AirNet Technology Inc. Announces Unaudited Financial Results for the First Half of 2023

December 26 2023 - 4:23AM

AirNet Technology Inc., formerly known as AirMedia Group Inc.

(“AirNet” or the “Company”) (Nasdaq: ANTE), today announced its

unaudited financial results for the first half of 2023.

|

AIRNET TECHNOLOGY INC. UNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEETS (In U.S. dollars in

thousands, except share and per share data) |

|

|

|

As of December 31, |

|

As of June 30, |

|

|

|

|

2022 |

|

2023 |

|

|

|

|

|

|

(Unaudited) |

|

|

Assets |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,700 |

|

$ |

132 |

|

|

Accounts receivable, net |

|

|

1,421 |

|

|

552 |

|

|

Other current assets, net |

|

|

65,072 |

|

|

28,527 |

|

|

Amount due from related parties |

|

|

601 |

|

|

199 |

|

|

Total current assets |

|

|

69,794 |

|

|

29,410 |

|

|

Property and equipment, net |

|

|

10,885 |

|

|

10,447 |

|

|

Long-term investments, net |

|

|

34,083 |

|

|

30,654 |

|

|

Long-term deposits, net |

|

|

371 |

|

|

62 |

|

|

Operating lease right-of-use assets |

|

|

16 |

|

|

8 |

|

|

TOTAL ASSETS |

|

|

115,149 |

|

|

70,581 |

|

|

Liabilities |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Short-term loan |

|

|

12,822 |

|

|

9,912 |

|

|

Accounts payable |

|

|

15,774 |

|

|

16,451 |

|

|

Accrued expenses and other current liabilities |

|

|

11,277 |

|

|

11,041 |

|

|

Deferred revenue |

|

|

7,745 |

|

|

7,366 |

|

|

Amount due to related parties |

|

|

1,174 |

|

|

1,207 |

|

|

Income tax payable |

|

|

1,865 |

|

|

1,232 |

|

|

Operating lease liability, current |

|

|

10 |

|

|

12 |

|

|

Consideration received from buyer |

|

|

29,000 |

|

|

27,580 |

|

|

Payable of earnout commitment |

|

|

22,120 |

|

|

21,037 |

|

|

Total current liabilities |

|

|

101,787 |

|

|

95,838 |

|

|

Non-current liabilities: |

|

|

|

|

|

|

|

|

Operating lease liability, non-current |

|

|

9 |

|

|

- |

|

|

Total liabilities |

|

|

101,796 |

|

|

95,838 |

|

|

AIRNET TECHNOLOGY INC. UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS - CONTINUED

(In U.S. dollars in thousands, except share and per share

data) |

|

|

|

As of December 31, |

|

As of June 30, |

|

|

|

|

2022 |

|

2023 |

|

|

|

|

|

|

(Unaudited) |

|

|

Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary shares ($0.04 par value; 22,500,000 shares authorized;

8,948,505 and 4,525,643 shares issued as of December 31, 2022 and

June 30, 2023; 8,923,687 and 4,499,654 shares outstanding as of

December 31, 2022 and June 30, 2023) |

|

|

359 |

|

|

|

181 |

|

|

Additional paid-in capital |

|

|

332,746 |

|

|

|

298,685 |

|

|

Treasury stock (245,818 shares as of December 31, 2022 and June 30,

2023) |

|

|

(1,148 |

) |

|

|

(1,148 |

) |

|

Accumulated deficit |

|

|

(318,239 |

) |

|

|

(322,164 |

) |

|

Accumulated other comprehensive income |

|

|

32,044 |

|

|

|

31,368 |

|

|

Total AirNet Technology Inc.'s shareholders' equity |

|

|

45,762 |

|

|

|

6,922 |

|

|

Non-controlling interests |

|

|

(32,409 |

) |

|

|

(32,179 |

) |

|

Total equity (deficits) |

|

|

13,353 |

|

|

|

(25,257 |

) |

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND DEFICITS |

|

$ |

115,149 |

|

|

$ |

70,581 |

|

|

AIRNET TECHNOLOGY INC. UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In U.S. dollars in thousands, except share and per share

data) |

|

|

|

Six months ended June 30, |

|

|

|

|

2022 |

|

|

2023 |

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

2,541 |

|

|

$ |

581 |

|

|

Business tax and surcharges |

|

|

(53 |

) |

|

|

(43 |

) |

|

Net revenues |

|

|

2,488 |

|

|

|

538 |

|

|

Cost of revenues |

|

|

(2,358 |

) |

|

|

(1,394 |

) |

|

Gross profit (loss) |

|

|

130 |

|

|

|

(856 |

) |

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Selling and marketing |

|

|

(748 |

) |

|

|

(359 |

) |

|

General and administrative |

|

|

(3,435 |

) |

|

|

(1,712 |

) |

|

Research and development |

|

|

(18 |

) |

|

|

(16 |

) |

|

Total operating expenses |

|

|

(4,201 |

) |

|

|

(2,087 |

) |

|

Loss from operations |

|

|

(4,071 |

) |

|

|

(2,943 |

) |

|

Interest expense, net |

|

|

(448 |

) |

|

|

(330 |

) |

|

Loss from long-term investments |

|

|

(1,275 |

) |

|

|

(618 |

) |

|

Other income, net |

|

|

4,798 |

|

|

|

199 |

|

|

Loss from operations before income taxes |

|

|

(996 |

) |

|

|

(3,692 |

) |

|

Income tax expenses |

|

|

(12 |

) |

|

|

(1 |

) |

|

Net loss |

|

|

(1,008 |

) |

|

|

(3,693 |

) |

|

Less: Net income from operations attributable to non-controlling

interests |

|

|

756 |

|

|

|

232 |

|

|

Net loss from operations attributable to AirNet Technology Inc.'s

shareholders |

|

$ |

(1,764 |

) |

|

$ |

(3,925 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to AirNet Technology Inc.’s shareholders per

ordinary share |

|

|

|

|

|

|

|

|

|

- Basic and diluted |

|

$ |

(0.27 |

) |

|

$ |

(1.10 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to AirNet Technology Inc.’s shareholders per

ADS |

|

|

|

|

|

|

|

|

|

- Basic and diluted |

|

$ |

(0.27 |

) |

|

$ |

(1.10 |

) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average ordinary shares used in calculating net loss

per ordinary share |

|

|

|

|

|

|

|

|

|

- Basic and diluted |

|

|

6,612,793 |

|

|

|

3,575,714 |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average ADS used in calculating net loss per ADS |

|

|

|

|

|

|

|

|

|

- Basic and diluted |

|

|

6,612,793 |

|

|

|

3,575,714 |

|

|

|

|

|

|

|

|

|

|

|

SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

Going concern

The Group has a history of operating losses and

negative operating cash flows and has negative working capital of

$66,428 as of June 30, 2023. These conditions raise substantial

doubt about the Group’s ability to continue as a going concern.

The Group plans to strengthen the air travel

media network business to drive its revenues and bring in cash to

keep operation. In addition, the Group tried to reach an agreement

to transfer its 33% equity investment in Unicom AirNet (Beijing)

Network Co., Ltd to an investor for cash to keep liquidity.

However, there is no assurance that the measures above can be

achieved as planned. As a result, management prepared the

consolidated financial statements assuming the Group will continue

as a going concern. The consolidated financial statements do not

include any adjustments that might result from the outcome of this

uncertainty.

Forward-Looking Statements

This announcement contains forward-looking

statements within the meaning of the safe harbor provisions of the

U.S. Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“will,” “expects,” “is expected to,” “anticipates,” “aim,”

“future,” “intends,” “plans,” “believes,” “are likely to,”

“estimates,” “may,” “should” and similar expressions. The Company

may also make written or oral forward-looking statements in its

reports filed with, or furnished to, the U.S. Securities and

Exchange Commission, in its annual reports to shareholders, in

press releases and other written materials and in oral statements

made by its officers, directors or employees to third parties.

Forward-looking statements are based upon management’s current

expectations and current market and operating conditions, and

involve inherent risks and uncertainties, all of which are

difficult to predict and many of which are beyond the Company’s

control, which may cause its actual results, performance or

achievements to differ materially from those in the forward-looking

statements. Further information is included in the Company’s

filings with the U.S. Securities and Exchange Commission. All

information provided in this announcement is as of the date of this

announcement, and the Company does not undertake any obligation to

update any forward-looking statement as a result of new

information, future events or otherwise, except as required under

law.

Company Contact

Linda Wang Investor Relations AirNet Technology

Inc. Tel: +86-10-8460-8678 Email: ir@ihangmei.com

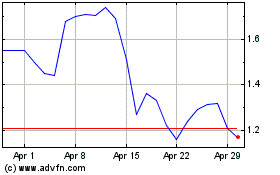

AirNet Technology (NASDAQ:ANTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

AirNet Technology (NASDAQ:ANTE)

Historical Stock Chart

From Apr 2023 to Apr 2024