U.S. index futures are registering a decline in pre-market

trading this Friday, anticipating a crucial report on the job

market as Wall Street seeks to overcome a lukewarm start to

January. The three major indices are set to end nine consecutive

weeks of gains, with the Nasdaq facing the biggest weekly drop,

down 3.3%.

At 05:27 AM, Dow Jones (DOWI:DJI) futures fell

89 points, or 0.24%. S&P 500 futures fell

0.26% and Nasdaq-100 futures fell 0.38%. The yield

on 10-year Treasury bonds was at 4.038%.

In the commodities market, West Texas Intermediate crude for

February rose 0.93%, to $72.86 per barrel. Brent crude for March

rose 0.70%, near $78.13 per barrel. Iron ore with a concentration

of 62%, traded on the Dalian exchange, fell 1.53%, to $139.33 per

metric ton.

On Friday’s economic agenda, investors await, at 08:30 AM, the

number of jobs created or lost by the economy (payroll) and the

unemployment rate for December. The ISM Index of December service

sector activity will be published at 10:00 AM by ISM. November

factory orders will be published at 10:00 AM by the Commerce

Department.

European markets are performing negatively, with the Stoxx 600

falling 0.9%. The retail sector led the losses, with German retail

shares falling more than expected in November. Inflation in the

eurozone rose to 2.9% annually in December. In the UK, house prices

rose 1.7% in 2023, defying expectations of a decline.

Asia-Pacific markets had a mixed week, with declines in most

indices, including Hong Kong’s Hang Seng and South Korea’s Kospi.

Inflation in the Philippines slowed, while Japan’s PMI for services

signaled stabilization in private sector activity. Japan’s Nikkei

225 index rose 0.3% on Friday.

In Thursday’s trading, U.S. indices had mixed performance, with

the Nasdaq and S&P 500 ending lower, while the Dow Jones closed

slightly higher. The Nasdaq fell 0.34% and the S&P 500 also

recorded a decline of 0.34%. The Dow rose 0.03%, despite

Walgreens (NASDAQ:WBA) shares plummeting due to

dividend cuts. U.S. employment data ruled out the possibility of an

interest rate cut in March, resulting in a negative reaction in the

markets. This led to an increase in interest rates and a fall in

U.S. government bonds, also affecting the country’s main stock

indices. The Nasdaq performed weaker compared to the S&P,

recording its fifth consecutive decline, with accumulated losses of

4% since December 28. Apple (NASDAQ:AAPL) shares

also fell due to concerns about iPhone sales.

Wall Street Corporate Highlights for Today

Microsoft (NASDAQ:MSFT), Apple

(NASDAQ:AAPL) – Microsoft is closing in on Apple in market value,

with a capitalization of about $2.73 trillion compared to Apple’s

$2.83 trillion. Microsoft has performed slightly better in stocks

in 2023 and is driven by continued growth in Azure and artificial

intelligence. Meanwhile, Apple faces challenges with competition in

China and macroeconomic pressures. The market value gap between the

two companies has not been this small since November 2021. Apple’s

shares have fallen 5.5% so far in 2024 and closed lower for four

consecutive days.

Apple (NASDAQ:AAPL), Disney

(NYSE:DIS) – The U.S. Securities and Exchange Commission (SEC)

decided that Apple and Disney cannot avoid shareholder votes on the

use of artificial intelligence. The AFL-CIO, the largest union

federation in the U.S., submitted similar proposals at four other

tech companies. The SEC believes these proposals transcend common

business issues.

Alphabet (NASDAQ:GOOGL) – Google, owner of

YouTube, violated U.S. labor law by refusing to negotiate with the

union representing YouTube Music contracted workers, according to

the National Labor Relations Board (NLRB). The agency rejected

Google’s claims that it should not be considered an employer of

these workers and, therefore, would not need to negotiate with the

union. The decision implies that Google must negotiate with the

Alphabet workers’ union.

Thermo Fisher Scientific (NYSE:TMO) – Thermo

Fisher Scientific decided to cease the sale of forensic technology

and equipment in Tibet, after offering human identification (HID)

technology used to track criminals. The company did not explain the

reasons behind the decision, which follows a similar restriction in

Xinjiang in 2019. Some shareholders welcomed the move, citing

concerns about human rights violations.

Brookfield Asset Management (NYSE:BNH),

American Tower Corp (NYSE:AMT) – Brookfield Asset

Management will acquire the loss-making Indian operations of

American Tower Corp for $2.5 billion, becoming the largest telecom

tower operator in India. ATC will exit India after almost 17 years,

while Brookfield positions itself to manage the challenges faced by

ATC due to high exposure to Vodafone Idea. India is experiencing an

increase in data demand and the implementation of 5G.

Nokia (NYSE:NOK) – Nokia signed a 5G patent

agreement with Honor, a Chinese smartphone manufacturer. However,

Nokia is still involved in legal disputes with other Chinese

manufacturers, such as Oppo and Vivo, over 4G and 5G patents.

Patent licensing revenues accounted for 39% of Nokia’s operating

profit in 2022. In December, Nokia stated it would not meet its

financial targets for 2023 due to ongoing discussions on renewing

patent licenses.

Verizon Communications (NYSE:VZ) – Analyst

Peter Supino of Wolfe Research upgraded Verizon Communications to

an Outperform from Peer Perform, highlighting confidence in

industrial economy stability and underestimation. He believes

Verizon will see declining capital expenses and leverage, as well

as potential sales increases and improved execution, offering an

attractive picture for investors.

Microchip Technology (NASDAQ:MCHP) – The U.S.

Department of Commerce plans to grant $162 million in subsidies to

Microchip Technology to increase semiconductor and microcontroller

unit production in the U.S. This funding will allow Microchip to

triple its production, helping to reduce dependence on global

supply chains and strengthen U.S. national and economic

security.

Qualcomm (NASDAQ:QCOM) – Qualcomm announced the

Snapdragon XR2+ Gen 2 chip designed for mixed and virtual reality

headsets. Samsung and Google (NASDAQ:GOOGL) plan to use the chip

but did not specify in which products it will be used. The mixed

reality headset market is heating up, with Apple launching its

Vision Pro headset soon.

Ford Motor (NYSE:F) – Ford Motor recorded its

best annual vehicle sales in the United States since 2020, with

1.99 million units sold in 2023, an increase of 7.1%. Crossover

SUVs and pickups drove demand, while electrified vehicles accounted

for nearly 17% of total sales. Ford ranked third in U.S. sales,

behind General Motors (NYSE:GM) and Toyota (NYSE:TM).

Tesla (NASDAQ:TSLA) – Tesla’s aggressive

real-time management strategy of its stores in China is boosting

its edge over dealerships like BYD in the world’s largest

automotive market. Tesla sold more than 1,500 electric vehicles on

average per store in the first 10 months of 2023, while BYD sold

fewer than 600. Although facing increasing competition, limited

production capacity, and the need to improve margins, Tesla

maintains its strong position. Additionally, Tesla is conducting a

recall of 1.62 million vehicles in China, including S, X, 3, and Y

models, following two recalls in the U.S. The automaker will

remotely update the software to prevent misuse of the Autosteer

function and correct door issues in some vehicles.

Fisker (NYSE:FSR) – Electric vehicle

manufacturer Fisker plans to add up to 50 partner dealerships in

the U.S., Canada, and Europe to expand its sales and delivery

network. The company, which has so far followed a

direct-to-consumer model, plans to ship its first Ocean vehicles to

new dealerships by the end of the first quarter.

Mobileye Global (NASDAQ:MBLY) – Autonomous

technology company Mobileye Global warned on Thursday that a

reduction in customer orders will result in weaker results in 2024

due to an oversupply of automotive chips. Its shares plummeted in

response, indicating that the automotive chip industry may face a

slowdown.

QuantumScape (NYSE:QS) – QuantumScape

registered an increase in pre-market trading, following a 43% gain

the previous day. Volkswagen, through its battery subsidiary

PowerCo, announced that QuantumScape’s solid-state battery cell

demonstrated significantly better performance than expected in

tests, successfully completing over 1,000 charging cycles. This

points to advances in technology that could result in more

affordable batteries, faster charging, and greater range.

Phillips 66 (NYSE:PSX) – Phillips 66 is in

active discussions to sell non-core assets, as part of its plan to

monetize $3 billion in non-core assets in 2024. There is no fixed

timeline for sales, and CEO Mark Lashier stated that it will be

determined by the value offered for these assets. The company seeks

to increase returns and cut costs after a period of

underperformance compared to rivals in the refining industry. The

CEO also expressed optimism about the long-term prospects of the CP

Chemical joint venture with Chevron (NYSE:CVX).

Exxon Mobil (NYSE:XOM) – Exxon Mobil announced

it will take a writedown of about $2.5 billion on assets in

California in the fourth quarter due to regulatory challenges.

Lower energy prices also affected operating profits, which could

fall about 30% compared to the previous year. The company will also

take a goodwill impairment of about $250 million in its chemicals

business.

SolarEdge (NASDAQ:SEDG) – The U.S. solar

industry will see modest growth in 2024, according to SolarEdge’s

chief financial officer, due to falling electricity prices and

support from the Inflation Reduction Act. Demand is expected to

increase with anticipation of lower interest rates and improvements

in tax incentives. Battery installation is also expected to

continue growing.

RTX (NYSE:RTX) – Industry veteran Phil Jasper

will take over as president of RTX’s Raytheon unit after Wesley

Kremer’s retirement at the end of the first quarter. The change

comes as Raytheon benefits from growing demand for its equipment

due to the war in Ukraine. Since the Russian invasion in 2022, RTX

has received $3 billion in orders related to the conflict.

United Parcel Service (NYSE:UPS),

FedEx (NYSE:FDX) – India’s antitrust body is

investigating global delivery companies, including DHL, UPS, and

FedEx, on suspicion of collusion in discounts and tariffs. The

investigation, initiated in October 2022, alleges that these

companies jointly controlled prices and discounts, possibly

violating Indian antitrust laws. The companies are cooperating but

deny the allegations.

AMC Entertainment (NYSE:AMC) – AMC

Entertainment’s shares fell 5% on Thursday to $5.30, hitting

another record low and ending a four-day losing streak. The stock

price is far below its peak during the meme stock craze, when it

reached $339.05 in June 2021. AMC recently issued shares to tackle

its debt of over $5 billion and faces liquidity challenges.

Costco (NASDAQ:COST) – Costco reported a 9.9%

increase in December sales, totaling $26.15 billion, driven by

e-commerce, with sales in the 17 weeks to December 31 reaching

$82.86 billion, an increase of 5.9%. Same-store sales in December

increased 8.5%, with a 5.2% increase in the 17 weeks. Online sales

in December grew by 17.7%.

Carrefour (EU:CA), PepsiCo

(NASDAQ:PEP) – Carrefour informed customers in France, Italy,

Spain, and Belgium that it will no longer sell PepsiCo products,

such as Pepsi, Lay’s, and 7up, due to price increases deemed

unacceptable. This decision affects over 9,000 stores and

represents two-thirds of the retailer’s global presence. Retailers

in various countries have halted orders from food companies due to

inflation concerns.

Conagra Brands (NYSE:CAG) – Conagra Brands

lowered its forecasts for organic net sales growth and annual

profit, due to a slower recovery in demand for packaged meals and

snacks. The company faces its tenth consecutive quarter of volume

decline and is increasing marketing and advertising spending in

some categories. Conagra also plans to lower prices in some

categories to stimulate demand.

Kura Sushi (NASDAQ:KRUS) – In the first

quarter, Kura Sushi USA, a Japanese restaurant chain, reported a

per-share loss of 18 cents, beating analysts’ expectations of a

10-cent loss. Comparable restaurant sales increased 3.8%, exceeding

estimates, while total sales reached $51.5 million, surpassing

expectations. The company projects sales between $239 million and

$244 million for the fiscal year 2024.

McDonald’s (NYSE:MCD) – McDonald’s CEO Chris

Kempczinski reported that the Israel-Hamas conflict and

misinformation have harmed its business in some Middle East markets

and beyond, due to boycott actions based on misconceptions about

the company’s stance.

Amer Sports – Amer Sports, a tennis racket

manufacturer and owner of sports brands like Wilson, revealed a 30%

revenue increase in the first nine months of 2023. The company

plans to conduct an initial public offering (IPO) in the U.S.,

capitalizing on the recovery of the IPO market. Amer Sports owns

iconic brands like Arc’teryx, Salomon, and Atomic, in addition to

the famous tennis racket brand Wilson. Its IPO is awaited at a time

when investor sentiment is recovering and the IPO market looks more

promising after a difficult period.

Citigroup (NYSE:C) – Citigroup plans to launch

its investment banking unit in China by the end of 2024, expanding

its market presence. The bank is also in active discussions to sell

non-core assets as part of its efforts to increase returns.

BlackRock (NYSE:BLK) – BlackRock named Leigh

Farris as its Global Head of Corporate Communications, bolstering

its position amidst pressure related to socially and

environmentally conscious capitalism. She will succeed Jim

Badenhausen and will join in March.

Berkshire Hathaway (NYSE:BRK.B),

Liberty (NASDAQ:LSXMA), SiriusXM

(NASDAQ:SIRI) – Berkshire Hathaway acquired 2.8 million shares of

Liberty SiriusXM tracking stock to capitalize on the discount

relative to Sirius XM Holdings’ stake. Berkshire Hathaway paid

about $82 million, raising its stake to about 20%. The investment

is seen as managed by Ted Weschler, not Warren Buffett. Liberty and

Sirius XM announced a deal in December to combine the tracking

stock with Sirius XM Holdings. The discount is about 35%, with

expectations for the gap to narrow as the transaction approaches,

but remains wide due to challenges in trading Sirius XM stock and

short selling.

Walgreens Boots Alliance (NASDAQ:WBA) –

Walgreens Boots Alliance’s dividend cut could hasten its exit from

the Dow Jones Industrial Average. The company is seen as vulnerable

to removal due to its low stock price and market cap. Walgreens’

shares fell after announcing a 48% dividend cut.

AlloVir (NASDAQ:ALVR) – AlloVir announced a

reduction of about 95% in its workforce following the termination

of three clinical trials related to its lead T-cell therapy,

posoleucel. The goal is to preserve capital, with the layoffs

primarily planned for the first quarter of 2024. The company

expects charges of about $13 million for severance and other

benefits. Shares are up 4.3% in Friday’s pre-market.

Fusion Pharmaceuticals (NASDAQ:FUSN) – Fusion

Pharmaceuticals, a clinical-stage oncology company, announced FDA

approval for a phase 2/3 protocol and development plan for FPI-2265

treatment targeting certain prostate cancers.

Eli Lilly (NYSE:LLY) – Eli Lilly launched

LillyDirect, offering streamlined access to treatments, including

weight loss medications. The site provides disease management

resources and facilitates access to healthcare providers and direct

delivery of certain Lilly medications. The company aims to improve

patient experience and outcomes.

Novo Nordisk (NYSE:NVO) – Novo Nordisk

announced research collaborations with U.S. biotech companies Omega

Therapeutics and Cellarity Inc. These partnerships aim to develop

new treatments for obesity and MASH liver disease. Novo will

reimburse research and development costs, and the agreements could

pay up to $532 million in upfront payments and commercial

milestones, plus royalties on sales.

Peloton Interactive (NASDAQ:PTON) –

Peloton Interactive partnered exclusively with

TikTok to bring its workout content to the short-video platform.

The company is focusing on software and content to drive subscriber

growth, as demand for connected home fitness equipment has waned

post-pandemic peak. This partnership marks Peloton’s first

collaboration outside its own channels.

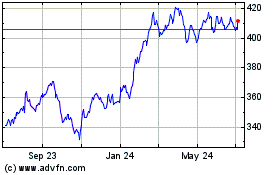

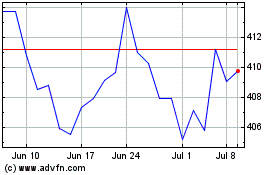

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Apr 2023 to Apr 2024