Form 8-K - Current report

December 20 2023 - 5:00PM

Edgar (US Regulatory)

0001819615FALSEBodega 19-B Parque Industrial Tibitoc P.H,ColombiaTocancipá - Cundinamarca00018196152023-12-182023-12-180001819615us-gaap:CommonStockMember2023-12-182023-12-180001819615us-gaap:WarrantMember2023-12-182023-12-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 18, 2023

Clever Leaves Holdings Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| British Columbia, Canada | | 001-39820 | | Not Applicable |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Bodega 19-B Parque Industrial Tibitoc P.H, Tocancipá - Cundinamarca, Colombia | | N/A |

| (Address of principal executive offices) | | (Zip Code) |

(561) 634-7430

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol (s) | | Name of each exchange on which registered |

| Common shares without par value | | CLVR | | The Nasdaq Stock Market LLC |

| Warrants, each warrant exercisable for one common share at an exercise price of $11.50 | | CLVRW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

As previously disclosed, Schultze Special Purpose Acquisition Sponsor, LLC (the “Sponsor”), a Delaware limited liability company was issued 4,900,000 warrants (the “Warrants”) to purchase common shares, without par value (the “Common Shares”) of Clever Leaves Holdings Inc. (the “Company”), with each Warrant entitling the Sponsor to purchase 1/30th of a Common Share at an exercise price of $11.50 per Warrant (or $345.00 per Common Share), which reflects the reverse share split effected by the Company at approximately 5:00 p.m. Eastern Time on August 24, 2023 in accordance with the terms of the warrant agreement dated as of December 10, 2018, as amended.

On or about June 2023, the Sponsor transferred the Warrants to Schultze Master Fund, Ltd., a Cayman Islands exempted company (“Master Fund”), the majority owner of the Sponsor. On December 18, 2023, the Company entered into a warrant termination agreement (the “Warrant Termination Agreement”) with Master Fund, pursuant to which the parties agreed to cancel and terminate all Warrants held by Master Fund, effective as of the date of the Warrant Termination Agreement. The foregoing description is qualified in its entirety by reference to the terms of the Warrant Termination Agreement, a copy of which is being filed as Exhibit 10.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

| | | | | |

Exhibit No. | Description |

| |

10.1 | |

104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Clever Leaves Holdings Inc. |

| |

| | By: | /s/ Henry R. Hague, III |

| | Name: | Henry R. Hague, III |

| | Title: | Chief Financial Officer |

Date: December 20, 2023

US-LEGAL-12437173/6 174008-0004 WARRANT TERMINATION AGREEMENT THIS WARRANT TERMINATION AGREEMENT (this “Agreement”) is made as of this 18th day of December, 2023, by and between Clever Leaves Holdings Inc. (the “Company” or “Clever Leaves”), a corporation organized under the laws of British Columbia, Canada, and Schultze Master Fund Ltd., a Cayman Islands exempted company (“Master Fund”). WHEREAS, Schultze Special Purpose Acquisition Sponsor, LLC (the “Sponsor”), a Delaware limited liability company majority owned by Master Fund, was previously issued 4,900,000 warrants (the “Warrants”) to purchase common shares, without par value (the “Common Shares”) of Clever Leaves, with each Warrant entitling the Sponsor to purchase 1/30th of a Common Share at an exercise price of $11.50 per Warrant (or $345.00 per Common Share), which reflects the reverse share split effected by the Company at approximately 5:00 p.m. Eastern Time August 24, 2023, in accordance with the terms of the warrant agreement dated as of December 10, 2018, as amended ( the “Warrant Agreement”). WHEREAS, the Sponsor transferred the Warrants to Master Fund on or about June, 2023. NOW, THEREFORE, for and in consideration of the promises and the mutual covenants hereinafter set forth, the parties hereto do hereby agree as follows: 1. Termination of the Warrant. As of the date hereof, the Warrants held by Master Fund are hereby canceled and terminated and are null and void and of no further effect. The parties hereto agree that no provision of the Warrant shall survive termination and no party hereto shall hereafter have any liabilities, rights, duties or obligations to the other party under or in connection with such Warrant. This Agreement does not amend or terminate the Warrant Agreement, nor does it amend or terminate that certain Waiver of Certain Rights, dated as of February 2, 2022, between the Sponsor and the Company, other than to the extent they relate to the termination of the Warrants. 2. Right to Enforce. The parties hereto shall have the right to enforce this Agreement and any of its provisions by injunction, specific performance, or other equitable relief, without bond and without prejudice to any other rights and remedies that the parties hereto may have for a breach of this Agreement. 3. Governing Law; Consent to Jurisdiction. The validity, interpretation, and performance of this Agreement and of the Warrants shall be governed in all respects by the laws of the State of New York, without giving effect to conflicts of law principles that would result in the application of the substantive laws of another jurisdiction. The Company hereby agrees that any action, proceeding or claim against it arising out of or relating in any way to this Agreement shall be brought and enforced in the courts of the State of New York or the United States District Court for the Southern District of New York, and irrevocably submits to such jurisdiction, which jurisdiction shall be exclusive. The Company hereby waives any objection to such exclusive jurisdiction and that such courts represent an inconvenient forum. 4. Authorization; Enforceability. The Company hereby represents and warrants to Master Fund and Master Fund hereby represents and warrants to the Company that it has all requisite corporate power and authority to execute and deliver this Agreement and to perform its obligations hereunder, to provide the representations and warranties under this Agreement and all necessary action has been duly and validly taken by such party to authorize the execution, delivery and performance of this Agreement. This Agreement has been duly and validly authorized, executed and delivered by such party and constitutes such party’s legal, valid and binding obligation, enforceable against such party in accordance with its terms, except that enforcement hereof may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws and by general equitable principles (whether applied in a proceeding in law or equity). 5. Binding Effect; Inurement. The Master Fund agrees that this Agreement shall be binding on it and its successors and assigns. 6. Counterparts. This Agreement may be executed in two counterparts, which taken together shall constitute

US-LEGAL-12437173/6 one instrument. Signed facsimile counterparts to this Agreement or signed counterparts delivered in .pdf or other electronic format shall be acceptable and binding and treated in all respects as having the same effect as an original signature.

US-LEGAL-12437173/6 IN WITNESS WHEREOF, the undersigned have executed this Agreement as of the 18th day of December, 2023. SCHULTZE MASTER FUND LTD. By: /s/ George J. Schultze Name: George J. Schultze Title: Director CLEVER LEAVES HOLDINGS INC. By: /s/ Henry R. Hague, III Name: Henry R. Hague, III Title: Chief Financial Officer

v3.23.4

Cover

|

Dec. 18, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 18, 2023

|

| Entity Registrant Name |

Clever Leaves Holdings Inc.

|

| Entity Incorporation, Date of Incorporation |

A1

|

| Entity File Number |

001-39820

|

| Entity Address, Address Line One |

Bodega 19-B Parque Industrial Tibitoc P.H,

|

| Entity Address, Postal Zip Code |

N/A

|

| City Area Code |

561

|

| Local Phone Number |

634-7430

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001819615

|

| Amendment Flag |

false

|

| Entity Address, City or Town |

Tocancipá - Cundinamarca

|

| Entity Address, State or Province |

CO

|

| Common shares without par value |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common shares without par value

|

| Trading Symbol |

CLVR

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each warrant exercisable for one common share at an exercise price of $11.50 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each warrant exercisable for one common share at an exercise price of $11.50

|

| Trading Symbol |

CLVRW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

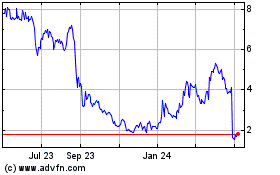

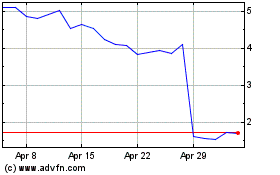

Clever Leaves (NASDAQ:CLVR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Clever Leaves (NASDAQ:CLVR)

Historical Stock Chart

From Apr 2023 to Apr 2024