SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For December, 2023

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

COMPANHIA DE SANEAMENTO

BÁSICO DO ESTADO DE SÃO PAULO - SABESP

PUBLICLY HELD COMPANY

Corporate Taxpayer’s

ID (CNPJ): 43.776.517/0001-80

Company Registry

(NIRE): 35.300.016.831

NOTICE

TO THE MARKET

Companhia

de Saneamento Básico do Estado de São Paulo – Sabesp (“Company” or “Sabesp”)

hereby informs its shareholders and the market in general that, on August 20, 2023, it received Official Letter 355/2023/CVM/SEP/GEA-2

(“Official Letter”), issued by the Brazilian Securities and Exchange Commission, as transcribed as follows:

“Rio

de Janeiro, December 20, 2023

To Mrs.

Catia

Cristina Teixeira Pereira

Investor

Relations Officer of

COMPANHIA

DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO ‒ SABESP

Phone:

(11) 3388-8247

Email:

dri@sabesp.com.br

C/C: Issuers

Listing and Supervision Department of B3 S.A. – Brasil, Bolsa, Balcão

Emails:

emissores@b3.com.br; ana.pereira@b3.com.br; ana.zane@b3.com.br

Subject:

Request for clarification – News article disclosed in the media

Dear Officer,

1. We

refer to the news article disclosed in the Broadcast/Agência Estado new portal on 12/18/2023, under the headline "TRT-2 condemns

Sabesp to pay pensions to retired beneficiaries, amounting to R$1.2 billion", with the following content:

TRT-2

condemns Sabesp to pay pensions to retired beneficiaries, amounting to R$1.2 billion.

12/18/2023

05:55 p.m.

The 9th

Panel of the Regional Labor Court of the Second Region of the State of São Paulo (TRT-2) decided, collectively and unanimously,

that Sabesp must pay pension supplements to the beneficiaries of retirees who requested values to be settled, after the sanitation

company argued that the calculations should be limited to the date of death of the retired employees.

According

to a decision published on Friday, December 15, the ruling includes both retired employees and pensioners as beneficiaries with material

rights. The panel followed the arguments of judge Bianca Bastos, rapporteur of the case.

She also

considered that Sabesp must increase/adjust the beneficiaries' salaries according to their category under the new Career and Salary Plan,

whenever the new remuneration structure implies a general increase or increase by category. According to a note released by TRT-2,

the decision includes 2.8 thousand beneficiaries, and the total amount due exceeds R$1.2 billion.

In addition

to determining that pensioners be considered eligible to receive the updated amounts, the 9th Panel also decided that the collective representation

on behalf of Sabesp’s Association of Retirees and Pensioners (AAPS) is "legitimate", however in the enforcement phase.

"Although the ruling stating that executions for the first appeal filed must always be individual, these appeals, according to the

interpretation of consumer law, can be individual or collective, so long as settlements are made individually".

Executions

for labor lawsuits begin when the debtor has not fulfilled an agreement, while settlement relates to the phase in which the amount subject

of the lawsuit is calculated. In this sense, individual settlement means that each beneficiary must submit their own lawsuit.

In any case,

the final solution is still pending a decision by the Superior Labor Court (TST), which suspended the judgment of appeals for this lawsuit

in April 2023, due to a request for review by Justice Maria Helena Mallmann.

Sabesp

was contacted but did not respond until the closing of this article.

2. Concerning

the content of the news article, particularly the highlighted excerpts, we hereby request that you state whether the information

contained in said news article is true, and if so, we request that you provide additional clarification on the matter and state the reasons

why you did not believe this was not a material fact, pursuant to CVM Resolution 44/21.

3. In

addition, we request that you inform the reasons why, in item 4.4 of the 2023 Reference Form, version 5.0, the company informed that the

amount for said lawsuits “is estimated at R$357.5 million on December 31, 2022", which is considerably lower than the amount

reported in the referred news article.

4. The

clarification must include a copy of this Official Letter and be forwarded through the Empresas.NET System, under the “Comunicado

ao Mercado” category, type “Esclarecimentos sobre questionamentos da CVM/B3”. Compliance with this request for clarification

through a Notice to the Market does not exempt the Company from the responsibility for the untimely disclosure of a Material Fact, pursuant

to CVM Instruction 44/21.

5. It

is worth noting that according to article 3 of CVM Resolution 44/21, the Investor Relations Officer is responsible for disclosing and

informing the CVM and, if applicable, the stock exchange and the organized over-the-counter market entity where the company’s securities

are traded, of any material act or fact occurred or related to its business, as well as for ensuring its wide and immediate dissemination,

simultaneously in all the markets in which such securities are traded.

6. We

would also like to remind the Company that it is obliged to question management, the controlling shareholders, as well as all other persons

with access to material acts or facts, to ascertain whether they are aware of any information that must be disclosed to the market, as

set down in the sole paragraph of article 4 of CVM Resolution 44/21.

7. Pursuant

to the sole paragraph of article 6 of CVM Resolution 44/21, it is the charge of controlling shareholders or management of publicly-held

companies to – directly or represented by the Investor Relations Officer – immediately disclose any pending material act or

fact to the market in the event of the information is out of the Company’s control, or if there is atypical fluctuation in the price

or traded amount of securities issued by publicly-held companies, or referenced thereto. Therefore, if any relevant information is leaked

(i.e. it has been disclosed by the press), a Material Fact must be disclosed to the market no matter if said information arises or not

from clarification provided by the company’s representatives.

8. We

also emphasize that article 8 of CVM Resolution 44/21 sets forth that it is the responsibility of controlling shareholders, executive

officers, members of the board of directors, the fiscal council, and any other bodies with technical or advisory roles created under statutory

provisions, as well as company employees to maintain the confidentiality of information on material acts or facts of which they have insider

knowledge because of the position they hold at the company until these acts or facts are disclosed to the market, as well as to ensure

that their subordinates and third parties in whom they trust will also maintain the confidentiality of said acts or facts, willfully accepting

the consequences for noncompliance.

9. As

determined by the Corporate Relations Department, we inform you that, in the exercise of its legal duties, said administrative authority,

pursuant to item II of article 9 of Law 6,385/76, and articles 7 and 8 of CVM Resolution 47/21, will impose, by December 21, 2023,

a punitive fine of R$1,000.00 (one thousand reals) on the Company, due to noncompliance with the required regulations, without prejudice

to other administrative sanctions.”

In compliance

with the Official Letter, the Company clarifies the following.

Initially,

it is worth noting that Collective Lawsuit 0060800-58.2006.5.02.0048, filed by Sabesp’s Association of Retirees and Pensioners (“AAPS”)

with the 48th Labor Court of São Paulo (“Lawsuit”), and which is the subject of the referred news article, has

not reached a final decision, and is currently under appeal with the Superior Labor Court. In this sense, there is no need to discuss

a definitive condemnatory ruling within the scope of the Lawsuit, much less about a loss to be incurred by the Company.

Furthermore,

as recognized in the Official Letter, this Lawsuit is duly reported and described in the Company's Reference Form.

This Official

Letter requests the Company to justify the discrepancy between the estimated amount of R$357.5 million indicated in the Reference Form

and the potential amount of R$1.2 billion stated in the news article. In this regard, the Company clarifies that the Lawsuit contemplates

several requests from AAPS. One of the requests from AAPS was appointed to the lower courts (first and second instance courts), but the

formula adopted by the defendant to calculate the amounts was not approved, thus prevailing the thesis defended by Sabesp. Therefore,

according to the understandings from these lower courts, we believe, in the lack of a better judgment, that the contingency amount presented

in the Company's Reference Form is correct.

Lastly, it

is important to note that the decision mentioned in the new article, issued by the 9th Panel of the Regional Labor Court of the Second

Region of the State of São Paulo (TRT-2), within the scope of provisional enforcement lawsuits filed by AAPS, addresses the appeals

filed by Sabesp and the Public Treasury of the State of São Paulo.

There was

no innovation in relation to the decision on the merits, since the TRT-2 has already expressed its intention to maintain the original

decision made by the 48th Labor Court of São Paulo, which is duly reported in the “main facts” section of item 4.4.

of the Company's Reference Form.

Therefore, there is

no new element or information within the scope of the new article that could be considered a material fact for the purposes of CVM Resolution

44/21. The Company reaffirms its commitment to keep its shareholders and the market duly informed, through the appropriate channels, about

any relevant developments on the matter.

São

Paulo, December 21, 2023.

Catia Cristina

Teixeira Pereira

Chief Financial Officer and Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: December 28, 2023

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP |

|

|

|

| By: |

/s/ Catia Cristina Teixeira Pereira

|

|

| |

Name: Catia Cristina Teixeira Pereira

Title: Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

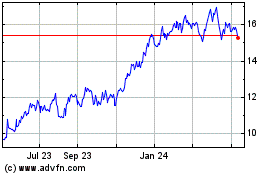

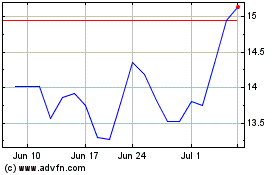

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Apr 2023 to Apr 2024