Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

December 28 2023 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 001-33765

AIRNET TECHNOLOGY INC.

(Exact name of registrant as specified in its charter)

Suite 301

No. 26 Dongzhimenwai Street

Chaoyang District, Beijing 100027

The People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F ¨

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

AIRNET TECHNOLOGY INC. |

| |

|

|

| Date: December 28, 2023 |

By: |

/s/ Dan Shao |

| |

Name: |

Dan Shao |

| |

Title: |

Chief Executive Officer |

EXHIBIT INDEX

Exhibit 99.1

AirNet Technology Inc.

Announces Unaudited Financial Results for the First Half of 2023

BEIJING, December 26, 2023 (GLOBE NEWSWIRE) -- AirNet Technology Inc., formerly known as AirMedia Group Inc. (“AirNet” or

the “Company”) (Nasdaq: ANTE), today announced its unaudited financial results for the first half of 2023.

AIRNET TECHNOLOGY INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(In U.S. dollars in thousands, except share

and per share data)

| | |

As of December 31, | | |

As of June 30, | |

| | |

2022 | | |

2023 | |

| | |

| | |

(Unaudited) | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 2,700 | | |

$ | 132 | |

| Accounts receivable, net | |

| 1,421 | | |

| 552 | |

| Other current assets, net | |

| 65,072 | | |

| 28,527 | |

| Amount due from related parties | |

| 601 | | |

| 199 | |

| Total current assets | |

| 69,794 | | |

| 29,410 | |

| Property and equipment, net | |

| 10,885 | | |

| 10,447 | |

| Long-term investments, net | |

| 34,083 | | |

| 30,654 | |

| Long-term deposits, net | |

| 371 | | |

| 62 | |

| Operating lease right-of-use assets | |

| 16 | | |

| 8 | |

| TOTAL ASSETS | |

| 115,149 | | |

| 70,581 | |

| Liabilities | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Short-term loan | |

| 12,822 | | |

| 9,912 | |

| Accounts payable | |

| 15,774 | | |

| 16,451 | |

| Accrued expenses and other current liabilities | |

| 11,277 | | |

| 11,041 | |

| Deferred revenue | |

| 7,745 | | |

| 7,366 | |

| Amount due to related parties | |

| 1,174 | | |

| 1,207 | |

| Income tax payable | |

| 1,865 | | |

| 1,232 | |

| Operating lease liability, current | |

| 10 | | |

| 12 | |

| Consideration received from buyer | |

| 29,000 | | |

| 27,580 | |

| Payable of earnout commitment | |

| 22,120 | | |

| 21,037 | |

| Total current liabilities | |

| 101,787 | | |

| 95,838 | |

| Non-current liabilities: | |

| | | |

| | |

| Operating lease liability, non-current | |

| 9 | | |

| - | |

| Total liabilities | |

| 101,796 | | |

| 95,838 | |

AIRNET TECHNOLOGY INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

- CONTINUED

(In U.S. dollars in thousands, except share

and per share data)

| | |

As of December 31, | | |

As of June 30, | |

| | |

2022 | | |

2023 | |

| | |

| | |

(Unaudited) | |

| Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Ordinary shares ($0.04 par value; 22,500,000 shares authorized; 8,948,505 and 4,525,643 shares issued as of December 31, 2022 and June 30, 2023; 8,923,687 and 4,499,654 shares outstanding as of December 31, 2022 and June 30, 2023) | |

| 359 | | |

| 181 | |

| Additional paid-in capital | |

| 332,746 | | |

| 298,685 | |

| Treasury stock (245,818 shares as of December 31, 2022 and June 30, 2023) | |

| (1,148 | ) | |

| (1,148 | ) |

| Accumulated deficit | |

| (318,239 | ) | |

| (322,164 | ) |

| Accumulated other comprehensive income | |

| 32,044 | | |

| 31,368 | |

| Total AirNet Technology Inc.'s shareholders' equity | |

| 45,762 | | |

| 6,922 | |

| Non-controlling interests | |

| (32,409 | ) | |

| (32,179 | ) |

| Total equity (deficits) | |

| 13,353 | | |

| (25,257 | ) |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND DEFICITS | |

$ | 115,149 | | |

$ | 70,581 | |

AIRNET TECHNOLOGY INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

(In U.S. dollars in thousands, except share

and per share data)

| | |

Six months ended June 30, | |

| | |

2022 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Revenues | |

$ | 2,541 | | |

$ | 581 | |

| Business tax and surcharges | |

| (53 | ) | |

| (43 | ) |

| Net revenues | |

| 2,488 | | |

| 538 | |

| Cost of revenues | |

| (2,358 | ) | |

| (1,394 | ) |

| Gross profit (loss) | |

| 130 | | |

| (856 | ) |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Selling and marketing | |

| (748 | ) | |

| (359 | ) |

| General and administrative | |

| (3,435 | ) | |

| (1,712 | ) |

| Research and development | |

| (18 | ) | |

| (16 | ) |

| Total operating expenses | |

| (4,201 | ) | |

| (2,087 | ) |

| Loss from operations | |

| (4,071 | ) | |

| (2,943 | ) |

| Interest expense, net | |

| (448 | ) | |

| (330 | ) |

| Loss from long-term investments | |

| (1,275 | ) | |

| (618 | ) |

| Other income, net | |

| 4,798 | | |

| 199 | |

| Loss from operations before income taxes | |

| (996 | ) | |

| (3,692 | ) |

| Income tax expenses | |

| (12 | ) | |

| (1 | ) |

| Net loss | |

| (1,008 | ) | |

| (3,693 | ) |

| Less: Net income from operations attributable to non-controlling interests | |

| 756 | | |

| 232 | |

| Net loss from operations attributable to AirNet Technology Inc.'s shareholders | |

$ | (1,764 | ) | |

$ | (3,925 | ) |

| | |

| | | |

| | |

| Net loss attributable to AirNet Technology Inc.’s shareholders per ordinary share | |

| | | |

| | |

| - Basic and diluted | |

$ | (0.27 | ) | |

$ | (1.10 | ) |

| | |

| | | |

| | |

| Net loss attributable to AirNet Technology Inc.’s shareholders per ADS | |

| | | |

| | |

| - Basic and diluted | |

$ | (0.27 | ) | |

$ | (1.10 | ) |

| | |

| | | |

| | |

| Weighted average ordinary shares used in calculating net loss per ordinary share | |

| | | |

| | |

| - Basic and diluted | |

| 6,612,793 | | |

| 3,575,714 | |

| | |

| | | |

| | |

| Weighted average ADS used in calculating net loss per ADS | |

| | | |

| | |

| - Basic and diluted | |

| 6,612,793 | | |

| 3,575,714 | |

SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

Going concern

The

Group has a history of operating losses and negative operating cash flows and has negative working capital of $66,428 as of June

30, 2023. These conditions raise substantial doubt about the Group’s ability to continue as a going concern.

The

Group plans to strengthen the air travel media network business to drive its revenues and bring in cash to keep operation. In addition,

the Group tried to reach an agreement to transfer its 33% equity investment in Unicom AirNet (Beijing) Network Co., Ltd to an investor

for cash to keep liquidity. However, there is no assurance that the measures above can be achieved as planned. As a result, management

prepared the consolidated financial statements assuming the Group will continue as a going concern. The consolidated financial statements

do not include any adjustments that might result from the outcome of this uncertainty.

Forward-Looking Statements

This announcement contains forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities

Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,”

“is expected to,” “anticipates,” “aim,” “future,” “intends,” “plans,”

“believes,” “are likely to,” “estimates,” “may,” “should” and similar expressions.

The Company may also make written or oral forward-looking statements in its reports filed with, or furnished to, the U.S. Securities and

Exchange Commission, in its annual reports to shareholders, in press releases and other written materials and in oral statements made

by its officers, directors or employees to third parties. Forward-looking statements are based upon management’s current expectations

and current market and operating conditions, and involve inherent risks and uncertainties, all of which are difficult to predict and many

of which are beyond the Company’s control, which may cause its actual results, performance or achievements to differ materially

from those in the forward-looking statements. Further information is included in the Company’s filings with the U.S. Securities

and Exchange Commission. All information provided in this announcement is as of the date of this announcement, and the Company does not

undertake any obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as

required under law.

Company Contact

Linda Wang

Investor Relations

AirNet Technology Inc.

Tel: +86-10-8460-8678

Email: ir@ihangmei.com

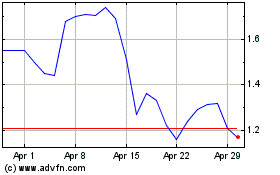

AirNet Technology (NASDAQ:ANTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

AirNet Technology (NASDAQ:ANTE)

Historical Stock Chart

From Apr 2023 to Apr 2024