false000123546800012354682024-01-032024-01-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 03, 2024 |

Liquidity Services, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

0-51813 |

52-2209244 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

6931 Arlington Road Suite 460 |

|

Bethesda, Maryland |

|

20814 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 202 4676868 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value |

|

LQDT |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD.

On January 3, 2024, Liquidity Services, Inc. (the “Company”) issued a press release announcing the acquisition of all of the issued and outstanding equity securities of Sierra Auction Management, Inc. (“Sierra Auction”) and G&G Salvage and Liquidations, Inc., pursuant to a definitive agreement, dated as of December 1, 2023, by and among Liquidity Services Operations LLC, a wholly-owned subsidiary of the Company, on the one hand, and Makers, Inc. and the other parties thereto, on the other hand.

Sierra Auction is a full-service auction company specializing in the sale of vehicles, equipment and surplus assets for government agencies, commercial businesses, and charities. Established in 1986 in Phoenix, AZ, Sierra Auction is the sole auction outlet for seized and forfeited assets from several prominent state and county government agencies in Arizona. Additionally, Sierra has partnered with numerous charity organizations to auction donated vehicles. The transaction accelerates Liquidity Services’ penetration of the southwest US market for municipal government surplus and expands the size of Liquidity Services’ overall transportation and used equipment footprint. The purchase price of $13.5 million was paid in cash at the time of closing and will be subject to a customary working capital adjustment. Sierra Auction's financial results will be included within the Company’s GovDeals reportable segment. The impact on the Company’s consolidated financial results is expected to be accretive in the 2024 fiscal year but it is not expected to be material in the Company’s 2024 fiscal year.

A copy of this press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 7.01 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities under that Section, nor shall it be deemed incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

LIQUIDITY SERVICES, INC. |

|

(Registrant) |

|

|

Date: January 3, 2024 |

By: |

/s/ Mark A. Shaffer |

|

Name: |

Mark A. Shaffer |

|

Title: |

Chief Legal Officer and

Corporate Secretary |

Exhibit 99.1

Liquidity Services Acquires Sierra Auction, a Leading Auctioneer of Vehicles, Equipment, and Surplus Assets for Government and Commercial Organizations

Acquisition strengthens and accelerates the company’s position as the leading online platform for the sale of vehicles, equipment, and surplus assets by government and commercial sellers

BETHESDA, Md., January 3, 2024 -- Liquidity Services, Inc. (NASDAQ: LQDT), a leading global commerce company powering the circular economy, today announced it has acquired Sierra Auction, a full-service auction company specializing in the sale of vehicles, equipment and surplus assets for government agencies, commercial businesses, and charities. Sierra hosts the largest weekly public online auctions in Arizona. The transaction accelerates Liquidity Services’ penetration of the southwest US market for municipal government surplus and expands the size of Liquidity Services’ overall transportation and used equipment footprint.

Established in 1986 in Phoenix, AZ, Sierra Auction is the sole auction outlet for seized and forfeited assets from several prominent state and county government agencies in Arizona. Additionally, Sierra has partnered with numerous charity organizations to auction donated vehicles.

“With Sierra’s strong track record of delivering value for government and commercial clients, this transaction enhances our business with immediate access to a growing portfolio of clients in the attractive southwestern US surplus market, expands our pre-and post-sale logistics services for fleet owners , and increases our network of buyers for used vehicles and high value equipment,” stated Bill Angrick, Chairman of the Board and Chief Executive Officer of Liquidity Services.

“Sierra hosts some of the largest monthly public auctions in the Southwest region. The combination of Sierra’s strengths in traditional auctions together with Liquidity Services' reach in digital auctions will be great for our customers and take our already strong business to the next level,” said Nick Carr, President of Sierra Auction.

Liquidity Services expects to retain Sierra’s current management team and its employees following the transaction.

Cautionary Note Regarding Forward-Looking Statements

This document contains forward-looking statements made pursuant to the Private Securities Litigation Reform Act of 1995. These statements are only predictions. The outcome of the events described in these forward-looking statements is subject to known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These statements include, but are not limited to, statements regarding the Company’s business outlook; expected future results; expected future effective tax rates; and trends and assumptions about future periods. You can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “would,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continues” or the negative of these terms or other comparable terminology. Our business is subject to a number of risks and uncertainties, and our past performance is no guarantee of our performance in future periods. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements.

There are several risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements in this document. Important factors that could cause our actual results to differ materially from those expressed as forward-looking statements are set forth in our filings with the U.S. Securities and Exchange Commission (SEC) from time to time, and include, among others: changes in political, business and economic conditions; the duration and impact of shortages in supply of used vehicles; the continuing impacts of geopolitical events, including armed conflicts in Ukraine, in and adjacent to Israel, and elsewhere; and impacts from escalating interest rates and inflation on the Company’s operations; the operations of customers, project size and timing of auctions, operating costs, and general economic conditions; retail clients investing in their warehouse operations capacity to handle higher

volumes of online returns, resulting in retailers sending the Company a reduced volume of returns merchandise or sending us a product mix lower in value due to the removal of high value returns; the numerous factors that influence the supply of and demand for used merchandise, equipment and surplus assets; the Company’s need to manage the attraction of sellers and buyers in a broad range of asset categories with varying degrees of maturity and in many geographies; economic and other conditions in local, regional and global sectors; the Company’s ability to integrate acquired companies, and execute on anticipated business plans such as the efforts underway with local and state governments to advance legislation that allows for online auctions for foreclosed and tax foreclosed real estate; the Company’s need to successfully react to the increasing importance of mobile commerce and the increasing environmental and social impact aspects of e-commerce in an increasingly competitive environment for our business, including not only risks of disintermediation of our e-commerce services by our competitors but also by our buyers and sellers; the Company’s ability to timely upgrade and develop our technology systems, infrastructure and marketing and customer service capabilities at reasonable cost while maintaining site stability and performance and adding new products and features; the Company’s ability to attract, retain and develop the skilled employees that we need to support our business; and other the risks and uncertainties set forth in the Company’s Annual Report on Form 10-K for the year ended September 30, 2023, which are available on the SEC and Company websites. There may be other factors of which we are currently unaware or which we deem immaterial that may cause our actual results to differ materially from the forward-looking statements.

All forward-looking statements attributable to us or persons acting on our behalf apply only as of the date of this document and are expressly qualified in their entirety by the cautionary statements included in this document. Except as may be required by law, we undertake no obligation to publicly update or revise any forward-looking statement to reflect events or circumstances occurring after the date of this document or to reflect the occurrence of unanticipated events.

About Liquidity Services

Liquidity Services (NASDAQ: LQDT) operates the world’s largest B2B e-commerce marketplace platform for surplus assets with over $10 billion in completed transactions to more than five million qualified buyers and 15,000 corporate and government sellers worldwide. The company supports its clients' sustainability efforts by helping them extend the life of assets, prevent unnecessary waste, and carbon emissions, and reduce the number of products headed to landfills.

About Sierra

Sierra is a full-service auction company based in Phoenix, Arizona. The privately held company auctions vehicles, equipment and surplus assets for government agencies, corporations, bankruptcy trustees, financial institutions, and charities.

Media Contacts:

Public Relations

Liquidity Services, Inc.

publicrelations@liquidityservices.com

Investor Relations

Liquidity Services, Inc.

investorrelations@liquidityservicesinc.com

v3.23.4

Document And Entity Information

|

Jan. 03, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 03, 2024

|

| Entity Registrant Name |

Liquidity Services, Inc.

|

| Entity Central Index Key |

0001235468

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

0-51813

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

52-2209244

|

| Entity Address, Address Line One |

6931 Arlington Road

|

| Entity Address, Address Line Two |

Suite 460

|

| Entity Address, City or Town |

Bethesda

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20814

|

| City Area Code |

202

|

| Local Phone Number |

4676868

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

LQDT

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

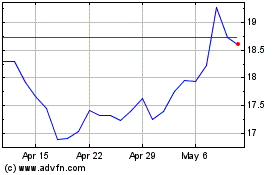

Liquidity Services (NASDAQ:LQDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

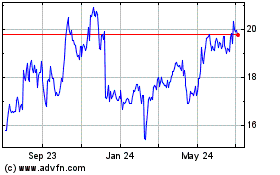

Liquidity Services (NASDAQ:LQDT)

Historical Stock Chart

From Apr 2023 to Apr 2024