false

0001476963

0001476963

2023-12-27

2023-12-27

0001476963

us-gaap:CommonStockMember

2023-12-27

2023-12-27

0001476963

NHWK:CommonStockPurchaseRightsMember

2023-12-27

2023-12-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (date of earliest event reported):

December 27, 2023

NightHawk Biosciences, Inc.

(Exact name of registrant as specified in

charter)

Delaware

(State or other jurisdiction of incorporation)

| 001-35994 |

26-2844103 |

| (Commission File Number) |

(IRS Employer Identification No.) |

627

Davis Drive, Suite

300

Morrisville, North Carolina 27560

(Address of principal executive offices and

zip code)

(919) 240-7133

(Registrant’s telephone number including

area code)

N/A

(Former Name and Former Address)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.0002 par value per share |

NHWK |

NYSE American LLC |

| Common Stock Purchase Rights |

None |

NYSE American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company ¨ |

|

If an emerging growth company, indicate by

checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.01 Completion of Acquisition or Disposition

of Assets.

Sale of Elusys Therapeutics, Inc.

On December 27, 2023, pursuant to that certain

Asset and Equity Interests Purchase Agreement, dated December 11, 2023 (the “Agreement”), by and between NightHawk Biosciences,

Inc. (the “Company”) and Elusys Holdings Inc., a Delaware corporation (“Buyer”), a company controlled by the Company’s

Chairman, Chief Executive Officer and President, Jeffrey Wolf, the Company completed the sale to Buyer of: (i) all of the issued and outstanding

equity interests in Elusys Therapeutics, Inc., a wholly owned subsidiary of the Company (“Elusys”), and (ii) the exclusive

right to use the name “NightHawk” and ownership of any and all trademark, goodwill and other rights in connection with such

name, which right and ownership will commence at a later date to be agreed upon by the parties (collectively, the “Purchased Assets”)

(such transaction, the “Transaction”). The closing had been subject to the prior satisfaction or waiver of certain closing

conditions, including a notice period that was waived.

Pursuant to the Agreement, at the December 27,

2023 closing of the Transaction (the “Closing”) the Buyer assumed certain specified liabilities and manufacturing commitments

relating to Elusys’ business, currently estimated at $40 million. The assumed liabilities

and manufacturing commitments include all amounts owed to the former owners of Elusys under that certain Agreement and Plan of Merger

and Reorganization by and among the Company, Heat Acquisition Sub 1, Inc., Elusys Therapeutics and Fortis Advisors LLC, in its capacity

as “Stockholders’ Representative,” which provides that the Company will remain liable if the Buyer fails to satisfy

the obligations it assumed under such agreement and the assumption by Buyer of all operating costs of Elusys, including the costs incurred

after the Closing related to Elusys employees, consultants, and regulatory and research costs (collectively, the “Assumed Liabilities”).

Mr. Wolf and William Ostrander, the Company’s Chief Financial Officer, will continue to serve in their current positions with the

Company and also continue to serve as the Chief Executive Officer and Chief Financial Officer, respectively, of the Buyer.

Pursuant to the Agreement, the Buyer was obligated

to pay the Company $500,000 on December 11, 2023, which payment was timely completed. The Buyer is further obligated to pay to the Company

on an annual basis a royalty fee equal to 3% of gross revenue received by Buyer or any of its affiliates or their respective successors

or licensees from all sales of the anthrax antitoxin known as ANTHIM® during the period commencing on January 1, 2024 and ending on

June 30, 2031; provided that, if as of December 31, 2028, the Company has not received an aggregate of $5,000,000 in such royalty fees,

Buyer will be obligated to pay to the Company no later than March 1, 2029 a cash payment equal to the difference between the aggregate

amount of such royalty fees received by the Company and $5,000,000.

The Buyer agreed, as a post-closing covenant,

to purchase from the Company, no later than January 20, 2024, a convertible promissory note in the aggregate amount of $2,250,000 (the

“Note”), the conversion of which is subject to both the Buyer’s election and obtaining stockholder approval of the issuance

of shares of the Company’s common stock upon such conversion. The Note will bear interest at a rate of 1% per annum, mature on the

one-year anniversary of its issuance and convert into shares of our common stock at the option of the Buyer only if stockholder approval

of the issuance of such shares of common stock issuable upon conversion of the Note is obtained prior to the maturity date. The conversion

price will be equal to 110% of the volume weighted average price (VWAP) of the Company’s common stock for the seven trading days

prior to December 11, 2023. Notwithstanding the foregoing, if the Company consummates a public financing, subject to certain exceptions,

within sixty days of December 11, 2023, the conversion price shall be adjusted to be 110% of the per share purchase price of the common

stock in such public financing. Such adjustment shall only be made upon the first financing in the event of multiple financings during

the foregoing period. Based upon a conversion price of $0.39281, which is 110% of the VWAP of our common stock for the seven trading days

prior to December 11, 2023, upon conversion of the Note (exclusive of interest), Buyer would be issued 5,727,960 shares of the Company’s

common stock upon conversion of the Note.

The foregoing description of the terms of the

Agreement and the Note does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreement

and the Note, copies of which are included as Exhibit 2.1 and 4.1, respectively, to this Current Report on Form 8-K and incorporated herein

by reference.

Shared Services Agreement

In connection with the Transaction, on the date

of Closing the Company entered into a shared services agreement (the “Shared Services Agreement”) with the Buyer setting forth

the terms on which the Company will provide to Buyer, on a transitional basis, certain services or functions that it has historically

provided to Elusys. Shared services will include various administrative, accounting, billing, cash management and banking and budgeting

services and other support services.

In consideration for such services, the Buyer will

pay fees to the Company for the services provided, and those fees will generally be in amounts intended to allow the Company to recover

all of its direct and indirect costs incurred in providing those services. The Company will charge the Buyer a fee for services performed

by (i) the Company’s employees which shall be a percentage of each employee’s base salary based upon an allocation of their

business time spent providing such services and (ii) third parties, the fees charged by such third parties. Buyer will also pay the Company

for general and administrative expenses incurred by the Company attributable to both the operation of the Buyer and the Company (other

than the provision of the services performed by Company employees) and the provision of the shared services.

The foregoing description of the terms of the

Shared Services Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of such agreement,

a copy of which is included as Exhibit 10.1 to this Current Report and incorporated herein by reference.

Item 2.03 Creation of a Direct Financial

Obligation or an Obligation Under an Off Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 of this

Current Report on Form 8-K is incorporated herein by reference into this Item 2.03 in its entirety.

Item 3.02 Unregistered Sales of Equity

Securities.

The information set forth in Item 1.01 of this

Current Report on Form 8-K is incorporated herein by reference into this Item 3.02 in its entirety. The Note and the shares of common

stock that may be issued under the Note are being offered and sold in a transaction exempt from registration under the Securities Act

in reliance on Section 4(a)(2) thereof and/or Rule 506(b) of Regulation D thereunder.

Item 9.01 Financial Statements and

Exhibits.

(b) Pro Forma Financial

Information

Pro forma financial information regarding the

Transaction was filed as Exhibit 99.1 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission

on December 12, 2023, is included as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

| (d) |

Exhibits. |

|

| |

|

|

|

| |

Exhibit

Number |

|

Description |

| |

2.1+ |

|

Asset

and Equity Interests Purchase Agreement by and between NightHawk Biosciences, Inc. and Elusys Holdings Inc., dated as December 11,

2023 (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange

Commission on December 12, 2023) |

| |

4.1 |

|

Form

of Convertible Note (incorporated by reference to Exhibit 4.8 to the Company’s Current Report on Form 8-K filed with the Securities

and Exchange Commission on December 12, 2023) |

| |

10.1 |

|

Form

of Shared Services Agreement between NightHawk Biosciences, Inc. and Elusys Holdings Inc. (incorporated by reference to Exhibit 10.2

to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on December 12, 2023) |

| |

99.1 |

|

Unaudited

Pro Forma Condensed Consolidated Balance Sheet as of September 30, 2023; Unaudited Pro Forma Condensed Statements of Operations for

the Nine Months Ended September 30, 2023; and Unaudited Pro Forma Condensed Statements of Operations for the Year Ended December

31, 2022. (incorporated by reference to Exhibit 99.1 to the Company’s Current Report on Form 8-K filed with the Securities

and Exchange Commission on December 12, 2023) |

| |

104 |

|

Cover

Page Interactive Data File (formatted in Inline XBRL and contained in Exhibit 101) |

| |

|

|

|

_____________

| + |

Schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish supplementally a copy of any omitted schedule or exhibit to the SEC upon request. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: December 27, 2023 |

NightHawk Biosciences, Inc. |

| |

|

| |

|

|

| |

By: |

/s/ William Ostrander |

| |

Name: |

William Ostrander |

| |

Title: |

Chief Financial Officer |

v3.23.4

Cover

|

Dec. 27, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 27, 2023

|

| Entity File Number |

001-35994

|

| Entity Registrant Name |

NightHawk Biosciences, Inc.

|

| Entity Central Index Key |

0001476963

|

| Entity Tax Identification Number |

26-2844103

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

627

Davis Drive

|

| Entity Address, Address Line Two |

Suite

300

|

| Entity Address, City or Town |

Morrisville

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

27560

|

| City Area Code |

(919)

|

| Local Phone Number |

240-7133

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Common Stock |

Common Stock, $0.0002 par value per share

|

| Trading Symbol |

NHWK

|

| Security Exchange Name |

NYSEAMER

|

| Common Stock Purchase Rights [Member] |

|

| Common Stock |

Common Stock Purchase Rights

|

| Trading Symbol |

None

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NHWK_CommonStockPurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

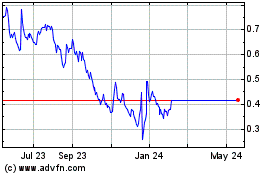

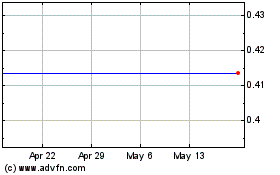

Nighthawk Biosciences (AMEX:NHWK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nighthawk Biosciences (AMEX:NHWK)

Historical Stock Chart

From Apr 2023 to Apr 2024