As

filed with the Securities and Exchange Commission on January 5, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

MY

SIZE, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

51-0394637 |

| (state or other jurisdiction

of |

|

(IRS employer |

| incorporation or organization) |

|

Identification No.) |

HaYarden

4, POB 1026, Airport City, Israel, 7010000

+972-3-600-9030

(Address

of Principal Executive Offices) (Zip Code)

MY

SIZE, INC.

2017

EQUITY INCENTIVE PLAN

(Full

title of the plan)

Corporation

Service Company

2711

Centerville Road, Suite 400

Wilmington,

DE 19808

1-800-927-9800

(Name

and address of agent for service)

Copies

to:

Gary Emmanuel, Esq.

Greenberg Traurig, P.A.

One Azrieli Center

Round Tower, 30th floor

132 Menachem Begin Rd

Tel Aviv, Israel 6701101

Telephone: +972 (0) 3.636.6033

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”,

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

|

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

|

Smaller reporting company ☒ |

| |

|

Emerging growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY

NOTE

The

purpose of this Registration Statement on Form S-8 (this “Registration Statement”) is for My Size, Inc. (the “Registrant”)

to register an additional 751,000 common stock, $0.001 par value per share, for issuance under the Registrant’s 2017 Equity Incentive

Plan.

In

accordance with General Instruction E of Form S-8, the contents of the Registrant’s Registration Statements on Form S-8 (File Nos.

333-222537, 333-227053, 333-248237 and 333-264249), filed with the Securities and Exchange Commission (the “Commission”)

on January 12, 2018, August 27, 2018, August 21, 2020 and April 12, 2022, respectively, are incorporated herein by reference and the

information required by Part II is omitted, except as supplemented by the information set forth below.

PART

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item

1. Plan Information.*

Item

2. Registrant Information and Employee Plan Annual Information. *

*

The documents containing the information specified in this Part I of Form S-8 (plan information and Registrant information and employee

plan annual information) will be sent or given to employees as specified by the Commission pursuant to Rule 428(b)(1) of the Securities

Act. Such documents are not required to be and are not filed with the Commission either as part of this Registration Statement or as

prospectuses or prospectus supplements pursuant to Rule 424. These documents and the documents incorporated by reference in this Registration

Statement pursuant to Item 3 of Part II hereof, taken together, constitute a prospectus that meets the requirements of Section 10(a)

of the Securities Act.

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

ITEM

3. INCORPORATION OF DOCUMENTS BY REFERENCE.

The

following documents, which have been filed with or furnished to the SEC by the registrant, are incorporated herein by reference into

this Registration Statement:

| |

(a) |

Annual Report on Form 10-K

for the year ended December 31, 2022 filed on April 14, 2023; |

| |

|

|

| |

(b) |

Quarterly Reports on Form 10-Q for the quarterly period

ended March 31, 2023, June 30, 2023 and September 30, 2023 filed on May

15, 2023, August

14, 2023 and November

14, 2023, respectively; |

| |

|

|

| |

(c) |

Current

Reports on Form 8-K or Form 8-K/A (excluding any reports or portions thereof that are deemed to be furnished and not filed) filed

on January

4, 2023,

January 10, 2023,

January 12, 2023,

April 14, 2023, May

16, 2023, July

18, 2023, August

14, 2023, August

25, 2023, November

3, 2023, November

15, 2023, and December

28, 2023, respectively; and |

| |

|

|

| |

(d) |

the

description of our common stock, which is contained in the registration statement on Form 8-A, filed with the SEC on June 14, 2016, as

supplemented by Exhibit 4.4 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed with the SEC on March

19, 2020, and as may be further updated or amended in any amendment or report filed for such purpose. |

All

documents or reports subsequently filed by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, and to the

extent designated therein, certain reports on Form 6-K, furnished by the registrant, after the date of this Registration Statement and

prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters

all securities offered hereby then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and

to be part hereof from the date of filing of such documents or reports. Any statement in a document or report incorporated or deemed

to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this Registration Statement to

the extent that a statement contained herein or in any other subsequently filed document or report which also is or is deemed to be incorporated

by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so

modified or superseded, to constitute a part of this Registration Statement.

ITEM

8. EXHIBITS.

A

list of exhibits filed with this Registration Statement on Form S-8 is set forth on the Exhibit Index and is incorporated herein by reference.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in Airport City, State of Israel, on January 5, 2024.

| |

MY SIZE, INC. |

| |

|

| |

By: |

/s/ Ronen

Luzon |

| |

Name: |

Ronen Luzon |

| |

Title: |

Chief Executive Officer |

| |

By: |

/s/ Or

Kles |

| |

Name: |

Or Kles |

| |

Title: |

Chief Financial Officer |

POWER

OF ATTORNEY

We,

the undersigned officers and directors of My Size, Inc., hereby severally constitute and appoint Ronen

Luzon and Or Kles and each of them, as our true and

lawful attorney to sign for us and in our names in the capacities indicated below any and all amendments or supplements, including any

post-effective amendments, to this registration statement on Form S-8 and to file the same, with exhibits thereto and other documents

in connection therewith, with the SEC, granting unto said attorney full power and authority to do and perform each and every act and

thing requisite or necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person,

hereby ratifying and confirming our signatures to said amendments to this registration statement signed by our said attorney and all

else that said attorney may lawfully do and cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act, this registration statement on Form S-8 has been signed below by the following persons in

the capacities and on the dates indicated.

| Signatures |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Ronen Luzon |

|

Chief Executive Officer

and Director |

|

January

5, 2024 |

| Ronen Luzon |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Or Kles |

|

Chief Financial Officer

|

|

January

5, 2024 |

| Or Kles |

|

(Principal Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ Arik

Kaufman |

|

Director |

|

January 5, 2024 |

| Arik Kaufman |

|

|

|

|

| |

|

|

|

|

| /s/ Oren

Elmaliah |

|

Director |

|

January 5, 2024 |

| Oren Elmaliah |

|

|

|

|

| |

|

|

|

|

| /s/ Oron

Branitzky |

|

Director |

|

January 5, 2024 |

| Oron Branitzky |

|

|

|

|

| |

|

|

|

|

| /s/ Guy

Zimmerman |

|

Director |

|

January 5, 2024 |

| Guy Zimmerman |

|

|

|

|

EXHIBIT

INDEX

Exhibit

5.1

|

gtlaw.com |

January

5, 2024

My

Size, Inc.

4

Hayarden St, P.O.B. 1026

Airport

City, Israel 7010000

| Re: |

My Size, Inc. Registration Statement on Form S-8 |

Ladies

and Gentleman:

We

are rendering this opinion in connection with the Registration Statement on Form S-8 (the “Registration Statement”)

to be filed with the Securities and Exchange Commission under the Securities Act of 1933, as amended, with respect to the registration

of 751,000 additional shares (the “Shares”) of common stock, $0.001 par value per share (“Common Stock”),

of My Size, Inc., a Delaware corporation (the “Company”), pursuant to the My Size, Inc. 2017 Equity Incentive Plan

(the “Plan”).

We

have examined: (i) the Registration Statement; (ii) the Company’s Amended and Restated Certificate of Incorporation, as amended

to date; (iii) the Company’s Amended and Restated By-Laws; (iv) the Plan, (v) certain resolutions of the Board of Directors of

the Company and the compensation committee of the Board of Directors of the Company related to the filing of the Registration Statement,

the authorization and issuance of the Shares and related matters, and (vi) the corporate proceedings relating to the registration of

the Shares pursuant to the Plan.

In

addition to the examination outlined above, we have conferred with various officers of the Company and have ascertained or verified,

to our satisfaction, such additional facts as we deemed necessary or appropriate for the purposes of this opinion. In our examination,

we have assumed the authenticity of all documents submitted to us as originals, the conformity to the original documents of all documents

submitted to us as copies, the genuineness of all signatures on documents reviewed by us and the legal capacity of natural persons.

We

have also assumed that, at the time of the issuance of the Shares: (i) the Registration Statement and any amendments thereto (including

post-effective amendments) will have become effective and will remain effective, (ii) no stop order of the Commission preventing or suspending

the use of the prospectus described in the Registration Statement will have been issued, (iii) the prospectus described in the Registration

Statement and any required prospectus supplement will have been delivered to the recipient of the Shares as required in accordance with

applicable law, (iv) the resolutions of the Board of Directors of the Company referred to above will not have been modified or rescinded,

(v) the Company will receive consideration for the issuance of the Shares required by the Plan and that is at least equal to the par

value of the Common Stock, (vi) all requirements of the Delaware General Corporate Law (“DGCL”), the Amended and Restated

Certificate of Incorporation, as amended to date, and the Amended and Restated By-Laws will be complied with when the Shares are issued,

(vii) sufficient shares of Common Stock will be authorized for issuance under the Amended and Restated Certificate of Incorporation of

the Company, as amended to date, that have not otherwise been issued or reserved for issuance and (viii) neither the issuance nor sale

of the Shares will result in a violation of any agreement or instrument then binding upon the Company or any order of any court or governmental

body having jurisdiction over the Company.

|

|

One Azrieli

Center, Round Tower, 30th floor, 132 Menachem Begin Rd ,Tel Aviv, Israel 6701101, Telephone: +972 (0) 3.636.6033 |

Based

on the foregoing, we are of the opinion that the Shares will be validly issued, fully paid and nonassessable by the Company when the

issuance of such Shares has been duly and validly approved by the board of directors of the Company and such Shares have been delivered

in accordance with the Plan.

We

do not express any opinion herein concerning any law other than the DGCL, as currently in effect.

We

consent to the filing of this opinion as an exhibit to the Registration Statement and we consent to the use of our name wherever it appears

in the Registration Statement.

Very

truly yours,

/s/

Greenberg Traurig, P.A.

Greenberg

Traurig, P.A.

Exhibit

23.2

Somekh

Chaikin

17

Ha’arba’a Street, PO Box 609

KPMG

Millennium Tower

Tel

Aviv 6100601, Israel

+972

3 684 8000

Consent

of Independent Registered Public Accounting Firm

We

consent to the use of our report dated April 14, 2023, with respect to the consolidated financial statements of My Size, Inc., incorporated

herein by reference and to the reference to our firm under the heading “Experts” in the prospectus.

| /s/

Somekh Chaikin |

|

| Somekh

Chaikin |

|

Member

Firm of KPMG International

Tel

Aviv, Israel

January

5, 2024

KPMG

Somekh Chaikin, an Israeli partnership and a member firm of the KPMG global organization of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee

Exhibit

107

Calculation

of Filing Fee Table

Form

S-8

(Form

Type)

My

Size, Inc.

(Exact

Name of Registrant as Specified in its Charter)

Table

1: Newly Registered Securities

| Security Type | |

Security Class Title | |

Fee Calculation Rule | |

Amount Registered | | |

Proposed Maximum Offering Price Per Share | | |

Maximum Aggregate Offering Price | | |

Fee Rate | | |

Amount of Registration Fee | |

| Equity | |

Common Stock, $0.001 par value per share, reserved for issuance pursuant to the My Size, Inc. 2017 Equity Plan (the “Plan”) | |

457(c); 457(h) | |

| 751,000 | (1) | |

$ | 0.66 | (2) | |

$ | 495,660.00 | | |

$ | 0.0001476 | | |

$ | 73.16 | |

| Total Offering Amount | | |

$ | | | |

| | | |

$ | 73.16 | |

| Total Fees Previously Paid | | |

| | | |

| | | |

| — | |

| Total Fee Offsets | | |

| | | |

| | | |

| — | |

| Net Fee Due | | |

| | | |

| | | |

$ | 73.16 | |

| (1) |

Pursuant to Rule 416(a)

under the Securities Act of 1933, as amended, this registration statement shall also cover any additional ordinary shares that become

issuable under the Plan by reason of any stock dividend, stock split, recapitalization or other similar transaction. |

| |

|

| (2) |

The

proposed maximum offering price per share is calculated in accordance with Rules 457(c) and 457(h) under the Securities Act, solely

for purposes of calculating the registration fee on the basis of $0.66 per share, the average of the high and low price of

the Registrant’s ordinary shares as reported on the Nasdaq Capital Market on January 3, 2024. |

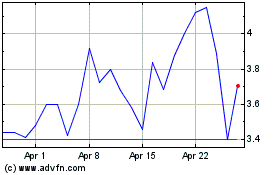

My Size (NASDAQ:MYSZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

My Size (NASDAQ:MYSZ)

Historical Stock Chart

From Apr 2023 to Apr 2024