false

0001066923

0001066923

2023-12-23

2023-12-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 23, 2023

Future FinTech Group Inc.

(Exact name of registrant as specified in its

charter)

| Florida |

|

001-34502 |

|

98-0222013 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

Americas Tower, 1177 Avenue of The Americas,

Suite 5100, New York, NY 10036

(Address of principal executive offices, including

zip code)

888-622-1218

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.001 per share |

|

FTFT |

|

Nasdaq Stock Market |

Item 5.02 Departure

of Directors or Certain officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 23, 2023

(the “Grant Date”), the Compensation Committee of the Board of Directors (the “Board”) of Future FinTech Group,

Inc. (the “Company”) granted certain stock awards of common stock of the Company, par value $0.001 (the “Common Stock”),

pursuant to the Company’s 2023 Omnibus Equity Plan, to sixteen officers and employees of the Company and its subsidiaries (the “Grantees”),

including: 200,000 shares to Shanchun Huang, Chief Executive Officer and President of the Company, 40,000 shares to Peng Lei, Chief Operating

Officer of the Company, and 30,000 shares to Hoo Lee, Corporate Secretary of the Company (collectively, the “Grants”).

The Grants vested immediately on the Grant Date and each of the Grantees also entered into an Unrestricted Stock Award Agreement with

the Company on December 23, 2023. The form of Unrestricted Stock Award Agreement is filed as Exhibits 10.1 to this Current Report

on Form 8-K and incorporated herein by reference.

Item 9.01 Financial

Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Future FinTech Group Inc. |

| |

|

| Date: December 26, 2023 |

By: |

/s/ Shanchun Huang |

| |

Name: |

Shanchun Huang |

| |

Title: |

Chief Executive Officer |

2

Exhibit 10.1

future

fintech group, Inc

UNRESTRICTED

STOCK AWARD aGREEMENT

THIS UNRESTRICTED STOCK AWARD

AGREEMENT (“Agreement”) is entered into by and between Future FinTech Group, Inc., a Florida corporation (the

“Company”) and the Grantee effective as of Grant Date. The Administrator has authorized this grant

of the Unrestricted Stock to the Grantee as set forth below. Unless otherwise indicated, any capitalized term used but not defined herein

shall have the meaning as described to such term in the Future FinTech Group, Inc. 2023 Omnibus Equity Plan (the “2023 Plan”).

|

Grantee: |

|

| Grant Date: |

December 23, 2023 |

|

Number of Shares:

Purchase Price (per Share): |

$0

|

The parties hereto agree as

follows:

1. Grant

of Unrestricted Stock. Subject in all respects to the 2023 Plan and the restrictions and conditions herein, the Grantee is hereby

granted Shares of Unrestricted Stock at the Purchase Price as set forth above.

2. No

Period of Restriction. The Unrestricted Stock is fully vested as of the Grant Date.

3. Stockholder

Rights. The Grantee will have the right to vote such Unrestricted Stock and the right to receive any dividends declared or paid

upon receiving such Unrestricted Stock.

4. Securities

Law Compliance. Shares of Common Stock acquired applicable to this Unrestricted Stock Award are subject to the terms and conditions

of the 2023 Plan (Securities Law and Other Regulatory Compliance). The Grantee acknowledges and makes the representations and warranties

as described below, and agrees to provide such other representations and warranties and take such actions as otherwise may be requested

by the Company for compliance with applicable laws, and any issuance of Common Stock by the Company shall be made in reliance upon the

express representations and warranties of the Grantee that:

(a) the

Grantee is acquiring the Common Stock for his or her own account, for investment purposes and without any present intention of distributing

or reselling said Common Stock, except as permitted under the Securities Act;

(b) the

Grantee is fully aware of the highly speculative nature of the investment in the Common Stock, the financial hazards involved in the investment,

and the lack of liquidity and restrictions on transferability of the Common Stock (e.g., that the Grantee may not be able to sell

or dispose of the Common Stock or use it as collateral for loans); and

(c) the

Grantee has received and had access to such information as the Grantee considers necessary and appropriate for deciding whether to invest

in the Common Stock and has had an opportunity to ask questions and receive answers from the Company regarding the terms and conditions

of the issuance.

5. Certificate(s)

Representing Unrestricted Stock. The Company shall issue Common Stock either in certificate form or in book entry form, registered

in the name of the Grantee.

6. Tax

Withholding. As a condition to the issuance of Common Stock applicable to this Unrestricted Stock Award, the Grantee must remit

to the Company the statutory minimum (but not more) amount necessary to satisfy any applicable Federal, state or local tax withholding

requirements.

7. Provisions

of Plan Control. This Agreement is subject to all terms, conditions and provisions of the 2023 Plan, including, without limitation,

the amendment provisions thereof, and to such rules, regulations and interpretations relating to the 2023 Plan as may be adopted by the

Board and as may be in effect from time to time. The 2023 Plan is incorporated herein by reference. If and to the extent that this Agreement

conflicts or is inconsistent with the terms, conditions and provisions of the 2023 Plan, the 2023 Plan shall control and this Agreement

shall be deemed to be modified accordingly. This Agreement contains the entire agreement and understanding of the parties with respect

to the subject matter hereof and supersedes any prior agreements and understandings (whether written or oral) between the Company and

the Grantee with respect to the subject matter hereof.

8. Successors,

Assigns and Transferees. This Agreement shall be binding upon, and inure to the benefit of, the parties hereto and each of their

respective successors and permitted transferees (including, upon the death of the Grantee, the Grantee’s estate).

9. Not

an Employment Contract. This Agreement is not an agreement of employment or an agreement to engage Grantee as a director or an

independent contractor. This Agreement does not guarantee that the Company or any affiliate will employ, retain, contract with or continue

to employ, retain or contract with the Grantee during the entire, or any portion of the, term of this Agreement, nor does it modify in

any respect the Company’s or any affiliate’s right to terminate or modify the Grantee’s employment, engagement or compensation.

10. Confidentiality.

The Grantee agrees that he/she will not disclose to any third party the grant of unrestricted stock award, number of shares granted and

the existence of this agreement unless it is required by the laws, regulations or rules of SEC.

11. Governing

Law. This Agreement shall be governed by, and construed in accordance with, the laws of the State of Florida, without giving

effect to any choice of law or conflict of law provision or rule.

12. Counterparts.

This Agreement may be executed and delivered (including by facsimile or other electronic transmission) with counterpart signature pages

or in separate counterparts each of which shall be an original and all of which taken together shall constitute one and the same agreement.

IN WITNESS WHEREOF, the parties have executed this

Agreement on the date set forth above.

| |

Future FinTech Group, Inc. |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

| |

|

|

| |

GRANTEE |

| |

|

|

| |

By: |

|

| |

Name: |

|

3

v3.23.4

Cover

|

Dec. 23, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 23, 2023

|

| Entity File Number |

001-34502

|

| Entity Registrant Name |

Future FinTech Group Inc.

|

| Entity Central Index Key |

0001066923

|

| Entity Tax Identification Number |

98-0222013

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity Address, Address Line One |

Americas Tower

|

| Entity Address, Address Line Two |

1177 Avenue of The Americas

|

| Entity Address, Address Line Three |

Suite 5100

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10036

|

| City Area Code |

888

|

| Local Phone Number |

622-1218

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

FTFT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

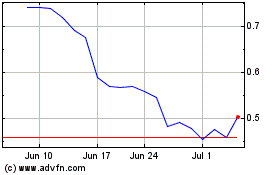

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Apr 2023 to Apr 2024