UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2023

Commission File Number: 001-35783

Alamos Gold Inc.

(Translation of registrant’s name into English)

Brookfield Place, 181 Bay Street, Suite 3910

Toronto, Ontario, Canada

M5J 2T3

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F o Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

EXHIBIT INDEX

| | | | | | | | |

EXHIBIT NO. | | DESCRIPTION |

| 99.1 | | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | Alamos Gold Inc. |

Date: December 21, 2023 | | | |

| | | | By: | | /s/ Scott K. Parsons |

| | | | Name: | | Scott K. Parsons |

| | | | Title: | | Senior Vice President, Investor Relations |

| | | | | | | | |

| Alamos Gold Inc. | |

| Brookfield Place, 181 Bay Street, Suite 3910, P.O. Box #823 | |

| Toronto, Ontario M5J 2T3 | |

| Telephone: (416) 368-9932 or 1 (866) 788-8801 | |

All amounts are in United States dollars, unless otherwise stated.

Alamos Gold Announces Renewal of Normal Course Issuer Bid

Toronto, Ontario (December 21, 2023) – Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today announced that it has filed with, and received acceptance from the Toronto Stock Exchange (“TSX”) of, a Notice of Intention to make a Normal Course Issuer Bid permitting Alamos to purchase for cancellation up to 34,485,405 Class A Common Shares (“Common Shares”), representing 10% of the Company’s public float of the Common Shares as at December 14, 2023, being 344,854,056 Common Shares. As at December 14, 2023, there were 396,857,869 Common Shares issued and outstanding.

Alamos may purchase Common Shares under the Normal Course Issuer Bid over the twelve-month period beginning December 24, 2023 and ending December 23, 2024. Any purchases made under the Normal Course Issuer Bid will be effected through the facilities of the TSX, alternative Canadian trading systems and/or the New York Stock Exchange. The maximum number of Common Shares that Alamos may purchase on the TSX on a daily basis, other than pursuant to block purchase exceptions, is 151,045 Common Shares.

The price for any repurchased Common Shares will be the prevailing market price at the time of the purchase. All Common Shares purchased by Alamos will be cancelled. Purchase and payment for the Common Shares will be made by Alamos in accordance with the requirements of the TSX and applicable securities laws.

A Normal Course Issuer Bid is being undertaken as the Company and its Board of Directors believe the price of its Common Shares from time to time to be not reflective of the underlying value of the Company. The Company believes it is advantageous to its shareholders to engage in repurchases of Common Shares, from time to time, when they are trading at prices which reflect a discount from their value by increasing the proportionate share of ownership of the Company to remaining shareholders. Under its previous Normal Course Issuer Bid which commenced on December 24, 2022 and will terminate on December 23, 2023, Alamos sought the purchase of up to 34,670,378 Common Shares and no purchases were made.

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America. This includes the Young-Davidson and Island Gold mines in northern Ontario, Canada and the Mulatos mine in Sonora State, Mexico. Additionally, the Company has a strong portfolio of growth projects, including the Phase 3+ Expansion at Island Gold, and the Lynn Lake project in Manitoba, Canada. Alamos employs more than 1,900 people and is committed to the highest standards of sustainable development. The Company’s shares are traded on the TSX and NYSE under the symbol “AGI”.

TRADING SYMBOL: TSX:AGI NYSE:AGI

FOR FURTHER INFORMATION, PLEASE CONTACT:

| | | | | |

| Scott K. Parsons | |

| Senior Vice President, Investor Relations | |

| (416) 368-9932 x 5439 | |

The TSX and NYSE have not reviewed and do not accept responsibility for the adequacy or accuracy of this release.

Cautionary Note

This news release includes certain statements that constitute forward-looking information within the meaning of applicable securities laws ("Forward-looking Statements"). All statements in this news release, including statements regarding potential future purchases by Alamos of its Common Shares pursuant to the NCIB, other than statements of historical fact, which address events, results, outcomes or developments that Alamos expects to occur are Forward-looking Statements. Forward-looking Statements are generally, but not always, identified by the use of forward-looking terminology such as "expects", is “expected", "anticipates", "plans" or “is planned”, “trends”, "estimates", "intends" or “potential” or variations of such words and phrases and similar expressions or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved or the negative connotation of such terms.

Alamos cautions readers not to place undue reliance on the forward-looking statements in the information and content on this news release as a number of factors could cause actual future results, conditions, actions or events to differ materially from the targets, outlooks, expectations, goals, estimates or intentions expressed in the Forward-looking Statements. These factors include, but are not limited to: changes in the financial markets, changes in applicable laws and governmental regulations, fluctuations the price of gold, fluctuations in relative currency values, risks related to obtaining and maintaining necessary permits and the unpredictability of and fluctuation in the trading price of the Company’s common shares.

Additional risk factors and details with respect to risk factors affecting the Company are set out in the Company’s latest Annual Information Form and MD&A, each under the heading “Risk Factors”, available on the SEDAR+ website at www.sedarplus.ca or on EDGAR at www.sec.gov. The foregoing should be reviewed in conjunction with the information found in this news release. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether written or oral, or whether as a result of new information, future events or otherwise, except as required by applicable law.

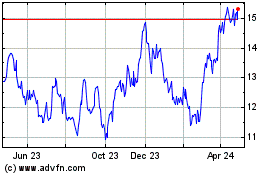

Alamos Gold (NYSE:AGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

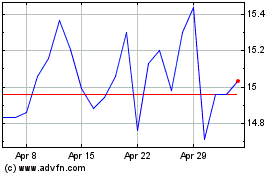

Alamos Gold (NYSE:AGI)

Historical Stock Chart

From Apr 2023 to Apr 2024