false

0001669400

0001669400

2023-12-31

2023-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 31, 2023

| Veritas

Farms, Inc. |

| (Exact

name of registrant as specified in charter) |

| Nevada |

|

333-210190 |

|

90-1254190 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 401

E. Las Olas Boulevard, Suite

1400 Fort

Lauderdale, FL |

|

33301 |

| (Address of principal

executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (833) 691-4367

| |

| (Former name or former

address, if changed since last report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act: None

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As used in this Current Report on Form 8-K, and

unless otherwise indicated, the terms “the Company,” “Veritas Farms,” “we,”

“us” and “our” refer to Veritas Farms, Inc. and its subsidiary.

Item 1.01 Entry into a Material Definitive Agreement.

Credit Line

On December 31, 2023, Veritas Farms, Inc. (the

“Company”) issued a secured convertible credit line promissory note in the principal amount for up to $3,000,000 (the “December

2023 Secured Convertible Promissory Note”), to the Cornelis F. Wit Revocable Living Trust (the “Wit Trust”), a principal

shareholder who holds securities of the Company that constitute a majority of the voting securities of the Company. The December 2023

Secured Convertible Promissory Note is secured by the Company’s assets and contains certain covenants and customary events of default,

the occurrence of which could result in an acceleration of the December 2023 Secured Convertible Promissory Note. The December 2023 Secured

Convertible Promissory Note is convertible as follows: aggregate loaned principal and accrued interest under the December 2023 Secured

Convertible Promissory Note may, at the option of the holder, be converted in its entirety into shares of our common stock at a conversion

price of $0.02 per share. The Note will accrue interest on the aggregate amount loaned at a rate of 10% per annum. All unpaid principal,

together with any then unpaid and accrued interest and other amounts payable under the December 2023 Secured Convertible Promissory Note,

is due and payable if not converted pursuant to the terms and conditions of the December 2023 Secured Convertible Promissory Note on

the earlier of (i) January 01, 2027, or (ii) following an event of default.

The foregoing summary of the December 2023 Secured

Convertible Promissory Note does not purport to be complete and is qualified in its entirety by reference to the full text of the December

2023 Secured Convertible Promissory Note attached hereto as Exhibit 10.1.

Second Amendment to Previously Issued and

Outstanding Secured Convertible Promissory Note

On December 31, 2023, the Company and the Wit

Trust entered into an Second Amendment to Secured Convertible Promissory Note originally signed October 21, 2021, which was then amended

and restated March 9, 2022, pursuant to which the Company and the Wit Trust amended the Secured Convertible Credit Line Promissory Note

in order to extended the maturity date of the Secured Convertible Credit Line Promissory Note from October 1, 2024 to January 1, 2027.

The foregoing summary of the Second Amendment

to Secured Convertible Promissory Notes does not purport to be complete and is qualified in its entirety by reference to the full text

of the Second Amendment to Secured Convertible Promissory Note attached hereto as Exhibit 10.2.

Item 2.03 Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure set forth under Item 1.01

of this Current Report on Form 8-K with respect to the issuance of the December 2023 Secured Convertible Promissory Note is incorporated

herein by reference.

Item 3.02. Unregistered Sale of Equity Securities.

The disclosure set forth

under Item 1.01 of this Current Report on Form 8-K with respect to the issuance of the December 2023 Secured Convertible Promissory

Note is incorporated by reference into this Item 3.02. The December 2023 Secured Convertible Promissory Note issued to the investor was

offered and sold in a transaction exempt from registration under the Securities Act of 1933, as amended, in reliance on Section 4(a)(2)

thereof.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: January 5, 2024 |

VERITAS

FARMS, INC. |

| |

|

|

| |

By: |

/s/

Thomas E. Vickers |

| |

|

Thomas

E. Vickers, Interim Chief Executive Officer |

3

Exhibit 10.1

SECURED CONVERTIBLE CREDIT LINE PROMISSORY NOTE

| US $3,000,000.00 |

December 31, 2023 |

| |

Fort Lauderdale, Florida |

FOR VALUE RECEIVED, Veritas

Farms, Inc. with a current principal office address of 401 E. Las Olas Blvd, STE 1400, Fort Lauderdale, FL 33301 (the “Maker”),

agrees and promises to pay to the order of the Cornelis F. Wit Revocable Living Trust, its successors and/or assigns (the “Holder”)

at the Holder’s address, or such other place as designated in writing by the Holder of this Secured Convertible Credit Line Promissory

Note (“Promissory Note”), the principal sum of THREE MILLION Dollars (US $3,000,000.00) (“Maximum Principal Amount Committed”)

or such lesser amount as shall equal the aggregate unpaid principal amount of all funds loaned by the Holder to the Maker in accordance

with the terms of this Promissory Note, with interest (“Interest”) on the aggregate amount loaned at a rate of 10% per annum.

The Maker may, from time to time, borrow under the terms of this Promissory Note up to but not exceeding the Maximum Principal Amount

Committed of this Promissory Note in increments of Two Hundred and Fifty Thousand Dollars ($250,000.00) at any time prior to the Maturity

Date (as defined herein), upon delivery to Holder of a Draw Notice (the form of which is attached hereto as Exhibit A) for such amount.

This Promissory Note includes

and evidences the following outstanding indebtedness of Maker to Holder pursuant to previously executed and delivered secured convertible

promissory notes by Maker for the benefit of the Holder:

| a. | Accrued interest in the amount of seven hundred and fifty thousand dollars ($750,000.00) relating to the

Secured Convertible Credit Line Promissory Note dated October 12, 2021 as amended on March 9, 2022 and December 31, 2023. |

All unpaid principal (“Principal”),

together with any then unpaid and accrued Interest and other amounts payable hereunder, shall be due and payable by Maker to Holder, if

not converted pursuant to the terms and conditions of this Promissory Note, on the earlier of (i) January 1, 2027, or (ii) following an

Event of Default (as defined below) (such date, the “Maturity Date”). All payments due hereunder shall be paid in lawful money

of the United States of America which shall be legal tender in payment of all debts, in immediately available funds, without offset, deduction

or recoupment. Any payment by check or draft shall be subject to the condition that any receipt issued therefore shall be ineffective

unless the amount due is actually received by the Holder. Each payment shall be applied first to the payment of all costs, fees and expenses

incurred by or payable to the Holder in connection with the collection or enforcement of this Promissory Note; second, to the payment

of all accrued and unpaid Interest hereunder; and third, to the payment of the unpaid Principal amount.

The proceeds of this Promissory

Note shall be used by the Maker for working capital.

As collateral security for

payment of the obligations under this Promissory Note, the Maker and the Holder have agreed that all obligations hereunder will be secured

by all the assets of the Maker, and Maker hereby grants to Holder a security interest and lien in all of Maker's assets, wherever located,

whether tangible or intangible, now existing, or hereafter acquired.

Optional Conversion. At any

time prior to the Maturity Date, a portion or all of the outstanding Principal amount of this Promissory Note, together with a portion

or all accrued but unpaid Interest hereunder (the “Outstanding Balance”), is convertible into shares of common stock of the

Maker (“Common Stock”), at the option of the Holder at a conversion price (“Conversion Price”) of two cents ($0.02)

per share of Common Stock.

Mechanics of Conversion. In

order to convert the Outstanding Balance, Holder shall deliver to the Maker a written Election to Convert (the form of which is attached

hereto as Exhibit B). Upon receipt of the written Election to Convert, the Maker shall issue and cause to be delivered with all reasonable

dispatch to or upon the written order of the Holder, and in such name or names as the Holder may designate, certificate(s) evidencing

the full number of Common Stock so purchased upon conversion of the Promissory Note. Such Common Stock shall be deemed to have been issued

and any person so designated to be named therein shall be deemed to have become a holder of record of such securities as of the date of

delivery of the Election to Convert, notwithstanding that the certificate(s) representing such securities shall not actually have been

delivered or that the securities transfer books of the Maker shall then be closed.

In the event that the outstanding

shares of Common Stock of the Maker hereafter is restructured or revised by recapitalization, reclassification, combination, split or

split-up or dividend, the aggregate number and kind of shares of Common Stock subject to conversion under this Promissory Note shall be

adjusted appropriately, both as to the number of shares of Common Stock and the Conversion Price. No fractional share of Common Stock

will be issued upon conversion, but any fractional share of Common Stock will be rounded up to the nearest whole share of Common Stock.

In case of any sale exchange,

tender offer, redemption or buyout of the Maker’s Common Stock, or any consolidation of the Maker with or merger of the Maker into

another corporation, or in case of any sale, transfer or lease to another corporation of all or substantially all other property of the

Maker, the Maker or such successor or purchasing corporation, as the case may be, shall execute with the Holder an agreement that the

Holder shall have the right thereafter, upon payment of the Conversion Price in effect immediately prior to such action, to convert this

Promissory Note, on the same basis which it would have or have been entitled to receive after the happening of such consolidation, merger,

sale, transfer or lease had such conversion been accomplished immediately prior to such action. Such agreement shall provide for adjustments,

which shall be as nearly equivalent as may be practicable to the adjustments provided herein. These provisions shall similarly apply to

successive consolidations, mergers, sales, transfers or leases.

This Promissory Note may be

prepaid at any time prior to the Maturity Date after providing the Holder with five (5) days notice of the Maker’s intent to process

the prepayment.

The occurrence of any of the

following shall constitute an “Event of Default” under this Promissory Note (each, an “Event of Default”): (a)

Maker shall fail to pay any Principal or Interest when due and payable hereunder; or (b) Maker shall fail to deliver the Common Stock

or recognize the Holder as a holder of record of such shares of Common Stock as of the date of delivery of the Election to Convert in

accordance with the terms hereof; or (c) a receiver, trustee or other similar official shall be appointed over Maker; or (d) Maker shall

make a general assignment for the benefit of creditors; or (e) Maker shall file a petition for relief under any bankruptcy, insolvency

or similar law; or (f) an involuntary proceeding shall be commenced or filed against Maker; or (g) Maker shall default or otherwise fail

to observe or perform any covenant, obligation, condition or agreement of Maker contained herein; or (h) any representation, warranty

or other statement made or furnished by or on behalf of Maker to Holder herein shall be false, incorrect, incomplete or misleading; or

(i) any lawsuit, money judgment, writ or similar process shall be entered or filed against Maker or any subsidiary of Maker or any of

its property or other assets for more than $100,000.00, unless otherwise consented to by Holder.

While an Event of Default

exists, the Maker hereby promises to pay Interest on the unpaid balance of this Promissory Note then outstanding at the rate representing

eighteen percent (18%) per annum or the highest rate allowed by law, whichever is lower, from the date of the Event of Default to until

and including the date actually paid. It is the intent of parties hereto that in no event shall the amount of Interest due or payment

in the nature of interest payable hereunder exceed the maximum rate of interest allowed by applicable law, as amended from time to time,

and in the event any such payment is paid by the Maker or received by Holder, then such excess sum shall be credited as a prepayment of

Principal, unless the Maker shall notify the Holder, in writing, that the Maker elects to have such excess sum returned forthwith.

This Promissory Note shall

not be modified except by an instrument in writing signed by the party against whom enforcements of such modification is sought. This

Promissory Note shall be governed and construed in accordance with the laws of the State of Florida, without regard to conflict of laws

or principles thereof. Any suit or proceeding relating to this Promissory Note shall be brought or instituted only in a court of competent

jurisdiction in Broward County, Florida. No waiver by the Holder of any default hereunder shall be deemed to constitute a waiver of any

subsequent default. No exercise of any right or remedy hereunder shall preclude the exercise of any other right or remedy. The Maker agrees

to pay or reimburse the Holder for all costs and expenses of enforcing and preserving its rights under this Promissory Note or any document

or instrument executed in connection herewith (including reasonable attorneys’ fees and costs, whether in or out of court, in original

or appellate proceedings or in bankruptcy).

The Maker and all others who

may become liable for the payment hereof jointly and severally: (a) waive presentment for payment, demand, notice of demand, notice of

non-payment or dishonor, protest and notice of protest of this Promissory Note, and all other notices in connection with the delivery,

acceptance, performance, default, or enforcement of the payment of this Promissory Note, (b) consent to all extensions of time, renewals,

postponements of time of payment of this Promissory Note, waivers or other modifications hereof from time to time prior to or after the

Maturity Date hereof, whether by acceleration or in due course, without notice, consent or consideration to any of the foregoing, (c)

agree to any substitution, exchange, addition or release of any party or person primarily or secondarily liable hereon, and (d) agree

that, notwithstanding the occurrence of any of the foregoing (except by the express written release by Holder), the Maker shall be and

remain directly and primarily liable for all sums due under this Promissory Note.

All issue taxes, documentary

stamp taxes, or other taxes (if any) required by law at any time to be affixed to this Promissory Note shall be paid by the Maker. The

Maker agrees to indemnify and hold the Holder, its affiliates, successors and assigns harmless from and against the aggregate of all expenses,

losses, costs, deficiencies, liabilities, penalties, fines, fees and damages (including related reasonable counsel and paralegal fees

and expenses) incurred or suffered by the Holder arising out of or resulting from the Maker’s failure to pay such documentary stamp

or other tax.

IN

WITNESS WHEREOF, the Maker has duly executed this Promissory Note as of the day and year first above written.

| |

Maker |

| |

Veritas Farms, Inc. |

| |

|

|

| |

By: |

/s/ Thomas E Vickers |

| |

|

Thomas E. Vickers |

| |

|

Chief Executive Officer |

| |

Holder |

| |

Cornelis F. Wit Revocable Living Trust |

| |

|

|

| |

By: |

/s/ Cornelis F. Wit |

| |

|

Cornelis F. Wit, Trustee |

Exhibit A

DRAW NOTICE

Cornelis F. Wit Revocable Living Trust

Via Email: CFWit@StackFinancialinc.com

The undersigned, Veritas Farms,

Inc. (the “Maker”), pursuant to the provisions of the Secured Convertible Credit Line Promissory Note (the “Promissory

Note”) dated December 31, 2023 by the Maker and agreed to by the Cornelis F. Wit Revocable Living Trust (the “Holder”),

wherein the Holder agreed and committed to loan Maker up to Three Million Dollars ($3,000,000.00) pursuant to the terms of the Promissory

Note, and to date has loaned $_____________ to the Maker, hereby exercises its right to draw down and borrow, and hereby draws down ______________________________

($____________) under the terms of the Promissory Note. Payment is requested to be received from the Holder within three (3) business

days of the date of this Draw Notice.

| Dated: __________________ |

|

| |

|

| Veritas Farms, Inc. |

|

| |

|

|

| By: |

|

|

| Name: |

|

|

| Title |

|

|

Exhibit B

FORM OF ELECTION TO CONVERT

The undersigned, Cornelis F. Wit Revocable Living Trust (the “Holder”),

the holder of the attached Secured Convertible Credit Line Promissory Note dated December 31, 2023 (“Promissory Note”) from

Veritas Farms, Inc. (“Maker”), hereby irrevocably elects to exercise its right to convert $_____________ of the Promissory

Note into shares of Common Stock of Veritas Farms, Inc. a Nevada corporation, as more fully described in the Promissory Note, and requests

that the documentation evidencing such securities be issued in the name of, and delivered to, __________________________________________,

whose address is __________________________.

| Dated: |

|

|

| |

|

| Holder |

|

| |

|

| |

|

| |

|

| |

|

| Signature |

|

| |

|

| Name |

|

|

|

| Title |

|

| |

|

| (Signature must conform in all respects to name of

Holder as specified in the Promissory Note) |

|

| |

|

| |

|

| (Insert Social

Security or Federal Tax I.D. Number of Promissory Note Holder) |

|

5

Exhibit 10.2

SECOND AMENDMENT TO

SECURED CONVERTIBLE CREDIT LINE PROMISSORY

NOTE

| US $3,000,000.00 |

December 31, 2023

Fort Lauderdale, Florida |

THIS SECOND AMENDMENT TO SECURED

CONVERTIBLE CREDIT LINE PROMISSORY NOTE (“Note”) is effective as of this 31st day of December, 2023, by and between Veritas

Farms, Inc., a Nevada corporation, having its principal place of business at 401 E Las Olas, Suite 1400, Fort Lauderdale, Florida 33301

(“Maker”), and the Cornelis F. Wit Revocable Living Trust, having an address at 646 Osprey Point Circle, Boca Raton, Florida

33431 (together with its successors and assigns, “Holder”).

RECITALS

WHEREAS, on October 12, 2021, Holder and Maker

entered into a Secured Convertible Credit Line Promissory Note dated October 12, 2021, in the principal amount of up to $1,500,000.00

made by Maker to Holder (the “Original Note”);

WHEREAS, on March 9, 2022, Holder and Maker amended

the Original Note and entered into an Amended and Restated Secured Convertible Credit Line Promissory Note dated March 9, 202, in the

principal amount of up to $3,000,000.00 made by Maker to Holder (the “First Amendment to Note”);

WHEREAS, Maker and Holder desire to modify and

amend the First Amendment to Note as set forth in this Note, and, accordingly, Maker and Holder have agreed to execute and deliver this

Note; and

AGREEMENT

NOW, THEREFORE, for and in

consideration of the mutual covenants and agreements set forth herein, and other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, Maker and Holder hereby covenant and agree as follows:

1.

Defined Terms; Recitals. Unless otherwise expressly defined herein, all capitalized terms used herein shall have the meanings

set forth for such terms in the Note. The recitals set forth above are hereby incorporated into the body of this Amendment as if fully

restated herein.

2.

Effect of Amendment. Except as expressly amended hereby, the Note shall continue in full force and effect and unamended.

In the event of any conflict or inconsistency between the provisions of the First Amendment to Note (other than this Amendment) and this

Amendment, the provisions of this Amendment shall control. From and after the date hereof, references to the “Note” (including,

without limitation, any and all references contained in this Amendment) shall mean the Note as amended by this Amendment.

3.

Maturity Date. The Maturity Date of the Note is hereby extended from October 1, 2024 to January 1, 2027.

4.

Binding Effect. This Amendment will be binding upon and inure to the benefit of the parties hereto and their respective

successors and assigns.

5.

Headings. The section headings that appear in this Amendment are for purposes of convenience of reference only and are not

in any sense to be construed as modifying the substance of sections in which they appear.

6.

Counterparts. This Amendment may be executed in one or more counterparts, each of which will constitute an original, and

all of which together shall constitute one and the same agreement. Executed copies hereof may be delivered by e-mail or facsimile and,

upon receipt, shall be deemed originals and binding upon the parties thereto. Without limiting or otherwise affecting the validity of

executed copies hereof that have been delivered by e-mail or facsimile, the parties will use best efforts to deliver originals as promptly

as possible after execution.

7.

Governing Law. This Amendment shall be governed and construed in accordance with the laws of the state of Florida, without

regard to its conflicts of law principles.

8.

Authority. The parties represent and warrant to each other that each has the full power, right and authority to execute

and perform this Amendment and all corporate action necessary to do so has been duly taken.

IN WITNESS WHEREOF, the parties

hereto have executed this Amendment on the dates set forth below, to be effective for all purposes, however, as of the last date executed

below.

| |

Maker |

| |

Veritas Farms, Inc. |

| |

|

| |

By: |

/s/ Thomas E Vickers |

| |

|

Thomas E. Vickers |

| |

|

Chief Executive Officer |

| |

|

| |

Holder |

| |

Cornelis F. Wit Revocable Living Trust |

| |

|

| |

By: |

/s/ Cornelis F. Wit |

| |

|

Cornelis F. Wit, Trustee |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

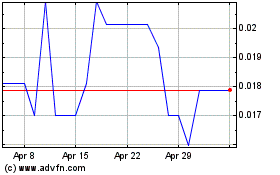

Veritas Farms (QB) (USOTC:VFRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Veritas Farms (QB) (USOTC:VFRM)

Historical Stock Chart

From Apr 2023 to Apr 2024