0001606698FALSE00016066982023-12-212023-12-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

___________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) December 20, 2023

Alpine 4 Holdings, Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-40913 | | 46-5482689 |

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION) | | (COMMISSION FILE NO.) | | (IRS EMPLOYEE IDENTIFICATION NO.) |

2525 E Arizona Biltmore Circle, Suite 237

Phoenix, AZ 85016

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

480-702-2431

(ISSUER TELEPHONE NUMBER)

(FORMER NAME OR FORMER ADDRESS, IF CHANGED SINCE LAST REPORT)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock | ALPP | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 5.07 Submission of Matters to a Vote of Security Holders.

On December 20, 2023, Alpine 4 Holdings, Inc., a Delaware corporation (the “Company”), sought and received shareholder approval for the following proposal (the “Written Consent Proposal”):

–For purposes of Nasdaq Rule 5635(d), the potential issuance of shares of Class A common stock to Ionic Ventures, LLC (“Ionic Ventures”), pursuant to the Purchase Agreement, dated as of November 17, 2023, (the “Ionic Ventures Purchase Agreement”), between the Company and Ionic Ventures; and the issuance and potential issuance of shares of Class A common stock to Mast Hill Fund, L.P. (“Mast Hill”) pursuant to a securities purchase agreement with Mast Hill dated as of June 29, 2023 (the “Mast Hill SPA”), pursuant to which the Company issued and sold to Mast Hill a senior convertible promissory note in the aggregate principal amount of $1,670,000 dated as of June 29, 2023 (the “Senior Note”), convertible into shares (the “Conversion Shares”) of the Company’s Class A common stock, as well as the issuance issue to Mast Hill of (i) shares of our Class A common stock underlying a common stock purchase warrant (the “Mast Hill Warrant”) to purchase 200,000 shares of Common Stock dated as of June 29, 2023 (the “MH Warrant Shares”), (ii) 67,400 shares of Common Stock (the “MH First Commitment Shares”), and 1,200,000 shares of Common Stock (the “MH Second Commitment Shares”), collectively representing more than 19.99% of the Company’s outstanding Class A common stock on the date the Company entered into the Ionic Ventures Purchase Agreement.

Ionic Ventures Purchase Agreement

By way of background, and as previously disclosed in a Current Report on Form 8-K filed by the Company, on November 17, 2023, the Company entered into a purchase agreement (the “Ionic Ventures Purchase Agreement”) with Ionic Ventures, LLC (“Ionic Ventures”), which provides that, upon the terms and subject to the conditions and limitations set forth therein, the Company has the right to direct Ionic Ventures to purchase up to an aggregate of $32,000,000 of shares of the Company’s Class A common stock over the 36-month term of the Ionic Ventures Purchase Agreement.

The purchase price of the purchase shares purchased by Ionic Ventures under the Ionic Ventures Purchase Agreement will be derived from the market prices of the Company’s Class A common stock. The Company will control the timing and amount of future sales, if any, of purchase shares to Ionic Ventures. Ionic Ventures has no right to require the Company to sell any purchase shares to Ionic, but Ionic Ventures is obligated to make purchases as the Company directs, subject to certain conditions. Under the Ionic Purchase Agreement, the Company may not issue or sell any shares of Class A common stock to Ionic which, when aggregated with all other shares of Class A common stock then beneficially owned by Ionic and its affiliates (as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 promulgated thereunder), would result in Ionic Ventures's beneficially owning more than 4.99% of the outstanding shares of Class A common stock.

The foregoing is only a summary of the material terms of the Ionic Ventures Purchase Agreement and does not purport to be a complete description of the rights and obligations of the parties thereunder. The summary of the Ionic Ventures Purchase Agreement and the offering and transactions described therein is qualified in its entirety by reference to such agreement, which was filed as an exhibit to the Company’s Current Report on Form 8-K, filed with the SEC on November 22, 2023.

Nasdaq Limitation

Pursuant to Nasdaq Rule 5635(d), if an issuer intends to issue securities in a transaction which could result in the issuance of 20% or more of the issued and outstanding shares of the issuer’s common stock on a pre-transaction basis for less than the Minimum Price (as defined in the Nasdaq Rules) for such stock, the issuer generally must obtain the prior approval of its stockholders (the “Equity Issuance Approval”).

Under the applicable Nasdaq rules, in no event could the Company have issued more than 4,921,566 shares of the Company's Class A common stock to Ionic Ventures under the Ionic Ventures Purchase Agreement or to Mast Hill under the Mast Hill agreements, or both, which number of shares is equal to 19.99% of the sum of (i) shares of the Class A common stock issued and outstanding immediately prior to the execution of the Ionic Ventures Purchase Agreement (the “Exchange Cap”), unless (a) the Company obtained stockholder approval to issue shares of Class A common stock in excess of the Exchange Cap in accordance with applicable Nasdaq rules (which condition was

satisfied by the Company’s obtaining the Equity Issuance Approval), or (b) the average price per share paid by the Investor for all of the shares of Class A common stock that the Company directs the Investor to purchase from the Company pursuant to the Ionic Ventures Purchase Agreement, if any, equals or exceeds $0.8919 per share (representing the lower of the official closing price of the Class A common stock on Nasdaq on the trading day immediately preceding the date of the Ionic Ventures Purchase Agreement and the average official closing price of the Class A common stock on Nasdaq for the five consecutive trading days ending on the trading day immediately preceding the date of the Ionic Ventures Purchase Agreement, as adjusted in accordance with applicable Nasdaq rules).

Reasons for the Equity Issuance Approval

The Company’s Class A common stock is currently listed on the Nasdaq Capital Market and, as such, the Company is subject to Nasdaq Rule 5635(d), which requires the Company to obtain stockholder approval prior to the sale, issuance or potential issuance of shares of Class A common stock (or securities convertible into or exercisable for Class A common stock) in connection with a transaction other than a public offering without stockholder approval if the aggregate number of shares issued would be equal to or greater than 20% of the Company’s outstanding voting power before the applicable issuance and the price per share of Class A common stock issued is less than the Minimum Price (as defined in the Nasdaq Rules).

The issuance prices under the Ionic Ventures Purchase Agreement, Mast Hill SPA, Senior Note, and Mast Hill Warrant at any given time may be lower than the Minimum Price applicable to the shares of Class A common stock to be sold under the Ionic Ventures Purchase Agreement, Mast Hill SPA, Senior Note, and Mast Hill Warrant. Accordingly, stockholder approval was required to issue shares in an amount more than 19.99% of the outstanding voting power on November 17, 2023, even if the price per share of Class A common stock issued in connection with any particular issuance is less than the applicable Minimum Price for the Ionic Ventures Purchase Agreement, Mast Hill SPA, Senior Note, and Mast Hill Warrant.

Written Consent to Approve the Written Consent Proposal

On December 20, 2023 (the “Voting Record Date”), Kent Wilson, the Company’s Chief Executive Officer and President, and a member of the Board of Directors, and Ian Kantrowitz, Vice President of Investor Relations and a member of the Board of Directors, who together hold voting capital representing in the aggregate approximately 72.41% of the outstanding voting power of the Company on the Voting Record Date, voted to approve the Written Consent Proposal.

As of the Voting Record Date, Mr. Wilson and Mr. Kantrowitz held shares of the Company’s capital stock, including shares of Class A, Class B, and Class C common stock, as well as shares of Series B Preferred Stock which by their terms (as described below) represent in the aggregate 200% of the outstanding voting power of the Company, which was more than the minimum number of votes necessary to authorize or approve the Written Consent Proposal at a meeting of stockholders at which all shares entitled to vote thereon were present and voted.

The Company’s capital stock outstanding as of the Voting Record Date consisted of the Company’s Class A common stock, Class B common stock, Class C common stock, and the Company’s Series B preferred stock. Holders of the Class A common stock are entitled to one (1) vote per share; the holders of the Class B common stock are entitled to ten (10) votes per share; and the holders of the Class C common stock are entitled to five (5) votes per share.

Pursuant to the Company’s Certificate of Incorporation, as amended to date, if at least one share of Series B Preferred Stock is issued and outstanding, then the total aggregate issued shares of Series B Preferred Stock at any given time, regardless of their number, shall have that number of votes (identical in every other respect to the voting rights of the holders of all classes of common stock or series of preferred stock entitled to vote at any regular or special meeting of stockholders) equal to two hundred percent (200%) of the total voting power of all holders of the Company’s common and preferred stock then outstanding, but not including the Series B Preferred Stock. If more than one share of Series B Preferred Stock is issued and outstanding at any time, then each individual share of Series B Preferred Stock shall have the voting rights equal to two hundred percent (200%) of the total voting power of all holders of the Company’s common and preferred stock then outstanding, but not including the Series B Preferred Stock divided by the number of shares of Series B Preferred Stock issued and outstanding at the time of voting.

As of the Voting Record Date, there were three shares of Series B Preferred Stock issued and outstanding, held by Mr. Wilson and Mr. Kantrowitz. Additionally, as of the Voting Record Date, the following number of shares of each class were issued and outstanding: (i) 24,607,833 shares of our Class A common stock issued and outstanding; (ii) 906,012 shares of our Class B common stock issued and outstanding; and (iii) 1,500,413 shares of our Class C common stock issued and outstanding. As such, the aggregate voting power was as follows: (i) 24,607,833 votes by the holders of the Class A common stock; (ii) 9,060,120 votes by holders of the Class B common stock; and (iii) 7,502,065 votes by holders of shares of our Class C common stock, for a total of 41,170,018 votes by the three classes of common stock.

As of the Voting Record Date, Mr. Wilson and Mr. Kantrowitz held an aggregate total of 82,340,036 votes, pursuant to the terms of the Company’s Certificate of Incorporation, which represented, in the aggregate, approximately 200% of the outstanding voting power of the Company as of such date and sufficient voting power to approve the Written Consent Proposal by written consent.

The approval of the Written Consent Proposal by Mr. Wilson and Mr. Kantrowitz constituted stockholder approval for purposes of Nasdaq Listing Rule 5635(d).

Information Statement

The Company plans to file a Preliminary Information Statement with the SEC shortly after the filing of this Current Report. The Information Statement will include additional background and information relating to the Ionic Ventures Purchase Agreement, Mast Hill SPA, Senior Note, and Mast Hill Warrant, the reasons for the Written Consent Proposal, and other information.

As a result of the approval of the Written Consent Proposal, on the date which is 20 calendar days after the definitive Information Statement is first distributed or made available to stockholders, the Company will comply with Nasdaq Rule 5635(d), as the approval of the Written Consent Proposal constitutes stockholder approval for the Company to issue shares of Class A common stock in an amount more than 19.99% of the outstanding voting power on November 17, 2023, even if the price per share of Class A common stock issued in connection with any particular issuance is less than the applicable Minimum Price for the Ionic Ventures Purchase Agreement, Mast Hill SPA, Senior Note, and Mast Hill Warrant.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

Exhibit Number | | Description |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

Alpine 4 Holdings, Inc.

By: /s/ Kent B. Wilson

Kent B. Wilson

Chief Executive Officer, President

(Principal Executive Officer)

Date: December 22, 2023

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

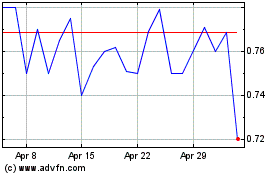

Alpine 4 (NASDAQ:ALPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

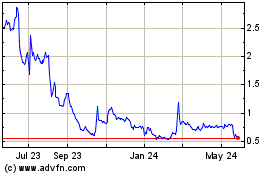

Alpine 4 (NASDAQ:ALPP)

Historical Stock Chart

From Apr 2023 to Apr 2024