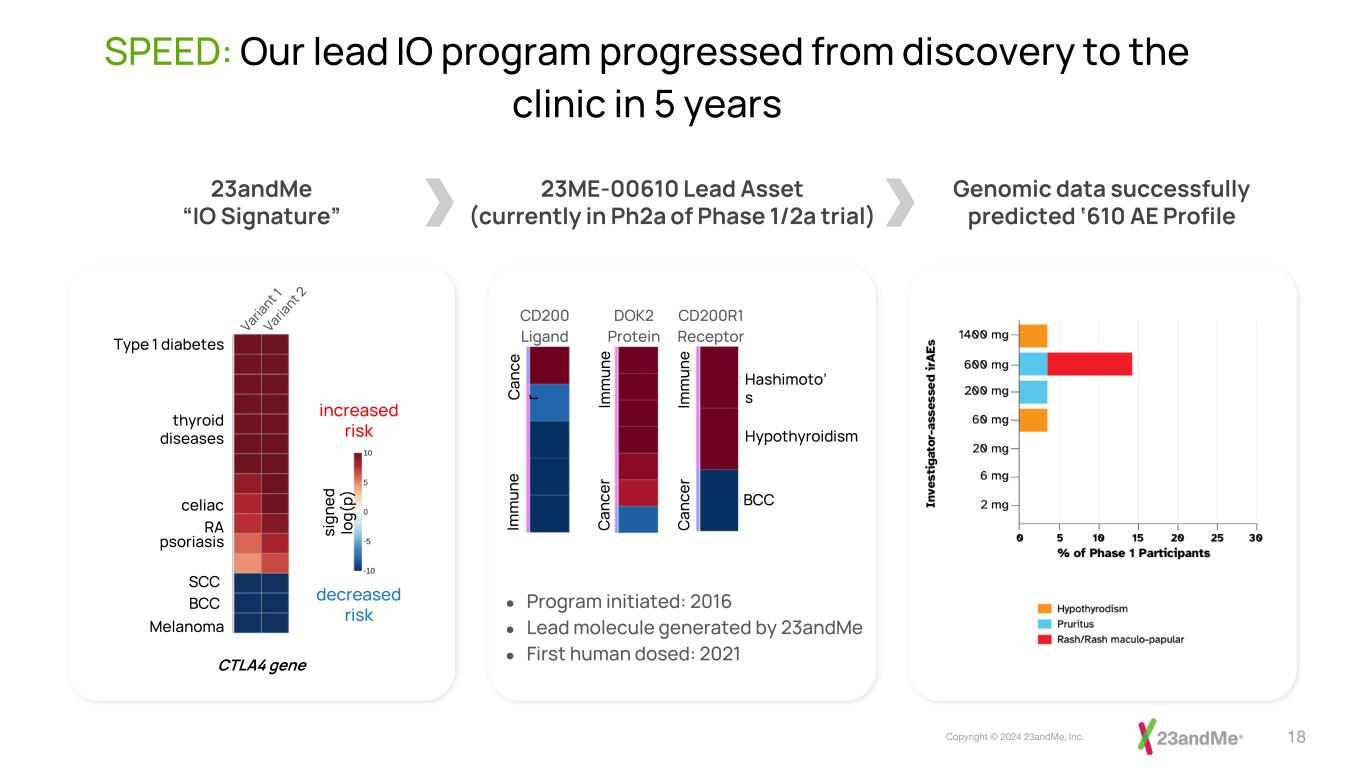

14Copyright © 2024 23andMe, Inc. Genomic data successfully predicted ‘610 AE Profile 23ME-00610 Lead Asset (currently in Ph2a*) 23andMe “IO Signature” Type 1 diabetes thyroid diseases celiac RA psoriasis SCC increased risk decreased risk si gn ed lo g( p) CTLA4 gene BCC Melanoma NEED: Our Unique Approach to De-risk Development: Leveraging Pleiotropy to Characterize Novel Cancer Targets *Currently in Phase 2a portion of Phase 1/2a

15Copyright © 2024 23andMe, Inc. NEED: Our FxG Efforts Leverage Pleiotropy to Identify Targets in Defined Areas of Medical Need in Asthma Barrier function Cell composition & mucin production Eczema GWAS 23andMe Asthma & COPD GWAS Validated targets with pharmacologically meaningful effects in disease relevant assays Bulk and single-cell RNA-seq Gene Editing 23andMe genetics In vitro functional genomics Disease-relevant readouts

Progression of Therapeutics at Speed

17Copyright © 2024 23andMe, Inc. SPEED: Our In-House Expertise in Antibody and Protein Engineering Enables Rapid Therapeutic Generation Protein engineering and biochemistry Antibody discovery and optimization Antibody formats and Fc engineering ● Experienced Antibody and Protein Engineering group ● Deep experience in protein engineering, biochemistry, structural biology, enabling diverse approaches to antibody discovery, antibody engineering, and automation M13 Phage610 Fab hCD200R1 NGS/Automation

18Copyright © 2024 23andMe, Inc. Type 1 diabetes thyroid diseases celiac RA psoriasis SCC increased risk decreased risk si gn ed lo g( p) CTLA4 gene BCC Melanoma SPEED: Our lead IO program progressed from discovery to the clinic in 5 years Im m un e C an ce r CD200 Ligand DOK2 Protein C an ce r Im m un e CD200R1 Receptor Im m un e C an ce r BCC Hashimoto’ s Hypothyroidism Genomic data successfully predicted ‘610 AE Profile 23ME-00610 Lead Asset (currently in Ph2a of Phase 1/2a trial) 23andMe “IO Signature” ● Program initiated: 2016 ● Lead molecule generated by 23andMe ● First human dosed: 2021

23andMe Therapeutics: Clinical Development

20Copyright © 2024 23andMe, Inc. Maike Schmidt, PhD Sr Group Head, Translational Sciences Jennifer Low, MD, PhD Head of Development Dylan Glatt, PhD Sr Clinical Pharmacologist, 23ME-00610 PTL Experienced Clinical Development Leadership Jyseleca (filgotinib)Avastin (bevacizumab) Tecentriq (atezolizumab) Erivedge (vismodegib) Vitrakvi (larotrectinib) Zelboraf (vemurafenib) Cotellic (cobimetinib)

21Copyright © 2024 23andMe, Inc.Note: ‘610 is in Phase 1/2a as of January 2024. 23andMe Therapeutics IO Pipeline: First-in-Class Potential Target Discovery 23ME’610 anti-CD200R1 Solid tumors, clinical stage, IO effectorless mAb Solid tumors, IO effector-enhanced mAb 23ME’1473 anti-ULBP6 Lead Optimization IND Enabling Phase 1 Phase 2 Phase 2a* 23ME’610/anti-CD200R1 ● Targets Innate and Adaptive Immunity ● Potent Ab with great PK/PD ● Phase 1 monotx with on-target AEs ● Ph2a data expected to be presented mid- 2024 23ME’1473/anti-ULBP6 ● Activator of tumor NK cells ● Effector-enhanced Ab with dual NK- activating MOA

23ME-00610* Anti-CD200R1 Antibody for Hard-to-Treat Solid Tumors Phase 1/2a *Wholly owned; development ongoing in multiple relapsed/refractory solid tumors (including neuroendocrine and ovarian)

23Copyright © 2024 23andMe, Inc. Potential activity in >60% of current patients not deriving efficacy from PD-(L)1 inhibitors Patients + Caregivers DESPERATELY seeking survival Lilly’s Ucenprubart: Clinical POC for CD200/R1 agonism in immune disease CD200/R1 is a dominant immune checkpoint* *PMIDs: 12960329, 23602662, 22264927, 19786546, 15557172, 22491458, 15220441, 34326171, 18081533, 24388216, 11099416 Addressing Critical Unmet Need in Solid Tumors ‘610 Development Rationale CD200 CD200R1 Highly expressed on tumor, stromal, and endothelial cells Restricted immune expression: myeloid > T > B Targeted by samalizumab for CLL and MM, failed to achieve target saturation* 23ME-00610 (‘610) is first-in-class *PMID: 31443741; https://investor.lilly.com/static-files/9efbede9-bd6a-4d7b-823e-2996b1c2d114

24Copyright © 2024 23andMe, Inc. ‘610 Activates T-cell Function by Blocking the CD200R1 Checkpoint *CD200-expressing cell types include tumor, stroma and endothelial IFN, interferon; IL, interleukin ● Subnanomolar affinity ● Kills tumor cells in vitro ● Anti-tumor activity in vivo ● Potential for monotherapy ○ activity on huPBMCs that do not respond to PD-1 antibody ● Potential for combination ● Well tolerated up to 1400 mg ● PK supports Q3W (or better) ● Promising therapeutic index, projected dose ≥ ~600 mg ● Monotherapy dev ongoing ○ Further expansion in NE and OC for safety, PK, PD and dose selection ● Indication CDPs and TPPs ‘610 Primary Pharmacology* ‘610 Clinical Development* * PMID: 37288324 * Rasco, et al., 2023, SITC Annual Meeting #619; Glatt, et al., 2023 SITC Annual Meeting #609 23ME-00610 (‘610), a Fully Humanized, Effectorless IgG1, Inhibits Immunosuppressive Signaling via High Affinity Binding to CD200R1

25Copyright © 2024 23andMe, Inc.Rasco, D, et al., 2023, SITC Annual Meeting #619 May 15, 2023 data cut-off date. Stable disease rate across ALL Phase 1 patients is 52% with median duration of 18.6 weeks ‘610 Phase 1 Results: Dose Escalation Duration of Treatment

26Copyright © 2024 23andMe, Inc.Rasco, D, et al., 2023, SITC Annual Meeting #619 ● 23ME-00610 treatment was well tolerated ● 19% reduction in target lesions at Week 24 and Week 40 assessment ● 58% size reduction in longest dimension of paratracheal lesion ● Patient continues on study drug at Cycle 13 with stable disease at time of data cutoff (May 2023) ‘610 Preliminary Clinical Activity in Neuroendocrine Cancer

27Copyright © 2024 23andMe, Inc. Q1 Q2 Q3 Q4 Q1^ Q2^ Q3 Q4 Q1 Q2 Q3 Q4 Q1 2023 2025 2026 ccRCC NE OV TMB-H/MSI-H 1400 mg SCLC OV NE 600 mg First Efficacy Assess. First Efficacy Assess. First Efficacy Assess. First Efficacy Assess. First Efficacy Assess. First Efficacy Assess. First Efficacy Assess. 6-mo PFS/OS 6-mo PFS/OS 6-mo PFS/OS 6-mo PFS/OS 6-mo PFS/OS 12-mo PFS/OS 12-mo PFS/OS 12-mo PFS/OS 12-mo PFS/OS 12-mo PFS/OS N=15 in each cohort Enrolling Fully Enrolled 6-mo PFS/OS 6-mo PFS/OS 12-mo PFS/OS 12-mo PFS/OS Safety: N= ≤ ~100 pts Efficacy: N= ≤ ~75 pts Safety: N= ≤ ~110 pts Efficacy: N= ≤ ~90 pts Safety in Phase 2a Population Efficacy in Phase 2a Population‘610 Phase 2a Data: Estimated Timeline* 2024 Safety: N= ≤ ~90 pts Efficacy: N= ≤ ~60 pts Safety: N= ~55-60 pts Efficacy: N= ~25-30 pts 140 g ccRCC = clear cell renal cell carcinoma OV = ovarian cancer (predominantly non-clear cell histology) NE = neuroendocrine First Efficacy Assess = ie., Preliminary ORR, patients continue to be scanned TMB-H/MSI-H = tumor mutational burden / microsatellite instability high tumors SCLC = small cell lung cancer (extensive stage) *Part of the Phase 1/2a clinical study of ‘610. Strictly estimated dates for discussion purposes only. Based on calendar year. Subject to change. ^Genotyping, tumor (archival) CD200/R1 IHC, tumor RNAseq, and pre/on-treatment tumor immunophenotyping exploratory analyses to identify potential correlates with activity

28Copyright © 2024 23andMe, Inc. PBMCs from each respective patient were incubated with 100 nM of 23ME-00610, anti–PD-1, or isotype control. Cells were stimulated with SEB. IFNγ levels were determined by enzyme-linked immunosorbent assay. Mean biologic triplicates were normalized to isotype control. * p-value<=0.05 compared to control PBMC, peripheral blood mononuclear cell; PD-1, programmed death–1; SEB, staphylococcal enterotoxin B. * * ** * * * * Blocking the CD200R1 pathway enhanced IFNγ production from SEB-stimulated PBMCs compared to isotype control and anti-PD1 in the majority of samples tested ‘610 Differentiation: Inhibition of CD200R1 Has the Potential to Address Resistance to Anti–PD1 Therapies

29Copyright © 2024 23andMe, Inc. • Preliminary data from ex-vivo combination of anti-PD-1 and anti-CD200R1 blockade increased IFNy (interferon-gamma) secretion from primary human T-cells 2 ug/mL per antibody. Representative data from one of four donors tested. Statistics: Ordinary one- way ANOVA with Tukey’s multiple comparisons test, **p<0.01, ****p<0.0001 ‘610 Differentiated Combo Potential: Anti-CD200R1 with Anti-PD-1 Potentially Enhances Immune Activation *23andMe internal data

30Copyright © 2024 23andMe, Inc. ● Complete enrollment of Phase 2a Dose Expansion Cohorts ○ Recently expanded Neuroendocrine, Ovarian cohorts ○ Initial Phase 2a data cohorts planned to be presented mid-2024 ○ Clinical development planning for Fast-to-Market strategies ○ Potential clinical combinations with assets with complementary mechanisms, to support earlier line indications ● Seeking partnerships to expand Phase 2a and conduct randomized Phase 2b/3 clinical trials – multiple readouts expected in 2024 ‘610 Next Steps

23ME-01473 Genetically validated NK Cell Activator (Anti-ULBP6) Antibody for [Metastatic] Solid Tumors

32Copyright © 2024 23andMe, Inc. 4Wang, et al., CLN-619 ASCO 2023 ULBP6 inhibition could benefit patients in broad range of tumor types with neoantigen loss Dual MOA achieves synergistic NK activation and tumor cell killing 23andMe developed major methodological improvements to targeting ULBP6 Tumor type Tumor ULBP6 Soluble ULBP6 Loss of antigen presentation1 HNSC2 +++ Under CDA ++ CESC3 +++ Under CDA +++ Additional tumor types under CDA +++ Under CDA +++ 1Dhatchinamoorthy et al., Front Immunol 2021 MOA1 NKG2D activation MOA2 NKG2D activation + ADCC = 23ME-01473 Effector enhanced MOA 1 MOA 2 Effector enhanced Fc External clinical validation: Monotherapy activity observed in NKG2D pathway activator (related mechanism) with complete and partial responses at a tolerable dose in early phase clinical trial4 23andMe ‘1473 targets the highest affinity NKG2D ligand with a tumor cell killing-enhanced antibody Targeting NK cells and NKG2D shows clinical promise 23ME’1473: Tumor Cell Killing-Enhanced Antibody Targets Major Resistance Mechanisms Hampering Immune Oncology 2HNSC, Head and Neck Squamous Cancer; 3CESC, Cervical Squamous Cell Cancer

33Copyright © 2024 23andMe, Inc. ADCC increases tumor cell killing 23ME-01473 Effector enhanced anti-ULBP6 Effector attenuated Isotype Effector enhanced CTRl NKG2D activation NKG2D activation + ADCC Green (GFP) Tumor Cells Immune cells 23ME-01473 Cytotoxic mediators MOA 1 MOA 2 MOA1 MOA1+2 ‘1473 Dual MOA: Effector Enhanced Antibody Binds to Tumor Cell Surface ULBP6/2/5 to Bolster NK Cell Antitumor Activity via ADCC

23andMe Therapeutics: Target Discovery

35Copyright © 2024 23andMe, Inc. Bill Richards Head of Therapeutics Discovery Patrick Collins Director, Functional Genomics Experienced Discovery Leadership Vladimir Vacic Research Fellow, Computational Biology Germaine Fuh Senior Director Antibody & Protein Engineering Antony Symons Senior Director Immunology & Inflammation Insights from the 23andMe database Computational Biology Functional Genomics Antibody Engineering Experienced team that delivered genetics-based targets from discovery to the clinic Immunology / Discovery Biology

36Copyright © 2024 23andMe, Inc. Hypothesis: loci associated with related phenotypes prioritize biologies not addressed by standard of care eczema >500 loci genetic determinants of allergy/T2 inflammation urticaria >300 loci genetic determinants of mast cell pathology neuro- inflamm >500 loci genetic determinants of airway hyper-reactivity COPD >200 loci genetic determinants of obstructive airway disease Leveraging Pleiotropy to Expand Airway Target Space sensory neuron biology: screen in iPSC-derived neuron models epithelial biology: screen mucociliary function in ALI culture mast cell biology: screen in IgE dependent & independent assays T2 cytokine biology: deprioritize or develop SM/inhaled modality asthma >600 loci Pleiotropy + functional genomics = best targets -+ + +

37Copyright © 2024 23andMe, Inc. Sequencing individuals from the tail ends of the polygenic risk score (PRS) distribution for whom the actual disease status does not match predictions Strategic Sequencing Based on Polygenic Risk Scores cases controls selected for sequencing Legend: Discovery of genes harboring rare variants of large effect

38Copyright © 2024 23andMe, Inc. FxG in Respiratory Disease & Beyond Cell type Disease opportunities* Macrophage Broad immune: skin, lung, GI Mast cells Urticaria, allergy, RA, eczema Fibroblasts Fibrosis, lung, skin, RA, IPF T cell Broad immune: skin, lung, GI Sensory Neurons Respiratory, IBD, eczema Endothelial cells RA, sarcoidosis, IBD, PAH Airway Smooth Muscle Asthma, COPD, PAH Dendritic cell Broad autoimmune: T1D, Graves Keratinocytes Skin

39Copyright © 2023 23andMe, Inc.PROPRIETARY AND CONFIDENTIAL