0001023459false00010234592024-01-032024-01-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

January 3, 2024

(Date of the earliest event reported)

Simulations Plus, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| California | 001-32046 | 95-4595609 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

42505 10th Street West, Lancaster, California 93534-7059

(Address of principal executive offices) (Zip Code)

661-723-7723

Registrant's telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14z-12 under Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | SLP | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition

On January 3, 2024, Simulations Plus, Inc., a California corporation (the “Company”), issued a press release announcing financial results for its first quarter of fiscal year 2024 ended November 30, 2023. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Report”).

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers Compensatory Arrangements of Certain Officers.

One January 3, 2024, Will Frederick, the Company’s Chief Financial Officer, was appointed to the additional role of Chief Operating Officer. Mr. Frederick will continue to serve as Chief Financial Officer of the Company, which position he has held since December 2020. There will be no change in Mr. Frederick’s current compensation as a result of his assumption of the additional role of Chief Operating Officer.

There is no arrangement or understanding between Mr. Frederick and any other person pursuant to which Mr. Frederick was appointed as Chief Operating Officer and Mr. Frederick has no direct or indirect interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K. No family relationship exists between Mr. Frederick and any other director or executive officer of the Company. The information required to be disclosed pursuant to Item 401(e) of Regulation S-K is incorporated herein by reference to the Definitive Proxy Statement filed by the Company with the Securities and Exchange Commission (the “Commission”) on December 22, 2023.

Item 7.01 Regulation FD Disclosure

On January 3, 2024, the Company issued a press release announcing the appointment of various individuals to leadership roles within the Company, including the appointment of Mr. Frederick as Chief Operating Officer. The press release is furnished as Exhibit 99.2 to this Report.

On January 3, 2024, the Company held an investor conference call reporting its financial results for its first quarter of fiscal year 2024 ended November 30, 2023. The PowerPoint presentation, which was used for this investor conference call, is attached as Exhibit 99.3 to this Report.

In accordance with General Instructions B.2 of Form 8-K, the information in this Report, including Exhibits 99.1, 99.2, and 99.3 (collectively, the “Exhibits”), is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such filing to this Report.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This Report, including the disclosures set forth herein and in the Exhibits attached hereto, contains certain forward-looking statements that involve substantial risks and uncertainties. When used herein, the terms “anticipates,” “expects,” “estimates,” “believes” and similar expressions, as they relate to us or our management, are intended to identify such forward-looking statements.

Forward-looking statements in this Report or reports hereafter furnished, including in other publicly available documents filed with the Commission, to the Company’s stockholders and other publicly available statements issued or released by us involve known and unknown risks, uncertainties and other factors which could cause our actual results, performance (financial or operating) or achievements to differ from the future results, performance (financial or operating) or achievements expressed or implied by such forward-looking statements. Such future results are based upon management’s best estimates based upon current conditions and the most recent results of operations. These risks include, but are not limited to, the risks set forth herein and in such other documents filed with the Commission, each of which could adversely affect our business and the accuracy of the forward-looking statements contained herein. Our actual results, performance or achievements may differ materially from those expressed or implied by such forward-looking statements.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | |

| SIMULATIONS PLUS, INC. |

| |

Dated: January 3, 2024 | By: /s/ Will Frederick |

| Will Frederick |

| Chief Financial and Operating Officer |

Exhibit 99.1

Simulations Plus Reports First Quarter Fiscal 2024 Financial Results

Total revenue of $14.5 million and diluted earnings per share (EPS) of $0.10

Maintains full-year revenue guidance of $66 to $69 million (+10-15%) and EPS guidance of $0.66 to $0.68

LANCASTER, CA, January 3, 2024 – Simulations Plus, Inc. (NASDAQ: SLP) (“Simulations Plus”), a leading provider of modeling and simulation software and services for pharmaceutical safety and efficacy, today reported financial results for its first quarter fiscal 2024, ended November 30, 2023.

First Quarter Financial Highlights

•Total revenue increased 21% to $14.5 million

•Software revenue increased 25% to $7.6 million, representing 52% of total revenue

•Services revenue increased 17% to $6.9 million, representing 48% of total revenue

•Gross profit increased 6% to $9.8 million; gross margin was 68%

•Adjusted EBITDA of $3.4 million, representing 23% of total revenue

•Net income of $1.9 million and diluted earnings per share (EPS) of $0.10, compared to net income of $1.2 million and diluted EPS of $0.06 in the first quarter of 2023

Management Commentary

“Our first quarter performance marked a successful start to the year and was in line with our expectations,” said Shawn O’Connor, Chief Executive Officer of Simulations Plus. “With these strong results, we are maintaining our guidance for the full year. Even though client funding and budget cycles remain softer than historical levels, we are cautiously optimistic that our market may be on the path to improvement.

“First quarter revenue increased 21% year-over-year, driven by higher software revenues in our Quantitative Systems Pharmacology (QSP) oncology modeling platform and our Physiologically Based Pharmacokinetics (PBPK) business unit that had a strong contribution from GastroPlus. I am proud of what our team accomplished this quarter to deliver a 67% increase in EPS.

“Today we announced in a separate press release four key strategic leadership appointments that will advance our objective to seamlessly and organically align with our clients’ needs. These appointments reflect our commitment to providing our organization with the leadership that best positions us for our next stage of growth.

“We entered the second quarter with a healthy pipeline, strong profitability, and a sound balance sheet. The underlying fundamentals of our market remain resilient as demand for modeling and simulation tools continues to play a greater role in drug development workflow. We remain focused on continuing to produce disciplined growth that delivers long-term returns for our shareholders.”

Fiscal 2024 Guidance

| | | | | | | | | | | | | | | |

| | | Fiscal 2024 Guidance | | Annual Increase |

| Revenue | | | $66M - $69M | | 10 - 15% |

| Software mix | | | 55 - 60% | | — |

| Services mix | | | 40 - 45% | | — |

| Diluted earnings per share | | | $0.66 - $0.68 | | 35 - 39% |

Quarterly Dividend

The Company’s Board of Directors declared a cash dividend of $0.06 per share of the Company’s common stock, payable on February 5, 2024, to shareholders of record as of January 29, 2024. The declaration of any future dividends will be determined by the Board of Directors each quarter and will depend on earnings, financial condition, capital requirements, and other factors.

Environmental, Social, and Governance

We focus our Environmental, Social, and Governance (ESG) efforts where we can have the most positive impact. To learn more about our latest initiatives and priorities, please visit our ESG website.

Webcast and Conference Call Details

Shawn O’Connor, chief executive officer, and Will Frederick, chief financial and operating officer, will host a conference call and webcast today at 5 p.m. Eastern Time to discuss the details of the Company’s performance for the quarter and certain forward-looking information. The call may be accessed by registering here or by calling 1-877-451-6152 or 1-201-389-0879. The webcast will be available on our website under Conference Calls & Presentations. A replay of the webcast will be available on the website approximately one hour following the call.

Non-GAAP Definitions

Adjusted EBITDA

Adjusted EBITDA is defined as earnings (loss) before interest, taxes, depreciation and amortization, stock-based compensation, (gain) loss on currency exchange, any acquisition- or financial-transaction-related expenses, and any asset impairment charges. Currency exchange excluded represents the exchange rate fluctuations on the foreign currency denominated transactions. The impact of transactions in foreign currency represents the effect of converting revenue and expenses occurring in a currency other than the functional currency. The Company believes that the non-GAAP financial measures presented facilitate an understanding of operating performance and provide a meaningful comparison of its results between periods. The Company’s management uses non-GAAP financial measures to, among other things, evaluate its ongoing operations in relation to historical results, for internal planning and forecasting purposes and in the calculation of performance-based compensation. Adjusted EBITDA represents a measure that we believe is customarily used by investors and analysts to evaluate the financial performance of companies in addition to the GAAP measures that we present. Our management also believes that Adjusted EBITDA is useful in evaluating our core operating results. However, Adjusted EBITDA is not a measure of financial performance under accounting principles generally accepted in the United States of America and should not be considered an alternative to net income or operating income as an indicator of our operating performance or to net cash provided by operating activities as a measure of our liquidity. The Company’s Adjusted EBITDA measure may not provide information that is directly comparable to that provided by other companies in its industry, as other companies in its industry may calculate non-GAAP financial results differently, particularly related to nonrecurring, unusual items.

Adjusted Diluted EPS

Adjusted diluted EPS is calculated based on net income excluding the impact of any acquisition- or financial-transaction-related expenses, any asset impairment charges, and tax provisions / benefits related to the previous items. The Company excludes the above items because they are outside of the Company’s normal operations and/or, in certain cases, are difficult to forecast accurately for future periods.

The Company believes that the use of non-GAAP measures helps investors to gain a better understanding of the Company’s core operating results and future prospects, consistent with how management measures and forecasts the Company’s performance, especially when comparing such results to previous periods or forecasts.

About Simulations Plus

Serving clients worldwide for more than 25 years, Simulations Plus is a leading provider in the biosimulation market providing software and consulting services supporting drug discovery, development, research, and regulatory submissions. We offer solutions that bridge artificial intelligence (AI)/machine learning, physiologically based pharmacokinetics, quantitative systems pharmacology/toxicology, and population PK/PD modeling approaches. Our technology is licensed and applied by major pharmaceutical, biotechnology, and regulatory agencies worldwide. For more information, visit our website at https://www.simulations-plus.com/. Follow us on LinkedIn | Twitter | YouTube.

Forward-Looking Statements

Except for historical information, the matters discussed in this press release are forward-looking statements that involve risks and uncertainties. Words like “believe,” “expect,” and “anticipate” mean that these are our best estimates as of this writing, but there can be no assurances that expected or anticipated results or events will actually take place, so our actual future results could differ significantly from those statements. Factors that could cause or contribute to such differences include, but are not limited to: our ability to successfully integrate the Immunetrics business with our own, as well as expenses we may incur in connection therewith, our ability to maintain our competitive advantages, acceptance of new software and improved versions of our existing software by our customers, the general economics of the pharmaceutical industry, our ability to finance growth, our ability to continue to attract and retain highly qualified technical staff, market conditions, macroeconomic factors, and a sustainable market. Further information on our risk factors is contained in our quarterly and annual reports and filed with the U.S. Securities and Exchange Commission.

Investor Relations Contacts:

Tamara Gonzalez

Financial Profiles

310-622-8234

slp@finprofiles.com

Renee Bouche

Simulations Plus Investor Relations

661-723-7723

renee.bouche@simulations-plus.com

SIMULATIONS PLUS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended November 30, | | |

| (in thousands, except per common share amounts) | | 2023 | | 2022 | | | | | | |

| Revenues | | | | | | | | | | |

| Software | | $ | 7,589 | | | $ | 6,074 | | | | | | | |

| Services | | 6,911 | | | 5,890 | | | | | | | |

| Total revenues | | 14,500 | | | 11,964 | | | | | | | |

| Cost of revenues | | | | | | | | | | |

| Software | | 991 | | | 885 | | | | | | | |

| Services | | 3,661 | | | 1,786 | | | | | | | |

| Total cost of revenues | | 4,652 | | | 2,671 | | | | | | | |

| Gross profit | | 9,848 | | | 9,293 | | | | | | | |

| Operating expenses | | | | | | | | | | |

| Research and development | | 1,217 | | | 1,166 | | | | | | | |

| Selling and marketing | | 1,989 | | | 1,485 | | | | | | | |

| General and administrative | | 5,682 | | | 5,764 | | | | | | | |

| Total operating expenses | | 8,888 | | | 8,415 | | | | | | | |

| | | | | | | | | | |

| Income from operations | | 960 | | | 878 | | | | | | | |

| | | | | | | | | | |

| Other income | | 1,446 | | | 740 | | | | | | | |

| | | | | | | | | | |

| Income before income taxes | | 2,406 | | | 1,618 | | | | | | | |

| Provision for income taxes | | (461) | | | (373) | | | | | | | |

| Net income | | $ | 1,945 | | | $ | 1,245 | | | | | | | |

| | | | | | | | | | |

| Earnings per share | | | | | | | | | | |

| Basic | | $ | 0.10 | | | $ | 0.06 | | | | | | | |

| Diluted | | $ | 0.10 | | | $ | 0.06 | | | | | | | |

| | | | | | | | | | |

| Weighted-average common shares outstanding | | | | | | | | | | |

| Basic | | 19,947 | | | 20,286 | | | | | | | |

| Diluted | | 20,279 | | | 20,825 | | | | | | | |

| | | | | | | | | | |

| Other comprehensive income, net of tax | | | | | | | | | | |

| Foreign currency translation adjustments | | (54) | | | 53 | | | | | | | |

| Comprehensive income | | $ | 1,891 | | | $ | 1,298 | | | | | | | |

SIMULATIONS PLUS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS | | | | | | | | | | | | | | |

| | (Unaudited) | | (Audited) |

| (in thousands, except share and per share amounts) | | November 30, 2023 | | August 31, 2023 |

| ASSETS | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 39,789 | | | $ | 57,523 | |

| Accounts receivable, net of allowance for credit losses of $37 and $46 | | 10,346 | | | 10,201 | |

| Prepaid income taxes | | 37 | | | 804 | |

| Prepaid expenses and other current assets | | 5,414 | | | 3,904 | |

| Short-term investments | | 74,101 | | | 57,940 | |

| Total current assets | | 129,687 | | | 130,372 | |

| Long-term assets | | | | |

| Capitalized computer software development costs, net of accumulated amortization of $17,580 and $17,199 | | 11,896 | | | 11,335 | |

| Property and equipment, net | | 487 | | | 671 | |

| Operating lease right-of-use assets | | 1,118 | | | 1,247 | |

| Intellectual property, net of accumulated amortization of $9,709 and $9,301 | | 8,281 | | | 8,689 | |

| Other intangible assets, net of accumulated amortization of $2,351 and $2,107 | | 12,954 | | | 12,825 | |

| Goodwill | | 19,099 | | | 19,099 | |

| Deferred tax assets | | 1,826 | | | 1,438 | |

| Other assets | | 430 | | | 425 | |

| Total assets | | $ | 185,778 | | | $ | 186,101 | |

| | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | |

| Current liabilities | | | | |

| Accounts payable | | $ | 317 | | | $ | 144 | |

| Accrued compensation | | 2,170 | | | 4,392 | |

| Accrued expenses | | 731 | | | 659 | |

| | | | |

| Contracts payable | | 2,290 | | | 3,250 | |

| Operating lease liability - current portion | | 420 | | | 442 | |

| Deferred revenue | | 2,660 | | | 3,100 | |

| Total current liabilities | | 8,588 | | | 11,987 | |

| Long-term liabilities | | | | |

| | | | |

| Operating lease liability | | 669 | | | 755 | |

| Contracts payable – net of current portion | | 4,180 | | | 3,330 | |

| Total liabilities | | 13,437 | | | 16,072 | |

| Commitments and contingencies | | — | | | — | |

| Shareholders' equity | | | | |

| Preferred stock, $0.001 par value - 10,000,000 shares authorized; no shares issued and outstanding | | $ | — | | | $ | — | |

| Common stock, $0.001 par value and additional paid-in capital —50,000,000 shares authorized; 19,937,961 and 19,937,961 shares issued and outstanding | | 146,591 | | | 144,974 | |

| Retained earnings | | 25,945 | | | 25,196 | |

| Accumulated other comprehensive loss | | (195) | | | (141) | |

| Total shareholders' equity | | 172,341 | | | 170,029 | |

| Total liabilities and shareholders' equity | | $ | 185,778 | | | $ | 186,101 | |

SIMULATIONS PLUS, INC.

Trended Financial Information*

(Unaudited)

(in millions except earnings per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | FY 2022 | | FY 2023 | | FY 2024 | | 2022 | | 2023 |

| | | | | | | | | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | FY | | FY |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Software | | | | | | | | | | $ | 7.4 | | | $ | 9.8 | | | $ | 9.6 | | | $ | 5.9 | | | $ | 6.1 | | | $ | 10.5 | | | $ | 10.6 | | | $ | 9.3 | | | $ | 7.6 | | | $ | 32.7 | | | $ | 36.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Services | | | | | | | | | | 5.0 | | | 5.0 | | | 5.3 | | | 5.8 | | | 5.9 | | | 5.3 | | | 5.6 | | | 6.3 | | | 6.9 | | | 21.2 | | | 23.1 | |

| Total | | | | | | | | | | $ | 12.4 | | | $ | 14.8 | | | $ | 15.0 | | | $ | 11.7 | | | $ | 12.0 | | | $ | 15.8 | | | $ | 16.2 | | | $ | 15.6 | | | $ | 14.5 | | | $ | 53.9 | | | $ | 59.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Margin | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Software | | | | | | | | | | 90.0 | % | | 92.0 | % | | 92.4 | % | | 86.1 | % | | 85.4 | % | | 92.0 | % | | 91.5 | % | | 89.4 | % | | 86.9 | % | | 90.6 | % | | 90.1 | % |

| Services | | | | | | | | | | 60.0 | % | | 59.3 | % | | 65.6 | % | | 68.2 | % | | 69.7 | % | | 66.2 | % | | 63.4 | % | | 62.1 | % | | 47.0 | % | | 63.5 | % | | 65.3 | % |

| Total | | | | | | | | | | 77.8 | % | | 80.9 | % | | 82.9 | % | | 77.2 | % | | 77.7 | % | | 83.4 | % | | 81.8 | % | | 78.4 | % | | 67.9 | % | | 79.9 | % | | 80.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from operations | | | | | | | | | | $ | 3.8 | | | $ | 5.5 | | | $ | 4.9 | | | $ | 0.7 | | | $ | 0.9 | | | $ | 4.0 | | | $ | 4.1 | | | $ | (0.3) | | | $ | 1.0 | | | $ | 14.9 | | | $ | 8.7 | |

| Operating Margin | | | | | | | | | | 30.6 | % | | 37.0 | % | | 33.1 | % | | 5.9 | % | | 7.3 | % | | 25.6 | % | | 25.2 | % | | -1.8 | % | | 6.6 | % | | 27.7 | % | | 14.6 | % |

| Net Income | | | | | | | | | | $ | 3.0 | | | $ | 4.4 | | | $ | 4.1 | | | $ | 1.0 | | | $ | 1.2 | | | $ | 4.2 | | | $ | 4.0 | | | $ | 0.5 | | | $ | 1.9 | | | $ | 12.5 | | | $ | 10.0 | |

| Diluted Earnings Per Share | | | | | | | | | | $ | 0.15 | | | $ | 0.21 | | | $ | 0.20 | | | $ | 0.05 | | | $ | 0.06 | | | $ | 0.20 | | | $ | 0.20 | | | $ | 0.03 | | | $ | 0.10 | | | $ | 0.60 | | | $ | 0.49 | |

| Adjusted EBITDA | | | | | | | | | | $ | 5.3 | | | $ | 7.2 | | | $ | 6.5 | | | $ | 2.5 | | | $ | 3.0 | | | $ | 6.2 | | | $ | 6.5 | | | $ | 4.9 | | | $ | 3.4 | | | $ | 21.5 | | | $ | 20.6 | |

| Adjusted Diluted EPS | | | | | | | | | | $ | 0.15 | | | $ | 0.21 | | | $ | 0.20 | | | $ | 0.06 | | | $ | 0.07 | | | $ | 0.21 | | | $ | 0.21 | | | $ | 0.18 | | | $ | 0.10 | | | $ | 0.61 | | | $ | 0.67 | |

| Cash Flow from Operations | | | | | | | | | | $ | 3.6 | | | $ | 2.6 | | | $ | 3.8 | | | $ | 7.9 | | | $ | 4.7 | | | $ | 5.5 | | | $ | 8.5 | | | $ | 3.1 | | | $ | 0.2 | | | $ | 17.9 | | | $ | 21.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue Breakdown by Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Americas | | | | | | | | | | $ | 8.5 | | | $ | 9.7 | | | $ | 11.2 | | | $ | 8.4 | | | $ | 8.5 | | | $ | 10.6 | | | $ | 10.8 | | | $ | 11.0 | | | $ | 10.9 | | | $ | 37.7 | | | $ | 40.8 | |

| EMEA | | | | | | | | | | 3.0 | | | 3.7 | | | 1.9 | | | 1.7 | | | 2.1 | | | 3.6 | | | 3.4 | | | 2.6 | | | 2.3 | | | 10.4 | | | 11.7 | |

| Asia Pacific | | | | | | | | | | 0.9 | | | 1.4 | | | 1.9 | | | 1.6 | | | 1.3 | | | 1.5 | | | 2.1 | | | 2.1 | | | 1.3 | | | 5.8 | | | 7.0 | |

| Total | | | | | | | | | | $ | 12.4 | | | $ | 14.8 | | | $ | 15.0 | | | $ | 11.7 | | | $ | 12.0 | | | $ | 15.8 | | | $ | 16.2 | | | $ | 15.6 | | | $ | 14.5 | | | $ | 53.9 | | | $ | 59.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Software Performance Metrics | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Revenue per Customer (in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commercial | | | | | | | | | | $ | 71 | | | $ | 101 | | | $ | 95 | | | $65 | | $68 | | $110 | | $97 | | $88 | | $79 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Services Performance Metrics | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Backlog (in millions) | | | | | | | | | | $ | 15.4 | | | $ | 17.0 | | | $ | 16.7 | | | $ | 15.9 | | | $ | 15.8 | | | $ | 15.4 | | | $ | 15.7 | | | $ | 19.5 | | | $ | 18.9 | | | | | |

*Numbers may not add due to rounding

SIMULATIONS PLUS, INC.

Reconciliation of Adjusted EBITDA to Net Income*

(Unaudited)

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | FY 2022 | | FY 2023 | | FY 2024 | | 2022 | | 2023 |

| | | | | | | | | | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | FY | | FY |

| Net Income | | | | | | | | | | $ | 3.0 | | | $ | 4.4 | | | $ | 4.1 | | | $ | 1.0 | | | $ | 1.2 | | | $ | 4.2 | | | $ | 4.0 | | | $ | 0.5 | | | $ | 1.9 | | | $ | 12.5 | | | $ | 10.0 | |

| Excluding: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest income and expense, net | | | | | | | | | | (0.1) | | | (0.1) | | | (0.1) | | | (0.4) | | | (0.8) | | | (1.0) | | | (1.1) | | | (1.3) | | | (1.3) | | | (0.7) | | | (4.1) | |

| Provision for income taxes | | | | | | | | | | 0.8 | | | 1.1 | | | 0.7 | | | (0.1) | | | 0.4 | | | 0.9 | | | 0.9 | | | (0.5) | | | 0.5 | | | 2.6 | | | 1.7 | |

| Depreciation and amortization | | | | | | | | | | 0.8 | | | 1.0 | | | 0.9 | | | 0.9 | | | 0.9 | | | 0.9 | | | 0.9 | | | 1.1 | | | 1.1 | | | 3.6 | | | 3.9 | |

| Stock-based compensation | | | | | | | | | | 0.6 | | | 0.7 | | | 0.7 | | | 0.7 | | | 0.9 | | | 1.2 | | | 1.1 | | | 1.1 | | | 1.3 | | | 2.7 | | | 4.2 | |

| (Gain) loss on currency exchange | | | | | | | | | | (0.1) | | | (0.1) | | | 0.2 | | | 0.2 | | | — | | | — | | | 0.3 | | | 0.2 | | | — | | | 0.2 | | | 0.5 | |

| Impairment of other intangibles | | | | | | | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 0.5 | | | — | | | — | | | 0.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Change in value of contingent consideration | | | | | | | | | | 0.1 | | | 0.1 | | | — | | | — | | | — | | | — | | | — | | | 0.7 | | | (0.1) | | | 0.3 | | | 0.7 | |

| Mergers & Acquisitions expense | | | | | | | | | | — | | | — | | | — | | | 0.3 | | | 0.3 | | | 0.1 | | | 0.4 | | | 2.5 | | | — | | | 0.3 | | | 3.3 | |

| Adjusted EBITDA | | | | | | | | | | $ | 5.3 | | | $ | 7.2 | | | $ | 6.5 | | | $ | 2.5 | | | $ | 3.0 | | | $ | 6.2 | | | $ | 6.5 | | | $ | 4.9 | | | $ | 3.4 | | | $ | 21.5 | | | $ | 20.6 | |

*Numbers may not add due to rounding

SIMULATIONS PLUS, INC.

Reconciliation of Adjusted Diluted EPS to Diluted EPS*

(Unaudited)

(in millions, except Diluted EPS and Adjusted Diluted EPS)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | FY 2022 | | FY 2023 | | FY 2024 | | 2022 | | 2023 |

| | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | FY | | FY |

| | | | | | | | | | | | | | | | | | | | | | |

| Net Income (GAAP) | | $ | 3.0 | | | $ | 4.4 | | | $ | 4.1 | | | $ | 1.0 | | | $ | 1.2 | | | $ | 4.2 | | | $ | 4.0 | | | $ | 0.5 | | | $ | 1.9 | | | $ | 12.5 | | | $ | 10.0 | |

| Excluding: | | | | | | | | | | | | | | | | | | | | | | |

| Mergers & Acquisitions expense | | — | | | — | | | — | | | 0.3 | | | 0.3 | | | 0.1 | | | 0.4 | | | 0.9 | | | — | | | 0.3 | | | 1.7 | |

| Immunetrics transaction costs | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 2.3 | | | — | | | — | | | 2.3 | |

| Cognigen trade name write-off | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 0.5 | | | — | | | — | | | 0.5 | |

| Tax effect on above adjustments | | — | | | — | | | — | | | (0.1) | | | (0.1) | | | — | | | (0.1) | | | (0.5) | | | — | | | (0.1) | | | (0.7) | |

| Adjusted Net income (Non-GAAP) | | $ | 3.0 | | | $ | 4.4 | | | $ | 4.1 | | | $ | 1.2 | | | $ | 1.5 | | | $ | 4.2 | | | $ | 4.3 | | | $ | 3.7 | | | $ | 1.9 | | | $ | 12.8 | | | $ | 13.8 | |

| Weighted-average common shares outstanding: | | | | | | | | | | | | | | | | | | | | | | |

| Diluted | | 20.7 | | | 20.7 | | | 20.8 | | | 20.9 | | | 20.8 | | | 20.5 | | | 20.4 | | | 20.4 | | | 20.3 | | | 20.7 | | | 20.5 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Diluted EPS (GAAP) | | $ | 0.15 | | | $ | 0.21 | | | $ | 0.20 | | | $ | 0.05 | | | $ | 0.06 | | | $ | 0.20 | | | $ | 0.20 | | | $ | 0.03 | | | $ | 0.10 | | | $ | 0.60 | | | $ | 0.49 | |

| Adjusted Diluted EPS (Non-GAAP) | | $ | 0.15 | | | $ | 0.21 | | | $ | 0.20 | | | $ | 0.06 | | | $ | 0.07 | | | $ | 0.21 | | | $ | 0.21 | | | $ | 0.18 | | | $ | 0.10 | | | $ | 0.61 | | | $ | 0.67 | |

*Numbers may not add due to rounding

Exhibit 99.2

Simulations Plus Announces Leadership Appointments Supporting Commitment to Clients and Driving Growth

LANCASTER, CA, JANUARY 3, 2024 -- Simulations Plus, Inc. (Nasdaq: SLP) (“Simulations Plus”), a leading provider of modeling and simulation software and services for pharmaceutical safety and efficacy, today announced the following leadership changes effective January 3, 2024.

“We are excited to announce key strategic appointments that will advance our objective to seamlessly and organically align with our clients’ needs,” said Shawn O’Connor, Chief Executive Officer. “We have a deep bench of talent at Simulations Plus, and I am delighted to recognize the excellent leadership and accomplishments that each person has demonstrated. This team has a wide range of experience, proven execution and a shared vision that will strengthen our ability to realize our strategic growth initiatives.”

Will Frederick, currently Chief Financial Officer, assumes the additional role of Chief Operating Officer in recognition of his operational leadership. Mr. Frederick has served as Chief Financial Officer since joining Simulations Plus in December 2020.

Dan Szot joins Simulations Plus as Chief Revenue Officer. In this new role, Mr. Szot oversees the sales and marketing teams to identify collaborative cross-selling opportunities and enhance productivity. Mr. Szot was previously at Dassault Systemes where he served as Global Vice President of Sales and Field Operations for the BIOVIA brand. In his over 20 years in the industry, Mr. Szot has had broad experience across all phases of drug development in large organizations in enterprise sales, research discovery and clinical applications. Mr. Szot reports to Shawn O’Connor, Chief Executive Officer.

Josh Fohey transitions from Vice President of Business Development to Senior Vice President, Operations. In this key operational role, Mr. Fohey will leverage his customer insights to provide leadership across all business units supporting client-focused services operations, product operations, and quality management. Mr. Fohey joined Simulations Plus in 2019 as Director of Operations and was promoted to Vice President, Operations in 2020. Prior to joining Simulations Plus, he had several operational, scientific, and business development roles during his 14 years at Covance. In his new role, Mr. Fohey reports to Will Frederick, Chief Financial Officer and Chief Operating Officer.

Sandra Suarez-Sharp, Ph.D. currently Vice President, Regulatory Affairs, is promoted to President, Regulatory Strategies. Dr. Suarez-Sharp joined Simulations Plus over three years ago and has been instrumental in initiating the company’s regulatory support to clients. Prior to joining Simulations Plus, Dr. Suarez-Sharp had a long and successful career at the Food and Drug Administration including roles in biopharmaceutics, bioequivalence, and clinical pharmacology. In her new role, she is responsible for expanding Simulations Plus’s Regulatory Strategies business unit, a fast-growing component of the company’s overall service offering that is critical to assisting clients in deploying Simulations Plus software and services for regulatory success. Dr. Suarez-Sharp reports to CEO Shawn O’Connor.

About Simulations Plus, Inc.

Serving clients worldwide for more than 25 years, Simulations Plus is a leading provider in the biosimulation market providing software and consulting services supporting drug discovery, development, research, and regulatory submissions. We offer solutions that bridge machine learning, physiologically based pharmacokinetics, quantitative systems pharmacology/toxicology, and population PK/PD modeling approaches. Our technology is licensed and applied by major pharmaceutical, biotechnology, and regulatory agencies worldwide. For more information, visit our website at www.simulations-plus.com. Follow us on LinkedIn | Twitter | YouTube.

Environmental, Social, and Governance (ESG)

We focus our Environmental, Social, and Governance (ESG) efforts where we can have the most positive impact. To learn more about our latest initiatives and priorities, please visit our ESG website.

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 – With the exception of historical information, the matters discussed in this press release are forward-looking statements that involve a number of risks and uncertainties. Words like “will,” “believe,” “expect” and “anticipate” mean that these are our best estimates as of this writing, but that there can be no assurances that expected or anticipated results or events will actually take place, so our actual future results could differ significantly from those statements. Factors that could cause or contribute to such differences include, but are not limited to: our ability to successfully integrate Immunetrics into our business, our ability to maintain our competitive advantages, acceptance of new software and improved versions of our existing software by our customers, the general economics of the pharmaceutical industry, our ability to finance growth, our ability to continue to attract and retain highly qualified technical staff, our ability to identify and close acquisitions on terms favorable to the Company, and a sustainable market. Further information on our risk factors is contained in our quarterly and annual reports and filed with the U.S. Securities and Exchange Commission.

Investor Relations Contacts:

Tamara Gonzalez

Financial Profiles

310-622-8234

slp@finprofiles.com

Renee Bouche

Simulations Plus Investor Relations

661-723-7723

renee.bouche@simulations-plus.com

1 Earnings Call – Q1 - FY24 January 3, 2024

With the exception of historical information, the matters discussed in this presentation are forward-looking statements that involve a number of risks and uncertainties. Words like “believe,” “expect” and “anticipate” mean that these are our best estimates as of this writing, but that there can be no assurances that expected or anticipated results or events will actually take place, so our actual future results could differ significantly from those statements. Factors that could cause or contribute to such differences include, but are not limited to: our ability to maintain our competitive advantages, acceptance of new software and improved versions of our existing software by our customers, the general economics of the pharmaceutical industry, our ability to finance growth, our ability to continue to attract and retain highly qualified technical staff, as well as expenses we may incur in connection therewith, and a sustainable market. Further information on our risk factors is contained in our quarterly and annual reports and filed with the U.S. Securities and Exchange Commission. Safe Harbor Statement 2

First Quarter Highlights $0.10 Diluted EPS $14.5M Revenue 23% Adj. EBITDA as % of Revenue $18.9M Backlog 3 CURRENT PERIOD Prior Year Comparison (1Q23) $12.0M Revenue $0.06 Diluted EPS 25% Adjusted EBITDA as % of Revenue $15.8M Backlog

▪ Overall software revenue growth of 25% ▪ Renewal rate improvement compared to last year ▪ Active and strong pipeline First Quarter Software Highlights -1% +27% ▪ 6 new customers ▪ 9 upsells to existing customers ▪ Continued strong performance in China (+51% YoY): 2 new biotech customers + good renewal outcomes ▪ 2 new customers ▪ 5 upsells to existing customers ▪ 2 nonrenewals - 1 small biotech; 1 push to CY24 +3% Q1 Revenue Growth Q1 Revenue Decline Q1 Revenue Growth General GastroPlus® (Physiologically Based Pharmacokinetics) MonolixSuite® (Clinical Pharmacology & Pharmacometrics) ADMET Predictor® (Cheminformatics) ▪ 9 new customers; 10 upsells to existing customers ▪ Biotech churn still exists ▪ Positive feedback from the Autumn training class with 600+ attendees 4

▪ Overall services revenue growth of 17% ▪ Total backlog $18.9M – projects to be performed within one year also increased ▪ Good momentum out of fiscal 2023 continues ▪ Choppy project flow due to data and other client delays First Quarter Services Highlights +100% +12% ▪ Excellent bookings quarter - continued momentum from Q4 FY23 ▪ Successful fall conference season with leads generated at ACCP, AAPS, and ACoP; good visibility and presenceQ1 Revenue Growth Q1 Revenue Growth General Clinical Pharmacology & Pharmacometrics (CPP) Quantitative Systems Pharmacology (QSP) ▪ Some benefit from Immunetrics acquisition ▪ Successfully drafted and delivered FDA-targeted regulatory report for DILIsym ▪ Received feedback from a client that information provided to their investor through QSP project led them to significantly reduce their position and avoid losses for a less than optimal therapeutic 5 Physiologically Based Pharmacokinetics (PBPK) ▪ Several client data delays impacted project deliveries / milestones ▪ Additional FDA grant awards ▪ Outlook good for year -12% Q1 Revenue Decline

Financial Results

52% 48% Software Services 51% 49% Software Services Revenue - Q1 FY24 (in millions) Software RevenueTotal Revenue Services Revenue +21% +25% +17% 1Q24 Mix 1Q23 Mix 7 $7.4 $6.1 $7.6 $5.1 $5.8 $6.9 $12.4 $12.0 $14.5 Software Services 1Q22 1Q23 1Q24

61% 39% Software Services 59% 41% Software Services Revenue - Trailing Twelve Months (TTM) (in millions) Software RevenueTotal Revenue Services Revenue 16% 21% 9% 1Q24 Mix 1Q23 Mix 8 $28.8 $31.4 $38.0 $19.4 $22.1 $24.1$48.2 $53.5 $62.1 Software Services 1Q22 1Q23 1Q24

Gross Margin Trends - Q1 FY24 9 90% 85% 87% 60% 70% 47% 78% 78% 68% Software Services Total 1Q22 1Q23 1Q24

Gross Margin Trends - TTM 10 89% 90% 90% 60% 66% 59% 77% 80% 78% Software Services Total 1Q22 1Q23 1Q24

Software Revenue by Business Unit 11 Software Business Unit as % of Software Revenue 1Q24 TTM 52% 20% 15% 13% 57% 18% 18% 7% PBPK CPP Cheminformatics PBPK CPP Cheminformatics QSP QSP

Avg. Revenue per Customer (in thousands) Software Performance Metrics - Q1 FY24 Commercial Customers Renewal Rates 12 $71 $68 $79 1Q22 1Q23 1Q24 93% 82% 84% 96% 90% 100% Accounts Fees 1Q22 1Q23 1Q24

Avg. Revenue per Customer (in thousands) Software Performance Metrics - TTM Commercial Customers Renewal Rates 13 $85 $83 $93 1Q22 1Q23 1Q24 86% 85% 83% 93% 93% 93% Accounts Fees 1Q22 1Q23 1Q24

Services Revenue by Business Unit 14 Services Business Unit as % of Services Revenue Q1 FY24 TTM REG 46% 30% 19% 5% CPP QSP PBPK REG 45% 28% 22% 5% CPP QSP PBPK

$15.4 $15.8 $18.9 1Q22 1Q23 1Q24 67 70 67 22 24 27 55 73 63 21 12 22 165 179 179 CPP QSP PBPK REG 1Q22 1Q23 1Q24 Services Performance Metrics Total Projects Backlog 15

Income Statement Summary - Q1 FY24 16 (in millions, except Diluted EPS) 1Q24 % of Rev 1Q23 % of Rev Revenue $14.5 100% $12.0 100% Revenue growth 21% (4)% Gross profit 9.8 68% 9.3 78% R&D 1.2 8% 1.2 10% S&M 2.0 14% 1.5 12% G&A 5.7 39% 5.8 48% Total operating exp 8.9 61% 8.4 70% Income from operations 1.0 7% 0.9 7% Income before income taxes 2.4 17% 1.6 14% Income taxes (0.5) 3% (0.4) 3% Effective tax rate 19% 23% Net income $1.9 13% $1.2 10% Diluted earnings per share $0.10 $0.06 Adjusted EBITDA $3.4 23% $3.0 25%

Balance Sheet Summary 17 November 30, 2023 August 31, 2023 Cash and short-term investments $113.9 $115.5 Total current assets 129.7 130.4 Total assets $185.8 $186.1 Current liabilities 8.6 12.0 Long-term liabilities 4.8 4.1 Total liabilities 13.4 16.1 Shareholders’ equity 172.3 170.0 Total liabilities and shareholders’ equity $185.8 $186.1 (in millions)

Fiscal 2024 Guidance 18 Guidance Total Revenue $66M to $69M Total Revenue Growth 10% to 15% Software Revenue Mix 55% to 60% Services Revenue Mix 40% to 45% Diluted EPS $0.66 to $0.68

STRONG FISCAL 2023 & START TO FISCAL 2024 Delivering on our commitment to scientific leadership Challenges being addressed 19 • Internal R&D investment • Expanding industry and regulatory partnerships • MIDD+ – 3rd annual SLP sponsored conference Enhancing our client facing capabilities Focus on Capital Allocation CONTINUED LEADERSHIP POSITION IN BIOSIMULATION MARKET Conclusion • Appointed new CRO to lead sales effort • Reorganized operations to put clients first • Focus on supporting accelerated growth in distributor network • Software renewal timing changes completed • Small biotech churn • General market dynamics: inflation, recession & forex • ASR program has been completed • Immunetrics acquisition completed in Q4

Adjusted EBITDA Non-GAAP Reconciliation* 20 FY 2022 FY 2023 FY 2024 2022 2023 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 FY FY Net Income $3.0 $4.4 $4.1 $1.0 $1.2 $4.2 $4.0 $0.5 $1.9 $12.5 $10.0 Excluding: Interest income and expense, net (0.1) (0.1) (0.1) (0.4) (0.8) (1.0) (1.1) (1.3) (1.3) (0.7) (4.1) Provision for income taxes 0.8 1.1 0.7 (0.1) 0.4 0.9 0.9 (0.5) 0.5 2.6 1.7 Depreciation and amortization 0.8 1.0 0.9 0.9 0.9 0.9 0.9 1.1 1.1 3.6 3.9 Stock-based compensation 0.6 0.7 0.7 0.7 0.9 1.2 1.1 1.1 1.3 2.7 4.2 (Gain) loss on currency exchange (0.1) (0.1) 0.2 0.2 — — 0.3 0.2 — 0.2 0.5 Impairment of other intangibles — — — — — — — 0.5 — — 0.5 Change in value of contingent consideration 0.1 0.1 — — — — — 0.7 (0.1) 0.3 0.7 Mergers & Acquisitions expense — — — 0.3 0.3 0.1 0.4 2.5 — 0.3 3.3 Adjusted EBITDA $5.3 $7.2 $6.5 $2.5 $3.0 $6.2 $6.5 $4.9 $3.4 $21.5 $20.6 (in millions) *Numbers may not add due to rounding

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

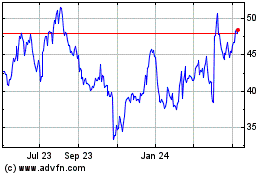

Simulations Plus (NASDAQ:SLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

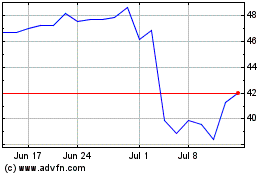

Simulations Plus (NASDAQ:SLP)

Historical Stock Chart

From Apr 2023 to Apr 2024