0000108516false00001085162023-12-202023-12-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 20, 2023 |

WORTHINGTON ENTERPRISES, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Ohio |

001-08399 |

31-1189815 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

200 West Old Wilson Bridge Road |

|

Columbus, Ohio |

|

43085 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (614) 438-3210 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Shares, Without Par Value |

|

WOR |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

Worthington Enterprises, Inc. (the “Registrant”) conducted a conference call on December 20, 2023, beginning at approximately 9:00 a.m., Eastern Time, to discuss the Registrant’s unaudited financial results for the second quarter of fiscal 2024 ended November 30, 2023. Additionally, the Registrant addressed certain issues related to the outlook for the Registrant and its subsidiaries and their respective markets for the coming months. A copy of the transcript of the conference call is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Form 8-K”).

The information contained in this Item 2.02 and in Exhibit 99.1 is being furnished pursuant to Item 2.02 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, unless the Registrant specifically states that the information is to be considered “filed” under the Exchange Act or incorporates the information by reference into a filing under the Exchange Act or the Securities Act of 1933, as amended.

In the conference call, the Registrant discussed financial measures prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) as well as non-GAAP financial measures to provide investors with additional information that the Registrant believes allows for increased comparability of the performance of the Registrant’s ongoing operations from period to period. Specifically, the Registrant referred to earnings before interest, taxes, depreciation and amortization (“EBITDA”) and adjusted EBITDA, each on a consolidated basis, for the Registrant's trailing twelve months (“TTM”) ended November 30, 2023 and August 31, 2023. EBITDA and adjusted EBITDA are non-GAAP financial measures and are used by management as measures of operating performance. EBITDA is calculated by adding or subtracting, as appropriate, interest expense, net, income tax expense and depreciation and amortization to/from net earnings attributable to controlling interest. Adjusted EBITDA is calculated by adding or subtracting, as appropriate, to/from EBITDA certain items that the Registrant believes are not necessarily indicative of the Registrant's operating performance, such those listed in the Non-GAAP Footnotes section below. The table below provides a reconciliation from net earnings attributable to controlling interest (the most comparable GAAP financial measure) to the non-GAAP financial measures, EBITDA and adjusted EBITDA, for the TTM ended November 30, 2023 and August 31, 2023.

Additionally, adjusted EBITDA for the TTM ended November 30, 2023 and August 31, 2023 is adjusted further to reflect the results of the Registrant, on a pro forma basis, to illustrate the estimated effects of the separation of Worthington Steel, Inc. from the combined company prior to December 1, 2023 (“the Separation”). This non-GAAP financial information, which the Registrant refers to as pro forma adjusted EBITDA, assumes the Separation occurred on June 1, 2022, the first day of the Registrant's fiscal 2023. Beginning in the third quarter of fiscal 2024, historical results will be restated to reflect the operations of Worthington Steel as a discontinued operation in periods prior the December 1, 2023 Separation. For further information on this pro forma presentation, refer to the Use of Non-GAAP Measures and Definitions schedules included in Exhibit 99.1 to the Registrant’s Current Report on Form 8-K filed on December 19, 2023.

|

|

|

|

|

|

|

|

|

|

|

TTM |

|

|

TTM |

|

|

|

November 30, |

|

|

August 31, |

|

(In thousands) |

|

2023 |

|

|

2023 |

|

Net earnings attributable to controlling interest (1) |

|

$ |

296,638 |

|

|

$ |

288,552 |

|

Interest expense, net |

|

|

15,801 |

|

|

|

21,244 |

|

Income tax expense |

|

|

88,544 |

|

|

|

85,477 |

|

Depreciation and amortization |

|

|

112,777 |

|

|

|

113,124 |

|

EBITDA |

|

|

513,760 |

|

|

|

508,397 |

|

Incremental expense related to (true-up of) Level5 earnout accrual (2) |

|

|

(1,050 |

) |

|

|

(525 |

) |

Impairment of long-lived assets (1)(3) |

|

|

3,168 |

|

|

|

3,168 |

|

Restructuring and other expense (income), net (1)(4) |

|

|

816 |

|

|

|

(1,621 |

) |

Separation costs (5) |

|

|

42,789 |

|

|

|

30,083 |

|

Loss on extinguishment of debt (6) |

|

|

1,534 |

|

|

|

1,534 |

|

Loss on sale of investment in ArtiFlex (7) |

|

|

300 |

|

|

|

300 |

|

Gain on sale of assets in equity income (9) |

|

|

(2,780 |

) |

|

|

- |

|

Sale-leaseback gain in equity income (8) |

|

|

(2,063 |

) |

|

|

(2,063 |

) |

Adjusted EBITDA |

|

$ |

556,474 |

|

|

$ |

539,273 |

|

|

|

|

|

|

|

|

Pro forma information (giving effect to the Separation) |

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

556,474 |

|

|

$ |

539,273 |

|

Removal of Worthington Steel, Inc. |

|

|

(253,163 |

) |

|

|

(230,452 |

) |

Shared overhead reallocation (10) |

|

|

(31,733 |

) |

|

|

(30,266 |

) |

Operational adjustments (11) |

|

|

(3,368 |

) |

|

|

(3,468 |

) |

Stock-based compensation (12) |

|

|

12,092 |

|

|

|

11,684 |

|

Pro forma adjusted EBITDA |

|

$ |

280,302 |

|

|

$ |

286,771 |

|

|

|

|

|

|

|

|

Consolidated net sales |

|

$ |

4,612,360 |

|

|

|

4,700,983 |

|

Removal of Worthington Steel, Inc. |

|

|

(3,287,063 |

) |

|

|

(3,340,355 |

) |

Pro forma net sales |

|

$ |

1,325,297 |

|

|

$ |

1,360,628 |

|

|

|

|

|

|

|

|

Pro forma adjusted EBITDA margin |

|

|

21 |

% |

|

|

21 |

% |

Non-GAAP Footnotes:

(1)Excludes the impact of noncontrolling interests.

(2)Reflects the compensation expense, and related true-ups, accrued in connection with the first annual payout under the Level5 earnout agreement.

(3)Impairment of long-lived assets are excluded because they do not occur in the ordinary course of the Registrant’s ongoing business operations, are inherently unpredictable in timing and amount, and are non-cash, so their exclusion facilitates the comparison of historical and current financial results.

(4)Restructuring activities consist of established programs that are not part of the Registrant’s ongoing operations, such as divestitures, closing or consolidating facilities, employee severance (including rationalizing headcount or other significant changes in personnel), and realignment of existing operations (including changes to management structure in response to underlying performance and/or changing market conditions).

(5)Reflects direct and incremental costs incurred in connection with the anticipated separation of the Registrant’s Steel Processing business, including audit, legal, and other fees paid to third-party advisors as well as direct and incremental costs associated with the separation of shared corporate functions.

(6)Reflects the loss realized in connection with the July 28, 2023, early redemption of the 2026 Notes. The loss resulted primarily from unamortized issuance costs and discount included in the carrying amount of the 2026 Notes and the acceleration of the remaining unamortized loss in equity related to a treasury lock derivative instrument executed in connection with the issuance of the 2026 Notes.

(7)Reflects the loss realized in connection with the August 3, 2022 sale of the Registrant’s 50% noncontrolling equity investment in ArtiFlex.

(8)Reflects our share of the gain realized by our engineered cabs joint venture, Taxi Workhorse, in connection with the sale of joint venture operations in Brazil, which totaled $2,780 on a pre-tax basis.

(9)During the three months ended May 31, 2023, Workhorse recognized a pre-tax gain of $10,315 related to a sale-leaseback transaction. The Registrant’s portion of this gain, which is recorded in equity income, was $2,063.

Pro Forma Footnotes:

(10)Reflects the excess of the Registrant's estimated post-separation corporate expenses over the amounts historically absorbed by our segments, including the re-allocation of costs historically attributed to Steel Processing that will continue post-separation as well as incremental corporate expenses resulting from lost economies of scale. Pro forma amounts within Corporate & Other reflect certain general overhead expenses that will not be allocated to the Registrant's segments post-separation but are included in the Registrant's historical segment reporting.

(11)Includes the estimated incremental material cost associated with intercompany purchases from Steel Processing post-separation that will be subject to arms-length commercial pricing arrangements specified in the Steel Supply Agreement between us and Worthington Steel entered into

in connection with the separation, net of anticipated costs to be recovered by us post-separation under the Transition Services Agreement between the Registrant and Worthington Steel entered into in connection with the Separation.

(12)For purposes of this pro forma presentation, adjusted EBITDA excludes stock-based compensation. Post-separation, management intends to change the profitability measure it uses to assess segment performance from adjusted EBIT to adjusted EBITDA. In connection with the change, management revised its definition of adjusted EBITDA to exclude non-cash stock-based compensation, in addition to the other excluded items as historically defined and measured by management.

In the conference call, the Registrant referred to free cash flow for the three months ended November 30, 2023. Free cash flow is a non-GAAP financial measure that management believes measures the Registrant's ability to generate cash beyond what is required for its business operations and capital expenditures. The following provides a reconciliation of net cash provided by operating activities (the most comparable GAAP financial measure) to free cash flow for the three-month period ended November 30, 2023.

|

|

|

|

|

|

|

Second |

|

|

|

Quarter |

|

(In thousands) |

|

2024 |

|

Net cash provided by operating activities |

|

$ |

134,990 |

|

Investment in property, plant and equipment |

|

|

(32,876 |

) |

Free cash flow |

|

$ |

102,114 |

|

In the conference call, the Registrant referred to the ratio of net debt to TTM adjusted EBITDA, which is a non-GAAP financial measure that is used by the Registrant as a measure of leverage. Net debt to adjusted EBITDA is calculated by subtracting cash and cash equivalents from net debt (defined as the aggregate of short-term borrowings, current maturities of long-term debt and long-term debt) and dividing the sum by adjusted EBITDA. The calculation of net debt to adjusted EBITDA for the twelve months ended November 30, 2023, along with a reconciliation of net cash provided by operating activities (the most comparable GAAP financial measure) to adjusted EBITDA for the same period, as mentioned in the conference call, is outlined below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Second |

|

|

First |

|

|

Fourth |

|

|

Third |

|

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

(In thousands) |

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities: |

|

$ |

134,990 |

|

|

$ |

59,696 |

|

|

$ |

229,234 |

|

|

$ |

182,152 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Changes in assets and liabilities, net of impact of acquisitions |

|

|

(74,895 |

) |

|

|

79,860 |

|

|

|

(60,582 |

) |

|

|

(78,197 |

) |

Interest expense, net |

|

|

2,169 |

|

|

|

3,083 |

|

|

|

4,514 |

|

|

|

6,035 |

|

Income tax expense |

|

|

7,198 |

|

|

|

28,777 |

|

|

|

40,514 |

|

|

|

12,055 |

|

Impairment of long-lived assets |

|

|

- |

|

|

|

(1,401 |

) |

|

|

(1,800 |

) |

|

|

(484 |

) |

Benefit from (provision for) deferred income taxes |

|

|

(1,968 |

) |

|

|

5,453 |

|

|

|

(4,670 |

) |

|

|

5,525 |

|

Loss on extinguishment of debt |

|

|

- |

|

|

|

(1,534 |

) |

|

|

- |

|

|

|

- |

|

Bad debt (expense) benefit |

|

|

(345 |

) |

|

|

799 |

|

|

|

1,678 |

|

|

|

(2,346 |

) |

Equity in net income of unconsolidated affiliates, net of distributions |

|

|

4,129 |

|

|

|

(10,225 |

) |

|

|

4,545 |

|

|

|

(23,218 |

) |

Net gain (loss) on sale of assets |

|

|

439 |

|

|

|

(105 |

) |

|

|

(530 |

) |

|

|

(46 |

) |

Stock-based compensation |

|

|

(6,175 |

) |

|

|

(4,516 |

) |

|

|

(5,420 |

) |

|

|

(4,975 |

) |

Less: noncontrolling interest |

|

|

(3,865 |

) |

|

|

(3,596 |

) |

|

|

(4,260 |

) |

|

|

(3,933 |

) |

EBITDA (1) |

|

$ |

61,677 |

|

|

$ |

156,291 |

|

|

$ |

203,223 |

|

|

$ |

92,568 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Incremental expense related to (true-up of) Level5 earnout |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,050 |

) |

Impairment of long-lived assets (1) |

|

|

- |

|

|

|

884 |

|

|

|

1,800 |

|

|

|

484 |

|

Restructuring and other expense (income), net (1) |

|

|

6 |

|

|

|

- |

|

|

|

(13 |

) |

|

|

824 |

|

Separation costs |

|

|

21,952 |

|

|

|

6,035 |

|

|

|

8,455 |

|

|

|

6,347 |

|

Loss on extinguishment of debt |

|

|

|

|

|

1,534 |

|

|

|

- |

|

|

|

- |

|

Loss on sale of investment in ArtiFlex |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

300 |

|

Gain on sale of assets in equity income |

|

|

(2,780 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

Sale-leaseback gain in equity income |

|

|

- |

|

|

|

- |

|

|

|

(2,063 |

) |

|

|

- |

|

Adjusted EBITDA (1) |

|

$ |

80,855 |

|

|

$ |

164,744 |

|

|

$ |

211,402 |

|

|

$ |

99,473 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TTM adjusted EBITDA (1) |

|

$ |

556,474 |

|

|

|

|

|

|

|

|

|

|

(1)Excludes the impact of noncontrolling interests.

|

|

|

|

|

|

|

November 30, |

|

(In thousands) |

|

2023 |

|

Short-term borrowings |

|

$ |

175,000 |

|

Current maturities of long-term debt |

|

|

150,269 |

|

Long-term debt |

|

|

298,549 |

|

Total debt |

|

$ |

623,818 |

|

Less: cash and cash equivalents |

|

|

(430,906 |

) |

Net debt |

|

$ |

192,912 |

|

|

|

|

|

TTM adjusted EBITDA |

|

$ |

556,474 |

|

|

|

|

|

Net debt to TTM adjusted EBITDA |

|

|

0.35 |

|

Additional non-GAAP financial measures referred to by the Registrant on the conference call, including reconciliations to the most comparable GAAP financial measures, are included in Exhibit 99.1 to the Registrant’s Current Report on Form 8-K filed on December 19, 2023. Such Exhibit 99.1 includes a copy of the Registrant’s news release issued on December 19, 2023 (the “Financial News Release”) reporting results for the three-month period ended November 30, 2023 (the Registrant’s fiscal 2024 second quarter). The Financial News Release was made available on the Registrant’s website throughout the conference call and will remain available on the Registrant’s website for at least one year.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits: The following exhibits are included with this Form 8‑K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

WORTHINGTON ENTERPRISES, INC. |

|

|

|

|

Date: |

December 22, 2023 |

By: |

/s/Patrick J. Kennedy |

|

|

|

Patrick J. Kennedy, Vice President -

General Counsel and Secretary |

TRANSCRIPT

12 - 20 - 2023

Worthington Enterprises, Inc.

Second Quarter 2024 Earnings

TOTAL PAGES: 13

Worthington Enterprises, Inc.

Second Quarter 2024 Earnings

CORPORATE SPEAKERS:

Marcus Rogier

Worthington Enterprises; Investor Relations

Andy Rose

Worthington Enterprises; President, Chief Executive Officer

Joe Hayek

Worthington Enterprises; Chief Financial and Operations Officer

PARTICIPANTS:

Phil Gibbs

KeyBanc Capital Markets; Analyst

Daniel Moore

CJS Securities; Analyst

John Tumazos

John Tumazos Very Independent Research; Principal

PRESENTATION:

Operator^ Good afternoon. And welcome to the Worthington Enterprises Second Quarter Fiscal 2024 Earnings Conference Call. (Operator Instructions)

This conference is being recorded at the request of Worthington Enterprises. If anyone objects, you may disconnect at this time.

I'd now like to introduce Marcus Rogier, Treasurer and Investor Relations Officer.

Mr. Rogier, you may begin.

Marcus Rogier^ Thank you, JL. Good morning, everyone. And welcome to Worthington Enterprises second quarter fiscal 2024 earnings call.

Results for our second quarter reflect the performance of the pre-separation consolidated Worthington Industries, including the Worthington Steel business, which became a stand-alone publicly traded company on December 1.

Given the recent separation, today's prepared remarks will primarily focus on the consolidated results as well as the performance of the remaining business segments within Worthington Enterprises, including building products, consumer products and sustainable energy solutions.

Worthington Enterprises, Inc.

Second Quarter 2024 Earnings

Worthington Steel will be hosting their second quarter earnings call separately on Friday morning of this week at 8:30 a.m.

So we'd please ask that you hold any questions about the steel processing business until then.

On our call today, we have Andy Rose, Worthington's President and Chief Executive Officer; and Joe Hayek, Worthington's Chief Financial and Operations Officer.

Before we get started, I'd like to note that certain statements made today are forward-looking within the meaning of the 1995 Private Securities Litigation Reform Act.

These statements are subject to risks and uncertainties that could cause actual results to differ from those suggested.

We issued our earnings release yesterday after the market close.

Please refer to it for more detail on those factors that could cause actual results to differ materially.

In addition, our discussion today will include non-GAAP financial measures.

A reconciliation of these measures with the most appropriate comparable GAAP measure is included in the earnings press release, which is available on our Investor Relations website.

Lastly, today's call is being recorded, and a replay will be made available later on our website.

At this point, I will turn the call over to Andy for opening remarks.

Andy Rose^ Thank you, Marcus. And good morning, everyone.

What a year it has been. I want to start the call by thanking our employees who have gone above and beyond to make this separation successful. Our people have stayed positive in the face of change and worked tirelessly to set both companies up for success. I am confident that the work done by our teams to create Worthington Steel and Worthington Enterprises was best-in-class.

I also want to thank our customers for continuing to have confidence in Worthington Steel and Worthington Enterprises throughout this process. Both businesses performed well over the past 15 months, and I know these two companies are better positioned for success today as two separate entities than when we began this journey back in 2022.

And finally, I'd like to thank our Board of Directors for having confidence in our leadership team to not only make the decision to separate the companies, but to dig in and help navigate the journey. This was truly a team effort across many constituencies.

Worthington Enterprises, Inc.

Second Quarter 2024 Earnings

December 1st marks the end of Worthington Industries, but it really represents a new beginning. We've taken one great company and created two great companies, both of which are well capitalized market-leading businesses poised for growth and value creation. We will maintain the best of what has made us great over 68 years, our philosophy, written down over 50 years ago by our founder, will continue to shape our culture, decision-making and performance. The philosophy is based on the golden rule. We treat our customers, employees, investors and suppliers as we would like to be treated.

The philosophy's first corporate goal for Worthington is to earn money for our shareholders and increase the value of their investment. This is underpinned by our performance-based culture. And above all, our belief in our most important asset, our people.

We are excited about our future in Worthington Enterprises and wish our friends at Worthington Steel best of luck in their future endeavors. Joe, you want to take us through the numbers?

Joe Hayek^ Sure. Thank you, Andy. And good morning, everybody. This is a unique quarter for us. And as Marcus mentioned, we'll be reporting the earnings of Worthington Industries as a consolidated entity. I'll go over those results then focus a bit more on the business units that now make up Worthington Enterprises, and we would ask that any questions related to Worthington Steel will be held for that team who have their earnings call scheduled for Friday morning.

In Q2, we reported consolidated earnings of $0.49 a share versus $0.33 per share in the prior year quarter. There were a few unique items that impacted our quarterly results, including the following. We incurred pretax expense of $22 million or $0.33 per share related to the separation of our steel processing business into a new public company, which was completed on December 1. This compares to separation expenses of $0.14 a share incurred in the prior year quarter. We may have some minor expenses related to the separation in Q3, and we believe that the majority of those expenses are behind us.

We recognized a pretax gain of $3 million or $0.04 a share related to the divestiture of the Brazilian business of our Cabs joint venture. In the prior year, the quarter benefited by $0.03 per share, primarily due to a gain on the divestiture of our WSP joint venture, which was partially offset by expenses related to an earnout at Level 5.

Excluding these items, we generated earnings of $0.78 per share in the current quarter compared to $0.44 a share in Q2 of last year. Furthermore, in Q2, estimated inventory holding losses in the steel processing business were $0.52 per share compared to inventory holding losses of $0.81 a share in Q2 of fiscal '23.

Finally, our consumer business recorded a charge of $3 million or $0.05 per share in the quarter related to a voluntary recall on our Balloon Time Mini tank.

Consolidated net sales in the quarter of $1.1 billion decreased 7.5% from the prior year primarily due to lower average selling prices in steel processing, combined with a shift in product mix, which was partially offset by higher volumes across most of our segments. The gross profit for

Worthington Enterprises, Inc.

Second Quarter 2024 Earnings

the quarter increased to $124 million from $106 million in the prior year, and our gross margin increased to 11.4% from 9%, primarily due to improved spreads in steel processing. Adjusted EBITDA in Q2 was $81 million, up from $64 million in Q2 of last year, and our trailing 12-month adjusted EBITDA was $556 million.

With respect to cash flows on our balance sheet, cash flow from operations was $135 million in the quarter, and free cash flow was $102 million.

During the quarter, we invested $33 million in capital projects, spent $21 million for an acquisition within the Steel Processing segment and paid $17 million in dividends. We also received $39 million in dividends from our unconsolidated JVs during the quarter, a 93% cash conversion rate on that equity income.

Looking at our balance sheet and liquidity position. Funded debt at quarter end of $624 million was up $175 million sequentially due to the Steel Processing segment borrowing on their credit facility at the end of the quarter. A portion of the borrowings by steel processing were used to pay $150 million dividend to Worthington Enterprises immediately before the December 1 business separation, which we in turn use to retire our $150 million 2024 notes earlier this month.

Adjusting for both of those items, Worthington Enterprises currently has approximately $300 million in debt outstanding averaging 3.6% and maturing between 2029 and 2034.

We ended Q2 with approximately $216 million in cash, which incidentally is yielding over 5%. Net interest expense of $2 million was down by $5 million, primarily due to the interest income we earned on our cash balances and to a lesser extent, lower average debt levels. We continue to operate with extremely low leverage, ending the quarter with a net debt to trailing EBITDA leverage ratio of under 0.5x and our cash balance and undrawn $500 million revolver provide ample liquidity.

Yesterday, the Worthington Enterprise's Board declared a dividend of $0.16 per share for the quarter, which is payable in March of 2024.

We'll now spend a few minutes on each of the businesses. I won't go into any details on steel processing and would point you to our earnings release from yesterday afternoon for that segment level detail and encourage you to listen to the earnings call the steel team will host on Friday morning.

In Consumer Products, net sales in Q2 were $148 million, down 4% from $154 million a year ago. The decrease was a result of lower average selling prices in our outdoor living business, and an unfavorable product mix in our tools business. Adjusted EBIT for the consumer business was $10 million and adjusted EBIT margin was 6.4% in Q2 compared to $13 million and 8.8% last year. Consumers earnings during the quarter were negatively impacted by $3 million pretax related to the voluntary recall we initiated for our Balloon Time Mini tank.

Worthington Enterprises, Inc.

Second Quarter 2024 Earnings

Excluding the impact of the recall, adjusted EBIT and EBIT margin for the quarter would have been in line with the prior year quarter. We did see a sequential improvement in adjusted EBIT compared to Q1, which is encouraging since volumes are typically down sequentially in our seasonally slower second quarter.

In consumer, September was a down month, but October and November saw improved sequential sales. The team and consumers weathered the headwinds they're facing quite well. And we've taken the opportunity to lean in with our channel partners that led to some recent market share gains that we expect will add to our growth in calendar 2024. We expect volumes and margins to gradually improve in our Outdoor Living business, and we expect to return to more seasonally normal patterns across our portfolio in the coming quarters. The markets we serve are robust, and we are well positioned heading into calendar 2024.

Building Products generated net sales of $123 million in Q2, down 13% from $142 million a year ago. The decrease was driven by a less favorable product mix, combined with lower average selling prices. Building Products generated adjusted EBIT of $40 million in the quarter, and adjusted EBIT margin was 32.8% compared to $41 million and 29.1% in Q2 of last year. The fact that EBIT decreased by less than $1 million, while revenues were down almost $20 million is encouraging and was a result of higher gross margins in our wholly owned businesses.

We are experiencing some destocking in our heating and cooling construction end markets particularly in the large format propane business as our customers are rightsizing inventories. The weakness there was offset in Q2 by EBIT growth in most of our other end markets driven by some of the initiatives we put in place months ago that are starting to have a positive impact.

WAVE contributed equity earnings of $21 million in the quarter, up from $19 million a year ago as their volumes increased and gross margins improved. That improvement was offset by a $2 million year-over-year decrease at ClarkDietrich, which continues to perform very well and contributed $14 million in equity earnings for the quarter. Both WAVE and ClarkDietrich are showing real resilience as they leverage opportunities related to infrastructure spending and their efforts in NPD and innovation.

In Sustainable Energy Solutions, net sales in Q2 of $28 million were down 28% or $11 million from the prior year, primarily due to lower volumes and an unfavorable product mix. SES reported an adjusted EBIT loss of $3 million in the current quarter as volumes remain too low to absorb the fixed costs in the business as compared to an adjusted EBIT of $1 million in Q2 of last year. As we've discussed in prior quarters, the economy in Europe remains challenged and growth in SES' volumes will be impacted by how quickly the emerging hydrogen and CNG ecosystems develop. Quoting activity and interest in our solutions remains high, which gives us confidence in that business going forward.

As I mentioned earlier, this is a unique quarter for us, and it is the last quarter that we'll report our segments as Worthington Industries. In preparation for the separation, this fall, we introduced a reconciliation for revenues and EBITDA at Worthington Enterprises that represents our best estimates for Worthington Enterprises results on a pro forma stand-alone basis, at the

Worthington Enterprises, Inc.

Second Quarter 2024 Earnings

separation of our Steel processing business been completed prior to the beginning of each period presented. We believe this reconciliation will help provide increased transparency and insights into our quarterly results.

Looking at Enterprises results for Q2 of 2024 in that same way, pro forma adjusted EBITDA would have been $51.3 million versus $57.7 million a year ago. The trailing 12 months ended November 30, Enterprises' pro forma adjusted EBITDA would have been $280 million, a slight decline from the $287 million in trailing 12 months pro forma adjusted EBITDA as of August 31. And our pro forma adjusted EBITDA margin was unchanged at 21%. The above figures do include a $3 million charge related to the recall that I mentioned earlier.

CapEx for Worthington Enterprises in the quarter was $12 million in the business segments, $3 million of which was related to the onetime CapEx that we've discussed previously, we'll be spending to modernize two of our facilities. Worthington Industries also had approximately $4 million in onetime CapEx related to IT and other systems that enable the separation of our Steel Processing business. At this point, I will turn it back over to Andy.

Andy Rose^ Thanks, Joe. Now that the separation is complete at Worthington Enterprises, we are laser-focused on maximizing the long-term growth potential of our consumer products, building products and sustainable energy businesses. We have more focused strategic priorities as a designer and manufacturer of market-leading products and brands that enable people to live safer, healthier and more expressive lives. We are a growth company with transformation, acquisitions and innovation as our strategic enablers. We believe in innovation in everything we do.

We expect to launch more new and enhanced products every year to better serve our customers. We are a disciplined acquirer of market-leading niche businesses that will bolster our consumer and building products brands. We transform our operations and use technology both in our operations and increasingly in the products we deliver to our customers. We believe in a balanced approach to profitably improving our ESG performance to benefit all stakeholders, and we are enabling a lower carbon economy with our products and services. As evidence, we recently released our fourth annual sustainability report.

And in conjunction, we're awarded Newsweek America's Most Responsible Companies and Greatest Workplaces for Diversity for 2024.

And finally, we are good stewards of capital, investing thoughtfully to deliver higher margins, more free cash flow and higher returns. We are proud of our history and who we are today, but we know we will be defined in the future by our ability to leverage these capabilities to reward our employees, our customers, our suppliers and our shareholders. Thanks for your time today. We'll now take any questions related to the separation or Worthington Enterprises.

QUESTION & ANSWER:

Worthington Enterprises, Inc.

Second Quarter 2024 Earnings

Operator^ Thank you. (Operator Instructions) Your first question comes from the line of Phil Gibbs of KeyBanc Capital Markets. Your line is open.

Phil Gibbs^ Hey, good morning.

Joe Hayek^ Morning, Phil.

Phil Gibbs^ Congratulations. We're here.

Joe Hayek^ Yes, sir. Thank you. Lots to be proud of, lots to look forward to. And as Andy said, lots of people in the building that we're in and all over our company deserve all the credit.

Phil Gibbs^ Awesome. Congratulations. The construction markets last quarter, you had bifurcated between aftermarket and retrofit with WAVE hanging in there being solid and ClarkDietrich tapering off. Any update on that thought, any further weakness in ClarkDietrich's backlog per se versus WAVE's? Any color you can provide there?

Joe Hayek^ Well, just sticking with Q2. WAVE was up a couple of million dollars. ClarkDietrich was down a couple of million dollars. Bear in mind, both of those companies are doing really well. WAVE is 65%, 70% repair and remodel.

ClarkDietrich is a little bit more focused on new. But if you look at the -- there are lots of different kind of construction market, trackers and analysts that are out there, some of them that we've looked at said that in November, commercial was still down a bit, but most of the other end markets and both of these companies play in a variety of different end markets were actually up year-over-year.

So not at all a market prognosticator, but with interest rates possibly being at a peak, and people getting a bit more optimistic about what '24 might look like relative to the fears that were out there in six months ago, we're pretty optimistic.

Phil Gibbs^ Thank you. And I'm not asking a direct question on Worthington Steel, but how is the relationship between the companies going to be moving forward just in terms of steel procurement. I know that was obviously something that was important to you all with the cylinders portfolio and some of the other businesses?

Andy Rose^ Yes. We have a long-term purchasing agreement with Worthington Steel. So we will be one of their larger customers, Phil. And we -- obviously, they have to make money on the steel that we buy, but we've been able to preserve a lot of the benefit that we get from having them -- having a close customer supplier relationship with them.

Phil Gibbs^ Thank you. And then just lastly, I know on the kind of investor presentations from a couple of months ago, you had talked about a decent amount of growth -- the CapEx in the next couple of years for the business post separation. Can you update us on what CapEx looks like

Worthington Enterprises, Inc.

Second Quarter 2024 Earnings

over the next year or two on these growth projects and really what you're targeting to accomplish with those investments? Thanks.

Joe Hayek^ Sure. So we have talked about what we call kind of our onetime facility modernization CapEx. It's two different facilities. It's roughly $80 million, and it's intended to modernize, automate and make those facilities kind of ready and able to continue to grow and do exceptionally well for the next 20 to 30 years.

The way that will roll out in the CapEx, our run rate CapEx for the business, excluding those two projects is going to be in kind of the mid-30s, roughly if we think about it as about 3% of sales. Those different -- and we -- I think we called it out this quarter about $3 million in the quarter was related to that. And so if you exclude that $3 million that gives us at Enterprises roughly $9 million in the quarter. It was $8 million in Q1, so that's $17 million for the first six months, tracking right on that kind of mid-30s number. But that $80 million, depending on supply chains and other factors, will kind of be underway in the next sort of several months in earnest, but it'll probably take 18 to 24 months to flush all the way through.

And what we will do is we'll keep everybody posted on the spending on those projects and then the spending on all the other parts of the business in the same way.

Operator^ Thank you. Your next question comes from the line of Daniel Moore of CJS Securities. Your line is open.

Daniel Moore^ Thank you. Good morning. Thanks for taking questions and congrats again. A lot of color, though. (Multiple speakers). Yes, absolutely. You gave a lot of color on the segments, but maybe we can drill down a little bit consumer to start revenue in Q1 was down 20%, but only down 4% this quarter and flat sequentially. So maybe just talk about to what extent that business is impacted by inventory destocking.

Is that now largely behind us? And where your expectations sounds like you expect to get back to growth with some share gains. Is that the case for the next two quarters or maybe take a little bit longer to inflect positively?

Joe Hayek^ Yes. I think it's definitely -- that's calendar 2024 business for us, Dan. But you're right, and I know that we were not kind of unique, right, with outdoor living focused and consumer-focused brands and companies had some real headwinds over the summer. We've talked about that, right, with the consumer being a bit more careful, spending more time and money on experiences versus things and outdoor activities, but then also the summer weather didn't help matters.

We did absolutely see that kind of moderate. We talked about September. September really, we think, was the trough for that leg of the real pronounced headwinds. So October and November got better for us. We're not totally through the woods, right?

Worthington Enterprises, Inc.

Second Quarter 2024 Earnings

The consumer is not back to spending the way that they were in 2021 and 2022, but we do expect to see more seasonally normal trends. And for us in Q3 and into Q4, that typically means sequential growth. So we're looking forward to that.

And as we said, the team did a nice job of kind of being there and being real thought partners with their customers. And so that led to some incremental share gains and some placement wins, which we think will be helpful as well.

Daniel Moore^ That's helpful, certainly. And then switching gears to Building Products. Revenue for -- still remains pressured with -- obviously, excluding the JVs because we don't count that revenue. But -- and then excluding JV's profitability, it was a little bit softer. So maybe your outlook there, we talked about ClarkDietrich and WAVE, but kind of the core fully consolidated building products.

Just talk about your visibility that you have in that business over the next couple of quarters? And when do you expect to maybe get back to sort of positive year-over-year growth?

Joe Hayek^ Sure. So that business, and we talked about this, there was the large format propane tanks, which is things that would sit outside buildings or be used for construction projects or be used to heat homes. That -- when we talk about mix, right, that -- those are more expensive products, which is why we talk about a negative mix and the revenue side of things. Saw some destocking there. It started in Q1.

It continued in Q2. We expect that will moderate a bit, and we should be -- we think we'll be through that by the end of Q4. We'll certainly see some of it in Q3, but it ought to get to where it has historically been, we think, by the time we get into the summer months. And so feel good about that business, just need to get through some of the inventory rightsizing that our customers are going through.

The upside in building products really was being down less than $1 million all in, some really good work on expense management side in addition to the gross margin side, the other end markets that were in there really picked up a lot of the slack and we expect and certainly hope that, that type of activity will continue, which gives us cause for optimism as we head into 2024.

Daniel Moore^ Very helpful. Maybe just one more, and I'll jump back out, and it's more of a longer-term sort of question on ClarkDietrich specifically. Obviously, as we talked about the last two years of that business exceptionally strong relative to kind of historic levels of profitability, and started to normalize a little bit. But just talk about what's changed in that business over the past few years that gives you confidence that the contribution will remain well above the sort of pre-pandemic levels? Thanks again.

Joe Hayek^ Sure. Clearly, that business has changed in terms of its equity income contribution for us. They've done a terrific job of understanding who their customers are, understanding what their customers really value. And that's being full service. It's being thoughtful about the entire kind of ecosystem that their customers participate in, not just delivering a load of steel, but

Worthington Enterprises, Inc.

Second Quarter 2024 Earnings

helping think about how those connectors and how the other accessories that they sell are important, how they can save contractors' time. And so yes, we do -- and we've talked about this, right? We don't expect that those results will stay forever or grow forever from where they were in 2022. They moderated some in 2023. We've talked about the moderating some in 2024.

But long-term, we're very bullish on that business. They've got a great management team. We're very happy to be a part of that JV.

Operator^ Thank you. (Operator Instructions) Your next question comes from the line of John Tumazos, John Tumazos Very Independent Research. Your line is open.

John Tumazos^ Congratulations on the $90 combined value of the two companies with Enterprises trading at more than the old Worthington before you announced it. Well done.

Andy Rose^ Thank you, John.

Joe Hayek^ Thanks, John.

John Tumazos^ I have a question on the quarterly dividend set at $0.16 or half of the old company dividend. I thought that was very low. I was in the context of the balance sheet allocation between the two companies, where there's almost no net debt in Enterprises, and you explained how there isn't really much capital spending relative to your cash flow, where the other company has the preponderance of the net debt and the imminent capital need to fund working capital because steel prices just rose. So in that context, why isn't the dividend payment larger since the balance sheet is so good? And could you -- some people might be concerned, Andy, that you're not confident in earnings, that's not really my worry.

My worry if you could address is that the balance sheet is super strong and the dividend is low to save up $0.5 billion or more of firepower for a transformational acquisition or an above-average pot for future acquisitions since you don't have reinvestment needs?

Andy Rose^ I think there's a question in there somewhere, John, but I'm going to take an attempt here.

John Tumazos^ I'll try to be more blunt. Are you going to make a corporate exchange acquisition? Are you going to transform the company, and that's why the dividend is so low and the balance sheet is so good?

Andy Rose^ Well, let me start by saying the past year or so, 1.5 years, has been about working towards the separation. And you've seen us very purposefully de-lever the business. We were very focused on maintaining our investment grade credit rating. And you're correct in that we certainly could pay a larger dividend.

I would tell you that historically, we've kind of revisited our dividend payout ratio in the June timeframe around that Board meeting.

Worthington Enterprises, Inc.

Second Quarter 2024 Earnings

And so we go through strategic planning in the spring, we do our operating plans and kind of look at cash flow forecasts and those types of things, and that's where we make those decisions.

I will tell you, we do believe that M&A is going to be an important part of our growth strategy. I don't expect that anytime soon, we're going to do some transformational acquisition that's going to double the size of the business. That's not historically what we've done. We've very much pursued kind of smaller tuck-in acquisitions that we can get our arms around pretty easily and plug them into our Worthington Business System, which includes transformation, innovation, and I think that's likely to be the strategy going forward. We look at a lot of different types of companies.

We look at a lot of different sizes of companies, but we've had a lot more success buying smaller tuck-ins and really accelerating their growth.

So that's kind of the plan right now. And so I do think as the company continues to grow, we have very high free cash flow for the business, so we can support higher dividends or potentially share buybacks. But right now, our focus is let's get the company separated, that's complete, let the dust settle and let's refocus and then kind of figure out what makes the most sense in terms of capital allocation.

John Tumazos^ If I could follow up. With the very successful separation and the stock price of Enterprises is more than the old stock price of the old Worthington, which may be in hindsight was really discounted because of the steel volatility contained. Should we expect that buybacks are going to be less of a use of capital going forward (inaudible) stock price is so successful?

Joe Hayek^ Hey, John, it's Joe. As Andy said, we'll ultimately determine the best capital allocation strategies for the business going forward. We've been balanced before. We've (inaudible) been opportunistic when it comes to buybacks. But -- it's still -- it will be an arrow in our quiver.

And ultimately, the Board and the management team will decide how best to deploy that.

John Tumazos^ Thank you.

Operator^ There are no further questions at this time.

I will now turn the call over back to Andy Rose for some closing remarks.

Andy Rose^ Well, thank you, everyone, for joining us today. It's an exciting time for us and I appreciate everybody's interest in Worthington Enterprises.

We wish everybody a terrific holiday season, a safe and Happy New Year.

And we'll look forward to speaking to you in 2024.

Worthington Enterprises, Inc.

Second Quarter 2024 Earnings

Joe Hayek^ Thanks, everybody.

Operator^ That concludes today's conference call.

You may now disconnect.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

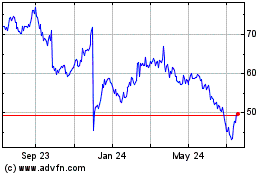

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

From Apr 2024 to May 2024

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

From May 2023 to May 2024