0001466593false00014665932023-12-152023-12-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 15, 2023

OTTER TAIL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Minnesota (State or other jurisdiction of incorporation or organization) | 0-53713 (Commission File Number) | 27-0383995 (I.R.S. Employer Identification No.) |

215 South Cascade Street, P.O. Box 496, Fergus Falls, MN 56538-0496

(Address of principal executive offices, including zip code)

(866) 410-8780

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares, par value $5.00 per share | OTTR | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

Integrated Resource Plan

On December 15, 2023, Otter Tail Power Company (OTP), a wholly-owned subsidiary of Otter Tail Corporation, submitted a second supplemental resource plan filing to the Minnesota Public Utilities Commission (MPUC). The supplemental filing updates OTP’s original 2022 Integrated Resource Plan (2022 IRP), which was filed on September 1, 2021, and updated through a supplemental filing on March 31, 2023. In the latest supplemental filing, OTP outlined its updated plan for meeting Minnesota customers’ anticipated capacity and energy needs while maintaining system reliability and low electric service rates. Based on feedback received on the preferred plan outlined in our March 31, 2023 supplemental filing, and a lack of interjurisdictional consensus on aspects of the plan, OTP is proposing bifurcating its resource planning. OTP is proposing to prospectively plan to serve its Minnesota customers with resources dedicated to and recovered solely from Minnesota customers and serve its other jurisdictions with resources dedicated to and recovered from those jurisdictions. Bifurcated resource planning would diverge from OTP’s historical practice of resource planning on an integrated basis for all jurisdictions served.

With the proposal of bifurcated resource planning, the supplemental filing outlines OTP’s preferred plan for Minnesota only. The preferred plan in this supplemental filing includes:

–repowering four of our existing wind facilities in 2025;

–the addition of approximately 200 megawatts of solar generation in 2025

–the addition of approximately 100 megawatts of wind generation in 2026;

–the addition of on-site liquified natural gas fuel storage at our Astoria Station natural gas plant in 2027;

–the designation of Coyote Station, a jointly-owned coal-fired generation plant, as an Available Maximum Emergency Resource beginning in 2029 and annually thereafter;

–a withdrawal from our 35 percent ownership interest in Coyote Station in the event we are required to make a major, non-routine capital investment in the plant; and

–the addition of approximately 50 megawatts of wind generation in 2032.

The timing of these resource additions is subject to project development requirements and may require adjustment given the passage of time. Some of these resources are expected to be available on a system wide basis.

The preferred plan requests the MPUC issue an order allowing the Minnesota’s jurisdictionally allocated share of the generation from Coyote Station be designated as an Available Maximum Emergency (AME) Resource beginning March 1, 2029, subject to a fatal flaw analysis to be performed by OTP. AME Resources are resources called on only in the event of a maximum generation event, such as in the cases of extreme heat, cold, or other extreme events. Designating Coyote Station as an AME Resource would allow us to retain Coyote Station’s capacity, thereby providing an important reliability benefit. This also helps ensure we remain compliant with market monitoring regulations and our contractual obligations to the co-owners of Coyote Station while advancing our compliance with Minnesota's carbon-free standard. The supplemental filing requests Minnesota customer rates continue to include the recovery of an allocated share of OTP’s costs associated with owning the plant, and a return on those costs, as well as the fixed costs of operating the plant. The variable cost of operating the plant, which consists primarily of variable fuel costs, would not be attributed to Minnesota customers, except when the plant is called upon in emergency situations.

Compared to the preferred plan outlined in our March 31, 2023 supplemental filing, this most recent supplemental filing reduces the total requested new renewable generation resources being added to our portfolio, adjusts the timing of requested renewable generation additions, requests the designation of Coyote Station as an AME Resource, and introduces bifurcated resource planning. A formal hearing on the IRP with the MPUC is scheduled for January 4, 2024. The supplemental IRP filing made December 15, 2023 outlines our proposed resource plan for Minnesota, and we anticipate filing future resource plans on a bifurcated basis in North Dakota and South Dakota.

Forward-looking Statements

Except for historical information contained here, the statements in this Current Report on Form 8-K are forward-looking and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The words “anticipate,” “could,” “estimate,” “may,” “plan,” “should,” “would” and similar words and expressions are intended to identify forward-looking statements. Such statements are based upon the current beliefs and expectations of management. Forward-looking statements made herein, which include future investments and capital expenditures, and expectations regarding regulatory proceedings, as well as other assumptions and statements, involve known and unknown risks and uncertainties that may cause our actual results in current or future periods to differ materially from the forecasted assumptions and expected results. The Company’s risks and uncertainties include, among other things, long-term investment risk, seasonal weather patterns and extreme weather events, the impact of government legislation and regulation including foreign trade policy and environmental laws and regulations, the impact of climate change including compliance with legislative and regulatory changes to address climate change, operational and economic risks associated with our electric generating facilities, risks associated with energy markets, the availability and pricing of resource materials, and changing macroeconomic and industry conditions. These and other risks are more fully described in our filings with the Securities and Exchange Commission, including our most recently filed Annual Report on Form 10-K, as updated in subsequently filed Quarterly Reports on Form 10-Q, as applicable. Forward-looking statements speak only as of the date they are made, and we expressly disclaim any obligation to update any forward-looking information.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| OTTER TAIL CORPORATION |

| |

| |

Date: December 21, 2023 | By: | /s/ Kevin G. Moug |

| | Kevin G. Moug |

| | Chief Financial Officer |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

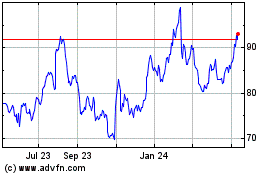

Otter Tail (NASDAQ:OTTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

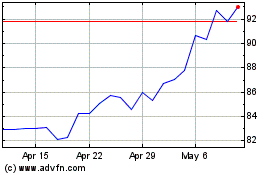

Otter Tail (NASDAQ:OTTR)

Historical Stock Chart

From Apr 2023 to Apr 2024