Form 8-K - Current report

December 26 2023 - 10:00AM

Edgar (US Regulatory)

false

0000704172

0000704172

2023-12-22

2023-12-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 22, 2023

PHI

GROUP, INC.

(Exact

name of registrant as specified in its charter)

| Wyoming |

|

001-38255-NY |

|

90-0114535 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 2323

Main Street, Irvine, CA |

|

92614 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 714-642-0571

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Precommencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Precommencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

Stock |

|

PHIL |

|

OTC

Markets |

SECTION

7 – REGULATION FD DISCLOSURE

Item

7.01 Regulation FD Disclosure

The

information in this Item 7.01 of this Current Report is furnished pursuant to Item 7.01 and shall not be deemed “filed’ for

any purpose, including for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section. The

information in this Current Report on Form 8-K shall not be deemed incorporated by reference into any filing under the Securities Act

or the Exchange Act regardless of any general incorporation language in such filing.

I.

Extension of Repurchase Date for the Company’s Common Stock

On

December 22, 2023, the Company’s Board of Directors passed a corporate resolution to extend the time period for the repurchase

of its own shares of common stock from the open market from time to time in accordance with the terms mentioned below and subject to

liquidity conditions, availability of funds, cash balances, cash flow conditions, satisfaction of certain open contractual obligations

and the judgment of the Company’s Board of Directors and Management with respect to optimal use of potentially available funds

in the future:

| 1. |

Purpose

of Repurchase: To enhance shareholder value. |

| 2. |

Details

of Repurchase: |

| |

a. |

Class

of shares to be repurchased: Common Stock of PHI Group, Inc. (n/k/a Philux Global Group, Inc.) |

| |

b. |

Number

of repurchasable shares: As many as economically conducive and optimal for the Company and its shareholders. |

| |

c. |

Total

repurchase dollar amount: To be determined by prevalent market prices at the times of |

| |

|

transaction. |

| |

d. |

Methods

of repurchase: Open market purchase and/or negotiated transactions. |

| |

e. |

Repurchase

period: As soon as practical until June 30, 2024. |

| |

f. |

The

Company intends to fund the proposed share repurchase program with proceeds from certain long-term financing programs, future

earnings, disposition of applicable non-core assets and other

potential sources, subject to liquidity, availability of funds, comparative judgment of optimal use of available cash in the future,

and satisfaction of certain open contractual obligations. |

| |

g. |

The

share repurchase program will be in full compliance with state and federal laws and certain covenants with the

Company’s creditors and may be terminated at any time based

on future circumstances and judgment of the Company. |

SECTION

9 – FINANCIAL STATEMENTS AND EXHBITS

Item

9.01 Financial Statements and Exhibits

The

following is a complete list of exhibit(s) filed as part of this report.

Exhibit

number(s) correspond to the number(s) in the exhibit table of Item 601 of Regulation S-K.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

December 26, 2023

PHI

GROUP, INC.

(n/k/a

PHILUX GLOBAL GROUP INC.) |

|

| (Registrant) |

|

| |

|

|

| By: |

/s/

Henry D. Fahman |

|

| |

Henry

D. Fahman |

|

| |

Chairman

and CEO |

|

EXHIBIT

10.1

WRITTEN

CONSENT OF DIRECTORS TO CORPORATE ACTION

WITHOUT

MEETING OF PHI GROUP, INC.

(N/K/A

PHILUX GLOBAL GROUP, INC.)

TO

EXTEND REPURCHASE OF COMMON STOCK

A

Wyoming Corporation

The

undersigned members of Board of Directors of PHI GROUP, INC. (n/k/a Philux Global Group, Inc.), a Wyoming corporation (the “Corporation”),

constitute a quorum and by their signatures below, hereby approve the following resolutions and consent to their adoption, without a

formal meeting of that Board of Directors (the “Board”), pursuant to Title 17-16-821 of the Wyoming Statues on this 22nd

day of December 2023.

WHEREAS,

on June 29, 2023, the Company’s Board of Directors passed a corporate resolution to extend the time period for the repurchase of

its own shares of common stock from the open market from time to time in accordance with the terms mentioned below:

| 1. |

Purpose

of Repurchase: To enhance future shareholder returns. |

| 2. |

Details

of Repurchase: |

| |

a. |

Class

of shares to be repurchased: Common Stock of PHI Group, Inc. |

| |

b. |

Amount

of repurchasable shares: As many as economically conducive and optimal for the Company. |

| |

c. |

Total

repurchase dollar amount: To be determined by prevalent market prices at the times of transaction. |

| |

d. |

Methods

of repurchase: Open market purchase and/or negotiated transactions. |

| |

e. |

Repurchase

period: As soon as practical until December 31, 2023. |

| |

f. |

The

Company intends to fund the proposed share repurchase program with proceeds from long-term

financing programs, future earnings, disposition of non-core assets and other potential sources,

subject to liquidity, availability of funds, comparative judgment of optimal use of available

cash in the future, and satisfaction of certain open contractual obligations. |

| |

g. |

The

share repurchase program will be in full compliance with state and federal laws and certain

covenants with the Company’s creditors and may be terminated at any time based on future

circumstances and judgment of the Company. |

WHEREAS,

in light of the additional time and resources required to close various long-term financing programs including long-term loans, investment

and asset management agreements and joint venture/partnership funding agreements, of the current corporate priorities, and of the business

development needs and investment opportunities, the Company’s Board of Directors has determined that it is in the best interests

of the Company and its shareholders to further extend the Common Stock repurchase period to a later date.

| 1 |

| RESOLUTION TO EXTEND REPURCHASE OF COMMON STOCK TO JUNE 30, 2024 |

BE

IT RESOLVED that, subject to liquidity, available funds, cash balances, cash flow conditions, satisfaction of certain open contractual

obligations and the judgment of the Company’s Board of Directors and Management with respect to optimal use of expected available

funds from financing programs, investment management contracts and other capital sources in the future, the Company is authorized to

repurchase its own shares of common stock from the open market from time to time in accordance with the terms mentioned below:

| 1. |

Purpose

of Repurchase: To enhance shareholder value. |

| 2. |

Details

of Repurchase: |

| |

a. |

Class

of shares to be repurchased: Common Stock of PHI Group, Inc. |

| |

b. |

Number

of repurchasable shares: As many as economically conducive and optimal for the Company and

its shareholders. |

| |

c. |

Total

repurchase dollar amount: To be determined by prevalent market prices at the times of transaction. |

| |

d. |

Methods

of repurchase: Open market purchase and/or negotiated transactions. |

| |

e. |

Repurchase

period: As soon as practical until June 30, 2024. |

| |

f. |

The

Company intends to fund the proposed share repurchase program with proceeds from certain

long-term financing programs, future earnings, disposition of applicable non-core assets and

other potential sources, subject to liquidity, availability of funds, comparative judgment

of optimal use of available cash in the future, and satisfaction of certain open contractual

obligations. |

| |

g. |

The

share repurchase program will be in full compliance with state and federal laws and certain

covenants with the Company’s creditors and may be terminated at any time based on future

circumstances and judgment of the Company. |

FURTHER

RESOLVED that in addition to and without limiting the foregoing, each officer of the Company be and hereby is authorized and directed

to take, or cause to be taken, such further action, and to execute and deliver, or cause to be delivered, for and in the name and on

behalf of the Company, all such instruments and documents as such officer may deem necessary, appropriate or in the best interests of

the Company to effectuate the intent of the foregoing resolutions and the transactions contemplated thereby (as conclusively evidenced

by the taking of such actions or the execution and delivery of such instruments and documents, as the case may be) and all action heretofore

taken by such officer in connection with the subject of the foregoing recitals and resolutions be, and it hereby is, approved, ratified

and confirmed in all respects as the act and deed of the Company.

By

their signatures below, the above resolutions have been duly authorized and adopted by the Company’s Board of Directors.

Dated:

December 22, 2023

| /s/

Henry Fahman |

|

/s/

Frank Hawkins |

| Henry

Fahman, Director |

|

Frank

Hawkins, Director |

| /s/

Steve Truong |

|

|

| Steve

Truong, Director |

|

|

| 2 |

| RESOLUTION TO EXTEND REPURCHASE OF COMMON STOCK TO JUNE 30, 2024 |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

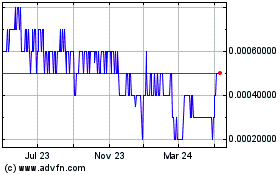

PHI (PK) (USOTC:PHIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

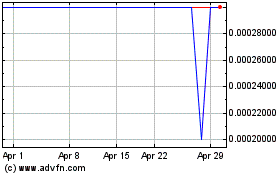

PHI (PK) (USOTC:PHIL)

Historical Stock Chart

From Apr 2023 to Apr 2024