UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

December 29, 2023

(Date of earliest event reported)

NovAccess Global Inc.

(Exact name of registrant as specified in its charter)

| Colorado | | 000-29621 | | 84-1384159 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| 8584 E. Washington Street, No. 127, Chagrin Falls, Ohio 44023 |

| (Address of principal executive offices) (Zip Code) |

213-642-9268

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| None | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 29, 2023, NovAccess Global Inc. (“NovAccess,” the “company” or “we”) entered into a letter agreement (the “letter agreement”) with AJB Capital Investments, LLC (“AJB”). On February 15, 2022, we issued a promissory note to AJB. Pursuant to the December 29, 2023 letter agreement, AJB agreed to loan us an additional $29,444, which will be added to the principal of the February 2022 note. This $29,444 loan has an original interest discount of 10% and bears interest at 10% per annum. AJB funded $9,000 of the loan to pay our auditors to commence work on the 2023 audit. The remaining balance will be funded upon the mutual agreement of AJB and the company.

We have previously issued AJB nine separate warrants to purchase a total of 8,250,000 shares of our common stock in connection with loans provided by AJB and extensions of those loans. These warrants would have expired on various dates ranging from August 20, 2026 to August 9, 2028. Pursuant to the letter agreement, in consideration of the new loan, we agreed to extend the expiration date of all of these warrants by two years.

The AJB letter agreement is filed as an exhibit to this Current Report on Form 8-K. The description above is qualified in its entirety by reference to the full text of the letter agreement.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure included under Item 1.01 above is incorporated by reference to this Item 2.03.

Item 9.01 Financial Statements and Exhibits.

Exhibit 10.1 Letter Agreement dated December 29, 2023 between NovAccess Global Inc. and AJB Capital Investments, LLC

Exhibit 104 Cover Page Interactive Data File (formatted as Inline XBRL)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

NovAccess Global Inc.

|

|

|

|

|

|

|

Dated: January 5, 2024

|

/s/ Dwain K. Irvin

|

|

|

|

By Dwain K. Irvin, Chief Executive Officer

|

|

NONE

false

0001039466

0001039466

2023-12-29

2023-12-29

Exhibit 10.1

December 29, 2023

NOVACCESS GLOBAL INC.

8584 E. Washington Street, No. 127

Chagrin Falls, OH 44023 Attn:

E-mail:

VIA ELECTRONIC MAIL

Re: Advance and Modifications to Warrants

Dear Sirs:

Reference is made to (i) those three securities purchase agreements dated August 20, 2021, February 15, 2022, and May 5, 2022 by and between NovAccess Global Inc., a Colorado corporation (the “Company”), and AJB Capital Investments, LLC, a Delaware limited liability company (the “Purchaser”) (collectively, as amended, the “Purchase Agreements”); (ii) those Promissory Notes of the Company issued in favor of the Purchaser, August 20, 2021 (the “August Note”), February 15, 2022 (the “ February Note”), and May 5, 2022 (the “May Note”); and (iii) the nine (9) common stock purchase warrants issued by the Company to the Purchaser pursuant to the Purchase Agreements and amendments thereto (collectively, the “Warrants”).

For good and valuable consideration, the Purchaser has agreed to advance up to $26,500 to the Company by increasing the aggregate outstanding principal amount of the February Note by an amount up to $29,444.44 (the “Advance”), $9,000 of such Advance amount shall be funded concurrently with the execution and delivery of this letter agreement (this “Letter Agreement”) and the remaining balance of $17,500 of the advance to be funded upon the mutual agreement of the parties.

In consideration for the Advance, the Company shall extend the termination date for each Warrant issued to the Purchaser for an additional two (2) years from the termination date set forth in each Warrant, which extensions shall be of immediate and automatic force and effect and not require any further action of the parties.

Except as otherwise set forth herein, all terms and conditions of the Warrants and all other Transaction Documents shall remain in full force and effect.

The modifications set forth in this Letter Agreement are limited to the matters expressly set forth herein and should not be construed as an indication that the Purchaser has agreed to any other modifications to, consents of, or waivers of any other terms or provisions of the Warrants, any other Transaction Documents, or of the terms of any other agreement, instrument or security or any modifications to, consents of, or waivers of any default that may exist or occur thereunder.

The Company hereby represents and warrants and covenants to the Purchaser that nothing contained herein or otherwise disclosed to the Purchaser by the Company in connection herewith constitutes material non-public information. As of the date hereof, the Company shall have disclosed all material, non-public information (if any) provided up to the date hereof to the Purchaser by the Company or any of its Subsidiaries or any of their respective officers, directors, employees, affiliates or agents, that has not previously been publicly disclosed by the Company in a filing with the Securities and Exchange Commission.

The Company hereby covenants and agrees that, as of the date hereof, (i) the Purchaser has no confidentiality or similar obligation under any agreement to the Company, any of its Subsidiaries or any of their respective officers, directors, employees, affiliates or agents and (ii) the Purchaser has not made any agreement with the Company, any of its Subsidiaries or any of their respective officers, directors, employees, affiliates or agent not to purchase or sell, long and/or short, the Common Stock or any other securities of the Company.

This Letter Agreement shall be governed by and construed in accordance with the laws of the State of Nevada without regard to choice of law principles. Any dispute arising under or relating to or in connection with this Letter Agreement shall be subject to the exclusive jurisdiction and venue of the State and/or Federal courts located in New York. This Letter Agreement may be executed in any number of counterparts, each of which shall be an original but all of which together shall constitute one and the same instrument.

Very truly yours,

AJB Capital Investments, LLC

By: /s/ Ari Blaine

Name: Ari Blaine

Title: Partner

Acknowledged and Agreed:

NOVACCESS GLOBAL INC.

By: /s/ Dwain K. Irvin

Name: Dwain K. Irvin

Title: Chief Executive Officer

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

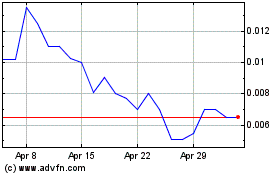

NovAccess Global (QB) (USOTC:XSNX)

Historical Stock Chart

From Mar 2024 to Apr 2024

NovAccess Global (QB) (USOTC:XSNX)

Historical Stock Chart

From Apr 2023 to Apr 2024